TUI AG: TUI upsizes its April convertible bond through launch of a tap issue

June 28 2021 - 11:39AM

UK Regulatory

TUI AG (TUI)

TUI AG: TUI upsizes its April convertible bond through launch of a tap issue

28-Jun-2021 / 17:37 CET/CEST

Dissemination of a Regulatory Announcement that contains inside information according to REGULATION (EU) No 596/2014

(MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

Inside information pursuant to Article 17 MAR and Article 17 of UK MAR

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA,

AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH, OR TO PERSONS IN ANY JURISDICTION TO WHOM, SUCH

DISTRIBUTION WOULD BE UNLAWFUL.

This announcement is an advertisement and is not a prospectus within the meaning of the Regulation (EU) 2017/1129 or

otherwise.

The Management Board of TUI AG ("TUI") resolved today, with the consent of the Supervisory Board, to launch a tap

offering (the "Offering") of senior unsecured bonds convertible as per their terms and conditions due 2028 in an

aggregate principal amount up to EUR 190 million (the "New Bonds"). The Bonds will be convertible into new and/or

existing no-par value ordinary registered shares of TUI (the "Shares") and be fully fungible with the EUR 400 million

convertible bonds issued on 16 April 2021 under ISIN DE000A3E5KG2 (the "Existing Bonds").

TUI intends to use the proceeds from the Offering for refinancing in particular to further reduce drawings under the

KfW facilities and towards a subsequent repayment of such facilities.

The New Bonds will be issued on the same terms (save for the issue price) as the Existing Bonds and will form a single

series (Gesamtemission) with the Existing Bonds (together, the "Bonds"). The final issue price will be determined

following an accelerated bookbuilding, expected today.

The New Bonds will be offered by way of an accelerated bookbuilding to institutional investors outside the United

States of America as well as outside of Australia, Japan, South Africa and any other jurisdiction in which offers or

sales of the New Bonds would be prohibited by applicable law (the "Offering"). In Canada, the Offering will only be

made in the provinces of Ontario, Québec, British Columbia or Alberta, to institutional investors who are both an

accredited investor and a Canadian permitted client under applicable Canadian securities laws. The existing

shareholders' pre-emptive rights (Bezugsrechte) to the New Bonds will be excluded.

TUI has agreed not to offer any Shares or equity-linked securities within a period of 60 calendar days after the

settlement of the Offering, and not to enter into any transaction having a similar economic effect, subject to

customary exemptions.

Settlement is expected to take place on or around 6 July 2021. TUI intends to apply for the New Bonds to be included in

the trading of the Existing Bonds on the unregulated Open Market Segment (Freiverkehr) of the Frankfurt Stock Exchange.

For further information, please contact:

ANALYST & INVESTOR ENQUIRIES

Mathias Kiep, Group Director Investor Relations, Controlling & Corporate Finance Tel: +44 (0)1293 645 925/

+49 (0)511 566 1425

Nicola Gehrt, Director, Head of Group Investor Relations Tel: +49 (0)511 566 1435

Contacts for Analysts and Investors in UK, Ireland and Americas

Hazel Chung, Senior Investor Relations Manager Tel: +44 (0)1293 645 823

Contacts for Analysts and Investors in Continental Europe, Middle East and Asia

Ina Klose, Senior Investor Relations Manager Tel: +49 (0)511 566 1318

MEDIA ENQUIRIES

Kuzey Alexander Esener, Head of Media Relations Tel: + 49 (0)511 566 6024

IMPORTANT NOTICE

This announcement may not be published, distributed or

transmitted, directly or indirectly, in the United States of

America (including its territories and possessions), Australia,

South Africa, Japan or any other jurisdiction where such

announcement could be unlawful. The distribution of this

announcement may be restricted by law in certain jurisdictions and

persons who are in possession of this document or other information

referred to herein should inform themselves about and observe any

such restrictions. Any failure to comply with these restrictions

may constitute a violation of the securities laws of any such

jurisdiction.

This announcement does not constitute an offer of, or a

solicitation of an offer to purchase, securities of the Company or

of any of its subsidiaries in the United States of America, Germany

or any other jurisdiction. Neither this announcement nor anything

contained herein shall form the basis of, or be relied upon in

connection with, an offer in any jurisdiction. The securities

offered will not be and have not been registered under the U.S.

Securities Act of 1933, as amended (the "Securities Act") and may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements under

the Securities Act.

In the United Kingdom, this announcement is only directed at

"qualified investors" within the meaning of Regulation (EU)

2017/1129 as it forms part of United Kingdom domestic law by virtue

of the European Union (Withdrawal) Act 2018 (the "EUWA") who (i)

are investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended) (the "Order") or (ii) are persons falling within

Article 49(2) (a) to (d) of the Order (high net worth companies,

unincorporated associations, etc. (all such persons together being

referred to as "Relevant Persons")). This document must not be

acted on, or relied upon, by persons who are not Relevant Persons.

Any investment or investment activity to which this document

relates is available only to Relevant Persons and will be engaged

only with Relevant Persons.

In member states of the European Economic Area, the placement of

securities described in this announcement is directed exclusively

at persons who are "qualified investors" within the meaning of

Regulation (EU) 2017/1129 of the European Parliament and of the

Council of 14 June 2017 (Prospectus Regulation).

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Bonds have been subject to a product approval process, which

has determined that: (i) the target market for the Bonds is

eligible counterparties and professional clients only, each as

defined in MiFID II; and (ii) all channels for distribution of the

Bonds to eligible counterparties and professional clients are

appropriate. Any person subsequently offering, selling or

recommending the Bonds (a "distributor") should take into

consideration the manufacturer's target market assessment; however,

a distributor subject to MiFID II is responsible for undertaking

its own target market assessment in respect of the Bonds (by either

adopting or refining the manufacturer's target market assessment)

and determining appropriate distribution channels. The target

market assessment is without prejudice to the requirements of any

contractual or legal selling restrictions in relation to any

offering of the Bonds and/or the underlying shares. For the

avoidance of doubt, the target market assessment does not

constitute: (a) an assessment of suitability or appropriateness for

the purposes of MIFID II; or (b) a recommendation to any investor

or group of investors to invest in, or purchase, or take any action

whatsoever with respect to the Bonds.

The Bonds are not intended to be offered, sold or otherwise made

available to and should not be offered, sold or otherwise made

available to any retail investor in the EEA or the United Kingdom

(the "UK"). For these purposes, a "retail investor" means (a) in

the EEA, a person who is one (or more) of: (i) a retail client as

defined in point (11) of Article 4(1) of MIFID II; (ii) a customer

within the meaning of Directive (EU) 2016/97 (as amended, the

"Insurance Distribution Directive"), where that customer would not

qualify as a professional client as defined in point (10) of

article 4(1) of MIFID II, and (b) in the UK, a person who is one

(or more) of (i) a retail client within the meaning of Regulation

(EU) no 2017/565 as it forms part of UK domestic law by virtue of

the EUWA or (ii) a customer within the meaning of the provisions of

the Financial Services and Markets Act 2000 of the UK (the "FSMA")

and any rules or regulations made under the FSMA to implement

Directive (EU) 2016/97, where that customer would not qualify as a

professional client, as defined in point (8) of Article 2(1) of

regulation (EU) No 600/2014 as it forms part of UK domestic law by

virtue of the EUWA.

Consequently, no key information document required by Regulation

(EU) No 1286/2014 (the "EU PRIIPs Regulation") or the EU PRIIPS

Regulation as it forms part of UK domestic law by virtue of the

EUWA (the "UK PRIIPS Regulation") for offering or selling the Bonds

or otherwise making them available to retail investors in the EEA

or the UK has been prepared and therefore offering or selling the

Bonds or otherwise making them available to any retail investor in

the EEA or the UK may be unlawful under the EU PRIIPs Regulation

and/or the UK PRIIPS Regulation.

(MORE TO FOLLOW) Dow Jones Newswires

June 28, 2021 11:39 ET (15:39 GMT)

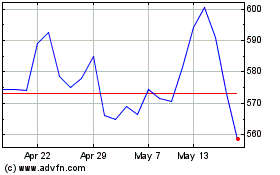

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

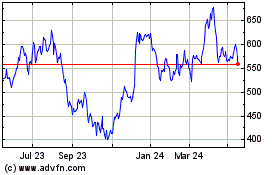

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024