TIDMSOHO

RNS Number : 2570R

Triple Point Social Housing REIT

05 March 2021

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU)

NO. 596/2014.

5 March 2021

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

RESULTS FOR THE YEARED 31 DECEMBER 2020

The Board of Triple Point Social Housing REIT plc (ticker: SOHO)

is pleased to announce its audited results for the year ended 31

December 2020.

31 December 20 31 December 2019

20

--------------------------------- --------------- -----------------

EPRA Net Tangible Assets per

share

(equal to IFRS NAV per share

) 106.42p 105.37p

E arnings per share (basic

and diluted) 6.82p 6.75p

- IFRS basis 4.61p 3.39p

- EPRA basis

Total annual ised rental income GBP31.6m (1) GBP25.4m (1)

V alu e of the portfolio

- IFRS basis GBP571.5m GBP471.6m

- Portfolio valuation basis GBP611.6m GBP503.8m

Weighted average unexpired 26.2 yrs 25.7 yrs

lease term

Dividend paid or declared per

Ordinary S hare 5.18p 5.095p

Financial highlights

-- EPRA Net Tangible Assets (equal to IFRS net asset value ) per

share of 106.42 pence as at 31 December 2020 (2019: 105.37 pence),

an increase of 1.0 % .

-- Portfolio independently valued as at 31 December 2020 at GBP

571.5 million on an IFRS basis (2019: GBP471.6 million) ,

reflecting a valuation uplift of 7.7 % against total invested funds

of GBP530.7 million (2)

. The properties have been valued on an individual basis.

-- The Group's properties were valued at GBP611.6 million on a

portfolio valuation basis (2019: GBP 503.8 million ) , reflecting a

portfolio premium of 7.0% or a GBP 40.1 million uplift against the

IFRS valuation (3) .

-- The portfolio's total annualised rental income was GBP31.6

million (1) as at 31 December 2020 (2019: GBP 25.4 million ) .

-- Operating profit for the year ended 31 December 2020 was

GBP30.2 million (2019: GBP 26.9 million ) .

-- Ongoing Charges Ratio of 1.57% as at 31 December 2019 (2019: 1.63%) .

-- In October 2020 , a further GBP55 million of gross proceeds

(GBP53.3 million net of costs) was raised through an issuance of

new ordinary shares , and in December 2020 the existing debt

facility was increased by GBP 3 0 million .

Operational highlights

-- Acquired 58 properties (400 units) during the year for a

total investment cost of GBP 78.9 million ( including costs )

bringing the total investment portfolio to 445 properties.

-- As at 31 December 2020, 20 out of the Group's 22 forward

funding projects had reached practical completion. The Group had

committed GBP56.2m (including acquisition costs) to these projects

of which GBP2.8m remained oustanding at the end of the year. Of the

remaining 2 schemes, one completed on 26 February 2021 and the

final project is due to complete imminently.

-- IFRS blended net initial yield of 5.27% based on the value of

the portfolio on an IFRS basis as at 31 December 2020 , against the

portfolio's blended net initial yield on purchase of 5.90 % .

-- Further diversif ied the portfolio:

o 155 local authorities

o 341 leases

o 20 Approved Providers

o 98 care providers

-- A s at 31 December 2020 , the weighted average unexpired

lease term (" WAULT ") was 26.2 years .

-- 100% of rental income due and payable for the period ended 31

December 2020, and due and payable at 28 February 2021 has been

collected (4) .

-- 100% of contracted rental income was either CPI or RPI linked.

Post Balance Sheet Activity

-- The Company declared a dividend of 1.295 pence per ordinary

share in respect of the period from 1 October to 31 December 2020.

This dividend will be paid on or around 26 March 20 21 to

shareholders on the register at 12 March 20 21 .

-- The dividend payable on 26 March 2021 brings the total

dividend per Ordinary Share paid by the Company to 5. 18 pence per

s hare in respect of the financial year to 31 December 2020 in line

with the Company's stated target. The Company intends to maintain

its strategy of paying a progressive dividend.

-- Since the year end, the Group has acquired 1 property

comprising 7 units, and exchanged on 1 property comprising 10

units, for GBP2.9 million (including acquisition costs) at net

initial yields in line with the Company's existing portfolio.

Notes:

1 Excluding ongoing forward funded schemes that are under an agreement for lease

2 Including acquisition costs

3 A portfolio valuation basis assumes the portfolio of

properties is held in a single company holding structure, is sold

to a third party on arms-length terms, and attracts lower

purchaser's costs of 2.30%

4 Due to a clerical error, there has been a short delay in the

payment of an immaterial amount of rent representing c.GBP45k

(0.16% of rent roll) for the quarter ended 31 December 2020. This

is expected to be paid in full in the next 2 weeks

Christopher Phillips, Chairman of Triple Point Social Housing

REIT plc, commented:

"T he fundamentals of our sector remain strong. The need is as

great - if not greater - than ever before. Our counterparties

remain committed to providing high-quality housing. In light of all

this, we look forward to 2021, conscious of the challenges that lie

ahead, but cautiously optimistic about the success that we can

achieve if we work hard to deliver the housing that our country,

and our residents, so desperately need . "

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management Tel: 020 7201 89 89

LLP

(Investment Manager)

Ben Beaton

Max Shenkman

Isobel Gunn-Brown

Akur Capital ( Joint Financial Tel: 020 7493 3631

Adviser)

Tom Frost

Anthony Richardson

Siobhan Sergeant

Stifel (Joint Financial Adviser Tel: 020 7710 7600

and

Corporate Broker)

Mark Young

Mark Bloomfield

Rajpal Padam

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com .

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

assets within the portfolio are subject to inflation-adjusted,

long-term (typically from 20 years to 30 years), Fully Repairing

and Insuring (" FRI ") leases with Approved Providers (being

Housing Associations, Local Authorities or other regulated

organisations in receipt of direct payment from local government).

The portfolio comprises investments into properties which are

already subject to an FRI lease with an Approved Provider, as well

as forward funding of pre-let developments but does not include any

direct development or speculative development.

There is increasing political pressure and social need to

increase housing supply across the UK which is creating

opportunities for private sector investors to help deliver this

housing . The Group's ability to provide forward funding for new

developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents as well as delivering returns to

investors.

Triple Point Investment Management LLP (part of the Triple Point

Group) is responsible for management of the Group's portfolio (with

such functions having been delegated to it by Langham Hall Fund

Management LLP, the Company's alternative investment fund

manager).

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust (" REIT ") and is a

constituent of the FTSE EPRA/NAREIT index.

CHAIRMAN'S STATEMENT

Introduction

When I wrote to shareholders in our Annual Report at the start

of last year, I said that we looked forward to 2020 with optimism.

I noted that we had challenges to tackle - particularly in terms of

accommodating increased regulation and our share price - but our

continued operational success left us well equipped to meet those

challenges and more as we moved forward into 2020. Little did I

know that 2020 would bring a challenge unique in our history. The

social and economic damage it has wrought does not need repeating

here. But I am pleased to report that, a year on, with vaccines

having helped turn the tide in our fight against the pandemic, that

optimism for our business seems justified. As this report shows,

2020 has been another year of strong performance, made possible by

the tireless work of all our stakeholders.

Despite - or perhaps because of - the unprecedented pressures of

2020, our stakeholders across the board rose to the challenge.

Commissioners continued to support our business model, referring

residents into our housing whenever possible to relieve pressure on

the NHS. Local Authorities continued to pay rent and care fees to

ensure the viability of schemes. Approved Providers continued to

provide essential housing services to keep properties as safe and

suitable as possible for our residents. Care providers continued to

provide care, implementing their infectious disease control

policies and managing the challenges of social distancing to ensure

our residents remained safe. As chairman of our Board, and a

long-term participant in social housing, I was proud to see

everyone pulling together in a time of adversity to focus on the

ultimate purpose of our business: to provide better, safer, more

affordable housing for some of the most vulnerable people in our

society in a way that benefits our shareholders precisely because

it benefits society.

Indeed, that we received 100% of rent during 2020, and paid all

dividends in full, is testament to the resilience of not just our

stakeholders, but also the wider business model which derives the

strength of its rental income from the positive social impact it

generates (1) . As you know, the capital that we raise from

investors is typically used to acquire, or fund the development of,

newly-built or newly-renovated community-based homes, supported by

local health Commissioners, that provide long-term homes for some

of the most vulnerable people in society. In doing so, our

properties can improve the health and wellbeing of our residents

while generating cost-savings for the government. In light of these

benefits, it is hardly surprising that the sector has received such

widespread support during the pandemic. Investments that meet a

social need are often the most resilient precisely because they

provide the services that our society cannot live without. In this

context, we were pleased to be shortlisted for Property Investor of

the Year at the Laing Buisson Awards.

For all the resilience of our business model during 2020, we

should not forget the tragic human cost of the pandemic. Inevitably

in a portfolio of our size, a limited number of the individuals

living in our properties were infected with the virus. This was

despite the best efforts of our Approved Providers and care

providers to protect our residents as much as possible - the heroic

efforts of our key workers deserve particular gratitude. But it is

also true that our portfolio was spared the widely-publicised high

rates of infections in care homes during 2020, and we did not have

any reports of Covid-19-related deaths. In part, this reflects the

nature of our properties, which are smaller residential properties

rather than institutional facilities with large common areas. But

it also reflects the commitment of our counterparties who worked

hard to contain and manage the virus, with much-needed PPE and

hand-creams donated to care workers.

Beyond its human impact, Covid-19 also caused some difficulties

during 2020 by delaying the deployment of our funds and the

progress of our construction projects. As discussed more below, in

the early weeks of the first lockdown Approved Providers

understandably hesitated before signing long-term leases given the

uncertainty of referrals. Building sites suffered from temporary

shortages in personnel and materials because of social distancing

and supply chain disruption. Despite these delays, we achieved full

dividend cover on an EPRA earnings run-rate basis in August 2020

and was 97.6% as at 31 December 2020 (31 December 2019: 89.4%).

For all the challenges the year brought us in the short-term,

there may well be some benefits over the longer-term. The social

care system, which is often overlooked by the media and

politicians, saw renewed political support as the importance of the

social care system in easing the burden on the NHS became clear.

This translated into a number of accelerated referrals into

Supported Housing properties as Commissioners sought to create more

capacity in hospitals, a trend which we think and hope will

continue beyond the pandemic. Politically and medically, the

pandemic may have reminded our country of the benefits of better

integration between healthcare and social care, and the persistent

demand for this type of housing helped us successfully complete

both an equity raise and an extension to our debt facility during

the year, as discussed more below.

Deployment

During March and April of 2020, our plans for deployment during

2020 looked set to fall short. With our country entering a sudden

and unprecedented lockdown, the ability of our stakeholders to

successfully launch new schemes became difficult. Commissioners

were distracted by the challenges of Covid-19. Care providers were

focused on protecting existing residents, sourcing PPE, and

managing complex staffing schedules in the new world of social

distancing. Without certainty of referrals and limited contact with

care providers, Approved Providers were understandably cautious

about signing new long-term lease commitments. All this resulted in

a slow-down in the number of schemes that we completed in the

second quarter of 2020, meaning that schemes did not launch as fast

as we had hoped, and funds were deployed slower than expected.

But once the initial shock of the lockdown had passed, and

operating conditions stabilised, our ability to acquire or develop

properties continued. During the first half of the year, we

acquired 16 properties, comprising 144 units, for a total

investment cost of GBP29.9 million. From the start of lockdown in

March until the end of the year, we acquired 51 properties,

comprising 309 units, for a total investment cost of GBP59.6

million. Across the entire year, we bought 58 properties,

comprising 400 units, for a total investment cost of GBP78.9

million at net initial yields in line with the Company's existing

portfolio. The continued demand for this type of housing reflects

not only the commitment of everyone - including government - to

providing much-needed new housing to vulnerable individuals, but

also the heightened awareness of the benefits that investment in

the social care system provides to the NHS and wider society.

At the start of the year, we had seven forward funding projects

under construction. All seven projects that were yet to be

completed by the time the first national lockdown was imposed on 23

March 2020 inevitably suffered delays. Through maintaining close

relationships with both the developers and contractors responsible

for delivering these projects, we were able to work with all

stakeholders to ensure that, by adapting operating practices to

manage the virus, any resultant interruptions were minimised. It's

testament to the success of this approach that we suffered no major

setbacks on any of our projects and by the end of the year all but

two had been completed. As of 31 December 2020, we have committed

GBP56.2 million to 22 projects, with 20 projects already

successfully completed (providing homes for 280 residents). Of the

remaining 2 schemes, one completed on 26 February 2021 and the

final project is due to complete imminently.

As a result of all this deployment, at the end of the year we

owned 445 properties (31 December 2019: 388), providing

accommodation for 3,124 residents (31 December 2019: 2,728), having

deployed since IPO an aggregate GBP530.7 million. A map showing the

location of our properties can be found on page 12. In the period,

we started leasing to five new Approved Providers (bringing the

total to 20), 10 new care providers (bringing the total to 98) and

working in six new Local Authorities (bringing the total to 155).

The portfolio's weighted average unexpired lease term (including

put/call options and reversionary leases) is 26.2 years (31

December 2019: 25.7 years).

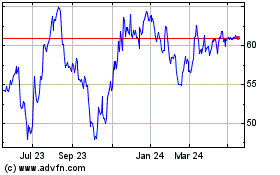

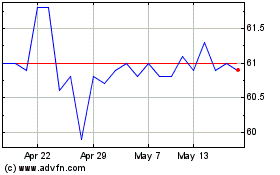

Share Price

At the start of the year, our share price ranged between 90

pence and 100 pence. Our business was not immune from the

turbulence caused by Covid-19 that swept across global financial

markets. Our share price dropped sharply in mid-March, reaching a

floor of 68 pence, before recovering to above 90 pence by the end

of March. Since then, it has continued to gain momentum,

consistently remaining above 100 pence and reaching an all-time

high of 113.50 pence in November. On 31 December 2020, we traded at

a premium of 4.77% to our net asset value of 106.42 pence per

share.

It is worth noting that, despite all that happened last year,

our share price was higher at the end of 2020 than it was at the

beginning. This reflects not only the resilience of our rental

income, but also our shareholders' endorsement of our

impact-focused investment strategy. Our ambition in 2021 is to

build upon our success in 2020 and maintain the upward momentum in

our share price.

Debt and Equity

Our deployment at the start of 2020 was funded by the GBP38.3

million that we drew down from our revolving credit facility with

Lloyds and NatWest in November 2019 (leaving GBP29.4 million

undrawn). The facility had been increased from GBP70 million to

GBP130 million in October 2019. Following further deployment, we

drew down an additional GBP16.0 million in May 2020 and the final

GBP13.4 million in October 2020.

In order to maintain target gearing levels following the recent

equity raise and continue to meet demand for new properties, in

December we signed a further GBP30 million increase in the

revolving credit facility. This increased the total facility amount

to GBP160 million and extended the initial term for a further 12

months, to 20 December 2023. The term of the revolving credit

facility may be extended by a further year, to 20 December 2024

(subject to the consent of the lenders).

In terms of equity, in October 2020 we successfully raised a

further GBP55 million of gross proceeds (GBP53.3 million net of

costs) through an issuance of new ordinary shares. This was part of

a 12-month placing programme (which will remain in place until the

end of September 2021) undertaken with our joint financial

advisers, Stifel Nicolaus Europe Limited and Akur Limited. During

the raise, we were pleased to see further investment from existing

shareholders, as well as first investments from new investors.

T he debt facility increase and equity raise do, of course,

provide us with further capital to meet our attractive pipeline and

persistent demand for Supported Housing. But they are also an

endorsement from our lenders and investors of our investment

strategy, even in the challenging circumstances.

Financial Results

As at 31 December 2020, our property portfolio was independently

valued at GBP571.5 million on an IFRS basis. This reflects a

valuation uplift of GBP40.7 million, or 7.7%, over our total

investment cost (including acquisition costs). The valuation of

GBP571.5 million equates to a blended valuation yield of 5.27%, an

improvement over the portfolio's blended net initial yield of

5.90%. This yield compression of 63 basis points reflects our

ability to buy high-quality properties at discounted prices

off-market through the Investment Manager's network of trusted

contacts in the sector.

As at 31 December 2020, our portfolio was also valued at

GBP611.6 million on a portfolio valuation basis. This assumes a

single sale of the property-holding SPVs to a third-party on an

arm's length basis, with purchasers' costs of 2.3%. The portfolio

valuation reflects a portfolio premium of GBP40.1 million, 7.02%,

against the IFRS valuation.

In June 2020, the Royal Institute of Chartered Surveyors

published guidance on the removal of material uncertainty clauses

when valuing Supported Housing. Our independent valuer, Jones Lang

LaSalle Limited, therefore no longer considers that there is

material uncertainty when valuing Supported Housing. This reflects

the timely receipt of rents in line with pre-Covid-19 levels and

continued market activity.

EPRA earnings per share was 4.61 pence in the year and IFRS

earnings per share was 6.82 pence. The EPRA NTA and audited IFRS

NAV per share was 106.42 pence, an increase of 1.0% since 31

December 2019.

Dividends

On 14 May 2020, we paid a dividend of 1.285 pence per share for

the period from 1 October 2019 to 31 December 2019, bringing our

total dividends for 2019 to our target level of 5.095 pence per

share.

During the rest of 2020, we paid three interim dividends of

1.295 pence per share each for the first three quarters of the

year. On 4 March 2021, we declared a dividend of 1.295 pence per

share for the final quarter of 2020, bringing the total dividend

for 2020 to our full year target of 5.18 pence per share. This

represents a 1.7% increase over 2019's aggregate dividend,

reflecting the CPI-based rent reviews typically contained in our

leases.

Full dividend cover on a look-through EPRA earnings run-rate

basis was achieved in August 2020 and was 97.6% as at 31 December

2020.

Social Impact

From the day we launched, the central thesis of our investment

strategy has been that, when deployed judiciously, private capital

can be used to benefit society at the same time as shareholders.

More than that, the strength of the returns we provide to

shareholders derives precisely from the social impact that the

investments generate. By funding the development of high-quality

newly-built and newly-renovated homes for residents whose rent is

funded by government, we save the government money at the same time

as improving the well-being of residents and generating a steady,

resilient income stream for our investors.

Although social impact is in our investment strategy's DNA, we

welcome the rise and growing adoption of Environmental, Social and

Governance metrics across the market and are committed to ensuring

ESG and impact metrics are explicitly considered throughout our

entire investment lifecycle. During 2020, the Investment Manager

helped pioneer and design sector-wide ESG and impact metrics,

signing up to become an early adopter. of sector-wide metrics which

are to be tested and implemented throughout 2021 and beyond. This

is further discussed in the Investment Manager's report on pages 34

to 35. Likewise, you will see elsewhere in this report an excerpt

from an independent impact report by social impact consultants The

Good Economy. We commissioned this report to ensure that we are

publicly held up to our own high impact standards and continue to

deliver a positive impact to society.

Outlook

Making predictions at a time like this is even more hazardous

than usual. Circumstances are changing with such speed, and such

consequence, that stating our outlook is particularly difficult.

But if 2020 taught our business anything, it is that a

well-executed investment strategy, predicated on meeting a critical

social need, can prove resilient even in a time of significant

disruption. I hope it is therefore not rash of me to predict that,

if we and our stakeholders continue to manage the risk of the

virus, and the government continues to support our investment

model, in 2021 we will achieve further strong financial and

operational performance as a result of the positive social impact

we deliver.

Indeed, the fundamentals of our sector remain strong. The need

is as great - if not greater - than ever before. Our counterparties

remain committed to providing high-quality housing. In light of all

this, we look forward to 2021, conscious of the challenges that lie

ahead, but cautiously optimistic about the success that we can

achieve if we work hard to deliver the housing that our country,

and our residents, so desperately need.

Before I finish, I would like to say that much of our continued

success is thanks to the Investment Manager's hard work. It has

built on its strong relationships, and continually refined its

processes, to deliver the high-quality homes that are central to

our positive social impact alongside financial and operational

performance. Likewise, we have benefited hugely from the hard work

of our corporate broker and joint financial adviser Stifel Nicolaus

Europe Limited, as well as our joint financial adviser Akur

Limited, both of which were instrumental in the success of our

equity raise during 2020.

Finally, I would like to thank our shareholders for their

continued support, and my fellow Board members for their ongoing

support and commitment throughout the year.

Chris Phillips

Chairman

4 March 2021

Note:

1 Due to a clerical error, there has been a short delay in the

payment of an immaterial amount of rent representing c.GBP45k

(0.16% of rent roll) for the quarter ended 31 December 2020. This

is expected to be paid in full in the next 2 weeks

STRATEGY AND BUSINESS MODEL

The Board is responsible for the Group's Investment Objective

and Investment Policy and has overall responsibility for ensuring

the Group's activities are in line with such overall strategy. The

Group's Investment Policy and Investment Objective are published

below.

Investment Objective

The Group's investment objective is to provide shareholders with

stable, long-term, inflation-linked income from a portfolio of

social housing assets in the United Kingdom with a focus on

Supported Housing assets. The portfolio comprises investments in

operating assets and the forward funding of pre-let development

assets, the Company seeks to optimise the mix of these assets to

enable it to pay a covered dividend increasing in line with

inflation and so generate an attractive risk-adjusted total

return.

Investment Policy

To achieve its investment objective, the Group invests in a

diversified portfolio of freehold or long leasehold social housing

assets in the UK. Supported Housing assets account for at least 80%

of the Group's gross asset value. The Group acquires portfolios of

social housing assets and single social housing assets, either

directly or via SPVs. Each asset is subject to a lease or occupancy

agreement with an Approved Provider for terms primarily ranging

from 20 years to 30 years, with the rent payable thereunder subject

to adjustment in line with inflation (generally CPI). Title to the

assets remains with the Group under the terms of the relevant

lease. The Group is not responsible for any management or

maintenance obligations under the terms of the lease or occupancy

agreement, all of which are serviced by the Approved Provider

lessee. The Group is not responsible for the provision of care to

residents of Supported Housing assets.

The social housing assets are sourced in the market by the

Investment Manager.

The Group intends to hold its portfolio over the long-term,

taking advantage of long-term upward-only inflation-linked leases.

The Group will not be actively seeking to dispose of any of its

assets, although it may sell investments should an opportunity

arise that would enhance the value of the Group as a whole.

The Group may forward fund the development of new social housing

assets when the Investment Manager believes that to do so would

enhance returns for shareholders and/or secure an asset for the

Group's portfolio at an attractive yield. Forward funding will only

be provided in circumstances in which:

(a) there is an agreement to lease the relevant property upon

completion in place with an Approved Provider;

(b) planning permission has been granted in respect of the site; and

(c) the Group receives a return on its investment (at least

equivalent to the projected income return for the completed asset)

during the construction phase and before the start of the

lease.

For the avoidance of doubt, the Group will not acquire land for

speculative development of social housing assets.

In addition, the Group may engage third party contractors to

renovate or customise existing social housing assets as

necessary.

Gearing

The Group uses gearing to enhance equity returns. The Directors

will employ a level of borrowing that they consider prudent for the

asset class and will seek to achieve a low cost of funds while

maintaining flexibility in the underlying security requirements and

the structure of both the Company's portfolio and the Group.

The Directors intend that the Group will target a level of

aggregate borrowings over the medium-term equal to approximately

40% of the Group's gross asset value. The aggregate borrowings will

always be subject to an absolute maximum, calculated at the time of

drawdown, of 50% of the Group's gross asset value.

Debt will typically be secured at the asset level, whether over

a particular property or a holding entity for a particular property

(or series of properties), without recourse to the Company and

having consideration for key metrics including lender diversity,

cost of debt, debt type and maturity profiles.

Use of Derivatives

The Group may use derivatives for efficient portfolio

management. In particular, the Group may engage in full or partial

interest rate hedging or otherwise seek to mitigate the risk of

interest rate increases on borrowings incurred in accordance with

the Investment Policy as part of the Group's portfolio management.

The Group will not enter into derivative transactions for

speculative purposes.

Investment Restrictions

The following investment restrictions apply:

-- the Group will only invest in social housing assets located in the United Kingdom;

-- the Group will only invest in social housing assets where the

counterparty to the lease or occupancy agreement is an Approved

Provider. Notwithstanding that, the Group may acquire a portfolio

consisting predominantly of social housing assets where a small

minority of such assets are leased to third parties who are not

Approved Providers. The acquisition of such a portfolio will remain

within the Investment Policy provided that at least 90% (by value)

of the assets are leased to Approved Providers and, in aggregate,

all such assets within the Group's total portfolio represent less

than 5% of the Group's gross asset value at the time of

acquisition;

-- at least 80% of the Group's gross asset value will be

invested in Supported Housing assets;

-- the unexpired term of any lease or occupancy agreement

entered into (or in the case of an acquisition of a portfolio of

assets, the average unexpired term of such leases or occupancy

agreements) shall not be less than 15 years, unless the Investment

Manager reasonably expects the term of such shorter lease or

occupancy agreement (or in the case of an acquisition of a

portfolio of assets, the average term of such leases or occupancy

agreements) to be extended to at least 15 years;

-- the maximum exposure to any one asset (which, for the

avoidance of doubt, will include houses and/or apartment blocks

located on a contiguous basis) will not exceed 20% of the Group's

gross asset value;

-- the maximum exposure to any one Approved Provider will not

exceed 30% of the Group's gross asset value, other than in

exceptional circumstances for a period not to exceed three

months;

-- the Group may forward fund social housing units in

circumstances where there is an agreement to lease in place and

where the Group receives a coupon (or equivalent reduction in the

purchase price) on its investment (generally slightly above or

equal to the projected income return for the completed asset)

during the construction phase and before entry into the lease.

Forward funding equity commitments will be restricted to an

aggregate value of not more than 20% of the Group's net asset

value, calculated at the time of entering into any new forward

funding arrangement;

-- the Group will not invest in other alternative investment

funds or closed-ended investment companies (which, for the

avoidance of doubt, does not prohibit the acquisition of SPVs which

own individual, or portfolios of, social housing assets);

-- the Group will not set itself up as an Approved Provider; and

-- the Group will not engage in short selling.

The investment limits detailed above apply at the time of the

acquisition of the relevant asset in the portfolio. The Group will

not be required to dispose of any investment or to rebalance its

portfolio as a result of a change in the respective valuations of

its assets or a merger of Approved Providers.

Investment Strategy

The Group specialises in investing in UK social housing, with a

focus on Supported Housing. The strategy is underpinned by strong

local authority demand for more social housing, which is reflected

in the focus on acquiring recently developed and refurbished

properties across the United Kingdom. The assets within the

portfolio have typically been developed for pre-identified

residents and in response to demand specified by local authorities

or NHS commissioners. On acquisition, the properties are subject to

inflation-adjusted, long-term (typically from 20 years to 30

years), fully repairing and insuring leases with specialist

Approved Providers in receipt of direct payment from local

government (usually Registered Providers regulated by the Regulator

of Social Housing). The portfolio comprises investments made into

properties already subject to a fully repairing and insuring lease

as well as forward funding of pre-let developments. The portfolio

will not include any direct development or speculative development

investments.

Business Model

The Group owns and manages social housing properties that are

leased to experienced housing managers (typically Registered

Providers, which are often referred to as housing associations)

through long-term, inflation-linked, fully repairing and insuring

leases. The vast majority of the portfolio and future deal pipeline

is made up of Supported Housing homes which are residential

properties that have been adapted or built such that care and

support can easily be provided to vulnerable residents who may have

mental health issues, learning difficulties or physical

disabilities. We are focused on acquiring specially or recently

developed properties in order to help local authorities meet

increasing demand for suitable accommodation for vulnerable

residents (the drivers of this demand are discussed in the

Investment Manager's report). Local authorities are responsible for

housing these residents and for the provision of all care and

support services that are required.

The Supported Housing properties owned by the Group are leased

to Approved Providers which are usually not-for-profit

organisations focused on developing, tenanting and maintaining

housing assets in the public (and private) sectors. Approved

Providers are approved and regulated by the Government through the

Regulator of Social Housing (or in rare instances, where the Group

contracts with care providers, the Care Quality Commission). All

the Group's leases with Approved Providers are linked to inflation,

have a duration of 20 years or longer, and are fully repairing and

insuring - meaning that the obligations for management, repair and

maintenance of the property are passed to the Approved Provider.

The Approved Provider is also responsible for tenanting the

properties. Typically, the Government funds both the rent of the

individuals housed in Supported Housing and the maintenance costs

associated with managing the property. In addition, because of the

vulnerable nature of the residents, the rent and maintenance costs

are paid directly from the local authority to the Approved

Provider. The rent received from the local authority by the

Approved Provider is then paid to the Group via the lease. Ultimate

funding for the rent and maintenance comes from the Department for

Work and Pensions in the form of housing benefit.

The majority of residents housed in Supported Housing properties

require support and/or care. This is typically provided by a

separate care provider regulated by the Care Quality Commission.

The agreement for the provision of care for the residents is

between the local authority and the care provider. The care

provider is paid directly by the local authority. Usually the Group

has no direct financial or legal relationship with the care

provider and the Group never has any responsibility for the

provision of care to the residents in properties the Group owns.

The care provider will often be responsible for nominating

residents into the properties and, as a result, will normally

provide some voids cover to the Approved Provider should they not

be able to fill the asset (i.e. if occupancy is not 100% it is

often the care provider rather than the Approved Provider that will

cover the cost). The Group receives full rent regardless of

underlying occupancy, but monitors occupancy levels and the payment

of voids cover by care providers, to ensure that Approved Providers

are appropriately protected.

Many assets that the Investment Manager sources for the Group

have been recently developed and are either specifically designed

new build properties or renovated existing houses or apartment

blocks that have been adapted for Supported Housing. The benefit of

buying recently-developed stock is that it has been planned in

response to local authority demand and is designed to meet the

specific requirements of the intended residents. In addition, it

enables the Group to work with a select stable of high-quality

developers on pipelines of deals rather than being reliant on

acquiring portfolios of already-built assets on the open market.

This has two advantages: firstly, it enables the Group to source

the majority of its deals off-market through trusted developer

partners and, secondly, it ensures the Group has greater certainty

over its pipeline with visibility over the long-term deal flow of

the developers it works with and knows it will not have to compete

with other funders.

As well as acquiring recently-developed properties, the Group

can provide forward funding to developers of new Supported Housing

properties. Being able to provide forward funding gives the Group a

competitive advantage over other acquirers of Supported Housing

assets as it enables the Group to offer developers a single funding

partner for both construction and the acquisition of the completed

property. This is often more appealing to developers than having to

work with two separate funders during the build of a new property

as it reduces practical and relationship complexity. As well as

strengthening developer relationships, forward funding enables the

Group to have a greater portion of new build properties in its

portfolio which typically attract higher valuations, are modern and

have been custom-built to meet the needs of the residents they

house, helping to achieve higher occupancy levels. The Group

benefits from the Investment Manager's long track record of

successfully forward funding a range of property and infrastructure

assets. The Group will only provide forward funding when the

property has been pre-let to an Approved Provider and other

protections, such as fixed-priced build contracts and deferred

developer profits, have been put in place to mitigate construction

risk.

Since the Company's IPO, the Group has set out to build a

diversified portfolio that contains assets leased to a variety of

Approved Providers, in a range of different counties, and serviced

by a number of care providers. This has been possible due to the

Investment Manager's 1 7 -year track record of asset-backed

investments, its active investment in the Supported Housing sector

since 2014, and the strong relationships it has enjoyed with local

authorities for over a decade. These relationships have enabled the

Group, in a relatively short space of time, to work with numerous

Approved Providers, care providers and local authorities to help

deliver new Supported Housing assets that provide homes to some of

the most vulnerable members of society.

KEY PERFORMANCE INDICATORS

In order to track the Group's progress the following key

performance indicators are monitored:

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE EXPLANATION

1. Dividend

---------------------------- ---------------------------- --------------------------- ---------------------------

Dividends paid to The dividend reflects the Total dividends of 5.18 The Company has declared a

shareholders and declared Company's ability to pence per share were paid dividend of 1.295 pence

during the period. deliver a low risk but or declared in respect of per Ordinary share in

growing the period 1 January respect of the period

income stream from the 2020 to 31 December 2020. 1 October 2020 to 31

portfolio. December 2020, which will

(2019: 5.095 pence) be paid on 26 March 2021.

Total dividends paid

and declared for the

period are in line with

the Company's target.

---------------------------- --------------------------- ---------------------------

2. EPRA Net Tangible Assets (NTA) (NEW)

---------------------------------------------------------- --------------------------- ---------------------------

The EPRA NTA is equal to EPRA NTA measure that 106.42 pence at 31 The EPRA NTA per share at

IFRS NAV as there are no assumes entities buy and December 2020. IPO was 98.0 pence.

deferred tax liabilities or sell assets, thereby This is an increase of

other adjustments crystalising certain levels (31 December 2019: 105.37 8.59% since IPO driven by

applicable to the Group of deferred tax liability. pence) growth in the underlying

under the REIT regime. asset value of

the investment properties.

---------------------------- --------------------------- ---------------------------

3. Loan to Value (LTV)

A proportion of our The Company uses gearing to 31.5% LTV at 31 December Borrowings comprise a

investment portfolio is enhance equity returns. 2020. GBP68.5 million private

funded by borrowings. Our placement of loan notes

medium to long term The LTV covenant on the (31 December 2019: 31.1% with MetLife and a GBP160

target L T V is 40% with a revolving credit facility LTV) million secured revolving

hard cap of 50%. with Lloyds is < 50%. credit facility with

Lloyds/NatWest of which

GBP130 million was

drawn as at 31 December

2020.

4. EPRA Earnings per S hare (NEW)

---------------------------------------------------------- --------------------------- ---------------------------

EPRA Earnings per share A measure of a Group's 4.61 pence per share EPRA EPS increased

excludes gains from fair underlying operating for the year ended 31 year-on-year by 36.0%.

value adjustment on results and an indication December 2020, based on

investment property that of the extent to which earnings excluding the The outlook remains

are included in the IFRS current dividend payments fair value gain on positive and we continue

calculation for Earnings are supported by earnings. properties, to invest to generate an

per share. calculated on the weighted attractive total return.

average number of shares

in issue during the year.

(31 December 2019: 3.39

pence)

---------------------------- --------------------------- ---------------------------

5 . Adjusted E arnings per S hare

---------------------------------------------------------- --------------------------- ---------------------------

Adjusted earnings per share A key measure which 4.90 pence per share This demonstrates the

includes adjustments for reflects actual cashflows for the period ended 31 Group's ability to meet

non-cash items. The supporting dividend December 2020, based on dividend payments from net

calculation is shown payments. earnings after deducting cash inflows. It

in Note 35. the fair value gain represents a dividend

on properties, cover for the year to 31

amortisation of loan December 2020 of 94.5%.

arrangement fees and

adding back capitalised

interest;

calculated on the weighted

average number of shares

in issue during the year.

(31 December 2019: 3.50

pence)

---------------------------- --------------------------- ---------------------------

6 . Weighted A verage U nexpired L ease T erm (WAULT)

---------------------------------------------------------- --------------------------- ---------------------------

The average unexpired lease The WAULT is a key measure 26.2 years at 31 December As at 31 December 2020,

term of the investment of the quality of our 2020 (includes put and the portfolio's WAULT

portfolio, weighted by portfolio. Long lease terms call options). stood at 26.2 years and

annual passing rents. underpin the remains well ahead of

Our target is a WAULT of at security of our income (31 December 2019: 25.7 the Group's minimum term

least 15 years. stream. years) of 15 years.

---------------------------- --------------------------- ---------------------------

7. Adjusted Portfolio Earnings per Share (NEW)

---------------------------------------------------------- --------------------------- ---------------------------

The post-tax earnings The Adjusted Portfolio EPS 17.94 pence per share The Adjusted Portfolio EPS

adjusted for the market reflects the application of for the period ended 31 shows the value per share

portfolio valuation using the portfolio value December 2020, as shown on on a long-term basis.

including portfolio and reflects page 140. The increase in the

premium. the potential increase in Adjusted Portfolio EPS

value the Group could (31 December 2019: 15.92 from the previous period

realise if assets are sold pence) is reflective of the

on a portfolio larger

basis. portfolio size.

---------------------------- --------------------------- ---------------------------

8 . Portfolio NAV

---------------------------------------------------------- ---------------------------- ----------------------------

The IFRS NAV adjusted for The Portfolio NAV measure The Portfolio NAV of The Portfolio NAV per share

the market portfolio is to highlight the fair GBP468.8 million equates to shows a good market growth

valuation including value of net assets on an a Portfolio NAV of 116.39 in the underlying asset

portfolio premium. ongoing, long-term pence per Ordinary value of the

basis and reflects the Share, as shown on page investment properties.

potential increase in value 140.

the Group could realise

under the special (31 December 2019:

assumption of a Portfolio NAV GBP401.9

hypothetical sale of the million equated to 114.53

underlying property pence per Ordinary Share)

investment portfolio in one

single

transaction.

---------------------------- ---------------------------- ----------------------------

9. Exposure to Largest Approved Provider

----------------------------------------------------------------------------------------------------------------------

The percentage of the The exposure to the largest 29.8% at 31 December 2020. Our maximum exposure limit

Group's gross assets that Approved Provider must be is 30%.

are leased to the single monitored to ensure that we (31 December 2019: 20.6%)

largest Approved are not The Group increased its

Provider. overly exposed to one target from 25% to 30% in

Approved Provider in the order to acquire properties

event of a default at a significant

scenario. discount to market value

that are leased to the

Group's largest Approved

Provider which provides

high-quality housing

services.

---------------------------- ---------------------------- ----------------------------

10. Total Return

----------------------------------------------------------------------------------------------------------------------

EPRA NTA plus total The total return measure EPRA NTA 106.42 pence at 31 The EPRA NTA per share at

dividends paid during the highlights the gross return December 2020. 31 December 2020 was 106.42

year. to investors including Total dividends paid during pence. Adding back

dividends paid the year ended 31 December dividends paid during

since the prior year. 2020 were 5.18 pence per the year of 5.18 pence per

share. Ordinary Share to the EPRA

NTA at 31 December 2020

Total return was 5.9% for results in an

the year to 31 December increase of 5.9%.

2020.

(31 December 2019: 6.5%)

---------------------------- ---------------------------- ----------------------------

EPRA PERFORMANCE MEASURES

The table below shows additional performance measures,

calculated in accordance with the Best Practices Recommendations of

the European Public Real Estate Association (EPRA). We provide

these measures to aid comparison with other European real estate

businesses.

Full reconciliations of EPRA Earning s and NAV are included in

Notes 3 5 and 3 6 of the consolidated financial statements

respectively. A full reconciliation of the other EPRA performance

measures are included in the Unaudited Performance Measures section

of the Annual Report .

KPI AND DEFINITION PURPOSE PERFORMANCE

1. EPRA Earnings per S hare

EPRA Earnings per share excludes A measure of a Group's underlying 4.61 pence per share for the period

gains from fair value adjustment on operating results and an indication to 31 December 2020.

investment property that of the extent to which

are included in the IFRS calculation current dividend payments are (31 December 2019: 3.39 pence)

for Earnings per share. supported by earnings.

Full dividend cover on a look-through

EPRA earnings run-rate basis was

achieved in August

2020 and following the equity raise

in October 2020 was 97.6% as at 31

December 2020.

======================================

2. EPRA Net Reinstatement Value (NRV) per share

------------------------------------------------------------------------------ --------------------------------------

The EPRA NRV adds back the A measure that highlights the value GBP463.3 million / 115.02 pence per

purchasers' costs deducted from the of net assets on a long-term basis. share as at 31 December 2020.

IFRS valuation.

GBP397.2 million / 113.20 pence per

share as at 31 December 2019.

-------------------------------------- -------------------------------------- --------------------------------------

3. EPRA Net Tangible Assets (NTA) per share

------------------------------------------------------------------------------ --------------------------------------

The EPRA NTA is equal to IFRS NAV as A measure that assumes entities buy GBP428.6 million / 106.42 pence per

there are no deferred tax liabilities and sell assets, thereby share as at 31 December 2020.

or other adjustments crystallising certain levels

applicable to the Group under the of deferred tax liability. GBP369.7 million / 105.37 pence per

REIT regime. share as at 31 December 2019.

-------------------------------------- -------------------------------------- --------------------------------------

4. EPRA Net Disposal Value (NDV)

------------------------------------------------------------------------------ --------------------------------------

The EPRA NDV provides a scenario A measure that shows the shareholder GBP420.9 million / 104.50 pence per

where deferred tax, financial value if assets and liabilities are share as at 31 December 2020.

instruments, and certain other not held until maturity.

adjustments are calculated as to the GBP364.7 million / 103.93 pence per

full extent of their liability. share as at 31 December 2019.

-------------------------------------- -------------------------------------- --------------------------------------

5 . EPRA Net Initial Yield (NIY)

Annualised rental income based on the A comparable measure for portfolio 5.27% at 31 December 2020.

cash rents passing at the balance valuations. This measure should make

sheet date, less non-recoverable it easier for investors 5.29% at 31 December 2019.

property operating expenses, divided to judge for themselves how the

by the market value of the property, valuation of a portfolio compares

increased with (estimated) with others.

purchasers' costs.

======================================

6 . EPRA 'Topped-Up' NIY

This measure incorporates an The topped-up net initial yield is 5.28% at 31 December 2020.

adjustment to the EPRA NIY in respect useful in that it allows investors to

of the expiration of rent-free see the yield based 5.29% at 31 December 2019.

periods (or other unexpired lease on the full rent that is contracted

incentives such as discounted rent at 31 December 2020.

periods and step rents).

======================================

7 . EPRA Vacancy Rate

Estimated Market Rental Value (ERV) A "pure" percentage measure of 0.29 % as at 31 December 2020 (1) .

of vacant space divided by ERV of the investment property space that is

w hole portfolio. vacant, based on ERV. 0.00% as at 31 December 2019.

======================================

7. EPRA Cost Ratio

====================================== ====================================== ======================================

Administrative & operating costs A key measure to enable meaningful 23.27% as at 31 December 2020.

(including & excluding costs of measurement of the changes in a

direct vacancy) divided by Group's operating costs. 28.35% as at 31 December 2019.

gross rental income.

====================================== ====================================== ======================================

Note:

1 This has increased from 0.00% due to there being two

properties in the portfolio without a lease, which are therefore

vacant.

INVESTMENT MANAGER'S REPORT

Review of the Business

The Chairman has described well both the challenges that

Covid-19 brought to the Group's business, and the impressive way

that all stakeholders rose to the challenges. As Investment

Manager, our priority was the safety and wellbeing of the Group's

residents and the people who support them. As the lockdown began in

early 2020, we moved quickly to speak to our Approved Providers and

care providers to understand how they were coping and to offer help

however we could. We made sure to share 'best practices' among

counterparties with a focus on ensuring resident safety. Inevitably

there have been cases of Covid-19 among individuals housed in our

properties. But our Approved Provider and care provider partners

have worked tirelessly to ensure that these were kept to a minimum,

and for that we are incredibly grateful.

The diligence, collaboration and resourcefulness of all

stakeholders is worth commenting on. Approved Providers postponed

non-essential maintenance wherever necessary as a way of minimising

the spread of infection while ensuring schemes remained safe and a

good standard of housing was maintained. Care providers continued

to provide the care and support that residents need and deserve,

implementing their infectious diseases policies and successfully

managing their complex staffing schedules at a time of social

distancing. Regulatory obligations were eased during the height of

lockdown, while government funding continued to flow uninterrupted.

Although the continuing lockdowns present further challenges, we

are pleased that Covid-19 was managed so capably and

collaboratively by all stakeholders during 2020.

In this context, it is worth reflecting on the resilience of the

Group's investment model, and its portfolio, during 2020. After

some initial delays, we were able to continue deploying capital

into new schemes, our forward funding projects continued, and

existing schemes continued to operate well and safely. The Group

received 100% of rent (1) . It paid all dividends due in full, and

achieved full dividend cover on a run-rate basis before the new

equity raise on 23 October. The share price ended the year higher

than it began, achieving an all-time high of 113.50 pence in

November. The Group drew GBP29.4 million of debt from its revolving

credit facility, secured a further GBP30 million increase to that

facility, and raised GBP55 million of equity capital from both

existing and new investors. This resilience may have contributed

towards the Group being shortlisted for Property Investor of the

Year at the Laing Buisson Awards, with the announcement of the

results of the awards postponed until early 2021.

As mentioned in our Chairman's Statement above, during 2020 the

Group bought 58 new schemes for a total investment cost (i.e.

including acquisition costs) of GBP78.9 million using the proceeds

of the extended revolving credit facility. These schemes provide

400 new units of accommodation. At the year end, the Group had 445

properties, containing 3,124 units of accommodation, leased to 20

Approved Providers, operating in 155 Local Authorities, with care

provided by 98 different care providers. In terms of forward

funding, during 2020 five of the Group's projects successfully

completed. As such, as at 31 December 2020, 20 of the 22 projects

that the Group has funded since inception were complete, and o f

the remaining 2 schemes, one completed on 26 February 2021 and the

final project is due to complete imminently. Covid-19 caused some

construction delays from staff and materials shortages, but the

successful completion of the projects reflects the resourcefulness

and strength of the Group's counterparties as well as the continued

demand by all stakeholders for high-specification properties in

areas of proven demand that add to the country's overall housing

stock.

Operational performance is always a function of the quality of

the investment processes in place. Strong performance is only

possible when good investments are made in the first place. We

therefore continually iterate our due diligence processes on the

principle that, as the market is always evolving and every

transaction is different, our processes should be continually

updated to reflect all of our latest experience. We continue to

reject at least as many deals as we invest in, and during the year

we piloted, and have begun adopting, a market-leading property

management system, Coyote. This software drives efficiencies by

managing properties through the entire investment lifecycle on a

single digital platform, and by automating the generation of

reports. It also gives us access to more data, which we can more

easily analyse, and it enables us to use third-party analytics

software.

This meticulous approach to due diligence has been developed

over the 17 years that we have been an investment manager. Since

2004, Triple Point Investment Management LLP has been investing in

high-impact investments which generate long-term predictable income

streams. We invest where there is a social challenge because the

greater the social need, the greater the demand, which in turn

drives long-term financial performance. Over the years of investing

in the social housing sector, we have developed a strong network

which enables us to successfully source off-market deals and work

with the sector's leading providers. We have also organically built

a multi-disciplinary social housing team which contains a diverse

blend of fund managers, social housing professionals, accountants,

lawyers and surveyors. Being part of a wider fund management

business means that we are able to keep in-house our business

functions including finance, marketing, legal, property management

and company secretary. We were recently authorised by the Financial

Conduct Authority as a full scope Alternative Investment Fund

Manager ("AIFM") and were appointed as the Company's AIFM, taking

over the Group's risk and portfolio management from 1 July 2020,

with the Board continuing to provide oversight and ensure the Group

acts within the Company's Investment Policy.

As the number of properties under our management has grown, it

has become more important than ever that we pro-actively manage the

portfolio. Central to that is ensuring that all properties are

properly maintained, and are looked after by the Approved Provider

which has the most suitable processes, Commissioner relationships,

and geographical focus for the specific properties. As part of this

strategy, during 2020 we transferred away all 15 properties that

the Group had with Westmoreland as part of Westmoreland's stock

rationalisation programme. To that end, we selected one of the

Group's existing Approved Providers which is already operating in

the local areas with strong Commissioner relationships. 12 of the

properties have already transferred with no material valuation

impact, and the Approved Provider has already begun managing the

properties to a high standard. Of the remaining three properties,

we expect one property to transfer shortly to the same Approved

Provider, and another property to transfer to another existing

Approved Provider of the Group. The final property is a two-bedroom

property with a value of less than GBP200,000 which is in the

process of being sold. If and when we identify the need for further

property transfers in future, we will take the same approach to

ensure we remain a responsible, pro-active landlord focused on

optimising the portfolio for the benefit of all stakeholders.

Market Review

One of the major themes for the Supported Housing market in 2020

was the robustness of its performance - reflected in its strong

rent collection and resultant continuing market activity - at a

time when many other property sectors suffered from the effects of

the pandemic. As described elsewhere, the Group's investment model

proved its resilience amid the disruptions of Covid-19, with all

rent received and its valuations upheld. Supported Housing was in

fact one of the first three property sectors to have its 'material

uncertainty' clause removed from valuations by the Royal Institute

of Chartered Surveyors.

Demand for supported housing remains strong - perhaps stronger

than ever. The last available data forecast a shortfall of 46,771

units by 2024-2025. (2) This demand has been driven by a growing UK

population; a growing incidence of people with long-term care needs

living to adulthood as a result of medical advances; and a

government policy of moving people with care needs out of

institutions and into the community, as enshrined in the Care Act

2014 and the Transforming Care Programme 2015. We do not have

up-to-date demand data since the pandemic began, but our experience

on the ground suggests that demand has grown as many Commissioners

have found a way through the obstacles that too often prevent

people being moved out of inappropriate institutional settings into

community-based homes. Commissioners have sought to create space in

hospitals for Covid-19 patients, and to achieve the long-term

health and financial benefits unlocked through Supported Housing.

Evidence suggests that every person living in Supported Housing

saves the government about GBP200 per week compared to them being

in a care home, and about GBP2,000 per week compared to them being

in a hospital. (3) At the same time, the independence that comes

with living in the community improves the health and well-being of

residents. (4)

The need for more, and better, community-based care settings was

powerfully reinforced by a report by the Care Quality Commission

published in October 2020 called Out of Sight - Who Cares?:

Restraint, segregation and seclusion review. (5) The report

describes how too many people in the UK with mental health

conditions, learning disabilities or autism are restrained,

secluded and segregated when they would be better served by a

tailored package of care based in the community. In the words of

the CQC, " This lack of support in the community often led to

people becoming increasingly distressed and, in some cases,

suicidal or violent " and most hospitals visited by the CQC were "

not therapeutic environments " that " could add to people's

distress " which was then " used as a rationale for using

restraint, seclusion and segregation ". In conclusion, the CQC's

first recommendation is that " People with a learning disability

and/or autistic people who may also have a mental health condition

should be supported to live in their communities ". To deepen its

engagement with issues like these, in January 2021 the Company

became a Supporter Member of Care England.

Another major theme in 2020, which was accelerated by Covid-19,

was the growing awareness of the value of socially-impactful

investments. The Group was established in 2017 to generate

shareholder returns by investing where there is identified local

need across the UK to deliver a positive social impact. As the

Impact Report by The Good Economy states, the Group has delivered

GBP136.1 million of Total Social Value in the year to December

2020. This is divided into GBP53.9 million of Social Impact (the

value of improved personal outcomes for residents) and GBP82.1

million of fiscal savings (savings generated for public budgets

through reduced costs). Overall, The Good Economy have calculated

that, for every GBP1 invested, the Group will generate GBP3.62 in

social value over the duration of the investment. Likewise, 65% of

residents in a survey by The Good Economy reported a greater

independence after moving into their accommodation. So it was

encouraging in 2020 to see growing collaboration between market

participants eager to enhance the positive impact that investing in

high-quality social housing can have on society. In May 2020, a

White Paper, Building a Sector Standard Approach for ESG Reporting

, was published to create a set of sector-wide ESG metrics. Because

of the benefits that standardised metrics will bring, we have

signed up as early adopters of those metrics which will be tested

throughout 2021. Likewise, we are active participants in the Equity

Impact Project being run by The Good Economy and Big Society

Capital to standardise impact metrics for equity investors in

social housing. This should create another set of valuable

cross-sector metrics which will drive up impact performance by

creating comparability for investors.

Our investment strategy has always been focused on investing

where there is clear long-term social need, and where our

properties will be managed by high-quality, well-governed

counterparties. But the importance of environmental efficiency is

becoming increasingly integral to our investment strategy.

Residential housing contributes to 15% of carbon emissions in the

UK, and the recent Energy White Paper is pushing for all social

housing properties to have an Energy Performance Certificate

("EPC") rating of 'C' or above by 2035 - which is only 14 years

away. (6) Although the government minimum for new tenancies is

currently still only an 'E', we want to do better - and believe

that, as a sector, we can do better. At the end of 2020, the entire

portfolio of the Group had an EPC rating of 'E' or above except for

3 units which dropped to an 'F' after further testing, though they

expect to be upgraded to at least an 'E' by April following works.

70% of the portfolio is rated 'C' or above, and 33% is rated 'B' or

above. This compares favourably to the market, with only 56% of

socially rented homes across the UK rated 'C' or above. (7)

Moreover, the portfolio's rating will improve over time as we

require an EPC rating of at least 'C' for existing or renovated

properties that the Group buys, and at least a 'B' for new-build

properties that the Group buys. Likewise, we require building

contractors on forward funding projects to sign up to the

guidelines of the Code of Considerate Contractors scheme as well as

the Site Waste Management Plan 2008, both of which encourage

environmental efficiency.

As mentioned, regulatory engagement reduced during Covid-19. The

Regulator of Social Housing sensibly paused its In-Depth

Assessments to enable Registered Providers to focus on operations.

When the full lockdown eased in the summer, regulatory engagement

re-started. In December 2020 one of the Group's Approved Providers,

My Space Housing Solutions, which comprised 8.5% of the investment

value of the Group's property portfolio at 31 December 2020,

received a non-compliant rating of G3, V3. The Group's independent

valuer, Jones Lang LaSalle Limited, confirmed that there should be

no impact on the value of the Group's portfolio as a result of this

rating. In October 2020, Westmoreland Supported Housing also

received a Regulatory Notice concerning its compliance with the

Rent Standard, though since the notice was published the Group has

reduced its exposure to Westmoreland from less than 0.5% of the

Group's portfolio value to 0%. We continue to speak directly to the

Regulator to better understand the areas they want the sector to

focus on and to ensure that our processes continue to evolve to

reflect the latest regulatory guidance.

Financial Review

The annualised rental income of the Group was GBP31.6 million as

at 31 December 2020. Excluding forward funding transactions, the

rental income of the Group for 2020 was GBP28.4 million, compared

to GBP21.1 million in the previous 12 months. The Group is a UK

REIT for tax purposes and is exempt from corporation tax on its

property rental business.

A fair value gain of GBP8.0 million was recognised during the

period on the revaluation of the Group's properties.

Earnings per share was 6.82 pence for the year, compared to 6.75

pence for the year ending 31 December 2019. EPS includes the fair

value gain on investment property which was lower this year

compared to last year due to slower deployment.

The EPRA earnings per share excludes the fair value gain on

investment property and was 4.61 pence for the year, compared to

3.39 pence for the year ending 31 December 2019. Adjusted portfolio

earnings per share were 17.94 pence for the year, where post-tax

earnings were adjusted for a valuation on a portfolio basis (as

opposed to individual property IFRS basis) (2019: 15.92 pence).

From the beginning of this year, the EPRA NAV has been replaced

by three EPRA NAV metrics which are shown in the Financial

Statements on page 141. The one most comparable to the previously

reported EPRA NAV measure is EPRA Net Tangible Asset (NTA), which,

therefore, the Group has adopted as its primary reporting metric.

The EPRA NTA per share as at the period end is 106.42 pence per

share, the same as the IFRS NAV per share. The IFRS NAV adjusted

for the portfolio valuation (including portfolio premium) was

GBP468.8 million, which equates to a Portfolio NAV of 116.39 pence

per share.

The audited IFRS NAV per share was 106.42 pence, a 1.0% increase

from 105.37 pence as at 31 December 2019.

The EPRA ongoing charges ratio is calculated as a percentage of

the average net asset value for the period under review. The

ongoing charges ratio for the period was 1.57% compared to 1.63% at

31 December 2019.

At the year end, the portfolio was independently valued at

GBP571.5 million on an IFRS basis, reflecting a valuation uplift of

7.7% against the portfolio's aggregate purchase price (including

acquisition costs). The valuation reflects a portfolio yield of

5.27%, against the portfolio's blended net initial yield of 5.90%

at the point of acquisition. This equates to a yield compression of

63 basis points, reflecting the quality of the Group's asset

selection and off-market acquisition process.

The Group's properties were valued at GBP611.6 million on a

portfolio valuation basis, reflecting a portfolio premium of 7.0%,

or GBP40.1 million, against the IFRS valuation, compared to a

portfolio valuation of GBP503.8 million and a portfolio premium of

6.82% or GBP32.2 million uplift for the year ending 31 December

2019. The portfolio valuation assumes a single sale of the

property-holding SPVs to a third-party on an arm's length basis

with purchaser's costs of 2.3%.

The Group held cash and cash equivalents of GBP53.7 million at

31 December 2020 of which GBP0.9 million was restricted and GBP2.8

million was committed for the completion of forward funded

transactions, leaving available cash of GBP50 million. During the

year cash from operating activities increased by GBP8.2

million.

Debt Financing

During 2020, the Group drew and deployed the remaining GBP29.4