SQS Software Quality Systems AG Trading Update (8000L)

January 14 2016 - 2:00AM

UK Regulatory

TIDMSQS

RNS Number : 8000L

SQS Software Quality Systems AG

14 January 2016

SQS Software Quality Systems AG

("SQS" or "the Company")

Trading Update

14(th) January 2016

SQS Software Quality Systems AG (AIM: SQS), the world's largest

specialist supplier of software quality services, is pleased to

provide an update on trading for the year ended 31 December

2015.

SQS continued to experience solid top line growth of 18% in

2015, notably in North America where growth was driven by two

acquisitions during the period. Results for the year are expected

to be in line with the Board's expectations with revenues of circa

EUR317m.

The Company ended the period with a net debt position of circa

EUR(7m), a substantial improvement from the net debt position of

EUR(26.5m) at the end of the first half. This was despite an

additional investment of EUR5m during the second half for

completing the acquisition of Galmont Consulting LLC and doubling

the test-centre capacity in Pune, India.

SQS continued to execute successfully on the stated strategy of

increasing revenues from Managed Services and Specialist

Consulting, as well as on growing the contribution from the US, all

underpinned by recent business wins and extensions. During H2 2015

we have further reduced the proportion of our business arising from

lower margin Regular Testing Services engagements.

Following the year end, SQS has been awarded a major new

multi-million dollar contract with an existing industrial client in

the US.

We are pleased to report that all three acquisitions made during

2015 (Bitmedia in Italy, Trissential and Galmont in the US) have

been successfully integrated and delivered positive contributions

to the Group's profitability in the past year, as well as the

expected strategic benefits.

Diederik Vos, CEO of SQS, commented: "The Group has performed

well in 2015 and I am pleased to end the financial year in a

considerably stronger position than we started. The Company

continues to effectively manage the challenges evident in Regular

Testing Services, and we have shown that the stated strategy of

focussing on Managed Services, Specialist Consulting and increasing

our efforts in the US have delivered the expected outcome. Looking

ahead, we believe there are significant geographic and vertical

market opportunities to be captured across our divisions and we

remain confident of continued progress in 2016."

Ends

Enquiries:

SQS Software Quality Systems AG Tel. +49 (0) 2203

91 54 0

Diederik Vos, Chief Executive

Officer

Rene Gawron, Chief Financial Officer

Numis Securities - Nomad and Joint Tel +44 (0) 20

Broker 7260 1000

Simon Willis / Jamie Lillywhite

/ Mark Lander

Stockdale Securities - Joint Broker Tel. +44 (0) 20

7601 6100

Robert Finlay / Antonio Bossi

FTI Consulting - Financial Media Tel. +44 (0)20

and Investor Relations 3727 1000

Matt Dixon / Dwight Burden sqs@fticonsulting.com

About SQS

SQS is the world's leading specialist in software quality. This

position stems from over 30 years of successful consultancy

operations. SQS consultants provide solutions for all aspects of

quality throughout the whole software product lifecycle driven by a

standardised methodology, offshore automation processes and deep

domain knowledge in various industries. Headquartered in Cologne,

Germany, the company now employs approximately 4,600 staff. SQS has

offices in Germany, UK, US, Australia, Austria, Egypt, Finland,

France, India, Ireland, Italy, Malaysia, the Netherlands, Norway,

Singapore, South Africa, Sweden, Switzerland and UAE. In addition,

SQS maintains a minority stake in a company in Portugal. In 2014,

SQS has generated revenues of EUR268.5 million.

SQS is the first German company to have a primary listing on

AIM, a market operated by the London Stock Exchange. In addition,

SQS shares are also traded on the German Stock Exchange in

Frankfurt am Main.

With over 10,000 completed projects under its belt, SQS has a

strong client base, including half of the DAX 30, nearly a third of

the STOXX 50 and 20 per cent of the FTSE 100 companies. These

include, among others, Allianz, BP, Commerzbank, Daimler, Deutsche

Post, Generali, Meteor, UBS and Volkswagen as well as other

companies from the six key industries on which SQS is focused.

For more information, see www.sqs.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFERLIIVLIR

(END) Dow Jones Newswires

January 14, 2016 02:00 ET (07:00 GMT)

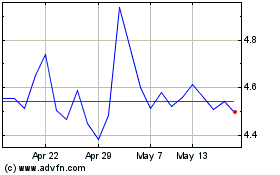

-1x Square (LSE:SQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

-1x Square (LSE:SQS)

Historical Stock Chart

From Jul 2023 to Jul 2024