Dow Jones received a payment from EQS/DGAP to publish this press

release.

TUI AG (TUI)

TUI AG: Annual Financial Report - Part 1

13-Dec-2018 / 08:00 CET/CEST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

13 December 2018

TUI GROUP

Full year results to 30 September 2018

HIGHLIGHTS

? Fourth consecutive year of double-digit earnings growth post-merger,

with 10.9% increase in underlying EBITA1 and continued strong ROIC

performance.

? TUI's sustained strong performance in a challenging market environment

demonstrates its successful transformation as an integrated provider of

holiday experiences, with strong strategic positioning and double

diversification across destinations and markets.

? Looking ahead, we continue to expect to deliver superior annual earnings

growth with improved seasonality, strong cash conversion and strong ROIC

performance. This will be driven by the benefits of our digitalisation

efforts, efficiency measures and differentiation strategy through the

disciplined expansion of own hotel and cruise offering, plus destination

experience content.

? Based on our growth strategy, we reiterate our guidance of at least 10%

CAGR in underlying EBITA for the three years to FY201,2. In the nearer

term, we expect to deliver at least 10% underlying EBITA growth in

FY191,3, with growth from investments, digitalisation and efficiency, as

well as our double-diversified business model, helping to mitigate market

challenges.

KEY FINANCIALS

Year ended

30

September

EURm 2018 2017 Change Constant

currency

change1

Turnover 19,524 18,535 +5.3% +6.3%

Underlying 1,147 1,102 +4.1% +10.9%

EBITA4

Reported 1,060 1,027 +3.3% +10.4%

EBITA5

Underlying 1.17 1.14 +2.6% +10.5%

earnings

per share6

Earnings 972 1,080 -10.0% -3.7%

before tax7

Group 732 645 +13.6% +22.7%

profit

attributabl

e to

shareholder

s of TUI AG

Leverage 2.7 times 2.5 times -0.2 times n/a

ratio8

Return on 23.0% 23.6% -0.6% points n/a

invested

capital

(ROIC)9

Dividend EUR0.72 EUR0.65 +10.9% n/a

per share

1 Based on constant currency growth

2 Three year CAGR from FY17 base to FY20

3 The FY18 base for underlying EBITA guidance is EUR1,187m, which excludes

EUR40m adverse impact from the revaluation of Euro loan balances in Turkish

hotel entities.

4 Underlying EBITA has been adjusted for gains/losses on disposal of

investments, restructuring costs according to IAS 37, ancillary acquisition

costs, conditional purchase price payments under purchase price allocations,

amortisation of intangibles from purchase price allocations, and other

expenses and income from one-off items

5 Reported EBITA comprises earnings before net interest result, income tax

and impairment of goodwill and excluding the result from the measurement of

interest hedges

6 For calculation of underlying earnings per share please refer to page 39

of the Annual Report

7 For reconciliation of earnings before tax to underlying EBITA, please

refer to page 65 of the Annual Report

8 Leverage ratio is calculated as the ratio of gross debt (including net

pension liabilities and discounted value of operating leases) to reported

EBITDAR

9 ROIC (return on invested capital) is calculated as the ratio of underlying

EBITA to the average for invested interest bearing capital for the Group or

relevant segment

Annual Report and Investor & Analyst Presentation and Webcast

A full copy of our Annual Report can be found on our corporate website:

http://www.tuigroup.com/en-en/investors [1]. A presentation and webcast for

investors and analysts will take place today at 09:30 GMT / 10:30 CET. The

presentation will be made available via our website beforehand. Details of

the webcast, which will be available for replay, will also be available

there.

FY18 RESULTS

? We have delivered a fourth consecutive year of strong earnings growth,

with underlying EBITA increasing to EUR1,147m, up 10.9% on prior year at

constant currency rates. This sustained strong performance demonstrates

TUI's successful transformation as an integrated provider of holiday

experiences, with strong strategic positioning and double diversification

across markets and destinations.

In EURm

Underlying EBITA FY17 1,102

Holiday Experiences +176

Markets & Airlines (formerly Sales & Marketing) -44

All other segments -22

Riu gains on hotel disposals (net of lost earnings) +43

Niki bankruptcy -20

Airline disruption -13

Underlying EBITA FY18 excluding FX translation 1,222

Foreign exchange translation10 -75

Underlying EBITA FY18 1,147

Rebase for Turkish revaluations +40

FY18 rebased for FY19 guidance 1,187

10 Includes EUR40m adverse non-cash impact from the revaluation of Euro loan

balances within Turkish hotel entities. The adverse impact was driven by the

weaker Turkish Lira. The FY18 base for underlying EBITA guidance is

EUR1,187m, which excludes this impact

? The significant growth in underlying EBITA was driven by a strong

Holiday Experiences performance, with continued high demand for our

portfolio of hotels and clubs, cruises and destination experiences.

Markets & Airlines delivered 4.7% growth in customers, further increases

in direct and online distribution, and with all markets now successfully

rebranded as TUI. As previously flagged in our Q3 results and pre-close

trading statement, the ability of Markets & Airlines to outperform was

limited by the prolonged hot weather this Summer in Northern Europe and

significant levels of airline disruption, in what continues to be a

challenging market environment.

Underlying FY18 at FY17 Variance at FY18 at Variance at

EBITA in EURm constant constant actual actual

currency currency rates rates

rates1 rates

Hotels & 494.5 356.5 +138.0 425.7 +69.2

Resorts

Cruises 324.6 255.6 +69.0 324.0 +68.4

Destination 46.9 35.1 +11.8 44.7 +9.6

Experiences

Holiday 866.0 647.2 +218.8 794.4 +147.2

Experiences

Northern 251.1 345.8 -94.7 254.1 -91.7

Region

Central Region 89.4 71.5 +17.9 89.1 +17.6

Western Region 109.3 109.2 +0.1 109.3 +0.1

Markets & 449.8 526.5 -76.7 452.5 -74.0

Airlines

All other -94.1 -71.6 -22.5 -99.9 -28.3

segments

Total TUI 1,221.7 1,102.1 +119.6 1,147.0 +44.9

Group

? Hotels & Resorts delivered strong earnings growth, with segmental ROIC

increasing to 14.5% (versus segmental WACC of 7.9%).

? Our portfolio strategy continues to pay off - the increase in earnings

(excluding net gains on disposals) was driven by a significant

improvement in earnings in our Turkish and North African hotels, as

demand increased significantly, as well as strong demand for Greece and

continued high demand for the Caribbean. Spain remains a key

destination, with demand normalising as expected in FY18.

? Occupancy rate increased from 79% to 83%, and average rate per bed by

2%.

? ROIC increased for the fourth successive year to 14.5%, demonstrating

the attractiveness of our portfolio of hotel and club brands across

multiple destinations, the benefit of having high levels of our own

distribution, and our disciplined approach to investment.

? We have opened 44 hotels since merger. Around 60% of these openings

are lower capital intensity (management contracts and 50% of owned

hotels due to joint venture structures). We remain on track to open

around 60 new hotels by the end of FY19.

? For further commentary on Hotels & Resorts, please see page 68 of the

Annual Report.

? Cruise delivered another year of strong growth, with record ROIC of

22.8% (versus segmental WACC of 6.2%).

? Growth was driven by new ship launches in Germany and UK, with

continued high occupancy and average daily rates across the fleets.

? Average daily rates increased across all three fleets, despite the

increase in capacity, demonstrating the strength of demand for our

brands.

? Segmental ROIC grew to a record 22.8%, reflecting our equity

participation in TUI Cruises as well as strong performances by our

Marella Cruises and Hapag-Lloyd Cruises subsidiaries.

? For further commentary on Cruise, please see page 69 of the Annual

Report.

? Destination Experiences delivered a significant increase in underlying

EBITA, with a strong ROIC of 26%.

? Performance was driven by higher volumes in Turkey, Greece and North

Africa, efficiencies in Spain, Portugal and Greece, and the inclusion of

earnings of Destination Management following completion of the

acquisition from Hotelbeds in August 2018.

? For further commentary on Destination Experiences, please see page 70

of the Annual Report.

? Markets & Airlines (formerly Sales & Marketing) delivered further growth

in customer volumes, as well as growth in earnings in several source

markets, in a challenging market environment.

? Despite the Summer heatwave and airline disruption, we delivered

earnings growth in several source markets, as well as an overall 4.7%

increase in customer volumes.

? Direct and online distribution mix increased to 74% (from 73%) and 48%

(from 46%) respectively, and the TUI rebrand has now been successfully

completed in all relevant markets.

? Continued high net promoter score of 50, demonstrating the strength of

our customer offer and focus on their holiday experience.

? We are focused on delivering further efficiency improvements through

the harmonisation of our three regional businesses, as well as the

benefits of digitalisation. Having successfully delivered the TUI

rebranding, we now have one common Markets & Airlines CEO, and have

identified further potential for harmonisation in business processes and

overheads. In addition, we will continue to expand the synergies from

One Aviation.

? For further commentary on Markets & Airlines please refer to page 70

of the Annual Report.

? The underlying EBITA result for All Other Segments reflects the impact

of a planned airline maintenance event at the start of the year, and an

aircraft towing incident in Q4, both in Corsair.

? Reported EBITA increased significantly, by 10.4% at constant currency

rates, as a result of the strong underlying performance and disciplined

management of separately disclosed items (SDIs). For further detail on

Adjustments, please refer to page 66 of the Annual Report. In order to

deliver further business harmonisation and efficiency in Markets &

Airlines, we expect an elevated level of Adjustments in FY19 of

approximately EUR125m.

? Underlying EPS increased to EUR1.17, or 10.5% growth at constant

currency rates. This was driven by a strong earnings performance, the

effect of more efficient financing, and continued low underlying effective

tax rate of 20%. For the calculation of underlying EPS, please refer to

page 39 of the Annual Report.

? The year on year reduction in EBT relative to the strong EBITA

performance reflects the inclusion in prior year EBT of EUR172m gain on

disposal of shares in Hapag-Lloyd AG, partly offset by lower net financing

costs.

? We operate within a clearly defined and disciplined capital allocation

framework. Our strong cash generation allows us to invest, pay dividends

and strengthen the balance sheet. Since the merger, we have generated

around EUR2 billion of disposal proceeds, which we have reinvested

primarily into our higher margin, lower seasonality and better quality

Holiday Experiences business, with a ROIC hurdle rate for growth

investments of at least 15% on average. We also invest via ring-fenced

joint ventures, make use of highly efficient asset finance and other

finance instruments, as well as more "asset light" hotel management

contracts, to optimise the cash flow available to shareholders. Finally,

we have a clear financial policy to ensure balance sheet stability,

targeting a leverage ratio of 3.0 times to 2.25 times and coverage ratio

of 5.75 times to 6.75 times.

DIVID

We remain committed to delivering attractive returns to our shareholders,

with a proposed dividend which has grown in line with underlying EBITA at

constant currency rates. The Executive Board and the Supervisory Board are

recommending a dividend of 72 cents per share in respect of the financial

year 2018. Subject to approval at the Annual General Meeting on 12 February

2019, shareholders who held relevant shares at close of business on 12

February 2019 will receive the dividend on 15 February 2019 and holders of

depositary instruments will receive the dividend on 26 February 2019.

Looking forward to FY19, we remain committed to growing dividend per share

in line with underlying EBITA1,3.

FUEL/FOREIGN EXCHANGE

Our strategy of hedging the majority of our jet fuel and currency

requirements for future seasons, as detailed below, remains unchanged. This

gives us increased certainty of costs when planning capacity and pricing.

The following table shows the percentage of our forecast requirement that is

currently hedged for Euros, US Dollars and jet fuel for our Markets, which

account for over 90% of our Group currency and fuel exposure.

Winter 2018/19 Summer 2019 Winter 2019/20

Euro 96% 72% 38%

US Dollars 90% 76% 42%

Jet Fuel 92% 87% 56%

As at 6 December 2018

OUTLOOK AND EXPECTED DEVELOPMENT

In FY18 we delivered the fourth consecutive year of double digit earnings

growth since the merger, with a continued strong ROIC performance. TUI's

sustained strong performance in a challenging market environment

demonstrates its successful transformation as an integrated provider of

holiday experiences, with strong strategic positioning and diversification

across destinations and markets. Looking ahead, we expect growth to

continue, driven by the benefits of our digitalisation efforts, efficiency

measures and differentiation strategy through the disciplined expansion of

our own hotel, cruise and destination experience content.

In Hotels & Resorts, our diversified portfolio means we will continue to

benefit from growth in demand for Turkey and North Africa, with a

normalisation in demand for Spain, including the Canaries. Demand also

remains strong for our year round destinations such as Mexico, the Caribbean

and Cape Verde. We will continue to develop our portfolio of destinations,

with a strong pipeline of own hotel openings for FY19 and beyond, and we

remain on track to open approximately 60 additional hotels since merger by

the end of FY19.

We will also launch three ships for our cruise brands in FY19. Bookings for

the new ships and the existing fleet are progressing well, with a continued

strong yield performance. Two ships exited our fleets (Marella Spirit and

Hapag-Lloyd Cruises' Hanseatic) in Autumn 2018. Five further new builds are

on order for TUI Cruises and Hapag-Lloyd Cruises, for delivery between end

of 2019 and FY26, as we continue to build on our leadership position in the

German-speaking cruise market.

We are re-shaping our Destination Experiences business based on the recent

acquisitions of Destination Management and Musement, from 23 to 49 countries

and from an off-line to fully digitalised business. We are also developing

our tailored TUI Tours offer. In order to achieve these strategic goals,

some additional investment into the digital platform (as operating cost)

will be required in FY19.

In Markets & Airlines, we are focussed on delivering business harmonisation,

especially in terms of business processes, overheads and aviation, and the

benefits of digitalisation. We expect the challenging market environment to

continue, and that this will be evident in our Q1/Q2 FY19 results. This

reinforces the importance of TUI's transformation away from the traditional

tour operator space, to become an integrated provider of holiday

experiences, and which helps to mitigate continued market challenges.

Currently Winter 2018/19 bookings are down 1% versus prior year and average

selling prices are down 2% versus prior year, with 60% of the programme

sold, two percentage points behind prior year11. As outlined above, the

programme to North Africa and Turkey has been expanded, offset by a

reduction in the programme to the Canaries. Flight capacity from Nordics has

been proactively reduced, with the planned closure of three airport bases as

we continue to drive efficiency in our airlines, and also following the

prolonged hot weather this Summer which has continued to subdue demand. We

have also reduced our flight capacity from Germany, as we continue to

improve our flight plan efficiency following the bankruptcies of Air Berlin

and Niki. Bookings for next Summer 2019 are at a very early stage. Only the

UK is more than 20% booked, and at this stage bookings are up 5% with

average selling price down 1%.

11 These statistics are up to 2 December 2018, shown on a constant currency

basis and relate to all customers whether risk or non-risk

With regard to the UK's exit from the EU in 2019, the main concern remains

whether our airlines will continue to have access to EU airspace. We will

continue to address the importance of there being a special agreement for

aviation to protect consumer choice with the relevant UK and EU ministers

and officials, and are in regular exchange with relevant regulatory

authorities. We are currently developing scenarios and mitigating strategies

for various outcomes, including a "hard Brexit", depending on the political

negotiations, with a focus to alleviate any potential impacts from Brexit

for the Group.

Based on our growth strategy, we reiterate our guidance of at least 10% CAGR

in underlying EBITA for the three years to FY201,2. In the nearer term, we

expect to deliver at least 10% underlying EBITA growth in FY191,3, with

growth from investments, digitalisation and efficiency, as well as our

double-diversified business model, helping to mitigate market challenges.

Further detail on FY19 expected development is set out in the table below.

FY19 guidance1 FY18

Turnover12 Around 3% growth EUR19,524m

Underlying EBITA At least 10% growth EUR1,187m1

rebased13 3

Adjustments EUR125m EUR87m

Net capex & EUR1.0bn-1.2bn EUR0.8bn

investments14

Leverage ratio 3.0 times to 2.25 times 2.7 times

Dividend per share Growth in line with EUR0.72

underlying EBITA rebased13

12 Excluding cost inflation relating to currency movements

13 Rebased to take into account EUR40m impact of revaluation of Euro loan

balances within Turkish Lira entities in FY18

14 Including PDPs, excluding aircraft assets financed by debt or finance

leases

ANNUAL GENERAL MEETING AND Q1 FY19

TUI Group will hold its Annual General Meeting and issue its Q1 FY19 Report

on 12 February 2019.

ANALYST & INVESTOR ENQUIRIES

Peter Krueger, Member of the Group Tel: +49 (0)511 566 1440

Executive Committee, Group Director of

Strategy, M&A and Investor Relations

Contacts for Analysts and Investors in UK, Ireland and Americas

Sarah Coomes, Head of Investor Tel: +44 (0)1293 645 827

Relations

Hazel Chung, Senior Investor Relations Tel: +44 (0)1293 645 823

Manager

Contacts for Analysts and Investors in Continental Europe,

Middle East and Asia

Nicola Gehrt, Head of Investor Tel: +49 (0)511 566 1435

Relations

Ina Klose, Senior Investor Relations Tel: +49 (0)511 566 1318

Manager

Jessica Blinne, Junior Investor Tel: +49 (0)511 566 1425

Relations Manager

ISIN: DE000TUAG000

Category Code: ACS

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

Sequence No.: 6873

EQS News ID: 757475

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=8e080343e3e3e5bb48431aa13ff7cbdd&application_id=757475&site_id=vwd&application_name=news

(END) Dow Jones Newswires

December 13, 2018 02:01 ET (07:01 GMT)

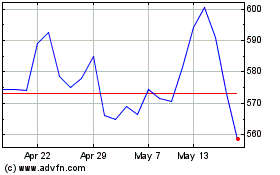

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

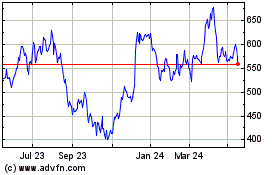

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024