TIDMSFR

RNS Number : 5452I

Severfield PLC

27 November 2018

27 November 2018

Interim results for the period ended 30 September 2018

Continued operational and strategic progress, UK order book of

GBP230m, India expansion underway, full year results in line with

expectations

Severfield plc, the market leading structural steel group,

announces its results for the six month period ended 30 September

2018.

Highlights

-- Revenue up 9% to GBP149.1m (H1 2017: GBP137.1m)

-- Underlying* profit before tax up 2% to GBP13.1m against a

particularly strong H1 2017 profit of GBP12.9m which included

higher than normal profits from certain project completions

-- Interim dividend increased by 11% to 1.0p per share (H1 2017:

0.9p per share)

-- Continued cash generation, resulting in period-end net funds

of GBP25.3m (31 March 2018: GBP33.0m) after the payment of 2018

final and special dividends (GBP10.3m)

-- Over 70 projects undertaken during the period in key market

sectors including the new stadium for Tottenham Hotspur FC, the

retractable roof for Wimbledon No. 1 Court and a new commercial

tower in London at 22 Bishopsgate

-- UK order book of GBP230m at 1 November 2018 (1 June 2018:

GBP237m) comprising more small, lower risk projects

-- Continued good performance from Indian joint venture - share

of profit of GBP0.4m (H1 2017: GBP0.1m)

-- Improving Indian market position reflected in order book of

GBP124m at 1 November 2018 (1 June 2018: GBP106m), expansion of

Bellary facility now underway

GBPm 6 months to 6 months to

30 September 30 September

2018 2017

(unaudited) (unaudited)

Revenue 149.1 137.1

Underlying* operating profit

(before JVs and associates) 12.5 12.7

Underlying* operating margin

(before JVs and associates) 8.4% 9.3%

Operating profit (before JVs and

associates) 12.5 11.4

Underlying* profit before tax 13.1 12.9

Profit before tax 13.1 11.5

Underlying* basic earnings per

share 3.54p 3.50p

Basic earnings per share 3.54p 3.14p

* Underlying results are stated before non-underlying items of

GBPnil (H1 2017: GBP1.3m):

- Amortisation of acquired intangible assets - GBPnil (H1 2017: GBP1.3m)

- The associated tax impact of the above - GBPnil (H1 2017: GBP0.3m)

Alan Dunsmore, Chief Executive Officer commented:

"Our continued operational and strategic progress has resulted

in another period of growth for the Group. In addition to a high

quality and stable UK order book, we continue to see good progress

in India and have established exciting new organic opportunities

for growth.

With our market-leading position, we are well placed to deliver

on our strategic objectives and generate enhanced value for our

shareholders."

For further information, please contact:

Alan Dunsmore

Severfield plc Chief Executive Officer 01845 577 896

Adam Semple

Group Finance Director 01845 577 896

Jefferies International Simon Hardy 020 7029 8000

Will Soutar 020 7029 8000

Camarco Ginny Pulbrook 020 3757 4980

Tom Huddart 020 3757 4980

Notes to editors:

Severfield is the UK's market leader in the design, fabrication

and construction of structural steel, with a total capacity of

c.150,000 tonnes of steel per annum. The Group has four sites,

c.1,300 employees and expertise in large, complex projects across a

broad range of sectors. The Group also has an established foothold

in the developing Indian market through its joint venture

partnership with JSW Steel (India's largest steel producer).

Interim statement 2018

Introduction

The first six months of the year have seen good progress across

the whole Group. We have delivered further revenue growth,

continued to improve our underlying operating margin from the 2018

full year position and reported another period of cash generation.

The half year results also show an increase in profit before tax

but this was against a particularly strong first half profit

performance in the prior period, which included higher than normal

profits from certain project completions. Our UK order book and

pipeline of potential future orders has remained stable with a good

balance of work across all key market sectors. Both the quality of

the order book and the strength of the UK pipeline are consistent

with our continued progress towards our strategic targets.

The market position of our Indian joint venture ('JSSL'),

continues to improve. This is reflected in JSSL's order book, which

has increased again to GBP124m, and a growing pipeline of

commercial opportunities, which positions the business well for the

future. JSSL has continued to perform well and the results for the

first six months of the year have benefited from revenue growth,

good operational performance and lower financing costs following

the repayment of the term debt in June 2017.

Financials

Revenue of GBP149.1m (2017: GBP137.1m) represents an increase of

GBP12.0m (9 per cent) compared with the prior period, predominantly

reflecting an increase in order flow and production activity during

the period.

Underlying operating profit (before JVs and associates) of

GBP12.5m (2017: GBP12.7m) represents a small decrease of GBP0.2m (2

per cent) over the prior period. This mainly reflects a lower

underlying operating margin (before JVs and associates) of 8.4 per

cent (2017: 9.3 per cent) which is predominantly due to the prior

year benefitting from higher than normal profits from certain

project completions. Notwithstanding this, the margin for the first

six months of the year compares favourably to the 2018 full year

underlying operating margin (before JVs and associates) of 8.3 per

cent, demonstrating further margin progression and improvements to

our operational execution.

The share of results of JVs and associates in the first half of

the year was a profit of GBP0.7m (2017: GBP0.3m). This includes a

share of profit from the Indian joint venture of GBP0.4m (2017:

GBP0.1m), reflecting revenue growth, good operational performance

and lower financing costs. The share of results of JVs and

associates also includes those of Composite Metal Flooring ('CMF')

Limited which has contributed a share of profit for the Group of

GBP0.3m (2017: GBP0.2m).

The Group's underlying operating profit was GBP13.2m (2017:

GBP13.0m) and underlying profit before tax was GBP13.1m (2017:

GBP12.9m), an increase of 2 per cent compared to the previous

period.

There were no non-underlying items in the period. Non-underlying

items in the prior period included the amortisation of acquired

intangible assets of GBP1.3m, identified on the acquisition of

Fisher Engineering in 2007, which are now fully amortised.

Non-underlying items are classified as such as they do not form

part of the profit monitored in the ongoing management of the

Group.

An underlying tax charge of GBP2.4m is shown for the period

(2017: GBP2.4m). This tax charge is recognised based upon the best

estimate of the average effective income tax rate on profit before

tax for the full financial year and equates to the UK statutory

rate of 19 per cent. The statutory profit before tax, which

includes both underlying and non-underlying items, is GBP13.1m

(2017: GBP11.5m). The statutory profit after tax is GBP10.8m (2017:

GBP9.4m) and has been transferred to reserves.

Underlying basic earnings per share is 3.54p (2017: 3.50p). This

calculation is based on the underlying profit after tax of GBP10.8m

(2017: GBP10.5m) and 303,951,597 shares (2017: 299,555,911 shares),

being the weighted average number of shares in issue during the

period. Basic earnings per share, which is based on the statutory

profit after tax, is 3.54p (2017: 3.14p). There are no contingent

shares outstanding under share-based payment schemes and,

accordingly, there is no difference between basic and diluted

earnings per share.

Net funds at 30 September 2018 were GBP25.3m (31 March 2018:

GBP33.0m) following the payment of the 2018 final dividend

(GBP5.2m) and special dividend (GBP5.2m). Operating cash flow for

the period before working capital movements was GBP13.9m (2017:

GBP14.1m). Net working capital increased by GBP9.7m during the

period reflecting the timing of ongoing contract works and the

unwinding of advance payments from customers. Excluding advance

payments, year-end net working capital represented approximately

five per cent of revenue, which is within the four to six per cent

range which we have been targeting over recent years.

Capital expenditure of GBP2.4m (2017: GBP3.3m) represents the

continuation of the Group's capital investment programme. This

predominantly included continued investment in new equipment for

our fabrication lines and site infrastructure improvements.

Depreciation in the period was GBP1.9m (2017: GBP1.8m).

The Group's defined benefit pension liability at 30 September

2018 was GBP16.7m, a decrease of GBP0.5m from the year-end position

of GBP17.2m. The decrease in the liability is primarily the result

of an increase in the assumption for corporate bond yields (used as

the discount rate in the calculation of scheme liabilities) and

ongoing deficit contributions made by the Group during the period.

The triennial funding valuation of the scheme was carried out in

2018 with a valuation date of 5 April 2017.

On 31 October 2018, the Group refinanced its existing borrowing

facilities of GBP25m with HSBC Bank plc and Yorkshire Bank. This

new facility, also a GBP25m revolving credit facility ('RCF'),

matures in October 2023. The facility continues to include an

accordion facility of GBP20m, which allows the Group to increase

the aggregate available borrowings to GBP45m at the Group's

request. The facility is subject to two financial covenants namely

the cover of interest costs and the ratio of net debt to

EBITDA.

Dividend

As part of the Group's commitment to a progressive dividend

policy, the board has decided to increase the interim dividend by

11 per cent to 1.0p per share (2017: 0.9p per share). The dividend

will be paid on 11 January 2019 to shareholders on the register on

14 December 2018.

UK review

The Group's main activities continue to be the design,

fabrication and construction of structural steel for construction

projects and more than 70 live projects were worked on during the

period. These cover a wide range of sectors that the Group can

service including commercial offices, industrial and distribution,

data centres, transport and retail. During the period, we continued

to work on three large projects in London, each of which have

project revenues in excess of GBP20m. These comprise a new

commercial tower at 22 Bishopsgate, where work remains ongoing, and

two projects where work is substantially complete, namely the new

stadium for Tottenham Hotspur FC and the retractable roof for

Wimbledon No. 1 Court. A fourth large project, for a major new

commercial head office building in London, was substantially

completed in the previous financial year.

Other significant projects worked on in the period included

commercial office developments in London and outside (including

North Wharf Road, St. Giles Circus, One Crown Place, Birmingham

Snowhill and Cardiff Central Square), two large data centres in

Belgium and the Republic of Ireland, two large industrial and

distribution projects for Amazon, and the Engineering Campus

Development at Manchester University.

Revenue has increased by nine per cent from the prior period

predominately reflecting an increase in order flow and production

activity during the period. The UK order book of GBP230m at 1

November 2018 continues to include a high proportion of smaller

projects, particularly in the industrial and distribution sector,

which typically have shorter lead times than, for example, the

large London projects (discussed above) which are either complete

or nearing completion. The order book, of which GBP183m is for

delivery over the next 12 months, remains in line with our normal

order book levels, which typically equate to eight to ten months of

annualised revenue. This provides us with good visibility of

earnings and supports continued progress towards our strategic

targets.

Significant new orders secured in the period include several

commercial office developments in London and in Manchester, a

significant number of industrial and distribution projects for a

variety of clients, a large project at Heathrow airport and a car

park development at Manchester airport. Furthermore, the new Google

Headquarters, for which an order of GBP50m was secured in December

2017, will require us to provide over 15,000 tonnes of structural

steelwork for an eleven storey head office building at Kings Cross

in London. Work on this project is scheduled to commence in the

second half of the current financial year.

Overall, the UK market continues to appear stable, with modest

economic growth forecast, in tandem with our pipeline of potential

future orders which also remains stable. We continue to see good

opportunities across the commercial office, industrial and

distribution, data centre and infrastructure sectors, together with

those in Europe and the Republic of Ireland. Whilst we are

currently seeing some lower tender margins on projects that we are

bidding we have been able to offset these with efficiency

improvements and other contract execution gains.

Looking further ahead, we continue to pursue a number of

significant infrastructure opportunities, particularly in the

transport sector, which are being driven by the UK government's

investment in infrastructure commitment which is targeted to

increase over the next few years. This will include projects such

as HS2 (both stations and bridges) and the expansion of Heathrow

airport. In addition, we also see good opportunities from the

government's ongoing Network Rail and Highways England investment

programmes. The combination of the Group's historical track record

in transport infrastructure, together with our in-house bridge

operations, leaves us well positioned to win work from such

projects, all of which have significant steelwork content.

The Group is working with industry bodies to identify and manage

any challenges caused by the UK's exit from the European Union. At

this stage, we have seen no material impact from Brexit, however

with continued uncertainty, we are scenario-planning and working

with our clients and others in the industry to ensure we are able

to respond to any future changes in market conditions.

The underlying operating margin (before JVs and associates) was

8.4 per cent (2017: 9.3 per cent) resulting in an underlying

operating profit (before JVs and associates) of GBP12.5m (2017:

GBP12.7m). Although underlying operating profit is broadly

unchanged, it was against a strong comparator in the prior period,

which included higher than normal profits from certain project

completions. Notwithstanding this, we are pleased that the first

half underlying operating margin has continued to improve from the

2018 full year position of 8.3 per cent, and remains firmly within

the margin range of 8 to 10 per cent required to achieve our

strategic profit target of doubling 2016 underlying profit before

tax to GBP26m by 2020.

The margin performance continues to reflect improvements in our

operational execution. This includes the benefits from our

programme of projects categorised under the banner of 'Smarter,

Safer, more Sustainable' which provides a framework for the ongoing

improvements to our business and factory processes, use of

technology and operating efficiencies. Our new dedicated 'SSS' team

is working on improving many aspects of our internal operations,

including the application of Lean manufacturing techniques,

together with our engineering forum which is looking at new and

innovative ways of working.

During the period, we have continued to invest in research and

development into advanced technologies to further improve

efficiencies and client service. We have also now fully rolled out

our new Group-wide production management system which will help

drive ongoing value through increased productivity coupled with

greater transparency and assurance.

In January 2018, we reorganised our factory operations in North

Yorkshire to drive further operational improvements, resulting in

the consolidation of steel fabrication at Dalton and Sherburn into

the Dalton facility. This combined facility is now operating at

scale and the reorganisation of our operational footprint has

contributed to increased operational efficiencies which are

benefitting operating margins. Furthermore, in February 2018, in

response to changes in the current work mix which has changed the

requirement for steel fabrication at our Lostock and Dalton

facilities, we transitioned a number of job roles from Lostock to

Dalton. This process has also been concluded successfully with both

facilities now operating with workforce capacities which are more

closely aligned with current and expected orders.

Our specialist cold rolled steel joint venture business, CMF,

has continued to grow and has performed well during the period. We

are the only fabricator in the UK to have both a hot and cold

rolled manufacturing capability. We continue to look at ways to

improve factory efficiencies at CMF and to expand the product

range, which now includes a growing purlin business, allowing the

Group to continue integrating elements of its supply chain.

The remedial bolt replacement works at Leadenhall were completed

during the prior year with the total expenditure being in line with

the non-underlying charge made back in 2015. Discussions remain

ongoing with all stakeholders to determine where the financial

liability for the remedial costs should rest.

India

The Indian joint venture has continued to grow and recorded a

profit in the period, of which the Group's after tax share was

GBP0.4m (2017: GBP0.1m). The higher profitability in the period

reflects both a good operating performance, together with lower

financing costs following the repayment of the term debt in June

2017. JSSL's revenue has increased to GBP32m compared with GBP22m

in the previous period, assisted by the higher order book coming

into the financial year. The impact of this has been offset by a

reduction in the operating margin to 7.0 per cent compared to 9.3

per cent in the previous period. The lower margin is consistent

with the ongoing fluctuations in the timing and mix of industrial

and commercial work in a growing order book.

The market for structural steel in India continued to improve

and we are seeing clear signs of the conversion of the market from

concrete to steel, which is vital to the success and long term

value of the business. This position is evident in an order book at

1 November 2018 of GBP124m (1 June 2018: GBP106m) which includes a

large commercial order (Sattva) in the state of Hyderabad, along

with a growing large number of potential higher margin commercial

projects in the pipeline. In addition, we also have visibility of

an increased pipeline of industrial work, including for our joint

venture partner, JSW Steel ('JSW'), which is currently increasing

its domestic steel output, a process which is expected to continue

in the short to medium term.

As a result of these continued market improvements, we have

agreed with JSW to increase factory capacity at the Bellary

facility from c.60,000 tonnes to c.90,000 tonnes. This project will

be financed by a combination of equity of c.GBP8m, provided in

equal cash amounts of c.GBP4m by the Group and JSW, and debt of

c.GBP8m, provided directly to JSSL by Indian lenders. Significant

work on this expansion will commence in the second half of the year

and will take around 12 to 18 months to complete. This will provide

the business with the springboard to deliver future profitable

growth, and its value will continue to build as it continues to

expand and develop.

Strategy

In addition to making good progress towards our 2020 strategic

profit target, we continue to pursue our three new areas of organic

growth - Severfield (Products & Processing) ('SPP'), Europe and

medium to high rise residential construction.

SPP, our new business venture at the Sherburn facility,

commenced trading in April 2018. This business is allowing us to

address smaller scale projects, a segment of the market that we

have not historically focused on, and provides a one-stop shop for

smaller fabricators to source high quality processed steel and

ancillary products. The business is developing in line with

expectations and has secured and delivered a number of orders to a

variety of new customers in the first six months of the year.

During this time, we have also gained more market intelligence on

both our customers and competitors and are developing our customer

relationships and pipeline of potential future orders.

We have continued to develop our European business venture,

which is based in the Netherlands, aided by a small locally-based

team which includes our business development director. During the

period, we have submitted a number of tenders for work in

continental Europe and there is now a growing pipeline of

opportunities which includes many potentially interesting and high

quality projects, certain of which are with clients with whom we

are used to working with in the UK. The European team's market

knowledge and experience has also been invaluable to our UK

business when tendering for and delivering European work, providing

us with a competitive advantage and the ability to deliver

excellent client service.

We have also maintained our focus on the market for medium to

high rise residential construction where we have developed a steel

solution. We continue to see plenty of potential opportunities and

discussions with a number of interested parties remain ongoing. We

remain highly focused on this area of potential growth and are

pushing hard to secure our first order which we believe will be an

important step in establishing a track record in the sector.

Safety

The Group strategy continues to support health and safety as

being at the forefront of everything we do.

There are now more than 150 behavioural safety coaches across

the Group, encouraging ownership of safety across all levels of the

business. The coaching programme has been extremely successful in

engaging employees in our 'Six Life Saving Rules' and 'SLAM'

messaging campaigns. This has positively contributed to the overall

safety culture, encouraging and empowering employees to raise their

concerns and highlight any best practise to coaches who can respond

to queries giving more direct and personal feedback.

The number of visits to site by board members continues to grow

year-on-year, and more emphasis is being given on employee

engagement, enabling the Group to gain vital feedback and

suggestions for improvement around safety. Work has finished on a

new in-house audit system allowing better analysis of site visits,

meaning prevention campaigns are better targeted to high potential

for harm incidents and minor injuries. By identifying key areas

within our working environment, we have been able to set out a

programme of senior management led quarterly presentations, to

deliver key messages across our employee network in our commitment

to a 'safety first' culture.

We recognise that mental health is a major concern in our

industry. In raising awareness of mental health, we have developed

an internal campaign ('Head's Up') to communicate a 'door is always

open' policy. We now have a growing community of over 25 mental

health first aiders, and have signed up to the Build UK Charter to

improve and promote positive mental health in construction.

Alongside our occupational health we have introduced an employee

helpline that gives those working with us and their families access

to qualified councillors for anything they require help with.

Sustainability remains a key part of this strategy, with work

being undertaken to develop a new all-encompassing policy which

cascades from board level. Smarter, Safer, more Sustainable stays

at the forefront of all new projects, with our dedicated team of

in-house experts ensuring that we always put safety at the core of

every decision whilst developing smarter ways of working.

Summary and outlook

The strong recent performance of the Group has continued in the

first six months of the current financial year. The Group has

delivered further revenue growth, a strong underlying profit

performance and continued cash generation and we continue to see

tangible benefits coming from our business improvement

initiatives.

In India, with the expansion of the operations in Bellary now

underway, an order book of GBP124m and a growing level of new

opportunities, which includes a number of higher margin commercial

projects, our joint venture business remains well positioned to

take advantage of a market for structural steel which continues to

improve.

With a quality order book and a stable pipeline of UK

opportunities, the outlook for the Group remains good. As a result,

we expect further progress during the second half of the financial

year and remain confident that the Group's full year results will

be in line with expectations.

Alan Dunsmore

Chief Executive Officer

Condensed consolidated interim financial information

Consolidated income statement

Six months ended Six months ended Year ended

30 September 2018 (unaudited) 30 September 2017 (unaudited) 31 March 2018 (audited)

Non- Non-underlying Non-underlying

Underlying underlying Total Underlying GBP000 Total Underlying GBP000 Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 149,089 - 149,089 137,107 - 137,107 274,203 - 274,203

Operating

costs (136,610) - (136,610) (124,414) (1,333) (125,747) (251,337) (1,333) (252,670)

------------ ---------- ------------ ----------- -------------- --------- -------------- --------------- --------------

Operating

profit

before

share of

results of

JVs

and

associates 12,479 - 12,479 12,693 (1,333) 11,360 22,866 (1,333) 21,533

Share of

results of

JVs

and

associates 738 - 738 283 - 283 882 - 882

Operating

profit 13,217 - 13,217 12,976 (1,333) 11,643 23,748 (1,333) 22,415

Finance

expense (109) - (109) (119) - (119) (236) - (236)

------------ ---------- ------------ ----------- -------------- --------- -------------- --------------- --------------

Profit

before tax 13,108 - 13,108 12,857 (1,333) 11,524 23,512 (1,333) 22,179

Taxation (2,351) - (2,351) (2,386) 253 (2,133) (4,385) 352 (4,033)

------------ ---------- ------------ ----------- -------------- --------- -------------- --------------- --------------

Profit for

the period 10,757 - 10,757 10,471 (1,080) 9,391 19,127 (981) 18,146

============ ========== ============ =========== ============== ========= ============== =============== ==============

Earnings

per share:

Basic 3.54p - 3.54p 3.50p (0.36p) 3.14p 6.38p (0.33p) 6.05p

Diluted 3.54p - 3.54p 3.50p (0.36p) 3.14p 6.29p (0.32p) 5.97p

Further details of non-underlying items are disclosed in note 7

to the condensed consolidated interim financial information.

Consolidated statement of comprehensive income

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Actuarial gain on defined benefit

pension scheme* 113 940 3,606

(Losses)/profits taken to equity

on cash flow hedges (265) 253 435

Reclassification adjustments on

cash flow hedges 176 (420) (346)

Tax relating to components of other

comprehensive income* (19) (160) (700)

Other comprehensive income

for the period 5 613 2,995

Profit for the period from continuing

operations 10,757 9,391 18,146

------------- ------------- ----------

Total comprehensive income for

the period attributable to equity

shareholders of the parent 10,762 10,004 21,141

============= ============= ==========

* These items will not be subsequently reclassified to the

consolidated income statement.

Consolidated balance sheet

At At At

30 September 30 September 31 March

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

ASSETS

Non-current assets

Goodwill 54,712 54,712 54,712

Other intangible assets 34 172 103

Property, plant and equipment 81,553 80,172 81,239

Interests in JVs and associates 19,194 17,857 18,456

Deferred tax asset - 513 -

------------- ------------- --------------------

155,493 153,426 154,510

------------- ------------- --------------------

Current assets

Inventories 8,122 6,368 9,646

Trade and other receivables 64,389 52,439 56,270

Derivative financial instruments 12 - 167

Cash and cash equivalents 25,409 31,602 33,114

------------- ------------- --------------------

97,932 90,409 99,197

------------- ------------- --------------------

Total assets 253,425 243,835 253,707

============= ============= ====================

LIABILITIES

Current liabilities

Trade and other payables (61,096) (59,980) (64,225)

Financial liabilities - finance

leases (139) (180) (180)

Financial liabilities - derivative - (33) -

financial instruments

Current tax liabilities (2,981) (2,635) (1,645)

(64,216) (62,828) (66,050)

------------- ------------- --------------------

Non-current liabilities

Retirement benefit obligations (16,692) (20,167) (17,248)

Financial liabilities - finance

leases - (139) (49)

Deferred tax liabilities (1,381) (790) (1,363)

(18,073) (21,096) (18,660)

------------- ------------- --------------------

Total liabilities (82,289) (83,924) (84,710)

------------- ------------- --------------------

NET ASSETS 171,136 159,911 168,997

============= ============= ====================

EQUITY

Share capital 7,599 7,488 7,492

Share premium 87,254 85,702 85,702

Other reserves 3,162 3,873 4,749

Retained earnings 73,121 62,848 71,054

------------- ------------- --------------------

TOTAL EQUITY 171,136 159,911 168,997

============= ============= ====================

Consolidated statement of changes in equity

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2018 7,492 85,702 4,749 71,054 168,997

Total comprehensive income

for the period - - (89) 10,851 10,762

Ordinary shares issued* 107 1,552 - - 1,659

Equity settled share-based

payments - - (1,498) 1,533 35

Dividends paid - - - (10,317) (10,317)

At 30 September 2018 (unaudited) 7,599 87,254 3,162 73,121 171,136

=============== =============== =============== =============== =============

*The issue of shares represents shares allotted to satisfy the

2015 Performance Share Plan award, which vested in June 2018, and

shares allotted under the Group's 2015 Save As You Earn share

option plan which became exercisable in the period.

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2017 7,471 85,702 3,710 57,274 154,157

Total comprehensive income

for the period - - (167) 10,171 10,004

Ordinary shares issued* 17 - - - 17

Equity settled share-based

payments - - 330 196 526

Dividends paid - - - (4,793) (4,793)

At 30 September 2017 (unaudited) 7,488 85,702 3,873 62,848 159,911

=============== =============== =============== =============== =============

*The issue of shares represents shares allotted to satisfy the

2014 Performance Share Plan award, which vested in June 2017.

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2017 7,471 85,702 3,710 57,274 154,157

Total comprehensive income

for the year - - 89 21,052 21,141

Ordinary shares issued* 21 - - - 21

Equity settled share-based

payments - - 950 218 1,168

Dividends paid - - - (7,490) (7,490)

At 31 March 2018 (audited) 7,492 85,702 4,749 71,054 168,997

=============== =============== =============== =============== =============

*The issue of shares represents shares allotted to satisfy the

2014 Performance Share Plan award, which vested in June and

November 2017.

Consolidated cash flow statement

Six months Six months Year

ended ended

30 September 30 September ended

2018 2017

(unaudited) (unaudited) 31 March

GBP000 GBP000 2018

(audited)

GBP000

Net cash flow from operating activities 3,198 11,414 19,039

Cash flows from investing activities

Proceeds on disposal of property,

plant and equipment 342 927 1,012

Purchases of land and buildings (82) (137) (412)

Purchases of plant and equipment (2,350) (3,160) (5,996)

Investment in JVs and associates - (5,330) (5,506)

----------------------- ----------------------- ----------------------

Net cash used in investing activities (2,090) (7,700) (10,902)

----------------------- ----------------------- ----------------------

Cash flows from financing activities

Proceeds from shares issued 1,659 - -

Interest paid (65) (78) (202)

Dividends paid (10,317) (4,793) (7,490)

Repayment of obligations under

finance leases (90) (90) (180)

Net cash used in financing activities (8,813) (4,961) (7,872)

----------------------- ----------------------- ----------------------

Net (decrease)/increase in cash

and cash equivalents (7,705) (1,247) 265

Cash and cash equivalents at beginning

of period 33,114 32,849 32,849

----------------------- ----------------------- ----------------------

Cash and cash equivalents at end

of period 25,409 31,602 33,114

======================= ======================= ======================

Notes to the condensed consolidated interim financial

information

1) General information

Severfield plc ('the Company') is a company incorporated and

domiciled in the UK. The address of its registered office is Severs

House, Dalton Airfield Industrial Estate, Dalton, Thirsk, North

Yorkshire, YO7 3JN.

The Company is listed on the London Stock Exchange.

The condensed consolidated interim financial information does

not constitute the statutory financial statements of the Group

within the meaning of section 435 of the Companies Act 2006. The

statutory financial statements for the year ended 31 March 2018

were approved by the board of directors on 20 June 2018 and have

been delivered to the registrar of companies. The report of the

auditors on those financial statements was unqualified, did not

draw attention to any matters by way of emphasis and did not

contain any statement under section 498 of the Companies Act

2006.

The condensed consolidated interim financial information for the

six months ended 30 September 2018 has been reviewed, not audited,

and was approved for issue by the board of directors on 26 November

2018.

2) Basis of preparation

The condensed consolidated interim financial information for the

six months ended 30 September 2018 has been prepared in accordance

with IAS 34 'Interim Financial Reporting' as adopted by the

European Union. The condensed consolidated interim financial

information should be read in conjunction with the statutory

financial statements for year ended 31 March 2018 which have been

prepared in accordance with International Financial Reporting

Standards ('IFRS') as adopted by the European Union.

In determining whether the Group's condensed consolidated

interim financial information can be prepared on the going concern

basis, the directors considered all factors likely to affect its

future development, performance and its financial position,

including cash flows, liquidity position and borrowing facilities

and the risks and uncertainties relating to its business

activities.

Having considered all the factors impacting the Group's

business, including certain downside sensitivities, the directors

are satisfied that the Group will be able to operate within the

terms and conditions of the Group financing facilities for the

foreseeable future.

3) Accounting policies

Except as described below, the accounting policies applied in

preparing the condensed consolidated interim financial information

are consistent with those used in preparing the statutory financial

statements for the year ended 31 March 2018.

Taxes on profits in interim periods are accrued using the tax

rate that will be applicable to expected total annual profits.

New and amended standards and interpretations need to be adopted

in the first interim financial statements issued after their

effective date (or date of early adoption).

There are no new IFRSs or IFRICs that are effective for the

first time for the six months ended 30 September 2018 which have a

material impact on the Group.

IFRS 15 - Revenue from contracts with customers

The Group has adopted IFRS 15 from 1 April 2018. The new

standard modifies the determination of how much revenue to

recognise, and when, and introduces a single, principles based

five-step model to be applied to all contracts with customers. IFRS

15 replaces the separate models for goods, services and

construction contracts currently included in IAS 11 'Construction

Contracts' and IAS 18 'Revenue'.

The implementation of IFRS 15 did not have a material impact on

the timing or amount of revenue recognised by the Group in the

current or comparative period. This is because, under IFRS 15, the

services provided under a typical contract for the Group represent

one performance obligation, providing the customer with an

integrated solution and where the services (and consequently any

variations and claims) are highly interrelated. Furthermore,

revenue on construction contracts meets the criteria for over time

recognition under IFRS 15 and revenue will be recognised with

reference to the measurement of contract progress (costs to

complete). This is similar to that under IAS 11 'Construction

Contracts'.

4) Risks and uncertainties

The principal risks and uncertainties which could have a

material impact upon the Group's performance over the remaining six

months of the year ending 31 March 2019, other than as disclosed

below, have not changed significantly from those disclosed on pages

62 to 68 of the strategic report included in the annual report for

the year ended 31 March 2018. The annual report is available on the

Company's website www.severfield.com. These risks and uncertainties

include, but are not limited to:

-- Health and safety

-- Information technology resilience

-- The commercial and market environment within which the Group

operates

-- Failure to mitigate onerous contract terms

-- Supply chain

-- The Indian joint venture

-- People

-- Brexit (new for 2018/19).

5) Segmental analysis

In accordance with IFRS 8, the Group has identified its

operating segments with reference to the information regularly

reviewed by the executive committee (the chief operating decision

maker ('CODM')) to assess performance and allocate resources. On

this basis the CODM has identified one operating segment

(construction contracts) which in turn is the only reportable

segment of the Group.

The constituent operating businesses have been aggregated as

they have businesses with similar products and services, production

processes, types of customer, methods of distribution, regulatory

environments and economic characteristics. Given that only one

operating and reporting segment exists, the remaining disclosure

requirements of IFRS 8 are provided within the consolidated income

statement and balance sheet.

Revenue, which relates wholly to construction contracts and

related assets, in all periods originated from the United

Kingdom.

There has been no change in the basis of segmentation or in the

basis of measurement of segment profit or loss in the period.

6) Seasonality

There are no particular seasonal variations which impact the

split of revenue between the first and second half of the financial

year. Underlying movements in contract timing and phasing, which

are an ongoing feature of the business, will continue to drive

moderate fluctuations in half yearly revenues.

7) Non-underlying items

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2018 2017 2018

GBP000 GBP000 GBP000

Amortisation of acquired

intangible assets - (1,333) (1,333)

Non-underlying items before

tax - (1,333) (1,333)

Tax on non-underlying items - 253 352

----------------------- -------------------- ---------------------

Non-underlying items after

tax - (1,080) (981)

======================= ==================== =====================

Non-underlying items have been separately identified to provide

a better indication of the Group's underlying business performance.

They have been separately identified as a result of their

magnitude, incidence or unpredictable nature. These items are

presented as a separate column within their consolidated income

statement category. Their separate identification results in a

calculation of an underlying profit measure in the same way as it

is presented and reviewed by management.

A non-underlying loss of GBP1,333,000 was recognised in the

first half of the prior period reflecting the amortisation of

customer relationships, which were identified on the acquisition of

Fisher Engineering in 2007. These relationships are now fully

amortised.

8) Taxation

The income tax expense reflects the estimated underlying

effective tax rate on profit before taxation for the Group for the

year ending 31 March 2019.

9) Dividends

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2018 2017 2018

GBP000 GBP000 GBP000

2017 final - 1.6p per share - 4,793 4,793

2018 interim - 0.9p per share - - 2,697

2018 final - 1.7p per share 5,158 - -

2018 special - 1.7p per share 5,158 - -

10,317 4,793 7,490

====================== ====================== ======================

The directors have declared an interim dividend in respect of

the six months ended 30 September 2018 of 1.0p per share (2017:

0.9p per share) which will amount to an estimated dividend payment

of GBP3,040,000 (2017: GBP2,697,000). This dividend is not

reflected in the balance sheet as it will be paid after the balance

sheet date.

10) Earnings per share

Earnings per share is calculated as follows:

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2018 2017 2018

GBP000 GBP000 GBP000

Earnings for the purposes

of basic earnings per share

being net profit attributable

to equity holders of the parent

company 10,757 9,391 18,146

-------------------- ------------------- ---------------------

Earnings for the purposes

of underlying basic earnings

per share being underlying

net profit attributable to

equity holders of the parent

company 10,757 10,471 19,127

-------------------- ------------------- ---------------------

Number of shares Number Number Number

Weighted average number of

ordinary shares for the purposes

of basic earnings per share 303,951,597 299,555,911 299,682,810

Effect of dilutive potential

ordinary shares and under

share plans - - 4,520,463

Weighted average number of

ordinary shares for the purposes

of diluted earnings per share 303,951,597 299,555,911 304,203,273

==================== =================== =====================

Basic earnings per share 3.54p 3.14p 6.05p

Underlying basic earnings

per share 3.54p 3.50p 6.38p

Diluted earnings per share 3.54p 3.14p 5.97p

Underlying diluted earnings

per share 3.54p 3.50p 6.29p

11) Property, plant and equipment

During the period, the Group acquired land and buildings of

GBP82,000 (2017: GBP137,000) and other property, plant and

equipment of GBP2,350,000 (2017: GBP3,160,000). The Group also

disposed of other property, plant and equipment for GBP342,000

(2017: GBP927,000) resulting in a profit on disposal of GBP88,000

(2017: GBP664,000).

12) Net funds

The Group's net funds are as follows:

At At At

30 September 30 September 31 March

2018 2017 2018

GBP000 GBP000 GBP000

Cash and cash equivalents 25,409 31,602 33,114

Unamortised debt arrangement

costs 51 114 83

Financial liabilities - finance

leases (139) (319) (229)

------------- ------------------ -------------------

Net funds 25,321 31,397 32,968

============= ================== ===================

13) Fair value disclosures

The Group's financial instruments consist of borrowings, cash,

items that arise directly from its operations and derivative

financial instruments. Cash and cash equivalents, trade and other

receivables and trade and other payables generally have short terms

to maturity. For this reason, their carrying values approximate to

their fair values. The Group's borrowings relate principally to

amounts drawn down against its revolving credit facility, the

carrying amounts of which approximate to their fair values by

virtue of being floating rate instruments.

Derivative financial instruments are the only instruments valued

at fair value through profit or loss, and are valued as such on

initial recognition. These are foreign currency forward contracts

measured using quoted forward exchange rates and yield curves

matching the maturities of the contracts. These derivative

financial instruments are categorised as level 2 financial

instruments.

The fair values of the Group's derivative financial instruments

which are marked-to-market and recorded in the balance sheet were

as follows:

At At At

30 September 30 September 31 March

2018 2017 2018

GBP000 GBP000 GBP000

Assets/(liabilities)

Foreign exchange contracts 12 (33) 167

============= ============= =========

14) Net cash flow from operating activities

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2018 2017 2018

GBP000 GBP000 GBP000

Operating profit from continuing

operations 13,217 11,643 22,415

Adjustments:

Depreciation of property,

plant and equipment 1,864 1,772 3,656

Gain on disposal of other

property, plant

and equipment (88) (664) (590)

Amortisation of intangible

assets 69 1,402 1,471

Movements in pension scheme

liabilities (443) (307) (560)

Share of results of JVs and

associates (738) (283) (882)

Share-based payments 35 526 1,168

Operating cash flows before

movements in working capital 13,916 14,089 26,678

Decrease/(increase) in inventories 1,524 1,382 (1,896)

(Increase)/decrease in receivables (8,151) 13,927 10,064

Decrease in payables (3,075) (15,884) (11,897)

Cash generated from operations 4,214 13,514 22,949

Tax paid (1,016) (2,100) (3,910)

-------------- -------------- ---------------------

Net cash flow from operating

activities 3,198 11,414 19,039

============== ============== =====================

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with a maturity of

three months or less.

15) Related party transactions

There have been no changes in the nature of related party

transactions as described in note 29 on page 162 of the annual

report for year ended 31 March 2018 and there have been no new

related party transactions which have had a material effect on the

financial position or performance of the Group in the six months

ended 30 September 2018.

During the period, the Group provided services in the ordinary

course of business to its Indian joint venture, JSW Severfield

Structures ('JSSL') and in the ordinary course of business

contracted with and purchased services from its UK joint venture,

Composite Metal Flooring Limited ('CMF'). The Group's share of the

retained profit in JVs and associates of GBP738,000 for the period

reflects a profit from JSSL of GBP431,000 and from CMF of

GBP307,000.

In May 2017, the board approved an additional equity investment

of GBP5,330,000 in JSSL, to support repayment of the joint

venture's remaining term debt. This decision was made with the

agreement of our joint venture partner, JSW, who also contributed a

similar investment.

16) Contingent liabilities

Liabilities have been recorded for the directors' best estimate

of uncertain contract positions, known legal claims, investigations

and legal actions in progress. The Group takes legal advice as to

the likelihood of success of claims and actions and no liability is

recorded where the directors consider, based on that advice, that

the action is unlikely to succeed, or that the Group cannot make a

sufficiently reliable estimate of the potential obligation. The

Group also has contingent liabilities in respect of other issues

that may have occurred, but where no claim has been made and it is

not possible to reliably estimate the potential obligation. These

potential liabilities are subject to uncertain future events, may

extend over several years and their timing may differ from current

assumptions. Management applies its judgement in determining

whether or not a liability on the balance sheet should be

recognised or a contingent liability should be disclosed.

The Company and its subsidiaries have provided unlimited

multilateral guarantees to secure any bank overdrafts and loans of

all other Group companies. At 30 September 2018 this amounted to

GBPnil (2017: GBPnil). The Group has also given performance bonds

in the normal course of trade.

17) Cautionary statement

The Interim Management Report ('IMR') has been prepared solely

to provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

The IMR contains certain forward-looking statements. These

statements are made by the directors in good faith based on the

information available to them up to the time of their approval of

this report but such statements should be treated with caution due

to the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

18) Statement of directors' responsibilities

The directors confirm that, to the best of their knowledge, the

condensed consolidated interim financial information has been

prepared in accordance with IAS 34 as adopted by the European

Union, and that the interim report includes a fair review of the

information required by DTR 4.2.7R and DTR 4.2.8R, namely:

-- An indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed consolidated interim financial information, and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

-- Material related party transactions that have occurred in the

first six months of the financial year and any material changes in

the related party transactions described in the last annual report

and financial statements.

The current directors of Severfield plc are listed in the annual

report for the year ended 31 March 2018. During the six months

ended 30 September 2018, Chris Holt resigned as a non-executive

director and stood down at the conclusion of the AGM on 4 September

2018. Except for this, there have been no changes in directors

during the period.

The maintenance and integrity of the Severfield plc website is

the responsibility of the directors; the work carried out by the

auditors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred to the financial statements since they were

initially presented on the website.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

By order of the board

Alan Dunsmore Adam Semple

Chief Executive Group Finance

Officer Director

27 November 2018 27 November 2018

Independent review report to Severfield plc

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2018 which comprises the consolidated

income statement, the consolidated statement of comprehensive

income, the consolidated balance sheet, the consolidated statement

of changes in equity, the consolidated cash flow statement and the

related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2018 is not prepared, in all material respects, in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU and the Disclosure Guidance and Transparency Rules ("the

DTR") of the UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards as adopted by the EU. The directors are

responsible for preparing the condensed set of financial statements

included in the half-yearly financial report in accordance with IAS

34 as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

David Morritt

for and on behalf of KPMG LLP

Chartered Accountants

One Sovereign Square

Sovereign Street

Leeds

LS1 4DA

27 November 2018

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FESFWMFASELF

(END) Dow Jones Newswires

November 27, 2018 02:00 ET (07:00 GMT)

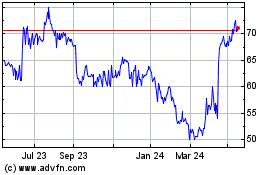

Severfield (LSE:SFR)

Historical Stock Chart

From Mar 2024 to Apr 2024

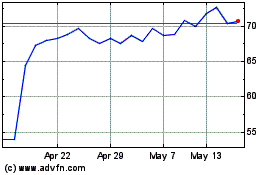

Severfield (LSE:SFR)

Historical Stock Chart

From Apr 2023 to Apr 2024