TIDMTOM

RNS Number : 8153J

TomCo Energy PLC

26 August 2021

26 August 2021

TOMCO ENERGY PLC

("TomCo" or the "Company")

Acquisition of Valkor's 50% interest in Greenfield

TomCo Energy plc (AIM: TOM), the US operating oil development

group focused on using innovative technology to unlock

unconventional hydrocarbon resources, is pleased to announce that

it has acquired from Valkor LLC ("Valkor") its 50% interest in

Greenfield Energy LLC ("Greenfield"), the 50/50 joint venture

company established by TomCo and Valkor in mid 2020, for wholly

deferred equity consideration (the "Acquisition").

Details of the Acquisition

Pursuant, inter alia, to the terms of a membership interest

purchase agreement ("MIPA"), entered into between the Company,

Valkor and Greenfield on 25 August 2021 (the "Effective Date") to

implement the Acquisition, Valkor has assigned its 50% membership

interest in Greenfield to the Company such that TomCo now owns 100%

of Greenfield and the existing joint venture ("JV") agreement

between TomCo and Valkor with respect to Greenfield has been

terminated.

The deferred consideration for the Acquisition comprises the

issue to Valkor of 592,830,258 new ordinary shares of no par value

in TomCo ("Ordinary Shares") (the "Acquisition Shares") which

currently equates, in aggregate, to 29% of the Company's issued

share capital as enlarged by the Acquisition Shares, subject to

adjustment to ensure that Valkor and any person acting in concert

with it shall not exceed a 29% ownership interest in the Company at

the time such shares are issued. Valkor currently has no

pre-existing interest in TomCo's issued share capital.

Issue of the Acquisition Shares is subject to Greenfield

receiving funds from, or drawing upon, a loan or credit facility in

connection with the construction of an oil sands processing

facility as specified in the FEED Study dated 21 July 2021 (as

amended or superseded) ("Financial Close"). In the event that

Financial Close is not achieved within 3 years of the Effective

Date no consideration is payable by the Company to Valkor and the

obligation to issue the Acquisition Shares will lapse. The value of

the maximum Acquisition Shares, based on the mid-market price of an

Ordinary Share at the close of business on 25 August 2021 (being

the latest practicable date prior to the date of this announcement)

is, in aggregate, approximately GBP3.1 million. The MIPA contains,

inter alia, certain customary representations and warranties from

Valkor in relation to the sale of its interest in Greenfield for a

transaction of this nature.

In connection with the Acquisition and shortly prior to

receiving the Acquisition Shares, Valkor has agreed to enter into a

lock-in and orderly market agreement with the Company. During the

period of 18 months from execution of this agreement, Valkor will,

subject to limited exceptions, not dispose or agree to dispose of

any Acquisition Shares or any other Ordinary Shares or interest in

Ordinary Shares from time to time acquired by or issued to it.

Thereafter, for so long as Valkor holds 10% or more of the

Company's issued ordinary share capital, Valkor has agreed not to

dispose or agree to dispose of any interest in Ordinary Shares

except with the prior written consent of the Company, with any

agreed disposal being subject to orderly market principles. The

limited exceptions include the acceptance of a recommended takeover

offer for the Company, the execution of an irrevocable commitment

to accept such an offer and a disposal pursuant to a court

order.

In addition, shortly prior to receiving the Acquisition Shares,

Valkor has also agreed to enter into a relationship and standstill

agreement with the Company and the Company's Nominated Adviser, to,

inter alia, regulate the ongoing relationship between itself and

the Company on arm's length terms and a normal commercial basis

and, save with the Nominated Adviser's prior written consent,

prohibit any acquisition of any interest in Ordinary Shares, other

than the Acquisition Shares, or making of any offer for all or any

of the Ordinary Shares, either by Valkor itself or by any person

with whom it may be acting in concert from time to time. Following

its execution, such agreement shall terminate and cease to apply

upon Valkor ceasing to hold 10% or more of the Company's issued

ordinary share capital.

Background to the Acquisition

The Acquisition follows the successful completion of all of the

planned trial work utilising Petroteq Energy Inc.'s existing oil

sands plant at Asphalt Ridge, Utah (the "POSP"), as announced by

the Company on 2 July 2021, the commencement of requisite due

diligence on Tar Sands Holdings II LLC ("TSHII") and its site as

announced on 9 June 2021 and, most recently, the receipt of the

finalised FEED (Front-End Engineering and Design) study for

production facilities, together with the associated third-party

technical verification report on the proposed process, as announced

on 27 July 2021 .

TSHII owns approximately 760 acres of land and certain

non-producing assets (the "Site") in Uintah County, Utah, USA.

Subject to securing the requisite funding and satisfactory due

diligence, Greenfield plans to use the Site, if ultimately acquired

via TSHII, for the future mining of oil sands and construction of a

commercial scale processing plant utilising the findings of the

FEED study, and other knowledge and experience gained from

Greenfield's operation of the POSP. The Site has existing

infrastructure, plant and equipment, together with an existing

Large Mine Permit No. M0470032, that could facilitate any future

development by Greenfield.

The FEED study covers the production facilities for a 5,000

barrels of oil per day ("bopd") oil sands project (the "Greenfield

Plant"). The Greenfield Plant is currently intended to be located

at the Site. The proposed plant is planned to consist of an initial

5,000 bopd train but configured for possible expansion to 10,000

bopd via a second future train.

The FEED study will be utilised as the basis for the EPC phase

of the project and TomCo's directors continue to believe that the

completed FEED study, together with the supporting third-party

technical verification report and recently completed testing

operations at the POSP, serve to provide a high level of confidence

in both the potential economics and the technical feasibility of

Greenfield's plans. The Acquisition enables TomCo to assume full

control of Greenfield and, the TomCo directors believe, should

facilitate discussions with potential debt and equity funders with

respect to the potential acquisition of TSHII and future plant

construction and achieve greater alignment with Valkor.

As at 31 March 2021, Greenfield had unaudited total assets of

approximately US$4.67 million and incurred an unaudited loss before

tax for the period from incorporation to 31 March 2021 of

approximately US$0.11 million.

Related Party Transaction

As a JV partner, Valkor is considered to be a related party of

the Company (as defined in the AIM Rules for Companies) and,

accordingly, the Acquisition constitutes a related party

transaction pursuant to AIM Rule 13. The TomCo directors, having

consulted with Strand Hanson Limited, the Company's Nominated

Adviser, consider that the terms of the Acquisition are fair and

reasonable insofar as the Company's shareholders are concerned.

Commenting, John Potter, CEO of TomCo, said : "We are delighted

to have reached agreement with Valkor to acquire their 50% interest

in Greenfield and look forward to welcoming Valkor as a substantial

shareholder in TomCo as and when Financial Close for construction

of the proposed Greenfield Plant is achieved within the next three

years.

"We are very excited by the future potential of Greenfield. The

due diligence undertaken so far on the Site has been positive such

that it appears ideally suited for the construction, subject to

funding, of Greenfield's first commercial scale plant, with

significant resources for potential exploitation. Additionally, the

recent results of the FEED study were most encouraging.

"Greenfield's focus remains on completing the requisite due

diligence on TSHII and the Site and progressing the necessary

funding package in order to, inter alia, pursue construction of an

initial 5,000 bopd facility at the earliest opportunity. We now

have full control of Greenfield which affords TomCo's shareholders

the opportunity to fully benefit from Greenfield's significant

potential."

Enquiries :

TomCo Energy plc

Malcolm Groat (Chairman) / John Potter (CEO) +44 (0)20 3823 3635

Strand Hanson Limited (Nominated Adviser)

James Harris / Matthew Chandler +44 (0)20 7409 3494

Novum Securities Limited (Broker)

Jon Belliss / Colin Rowbury +44 (0)20 7399 9402

IFC Advisory Limited (Financial PR)

Tim Metcalfe / Florence Chandler +44 (0)20 3934 6630

For further information, please visit www.tomcoenergy.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDGGDIBSDDGBU

(END) Dow Jones Newswires

August 26, 2021 02:00 ET (06:00 GMT)

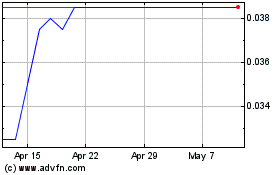

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Apr 2023 to Apr 2024