TIDMAISI

RNS Number : 3605P

Aisi Realty Public Limited

30 September 2011

30 September 2011

Aisi Realty Public Limited

("Aisi" or "the Company")

Unaudited Financial Results for the six months ended 30 June

2011

Overview

The Board of Aisi today reports its half year results for the

six months ended 30 June 2011. As at 30 June 2011, the investment

portfolio was valued at $36 million compared with $43 million as at

31 December 2010, following an impairment of $7.8 million against

the land and property assets of the Company as considered

appropriate by the Board of Directors due to the risks associated

with the probable development of the projects The revised portfolio

valuation together with other operating expenses and a further

impairment against doubtful receivables and advance payments

resulted in a pre-tax loss of $16.5 million for the six months

ended 30 June 2011 (2010: loss $3.9 million).

Operational Review

The Group has signed up additional tenants at its Brovary

Logistics Property ("Terminal Brovary") during the period and as at

the date of these interims, has in situ tenants and signed

preliminary agreements to lease space at Terminal Brovary

approximating 30% of total available space.

The EBRD construction loan was restructured on 1 June 2011 and

became effective on 20 September 2011.

All other portfolio projects remain on hold.

Outlook

The Directors consider that following the agreement with South

East Continental Unique Real Estate (SECURE) Management, under

which the Company has entered into an $8,000,000 convertible Bond

subscription agreement with Narrowpeak Consultants Limited (the

"Investor"), the Company will have adequate working capital and

liquidity to meet a considerable part of its existing liabilities.

This together with improving market fundamentals and the effect of

new lettings at Brovary Logistics Park, make the Board of Directors

cautiously optimistic as to the future prospects of the Group

Further enquiries:

AISI Realty Public Ltd

Lambros Anagnostopoulos / Beso Sikharaulitze, +38 044 459 3000

Seymour Pierce Limited

Nandita Sahgal / David Foreman +44 (0)20 7107 8000

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2011

Note Six month ended

----------------------------

30 June 2011 30 June 2010

------------- -------------

US$ US$

Revenue from operations

Fair value (losses) on investment

property (7 833 811) (1 982 148)

Income from operations, net 184 633 49 826

(7 649 178) (1 932 322)

Expenses

Administration expenses (2 668 358) (2 790 321)

Finance costs, net (1 020 603) 789 256

Other income/(expenses), net (5 255 472) 33 291

Loss before taxation (16 593 611) (3 900 096)

Tax - (2 283)

Loss for the period (16 593 611) (3 902 379)

Other comprehensive income 51 523 -

------------- -------------

Total comprehensive income for the

period (16 542 088) (3 902 379)

============= =============

Attributable to:

Equity holders of the parent (16 538 804) (3 912 740)

Non controlling interests (3 284) 10 361

(16 542 088) (3 902 379)

============= =============

Losses per share attributable to equity

holders of the parent (cent) 4 (4,0) (2,0)

INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 June 2011

30 June 31 December 30 June

2011 2010 2010

---------- ------------ ----------

US$ US$ US$

Assets

Non-current assets

Property, plant and equipment 32 427 54 783 59 294

Investment property under 35 834

construction 6 286 553 10 300 000 098

29 842 22 872

Investment property 579 33 631 000 426

Advances for investments 2 000 000 6 000 000 8 525 887

VAT non-current 2 923 102 2 926 939 2 991 494

41 084 70 283

661 52 912 722 199

========== ============ ==========

Current assets

Accounts receivable 2 565 758 3 487 598 3 088 679

Cash and cash equivalents 18 504 291 053 1 708 152

2 584 262 3 778 651 4 796 831

========== ============ ==========

Total assets 43 668 56 691 373 75 080

923 030

========== ============ ==========

INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(continued)

as at 30 June 2011

30 June 31 December 30 June

2011 2010 2010

------------ ------------- ------------

US$ US$ US$

Equity and Liabilities

Share capital 5 431 918 5 431 918 2 283 299

Share premium 92 683 930 92 683 930 92 683 930

(Accumulated losses)/Retained (90 809 (53 195

earnings 707) (74 217 972) 839)

Advances for issue of shares 2 062 471 2 062 471 4 987 972

Other reserves 68 390 68 390 68 390

Translation difference reserve (1 027 228) (1 068 153) (1 377 231)

------------ ------------- ------------

8 409 774 24 960 584 45 450 521

Non controlling interests 1 027 508 1 030 793 1 326 347

Total equity 9 437 282 25 991 377 46 776 868

============ ============= ============

Non current liabilities

Borrowings 15 550 059 15 529 412 14 588 235

Obligations under finance

leases 583 584 591 245 596 711

Accounts payable 998 910 673 078 871 036

-------------

17 132 553 16 793 735 16 055 982

============ ============= ============

Current liabilities

Borrowings 793 476 41 237 1 411 765

Accounts payable 15 147 558 13 234 905 10 172 863

Obligations under finance

leases 24 483 44 969 76 885

Current tax liabilities 554 352 510 240 510 240

Provisions 579 219 74 910 75 427

-------------

17 099 088 13 906 261 12 247 180

-------------

Total liabilities 34 231 641 30 699 996 28 303 162

============ ============= ============

Total equity and liabilities 43 668 923 56 691 373 75 080 030

============ ============= ============

On 30 September 2011 theBoard of Directors of Aisi Realty Public

Ltd authorised the issue of these financial statements.

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months period ended 30 June 2011

Attributable to equity holders of

the Parent

--------- ---------------------------------------------------- --------- ------------ -------- ------------ -------------

Retained

earnings, Advances

Notes net of for Non

Share Share payables from minority Other issue of Translation controlling

capital premium shareholders interest reserves shares difference Total interests Total

US$ US$ US$ US$ US$ US$ US$ US$ US$ US$

--------- --------- -------------- ------------- ---------- --------- ------------ -------- ------------ -------------

Balance -

1 January 5 431 92 683 2 062 (1 068 24 960

2011 918 930 - (74 217 972) 68 390 471 153) 584 1 030 793 25 991 377

========= ========= ============== ============= ========== ========= ============ ======== ============ =============

Total comprehensive

income for (16 550

the period (16 591 735) 40 925 809) (3 284) (16 554 093)

Balance - 5 431 92 683 2 062 (1 027 8 409

30 June 2011 918 930 - (90 809 707) 68 390 471 228) 774 1 027 508 9 437 282

========= ========= ============== ============= ========== ========= ============ ======== ============ =============

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months period ended 30 June 2011

30 June 2011 30 June 2010

US$ US$

Operating activities

Loss before taxation (16 593 611) (3 900 096)

Adjustments for:

Depreciation of property, plant and equipment 19 921 34 400

Impairment of investment advances and accounts

receivable 4 802 851 -

Tax paid - (2 285)

Foreign exchange losses/(gain) 120 683 (928 734)

Loss on revaluation of investment property 7 833 811 1 982 148

Other expenses 504 409 -

Interest expense 547 768 -

Interest income (2 299) (61 857)

------------- -------------

Operating loss before working capital changes (2 766 467) (2 876 424)

Increase in advances to related parties (618) -

(Increase)/Decrease in prepayments

and other current assets (103 296) (1 312 616)

Increase/(Decrease) in trade and other payables 927 980 84 737

Increase/(Decrease) in financial lease

liabilities (28 147) 10 672

Increase/(Decrease) in payables due to related

parties 1 221 904 1 720 925

Cash flows from operating activities (748 644) (2 372 706)

============= =============

Investing activities

(Increase)/Decrease in VAT receivable 43 035 222 215

(Increase) in advances for investments - 772 058

Increase in payables to constructors (10 671) -

Additions to investment property (90 157) (2 496 672)

Changes of property, plant and equipment 50 035 (20 930)

Cash flows from investing activities (7 758) (1 523 329)

============= =============

Financing activities

Proceeds from other borrowings 471 999 (37 967)

Net cash from financing activities 471 999 (37 967)

============= =============

Effect of foreign exchange rates on cash and

cash equivalents 11 854 621 497

Net increase in cash and cash equivalents (272 549) (3 312 505)

Cash and cash equivalents:

At beginning of the period 291 053 5 020 657

At end of the period 18 504 1 708 152

============= =============

Unaudited notes forming part of the condensed consolidated

interim financial information for the six months ended 30 June

2011

1. Incorporation and principal activities

Country of incorporation

The Company was incorporated in Cyprus on 23 June 2005 as a

private company with limited liability under the Companies Law,

Cap. 113. On 19 March 2006 it was converted into a Public Limited

Liability Company, by filing a statement in lieu of prospectus. Its

registered office is at Totalserve House, 17 Gr. Xenopoulou Street,

3106 Limassol, Cyprus.

Principal activity

The consolidated financial statements of the Company as at and

for the six months period ended 30 June 2011 comprise the Company

and its subsidiaries (together referred to as the "Group").

The principal activity of the Group, which is unchanged from

last year, is the investment in real estate including the

development, operation and selling of real estate assets,in major

population centres of Ukraine.

2. General information

This condensed consolidated interim financial information was

approved by the Board on 30 September 2011.

The interim financial information for the six months ended 30

June 2011 and 30 June 2010 is unreviewed and unaudited and does not

constitute statutory accounts The comparative financial information

for the year ended 31 December 2010 has been derived from the

statutory financial statements for that period. Statutory accounts

for the year ended 31 December 2010 were approved by the Board of

directors on 8 August 2011. The Independent Auditors' Report on

those accounts was both qualified and also contained an emphasis of

matter in relation to the Group's ability to continue as a going

concern and other matters.

3. Going concern

These consolidated financial statements have been prepared on a

going concern basis, which contemplates the realisation of assets

and the repayment of liabilities in the normal course of business.

The recoverability of the Group's assets, as well as the future

operations of the Group, may be significantly affected by the

current and future economic environment, as well as the full

settlement of the existing company liabilities, as they appear in

the financial statements, taking into account the restructuring of

the Group. The Group incurred a loss before tax of US$ 16 591 735

during the six months ended 30 June 2011. At 30 June 2011, the

Group's total assets exceed its total liabilities by US$8 409

774.

The directors consider it is appropriate to prepare these

consolidated financial statements on the going concern basis as the

Group has succeeded to secure additional funding in August 2011 so

as to ensure its continued operations. The consolidated financial

statements do not include any adjustments should the Group be

unable to obtain appropriate funds and consequently not be a going

concern.

4. Earnings and net assets per share attributable to equity

holders of the parent

a. Weighted average number of ordinary shares

30 June 2011 30 June 2010

------------- -------------

Number Number

Issued ordinary shares capital 414 272 792 192 194 975

Weighted average number of ordinary shares 414 272 792 192 194 975

Diluted weighted number of ordinary shares 414 272 792 192 194 975

b. Basic, diluted and adjusted earnings per share

Profit (Loss) after tax 30 June 2011 30 June 2010

------------- -------------

US$ US$

Basic (16 591 735) (3 912 740)

Diluted (16 591 735) (3 912 740)

Adjusted (16 591 735) (3 912 740)

Earnings per share 30 June 2011 30 June 2010

------------- -------------

US$ US$

Basic (0,04) (0,02)

Diluted (0,04) (0,02)

Adjusted (0,04) (0,02)

c. Net assets per share

30 June 2011 30 June 2011 30 June 2011

------------- ----------------- ---------------------

Net assets Number of shares Net assets per share

US$ Number US$

Basic 8 409 774 414 272 792 0,02

Diluted 8 409 774 414 272 792 0,02

Adjusted 8 409 774 414 272 792 0,02

30 June 2010 30 June 2010 30 June 2010

------------- ----------------- ---------------------

Net assets Number of shares Net assets per share

US$ Number US$

Basic 45 450 521 192 194 975 0,24

Diluted 45 450 521 192 194 975 0,24

Adjusted 45 450 521 192 194 975 0,24

5. Events after the end of the reporting period

Financial Restructuring-Convertible Bond

On 15 March 2011, the Company announced that the Board was in

discussions with (i) certain existing Shareholders; and (ii) an

independent third party investor group to provide a working capital

facility, or other cash injection, to meet the short term funding

requirements of the Group.

On 1 July 2011 the Company has signed an agreement with South

East Continental Unique Real Estate (SECURE) Management, under

which the Company entered into a subscription agreement with

Narrowpeak Consultants Limited (the "Investor"), a member of the

SECURE Management group, for a substantial investment in the

Company on certain terms.

Under the agreement, the Investor conditionally agreed to

subscribe for Bonds issued by the Company with aggregate value of

US$8 million which shall be convertible, in certain circumstances,

into 5.135.000 New Ordinary shares (see note below), and will be

issued with class B warrants to subscribe for up to 1.091.000 New

Ordinary shares. Each Class B Warrant will entitle the holder

thereof to receive certain New Ordinary Share. The Class B Warrants

may be exercised at any time from the earlier of the Maturity Date

and exercise of not less than 75 % of the Bonds to the third

anniversary of the date of the Class B Warrant Instrument. The

exercise price of the Class B Warrants will be the nominal value

per Existing Ordinary Shares or New Ordinary Shares as at the date

of exercise. The Class B Warrant Instrument will have anti-dilution

protections so that, in the event of further share issuances by the

Company, the number New Ordinary Shares to which the Investor is

entitled will be adjusted so that the Investor receives the same

percentage of the issued share capital of the Company (as nearly as

practicable), as would have been the case had the issuances not

occurred. This anti-dilution protection for the Investor will lapse

on the earlier of (i) the expiration of the Class B Warrants; and

(ii) capital increase(s) undertaken by the Company generating

cumulative gross proceeds in excess of US$100,000,000.

The bonds and the class B warrants will be subscribed for and

issued to the Investor in two tranches. The principal term of the

bonds will be eight months and the annual interest during this

eight month period will be 1% per annum. On the date eight calendar

months following the issue of the first tranche of bonds (the

"Maturity Date"), if the paid and then then current liabilities are

equal to or less than US$6.4 million, the bonds will automatically

be converted into the ordinary shares else the bonds will be

converted into shares at the sole discretion of the Investor. In

such circumstances, from the Maturity Date until such conversion

the bonds will bear interest at 10% per annum. The bonds are

collateralised by all the freehold assets of the Group which are

not mortgaged.

Notwithstanding the above, the bonds will be able to be

converted into ordinary shares at the Investor's discretion at any

time between the date of the bond instrument and 31 December 2013

(excluding the Settlement Agreement-below).

For further details please revert to the Circular dated 1 July

2011 and the related AIM announcements.

On 15 June 2011, the Investor also entered into a Bridge Loan

Facility Agreement to provide the Group with funds to meet certain

urgent liabilities that caused a high risk of default to the Group.

The Bridge Loan Facility is secured by means of a mortgage granted

by Group.

New Ordinary Shares

On 24 July 2011, The Group obtained shareholder approval for a

proposed capital reorganisation resulting in the consolidation of

all existing ordinary shares of the Company on a 100 for 1 basis.

For further details please revert to the Circular dated 1 July

2011.

Settlement Agreement

As a condition precedent for the Investment, the Group and the

management signed a settlement agreement, resulting in the

Investment Manager releasing the Company from all claims and

liabilities that had arisen under the investment management

agreement which were owed by the Company to the Investment Manager.

In consideration for this release, the Investment Manager will

receive (i) cash payment of US$300,000; and (ii) Class A Warrants

to subscribe for up to 273,000 New Ordinary Shares. The Class A

Warrants have substantially the same terms as the Class B Warrants

but will not benefit from the anti-dilution protection granted to

the Class B Warrants.

The Settlement Agreement constituted a related party transaction

under Rule 13 of the AIM Rules for Companies. For further details

please revert to the Circular of 1 July 2011.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDCXGXBGBG

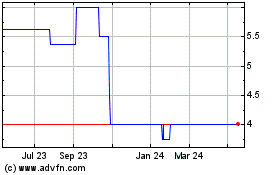

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2023 to Jul 2024