TIDMSNT

RNS Number : 8688C

Sabien Technology Group PLC

14 October 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310.

The directors take responsibility for this announcement.

14 October 2022

Sabien Technology Group plc

("Sabien" or the "Company" or the "Group")

Final Results and Audited Annual Report and Accounts for the

Year to 30 June 2022

(AIM: SNT)

Final Results

The Board of Directors of Sabien is pleased to announce the

publication of the audited annual report and accounts for the year

to 30 June 2022 (the "Annual Report").

Sabien Technology Group highlights 2022

-- Sales for the year GBP0.68m (2021: GBP0.97m)

-- Management fee from associated party GBP0.15m (2021: GBPnil).

-- Loss before tax GBP0.74m (2021 GBP0.51m loss)

-- Sales from Alliance Partners GBP0.06m (2021: GBP0.04m)

-- Deferred revenue carried into 2023 GBP0.18m (2021: GBP0.02m)

-- Forward orders carried into 2023 GBP0.09m (2021: GBP0.04m)

-- Overseas sales GBP0.06m (2021: GBP0.04m)

-- Net cash balance at 30 June 2022 was GBP0.33m (30 June 2021: GBP1.22m)

Highlights since the year end

-- Sales of GBP0.13m to 30 September 2022.

-- Net cash balance at 30 September 2022 of GBP0.63m.

-- GBP500k gross placing and GBP100k oversubscribed broker option.

The Annual Report will be published on the Company's website (

https://sabien.com/sabien-technology-investors-2/ ) in compliance

with its articles of association and the electronic communications

provisions of the Companies Act 2006. A copy of the Annual Report

can also be accessed through the Financial Reports tab at the link

below.

http://www.rns-pdf.londonstockexchange.com/rns/8688C_1-2022-10-13.pdf

Key extracts from the Annual Report can also be viewed

below.

Richard Parris, Executive Chairman, commented,

"Sabien is a microcosm of the challenges and opportunities

facing the world today. The Group has developed, and is developing,

a series of operations whose purpose and growth are both strong now

and likely to strengthen further in the medium term. The Board of

Sabien has prepared for this growth through acquiring selectively,

partnering constructively and managing prudently. We look forward

to the future with greater confidence than we have for some

time."

Notice of AGM

The Company will hold its Annual General Meeting at 11.00 am on

22 November at the offices of Peterhouse Capital Limited, 80

Cheapside, London, EC2V 6DZ (the "AGM"). The notice of the AGM will

be published on the Sabien website and notified shortly to

shareholders.

- Ends -

For further information please contact:

For Further Information:

Sabien Technology Group plc

Richard Parris, Executive Chairman +44 20 7993 3700

Allenby Capital Limited (Nominated

Adviser)

John Depasquale / Nick Harriss +44 203 328 5656

Peterhouse Capital Limited (Broker)

Duncan Vasey / Lucy Williams +44 207 469 0930

Executive Chairman's Statement

On 1 July 2021 the world in which Sabien operates was a

different place from that which faces the company into 2023.

Specifically, Covid was still a clear and present danger and the

economic impact of our addressing this danger less understood or

assessed. Today, Covid appears more under control but the impact of

our fight against it is only now becoming apparent. Inflation

figures, last seen in the 1970s, combine with fiscal and monetary

structures ill--suited to combat them. The flight from cities

appears more structural than temporary with consequential impacts

on where we live and work. Energy pricing, and the

inter--dependence of the market at a time of war, poses a

fundamental risk for the economic system which prevailed

pre--Covid.

In short: I believe that there is no return to "normal" and that

the establishment of a new "normal" is months, if not years,

away.

Sabien, under the management's leadership, recognised these

changes early. During the year ended 30 June 2022, Sabien's Green

Aggregation Strategy has focussed on three principal technology led

initiatives. M2G, the existing Sabien CO2 mitigation device for

commercial boilers, the UK rollout of Proton's oil to hydrogen

technology, and the City Oil Field Inc. ("COF") plastic to oil

technology.

We have shared the development of these initiatives with

shareholders and the wider market throughout. In support of them,

and our continuing development, the Company has raised GBP0.6m

through a placing and broker option. This provides the Company with

the wherewithal to secure the opportunities presented to it, for

the benefits of shareholders and stakeholders alike.

M2G Business

Despite the world semi--conductor supply shortage and its impact

on the completion of sales during the second half of the 2022

financial year, the Board is very pleased with the growth of the

new M2G Cloud business.

During the 2022 financial year, 293 M2G Cloud Solutions were

sold (2021: nil) of which 262 (89.4% of the annual total) occurred

in the second half of the year. In addition, the Company has

deferred revenue of GBP175k, and open orders of GBP91k, that will

carry over into FY23 as well as GBP23k of recurring revenue from

the M2G Cloud Solutions sold to date to be recognised in FY23. In

total, M2G has 2023 revenue identified and charged, but not yet

booked, of GBP289k (July 2021 forward revenue: GBP43k).

The Board is encouraged that despite the supply chain problems

affecting many companies, it has secured revenue which, had it

fallen in the year to 30 June 2022 would have resulted in a stable

performance year--on--year including other income of GBP0.15m

(2021:GBPnil) to the associated party b.grn Group Ltd ("b.grn"). It

is encouraged, further, that the momentum of revenue is growing

through the first half of the Company's financial year to 30 June

2023.

The Board was also pleased to recently announce that Sabien is

working with City Energy Network Ltd and EDF Plc to obtain The

Standard Assessment Procedure (SAP) approval for M2G. This has the

potential to expand Sabien's reach for the M2G product line into

the residential/domestic market via district heating schemes and

increases its current addressable market by three times.

COF / b.grn Business

During the financial year to 30 June 2022, Sabien signed a sales

agency agreement with COF. COF is a South Korean business that has

developed an innovative proprietary technology -- Resource

Gathering Operation (RGO), which focuses on the production of light

and ultra--pure fuel products from low temperature processing of

end--of--life plastics. In August 2022 we announced that the sales

agency agreement had been renewed for a further year. We also

announced that construction has started on the first commercial COF

installation in South Korea.

During the year the business has been developed in combination

with Sabien's development partner b.grn Group Ltd ("b.grn"). Key

milestones have been reached including the establishment of a range

of partner relationships with funding partners and professional

advisors. The latter includes development managers, ESG advisors,

and real estate advisors. In consultation with advisers, b.grn has

assessed a range of potential sites in England and Wales for the

first European COF installation. As previously announced,

exclusivity was agreed on a site near Northampton; discussions were

held in relation to a site on the Humber Estuary; and most recently

an indicative bid was submitted to acquire the ex--Anglesey

Aluminium site in Anglesey, supported by b.grn funding partners,

from the site's administrators. These three main sites considered

to date are not being actively pursued, primarily due to the level

of cost involved in acquiring the sites or the time required to

develop them.

Through this work to date, the Board has developed a strong

understanding of the emerging real estate market in key locations

in the UK. Within this, the Company and b.grn have developed an

advanced assessment of the most efficient sites for the deployment

of COF. From this emerging knowledge, the Company and b.grn are now

actively considering a number of sites in the UK, and beyond, where

b.grn could deploy COF without, necessarily, acquiring the

underlying real estate. Investigations into potential sites

continue with b.grn's partners. It is likely that the first active

deployment will be an initial 24 tonne ("24t") per day plastic to

oil proof of concept plant.

During the year, Sabien charged management fees of GBP0.15m to

b.grn (2021: GBPnil) comprising Sabien board time managing the

project and the recharge of professional fees incurred during the

year to 30 June 2022.

Proton UK Business

During the year Sabien has been working with multiple UK oil

field owners to identify suitable sites on which to deploy the

Proton Technologies Canada Inc. ("Proton") proprietary hydrogen

capture technology. In the long term, owners are motivated to

develop such hydrogen production facility on their near to end of

life fields. The Board believes that this motivation is secular and

is likely to grow as the global fuel portfolio adapts to the clear

trends in hydrocarbon demand. In the short term, reflecting the

current high level of oil prices in the market, field owners have

focussed on maximising short term oil production. The Proton

project continues to hold strong prospects for the Group, however

is not a current area of primary focus for the field owners due to

the high oil price.

Sabien is working with Proton to develop its option to install a

COF plant at Proton's Saskatchewan site. Sabien and Proton have

discussed various options for the sale of the off--take oil from

the COF process and both teams are motivated to develop the first

North American COF installation.

Aeristech investment

Sabien invested GBP100k in Aeristech in February 2021 at a price

of GBP2.40 per share. The investment was made to support

Aeristech's development of e--boost technologies for hydrogen fuel

cell, hybrid electric, and internal combustion engine powertrains.

Since Sabien's investment, Aeristech has made excellent progress in

developing its customer base and has raised funds at up to GBP3.00

per share.

Financial results

In the year to 30 June 2022, the Group has generated revenue of

GBP0.68m (2021: GBP0.97m), with GBP0.56m recorded in the second

half as well as GBP0.15m other income in relation to b.grn. Whilst

overall revenue has decreased in comparison to 2021, the Group

carries GBP0.29m (2021: GBP0.04m) into 2023. The forward revenue

comprises deferred revenue unable to be completed in 2022 due to

delayed supply chain caused by the worldwide semiconductor

shortage, forward orders, and a growing level of recurring revenue

from the M2G Cloud rollout.

Following the year end, the Group has closed a GBP500k placing

from existing and new investors and a GBP100k oversubscribed broker

option. Combined with our forward orders and revenue, the Group is

well placed in 2023 to take its three main business lines to the

next stages in their development.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 JUNE 2022

2022 2021

----------------------------------------- ------ ------------------ ------------------

Notes GBP000 GBP000

----------------------------------------- ------ ------------------ ------------------

Revenue 679 971

Cost of sales (231) (153)

Gross profit 448 818

Administrative expenses (1,327) (1,182)

========================================= ====== ================== ==================

Exceptional item 8 (9) (180)

========================================= ====== ================== ==================

Operating loss 7 (888) (544)

========================================= ====== ================== ==================

Other income 10 158 35

========================================= ====== ================== ==================

Finance cost 12 (13) -

========================================= ====== ================== ==================

Loss before tax (743) (509)

========================================= ====== ================== ==================

Tax credit 13 - -

========================================= ====== ================== ==================

Loss for the year attributable to equity

holders of the parent company (743) (509)

========================================= ====== ================== ==================

Other comprehensive income - -

========================================= ====== ================== ==================

Total comprehensive income for the year (743) (509)

========================================= ====== ================== ==================

Loss per share in pence -- basic 14 (5.06) (6.22)

========================================= ====== ================== ==================

Loss per share in pence -- diluted 14 (5.06) (6.22)

========================================= ====== ================== ==================

CONSOLIDATED AND COMPANY STATEMENTS OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Group Group Company Company

------------------------------- ------ ----------------- ----------------- ---------------- -----------------

2022 2021 2022 2021

------------------------------- ------ ----------------- ----------------- ---------------- -----------------

Notes GBP000 GBP000 GBP000 GBP000

=============================== ====== ================= ================= ================ =================

ASSETS

=============================== ====== ================= ================= ================ =================

Non--current assets

=============================== ====== ================= ================= ================ =================

Property, plant and equipment 15 2 35 - -

=============================== ====== ================= ================= ================ =================

Intangible assets 16 152 57 97 -

=============================== ====== ================= ================= ================ =================

Investments 18 200 100 200 100

=============================== ====== ================= ================= ================ =================

Total non--current assets 354 192 297 100

=============================== ====== ================= ================= ================ =================

Current assets

=============================== ====== ================= ================= ================ =================

Inventories 17 40 24 - -

=============================== ====== ================= ================= ================ =================

Trade and other receivables 20 387 51 231 180

=============================== ====== ================= ================= ================ =================

Cash and bank balances 21 573 1,399 306 977

=============================== ====== ================= ================= ================ =================

Total current assets 1,000 1,474 537 1,157

=============================== ====== ================= ================= ================ =================

TOTAL ASSETS 1,354 1,666 834 1,257

=============================== ====== ================= ================= ================ =================

EQUITY AND LIABILITIES

=============================== ====== ================= ================= ================ =================

Current liabilities

=============================== ====== ================= ================= ================ =================

Trade and other payables 22 487 161 98 99

=============================== ====== ================= ================= ================ =================

Borrowings 23 138 36 102 -

=============================== ====== ================= ================= ================ =================

Total current liabilities 625 197 200 99

=============================== ====== ================= ================= ================ =================

Non--current liabilities

=============================== ====== ================= ================= ================ =================

Borrowings 23 109 145 - -

=============================== ====== ================= ================= ================ =================

Total non--current liabilities 109 145 - -

=============================== ====== ================= ================= ================ =================

Equity

=============================== ====== ================= ================= ================ =================

Equity attributable to equity

holders of the parent

=============================== ====== ================= ================= ================ =================

Share capital 24 3,354 3,350 3,354 3,350

=============================== ====== ================= ================= ================ =================

Share premium 3,543 3,508 3,543 3,508

=============================== ====== ================= ================= ================ =================

Other reserves 1 1 10 1

=============================== ====== ================= ================= ================ =================

Retained earnings (6,278) (5,535) (6,273) (5,701)

=============================== ====== ================= ================= ================ =================

Total equity 620 1,324 634 1,158

=============================== ====== ================= ================= ================ =================

TOTAL EQUITY AND LIABILITIES 1,354 1,666 834 1,257

=============================== ====== ================= ================= ================ =================

CONSOLIDATED AND COMPANY CASH FLOW STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2022

Group Group Company Company

------------------------------------------- ------------ --------- --------------- -------------

2022 2021 2022 2021

------------------------------------------- ------------ --------- --------------- -------------

GBP000 GBP000 GBP000 GBP000

=========================================== ============ ========= =============== =============

Cash flows from operating activities

=========================================== ============ ========= =============== =============

Loss before taxation (743) (509) (572) (993)

=========================================== ============ ========= =============== =============

Adjustments for:

=========================================== ============ ========= =============== =============

Depreciation and amortisation 63 51 3 -

=========================================== ============ ========= =============== =============

Loss on disposal of fixed assets - 11 - -

=========================================== ============ ========= =============== =============

Gain on foreign currency reserve (9) - - -

=========================================== ============ ========= =============== =============

Finance cost 13 - 3 -

=========================================== ============ ========= =============== =============

Less movement in interest accrual (2) - (2) -

=========================================== ============ ========= =============== =============

Fixed assets transferred to inventory 6 - - -

=========================================== ============ ========= =============== =============

Equity settled current liability 33 - 33 -

=========================================== ============ ========= =============== =============

(Decrease) / increase in trade and other

receivables (334) 32 (65) 284

=========================================== ============ ========= =============== =============

(Increase) / decrease in inventories (16) 15 - -

=========================================== ============ ========= =============== =============

Increase / (decrease) in trade and other

payables 326 (466) 14 (430)

=========================================== ============ ========= =============== =============

Net cash outflow from operating activities (663) (866) (586) (1,139)

=========================================== ============ ========= =============== =============

Cash flows from investing activities

=========================================== ============ ========= =============== =============

Investments acquired (100) (100) (100) (100)

=========================================== ============ ========= =============== =============

Purchase of property, plant and equipment - (33) - -

=========================================== ============ ========= =============== =============

Purchase of intangible assets (131) - (100) -

=========================================== ============ ========= =============== =============

Net cash used in investing activities (231) (133) (200) (100)

=========================================== ============ ========= =============== =============

Cash flows from financing activities

=========================================== ============ ========= =============== =============

Proceeds from borrowings 100 - 100 -

=========================================== ============ ========= =============== =============

Repayment of borrowings (36) - - -

=========================================== ============ ========= =============== =============

Interest paid (11) - - -

=========================================== ============ ========= =============== =============

Proceeds from share issues 15 1,700 15 1,700

=========================================== ============ ========= =============== =============

Share issue costs - (80) - (80)

=========================================== ============ ========= =============== =============

Net cash generated by financing activities 68 1,620 115 1,620

=========================================== ============ ========= =============== =============

Net (decrease) / increase in cash and

cash equivalents (826) 621 (671) 381

=========================================== ============ ========= =============== =============

Cash and cash equivalents at the beginning

of the year 1,399 778 977 596

=========================================== ============ ========= =============== =============

Cash and cash equivalents at the end of

the year 573 1,399 306 977

=========================================== ============ ========= =============== =============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EANEDFSLAFFA

(END) Dow Jones Newswires

October 14, 2022 02:00 ET (06:00 GMT)

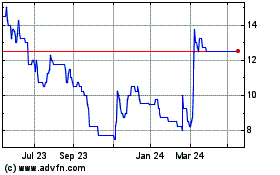

Sabien Technology (LSE:SNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sabien Technology (LSE:SNT)

Historical Stock Chart

From Jul 2023 to Jul 2024