TUI AG: Pre-Close Trading Update (727705)

September 27 2018 - 2:01AM

UK Regulatory

Dow Jones received a payment from EQS/DGAP to publish this press

release.

TUI AG (TUI)

TUI AG: Pre-Close Trading Update

27-Sep-2018 / 08:00 CET/CEST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

27 September 2018

TUI GROUP

Pre-Close Trading Update

Prior to entering its close period ahead of reporting its full year results

for the twelve months ending 30 September 2018 on 13 December 2018, TUI

Group announces the following update on current trading.

Chief Executive of TUI Group, Friedrich Joussen, commented:

"The financial year is closing out as we expected, with the fourth

consecutive year of double digit growth in underlying EBITA since the

merger1. Having continued to expand our hotel and cruise offer, occupancies

and yields remain high, and the number of customers purchasing holidays from

us has grown in all major markets, even with the sustained period of hot

weather in Northern Europe this Summer. This demonstrates the strength and

resilience of demand for our holiday experiences, although as previously

stated the hot weather has limited our ability to outperform. Whilst at an

early stage, trading for future seasons is overall in line with our

expectations. Our strong positioning as a leading holiday product provider

with own distribution, as well as our balanced portfolio of destinations and

markets, mean that we are well positioned to continue to deliver against our

growth strategy. We therefore reiterate our guidance of at least 10%1

underlying EBITA growth in FY18."

1 Assuming constant foreign exchanges rates are applied to the result in the

current and prior period

Current Trading

Overall, trading since our last update has remained in line with our

expectations. In Hotels & Resorts our strategy of having a balanced

portfolio of destinations continues to pay off, as we benefit from the

return in demand for Turkey, North Africa and increased demand for Greece,

as well as delivering new openings in South East Asia and the Caribbean. As

expected, demand for Spain is normalising from the very high levels seen in

recent years. We have a strong pipeline of hotel openings for FY19,

including year round destinations such as Cape Verde, Mexico, the Caribbean

islands and the Maldives, and we expect to deliver on the guidance we set

out at the time of the merger of around 60 additional hotel openings by the

end of FY19.

In Cruises, the launches of the new TUI Cruises Mein Schiff 1 and Marella

Explorer this Summer have gone very well, and yield performance remains

strong across our three fleets. A dry dock for the Europa means that

Hapag-Lloyd Cruises will have a more subdued earnings performance in the

final quarter of FY18. In FY19 we will launch three ships (new TUI Cruises

Mein Schiff 2, Marella Explorer 2 and Hanseatic Nature for Hapag-Lloyd

Cruises), with additional launches scheduled in future years. We continue to

see strong demand for our unique cruise brands.

Destination Experiences continues to perform very well, with strong organic

growth in the final quarter. Having expanded our regional capability in

destinations with the acquisition of the destination management business of

Hotelbeds Group, we recently announced the acquisition of Musement, an

online platform for selling tours and activities in destinations around the

world. This will enable the creation of a scalable digital platform to

source, produce and distribute tours and activities to TUI and non-TUI

customers.

Customer volumes in Sales & Marketing are up 4% on prior year for Summer

2018, benefitting in particular from increased capacity to Turkey, Greece

and North Africa as well as smaller destinations such as Bulgaria, and an

increase in the volume of customers staying in our Group hotels. As

anticipated, volumes to Spain have continued to normalise compared with the

very high growth seen in recent years. As noted in our Q3 update, there are

a number of external factors which have made operations more challenging,

including the unusually hot Summer in Northern Europe and higher than normal

level of airline operational disruption. Despite this, we have continued to

grow our customer base, demonstrating once again the strength of the TUI

brand and product offer, coupled with further growth in the proportion of

direct and online distribution.

Summer 20182

............

YoY Total Total Total Programme

variatio sold (%)

n%

Revenue Customers ASP

Northern Region +4 +2 +1 97

Central Region +8 +7 +1 98

Western Region +3 +2 +1 100

Total Sales & Marketing +5 +4 +1 98

2 These statistics are up to 23 September 2018, shown on a constant currency

basis and relate to all customers whether risk or non-risk

Sales & Marketing trading for Winter 2018/19 (which is low season for most

markets) is at a relatively early stage, with around one third of the

programme sold. Performance is positive overall, with customer volumes up

2%. Bookings in most markets are ahead of prior year and tracking in line

with capacity. In Nordics, we are seeing a later booking profile this

Winter, in line with the market, against strong prior year comparatives and

as a knock-on impact from the prolonged hot Summer in Scandinavia. Average

selling price overall for Sales & Marketing is down 1% on prior year. This

reflects a proactive remix of capacity, enabling us to capitalise on the

returning popularity of North Africa and Turkey, and also to reduce our

capacity to the Canaries where demand is normalising.

Foreign Exchange & Fuel

Our strategy of hedging the majority of our currency and jet fuel

requirements for future seasons, as detailed below, remains unchanged. This

gives us certainty of costs when planning capacity and pricing. The

following table shows the percentage of our forecast requirement that is

currently hedged for Euros, US Dollars and jet fuel for Sales & Marketing,

which account for over 90% of our Group currency and fuel exposure.

Summer 2018 Winter 2018/19 Summer 2019

Euro 97% 86% 55%

US Dollars 94% 85% 66%

Jet Fuel 93% 87% 75%

As at 21 September 2018

At our Q3 update we flagged approximately EUR35m adverse translation impact

on underlying EBITA compared with rates prevailing in the prior year,

including the impact from the revaluation of Euro loan balances within

Turkish hotel entities. As detailed at Q3, this is a non-cash impact, as

Euro loans are repaid with Euro income. Since the Q3 update the Turkish Lira

has further weakened, leading to an increase in the revaluation impact. We

now expect approximately EUR70m adverse impact in total from foreign

exchange translation on the FY18 underlying EBITA result, subject to further

movements in exchange rates to 30 September 2018.

Outlook

FY18 is closing out in line with our expectations and we reiterate our

guidance of at least 10% growth in underlying EBITA1. Whilst at an early

stage, trading for future seasons is overall in line with our expectations.

Our strong positioning as a leading holiday product provider with own

distribution, as well as our balanced portfolio of destinations and markets,

mean that we are well positioned to continue to deliver against our growth

strategy.

Annual Report 2017/18

TUI Group will issue its Annual Report on Thursday 13 December 2018 and hold

a presentation for investors and analysts on the same day. Further details

will follow.

Analyst & Investor Enquiries

Peter Krueger, Member of the Group

Executive Committee, Group Director of

Strategy, M&A and Investor Relations

Tel: +49 (0)511 566 1440

Contacts for Analysts and Investors in UK, Ireland and Americas

Sarah Coomes, Head of Investor Tel: +44 (0)1293 645 827

Relations

Hazel Chung, Senior Investor Relations Tel: +44 (0)1293 645 823

Manager

Contacts for Analysts and Investors in Continental Europe,

Middle East and Asia

Nicola Gehrt, Head of Investor Tel: +49 (0)511 566 1435

Relations

Ina Klose, Senior Investor Relations Tel: +49 (0)511 566 1318

Manager

Jessica Blinne, Junior Investor Tel: +49 (0)511 566 1425

Relations Manager

ISIN: DE000TUAG000, DE000TUAG299

Category Code: TST

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 6082

EQS News ID: 727705

End of Announcement EQS News Service

(END) Dow Jones Newswires

September 27, 2018 02:01 ET (06:01 GMT)

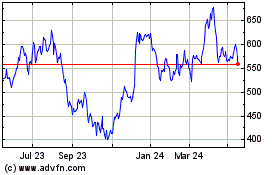

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

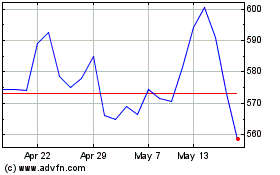

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024