Aisi Realty Public Limited Half Yearly Report -10-

September 05 2012 - 2:00AM

UK Regulatory

of market value. All the payments are projected in nominal US

dollar amounts and thus incorporate relevant inflation measures.

Valuation Approach

In addition to the above general valuation methodology, the appraisers

have taken into account in arriving at Market Value the following:

Pre Development

In those instances where the nature of the 'Project' has been

defined, it was assumed that the subject property will be developed

in accordance with this blueprint. The final outcome of the development

of the property is determined by the Board of Directors decision,

which is based on existing market conditions, profitability of

the project, ability to finance the project and obtaining required

construction permits.

Development

In terms of construction costs, the budgeted costs have been

taken into account in considering opinions of value. However,

the appraisers have also had regard to current construction rates

passing in the market which a prospective purchaser may deem

appropriate to adopt in constructing each individual scheme.

Although in some instances the appraisers have adopted the budgeted

costs provided, in some cases the appraisers' own opinions of

costs were used.

Post Development

Rental values have been assessed as at the date of valuation

but having regard to the existing occupational markets taking

into account the likely supply and demand dynamics during the

anticipated development period. The standard letting fees were

assumed within the valuations. In arriving at their estimates

of gross development value ("GDV"), the appraisers have capitalized

their opinion of net operating income, having deducted any anticipated

non-recoverable expenses, such as land payments, and permanent

void allowance, which has then been capitalized into perpetuity.

The capitalization rates adopted in arriving at the opinions

of GDV reflect the appraisers' opinions of the rates at which

the properties could be sold as at the date of valuation.

In terms of residential developments, the sales prices per sq.

m. again reflect current market conditions and represent those

levels the appraisers consider to be achievable at present. It

was assumed that there are no irrecoverable operating expenses

and that all costs will be recovered from the occupiers/owners

by way of a service charge.

The valuations take into account the requirement to pay ground

rental payments and these are assumed not to be recoverable from

the occupiers. In terms of ground rent payments, the appraisers

have assessed these on the basis of information available, and

if not available they have calculated these payments based on

current legislation defining the basis of these assessments.

Property tax is not presently payable in Ukraine.

3.18 Non--current liabilities

Non--current liabilities represent amounts that are due in more

than twelve months from the reporting date.

3.19 Project/Special Purpose Vehicle Related Transaction Expenses

Expenses incurred by the Group for acquiring a subsidiary or

associated company and are directly attributable to such acquisition

are recognized in the statement of comprehensive income.

3.20 Provisions

Provisions are recognized when the Group has a present obligation

(legal or constructive) as a result of a past event, it is probable

that the Group will be required to settle the obligation and

a reliable estimate can be made of the amount of the obligation.

The amount recognized as a provision is the best estimate of

the consideration required to settle the present obligation at

the end of the reporting period, taking into account the risks

and uncertainties surrounding the obligation. When a provision

is measured using the cash flows estimated to settle the present

obligation, its carrying amount is the present value of those

cash flows (where the effect of the time value of money is material).

When some or all of the economic benefits required to settle

a provision are expected to be recovered from a third party,

a receivable is recognized as an asset if it is virtually certain

that reimbursement will be received and the amount of the receivable

can be measured reliably.

3.21 Financial liabilities and equity instruments

3.21.1 Classification as debt or equity

Debt and equity instruments issued by a Group entity are classified

as either financial liabilities or as equity in accordance with

the substance of the contractual arrangements and the definitions

of a financial liability and an equity instrument.

3.21.2 Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of an entity after deducting all of its

liabilities. Equity instruments issued by the Group are recognized

at the proceeds received, net of direct issue costs. Ordinary

shares are classified as equity. The difference between the fair

value of the consideration received by the Company and the nominal

value of the share capital being issued is taken to the share

premium account

Repurchase of the Company's own equity instruments is recognized

and deducted directly in equity. No gain or loss is recognized

in the statement of comprehensive income on the purchase, sale,

issue or cancellation of the Company's own equity instruments.

3.21.3 Financial liabilities

Financial liabilities are classified as either financial liabilities

"at FVTPL" or "other financial liabilities".

3.21.3.1 Financial liabilities at FVTPL

Financial liabilities are classified as at FVTPL when the financial

liability is either held for trading or it is designated as at

FVTPL.

A financial liability is classified as held for trading if:

* it has been acquired principally for the purpose of

repurchasing it in the near term; or

* on initial recognition it is part of a portfolio of

identified financial instruments that the Group

manages together and has a recent actual pattern of

short-term profit-taking; or

* it is a derivative that is not designated and

effective as a hedging instrument.

A financial liability other than a financial liability held for

trading may be designated as at FVTPL upon initial recognition

if:

* such designation eliminates or significantly reduces

a measurement or recognition inconsistency that would

otherwise arise; or

* the financial liability forms part of a group of

financial assets or financial liabilities or both,

which is managed and its performance is evaluated on

a fair value basis, in accordance with the Group's

documented risk management or investment strategy,

and information about the grouping is provided

internally on that basis; or

* it forms part of a contract containing one or more

embedded derivatives, and IAS 39 Financial

Instruments: Recognition and Measurement permits the

entire combined contract (asset or liability) to be

designated as at FVTPL.

Financial liabilities at FVTPL are stated at fair value, with

any gains or losses arising on remeasurement recognized in profit

or loss. The net gain or loss recognized in profit or loss incorporates

any interest paid on the financial liability and is included

in the "other gains and losses" line item in the consolidated

statement of comprehensive income. Fair value is determined in

the manner described in section 2.20.8.

3.21.3.2 Other financial liabilities

Other financial liabilities (including borrowings) are subsequently

measured at amortised cost using the effective interest method.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate

is the rate that exactly discounts estimated future cash payments

(including all fees and points paid or received that form an

integral part of the effective interest rate, transaction costs

and other premiums or discounts) through the expected life of

the financial liability, or (where appropriate) a shorter period,

to the net carrying amount on initial recognition.

3.21.3.3 De-recognition of financial liabilities

The Group derecognises financial liabilities when, and only when,

the Group's obligations are discharged, cancelled or they expire.

The difference between the carrying amount of the financial liability

derecognized and the consideration paid and payable is recognized

in profit or loss.

3.22 Value added tax

VAT is levied at the following rates:

* 20% on Ukrainian domestic sales and imports of goods,

works and services and 0% on export of goods and

provision of works or services to be used outside

Ukraine.

* 17% on Cyprus domestic sales and imports of goods,

works and services and 0% on export of goods and

provision of works or services to be used outside

Cyprus.

A taxpayer's VAT liability equals the total amount of VAT collected

within a reporting period, and arises on the earlier of the date

of shipping goods to a customer or the date of receiving payment

from the customer. A VAT credit is the amount that a taxpayer

is entitled to offset against his VAT liability in a reporting

period. Rights to VAT credit arise on the earlier of the date

of payment to the supplier or the date goods are received. The

part of VAT credit expected to be recovered in the long-term

prospective is classified as non-current being discounted for

reflecting principal market assumptions as to projects realization.

Initial loss on discounting VAT credit, non-current was recognized

as part of finance costs.

3.23 Offsetting financial instruments

Financial assets and financial liabilities are offset and the

net amount reported in the consolidated statement of financial

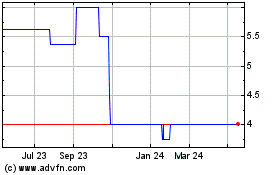

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2024 to Aug 2024

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Aug 2023 to Aug 2024