Screen PLC - Final Results

May 15 1998 - 12:09PM

UK Regulatory

RNS No 5597w

SCREEN PLC

15th May 1998

Year ended 31 December 1997

Chairman's Statement

I present our results for the year ended 31 December 1997.

As at 31 December 1996, the group only comprised Screen plc and a 60% holding

in Karline. In the Alternative Investment Market admission document,

published on 18 February 1997, a proforma set of results was disclosed as if

Screen PLC had owned the whole of the issued share capital of Karline and

Petards International for the year ended 31 December 1996. When compared with

these proforma results for 1996, turnover increased by 74% to #4.308 million

(1996 on a pro forma basis: #2.472 million). As announced in January the loss

for the year after taxation and minority interest amounted to #1.293 million

(1996 on a proforma basis: #340,000 profit). Furthermore, goodwill has been

received on a company by company basis within the group. Following this

review, goodwill on acquisitions of #612,000 has been written off directly to

reserves in the financial year.

Late in 1997, when it appeared from information presented to the Board that

the group might not meet its targets, we commissioned detailed reviews of both

the group's commercial and financial position from external advisors. This

work revealed that the group would make substantial losses, a significant

proportion of which arose from businesses acquired during the year, which had

not been adequately integrated into the group. Additionally, the group

suffered from a lack of financial and management focus in part brought about

by the management time spent on these acquisitions. One consequence of these

reviews was the departure of our senior line executive director and our

finance director.

We were delighted to be able to appoint in January 1998 Mr Martin Brayshaw as

chief executive. Mr Brayshaw is a successful and experienced line executive

having previously been commercial director of Defence Systems Group Limited

and chief executive of Pex plc.

Following his appointment, Mr Brayshaw instituted further financial analyses,

which revealed that the company needed an urgent capital injection. The

directors and certain senior managers immediately made available #150,000 from

their personal resources and put in place arrangements for a placing of new

equity finance in March 1998 to raise a further #600,000 gross of expenses.

Other key changes initiated include: -

- A restructuring and streamlining of the business.

SecurScan has been fully integrated with Karline with a consequent reduction

in staffing levels. Similarly, the Omniwatch operation has been absorbed into

the Petards International business, again producing manpower savings.

- Disposal of non-core activities.

We have contracted to sell Executive Security, our loss making monitoring and

security services business. The disposal will provide additional cash

resources and free management time.

- Improved financial focus.

This is being achieved through tighter disciplines and emphasis on cash

management.

These and other changes have produced a cohesive management team focused on

delivering profit and growth.

Our principal operations now comprise:

Petards International Limited which continues to promote its command and

control systems with considerable success. Our CCTV systems are now used in

more than 40 town centre schemes by local authorities and the police as well

as with a growing number of commercial organisations and HM Prison Service.

Petards International has also taken responsibility for Omniwatch, the alarm

visual verification product now being sold through intermediaries and where

our first customer installations have now taken place. With the

continued growth of CCTV surveillance and the demonstrable effectiveness of

such systems we are confident demand for our systems will continue to grow.

Petards Datax Limited, a company we formed in June 1997, which specialises in

mobile data systems has got off to a very promising start. Our computer based

systems are located within vehicles and communicate via a diverse

range of secure telecommunications links. A dashboard mounted touch screen

display provides a simple to operate user interface. The emergency services

are our prime market and since our acquisition of the business we have

won contracts with ambulance services, fire brigades and we now number 14

police forces amongst our customers.

Karline Security Systems plc, security systems designers and integrators, has

absorbed the SecurScan business, acquired in July of last year. Karline has

substantially completed its largest ever project in Milton

Keynes town centre. Karline continues to focus on projects capable of

returning an acceptable gross margin together with ongoing maintenance

revenues.

Whilst much work still needs to be done to complete the restructuring of the

business and to return the group to profitability, the order books of our core

business are healthy. We look forward to providing further news of our

progress when we publish our interim results.

Owen Williams

Chairman

Screen PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 DECEMBER 1997

Audited Audited Proforma

12 months 13 months 12 months

ended ended ended

31 December 31 December 31 December

1997 1996 1996

#000s #000s #000s

Turnover 4,308 1,787 2,472

Cost of sales (3,047) (1,200) (1,353)

----- ----- -----

Gross profit 1,261 587 1,119

Administrative expenses (2,621) (426) (699)

----- ----- -----

Operating(loss)/profit (1,360) 161 420

Profit/(loss)on disposal 37 (12) -

of investments

Net interest payable (23) (13) (31)

----- ----- -----

(Loss)/profit on (1,346) 136 389

ordinary activities

before taxation

Taxation 49 (62) (49)

----- ----- -----

(Loss)/profit on (1,297) 74 340

ordinary activities

after taxation

Minority interest 4 (33) -

- equity ----- ----- -----

(Loss)/profit for the (1,293) 41 340

financial year ----- ----- -----

(Loss)/earnings per (0.7p) 2.3p 0.2p

share

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 1997

Audited Audited Proforma

31 December 31 December 31 December

1997 1996 1996

#000s #000s #000s

Fixed assets

Intangible assets 509 136 268

Tangible assets 610 137 205

----- ------ -----

1,119 273 473

Current assets

Stocks 378 105 142

Debtors 1,586 660 1,128

Cash at bank 381 4 1,327

and in hand ----- ------ ------

2,345 769 2,597

Creditors: amounts (2,928) (909) (1,171)

falling due within ------ ------ -----

one year

Net current (liabilities)/ (583) (140) 1,426

assets

Total assets less 536 133 1,899

current liabilities

Creditors: amounts

falling due after more

than one year (168) (18) (143)

------ ----- -----

Net assets 368 115 1,756

------ ----- -----

Capital and reserves

Called up share capital 204 -

Share premium account 2,019 -

Capital reserve - 2

Profit and loss account (1,856) 39

----- -----

367 41

Minority interest 1 74

- equity ----- -----

368 115

----- -----

Notes

1. Non statutory accounts

These statements do not constitute financial statements within the

meaning of section 240 of the Companies Act 1985.

2. Structure of group

Significant differences in the group structure exist for the two years

being reported on. The group consisted of Screen PLC and a 60% holding of

Karline Security Systems PLC as at 31 December 1996. The group structure had

changed by 31 December 1997 and consisted of Screen PLC, 100% holdings in

Karline Security Systems PLC, Petards International Limited, Petards OmniWatch

Limited (formerly Screen Security Limited), Executive Security (Wentworth)

Services Limited, Executive Security (Yorkshire) Services Limited and

SecurScan Limited and a 90% holding in Petards Datax Limited. Screen PLC, as

set out in its Placing and Admission to the Alternative Investment Market

prospectus, disclosed pro forma financial information showing the Profit and

Loss account for the year ended 31 December 1996 as if Screen, Karline and

Petards were a group at that date. Additionally, a pro forma Balance Sheet was

disclosed in the same prospectus on the basis that Screen, Karline and Petards

were a group at 31 December 1996. This pro forma Balance Sheet was then

further modified as if the placing which took place pursuant to Screen's

admission to the Alternative Investment Market had occurred prior to 31

December 1996. These pro forma figures are included in this announcement for

illustrative purposes only.

3. Taxation

A tax refund arises from carrying back losses sustained in the year

against tax paid on 1996 profits.

4. Earnings per share

The loss per share for the year to 31 December 1997 is based on the

weighted averaged number of 0.1p ordinary shares of 189,138,406. The earnings

per share for the 13 months to 31 December 1996 is based on a weighted average

number of ordinary shares of 1,800,995 to allow for the sub-division of share

which occurred during the year. The exercise of share options would not

significantly dilute the earnings per share.

5. Capital raised after the year end

In March 1998 additional share capital of #750,000 gross was raised,

#150,000 from directors and certain senior managers and #600,000 through a

Placing with investors.

6. 1997 Report and Accounts

Copies of the 1997 report and accounts will be sent to shareholders in

due course.

7. Announcement

Copies of this announcement will be available from the nominated

adviser: Smith & Williamson, No.1 Riding House Street, London, W1A 3AS for 14

days from the date of this announcement.

END

FR SFIFIIUAUFII

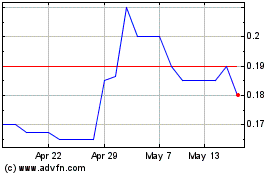

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Sep 2024 to Oct 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Oct 2023 to Oct 2024