TUI AG (TUI)

TUI AG: 3rd Quarter Results

13-Aug-2019 / 08:00 CET/CEST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

9 Months 2019

TUI Group - financial highlights

EUR million Q3 Q3 2018 Var. 9M 9M 2018 Var. % Var. %

2019 adjusted % 2019 adjusted at

constant

currency

Turnover 4,745 4,576.7 + 3.7 11,421 11,142.6 + 2.5 + 2.8

.0 .4

Underlying

EBITA 1

Hotels & 91.5 72.4 + 226.9 244.7 - 7.3 - 18.6

Resorts 26.4

Cruises 101.5 88.7 + 207.9 182.4 + 14.0 + 14.0

14.4

Destination 15.3 17.4 - 4.9 4.1 + 19.5 + 17.1

Experiences 12.1

Holiday 208.3 178.5 + 439.7 431.2 + 2.0 - 5.0

Experiences 16.7

Northern - 14.2 n. a. - - 111.6 - - 134.8

Region 58.6 263.7 136.3

Central 8.2 31.5 - - - 113.2 - 5.7 - 5.7

Region 74.0 119.6

Western - - 8.5 - - - 113.7 - 91.2 - 91.2

Region 53.5 529.4 217.4

Markets & - 37.2 n. a. - - 338.5 - 77.5 - 77.0

Airlines 103.9 600.7

All other - 3.5 - 28.9 + - 38.7 - 75.6 + 48.8 + 44.2

segments 87.9

TUI Group 100.9 186.8 - - 17.1 n. a. n. a.

46.0 199.7

84.1 176.0 - - - 27.4 -

EBITA 2, 3 52.2 262.6 858.4

Underlying 219.3 287.0 - 141.8 312.5 - 54.6

EBITDA 3, 4 23.6

EBITDA 3, 4 210.4 281.2 - 103.7 285.4 - 63.7

25.2

EBITDAR 3, 396.9 459.9 - 634.6 794.7 - 20.1

4, 5 13.7

Net gain / 47.3 104.8 - - - 105.8 -

net loss 54.9 240.4 127.2

for the

period

Earnings 0.04 0.17 - - 0.54 - 0.31 - 74.2

per share 3 76.5

EUR

Net capex 238.8 378.4 - 890.4 585.7 + 52.0

and 36.9

investments

Equity 19.8 21.4 - 1.6

ratio (30

June) 6 %

Net debt / - 589.4 n. a.

Net cash 994.6

(30 June)

Employees 71,847 66,632 + 7.8

(30 June)

Differences may occur due to rounding.

This Quarterly Statement of the TUI Group was prepared for the reporting

period 9M 2019 from 1 October 2018 to 30 June 2019.

The TUI Group applied IFRS 15 and IFRS 9 retrospectively from 1 October

2018. In contrast to IFRS 15, IFRS 9 was introduced without restating the

previous year's figures.

In Q1 2019, the Italian tour operators were transferred from All other

segments to the Central Region. In addition, the Crystal Ski companies,

which provide services in the destinations, were reclassified from Northern

Region to Destination Experiences. Prior-year figures were adjusted

accordingly.

1 In order to explain and evaluate the operating performance by the

segments, EBITA adjusted for one-off effects (underlying EBITA) is

presented. Underlying EBITA has been adjusted for gains / losses on disposal

of investments, restructuring costs according to IAS 37, ancillary

acquisition costs and conditional purchase price payments under purchase

price allocations and other expenses for and income from one-off items.

Please also refer to page 6 for further details.

2 EBITA comprises earnings before interest, income taxes and goodwill

impairment. EBITA includes amortisation of other intangible assets. EBITA

does not include measurement effects from interest hedges.

3 Continuing operations.

4 EBITDA is defined as earnings before interest, income taxes, goodwill

impairment and amortisation and write-ups of other intangible assets,

depreciation and write-ups of property, plant and equipment, investments and

current assets. The amounts of amortisation and depreciation represent the

net balance including write-backs. Underlying EBITDA has been adjusted for

gains / losses on disposal of investments, restructuring costs according to

IAS 37, ancillary acquisition costs and conditional purchase price payments

under purchase price allocations and other expenses for and income from

one-off items.

5 For the reconciliation from EBITDA to the indicator EBITDAR, long-term

leasing and rental expenses are eliminated.

6 Equity divided by balance sheet total in %, variance is given in

percentage points.

Highlights

· Our Holiday Experiences continue to deliver a strong performance,

despite the challenges we currently face in our Markets & Airlines

business, demonstrating the strength of our integrated business model.

· Our Hotels & Resorts result in Q3 is supported by our asset portfolio of

diversified destinations. Whilst Riu saw lower demand in Spain resulting

from the continued shift of demand from Western to Eastern Mediterranean,

our Turkish hotels saw a significant year on year earnings improvement as

a result of this demand shift.

· Our strong Cruises result reflects the capacity expansions across the

fleet this Summer, with strong volumes in TUI Cruises, and strong increase

in yields for both Marella and Hapag-Lloyd Cruises.

· Destination Experiences continued to grow with our Musement integration

well on track, with the basis set for the business to benefit from strong

Summer season volumes in Q4.

· Markets & Airlines continued to see a weak demand environment leading to

a later booking behaviour by our customers, reflecting the ongoing

knock-on impact of the Summer 2018 heatwave and Brexit uncertainty. Number

of customers were marginally ahead of prior year however and the segment

delivered a stable underlying result outside of the 737 MAX grounding

impact.

· As outlined in our ad-hoc announcement in March, Q3 was negatively

impacted by the 737 MAX aircraft grounding. Resumption of the 737 MAX

remains subject to the clearance decision of the civil aviation

authorities and we have secured replacement aircraft leases out to the end

of our Summer 2019 programme. We anticipate 737 MAX related costs of

approximately up to EUR 300 m for the current financial year.

· In the last quarter we made significant progress to deliver on our four

strategic initiatives:

· Grow Hotel & Cruise business with vertical integration to drive

premium returns;

· Retain and where possible extend strong positions in Markets &

Airlines;

· Add scale in new markets, with our new GDN-OTA (Global Distribution

Network Online Travel Agent) platform; and

· Add scale in Destination Experience markets with our new tours and

activities platform.

· Hotels & Cruises - we will continue to leverage our distribution scale

to increase yields in our content businesses and further invest in

portfolio diversification. We will both continue to be selective in our

approach and apply a blended ROIC target rate of > 15 %.

· Markets & Airlines - we have set up a Markets Transformation Programme

to improve our market competitiveness. The programme will focus on CRM and

digital upselling, harmonisation of purchasing, airline efficiency, mobile

distribution and common IT platforms to retain and where possible, extend

our market share.

· New markets - we will build reach in complementary markets through our

scalable GDN-OTA platform and have seen strong growth momentum already to

date. Our target of 1 m additional customers from new markets by 2022 may

be achieved earlier.

· Destination Experiences - we will drive scale in our new digitalised

platform by both expanding our product portfolio and by extending to

further 3rd party distribution channels such as Ctrip.

· As part of our ongoing review of our business portfolio, we are pleased

to announce we have signed an agreement post balance sheet date relating

to the disposal of two non-core German specialist businesses. The disposal

of Berge & Meer and Boomerang reflects our drive to focus on clear

synergistic businesses. We anticipate the disposal, for an agreed

enterprise value of EUR 96 m to EUR 106 m (including EUR 10 m earn-out),

to complete in the first quarter of the next financial year.

· As expected, net debt as at 30 June 2019 reflects the full utilisation

of disposal proceeds received over the past few years and the increase in

financing related to our aircraft re-fleeting programme. TUI is in a

robust financial position, with a considerable level of financing and

liquidity headroom.

· We therefore reiterate FY19 underlying EBITA guidance stated in our ad

hoc announcement of 29 March 2019 of approximately up to - 26 % compared

with underlying EBITA rebased in FY18 of EUR 1,177 m1.

1 Based on constant currency: FY18 result rebased in December 2018 to EUR

1,187 m to take into account EUR 40 m impact for revaluation of Euro loan

balance within Turkish Lira entities, and adjusted further to EUR 1,177 m

for retrospective application of IFRS 15.

At a glance

For further detail, please see Segmental Performance on pages 6 to 11.

Results at a glance

EUR million Q3 2019 9M 2019

Underlying EBITA FY18 (originally reported) + 193 + 35

IFRS 15 impact - 6 - 18

Turkish Lira revaluation impact (prior year) + 8 + 18

Underlying EBITA FY18 (rebased) + 195 + 35

Holiday Experiences + 28 + 21

Markets & Airlines - 31 - 174

All other segments + 24 + 33

Special items

Prior year: Riu gains on disposal (Hotels & - 8 - 43

Resorts)

Prior year: Niki bankruptcy impact (Central - + 20

Region)

Prior year: Airline disruptions (Markets & + 13 + 13

Airlines)

Q1 FY19: Northern Region hedging gain - + 29

Q2 / Q3 FY19: 737 MAX grounding (Markets & - 144 - 149

Airlines)

Q2 / Q3 FY19: Easter timing (Markets & + 22 -

Airlines)

Underlying EBITA FY19 at constant currency + 99 - 215

Foreign exchange translation + 2 + 15

Underlying EBITA FY19 + 101 - 200

Expected development and guidance

Holiday Experiences

Holiday Experiences continues to deliver a strong performance overall. The

strength in our model lies not only in the investment we have made in recent

years to expand our differentiated content and our integrated model (driving

higher occupancies, rates and yields in our hotels and cruise ships), but

also in our expansion of multiple hotel destinations. Our diversified

destination strategy is delivering clear benefits from the shift in demand

from Western to Eastern Mediterranean and we expect this benefit to continue

in Q4.

We have opened 23 own hotels so far in FY19, and expect to open 26 in total.

This will bring the total since merger to 70, slightly ahead of our original

target of around 60 hotels. Around two thirds of our 70 openings since

merger are of lower capital intensity, (operated under either a management

or franchised contract or owned with JV partner), reflecting our disciplined

approach in ownership.

In Cruises, we have launched three ships this year, new Mein Schiff 2,

Marella Explorer 2 and Hanseatic nature. All our brands continue to perform

well, driven by robust demand for our attractive itineraries and premium

all-inclusive, as well as luxury and expedition product offerings.

Within Destination Experiences, we expect excursions and activities

contributions to grow, with Musement integration costs in the year partly

offsetting. In the coming months, we will expand the product portfolio and

3rd party distribution channels (such as with Ctrip) of our digitalised

platform, driving further future growth.

Markets & Airlines

As previously communicated, we expect our FY19 full-year results to be

impacted by the 737 MAX grounding. We have seen a later booking behaviour to

date from the ongoing knock-on impact of last year's extraordinary hot

Summer with demand continuing to be impacted by Brexit uncertainty. In

addition, overcapacity to Spanish destinations has resulted in increased

competition, putting pressure on margins for the division.

For Summer 2019, 87 % of the programme has been sold compared with 88 % at

this time last year. Bookings are down 1 %, with average selling price up 1

%1. As we approach August, we expect improvement in Summer trading as we lap

the height of last year's heatwave. Bookings and margins have improved

year-on-year over the most recent weeks, however pricing remains behind cost

inflation, therefore we continue to anticipate margins to be lower than

prior year.

1 These statistics are up to 4 August 2019, shown on a constant currency

basis, and relate to all customers whether risk or non-risk.

Guidance

We therefore reiterate FY19 underlying EBITA guidance stated in our ad hoc

announcement of March 2019 of approximately up to - 26 %, compared with

underlying EBITA rebased in FY18 of EUR 1,177 m2.

2 Based on constant currency: FY18 result based in December 2018 to EUR

1,187 m to take into account EUR 40 m impact for revaluation of Euro loan

balance within Turkish Lira entities, and adjusted further to EUR 1,177 m

for retrospective application of IFRS 15.

Based on current foreign exchange rates, we expect approximately EUR 15 m

positive impact on underlying EBITA compared with rates prevailing in the

prior year.

Consolidated earnings

Turnover

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Hotels & 154.5 161.0 - 4.0 425.5 448.9 - 5.2

Resorts

Cruises 256.3 222.7 + 15.1 680.9 619.6 + 9.9

Destination 259.4 65.8 + 294.2 562.2 131.4 + 327.9

Experiences

Holiday 670.2 449.5 + 49.1 1,668.6 1,199.9 + 39.1

Experiences

Northern 1,599.6 1,616.0 - 1.0 3,722.9 3,842.6 - 3.1

Region

Central 1,598.4 1,525.7 + 4.8 3,823.1 3,761.3 + 1.6

Region

Western 804.3 846.6 - 5.0 1,861.4 1,911.2 - 2.6

Region

Markets & 4,002.3 3,988.3 + 0.4 9,407.4 9,515.1 - 1.1

Airlines

All other 72.5 138.9 - 47.8 345.4 427.6 - 19.2

segments

TUI Group 4,745.0 4,576.7 + 3.7 11,421.4 11,142.6 + 2.5

TUI Group 4,776.7 4,576.7 + 4.4 11,454.6 11,142.6 + 2.8

at constant

currency

Underlying EBITA

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Hotels & 91.5 72.4 + 26.4 226.9 244.7 - 7.3

Resorts

Cruises 101.5 88.7 + 14.4 207.9 182.4 + 14.0

Destination 15.3 17.4 - 12.1 4.9 4.1 + 19.5

Experiences

Holiday 208.3 178.5 + 16.7 439.7 431.2 + 2.0

Experiences

Northern - 58.6 14.2 n. a. - 263.7 - 111.6 - 136.3

Region

Central 8.2 31.5 - 74.0 - 119.6 - 113.2 - 5.7

Region

Western - 53.5 - 8.5 - 529.4 - 217.4 - 113.7 - 91.2

Region

Markets & - 103.9 37.2 n. a. - 600.7 - 338.5 - 77.5

Airlines

All other - 3.5 - 28.9 + 87.9 - 38.7 - 75.6 + 48.8

segments

TUI Group 100.9 186.8 - 46.0 - 199.7 17.1 n. a.

TUI Group 98.9 194.6* - 49.2 - 214.5 35.3* n. a.

at constant

currency

* Rebased previous year's numbers adjusted for EUR 8 m and EUR 18 m in 9 m

2018, arising from the revaluation of Euro loan balances within Turkish

hotel entities.

EBITA

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Hotels & 91.5 72.4 + 26.4 226.9 244.6 - 7.2

Resorts

Cruises 101.5 88.7 + 14.4 207.9 182.4 + 14.0

Destination 11.8 16.9 - 30.2 - 7.5 3.0 n. a.

Experiences

Holiday 204.8 178.0 + 15.1 427.3 430.0 - 0.6

Experiences

Northern - 63.2 9.4 n. a. - 290.9 - 125.0 - 132.7

Region

Central 5.1 28.4 - 82.0 - 126.2 - 122.6 - 2.9

Region

Western - 56.6 - 11.5 - 392.2 - 226.6 - 129.7 - 74.7

Region

Markets & - 114.7 26.3 n. a. - 643.7 - 377.3 - 70.6

Airlines

All other - 6.0 - 28.3 + 78.8 - 46.2 - 80.1 + 42.3

segments

TUI Group 84.1 176.0 - 52.2 - 262.6 - 27.4 - 858.4

Discontinued - 41.4 n. a. - 41.4 n. a.

operations

Total 84.1 217.4 - 61.3 - 262.6 14.0 n. a.

Segmental performance

Holiday Experiences

Holiday Experiences

EUR Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

million adjusted adjusted

Turnover 670.2 449.5 + 49.1 1,668.6 1,199.9 + 39.1

Underlying 208.3 178.5 + 16.7 439.7 431.2 + 2.0

EBITA

Underlying 206.8 186.3* + 11.0 426.8 449.4* - 5.0

EBITA at

constant

currency

* Rebased previous year's numbers adjusted for EUR 8 m in Q3 2018 and EUR 18

m in 9 m 2018, arising from the revaluation of Euro loan balances within

Turkish hotel entities.

Hotels & Resorts

Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Total 369.1 334.6 + 10.3 960.4 897.9 + 7.0

turnover

in EUR

million

Turnoverin 154.5 161.0 - 4.0 425.5 448.9 - 5.2

EUR

million

Underlying 91.5 72.4 + 26.4 226.9 244.7 - 7.3

EBITA in

EUR

million

Underlying 90.0 80.21 + 12.2 214.1 262.91 - 18.6

EBITA at

constant

currency

rates in

EUR

million

Capacity 11,922 10,911 + 9.3 28,689 27,103 + 5.9

hotels

total 2 in

'000

Riu 4,665 4,484 + 4.0 13,266 12,917 + 2.7

Robinson 958 823 + 16.3 2,241 2,070 + 8.3

Blue 1,149 944 + 21.6 3,169 2,712 + 16.9

Diamond

Occupancy 79.8 80.2 - 0.4 78.2 78.4 - 0.2

rate

hotels

total 3 in

%

variance

in %

points

Riu 88.9 88.4 + 0.5 85.7 87.1 - 1.4

Robinson 66.9 64.4 + 2.5 67.4 63.6 + 3.8

Blue 77.2 83.4 - 6.2 77.9 80.4 - 2.5

Diamond

Average 60 57 + 5.4 67 64 + 4.0

revenue

per bed

hotels

total 4, 5

in EUR

Riu 58 58 + 0.1 65 65 + 0.2

Robinson 86 86 + 0.5 92 92 - 0.9

Blue 113 104 + 8.0 122 114 + 7.1

Diamond

Turnover measures include fully consolidated companies, all other KPIs incl.

companies measured at equity.

1 Rebased previous year's numbers adjusted for EUR 8 m in Q3 2018 and EUR 18

m in 9 m 2018, arising from the revaluation of Euro loan balances within

Turkish hotel entities.

2 Group owned or leased hotel beds multiplied by opening days per period.

3 Occupied beds divided by capacity.

4 Arrangement revenue divided by occupied beds.

5 Previous year revenue per bed restated to reflect revised PY rate at Blue

Diamond.

· Hotels & Resorts underlying EBITA for Q3 was up EUR 19 m on prior year

at constant currency rates, excluding last year's EUR 8 m gain on

disposals in Riu. Occupancy remained high across the segment at 80 %.

Average revenue per bed increased by 5 %, helped by the shift of demand to

Eastern Mediterranean, reflecting improving rates in Turkey.

· In Riu, as expected from the shift of demand from Western to Eastern

Mediterranean, underlying EBITA decreased year on year as Riu came off

record highs. Additionally, last year benefitted from EUR 8 m disposal

proceeds in the same period. In spite of this destination shift, occupancy

at Riu increased by 1 ppts to 89 %. Average rate remained at EUR 58.

· Robinson saw a good operational performance in the quarter with

occupancy increasing by 3 ppts to 67 % and average rate of EUR 86 in line

with prior year. This was driven by increased demand for our clubs in

Turkey, and the benefit of reopening our flagship club Jandia Playa in

Fuerteventura, which was closed for renovation in the prior year.

Underlying EBITA increased by EUR 1 m in the period.

· Blue Diamond earnings declined by EUR 4 m in the period due to higher

interest and depreciation costs of our new properties and lower occupancy

rates across the portfolio, particularly in our new openings. Occupancy

rate fell by 6 ppts to 77 %, and average rate is up 2 % excluding FX and

up 8 % including FX.

· As anticipated, our other hotels result increased by EUR 19 m versus

prior year reflecting the return of demand to Turkey, delivering improving

rates and occupancy.

· Since merger, 67 new hotels have been opened, 66 % of which are in lower

capital intensity models (managed, franchised or owned via joint venture).

Cruises

Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Turnover1 256.3 222.7 + 15.1 680.9 619.6 + 9.9

in EUR

million

Underlying 101.5 88.7 + 14.4 207.9 182.4 + 14.0

EBITA in

EUR million

Underlying 101.6 88.7 + 14.5 207.9 182.4 + 14.0

EBITA at

constant

currency in

EUR million

Occupancyin

%

variance in

% points

TUI Cruises 99.5 98.8 + 0.6 99.3 99.2 + 0.2

Marella 98.5 100.3 - 1.8 99.7 99.9 - 0.2

Cruises2

Hapag-Lloyd 74.7 75.6 - 0.9 76.3 76.1 + 0.2

Cruises

Passenger

daysin '000

TUI Cruises 1,609 1,239 + 29.9 4,427 3,753 + 18.0

Marella 906 799 + 13.4 2,348 2,050 + 14.6

Cruises2

Hapag-Lloyd 81 87 - 5.9 232 254 - 8.8

Cruises

Average

daily rates

3 in EUR

TUI Cruises 190 200 - 5.1 163 165 - 1.4

Marella 144 138 + 4.8 144 135 + 6.9

Cruises 2,

4 in GBP

Hapag-Lloyd 584 571 + 2.3 620 590 + 5.1

Cruises

1 No turnover is carried for TUI Cruises as the joint venture is

consolidated at equity.

2 Rebranded from Thomson Cruises in October 2017.

3 Per day and passenger.

4 Inclusive of transfers, flights and hotels due to the integrated nature of

Marella Cruises.

· Cruises underlying EBITA increased by EUR 13 m in Q3. All three brands

saw growth in the quarter from additional capacity versus prior year.

· TUI Cruises result was up by EUR 9 m versus prior year. As expected, the

increase in capacity of 30 % (new Mein Schiff 1 launched H2 FY18 and new

Mein Schiff 2 launched Q2 FY19) helped to deliver a strong contribution in

the quarter. Average daily rate was down 5 % to EUR 190 compared to prior

year, which reflects in part our itinerary mix and the significant

increase in German ocean cruise capacity this year.

· Marella Cruises underlying EBITA was up by EUR 3 m reflecting the

addition of Marella Explorer 2 launched in May and average daily rate

increasing by 5 %. The result was partially offset by the exit of Marella

Spirit in Q1 of this financial year.

· Hapag-Lloyd Cruises underlying EBITA increased by EUR 1 m on prior year,

driven by average daily rate up 2 % across the fleet and the new Hanseatic

nature joining the fleet in May, partially offset by the exit of Hanseatic

at the start of FY19.

Destination Experiences

EUR Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

million adjusted adjusted

Total 379.7 143.8 + 164.0 797.5 288.2 + 176.7

turnover

Turnover 259.4 65.8 + 294.2 562.2 131.4 + 327.9

Underlying 15.3 17.4 - 12.1 4.9 4.1 + 19.5

EBITA

Underlying 15.2 17.4 - 12.6 4.8 4.1 + 17.1

EBITA at

constant

currency

· Q3 earnings growth, as in H1, was driven by the integration of last

year's acquisition of Destination Management, offset partly by start-up

losses in Musement.

· The number of excursions and activities sold in Q3 almost doubled versus

prior year, reflecting the acquisition of Destination Management and

Musement.

Markets & Airlines

Markets & Airlines

Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Turnoverin 4,002.3 3,988.3 + 0.4 9,407.4 9,515.1 - 1.1

EUR

million

Underlying - 103.9 37.2 n. a. - 600.7 - 338.5 - 77.5

EBITA in

EUR

million

Underlying - 103.2 37.2 n. a. - 599.1 - 338.5 - 77.0

EBITA at

constant

currency

in EUR

million

Direct 74 74 - 74 74 -

distributi

on mix1 in

%

variance

in %

points

Online 48 47 + 1 49 48 + 1

mix2 in %

variance

in %

points

Customers3 6,028 6,024 + 0.1 12,574 12,732 - 1.2

in '000

1 Share of sales via own channels (retail and online).

2 Share of online sales.

3 In Q1 2019, the Italian tour operators were transferred from All other

segments to the Central Region. In addition, the Crystal Ski companies,

which provide services in the destinations, were reclassified from Northern

Region to Destination Experiences.

· As expected, the Markets & Airlines Q3 result reflects tougher prior

year comparables (pre-heatwave), the flagged grounding costs for the

Boeing 737 MAX, the continued weaker consumer confidence due to continued

Brexit uncertainty, the knock-on impact of the Summer 2018 heatwave

resulting in delayed customer bookings, compounded by reduced pricing and

margin pressure from overcapacities to Spain.

Northern Region

Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Turnover 1,599.6 1,616.0 - 1.0 3,722.9 3,842.6 - 3.1

in EUR

million

Underlying - 58.6 14.2 n. a. - 263.7 - 111.6 - 136.3

EBITA in

EUR

million

Underlying - 57.8 14.2 n. a. - 262.0 - 111.6 - 134.8

EBITA at

constant

currency

in EUR

million

Direct 94 94 - 93 93 -

distributi

on mix1 in

%

variance

in %

points

Online 66 65 + 1 67 65 + 2

mix2 in %

variance

in %

points

Customers 2,159 2,211 - 2.4 4,405 4,574 - 3.7

in '000

1 Share of sales via own channels (retail and online).

2 Share of online sales.

· In the UK, Q3 demand continued in the same theme as we saw during the

first half, impacted by the same factors as outlined above, with no

external change to this environment. Customer volumes declined 1 % on

prior year, improving from the 5 % decline in H1, however margins remain

significantly lower versus prior year.

· For the Nordics, customer numbers saw a slight improvement, down 6 % for

the third quarter, up from 8 % down in the first half. As previously

communicated, the Nordics saw an acute knock-on impact from last Summer's

heatwave, with the region additionally influenced by the environmental

discussions which has continued to weigh on customer decisions to travel.

· Share of earnings for Canada decreased by EUR 8 m in the quarter,

reflecting 737 MAX grounding costs.

· Northern Region benefitted from the later Easter timing of EUR 14 m in

the quarter, however this was fully offset by the grounding of the 737

MAX, costing the region EUR 84 m, with overall underlying EBITA declining

by EUR 73 m.

Central Region

Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Turnoverin 1,598.4 1,525.7 + 4.8 3,823.1 3,761.3 + 1.6

EUR

million

Underlying 8.2 31.5 - 74.0 - 119.6 - 113.2 - 5.7

EBITA in

EUR

million

Underlying 8.1 31.5 - 74.3 - 119.7 - 113.2 - 5.7

EBITA at

constant

currency

in EUR

million

Direct 50 49 + 1 50 50 -

distributi

on mix1 in

%

variance

in %

points

Online 22 21 + 1 21 21 -

mix2 in %

variance

in %

points

Customers3 2,249 2,170 + 3.6 4,629 4,605 + 0.5

in '000

1 Share of sales via own channels (retail and online).

2 Share of online sales.

3 In Q1 2019, the Italian tour operators were transferred from All other

segments to the Central Region. Prior-year figures were adjusted

accordingly.

· The Q3 result, driven primarily by Germany, saw a decline in underlying

EBITA versus prior year, with the benefit of later Easter timing of EUR 7

m and positive trading in the region fully offset by replacement 737 MAX

aircraft costs of EUR 17 m.

· Customer volumes for Central Region increased by 4 % in Q3, reflecting

the solid recovery in German customer bookings and the continued strong

volume increase in Poland as we continue to drive growth in this market.

· Distribution continues to be key to improving this low margin region.

Both direct and online distribution for the Central Region grew by 1 ppt

to 50 % and 22 % respectively.

Western Region

Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Turnoverin 804.3 846.6 - 5.0 1,861.4 1,911.2 - 2.6

EUR

million

Underlying - 53.5 - 8.5 - 529.4 - 217.4 - 113.7 - 91.2

EBITA in

EUR

million

Underlying - 53.5 - 8.5 - 529.4 - 217.4 - 113.7 - 91.2

EBITA at

constant

currency

in EUR

million

Direct 75 73 + 2 75 74 + 1

distributi

on mix1 in

%

variance

in %

points

Online 56 53 + 3 58 56 + 2

mix2 in %

variance

in %

points

Customers 1,620 1,642 - 1.3 3,539 3,553 - 0.4

in '000

1 Share of sales via own channels (retail and online).

2 Share of online sales.

· Western Region underlying EBITA was down EUR 45 m versus prior year,

with little recovery in trading and margin remaining weak.

· In Belgium, customer numbers improved by 3 % in the quarter driven

largely by seat-only customers, with tour operator customers and

underlying EBITA contribution down.

· In the Netherlands, customer volumes were down 4 % year on year, with

pricing and margin remaining weak throughout the period.

· France, despite our best efforts to turn this region around, has

experienced a contracting market, reducing the impact of our rebranding

campaign last year. The knock-on impact of the extraordinary hot Summer

last year continues to be a factor, with recent good weather in the region

negatively impacting trading further.

· Timing of Easter added EUR 1 m contribution to the quarter with the 737

MAX grounding costing the region EUR 43 m.

All other segments

EUR Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

million adjusted adjusted

Turnover 72.5 138.9 - 47.8 345.4 427.6 - 19.2

Underlying - 3.5 - 28.9 + 87.9 - 38.7 - 75.6 + 48.8

EBITA

Underlying - 4.7 - 28.9 + 83.7 - 42.2 - 75.6 + 44.2

EBITA at

constant

currency

· The result for All other segments improved due to the phasing of Head

Office costs year on year, which will be weighted towards the final

quarter this year.

· On 18 March 2019 TUI announced the disposal of a majority stake in

Corsair. The non-repeat of Corsair Q3 losses helped to deliver a benefit

in the All other segments result. On a FY basis, Corsair will show a

negative impact versus prior year as positive Q4 earnings contribution

will not be consolidated in this financial year's results.

Cash flow / Net capex and investments / Net financial position

The cash inflow from operating activities decreased by EUR 578.7 m to EUR

700.8 m. As well as the lower earnings in 9M 2019. This was mainly driven by

lower customer deposits from a later booking behaviour and higher

prepayments.

Net debt is defined as financial debt less cash and cash equivalents and

future short-term interest-bearing investments. As expected, net debt as at

30 June 2019 reflects the full utilisation of proceeds of disposals received

over the past few years and the increase in financing related to our cruise

and aircraft re-fleeting programme.

Net financial position

30 Jun 2019 30 Jun 2018 Var. %

Financial debt - 2,637.0 - 2,030.5 - 29.9

Cash and cash equivalents 1,564.9 2,598.0 - 39.8

Short-term interest-bearing 77.5 21.9 + 253.9

investments

Net debt / net cash - 994.6 589.4 n. a.

Net capex and investments

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Cash gross

capex

Hotels & 73.7 78.8 - 6.5 260.3 193.9 + 34.2

Resorts

Cruises 25.4 185.5 - 86.3 225.4 223.6 + 0.8

Destination 3.2 3.3 - 3.0 12.8 6.2 + 106.5

Experiences

Holiday 102.3 267.6 - 61.8 498.5 423.7 + 17.7

Experiences

Northern 10.5 19.6 - 46.4 41.0 43.0 - 4.7

Region

Central 8.8 5.3 + 66.0 23.4 15.5 + 51.0

Region

Western 3.9 12.1 - 67.8 24.9 25.1 - 0.8

Region

Markets & 23.2 37.0 - 37.3 89.3 83.6 + 6.8

Airlines

All other 17.4 23.7 - 26.6 98.6 116.5 - 15.4

segments

TUI Group 142.9 328.3 - 56.5 686.4 623.8 + 10.0

Net pre 56.2 37.9 + 48.3 1.9 17.7 - 89.3

delivery

payments on

aircraft

Financial 64.1 55.8 + 14.9 210.8 80.0 + 163.5

investments

Divestments - 24.3 - 43.6 + 44.3 - 8.7 - 135.8 + 93.6

Net capex 238.9 378.4 - 36.9 890.4 585.7 + 52.0

and

investments

The increase in net capex and investments in 9M 2019 was mainly driven by

the acquisition of Marella Explorer 2, openings in Hotels & Resorts related

to our core hotel brands Riu, Robinson and TUI Blue as well as the openings

of the online platform Musement and further companies from Hotelbeds. The

development of divestments was related to the sale of the majority stake in

Corsair, while the prior-year figure included the sale of three Riu

entities.

Foreign exchange / Fuel

Our strategy of hedging the majority of our jet fuel and currency

requirements for future seasons, as detailed below, remains unchanged. This

gives us certainty of costs when planning capacity and pricing. The

following table shows the percentage of our forecast requirement that is

currently hedged for Euros, US Dollars and jet fuel for our Markets &

Airlines division, which account for over 90 % of our Group currency and

fuel exposure.

Foreign Exchange / Fuel

Summer 2019 Winter 2019 / 20 Summer 2020

%

Euro 103 77 38

US Dollar 94 83 56

Jet fuel 95 92 72

As at 8 August 2019.

Interim financial statements

Financial position of the TUI Group as at 30 Jun 2019

EUR million 30 Jun 2019 30 Sep 2018 1 Oct 2017

adjusted* adjusted*

Assets

Goodwill 2,974.7 2,913.1 2,889.5

Other intangible 673.5 643.2 548.1

assets

Property, plant 5,651.9 4,876.3 4,253.7

and equipment

Investments in 1,476.4 1,402.3 1,284.1

joint ventures

and associates

Trade and other 62.5 103.3 138.7

receivables

Derivative 44.6 83.2 79.9

financial

instruments

Other financial 44.8 54.3 69.5

assets

Touristic 192.0 157.3 185.2

payments on

account

Other 261.2 184.4 73.1

non-financial

assets

Income tax assets 9.6 9.6 -

Deferred tax 331.2 228.0 326.0

assets

Non-current 11,722.4 10,655.0 9,847.8

assets

Inventories 124.0 118.5 110.2

Trade and other 810.3 821.9 700.9

receivables

Derivative 280.3 441.8 215.4

financial

instruments

Other financial 77.5 18.7 11.9

assets

Touristic 1,596.2 731.3 583.9

payments on

account

Other 129.4 140.2 81.7

non-financial

assets

Income tax assets 139.3 114.1 98.7

Cash and cash 1,564.9 2,548.0 2,516.1

equivalents

Assets held for - 5.5 9.6

sale

Current assets 4,721.9 4,940.0 4,328.4

Total assets 16,444.3 15,595.0 14,176.2

* Prior-year figures adjusted due to retrospective application of IFRS 15

and PPA adjustments.

Financial position of the TUI Group as at 30 Jun 2019

EUR million 30 Jun 2019 30 Sep 2018 1 Oct 2017

adjusted* adjusted*

Equity and

liabilities

Subscribed capital 1,502.9 1,502.9 1,501.6

Capital reserves 4,200.5 4,200.5 4,195.0

Revenue reserves - 3,143.4 - 2,058.4 - 2,798.3

Equity before 2,560.0 3,645.0 2,898.3

non-controlling

interest

Non-controlling 698.2 634.8 594.0

interest

Equity 3,258.2 4,279.8 3,492.3

Pension provisions 1,049.0 962.2 1,094.7

and similar

obligations

Other provisions 693.5 768.1 801.4

Non-current 1,742.5 1,730.3 1,896.1

provisions

Financial 2,435.0 2,250.7 1,761.2

liabilities

Derivative financial 53.2 12.8 50.4

instruments

Other financial 20.9 14.4 43.9

liabilities

Other non-financial 90.0 89.0 106.3

liabilities

Touristic advance 0.1 - -

payments received

Income tax 69.3 108.8 150.2

liabilities

Deferred tax 116.3 187.9 106.4

liabilities

Non-current 2,784.8 2,663.6 2,218.4

liabilities

Non-current 4,527.3 4,393.9 4,114.5

provisions and

liabilities

Pension provisions 29.8 32.6 32.7

and similar

obligations

Other provisions 333.0 348.3 349.9

Current provisions 362.8 380.9 382.6

Financial 202.0 192.2 171.9

liabilities

Trade payables 2,331.0 2,692.5 2,433.1

Derivative financial 110.6 65.7 217.2

instruments

Other financial 101.8 93.3 103.8

liabilities

Touristic advance 4,985.4 2,824.8 2,700.4

payments received

Other non-financial 497.2 585.7 495.1

liabilities

Income tax 68.0 86.2 65.3

liabilities

Current liabilities 8,296.0 6,540.4 6,186.8

Current provisions 8,658.8 6,921.3 6,569.4

and liabilities

Total provisions and 16,444.3 15,595.0 14,176.2

liabilities

* Prior-year figures adjusted due to retrospective application of IFRS 15

and PPA adjustments.

Income statement of the TUI Group for the period from 1

Oct 2018 to 30 Jun 2019

EUR million Q3 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

2019 adjusted* adjusted*

Turnover 4,745. 4,576.7 3.7 11,421. 11,142.6 2.5

0 4

Cost of sales 4,459. 4,188.3 6.5 10,979. 10,476.9 4.8

2 1

Gross profit 285.8 388.4 - 26.4 442.3 665.7 - 33.6

Administrative 282.0 300.9 - 6.3 920.2 921.6 - 0.2

expenses

Other income 1.6 13.4 - 88.1 14.5 62.0 - 76.6

Other expenses 2.1 1.6 31.3 16.0 1.9 742.1

Impairment of - 7.0 1.2 n. a. - 9.8 28.2 n. a.

financial

assets

Financial 11.7 23.6 - 50.4 81.6 41.3 97.6

income

Financial 39.8 56.5 - 29.6 118.9 124.6 - 4.6

expenses

Share of 76.7 75.7 1.3 184.0 189.9 - 3.1

result of

joint ventures

and associates

Earnings 58.9 140.9 - 58.2 - 322.9 - 117.4 - 175.0

before income

taxes

Income taxes 11.6 36.1 - 67.9 - 82.5 - 11.6 - 611.2

Result from 47.3 104.8 - 54.9 - 240.4 - 105.8 - 127.2

continuing

operations

Result from - 41.4 n. a. - 41.4 n. a.

discontinued

operations

Group profit / 47.3 146.2 - 67.6 - 240.4 - 64.4 - 273.3

loss for the

year

Group profit / 21.7 140.6 - 84.6 - 320.1 - 140.3 - 128.2

loss for the

year

attributable

to

shareholders

of TUI AG

Group profit / 25.6 5.6 357.1 79.7 75.9 5.0

loss for the

year

attributable

to

non-controllin

g

interest

* Prior-year figures adjusted due to retrospective application of IFRS 15

and previous year's structure was adjusted due to the first time application

of IFRS 9.

Condensed cash flow statement of the TUI Group

EUR million 9M 2019 9M 2018

Cash inflow from operating activities 700.8 1,279.5

Cash outflow from investing activities - 948.8 - 584.8

Cash outflow from financing activities - 718.2 - 573.6

Net change in cash and cash equivalents - 966.2 121.1

Change in cash and cash equivalents due to - 17.7 - 39.2

exchange rate fluctuation

Change in cash and cash equivalents due to + 0.8 -

changes in the group

of consolidated companies

Cash and cash equivalents at beginning of 2,548.0 2,516.1

period

Cash and cash equivalents at end of period 1,564.9 2,598.0

Alternative performance measures

Key indicators used to manage the TUI Group are underlying EBITA and EBITA.

EBITA comprises earnings before interest, taxes and goodwill impairments.

EBITA includes amortisation of other intangible assets. It does not include

the result from the measurement of interest hedges.

Underlying EBITA has been adjusted for gains on disposal of financial

investments, restructuring expenses according to IAS 37, all effects from

purchase price allocations, ancillary acquisition costs and conditional

purchase price payments and other expenses for and income from one-off

items.

The table below shows a reconciliation of earnings before taxes from

continuing operations to underlying earnings.

Reconciliation to underlying EBITA (continuing operations)

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted* adjusted*

Earnings 58.9 140.9 - 58.2 - 322.9 - 117.4 - 175.0

before

income

taxes*

plus: Net 26.0 36.7 - 29.2 58.7 88.5 - 33.7

interest

expense

less: Income - 0.8 - 1.6 50.0 1.6 1.5 6.7

/ plus:

Expense from

the

measurement

of interest

hedges

EBITA* 84.1 176.0 - 52.2 - 262.6 - 27.4 - 858.4

Adjustments:

plus: Losses 0.6 - 0.6 11.7 - 0.6

/ less:

Profit on

disposals

plus: 0.8 0.9 2.4 14.3

Restructurin

g expense

plus: 8.9 6.7 27.7 21.7

Expense from

purchase

price

allocation

plus: 6.5 3.8 21.1 9.1

Expense from

other

one-off

items

Underlying 100.9 186.8 - 46.0 - 199.7 17.1 n. a.

EBITA*

* Prior-year figures adjusted due to retrospective application of IFRS 15.

One-off items carried here include adjustments for income and expense items

that reflect amounts and frequencies of occurrence rendering an evaluation

of the operating profitability of the segments and the Group more difficult

or causing distortions. These items include in particular major

restructuring and integration expenses not meeting the criteria of IAS 37,

material expenses for litigation, gains and losses from the sale of aircraft

and other material business transactions with a one-off character.

In the first nine months, adjustments (including individual items and

purchase price allocations) totalling EUR 62.9 m (previous year: EUR 44.5 m)

were made. The individual items adjusted in the period under review mainly

relate to one-off expenses in connection with the conversion of the pension

plan in the United Kingdom to a defined contribution plan and the loss on

the Corsair disposal. In the prior-year period, in addition to expenses from

purchase price allocations, restructuring costs for the integration of

Transat in France and the restructuring of our German airline in particular

had to be adjusted.

The TUI Group's underlying EBITA declined by EUR 216.8 m to a loss of EUR-

199.7 m.

Key figures of income statement (continuing operations)

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Earnings 396.9 459.9 - 13.7 634.6 794.7 - 20.1

before

interest,

income

taxes,

depreciation

, impairment

and rent

(EBITDAR)

Operating 186.5 178.7 + 4.4 530.9 509.3 + 4.2

rental

expenses

Earnings 210.4 281.2 - 25.2 103.7 285.4 - 63.7

before

interest,

income

taxes,

depreciation

and

impairment

(EBITDA)

Depreciation 126.3 105.2 + 20.1 366.3 312.8 + 17.1

/

amortisation

less

reversals

of

depreciation

*

Earnings 84.1 176.0 - 52.2 - 262.6 - 27.4 - 858.4

before

interest,

income taxes

and

impairment

of goodwill

(EBITA)

Earnings 84.1 176.0 - 52.2 - 262.6 - 27.4 - 858.4

before

interest and

income taxes

(EBIT)

Expense from 0.8 1.6 - 50.0 - 1.6 - 1.5 - 6.7

the

measurement

of interest

hedges

Net interest - 26.0 - 36.7 + 29.2 - 58.7 - 88.5 + 33.7

expense

Earnings 58.9 140.9 - 58.2 - 322.9 - 117.4 - 175.0

before

income taxes

(EBT)

* On property, plant and equipment, intangible assets, financial and other

assets.

Other segment indicators

Underlying EBITDA

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Hotels & 118.9 96.9 + 22.7 305.0 318.5 - 4.2

Resorts

Cruises 127.0 107.4 + 18.2 273.6 234.5 + 16.7

Destination 19.0 19.7 - 3.6 16.4 10.6 + 54.7

Experiences

Holiday 264.9 224.0 + 18.3 595.0 563.6 + 5.6

Experiences

Northern - 43.1 26.0 n. a. - 222.3 - 76.7 - 189.8

Region

Central 13.4 36.6 - 63.4 - 103.1 - 98.1 - 5.1

Region

Western - 48.4 - 5.3 - 813.2 - 202.4 - 102.3 - 97.8

Region

Markets & - 78.1 57.3 n. a. - 527.8 - 277.1 - 90.5

Airlines

All other 32.5 5.7 + 470.2 74.6 26.0 + 186.9

segments

TUI Group 219.3 287.0 - 23.6 141.8 312.5 - 54.6

EBITDA

EUR million Q3 2019 Q3 2018 Var. % 9M 2019 9M 2018 Var. %

adjusted adjusted

Hotels & 118.9 96.9 + 22.7 304.9 318.4 - 4.2

Resorts

Cruises 127.0 107.4 + 18.2 273.6 234.5 + 16.7

Destination 17.9 19.1 - 6.3 11.5 9.5 + 21.1

Experiences

Holiday 263.8 223.4 + 18.1 590.0 562.4 + 4.9

Experiences

Northern - 44.7 24.1 n. a. - 240.6 - 81.3 - 195.9

Region

Central 11.2 34.3 - 67.3 - 107.4 - 105.1 - 2.2

Region

Western - 50.4 - 7.1 - 609.9 - 208.3 - 115.0 - 81.1

Region

Markets & - 83.9 51.3 n. a. - 556.3 - 301.4 - 84.6

Airlines

All other 30.5 6.5 + 369.2 70.0 24.4 + 186.9

segments

TUI Group 210.4 281.2 - 25.2 103.7 285.4 - 63.7

Discontinued - 41.4 n. a. - 41.4 n. a.

operations

Total 210.4 322.6 - 34.8 103.7 326.8 - 68.3

Employees

30 Jun 2019 30 Jun 2018 Var. %

adjusted

Hotels & Resorts 29,363 27,173 + 8.1

Cruises* 349 304 + 14.8

Destination Experiences 9,863 6,223 + 58.5

Holiday Experiences 39,575 33,700 + 17.4

Northern Region 12,652 12,537 + 0.9

Central Region 10,653 10,485 + 1.6

Western Region 6,620 6,614 + 0.1

Markets & Airlines 29,925 29,636 + 1.0

All other segments 2,347 3,296 - 28.8

TUI Group 71,847 66,632 + 7.8

* Excludes TUI Cruises (JV) employees. Cruises employees are primarily hired

by external crew management agencies.

Cautionary statement regarding forward-looking statements

The present Quarterly Statement contains various statements relating to

TUI's future development. These statements are based on assumptions and

estimates. Although we are convinced that these forward-looking statements

are realistic, they are not guarantees of future performance since our

assumptions involve risks and uncertainties that could cause actual results

to differ materially from those anticipated. Such factors include market

fluctuations, the development of world market prices for commodities and

exchange rates or fundamental changes in the economic environment. TUI does

not intend to and does not undertake any obligation to update any

forward-looking statements in order to reflect events or developments after

the date of this Statement.

ISIN: DE000TUAG000

Category Code: QRT

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

Sequence No.: 16542

EQS News ID: 856195

End of Announcement EQS News Service

(END) Dow Jones Newswires

August 13, 2019 02:00 ET (06:00 GMT)

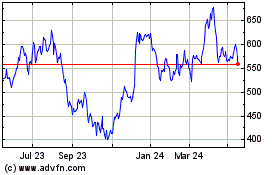

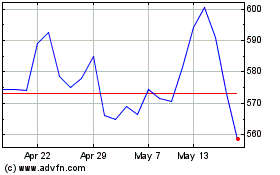

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024