RNS Number:1267P

Titanium Asset Management Corp

29 February 2008

This announcement replaces RNS 0360P released at 08:53 on 29 February 2008. The

only changes are that the figure on the balance sheet for 'cash and cash

equivalents' is 19,388 rather than 19,338 and on the cash flow statement the

figure for restricted cash investments is 55,587 rather than 55,857. The full

text of the corrected announcement is set out below.

TITANIUM ASSET MANAGEMENT CORP

FINAL RESULTS FOR THE PERIOD ENDED 31 DECEMEBR 2007

Chairman's Statement

I am delighted to present this statement as Chairman of Titanium Asset

Management Corp.

We successfully raised US$120mn and were admitted to trading AIM, a market

operated by the London Stock Exchange, in June 2007. This was a reflection of

the skills of our placing agent, Sunrise Securities Corp, and we are very

grateful for the support of our new shareholders.

As a special purpose acquisition company our strategy has been to acquire a

number of specialist asset managers and we have, I believe, made an encouraging

start in implementing this strategy through the purchase of two high quality

asset management firms, Wood Asset Management, Inc and Sovereign Holdings, LLC,

respectively a US equity and a US fixed income manager. We have had a number of

exploratory discussions with other firms and on January 8th 2008 announced the

signing of a non-binding Letter of Intent to acquire another asset management

business. . I am pleased to report that the Company is today announcing the

proposed acquisition of National Investment Services, Inc, an institutional

asset management firm with offices in Milwaukee and Chicago.

Two events that we did not foresee were, first, the sudden illness and then

death of Gary Wood shortly after we bought his firm. We were deeply saddened to

lose Gary after such a short period working together but it is a tribute to the

team that he assembled at Wood Asset Management that the firm has continued to

generate good investment performance and service its clients, now under the

direct management of my colleague and the Company's Chief Executive, John

Sauickie.

The second event has been the extreme dislocation in financial markets that has

occurred since last August. In addition to impacting directly on asset prices,

this has clearly increased risk aversion amongst investors and has in some cases

made it harder for us to implement business decisions with certain

counterparties.

While we should expect this volatility to continue for some months, we believe

that the recent actions of the US Federal Reserve will begin to restore a degree

of investor confidence as the year progresses. We do not expect recent market

events to prevent us from continuing to implement our business strategy. We are

looking to acquire high quality firms; to the extent that recent volatility has

'stress tested' asset managers it will, in our view, help us to identify truly

excellent businesses.

John Kuzan

Chairman

For further information:

Titanium Asset Management Corp.

John Sauickie, Chief Executive Officer + 1 941 361 2191

Nigel Wightman, Executive Director + 44 7789 277849

Seymour Pierce Ltd

Jonathan Wright +44 20 7107 8000

Penrose Financial

Gay Collins +44(0) 20 7786 4888

Kay Larsen

titanium@penrose.co.uk

CONSOLIDATED STATEMENT OF INCOME

For the period of February 2, 2007 (inception) to December 31, 2007

(in thousands except per share amounts)

Revenue $2,437

Operating expenses 3,905

--------

Operating loss (1,468)

Interest income 2,191

--------

Income before taxes 723

Income tax expense 280

--------

Net income $443

--------

Basic earnings per share 0.03

Diluted earnings per share 0.03

CONSOLIDATED BALANCE SHEET at December 31, 2007

ASSETS

Current assets

Cash and cash equivalents $19,388

Restricted cash 55,587

Other current assets 500

----------

Total current assets 75,475

Other assets

Goodwill 21 ,987

Intangible assets, net 15,340

Property and equipment 3

Deferred tax benefit 377

---------

37,707

----------

Total Assets $113,182

----------

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts payable and accruals $1,258

Commitments

Temporary equity 55,587

Stockholders' equity

Common stock 2

Additional paid in capital 55,892

Retained earnings 443

-----------

Total stockholders' equity 56,337

----------

Total Liabilities and Stockholders' equity $113,182

----------

CONSOLIDATED CASH FLOW STATEMENT

For the period of February 2, 2007 (inception) to December 31,2007

Net income $443

Adjustments to reconcile net income to net cash and 1,654

cash equivalents provided by operating activities:

Depreciation and amortization charges

Changes in assets and liabilities:

Decrease (increase) in:

Fees receivable (388)

Deferred tax asset (377)

Other receivables (22)

Prepaid expenses and other assets (90)

Increase (decrease) in:

Accounts payable 149

Income taxes payable 657

Accrued expenses and other current liabilities 452

---------

Net cash provided by operating activities 2,478

---------

Cash flows from investing activities

Purchases of property and equipment (19)

Cash paid for acquisition of subsidiaries (33,965)

Restricted cash investments (55,587)

----------

Net cash used in investing activities (89,571)

Cash flows from financing activities

Issue of share capital 120,025

Costs associated with share issue (9,652)

Share capital redeemed (3,892)

----------

Net cash from financing activities 106,481

----------

Net increase in cash and cash equivalents $19,388

Cash and cash equivalents

Beginning -

----------

Ending $19,388

----------

NOTES ON CONSOLIDATED FINANCIAL STATEMENTS

For the period of February 2, 2007 (inception) to December 31, 2007

1 Summary of business and significant accounting policies

Nature of business

Titanium Asset Management, Corp. (the "Company") is a special purpose

acquisition company which seeks to acquire privately owned asset management

businesses. To date the Company has acquired two asset management businesses and

their results are consolidated with those of the company from October 1, 2007.

The Company, through its wholly owned subsidiaries provides equity, fixed income

and balanced investment management services to corporate and individual clients

throughout the United States. The Company does not take title to, or custody of,

client securities.

Cash equivalents and concentration of credit risk

For the purposes of reporting cash flows, the Company considers all highly

liquid investments with an original maturity of three months or less to be cash

equivalents. The Company periodically maintains cash balances with a financial

institution, which at times throughout the year exceeds the federally insured

limits. Management believes that the use of a credit quality financial

institution minimizes the risk of loss associated with cash and cash

equivalents.

Use of Estimates

The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates.

Basis of consolidation

The accompanying consolidated financial statements include the accounts of the

Company and its wholly owned subsidiaries. All inter-company transactions have

been eliminated in consolidation.

Revenue recognition

Revenue represents fees receivable for investment management and advisory

services provided during the period. Management fees are recognised in

accordance with the contractual arrangement and as the services are provided.

Property and equipment

Property and equipment are stated at cost. Cost includes expenditures for major

improvements and replacements with significant capital additions. Maintenance,

repairs and minor renewals, which do not materially extend the life of assets,

are charged to expense as incurred. Depreciation is computed using the

straight-line method over the estimated useful lives of the assets as follows:

furniture and fixtures - 2 years

Impairment of long-lived assets

The Company complies with the provisions of Statement of Financial Accounting

Standards ("SFAS") No. 144, Accounting for the Impairment or Disposal of

Long-Lived Assets. This statement requires that long-lived assets be reviewed

for impairment when events or circumstances indicate that their carrying amount

may not be recoverable. In management's opinion, no such events or changes in

circumstances have occurred in the current year.

Goodwill and intangibles

Goodwill is the excess of the amount paid to acquire a business over the fair

value of the net assets acquired. Pursuant to SFAS No. 142, Goodwill and Other

Intangible Assets, the carrying amount of goodwill is reviewed for impairment

annually or whenever events or changes in circumstances indicate that the

carrying amount might not be recoverable. If the fair value of the operations to

which the goodwill relates is less than the carrying amount of the unamortized

goodwill, the carrying amount will be reduced with a corresponding charge to

expense.

We will test goodwill for impairment at least annually (first day of our fourth

quarter), or more often if deemed necessary based on certain circumstances. Our

goodwill impairment test will be a two-step process: Step 1 - test for potential

impairment by comparing the fair value of each reporting unit with its carrying

amount; if the fair value of the reporting unit is greater than its carrying

amount (including recorded goodwill), then no impairment exists and Step 2 is

not performed; Step 2 - if the carrying amount of the reporting unit (including

recorded goodwill) is greater than its fair value, then the amount of the

impairment, if any, is measured and recorded as needed.

Intangible assets with definite lives are amortized over their estimated useful

life and reviewed for impairment in accordance with SFAS 144. Intangible assets

with definite lives are amortized using the straight-line method over their

estimated useful lives.

The value of the non-compete agreement signed in connection to the Wood Asset

Management, Inc. acquisition (see note 14) has been charged to expense

($829,000) in operating expenses, as of December 31, 2007, due to the untimely

death of the previous owner with whom the agreement was with.

Leases

Rentals paid under operating leases are charged to the profit and loss account

in the period when they become payable.

Earnings per share

Earnings per share is computed by dividing net income by the weighted average

number of shares of common stock and restricted stock outstanding during the

period. Warrants have been treated as dilutive to the extent that they are

exercisable below the average share price for the period.

Temporary equity

The proceeds from the issue of common shares bearing the right to require

repayment as explained in Note 13 have been classed as temporary equity to

reflect the potential for stockholders to require repurchase of their shares.

Option granted in relation to share issue

The fair value of the option granted to Sunrise Securities Corp. has been

credited to non-current liabilities. The cost of the option has been netted off

against reserves along with the other costs of admission.

Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109,

"Accounting for Income Taxes." Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to differences between

financial statement carrying amounts of existing assets and liabilities and

their respective tax bases and operating loss and other loss carryforwards.

Deferred tax assets and liabilities are measured using enacted tax rates

expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled.

2 Cash and cash equivalents

2007

Cash held by Group companies $19,388

Cash held in trust for the Company 55,587

----------

$74,975

----------

The trust amount is held in a trust fund at a branch of J.P. Morgan Chase Bank,

N.A. maintained by Continental Stock Transfer and Trust Company, as trustee,

pursuant to an investment management agreement. The proceeds held in the trust

fund will not be released except upon a number of events as set forth in the

document published by the Company in connection with its admission to AIM.

3 Stockholders' equity

The company has authorized 54,000,000 shares of Common Stock, 720,000 shares of

Restricted stock and 1,000,000 shares of Preferred Stock, all with a par value

of $0.0001 per share. As of December 31, 2007 the Company had issued and

outstanding Common Stock shares and Restricted Stock shares of 22,993,731 and

696,160 respectively. As of December 31, 2007, no Preferred Stock shares have

been issued and accordinfgly the associated rights have not been established.

During the period the Company executed various Private Placement offerings of

Common Stock and Restricted Stock as follows:

Date Class Number Price Proceeds Purpose

(in $

thousands)

02/02/07 Common stock 2,880,000 0.7c 20 Start up capital

02/02/07 Restricted 720,000 0.7c 5 Start up capital

shares

06/21/07 Units 1 20,000,000 $6.00 120,000 Finance

acquisitions

10/01/07 Common stock 727,273 $5.50 - Wood acquisition

10/01/07 Common stock 181,818 $5.50 - Sovereign

acquisition

1 Each unit comprised 1 common share and 1 warrrant to subscribe for common

shares at $4. The warrants expire on June 20, 2011.

The holders of Common Stock arising from the issue of units on June 21, 2007 are

entitled to require the Company to repurchase their shares if at the time the

Company seeks approval for a business combination and the stockholders vote

against the proposal. The holders of Common Stock are also entitled to require

the Company to repurchase their shares if the Company seeks approval to extend

the deadline for a qualifying business combination and the shareholders vote

against the proposal. The repurchase price will be a per share price equal to a

pro-rata share of the trust fund, including interest earned and net of expenses

and taxes thereon.

As part of the AIM listing the Company granted an option to Sunrise Securities

Corp to acquire 2 million units at a price of $6.60. This option has been valued

at $2,091,000 and is recorded as a non-current liability on the balance sheet of

the Company.

4 Acquisitions

The financial statements include the results for Wood Asset Management Inc and

Sovereign Holdings LLC from October 1, 2007, the date of acquisition. As at

December 31, 2007 Titanium Asset Management Corp held 100% of the issued share

capital of Wood Asset Management Inc and a 100% economic interest in Sovereign

Holdings LLC.

Wood Asset Management Inc

Details Consideration Fair value Goodwill

Cash $29,164 $-

Shares issued 4,000 -

Existing customers - 12,026

Non-compete agreement - 829

Brands - 444

--------- --------- ---------

$33,164 $13,299 $19,865

--------- --------- ---------

Sovereign Holdings LLC

Details Consideration Fair value Goodwill

Cash $4,801 $-

Shares issued 1,000 -

Existing customers - 2,665

Non-compete agreement - 833

Brands - 181

-------- -------- --------

$5,801 $3,679 $2,122

-------- -------- --------

5 Earnings per common share

The calculation of basic earnings per ordinary share is based on the profit for

the year of $442,210 and on 14,312,262 common shares, being the weighted average

number of common shares in issue during the year.

The diluted earnings per share is based on profit for the year before

extraordinary items of $442,210 and on 17,489,985 common shares, calculated as

follows:

2007

Basic weighted average number of shares 14,312,262

Dilutive effect of warrants 3,177,723

-------------

6 Report and Accounts

The report and accounts of the Company for the period from inception to 31

December 2007 and being despatched to stockholders shortly. Copies of the report

and accounts will be available to the public free of charge from the offices of

Seymour Pierce, 20 Old Bailey, London EC4M 7EN for at least one month and will

be available to be downloaded from the Company's website at www.ti-am.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SESFMUSASEIE

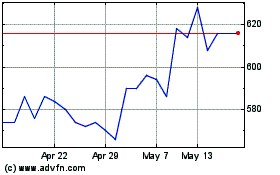

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

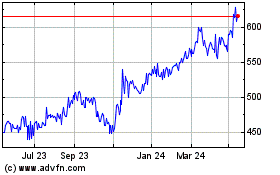

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024