Aisi Realty Public Limited Half Yearly Report -19-

September 05 2012 - 2:00AM

UK Regulatory

Currency risk arises when commercial transactions and recognized

financial assets and liabilities are denominated in a currency that

is not the Group's functional currency. Most of the Group's

financial assets are denominated in the functional currency.

Interest Rate Risk

The Group's income and operating cash flows are substantially

independent of changes in market interest rates as the Group has no

significant interest-bearing assets. On June 30(th) , 2012, cash

and cash equivalent financial assets amounted to US$154.672

(2011:US $18.504).

The Group is exposed to interest rate risk in relation to its

borrowings amounting to US$15.813.857 (2010: US$16.343.535) as they

are issued at variable rates tied to the Libor. Management monitors

the interest rate fluctuations on a continuous basis and evaluates

hedging options to align the Group's strategy with the interest

rate view and the defined risk appetite. Although no hedging has

been applied for the reporting period, such may take place in the

future if deemed necessary in order to protect the cash flow of a

property asset through different interest rate cycles.

The Group's exposures to financial risk are discussed also in

note 4.

27.6 Credit Risk Management

The Group has no significant credit risk exposure. The credit

risk emanating from the liquid funds is limited because the Group's

counterparties are banks with high credit-ratings assigned by

international credit rating agencies. The Credit risk of

receivables is reduced as the majority of the receivables represent

VAT to be offset through VAT income in the future.

27.7 Liquidity Risk Management

Ultimate responsibility for liquidity risk management rests with

the Board of Directors, which applies a framework for the Group's

short, medium and long term funding and liquidity management

requirements.The Treasury function of the Group manages liquidity

risk by preparing and monitoring forecasted cash flow plans and

budgets while maintaining adequate reserves. The following table

details the Group's contractual maturity of its financial

liabilities. The tables below have been drawn up based on the

undiscounted contractual maturities including interest that will be

accrued.

30 June 2012 Carrying Total Less than From one More than

amount one year to two years

two years

--------------------------- ----------- ----------- ----------- ----------- -----------

US$ US$ US$ US$ US$

--------------------------- ----------- ----------- ----------- ----------- -----------

Financial assets

--------------------------- ----------- ----------- ----------- ----------- -----------

Cash at Bank 154.672 154.672 154.672 - -

--------------------------- ----------- ----------- ----------- ----------- -----------

Financial liabilities

--------------------------- ----------- ----------- ----------- ----------- -----------

Interest bearing 15.813.857 15.813.857 15.813.857 - -

borrowings

--------------------------- ----------- ----------- ----------- ----------- -----------

Trade and other payables 4.257.618 4.257.618 3.893.586 - 364.032

--------------------------- ----------- ----------- ----------- ----------- -----------

Finance lease liabilities 668.311 2.583.658 116.609 2.467.050

--------------------------- ----------- ----------- ----------- ----------- -----------

Current and Provisional 1.167.227 1.167.227 1.167.227 - -

tax liabilities

--------------------------- ----------- ----------- ----------- ----------- -----------

30 June 2011 Carrying Total Less than From one More than

amount one year to two years

two years

--------------------------- ----------- ----------- ----------- ----------- -----------

US$ US$ US$ US$ US$

--------------------------- ----------- ----------- ----------- ----------- -----------

Financial assets

--------------------------- ----------- ----------- ----------- ----------- -----------

Accounts receivable 2.472.502 2.472.502 2.472.502 - -

--------------------------- ----------- ----------- ----------- ----------- -----------

Cash at Bank 18.504 18.504 18.504 - -

--------------------------- ----------- ----------- ----------- ----------- -----------

Financial liabilities

--------------------------- ----------- ----------- ----------- ----------- -----------

Interest bearing 16.343.535 16.343.535 1.128.296 2.338.824 12.876.415

borrowings

--------------------------- ----------- ----------- ----------- ----------- -----------

Accounts payable 16.077.102 16.077.102 15.408.783 668.319 -

--------------------------- ----------- ----------- ----------- ----------- -----------

Finance lease liabilities 608.067 2.453.703 92.199 92.199 2.269.305

--------------------------- ----------- ----------- ----------- ----------- -----------

Current and Provisional 1.133.571 1.133.571 1.133.571 - -

tax liabilities

--------------------------- ----------- ----------- ----------- ----------- -----------

28. Events after the end of the reporting period

Financial Restructuring-EBRD

As per the Terminal Brovary EBRD loan restructuring agreed by

the old management a month prior to the Company's restructuring in

H1 2011, several payments are coming due in the next couple of

months. The Group has entered into discussions with the Bank,

aiming at matching the revenue inflows with the loan payment

outflows.

Settlement Agreement-UVK

In late July 2012, the Group has proceeded with an amicable

settlement with UVK, a logistics company that had originally signed

a contract to rent out 100% of Terminal Brovary. Due to the fact

that the terminal was not delivered on time in July 2009, UVK

tabled several claims and following negotiations an agreement was

signed entitling them to a US$3m payment, while at the same time

UVK received as security a mortgage over AISI Bella Odessa plot.

Following a payment of US$1.500.000 in August and November 2009 the

Group did not proceed in paying the rest and thus UVK enforced the

mortgage on Bela, a fact that resulted in a protracted legal

battle. In July 2012 UVK and the Group agreed to settle out of

court for US$1.000.000 whilst the Group had provided for the whole

US$1.500.000 in its accounts. The Group paid US$300.000 in cash

whilst the rest is guaranteed via a bank guarantee letter, with the

letter itself being secured by mortgaging certain of the plots of

the Group a well as a cash collateral of US$200.000.

Liquidation request by AISI Realty Capital LLC

On 23/7/2012 the Company was notified that the ex manager, AISI

Realty Capital LLC, has initiated a liquidation process in Cyprus

claiming the remaining amount of US$225.000 resulting from the

settlement agreement signed in July 2011 as amended in April 2012.

In this claim, AISI Realty Capital LLC is being represented by Mr.

Besik Sikharulidze, who had been a member of the Board of Directors

of the Company until 30/8/2012. The Company has initiated its

defence strategy in respect thereof, and expects the issue to be

resolved prior to any court hearing.

Loan Repayment AISI Capital Ltd- AISI Bella LLC

As part of the Group's restructuring process, AISI Bella has

repaid the principal and interest of a loan (amounting in total to

US$26.851.335) granted by AISI Capital Ltd, the Group's financing

Company. As a result, outstanding loans to AISI Capital Ltd by the

Ukrainian subsidiaries at the end of August 2012 amount to

US$62.4m, including interest payable.

Taxes paid-AISI Bella LLC

In August AISI Bella has paid an amount of US$133.984 related to

property taxes for the period from 1 January 2008 till 30 March

2009, that had been previously provided in the Company's

accounts.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDCRSGBGDS

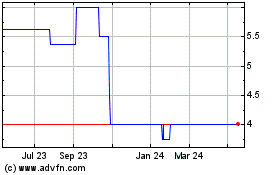

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2024 to Aug 2024

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Aug 2023 to Aug 2024