TIDMOPM

RNS Number : 9400V

1PM PLC

18 January 2013

For Immediate Release 21 January 2013

1pm plc

("1pm", the "Group" or the "Company")

INTERIM RESULTS

FOR THE SIX MONTHS ENDED 30 NOVEMBER 2012

Strong trading momentum maintained

1pm, the AIM quoted independent provider of asset finance

facilities to the SME sector, announces its interim results for the

six month period to 30 November 2012.

Commenting on the results, 1pm CEO, Maria Hampton, said:

"I am pleased to report that the Group has made an excellent

start to the year. The interim results demonstrate that the strong

trading momentum delivered in the Group's year end to 31 May 2012

has continued into the current year.

Financial Highlights

-- Revenue for the period increased 24% to GBP1.42m (H1 2012: GBP1.15m)

-- Profit before taxation increased 55% to GBP0,33m (H1 2012: GBP0.21m)

-- Earnings per share up 50% to 0.008p (H1 2012: 0.005p)

-- Net receivables increased 22% to GBP12.04m (H1 2012: GBP9.86m)

Operational Highlights

-- New business written during period up 50% compared to same period last year

-- Total lease portfolio increased to GBP13.20m (H1 2012: GBP10.85m)

-- Overdraft facility increased from GBP350k to GBP500k for

additional working capital flexibility

-- Relationships now established with 65 leasing brokers

nationwide, an increase of 21 over the period

On current trading and prospects, Ms. Hampton added:

"Notwithstanding the continuing challenging economic backdrop in

the UK, the Group is on track to deliver its strategic aims and the

Board is confident that the positive trading momentum experienced

in the first six months of this trading year will continue.

"As a result, the Board now expects 1pm's profit before tax for

the year ending 31 May 2013 to be significantly ahead of current

market expectations."

For further information, please contact:

1pm plc www.1pm.co.uk

Mike Johnson, Chairman 0844 967 0944

Maria Hampton, Managing Director 0844 967 0944

WH Ireland (NOMAD)

Mike Coe

Marc Davies 0117 945 3470

Winningtons PR Ltd

Paul Vann Paul.Vann@winningtons.co.uk

07768 807631

CHIEF EXECUTIVE'S STATEMENT

Financial Results

I am pleased to report that the Group has made an excellent

start to the year. The interim results for the six months ended 30

November 2012 demonstrate that the strong trading momentum

delivered in the Group's year end to 31 May 2012 has continued into

the current year.

Total revenue for the first six months of the current year rose

24% to GBP1.42m compared with the same period last year (H1 2012:

GBP1.15m) with profit before tax increasing by 55% to GBP332k (H1

2012: GBP214k). Earnings per share increased 50% to 0.008p (H1

2012: 0.005p). 1pm has now been profitable on a monthly basis since

July 2010.

The Group's balance sheet has also been further strengthened

during the period. As at 30 November 2012, net assets stood at

GBP4.23m (H1 2012: GBP3.7m), a 14% increase since the previous year

end.

Operations

The Group wrote GBP3.9m of new business during the first six

months of the trading year, a 50% increase compared with the

corresponding period last year (H1 2012: GBP2.6m) and included

record GBP841k of new business written during October 2012.

At the period end, the lease portfolio had increased to

GBP13.20m, a 22% increase over the same period last year (H1 2012:

GBP10.85m) and a 20% increase since the year end last May (FY2012:

GBP11m). The portfolio has an average loan value of GBP7,5k (H1

2012: GBP7,6k) with no single customer representing more than 0.54%

of the total portfolio value (H1 2012: 0.50%).

The Group has formed relationships with a further 21 leasing

brokers since the year end in May 2012 and is now in partnership

with over 65 leasing brokers nationwide. These brokers provide a

vital source of new business to the Group and the Board remains

committed to developing existing relationships and building new

partnerships across the UK to further enhance our geographical

representation.

1pm offers finance across a wide variety of sectors and assets

throughout Great Britain and Northern Ireland and will continue to

review and develop its policies and procedures to meet the

continuing growth in demand from SMEs as they increasingly turn to

the asset leasing industry as a source of business finance.

Whilst reporting strong organic growth and record levels of new

business, the Board is also actively seeking portfolio acquisition

opportunities; however the quality and cost of any such

transactions would need very careful scrutiny.

These interim results are a reflection of the hard work and

dedication of the Company's staff. Since the year-end, two

additional members of staff have been recruited and we will

continue to invest in the training and career development of all

staff members.

Financing

During the period 1pm's bankers agreed to increase the Group's

overdraft facility from GBP350k to GBP500k. The increase in the

overdraft will provide the Group with additional working capital

flexibility.

GBP920k of new funding has been received since 31 May 2012 from

high net worth individuals and Self-Invested Personal Pension

(SIPP) funds, bringing the total raised from sources of this type

to GBP1.87m. More information regarding how individuals or

organisations may provide funding to 1pm is available on the

Group's website http://www.1pm.co.uk/Funding.

These and other funding lines provide 1pm with the raw material

to continue to grow its lease portfolio. The Group has sufficient

funds to exceed new business targets for the year, yet continues to

seek additional sources of funding to facilitate further

growth.

Outlook

The Board's aim is to maximise the opportunities that have

arisen via the global economic financial crisis, which has impacted

on many providers' appetite to lend.

On top of the funding gap already in existence within the

mainstream banking sector, which despite Government intervention,

continues to shy away from lending to SMEs, in November 2012, a

major competitor within the industry, operating across the UK, also

withdrew from the leasing market.

This withdrawal paves the way for the remaining lease providers

to fill the estimated GBP1bn per year gap it has left.

The Group will continue to offer much needed financing solutions

to SMEs and deliver sustainable growth for its shareholders.

Notwithstanding the continuing challenging economic backdrop in

the UK, the Group is on track to deliver its strategic aims and the

Board is confident that the positive trading momentum experienced

in the first six months of this trading year will continue.

As a result, the Board now expects 1pm's profit before tax for

the year ending 31 May 2013 to be significantly ahead of current

market expectations.

M Hampton

CEO, 1pm plc

Independent Review Report to 1 pm plc

Introduction

We have been instructed by the company to review the financial

information set out on pages 5 to 9 and we have read the other

information contained in the interim report and considered whether

it contains any apparent misstatements or material inconsistencies

with the financial information.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of, and has been approved

by the directors. The directors are responsible for preparing the

half-yearly financial report in accordance with the rules of the

London Stock Exchange for companies trading securities on AIM, a

market operated by the London Stock Exchange plc. The Disclosure

and Transparency Rules require that the accounting policies and

presentation applied to the half yearly figures must be consistent

with those applied in the latest published annual accounts except

where the accounting policies and presentation are to be changed in

the subsequent annual financial statements, in which case the new

accounting policies and presentation should be followed, and the

change and the reasons for the changes should be disclosed in the

half yearly financial report. The condensed set of financial

statements included in this half yearly financial report has been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting".

Our responsibility

Our responsibility is to express a conclusion on the condensed

set of financial statements in the half yearly financial report

based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information performed by the Independent Auditor

of the Entity," issued by the Auditing Practices Board for use in

the United Kingdom. A review consists principally of making

enquiries of group management and applying analytical and other

review procedures to the financial information. A review excludes

audit procedures such as tests of controls and verification of

assets, liabilities and transactions. It is substantially less in

scope than an audit performed in accordance with Auditing Standards

and therefore provides a lower level of assurance than an audit.

Accordingly we do not express an audit opinion on the financial

information.

Review conclusion

On the basis of our review, nothing has come to our attention

that causes us to believe that the condensed set of financial

statements in the half yearly financial report for the six months

ended 30 November 2012 is not prepared, in all material respects,

in accordance with International Accounting Standard 34.

Moore Stephens

Registered Auditors

Chartered Accountants

30 Gay Street

Bath BA1 2PA

21(st) January 2013

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS TO 30 November 2012

Independently Independently Audited

Reviewed Reviewed 12 months

6 months 6 months to

to to 31 May

30 November 30 November

2012 2011 2012

Note GBP GBP GBP

REVENUE 1,424,855 1,151,331 2,310,571

Cost of sales (757,630) (639,133) (1,275,253)

GROSS PROFIT 667,225 512,198 1,035,318

Administrative expenses (327,009) (285,885) (576,542)

OPERATING PROFIT/(LOSS) 340,216 226,313 458,776

- -

Finance expense (8,582) (12,020) (22,749)

PROFIT / (LOSS) BEFORE

TAXATION 331,634 214,293 436,027

Tax expense (65,291) (42,829) (87,602)

PROFIT / (LOSS) ON AFTER

TAXATION 266,343 171,464 348,425

Attributable to equity

holders of the company 266,343 171,464 348,425

Profit per share attributable

to the equity holders of

the company during the

Period

- basic and diluted 50.007844p 0.005227p 0.010447p

All of the above amounts are in respect of continuing

operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE SIX MONTHS TO 30 November 2012

Independently

Reviewed Independently Audited

as at Reviewed 12 months

30 November as at as at

2012 30 November 31 May

2011 2012

GBP GBP GBP

ASSETS

NON CURRENT ASSETS

Deferred income taxes

Property, plant and equipment - 111,881 24,278

35,059 36,701 38,621

35,059 148,582 62,899

CURRENT ASSETS

Cash at bank and in hand 4,598 15,638 5,187

Trade and other receivables 12,045,353 9,856,426 10,111,880

TOTAL CURRENT ASSETS 12,049,951 9,872,064 10,117,067

TOTAL ASSETS 12,085,010 10,020,646 10,179,966

EQUITY

Called up share capital 2,315,132 2,236,725 2,315,132

Share premium account 1,569,340 1,567,249 1,569,340

Retained earnings 342,632 (100,672) 76,289

TOTAL EQUITY 4,227,104 3,703,302 3,960,761

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 4,178,884 3,250,026 2,993,732

NON CURRENT LIABILITIES

Trade and other payables 3,679,022 3,067,318 3,225,473

TOTAL LIABILITIES 7,857,906 6,317,344 6,219,205

TOTAL EQUITY AND LIABILITIES 12,085,010 10,020,646 10,179,966

CONSOLIDATED INTERIM CASH FLOW STATEMENT

FOR THE SIX MONTHS TO 30 November 2012

Independently

Independently Reviewed

Reviewed 6 months Audited 12

6 months to to months to

30 November 30 November 31 May

2012 2011 2012

GBP GBP GBP

Cash flows from operating activities

Cash generated from operations (457,986) (87,718) 3,308

Interest Paid (8,582) (12,020) (22,749)

Net cash generated from operating

activities (466,568) (99,738) (19,441)

Cash flows from investing activities

Purchase of property, plant and

equipment (3,940) (17,139) (28,289)

Net cash generated from investing

activities (3,940) (17,139) (28,289)

Cash flows from financing activities

Term loans - 50,000 -

Issue of shares net of costs - - 80,498

Net cash generated from financing

activities - 50,000 80,498

Increase / (decrease) in cash

and cash equivalents (470,508) (66,877) 32,768

Cash and cash equivalents at

the beginning of the year (61,127) (93,895) (93,895)

Cash and cash equivalents at

the end of the year (531,635) (160,772) (61,127)

STATEMENTS OF CHANGES IN EQUITY

Share Share Retained Total

Capital Premium Earnings Equity

Balance at 31 May 2012 2,315,132 1,569,340 76,289 3,960,761

Movement in share capital - - - -

Profit for period - - 266,343 266,343

Balance at 30 November 2012 2,315,132 1,569,340 342,632 4,227,104

Balance at 30 November 2011 2,236,725 1,567,249 (100,672) 3,703,302

Movement in share capital 78,407 2,091 80,498

Profit /(loss) for the period - - 176,961 176,961

Balance at 31 May 2012 2,315,132 1,569,340 76,289 3,960,761

1 BASIS OF PREPARATION

The financial information set out in the interim report does not

constitute statutory accounts as defined in section 434(3) and

435(3) of the Companies Act 2006. The Group's statutory financial

statements for the year ended 31 May 2012 prepared in accordance

with IFRS as adopted by the European Union and with the Companies

Act 2006 have been filed with the Registrar of Companies. The

auditor's report on those financial statements was unqualified and

did not contain a statement under Section 498(2) of the Companies

Act 2006.

These interim financial statements have been prepared under the

historical cost convention.

These interim financial statements have been prepared in

accordance with the accounting policies set out in the most

recently available public information, which are based on the

recognition and measurement principles of IFRS in issue as adopted

by the European Union (EU) and are effective at 31 May 2012 or are

expected to be adopted and effective at 31 May 2013. The financial

information for the six months ended 30 November 2011 and the six

month period 30 November 2012 are unaudited and do not constitute

the groups statutory financial statements for these periods. The

accounting policies have been applied consistently throughout the

Group for the purposes of preparation of these interim financial

statements.

2 BASIS OF CONSOLIDATION

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(it's subsidiaries). Control is achieved where the Company has the

power to govern the financial and operating policies of an entity

so as to obtain benefit from its activities.

All intra-group transactions, balances, income and expenses are

eliminated on consolidation.

3 TAXATION

Taxation charged for the period ended 30 November 2012 is

calculated by applying the directors' best estimate of the annual

tax rate to the result for the period.

4 SHARE CAPITAL

The Articles of Association of the company state that there is

an unlimited authorised share capital.

Each share carries the entitlement to one vote.

As at 30 November 2012, the company had an issued and fully paid

share capital of 3,395,618,769.

5 EARNINGS PER ORDINARY SHARE

The earnings per ordinary share has been calculated using the

profit for the period and the weighted average number of ordinary

shares in issue during the period as follows:

Six months

to

30 November

2012

GBP

Profit/(loss) for the period

after taxation 266,343

Number

Basic weighted average of ordinary

shares 3,395,618,769

Pps

Basic earnings (pence per share) 0.007844

The basic earnings per share is calculated on the weighted

average number of shares in issue during the period.

6 COPIES OF THE INTERIM REPORT

Copies of the interim report are available from www.1pm.co.uk

and the company secretary at the company's registered office: 15 St

James's Parade, Bath BA1 1UL.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QVLFFXFFEBBD

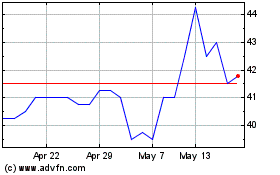

Time Finance (LSE:TIME)

Historical Stock Chart

From Jun 2024 to Jul 2024

Time Finance (LSE:TIME)

Historical Stock Chart

From Jul 2023 to Jul 2024