TIDMSSTY

RNS Number : 2435R

Safestay PLC

10 September 2014

SAFESTAY PLC

UNAUDITED RESULTS FOR THE PERIOD FROM 29 JANUARY 2014 TO 30 JUNE

2014

Chairman's statement

I am pleased to present the maiden set of interim results of

Safestay plc following its admission to trading on AIM on 2 May

2014.

The Company owns and operates a brand of contemporary hostels,

designed to appeal to a broad range of guests. Known as a "boutique

hostel" within the travel industry, its aim is to provide safe,

stylish accommodation which offers a more attractive alternative to

both traditional hostels and budget hotel accommodation.

The Company was incorporated on 29 January 2014 and admitted to

AIM on 2 May 2014, at which time GBP7.6m was raised from new

investors, which combined with a Coutts & Co loan facility of

GBP5.6m was used to acquire the Safestay joint venture and to

provide working capital. At the time of the Company's admission to

AIM, the joint venture owned a freehold property in Elephant &

Castle from which it operated the Safestay hostel and,

subsequently, on 24 May 2014, the Group acquired a second hostel in

York for GBP2.35m.

Although these results are for the period from incorporation on

29 January 2014 to 30 June 2014, as a result of the listing and

acquisition of the Safestay Joint venture, the Group commenced

trading on 2 May 2014 and these results therefore only include the

trading from that date to 30 June 2014.

Safestay Elephant & Castle

This hostel is located at John Smith House, in Elephant &

Castle, in the London Borough of Southwark, in what were the former

headquarters of the Labour Party. The freehold property has a gross

internal area of 37,000 square feet with 413 beds located in 74

separate rooms.

The hostel opened its doors for business in June 2012 since when

it has seen significant growth in occupancy and average bed rates,

which together drive total bed revenue.

For the six months to 30 June 2014, occupancy at the hostel was

75.6% (2013: 64.1%), which was above the budget for the period. The

average bed rate for the six months to 30 June 2014 increased by

12.2% over the same period last year. Both of these factors

generated an overall increase in total bed revenue for the six

months to 30 June 2014 of 31.8% when compared with the six months

to 30 June 2013.

Safestay York

Located inside the historic walled city of York, this 153 bed

hostel operating from a freehold property was acquired by the Group

on 24 May 2014 as part of its strategy to add venues to the Group

to create a portfolio of hostels in selected locations in the UK

and Europe. Although the average bed rate of the hostel is at

reasonable levels, historically, the occupancy level has been below

50%.

For the six months to 30 June 2014, occupancy was 50.9% compared

with 44.1% in the same period in 2013.

A refurbishment and re-branding of the hostel has commenced

since the period end, which the Directors anticipate will result in

increased occupancy and bed revenue.

In line with its strategy outlined above, the Board is reviewing

further potential acquisition opportunities, and expects that

expansion of the portfolio will follow in due course.

Larry Lipman

Chairman

Contacts:

Larry Lipman Chairman, Safestay Plc: 020 8815 1600

Tom Griffiths, Westhouse Securities Limited: 020 7601 6100

Unaudited

Condensed consolidated income Period

statement from

29 January

to

30 June

2014

Note GBP000

-------------

Revenue 3 502

Cost of sales (41)

Gross profit 461

Administrative expenses (240)

Operating profit 221

Finance costs (84)

Profit before tax 137

Tax (30)

-------------

Profit for the financial period

attributable to owners of the

parent company 107

-------------

Basic earnings per share 5 5.10

Diluted earnings per share 5 4.68

Unaudited

Period

Condensed consolidated statement of comprehensive income from

29 January

to

30 June

2014

GBP000

-----------

Profit for the period 107

Total comprehensive income for the period attributable

to owners of the parent company 107

-----------

Condensed consolidated statement of Unaudited

financial position 30 June

2014

Note GBP000

-----------

Non-current assets

Property, plant and equipment 8 14,701

Current assets

Stock 2

Trade and other receivables 230

Cash and cash equivalents 1,423

1,655

-----------

Total assets 16,356

-----------

Current liabilities

Loans 9 1,800

Trade and other payables 820

2,620

-----------

Non-current liabilities

Loans 9 7,905

-----------

Total liabilities 10,525

-----------

Net assets 5,831

-----------

Equity

Share capital 10 132

Share premium account 11 5,580

Share-based payment reserve 12

Retained earnings 107

Total equity attributable to owners of the

parent company 5,831

-----------

Condensed consolidated statement of cash Unaudited

flows Period from

29 January

to

30 June 2014

Note GBP000

-------------

Cash flows from operating activities

Cash generated from operations 7 223

Interest paid (25)

-------------

Net cash generated from operating activities 198

-------------

Cash flows from investing activities

Purchase of property, plant and equipment (2,510)

Net cash outflow on acquisition of subsidiaries (5,320)

Net outflow from investing activities (7,830)

-------------

Cash flows from financing activities

Issue of shares 4,800

Payment for share issue costs (896)

Repayment of borrowings (4,546)

Increase in borrowings 5,600

Issue of loan notes 4,324

Loan arrangement fees (227)

Net cash inflow from financing activities 9,055

-------------

Net increase in cash and cash equivalents 1,423

Cash and cash equivalents at beginning of

period -

Cash and cash equivalents at end of period 1,423

-------------

Condensed consolidated Total

statement of changes in Share Share-based Retained

equity capital Share premium payment earnings

account reserve

GBP000 GBP000 GBP000 GBP000 GBP000

--------- -------------- ------------ ---------- -------

Comprehensive income

Profit for the period from

29 January 2014 to 30 June

2014 - - - 107 107

Transactions with owners

Shares issued in the period 132 5,580 12 - 5,724

Balance at 30 June 2014 132 5,580 12 107 5,831

--------- -------------- ------------ ---------- -------

1. Basis of preparation and accounting policies

The condensed interim consolidated financial statements of the

Company and its subsidiaries ("the Group") for the period from 29

January 2014 to 30 June 2014 ("the period") have been prepared

using accounting policies consistent with International Financial

Reporting Standards (IFRS) as adopted by the European Union. This

interim statement does not constitute full accounts as defined by

Section 434 of the Companies Act 2006.

These condensed interim financial statements have not been

audited, do not include all of the information required for full

annual financial statements. While the financial figures included

within this interim report have been computed in accordance with

IFRS applicable to interim periods, this report does not contain

sufficient information to constitute an interim financial report as

set out in International Accounting Standard 34 Interim Financial

Reporting.

2. Operating segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision makers.

The chief operating decision makers, who are responsible for

allocating resources and assessing performance of the operating

segments, have been identified as the executive directors.

Currently there is only one operating segment, which is the

operation of hostel accommodation in the UK.

3. Revenue

Revenue is stated net of VAT and comprises revenues from

overnight hostel accommodation and the sale of ancillary goods.

Accommodation and the sale of ancillary goods is recognised when

services are provided.

Sale of ancillary goods comprises sales of food, beverages and

merchandise.

Deferred income comprises deposits received from customers to

guarantee future bookings of accommodation. This revenue is

recognised once the bed has been occupied.

4. Business combinations

On 2 May 2014, Safestay plc acquired 100% of the partner's

interest in the Safestay joint venture, which owns and operates the

Safestay Elephant & Castle hostel. The joint venture was

between Safeland plc and Moorfield Funds who owned 20% and 80%

respectively. Moorfield Funds sold their interest for GBP6.242m.

Safeland plc demerged their 20% interest in consideration of

3,617,246 Safestay shares.

Assets acquired and liabilities recognised at the date of acquisition

were as follows:

GBP000

Non-current assets

Property, plant and equipment 12,200

Current assets

Stock 3

Trade and other receivables 117

Cash and cash equivalents 922

1,042

-------

Total assets 13,242

-------

Current liabilities

Bank loans 250

Trade and other payables 645

895

-------

Non-current liabilities

Bank loans 4,296

-------

Total liabilities 5,191

-------

Net assets 8,051

-------

Consideration transferred:

3,617,246 Safestay plc shares issued to Safeland plc 1,809

Cash paid to Moorfield fund 6,242

-------

8,051

-------

The directors have completed a review of the fair value of the

assets acquired and liabilities recognised and consider there is no

material difference to the amounts shown in the table above.

5. Earnings per share

Unaudited

Period from

29 January

to

30 June

2014

GBP000

Profit for the financial period attributable to owners of

the parent company 107

-------------

No.

000

Weighted average number of ordinary shares for

the purposes of basic earnings per share 2,100

Effect of potential dilutive ordinary shares:

share options 189

Weighted average number of ordinary shares for the purposes

of diluted earnings per share 2,289

-------------

Basic earnings per share 5.10p

Diluted earnings per share 4.68p

Diluted Earnings per share is calculated by adjusting the

earnings and number of shares for the effects of dilutive options

and other dilutive potential ordinary shares.

6. Dividends

No interim dividend has been declared or paid.

7. Cash flows from operating activities

Unaudited

Period from

29 January

to

30 June 2014

GBP000

Profit before tax 137

Depreciation 9

Finance costs 84

Share-based payments charge 12

242

Changes in working capital

Decrease in stock 1

Increase in trade and other receivables (113)

Increase in trade and other payables 93

223

-------------

8. Property, plant and

equipment

Freehold Plant and equipment

Land and buildings Six months Total

GBP000 GBP000 GBP000

-------------------------------------- ----------------------- -------------------

Cost

Acquisitions 12,127 73 12,200

Additions 2,471 39 2,510

-------------------------------------- ----------------------- -------------------

End of period 14,598 112 14,710

-------------------------------------- ----------------------- -------------------

Depreciation

Charge for the period - 9 9

-------------------------------------- ----------------------- -------------------

End of period - 9 9

-------------------------------------- ----------------------- -------------------

Net book value

30 June 2014 14,598 103 14,701

-------------------------------------- ----------------------- -------------------

Freehold land and buildings comprises the two hostels, Safestay

Elephant & Castle and Safestay York. Both properties are

pledged to secure banking facilities and loan notes granted to the

Group.

Due to the high residual value and long useful life,

depreciation on the property is negligible.

9. Loans

Unaudited

Year

ended

30 June

2014

GBP000

---------

At amortised cost

Bank loan 5,600

Convertible loan notes 2,800

Loan notes 1,524

---------

9,924

Unamortised Borrowing costs (219)

---------

9,705

---------

The Bank loan has a term of five years on which interest is

payable at 3.25% over LIBOR. The Group has given security to the

bank including a first ranking charge over the Group's freehold

hostel in the Elephant & Castle. There were no breaches in bank

loan covenants as at 30 June 2014.

The convertible loan notes were issued on 2 May 2014. They are

convertible into Ordinary Shares at the option of the noteholder,

at any time prior to redemption, as a rate which values each

Ordinary Share at 57.5p per share. The redemption period is three

years from the date of issue. Interest is payable at 6% per annum.

The convertible loan notes are secured by way of a charge over the

Group's hostel in the Elephant & Castle, ranking after the

security granted to the bank.

The loan notes were issued on 24 May 2014. They are repayable in

one year. The rate of interest on the Loan notes is 0.75% per month

for the first eight months and then 11% per annum for the remaining

four months. The loan notes are secured over the Group's Hostel in

York.

All of the Group's loans disclosed above comprise borrowings in

sterling.

The repayment profiles of the loans are as follows:

Convertible Other short Total

loan notes Bank loan term loan

GBP000 GBP000 GBP000 GBP000

------------ ---------- ------------ -------

Due within one year - 300 1,524 1,824

Between two and five years 2,800 5,300 - 8,100

Balance at 30 June 2014 2,800 5,600 1,524 9,924

------------ ---------- ------------ -------

10. Share capital

GBP000

--------

Allotted, issued and fully paid

1 Ordinary Share of 1p issued on 29 January -

2014

13,217,246 Ordinary Shares of 1p each issued

on 2 May 2014 132

--------

13,217,247 Ordinary Shares of 1p each as at

30 June 2014 132

--------

11. Share premium

Share premium received on 13,217,246 Ordinary Shares

issued on

2 May 2014 at 49p per share 6,476

Share issue costs (896)

-----------

5,580

-----------

Copies of this announcement are available on the Company's

website www.safestay.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR MMGGLVLVGDZM

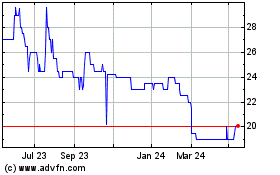

Safestay (LSE:SSTY)

Historical Stock Chart

From Jul 2024 to Aug 2024

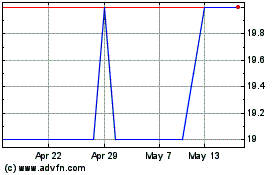

Safestay (LSE:SSTY)

Historical Stock Chart

From Aug 2023 to Aug 2024