TIDMTHRU

RNS Number : 8904J

Thruvision Group PLC

10 December 2018

10 December 2018

Thruvision Group plc

("Thruvision" or the "Group")

Interim Results for the six months ended 30 September 2018

Thruvision (AIM: THRU) the specialist provider of

people-screening technology to the international security market

announces its unaudited results for the six months ended 30

September 2018.

Key Highlights

-- Revenues for the six months ended 30 September 2018 of GBP3.2

million (H1 2018: GBP0.3 million)

-- Operating loss before tax reduced to GBP(0.8) million (H1 2018: GBP(1.7) million).

-- Additional investment in sales and engineering increased the

cost base to GBP(2.1) million (H1 2018: GBP(1.7) million)

-- A record number of 60 Thruvision units shipped in the first

half across our four target markets (H1 2018: 3 units)

-- Broad-based sales success

o new flagship customers, including Los Angeles Metro following

US Transportation Security Administration ("TSA") approval, Sony,

Next plc and The Hut Group

o repeat sales to existing customers, including Boots and

Hermes

o continued strengthening of international sales pipeline.

-- Average revenue per unit (including accessories) of GBP52k

with gross margin of 39% (H1 2018:GBP58K and (7%))

-- GBP3.3 million cash returned to shareholders by way of a

Tender Offer process in August 2018 reducing the number of Ordinary

Shares in issue to 145,454,118

-- Since 31 March 2018, completion of the formal process to

separate from the Digital Barriers business that was divested in

October 2017

-- Cash at 30 September 2018 of GBP12.6 million, with cash at 7

December 2018 of GBP11.7 million

Summary of Results

30-Sep-18 30-Sep-17 FY 2018

---------- ---------- --------

Unaudited Unaudited Audited

---------- ---------- --------

Number of units sold 60 3 57

---------- ---------- --------

GBP'000 GBP'000 GBP'000

---------- ---------- --------

Revenue 3,169 344 3,103

---------- ---------- --------

Gross Profit 1,243 (23) 1,079

---------- ---------- --------

Gross Margin 39% (7%) 35%

---------- ---------- --------

Overheads (2,083) (1,660) (3,654)

---------- ---------- --------

Operating (loss) (840) (1,683) (2,575)

---------- ---------- --------

Commenting on the results, Colin Evans, Managing Director of

Thruvision, said:

"We are pleased with the progress we have made in the first half

of this year. We continue to deliver additional units to existing

customers, and we are also winning new customers across a variety

of geographies and markets, with particular success in

Transportation and Loss Prevention. This, combined with our

deepening relationship with TSA and the very high profile nature of

the LA Metro deployment is testament to the international appeal of

our solution and the scale of the opportunity ahead."

For further information please contact:

Thruvision Group plc

Tom Black, Executive Chairman

Colin Evans, Managing Director +44 (0)1235 425 400

Investec Bank plc

Andrew Pinder / Sebastian Lawrence / Patrick

Robb +44 (0)20 7597 5970

FTI Consulting LLP

Matt Dixon / Harry Staight +44 (0)20 3727 1000

About Thruvision

Thruvision Group plc is a specialist provider of

people-screening technology. Using patented passive terahertz

technology, Thruvision is uniquely capable of detecting metallic

and non-metallic threats including weapons, explosives and

contraband items that are hidden under clothing, at distances up to

10m. Addressing the growing need for fast, safe and effective

security, Thruvision has been vetted and approved by the US

Transportation Security Administration. More than 200 units have

been deployed worldwide over the last five years for applications

including mass transit and aviation security, facilities and public

area protection, customs and border control and supply chain loss

prevention.

www.thruvision.com

Chairman's Statement

The momentum that we saw building early in 2018 has continued in

H1 2019 and has resulted in the delivery of a good performance in

the first half of the year. Overall, our confidence about the size

of the market opportunity has continued to increase during the

period, and we made good strategic progress in positioning

Thruvision to take advantage of this.

New 'flagship' customers, including Los Angeles Metro, Next plc

and Sony, purchased Thruvision units after comprehensive testing,

and repeat orders were received from customers in Asia and the UK.

This, combined with the US Government's Transportation Security

Administration ("TSA") approving Thruvision for use in the mass

transport market and the start of a test programme with TSA's

Innovation Task Force looking at future airport checkpoint

screening, provided the international market with an important

validation of the merits of our technology.

Following the divestment of Digital Barriers to Volpi Capital in

October 2017, we successfully completed the return of cash to

shareholders through a Tender Offer process that completed in

August 2018. During the period we also completed the formal process

of separating Digital Barriers from the Group.

Outlook

With a continuing strengthening of our sales pipeline, and our

production capacity increasing, the business is trading in line

with management's expectations. The Board therefore remains

confident that Thruvision is very well placed to become a leading

new technology provider to the international security market.

Business review

Update by market segment

In our Annual Report for FY 2018, we identified four clear

market segments where we believe Thruvision has strongest

differentiation and the greatest opportunity for growth. We have

made good progress in each of these areas as follows:

-- Loss Prevention: screening staff for items being removed,

without permission, from distribution centres or factories. With

the continuing significant shift towards online retailing, we have

focused on leading branded goods manufacturers and suppliers, where

a clear return on investment on deploying Thruvision to reduce

losses due to theft exists. In the period we added Next plc, Sony

Digital Audio Distribution Company (DADC) and The Hut Group as new

customers, and made further sales to two existing customers, Boots

and Hermes. In October, a leading UK loss prevention association,

Retail Risk, awarded Thruvision "Best Newcomer" at its 2018 Fraud

Awards.

-- Customs: screening travellers for prohibited items such as

cash and drugs. We sold and delivered a second tranche of

Thruvision units to an Asian Customs agency, and we supported Hong

Kong Customs in installing a fourth tranche of Thruvision units on

the new Hong Kong to Macau Bridge that was officially opened in the

Autumn of 2018.

-- Transportation: screening travellers for weapons in railways,

subways and airports. After successfully completing two years of

comprehensive TSA laboratory and operational trials, Los Angeles

Metro purchased Thruvision as part of its strategy to detect and

deter acts of terrorism. TSA's Innovation Task Force also awarded

us a contract to investigate the potential for using Thruvision as

part of new, higher passenger throughput airport security

capability. In Asia, we delivered a major order to the Philippines

to strengthen its transport infrastructure against terrorist

attack.

-- Entrance security: screening visitors for weapons at

entrances to high security buildings. Here, we sold and delivered

two Thruvision projects in China. The first was a major new 'Silk

Road' conference centre where fast, discreet security is required.

The second project, for a Government customer, required very high

levels of security assurance.

We added two new specialist value-added reseller partners

covering North America and Israel and continued supporting the

efforts of our partners in Hong Kong, China, South East Asia and

Australia to sell and deliver Thruvision.

Brexit

The Board has considered the principal risks and uncertainties

possible as a result of Brexit. The principal risks considered are

sales delays, import tax, intra-EU contracts, intellectual

property, and foreign currency movements. To date the Board does

not consider the triggering of the Brexit process to have a

material impact on the interim financial statements and ongoing

operation of the business.

Engineering

Given increasing demand, we have successfully manufactured our

new TSA-approved Thruvision TAC product in the US using a

high-precision manufacturing partner in Florida. We also increased

our overall monthly manufacturing output in line with order intake

and are confident we can now sustain an average of 20 units per

month, if required.

New product research and development has also continued with a

new product prototype for outdoor use expected to be delivered

under contract to TSA in H2 2019.

People

Overall headcount increased from 23 to 27 during the period as

the Group invested in further pre-sales and engineering resource to

support increased demand.

Financial review

Financial results

For the period ended 30 September 2018, revenues increased to

GBP3.2 million (H1 2018: GBP0.3 million, FY 2018 GBP3.1 million),

with 60 Thruvision units sold. (H1 2018: 3 units, FY 2018: 57

units) resulting in a reduced operating loss of GBP(0.8) million

(H1 2018: GBP(1.7) million, FY 2018: GBP(2.5) million).

The gross margin increased to 39% (H1 2018: (7%), FY 2018: 35%)

principally as a result of new product sales.

The operating loss of GBP(0.8) million (H1 2018: GBP(1.7)

million, FY 2018: GBP(2.5) million) was achieved after further

investment in our sales and engineering activities to support

future revenue expansion.

Key Performance Indicators ("KPIs")

The Group considers the following to be the relevant KPIs which

track the trading performance and position of the business.

Financial KPIs

30-Sep-18 30-Sep-17 FY 2018

GBP'000 GBP'000 GBP'000

-------------------------- ---------- ---------- --------

Revenue 3,169 344 3,103

-------------------------- ---------- ---------- --------

Average revenue per unit 52 58 51

-------------------------- ---------- ---------- --------

Gross Profit 1,243 (23) 1,079

-------------------------- ---------- ---------- --------

Gross Margin 39% (7%) 35%

-------------------------- ---------- ---------- --------

Overheads (2,083) (1,660) (3,654)

-------------------------- ---------- ---------- --------

Operating (loss) (840) (1,683) (2,575)

-------------------------- ---------- ---------- --------

Non-financial KPIs

30-Sep-18 30-Sep-17 FY 2018

---------------------------------- ---------- ---------- --------

No of units sold 60 3 57

Number of staff at end of period 27 23 23

---------------------------------- ---------- ---------- --------

Revenue

Thruvision revenues have increased to GBP3.2 million in the

period to 30 September 2018 (H1 2018: GBP0.3 million, FY 2018

GBP3.1 million). Revenues from unit sales contributed GBP3.1

million (H1 2018: GBP0.2 million, FY 2018 GBP2.9 million), and

development revenue from the US Transport Security Administration

of GBP47k (H1 2018: GBP132k, FY 2018 GBP208k). The growth in

revenues over the prior year reflects strong growth in organic unit

sales in our main markets, with unit volumes increasing to 60 (H1

2018: 3 units, FY 2018: 57 units).

30-Sep-18 30-Sep-17 FY 2018

Revenue GBP'000 GBP'000 GBP'000

---------------- --------- --------- --------

Units 3,122 212 2,895

Development 47 132 208

---------------- --------- --------- --------

Total 3,169 344 3,103

---------------- --------- --------- --------

The principal growth driver for the business is unit sales and,

while we expect to continue to be awarded customer funded

development contracts, we do not expect this to form a material

proportion of revenues in the future.

Gross Profit Margin

Gross margin increased to 39% in the year (H1 2018: (7%), FY

2018: 35%). The increase in gross margin compared to the prior year

is primarily due to a one-off stock provision of GBP168k provided

in the period ended 30 September 2017. The gross margin

attributable to unit revenues increased from 34% (FY 2018) to 39%

for the 6 months ending 30 September 2018 principally as a result

of new product sales.

Gross Margin 30-Sep-18 30-Sep-17 FY 2018

GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- -------

Unit Revenue 3,122 212 2,895

Unit Gross Profit 1,225 (80) 991

-------------------------- --------- --------- -------

Gross margin % 39% (38%) 34%

Development Revenue 47 132 208

Development Gross Profit 18 57 88

-------------------------- --------- --------- -------

Gross margin % 38% 43% 42%

Overall Revenue 3,169 344 3,103

Overall Gross Profit 1,243 (23) 1,079

-------------------------- --------- --------- -------

Gross margin % 39% (7%) 35%

-------------------------- --------- --------- -------

Loss from Operations

Losses from operations in the period were GBP(0.8) million (H1

2018: GBP(1.7) million, FY 2018: GBP(2.5) million), including share

based payments principally driven by strong sales growth, and an

overall overhead increase in the period GBP(2.1) million (H1 2018:

GBP(1.7) million, FY 2018 GBP(3.7) million).

Thruvision continues to invest in sales and marketing

activities, developing new markets and segments, whilst further

investing in our engineering and manufacturing capacity including

R&D. Thruvision generated foreign exchange gains of GBP0.1

million during the period, as a result of the movement in the

GBP:USD exchange rate.

Cash Flows

Cash and cash equivalents at 30 September 2018 were GBP12.6

million (H1 2018: GBP0.1 million continuing (GBP2.4 million

discontinuing), FY 2018: GBP17.6 million), reflecting GBP3.35

million (GBP3.5 million including associated fees) returned to

shareholders by way of a Tender Offer process in August 2018

(reducing shares in issue to 145,454,118), and GBP1.5m of operating

loss and working capital investment in inventory and debtors.

THRUVISION GROUP PLC

Consolidated income statement

for the six months ended 30 September 2018

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

----------------------------- ----- ------------- ------------- ----------------

Revenue 2 3,169 344 3,103

Cost of sales (1,926) (367) (2,024)

----------------------------- ----- ------------- ------------- ----------------

Gross profit 1,243 (23) 1,079

Administration costs (2,083) (1,660) (3,654)

Other income 5 - 51

Operating loss (835) (1,683) (2,524)

Finance revenue 41 - 70

Finance costs - (749) (758)

----------------------------- ----- ------------- ------------- ----------------

Loss before tax (794) (2,432) (3,212)

Income tax - (22) 90

----------------------------- ----- ------------- ------------- ----------------

Loss for the period /

year from continuing

operations (794) (2,454) (3,122)

----------------------------- ----- ------------- ------------- ----------------

Discontinued operations

Loss from discontinued operation

(net of tax) (330) (11,329) (16,429)

Loss for the period /

year (1,124) (13,783) (19,551)

Adjusted loss: 3

Loss before tax from

continuing operations (794) (2,432) (3,212)

Share buyback costs 116 - -

Share-based payment 68 35 52

Financing set up fees - 263 263

Adjusted loss before

tax for the period /

year from continuing

operations (610) (2,134) (2,897)

----- ------------- -------------

THRUVISION GROUP PLC

Consolidated statement of comprehensive income

for the six months ended 30 September 2018

6 months 6 months Year ended

ended ended

30 September 30 September 31 March 2018

2018 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------- ------------- --------------

Loss for the period /

year from continuing

operations (794) (2,454) (3,122)

Loss for the period /

year from discontinued

operations (330) (11,329) (16,429)

-------------------------------------- ------------- ------------- --------------

Loss for the period /

year attributable to

owners of the parent (1,124) (13,783) (19,551)

Other comprehensive (loss)/income

from continuing operations

------------------------------------- ------------- ------------- --------------

Other comprehensive income

that may be subsequently

reclassified to profit

and loss:

Exchange differences

on retranslation of foreign

operations - discontinued (5) (926) (694)

Reclassification to profit

and loss - - 701

-------------------------------------- ------------- ------------- --------------

Net other comprehensive

income to be reclassified

to profit or

loss in subsequent periods (5) (926) 7

-------------------------------------- ------------- ------------- --------------

Total comprehensive loss

attributable to owners

of the parent (1,129) (14,709) (19,544)

-------------------------------------- ------------- ------------- --------------

THRUVISION GROUP PLC

Consolidated statement of financial position

at 30 September 2018

30 September 30 September 31 March 2018

2018 2017

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ------------- ------------- --------------

Assets

Non current assets

Property, plant and

equipment 387 407 278

Goodwill - - -

Other intangible assets 8 - 2

------------------------------ ----- ------------- ------------- --------------

395 407 280

Current assets

Inventories 2,237 2,359 1,813

Trade and other receivables 1,496 877 1,229

Current tax recoverable 90 145 90

Cash and cash equivalents 12,636 113 17,587

------------------------------ ----- ------------- ------------- --------------

16,459 3,494 20,719

------------------------------ ----- ------------- ------------- --------------

Assets classified as

held for resale 10 - 36,070 -

Total assets 16,854 39,971 20,999

Equity and liabilities

Attributable to owners

of the parent

Equity share capital 6 1,618 1,814 1,814

Share premium - 109,078 109,078

Capital redemption

reserve - 4,786 4,786

Merger reserve - 454 -

Translation reserve 3 (925) 8

Other reserves - (307) -

Retained earnings 13,452 (90,640) (96,207)

------------------------------ ----- ------------- ------------- --------------

Total equity 15,073 24,260 19,479

Non current liabilities

Provisions 38 62 36

Current liabilities

Trade and other payables 1,743 1,871 1,455

Provisions - 28 29

------------------------------ ----- ------------- ------------- --------------

1,743 1,899 1,484

------------------------------ ----- ------------- ------------- --------------

Liabilities directly

associated with assets

classified as held

for sale 10 - 13,750 -

------------------------------ ----- ------------- ------------- --------------

Total liabilities 1,781 15,711 1,520

------------------------------ ----- ------------- ------------- --------------

Total equity and liabilities 16,854 39,971 20,999

------------------------------ ----- ------------- ------------- --------------

THRUVISION GROUP PLC

Consolidated statement of changes in equity

for the 6 months ended 30 September 2018

Ordinary Share Capital Merger Translation Other Total

share premium redemption reserve reserve reserves Retained equity

capital account reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

At 31 March

2017 1,814 109,078 4,786 454 1 (307) (76,912) 38,914

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

Loss for the

period - - - - - - (13,783) (13,783)

Other

comprehensive

income - - - - (926) - - (926)

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

Total

comprehensive

loss - - - - (926) - (13,783) (14,709)

Share-based

payment

credit - - - - - - 55 55

At 30

September

2017 1,814 109,078 4,786 454 (925) (307) (90,640) 24,260

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

Loss for the

period - - - - - - (5,768) (5,768)

Other

comprehensive

income - - - - 933 - - 933

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

Total

comprehensive

loss - - - - 933 - (5,768) (4,835)

On disposal of

Video

Business - - - (454) - 307 147 -

Share-based

payment

charge - - - - - - 54 54

At 31 March

2018 1,814 109,078 4,786 - 8 - (96,207) 19,479

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

Loss for the

period - - - - - - (1,124) (1,124)

Other

comprehensive

income - - - - (5) - - (5)

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

Total

comprehensive

loss - - - - (5) - (1,124) (1,129)

Capital

reduction - (109,078) (4,786) - - - 113,864 -

Share buyback (196) - - - - (3,149) (3,345)

Share-based

payment

credit - - - - - - 68 68

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

At 30

September

2018 1,618 - - - 3 - 13,452 15,073

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- --------------

THRUVISION GROUP PLC

Consolidated statement of cash flows

for the 6 months ended 30 September 2018

6 months 6 months Year ended

ended 30 ended 30 31 March

September September 2018

2018 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------- ----------- -----------

Operating activities

Loss before tax from continuing

operations (794) (2,432) (3,212)

Loss before tax from discontinued

operations (330) (11,329) (16,337)

---------------------------------------- ----------- ----------- -----------

Loss before tax (1,124) (13,761) (19,549)

Non-cash adjustment to reconcile loss before

tax to net cash flows

Depreciation of property,

plant and equipment 77 257 400

Amortisation of intangible

assets 1 616 716

Impairment of goodwill - 4,291 4,291

Share-based payment transaction

expense 68 55 109

Unrealised gains on foreign

exchange 6 (71) 62

Realisation of foreign exchange

losses on disposal of Video

Business - - 708

Disposal of fixed assets 29 26 (5)

Loss on disposal of Video

Business - - 2,085

Recovery of purchase consideration - (1,126) (1,126)

Finance income (41) - (70)

Finance costs - 1,126 1,227

Non-cash consideration - - 7,635

Non-cash settlement of borrowings

- repayment of loan out of

disposal proceeds - - (7,635)

Working capital adjustments:

Decrease in trade and other

receivables (267) 1,119 (109)

Decrease / (increase) in inventories (424) 466 (108)

Increase / (decrease) in trade

and other payables 208 795 370

Increase / (decrease) in deferred

revenue 82 626 762

Decrease in provisions (27) (28) (54)

---------------------------------------- ----------- ----------- -----------

Cash utilised in operations (1,412) (5,609) (10,291)

Tax received - 617 762

---------------------------------------- ----------- ----------- -----------

Net cash flow from operating

activities (1,412) (4,992) (9,529)

---------------------------------------- ----------- ----------- -----------

Investing activities

Purchase of property, plant &

equipment (213) (65) (196)

Expenditure on intangible assets (7) (9) (2)

Interest received 41 - 70

Cash proceeds from disposal of

Video Business - - 19,187

Cash balance in Video Business

at disposal - - (928)

Recovery of purchase consideration - 1,126 1,126

---------------------------------------- ----------- ----------- -----------

Net cash flow from investing

activities (179) 1,052 (19,257)

---------------------------------------- ----------- ----------- -----------

Financing activities

Share buyback - reduction in (3,345) - -

share capital

Proceeds from borrowings - 5,442 7,635

Finance costs - - (741)

---------------------------------------- ----------- ----------- -----------

Net cash flow from financing

activities (3,345) 5,442 6,894

---------------------------------------- ----------- ----------- -----------

Net increase / (decrease) in

cash and cash equivalents (4,936) 1,502 16,622

Cash and cash equivalents at

beginning of period / year 17,587 1,002 1,002

Effect of foreign exchange rate

changes on cash and cash equivalents (15) 24 (37)

---------------------------------------- ----------- ----------- -----------

Cash and cash equivalents at

end of period / year 12,636 2,528 17,587

---------------------------------------- ----------- ----------- -----------

Reconciliation of net cash and

cash equivalents

---------------------------------------- ------- ------ -------

Cash and cash equivalents (disclosed

within current assets) 12,636 113 17,587

Cash held by disposal group (disclosed - 2,415 -

within assets classified as held

for resale)

---------------------------------------- ------- ------ -------

Net cash and cash equivalents

at end of period / year 12,636 2,528 17,587

---------------------------------------- ------- ------ -------

1. Accounting policies

Basis of preparation

The consolidated interim financial statements include those of

Thruvision Group plc and all of its subsidiary undertakings

(together "the Group") drawn up at 30 September 2018, and have been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting" ("IAS 34") as adopted for use in the

European Union ("EU"). The consolidated interim financial

statements have been prepared using accounting policies and methods

of computation consistent with those applied in the consolidated

financial statements for the period ended 31 March 2018.

The Group is a public limited company incorporated and domiciled

in England & Wales and whose shares are quoted on AIM, a market

operated by The London Stock Exchange.

Accounting policies

The annual consolidated financial statements of the Group are

prepared on the basis of International Financial Reporting

Standards ("IFRS"). The consolidated interim financial statements

are presented on a condensed basis as permitted by IAS 34 and

therefore do not include all the disclosures that would otherwise

be required in a full set of financial statements and should be

read in conjunction with the most recent Annual Report and Accounts

which were approved by the Board of Directors on 25 June 2018 and

have been filed with Companies House. The condensed interim

financial statements do not constitute statutory accounts as

defined in Section 435 of the Companies Act 2006 and are unaudited

for all periods presented. The financial information for the

12-month period ended 31 March 2018 is extracted from the financial

statements for that period. The auditors' report on those financial

statements was unqualified and did not contain an emphasis of

matter reference and did not contain a statement under section

498(2) or (3) of the Companies Act 2006.

The half year results for the current period to 30 September

2018 have not been audited or reviewed by auditors pursuant to the

Auditing Practices Board guidance of Review of Interim Financial

Information.

The comparative statement of comprehensive income has been

re-presented as if an operation discontinued during the prior year

had been discontinued from the start of the comparative year.

Adoption of new and revised International Financial Reporting

Standards

The Group's accounting policies have been prepared in accordance

with IFRS effective as at its reporting date of 30 September 2018.

The IASB issued amendments to 4 standards under Annual improvement

2012-2014 cycle together with amendments to IAS 1. These amendments

had an effective date after the date of 1 January 2016 and have

been applied by the Group. These did not have a material impact on

the Group's financial statements in the period of initial

application.

Standards Issued

The standards and interpretations that are issued up to the date

of issuance of the Group's interim financial statements are

disclosed below. The Group has adopted these standards, if

applicable, when these became effective. Further details are

disclosed in the 31 March 2018 Annual Report available on the

Group's website: thruvision.com

IFRS 9 Financial Instruments, IFRS 15 Revenue from Contracts

with Customers

Management have conducted an assessment of IFRS 9 and IFRS 15

using the modified retrospective method. The Directors have

assessed the impact of IFRS 15 with the study focussing on:

-- revenue recognition; and

-- accounting for commission on sales.

The assessment for both IFRS 9 and IFRS 15 show these haven't

materially impacted the Group's financial results for the interim

period to 30 September 2018.

IFRS 16 Leases

Management have assessed the impact of IFRS 16 and have

concluded this will materially impact the value of Property, plant

and equipment and Lease liabilities on the Balance Sheet. The

impact has not been reflected in these interim results and will be

completed in advance and included in the full year results to 31

March 2019 using the modified retrospective method. The Group's

lease commitments are detailed in Note 20 in the 31 March 2018

Annual Report.

1. Accounting policies (continued)

Going concern

The Group's loss before tax from continuing operations for the

period was GBP0.8 million (H1 2018: GBP2.5 million, FY 2018 GBP3.1

million). As at 30 September 2018 the Group had net current assets

of GBP14.7 million (31 March 2018: GBP19.2 million) and net cash

reserves of GBP12.6 million (31 March 2018: GBP17.6 million).

The Board has reviewed cash flow forecasts for the period up to

and including 31 December 2019. These forecasts and projections

take into account reasonably possible changes in trading

performance and show that the Group will be able to operate within

the level of current funding resources. The Directors therefore

believe there is sufficient cash available to the Group to manage

through these requirements.

As with all businesses, there are particular times of the year

where the Group's working capital requirements are at their peak.

However, the Group is well placed to manage business risk

effectively and the Board reviews the Group's performance against

budgets and forecasts on a regular basis to ensure action is taken

where needed.

The Directors therefore are satisfied that the Group has

adequate resources to continue operating for a period of at least

12 months from the approval of these accounts. For this reason,

they have adopted the going concern basis in preparing the

financial statements.

Financial instruments

The Group classifies financial instruments, or their component

parts, on initial recognition as a financial asset, a financial

liability or an equity instrument in accordance with the substance

of the contractual arrangement.

2. Segmental information

During the period ended 30 September 2017 the directors believed

that providing segment analysis that showed the Video Business as a

separate segment to the Thruvision Business would aid readers of

the Financial Statements. The Video Business was subsequently

disposed of on 31 October 2017, and as a result at 30 September

2017 the Video Business was classified as an asset held for sale,

and has since been reported as a discontinued operation.

Until the disposal of the segment, the Group's 'Video Business'

Division was focused on the advanced surveillance market. This

covered image and data capture (for example, unattended ground

sensors), a range of processing and enhancement techniques (for

example, thermal image processing, image stabilisation, and

enhancing low light performance), image transmission (both wired

and wireless technologies) and a range of analytics algorithms.

The Group's continuing Thruvision Business is focused on

stand-off passive body scanning technology.

In accordance with IFRS 8, the Group derived the information for

its operating segments using the information used by the Chief

Operating Decision Maker and supplemented this with additional

analysis to assist readers of the Annual Report to better

understand the impact of the proposed divestment. The Group

identified the Board of Directors as the Chief Operating Decision

Maker as the Board is responsible for the allocation of resources

to operating segments and assessing their performance.

Historically central overheads, which primarily relate to

operations of the Group function, are not allocated to the business

units. Following the sale of the Video Business, some of these

central costs transferred to the Video Business or ceased.

Consistent with the reporting of the Video Business as a

discontinued operation, these central costs were classified as

discontinued. Group financing (including finance costs and finance

income) and income taxes are managed centrally and are not

allocated to an operating segment. No operating segments have been

aggregated to form the above reportable segments.

2. Segmental information (continued)

6 months ended 30 September 2018

Solutions Central

----------------- -----------------------------------------------

Video Business Thruvision Central Central

Discontinued Continuing Discontinued Continuing Total

Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ----------------- ------------ ----------------- -------------- ------------

Revenue - 3,169 - - 3,169

-------------------------------- ----------------- ------------ ----------------- -------------- ------------

Depreciation - 77 - - 77

-------------------------------- ----------------- ------------ ----------------- -------------- ------------

Segment adjusted operating

loss - (295) - (356) (651)

Share based payment charge - (19) - (49) (68)

Share buyback costs - - - (116) (116)

Discontinued exceptional

costs (95) - - - (95)

Release of deferred

consideration - - (235) - (235)

Segment operating loss (95) (314) (235) (521) (1,165)

Finance income - - - 41 41

-------------------------------- ----------------- ------------ ----------------- -------------- ------------

Segment loss before tax (95) (314) (235) (480) (1,124)

Loss attributable to

discontinued

operations (330)

-------------------------------- ----------------- ------------ ----------------- -------------- ------------

Loss before tax from continuing

operations (794)

Income tax expense -

-------------------------------- ----------------- ------------ ----------------- -------------- ------------

Loss for the period from

continuing operations (794)

-------------------------------- ----------------- ------------ ----------------- -------------- ------------

Following a review of key management time spent on the

Thruvision segment, an increased cost has been allocated to the

Thruvision segment, with a corresponding reduced cost being

allocated to Central costs. This better reflects the actual time

spent on developing the business following the conclusion of the

sale of the Video Business, and is in line with how the management

accounts have been presented internally since 1 April 2018.

6 months ended 30 September 2017

Services Solutions Central

---------------- ---------------------------- ------------------------------

Video

Services Business Thruvision Central Central

Discontinued Discontinued Continuing Discontinued Continuing Total

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ---------------- -------------- ------------ --------------- ------------- -----------

Total segment

revenue - 11,228 344 - - 11,572

Revenue - 11,228 344 - - 11,572

----------------- ---------------- -------------- ------------ --------------- ------------- -----------

Depreciation - 173 84 - - 257

----------------- ---------------- -------------- ------------ --------------- ------------- -----------

Segment adjusted

operating

loss - (4,994) (864) (1,377) (784) (8,019)

Amortisation of

intangibles

initially

recognised on

acquisition - (616) - - - (616)

Share based

payment charge - - - (20) (35) (55)

Acquisition

related

income/(costs) - 1,126 - - - 1,126

Restructuring

costs - (779) - - - (779)

Impairment of

goodwill

and intangibles - (4,291) - - - (4,291)

Segment

operating loss - (9,554) (864) (1,397) (819) (12,634)

Finance costs - - - (378) 749) (1,127)

----------------- ---------------- -------------- ------------ --------------- ------------- -----------

Segment loss

before tax - (9,554) (864) (1,775) (1,568) (13,761)

Loss attributable to discontinued

operations (11,329)

----------------------------------- -------------- ------------ --------------- ------------- -----------

Loss before tax from continuing

operations (2,432)

Income tax expense (22)

----------------------------------- -------------- ------------ --------------- ------------- -----------

Loss for the year from

continuing operations (2,454)

----------------------------------- -------------- ------------ --------------- ------------- -----------

12 months ended 31 March 2018

Services Solutions Central

--------------------------------- ------------------ --------------------------------------------

Video

Services Business Thruvision Central Central

Discontinued Discontinued Continuing Discontinued Continuing Total

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Total segment

revenue - 13,129 3,103 - - 16,232

Revenue - 13,129 3,103 - - 16,232

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Depreciation - 218 182 - - 400

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Segment adjusted

operating

loss - (5,830) (752) (1,642) (1,720) (9,944)

Amortisation of

intangibles

initially

recognised on

acquisition - (716) - - - (716)

Share based

payment charge - - - (57) (52) (109)

Acquisition

related income - 1,126 - - - 1,126

Loss on disposal

and related

costs - (4,458) - - - (4,458)

Impairment of

goodwill

and intangibles - (4,291) - - - (4,291)

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Segment

operating loss - (14,169) (752) (1,699) (1,772) (18,392)

Finance income - - - - 70 70

Finance costs - - - (469) (758) (1,227)

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Segment loss

before tax - (14,169) (752) (2,168) (2,460) (19,549)

Income tax

(expense)

(discontinued) (92)

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Loss before tax

from

discontinued

operations (16,429)

Loss before tax

from continuing

operations (3,212)

Income tax

credit 90

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Loss for the

year from

continuing

operations (3,122)

----------------- --------------- ------------------ ------------ --------------- ------------- -----------

Analysis of revenue by customer

There have been two (H1 17: three) individually material

customers during the period representing GBP1,826,000 of revenue

(H1 17: GBP307,000).

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------- ------------- ------------- ------------

Asia Pacific 2,287 (10) 1,404

Europe, Middle East and Africa 518 116 1,286

Americas 364 238 413

3,169 344 3,103

-------------------------------- ------------- ------------- ------------

The Group's non-current assets by geography are detailed

below:

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------- ------------- ------------- ------------

United Kingdom 369 407 258

United States of America 26 - 22

395 407 280

-------------------------- ------------- ------------- ------------

3. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a more relevant measure of the

Group's underlying performance. Adjusted loss is not defined under

IFRS and has been shown as the Directors consider this to be

helpful for a better understanding of the performance of the

Group's underlying business. It may not be comparable with

similarly titled measurements reported by other companies and is

not intended to be a substitute for, or superior to, IFRS measures

of profit. The net adjustments to loss before tax from continuing

operations are summarised below:

6 months 6 months Year ended

ended ended 31 March

30 September 30 September 2018

2018 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------ -------------- -------------- -------------

Share buyback costs (i) 116 - -

Share-based payment (ii) 68 35 52

Financing set-up costs (iii) - 263 263

Total adjustments 184 298 315

------------------------------ -------------- -------------- -------------

(i) On 24 July 2018 a Special Resolution was passed to allow the

Group to repurchase up to 47,000,000 ordinary shares at 17p each.

The legal and professional fees incurred in connection with the

repurchase of shares have been split out from continuing costs.

(ii) The performance condition associated with LTIP awards made

from July 2015 are subject to a non-market based performance

measure. Accordingly, should these LTIP awards fail to vest, the

share based payment charge will be added back to the income

statement. Historic LTIP awards have been made with a market based

performance measure which in the event that LTIPs fail to vest the

share based payment charge is not added back to the income

statement. To date the majority of historic LTIP awards have failed

to vest. The inclusion provides consistency over time allowing a

better understanding of the financial position of the Group.

(iii) On 28 September 2017 the Group arranged an unsecured

GBP5.25 million loan facility with Herald Investment Trust,

incurring legal and set up fees.

4. Loss per share

The following reflects the loss and share data used in the basic

and diluted loss per share calculations:

6 months 6 months Year ended

ended 30 ended 30 31 March

September September 2018

2018 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ ------------------

Loss from continuing operations

attributable to ordinary shareholders (794) (2,454) (3,122)

---------------------------------------- ------------ ------------ ------------------

Loss from continuing and discontinued

operations attributable to ordinary

shareholders (1,129) (13,783) (19,551)

Weighted average number of shares 145,454,118 165,130,024 165,130,024

---------------------------------------- ------------ ------------ ------------------

Basic and diluted loss per share

- continuing operations (0.55p) (1.49p) (1.89p)

---------------------------------------- ------------ ------------ ------------------

Basic and diluted loss per share

- continuing and discontinued

operations (0.78p) (8.35p) (11.84p)

---------------------------------------- ------------ ------------ ------------------

4. Loss per share (continued)

6 months 6 months Year ended

ended ended 30 31 March

30 September September 2018

2018 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss from continuing operations

attributable to ordinary shareholders (794) (2,454) (3,122)

Share buyback costs 116 - -

Share-based payment 68 35 52

Financing set up fees - 263 263

Adjusted (loss)/profit after

tax (610) (2,156) (2,807)

------------------------------------------ -------------- ------------ ------------------

Weighted average number of shares 145,454,118 165,130,024 165,130,024

------------------------------------------ -------------- ------------ ------------------

Basic and diluted loss per share (0.55p) (1.49p) (1.89p)

------------------------------------------ -------------- ------------ ------------------

Basic and diluted adjusted (loss)/profit

per share (0.42p) (1.31p) (1.70p)

------------------------------------------ -------------- ------------ ------------------

The inclusion of potential Ordinary Shares arising from LTIP

awards would be anti-dilutive. Basic and diluted loss per share has

therefore been calculated using the same weighted number of

shares.

5. Goodwill

Carrying amount of goodwill allocated to operating segments:

6 months 6 months Year ended

ended ended 31 March

30 September 30 September 2018

2018 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------- -------------- -------------- ------------

Video Business - 12,151 -

Thruvision - - -

Goodwill - 12,151 -

--------------- -------------- -------------- ------------

Historically the Group was organised into Services and

Solutions. In light of the completed disposal of the Video Business

on 31 October 2017, the directors believed that providing segment

analysis that showed the Video Business as a separate segment to

the Thruvision Business would aid readers of the Financial

Statements. Combined, the Video Business and Thruvision made up the

previously reported Solutions segment. Consequently goodwill

acquired through business combinations has been allocated for

impairment testing purposes. These segments were deemed to be the

two cash-generating units ('CGUs') for impairment testing.

The Group conducts annual impairment tests on the carrying value

of the CGUs in the statement of financial position as at 28

February each year. Impairment testing is only re-performed if an

impairment triggering event occurs in the intervening period. As a

result of the proposed divestment the impairment review conducted

at the annual testing date was revisited in the Annual Report for

the year ended 31 March 2018.

Following the classification of the disposal group as held for

sale, the recoverable amount of the Video Business CGU as at 30

September 2017 was based on fair value less costs of disposal. Fair

value was assessed based on the agreed consideration for the Video

Business, and as a result an impairment of GBP4.3 million in the

carrying amount of goodwill was required.

The movement in goodwill in the prior period is a result of

foreign exchange movement (decrease GBP0.6m) and the impairment of

GBP4.3m.

6. Issued share capital

On 15 August 2018 the Group repurchased 19,675,906 Ordinary

shares at 17p per share for a total consideration of GBP3,345k.

As at 30 September 2018, there were 145,454,118 Ordinary Shares

in issue (30 September 2017: 165,130,024, 31 March 2018:

165,130,024). In addition, there were 163,124 Deferred Shares in

issue (31 March 2018 and 30 September 2017: 163,124).

7. Share options

The following share awards were granted in the six month period

ended 30 September 2018:

EMI Approved Sharesave

Options options

Grant date 28 Aug 2018 21 Sept

2018

------------- ----------

Number granted 360,000 1,443,600

------------- ----------

Fair value per option/award 13.47p 9.46p

------------- ----------

Exercise price 25.00p 20.00p

------------- ----------

Vesting period (years) 3.0 3.0

------------- ----------

The vesting and exercise of EMI share awards and Sharesave

option awards are not subject to performance conditions.

The share-based payment charge in the period amounts to GBP68k

(H1 2018: GBP35k, FY 2018: GBP52k), with the fair value charge

attributable to new awards in the period determined using a Black

Scholes calculation. Share option awards made prior to 2015 have

been made with a market based performance measure which in the

event that LTIPS fail to vest the share-based payment charge is not

added back to the income statement. To date the majority of these

historic LTIP awards have failed to vest.

8. Related Party Transactions

As noted in note 7 above, on 21 September 2018 Sharesave Options

were offered to employees as well as Directors of the Business. The

following sharesave options with a vesting date of 1 November 2021

were taken up by Directors of the Group:

Sharesave Exercise

Options Price

Tom Black 90,000 20.00p

---------- ---------

Colin Evans 90,000 20.00p

---------- ---------

9. Financial instruments

Fair value hierarchy

The Group uses the following hierarchy for determining and

disclosing the fair values of financial instruments by valuation

techniques:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities;

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly; and

Level 3: techniques which use inputs which have a significant

effect on the recorded fair value that are not based on observable

market data.

The Group had one Level 2 financial liability of GBP30k (H1

2018: GBPnil, FY 2018 GBPnil) as a result of a financial swap

measured at fair value. The fair values of other financial assets

and liabilities, which are short term, are not disclosed as the

Directors estimate that the carrying amount of the financial assets

and liabilities are not significantly different to their fair

value. These financial assets and liabilities are carried at

amortised cost.

10. Disposal group classified as held for sale

Video Business

As reported in the 2017 Annual Report, the Board undertook a

far-reaching internal review of the Group in early 2017. As a

result of the review, the Board concluded that a sale of the Video

Business would be in the best interests of the Group. A sale

process was undertaken, managed by Investec Bank plc, which

involved approaching a full range of potential trade and financial

buyers. Following a multi-staged and competitive process, the Board

received a number of indicative offers from interested parties. The

disposal group was classified as held for sale in September

2017.

The sale completed on 31 October 2017.

In the six months ended 30 September 2018 revenues attributable

to the disposal group amounted to GBPnil (H1 2018: GBP11.2 million,

FY 2018: GBP13.1 million) with a loss attributable to the disposal

group of GBP0.4 million (H1 2018: GBP11.3 million, FY 2018: GBP16.4

million).

The basic and diluted loss per share from discontinued

operations for the six months ended 30 September 2018 is 0.22 pence

(H1 2018: 6.86 pence, FY 2018: 9.52 pence) based on 145,454,118 (H1

2018 and FY 2018: 165,130,024) weighted average shares in issue.

The inclusion of potential Ordinary Shares arising from LTIP awards

would be anti-dilutive. Basic and diluted loss per share has

therefore been calculated using the same weighted number of

shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR ZKLFBVLFBFBK

(END) Dow Jones Newswires

December 10, 2018 02:00 ET (07:00 GMT)

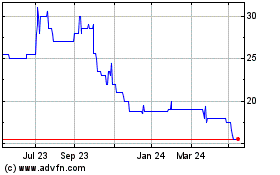

Thruvision (LSE:THRU)

Historical Stock Chart

From May 2024 to Jun 2024

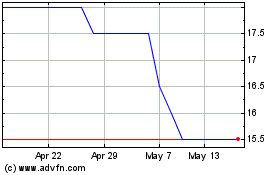

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2023 to Jun 2024