TUI AG: After 737 MAX grounding: TUI secures additional flight capacity to guarantee customers' holidays / Update on guidance... (793413)

March 29 2019 - 3:52AM

UK Regulatory

Dow Jones received a payment from EQS/DGAP to publish this press

release.

TUI AG (TUI)

TUI AG: After 737 MAX grounding: TUI secures additional flight capacity to

guarantee customers' holidays / Update on guidance of underlying EBITA

rebased for FY19

29-March-2019 / 08:52 CET/CEST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

*Inside Information according to article 17 MAR*

*After 737 MAX grounding: TUI secures additional flight capacity to

guarantee customers' holidays / Update on guidance of underlying EBITA1

rebased for FY19*

*Hanover, 29 March 2019*. Following the grounding of the 737 MAX aircraft,

TUI has made arrangements in order to guarantee customers' holidays. The

Group is utilising spare aircraft of its fleet, extending expiring leases

for aircraft that were supposed to be replaced by 737 MAX aircraft, as well

as leasing in additional aircraft. TUI's fleet, which comprises around 150

aircraft, currently includes 15 grounded 737 MAX for the UK, Belgium, the

Netherlands and Sweden. A further eight 737 MAX are scheduled for delivery

by the end of May 2019.

*Considerable uncertainty around when the 737 MAX will return to service*

No dates have yet been announced for modifications of the existing aircraft

model by the manufacturer, neither for approval of such modifications by the

Federal Aviation Administration (FAA) and the European Aviation Safety

Agency (EASA). Therefore, TUI has taken precautions along with other

airlines, covering the time until mid-July, in order to be prepared for the

Easter-, Whitsun- and start of the summer holiday season and to secure

holidays for its customers and their families.

*Update on guidance for underlying EBITA1 rebased*

Assuming 737 MAX flight resumption latest by mid-July, the Group currently

expects to see a one-off impact on underlying EBITA1 rebased of approx. EUR

200m in connection with the 737 MAX grounding. This impact is especially

attributable to costs related to the replacement of aircraft, higher fuel

costs, other disruption costs, and the anticipated impact on trading. As a

result of this one-off impact, the Executive Board of TUI AG has decided

today to update the guidance and now expects an underlying EBITA1 rebasedfor

FY19 of approx. minus 17% (previously 'broadly flat') compared with FY18 of

EUR 1,177m2.

Should it not become clear within the coming weeks that flying the 737 MAX

will resume by mid-July, TUI will need to extend the abovementioned measures

until the end of the summer season. The current assumption for this

additional one-off impact until 30 September 2019 is up to EUR 100m. For

this scenario the Executive Board of TUI AG has also decided today to update

the guidance for the underlying EBITA1 rebasedfor FY19 to up to minus 26%

compared with FY18 of EUR 1,177m2.

*TUI Group's management is holding a conference call on 29 March 2019, at

02:00pm GMT (03:00pm CET) to give more insight on the ad-hoc announcement.

The dial in details for the call will follow in shortly. *

*Contact:*

*Analysts & Investors*

Peter Krueger, Group Director of Strategy, M&A and Investor Relations, Tel:

+49 (0)511 566 1440

Contacts for Analysts and Investors in UK, Ireland and Americas

Sarah Coomes, Head of Investor Relations, Tel: +44 (0)1293 645 827

Hazel Chung, Senior Investor Relations Manager, Tel: +44 (0)1293 645 823

Contacts for Analysts and Investors in Continental Europe, Middle East and

Asia

Nicola Gehrt, Head of Investor Relations, Tel: +49 (0)511 566 1435

Ina Klose, Senior Investor Relations Manager, Tel: +49 (0)511 566 1318

*Media*

Kuzey Alexander Esener, Head of Media Relations, Tel: +49 (0)511 566 6024

FORWARD-LOOKING STATEMENTS

This announcement contains a number of statements related to the future

development of TUI. These statements are based both on assumptions and

estimates. Although we are convinced that these future-related statements

are realistic, we cannot guarantee them, for our assumptions involve risks

and uncertainties which may give rise to situations in which the actual

results differ substantially from the expected ones. The potential reasons

for such differences include market fluctuations, the development of world

market fluctuations, the development of world market commodity prices, the

development of exchange rates or fundamental changes in the economic

environment. TUI does not intend or assume any obligation to update any

forward-looking statement to reflect events or circumstances after the date

of this announcement.

1 Underlying EBITA has been adjusted for gains/losses on disposal of

investments, restructuring costs according to IAS 37, ancillary acquisition

costs and conditional purchase price payments under purchase price

allocations and other expenses for and income from one-off items. EBITA

comprises earnings before interest, taxes and goodwill impairments. It

includes amortisation of other intangible assets and it does not include the

result from the measurement of interest hedges.

2 Rebased in December 2018 to EUR 1,187m to take into account EUR 40m impact

for revaluation of Euro loans balances within Turkish Lira entities in FY18

and further rebased to EUR 1,177m for retrospective application of IFRS 15.

Contact:

Peter Krueger, Member of the Group Executive Committee - Group Director

Strategy, M&A & Investor Relations, Tel: +49 (0)511 566 1425

Contacts for Analysts and Investors in UK, Ireland and Americas

Sarah Coomes, Head of Investor Relations, Tel: +44 (0)1293 645 827

Hazel Chung, Investor Relations Manager, Tel: +44 (0)1293 645 823

Contacts for Analysts and Investors in Continental Europe, Middle East and

Asia

Nicola Gehrt, Head of Investor Relations, Tel: +49 (0)511 566 1435

Ina Klose, Investor Relations Manager, Tel: +49 (0)511 566 1318

ISIN: DE000TUAG000

Category Code: MSCU

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

OAM Categories: 2.2. Inside information

Sequence No.: 7992

EQS News ID: 793413

End of Announcement EQS News Service

(END) Dow Jones Newswires

March 29, 2019 03:52 ET (07:52 GMT)

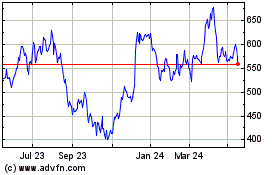

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

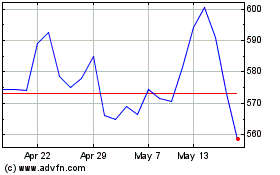

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024