TIDMSDI

RNS Number : 9813H

SDI Group PLC

09 December 2020

SDI Group plc

("SDI", "SDI Group", the "Company", or the "Group")

Interim results for the six months ended 31 October 2020

SDI Group plc, the AIM quoted Group focused on the design and

manufacture of scientific and technology products for use in

digital imaging and sensing and control applications, is pleased to

announce another strong set of results and solid operational

progress for the six months to end October 2020.

Financial Highlights

-- Revenue increased 23% to GBP14.13m (2019: GBP11.45m) including 7.7% organic growth

o Strong contribution from products designed into equipment used

in testing for and treating COVID-19, offset by impact of the

pandemic on the broader economy

-- Adjusted operating profit* for the period increased 52% to GBP3.20m (2019: GBP2.10m)

o Reported operating profit increased 56% to GBP2.53m (2019:

GBP1.62m)

-- Adjusted profit before tax* increased 52% to GBP3.03m (2019: GBP2.00m)

o Reported profit before tax increased 56% to GBP2.37m (2019:

GBP1.52m)

-- Adjusted diluted EPS* increased 45% to 2.47p (2019: 1.70p)

o Reported diluted EPS increased 48% to 1.95p (2019: 1.32p)

-- Cash generated from operations increased 130% to GBP4.72m (2019: GBP2.05m)

-- Net debt** at 31 October 2020 is GBP0.34m (30 April 2020: net debt of GBP4.04m)

* before reorganisation costs, acquisition costs, amortisation

of acquired intangibles and share based payment costs

** bank finance less cash and cash equivalents

Operational Highlights

-- While maintaining safe working conditions, the Group has

adapted to changing patterns of demand and has dramatically

increased capacity and output in areas where its products could

contribute to the global response to the COVID-19 pandemic

-- Post period end, acquisition of Monmouth Scientific Limited

Ken Ford, Chairman of SDI Group, said:

"We are pleased to report another strong set of financial

results. I would like to thank all our staff for their hard work

and ability to rapidly adapt to changing working environments. Our

business model has shown resilience in the period and despite the

ongoing uncertainties, the Board remains confident that SDI will

deliver a full year financial performance in line with market

expectations."

Enquiries

SDI Group plc 01223 320480

Ken Ford, Chairman

Mike Creedon, CEO

Jon Abell, CFO

www.thesdigroup.net

finnCap Ltd 020 7220 0500

Ed Frisby/Kate Bannatyne - Corporate Finance

Andrew Burdis/Sunila de Silva - ECM

JW Communications 07818 430877

Julia Wilson - Investor & Public Relations

About SDI Group plc:

SDI designs and manufactures scientific and technology products

for use in digital imaging and sensing and control applications

including life sciences, healthcare, astronomy, manufacturing,

precision optics and art conservation. SDI operates through its

company divisions: Atik Cameras, Synoptics, Graticules Optics,

Sentek, Astles Control Systems, Applied Thermal Control, MPB

Industries, Chell Instruments and Monmouth Scientific.

SDI continues to grow by developing its own technology

advancements and by improving its global sales channels, as well as

through pursuing strategic, complementary acquisitions.

www.thesdigroup.net

Chairman's statement

Despite the coronavirus pandemic, for the six month period ended

October 2020, the SDI Group plc is pleased to report revenues,

adjusted profit before tax and profits before tax, all

significantly higher than the equivalent six month period ended 31

October 2019. Although trading conditions remain challenging, the

need for digital imaging and sensing and control products in the

life science and medical industries has been robust and during this

pandemic, some of our companies have been awarded large one-off

contracts to supply equipment to help test for, or treat, COVID-19.

These contracts have ensured that the Group is trading broadly in

line with forecasts set prior to the pandemic.

During the period the Group put in place measures for a safe

working environment for our staff to continue to manufacture

products which are essential in the fight against the COVID-19

pandemic. Changes to our working practices and reorganising our

work force to keep our staff safe allowed us to keep all operation

open throughout the period.

Trading

Across the Group, orders were negatively impacted at the

beginning of the half year, in May 2020, but began to steadily

increase as the global lockdown eased and demand returned. By

September 2020 order intake had returned to near pre-pandemic

expectations with many of our businesses fulfilling order to supply

OEM products for contracts which had previously been put on hold by

our major industrial and life science equipment customers.

Revenues

Group revenues for the period ended October 2020 increased by

23% to GBP14.13m (2019: GBP11.45m) including 7.7% organic

growth.

Sales in our digital imaging reporting segment grew by 23% to

GBP6.94m (2019: GBP5.64m). The increase in turnover has come from a

one-off contract related to the supply of equipment to test for

COVID-19 awarded to Atik and from sales of systems being

manufactured at the Synoptics site. Synoptics has posted good

revenues with its Synbiosis division having a record month for

turnover in October 2020.

The sensing and control reporting segment showed overall

positive turnover growth of 24%, due to the contribution from MPB

of a one-off contract completed during the period to supply 40,000

flowmeters for production of Rapidly Manufactured Ventilator

Systems to treat COVID-19 patients, and to the revenues generated

by Chell Instruments acquired after the October 2019 period

end.

Profits

Group profit before tax increased by 56% to GBP2.37m (2019:

GBP1.52m). The increase in profitability was driven by organic

revenue growth, Chell Instruments (acquired after the period ended

October 2019) and reduced overheads. During the reporting period,

the Group has been actively reducing its overall costs, with the

largest decrease in overheads coming from reduction in salary

costs. At our UK and US-based facilities within the Group where

orders were negatively impacted by the COVID-19 pandemic we

furloughed 19% of our workforce during the period under UK and US

Government job retention schemes. Staff are returning to working at

pre-pandemic levels to fulfil orders which were largely deferred

due to the global lockdown. We continue to monitor our forecasts

against the background of second wave lockdowns and potential

Brexit disruption and any supply-chain issues these could

cause.

In addition to GAAP results, the Group also provides adjusted

results in which certain one-time and non-cash charges are

excluded, to help shareholders understand the underlying operating

performance. Adjusted operating profit increased by 52% to GBP3.20m

(2019: GBP2.10m).

Basic earnings per share increased by 48% from 1.37p to 2.03p;

diluted earnings per share also increased by 48% to 1.95p (2019:

1.32p). Adjusted diluted EPS increased by 45% to 2.47p (2019:

1.70p).

Cash flow

Cash generated from operations increased by 130% to GBP4.72m

(2019: GBP2.05m). Contributing to this was a reduction in average

debtor days in both reporting segments and the Group benefitting

from a substantial increase in advanced payments at Atik Cameras.

These have contributed to a substantial reduction in net debt in

the period. Net bank debt, or bank debt less cash, reduced to

GBP0.34m at 31 October 2020 from GBP4.04m at 30 April 2020.

Operations and COVID-19

Following UK government guidelines around social distancing and

hygiene, SDI has invested during the period to make our

manufacturing facilities COVID-19 safe. We operate manufacturing in

many sites across the UK and in addition have a manufacturing site

in Portugal. We have been able to put protocols in place to keep

each facility operational while minimizing risk to our employees.

Production staff are now back working full-time in our

manufacturing facilities, indeed, many did not stop during lockdown

and our sales and administration teams currently operate a shift

system, with time working from home and in the office. To date,

these measures, alongside our staff's diligence and hard work, has

meant we have been minimally impacted by COVID-19 infections among

our employees.

Our planned expansion of the Atik production site in Lisbon,

Portugal was successfully completed in the first quarter of 2020.

Having the site operational with twice the manufacturing capacity

has allowed Atik to safely work on a significant one-off contract

to manufacture cameras for RT-PCR testing equipment (DNA

amplification) to detect the virus which causes COVID-19. Atik

expects to complete delivery of the order by February 2021. This

date ties in with the timing of Atik's OEM contract with a major

life science equipment supplier resuming to similar levels as

previously experienced..

Acquisitions

On 2 December 2020, after the interim period end, SDI acquired

Monmouth Scientific Limited ("Monmouth Scientific") for an initial

consideration of GBP2.66m in cash and shares in SDI Group plc.

Further payments will be made up to a maximum total consideration

of GBP6.94 million depending on net assets delivered at completion

and on profits made by Monmouth Scientific in the 12 months to 31

March 2021, and these will be funded through our existing cash and

loan facilities. Monmouth Scientific specialises in the design,

manufacture and service of clean air solutions for a variety of

scientific, medical and other technical sectors, protecting the

purity of the air of both the controlled activity and of the

operator. Principal products are bespoke and modular cleanrooms,

biological safety cabinets, fume cupboards and laminar flow

cabinets. For the year ended 31 March 2020 the Company achieved

revenues of GBP6.2m, and profit before tax of GBP0.28m. The

Acquisition is in line with the Group's strategy of acquiring

complementary businesses serving scientific, medical and other

technical sectors with capable management teams in place and with

opportunities to grow further under the SDI Group structure.

Monmouth Scientific will be part of SDI Group's Sensors and Control

reporting segment. The acquisition is in line with our previously

announced strategy of organic and acquisitive growth and is

expected to be immediately earnings enhancing.

The Group continues to look for complementary acquisitions

fitting our criteria, and we would hope to identify at least one

that we can complete in 2021.

Outlook

The SDI Group's diversified portfolio of companies has meant

that we have been protected against the worst of the commercial

downturn caused by the pandemic and some companies in our Group

have secured significant one-off contracts because of it. The Board

would like to thank all our staff for their hard work and ability

to rapidly adapt to changing working environments which have all

contributed to help secure SDI's stability and future growth. Due

to the resilience of our business model to date, and despite the

potential for economic variability, influenced by possible second

or third wave global lockdowns, political conditions (including

Brexit) and currency fluctuations, the Board is confident that SDI

will deliver a full year financial performance in line with market

expectations.

Ken Ford, Chairman

8(th) December 2020

Product Portfolio

Digital Imaging

The digital imaging segment consists of three divisions, Atik

Cameras, Graticules Optics and Synoptics.

Atik Cameras

Atik Cameras offers three brands of camera:

(a) Atik - highly sensitive cameras for life science and

industrial applications, as well as deep-sky astronomy;

(b) Quantum Scientific Imaging (QSI) - high performance cameras

with applications in astronomy, life science and flat panel display

inspection; and

(c) Opus Instruments - infrared reflectography cameras for art

conservation and restoration.

Graticules Optics

Designs and manufactures precision micro pattern products on

glass, film and metal foil.

Synoptics

Offers a range of instruments under four brands:

(a) Syngene - advanced systems for documentation and analysis of

gels for molecular biologists. This brand utilises some of the

range from Atik Cameras;

(b) Synbiosis - equipment for microbiologists to automate colony

counting and zone measurement;

(c) Synoptics Health - ProReveal, to detect residual proteins on

surgical instruments; and

(d) Fistreem - water purification products and vacuum ovens.

Sensors and Control

The sensors and control segment currently encompass six

divisions: Applied Thermal Control and Thermal Exchange, Astles

Control Systems, Chell Instruments, MPB Industries, Sentek and

Monmouth Scientific,

Applied Thermal Control and Thermal Exchange

Applied Thermal Control and Thermal Exchange have been merged

into a single division and manufacture and supply chillers, coolers

and heat exchangers used within industrial, medical and scientific

markets.

Astles Control Systems

Astles is a supplier of chemical dosing and control systems to

manufacturing customers worldwide.

Chell Instruments

Specialises in the design, manufacture and calibration of

pressure, vacuum, and gas flow measurement instruments for a

variety of sectors including aerospace, vehicle aerodynamics, gas

and steam turbine testing and power generation industries.

MPB Industries

Designs and manufactures flowmeters and other equipment for

measuring liquids and gases for industrial and scientific

applications.

Sentek

Sentek manufactures and markets off-the-shelf and custom-made,

reusable and single-use electrochemical sensors for use in

laboratory analysis, food, beverage, pharmaceutical and personal

care manufacturing, as well as the leisure industry.

Monmouth Scientific

Acquired on 2 December 2020. The company designs, manufactures

and services clean air solutions specialising in cleanrooms,

biological safety fume cupboards and laminar flow cabinets

Consolidated income statement

Unaudited for the six months ended 31 October 2020

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2020 2019 2020

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- -------- ------------ -------- ------------ --------- ----------

Revenue 14,126 11,445 24,498

--------- ----------

Costs of sales (4,724) (3,680) (7,899)

------------------------------- -------- ------------ -------- ------------ --------- ----------

Gross Profit 9,402 7,765 16,599

--------- ----------

Other operating income 7 - 19

--------- ----------

Operating expenses (6,874) (6,144) (13,107)

--------- ----------

Analysed as:

--------- ----------

Reorganisation costs (129) (59) (110)

-------- -------- --------- ----------

Share based payments (152) (140) (276)

-------- -------- --------- ----------

Acquisition and fundraising

costs - - (58)

-------- -------- --------- ----------

Amortisation of acquired

intangible assets (379) (282) (647)

-------- -------- --------- ----------

Expected credit loss - - (165)

-------- -------- --------- ----------

Other operating costs (6,214) (5,663) (11,851)

-------- -------- --------- ----------

Operating expenses (6,874) (6,144) (13,107)

------------------------------- -------- ------------ -------- ------------ --------- ----------

Operating profit 2,535 1,621 3,511

--------- ----------

Net financing expense (164) (104) (254)

------------------------------- -------- ------------ -------- ------------ --------- ----------

Profit before taxation 2,371 1,517 3,257

--------- ----------

Income tax charge (393) (189) (666)

------------------------------- -------- ------------ -------- ------------ --------- ----------

Profit for the period 1,978 1,328 2,591

------------------------------- -------- ------------ -------- ------------ --------- ----------

Earnings per share 5

--------- ----------

Basic earnings per

share 2.03p 1.37p 2.66p

--------- ----------

Diluted earnings per

share 1.95p 1.32p 2.56p

------------------------------- -------- ------------ -------- ------------ --------- ----------

Consolidated statement of comprehensive income

Unaudited for the six months ended 31 October 2020

6 months to 6 months to 12 months to

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------- ------------ ------------ -------------

Profit for the period 1,978 1,328 2,591

-------------

Other comprehensive income

-------------

Exchange differences

on translating foreign

operations 48 26 41

----------------------------- ------------ ------------ -------------

Total comprehensive profit

for the period 2,026 1,354 2,632

----------------------------- ------------ ------------ -------------

Consolidated balance sheet

Unaudited at 31 October 2020

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ----------- ----------- ---------

Assets

---------

Non-current assets

---------

Intangible assets 21,110 16,900 21,650

Property, plant and equipment 3,584 3,281 3,901

Deferred tax asset 219 182 246

------------------------------- ----- ----------- ----------- ---------

24,913 20,363 25,797

Current assets

Inventories 4,087 2,785 3,728

Trade and other receivables 4,456 3,425 3,617

Cash and cash equivalents 3,436 2,727 5,290

------------------------------- ----- ----------- ----------- ---------

11,979 8,937 12,635

------------------------------- ----- ----------- ----------- ---------

Total assets 36,892 29,300 38,432

------------------------------- ----- ----------- ----------- ---------

Liabilities

---------

Non-current liabilities

---------

Borrowings 6 2,400 3,300 7,962

---------

Lease liabilities 6 2,211 2,058 2,414

---------

Deferred tax liability 2,037 1,356 2,134

------------------------------- ----- ----------- ----------- ---------

6,648 6,714 12,510

------------------------------- ----- ----------- ----------- ---------

Current liabilities

---------

Trade and other payables 5,412 2,927 3,350

---------

Provisions for warranty 85 16 85

---------

Borrowings 6 1,371 - 1,371

---------

Lease liabilities 6 562 449 539

---------

Current tax payable 510 597 513

------------------------------- ----- ----------- ----------- ---------

7,940 3,989 5,858

---------

Total liabilities 14,588 10,703 18,368

------------------------------- ----- ----------- ----------- ---------

Net assets 22,304 18,597 20,064

------------------------------- ----- ----------- ----------- ---------

Equity

---------

Share capital 978 972 975

Merger reserve 3,030 3,030 3,030

Share premium account 8,805 8,696 8,746

Share-based payment reserve 619 424 467

Foreign exchange reserve 229 166 181

Retained earnings 8,643 5,309 6,665

------------------------------- ----- ----------- ----------- ---------

Total equity 22,304 18,597 20,064

------------------------------- ----- ----------- ----------- ---------

Consolidated statement of cash flows

Unaudited for the six months ended 31 October 2020

6 months to 6 months 12 months

31 October to to

2020 31 October 30 April

Unaudited 2019 2020

GBP'000 Unaudited Audited

GBP'000 GBP'000

---------------------------------------- ------------ ------------ ----------

Operating activities

----------

Profit for the period 1,978 1,328 2,591

Depreciation, amortisation and

impairment 1,096 919 2,020

Finance costs and income 164 104 254

Impairment of intangibles 18 - 22

Changes in provisions - 5 74

Taxation expense in the income

statement 393 189 666

Employee share-based payments 152 140 276

---------------------------------------- ------------ ------------ ----------

Operating cash flow before movement

in working capital 3,801 2,685 5,903

Changes in inventories (400) (201) (539)

Changes in trade and other receivables (745) (94) 726

Changes in trade and other payables 2,059 (339) (921)

---------------------------------------- ------------ ------------ ----------

Cash generated from operations 4,715 2,051 5,169

Interest paid (164) (104) (253)

Income taxes paid (493) (312) (786)

---------------------------------------- ------------ ------------ ----------

Cash generated from operating

activities 4,058 1,635 4,130

Cash flows from investing activities

Capital expenditure on fixed

assets (109) (226) (506)

Sale of property plant and equipment - 3 -

Expenditure on development and

other intangibles (116) (257) (582)

Acquisition of subsidiaries,

net of cash - - (5,182)

Net cash used in investing activities (225) (480) (6,270)

Cash flows from financing activities

Payments of lease liabilities (224) (225) (511)

Foreign exchange movements 107 - -

Proceeds from bank borrowings - - 6,496

Repayment of borrowings (5,562) (700) (1,143)

Issues of shares - - 80

---------------------------------------- ------------ ------------ ----------

Net cash (used in)/from financing

activities (5,679) (925) 4,922

---------------------------------------- ------------ ------------ ----------

Net (decrease)/increase in cash

and cash equivalents (1,846) 230 2,782

Cash and cash equivalents, beginning

of period 5,290 2,494 2,494

Foreign currency movements on

cash balances (8) 3 14

---------------------------------------- ------------ ------------ ----------

Cash and cash equivalents, end

of period 3,436 2,727 5,290

---------------------------------------- ------------ ------------ ----------

Consolidated statement of changes in equity

Unaudited for the six months ended 31 October 2020

6 months to 31 October Own shares Share-based

2020 - unaudited Share Merger Foreign Share held by payment Retained

capital reserve exchange premium EBT reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Balance at 1 May 2020 975 3,030 181 8,746 - 467 6,665 20,064

Shares issued 3 - - 59 - - - 62

Share based payments - - - - - 152 - 152

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Transactions with

owners 3 - - 59 - 152 - 214

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Profit for the period - - - - - - 1,978 1,978

Foreign exchange on

consolidation of

subsidiaries - - 48 - - - - 48

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Total comprehensive

income for the period - - 48 - - - 1,978 2,026

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Balance at 31 October

2020 978 3,030 229 8,805 - 619 8,643 22,304

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

6 months to 31 October Own shares Share-based

2019 - unaudited Share Merger Foreign Share held by payment Retained

capital reserve exchange premium EBT reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Balance at 1 May 2019 972 3,030 140 8,696 (17) 284 3,981 17,086

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Share based payments - - - - - 140 - 140

Release of shares

on option exercise - - - - 17 - - 17

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Transactions with

owners - - - - 17 140 - 157

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Profit for the period - - - - - - 1,328 1,328

Foreign exchange on

consolidation of

subsidiaries - - 26 - - - - 26

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Total comprehensive

income for the period - - 26 - - - 1,328 1,354

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Balance at 31 October

2019 972 3,030 166 8,696 - 424 5,309 18,597

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

12 months to 30 April Own shares Share-based

2020 - audited Share Merger Foreign Share held by payment Retained

capital reserve exchange premium EBT reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Balance at 30 April

2019 972 3,030 140 8,696 (17) 284 3,981 17,086

Restatement for IFRS16 - - - - - - - -

("Leases")

Adjusted balances

at 30 April 2019 972 3,030 140 8,696 (17) 284 3,981 17,086

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Shares issued 3 - - 50 17 - - 70

Share-based payments

transfer - - - - - (93) 93 -

Share based payments - - - - - 276 - 276

Transactions with

owners 3 - - 50 17 183 93 346

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Profit for the year - - - - - - 2,591 2,591

---------

Foreign exchange on

consolidation of

subsidiaries - - 41 - - - - 41

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Total comprehensive

income - - 41 - - - 2,591 2,632

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Balance at 30 April

2020 975 3,030 181 8,746 - 467 6,665 20,064

----------------------- --------- --------- ---------- --------- ----------- ------------ ---------- ---------

Notes to the interim financial statements

1. General information and basis of preparation

SDI Group plc (formerly known as Scientific Digital Imaging plc

(the "Company")), a public limited company, is the Group's ultimate

parent. It is registered in England and Wales. The consolidated

interim financial statements of the Company for the period ended 31

October 2020 comprise the Company and its subsidiaries (together

referred to as the "Group").

The unaudited consolidated interim financial statements are for

the six months ended 31 October 2020. These interim financial

statements have been prepared using the recognition and measurement

principles of International Accounting Standards, International

Financial Reporting Standards and Interpretations adopted for use

in the European Union (collectively EU IFRS). The consolidated

interim financial information has been prepared under the

historical cost convention, as modified by the recognition of

certain financial instruments at fair value. The consolidated

interim financial statements are presented in British pounds (GBP),

which is also the functional currency of the ultimate parent

company.

The consolidated interim financial information was approved by

the Board of Directors on 8 December 2020

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The figures for the year ended 30 April 2020

have been extracted from the statutory financial statements of SDI

Group plc which have been filed with the Registrar of Companies.

The auditor's report on those financial statements was unqualified

and did not contain a statement under section 498(2) or 498(3) of

the Companies Act 2006. The financial information for the six

months ended 31 October 2020 and for the six months ended 31

October 2019 has not been audited.

2. Principal accounting policies

The principal accounting policies adopted in the preparation of

the condensed consolidated interim information are consistent with

those followed in the preparation of the Group's financial

statements for the year ended 30 April 2020.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

interim financial statements.

3. Alternative Performance Measures

The Group uses Adjusted Operating Profit, Adjusted Profit Before

Tax, Adjusted EPS and Net Operating Assets as supplemental measures

of the Group's profitability and investment in business-related

assets, in addition to measures defined under IFRS. The Group

considers these useful due to the exclusion of specific items that

are considered to hinder comparison of underlying profitability and

investments of the Group's segments and businesses, and is aware

that shareholders use these measures to evaluate performance over

time. The adjusting items for the alternative measures of profit

are either recurring but non-cash charges (share-based payments and

amortisation of acquired intangible assets) or exceptional items

(reorganisation costs and acquisition and fundraising costs).

The following table is included to define the term Adjusted

Operating Profit:

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ ----------

Operating Profit (as reported) 2,535 1,621 3,511

----------

Adjusting items (all costs):

----------

Non-underlying items

----------

Share based payments 152 140 276

----------

Amortisation of acquired intangible

assets 379 282 647

----------

Exceptional items

----------

Reorganisation costs 129 59 110

----------

Acquisition and fundraising costs - - 58

------------------------------------- ------------ ------------ ----------

Total adjusting items within

Operating Profit 660 481 1,091

----------

Adjusted Operating Profit 3,195 2,102 4,602

------------------------------------- ------------ ------------ ----------

Adjusted Profit Before Tax is defined as follows:

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ------------ ------------ ----------

Profit before tax (as reported) 2,371 1,517 3,257

------------

Adjusting items (as above) 660 481 1,091

------------

Adjusted Profit Before Tax 3,031 1,998 4,348

--------------------------------- ------------ ------------ ----------

3. Alternative Performance Measures (continued)

Adjusted EPS is defined as follows:

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ ------------

Profit for the period (as reported) 1,978 1,328 2,591

------------

Adjusting items (as above) 660 481 1,091

------------

Less: taxation on adjusting

items calculated at the UK

statutory rate (125) (91) (207)

------------ ------------ ------------

Adjusted net profit 2,513 1,718 3,475

------------

Divided by diluted weighted

average number of shares in

issue (Note 5) 101,611,426 100,846,707 101,206,148

------------

Adjusted diluted EPS 2.47p 1.70p 3.43p

------------------------------------- ------------ ------------ ------------

Net Operating Assets is defined as follows:

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ---------

Net assets 22,304 18,597 20,064

---------

Deferred tax asset 219 182 246

---------

Corporation tax asset 79 - 52

---------

Cash and cash equivalents 3,436 2,727 5,290

---------

Borrowings (current and non-current) (6,544) (5,807) (12,286)

---------

Deferred tax liability (2,037) (1,356) (2,134)

---------

Current tax payable (510) (597) (513)

-------------------------------------- ----------- ----------- ---------

Total adjusting items within

Net assets (5,357) (4,851) (9,345)

---------

Net Operating Assets 27,661 23,448 29,409

-------------------------------------- ----------- ----------- ---------

4. Segmental analysis

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

GBP'000

GBP'000 GBP'000

------------------------------------- ------------ ------------ ----------

Revenues

----------

Digital Imaging 6,940 5,639 11,050

----------

Sensors & Control 7,186 5,806 13,448

----------

Other - - -

------------------------------------- ------------ ------------ ----------

Group 14,126 11,445 24,498

----------

Adjusted Operating Profit

----------

Digital Imaging 2,075 1,210 2,382

----------

Sensors & Control 1,569 1,361 3,028

----------

Other (449) (469) (808)

------------------------------------- ------------ ------------ ----------

Group 3,195 2,102 4,602

----------

Amortisation of acquired intangible

assets

----------

Digital Imaging (92) (90) (182)

----------

Sensors & Control (291) (192) (465)

----------

Other - - -

------------------------------------- ------------ ------------ ----------

Group (383) (282) (647)

------------------------------------- ------------ ------------ ----------

A reconciliation of Adjusted Operating Profit to Operating

Profit for the Group is provided in Note 3.

Analysis of amortisation of acquired intangible assets has been

included separately as the Group considers it to be an important

component of profit which is directly attributable to the reported

segments.

The Other category includes costs which cannot be allocated to

the other segments, and consists principally of Group HQ costs.

4. Segmental analysis (continued)

31 October 31 October 30 April

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ----------- ----------- ---------

Operating assets excluding acquired

intangible assets

---------

Digital Imaging 6,942 6,508 6,281

---------

Sensors & Control 5,825 4,110 5,993

---------

Other 331 53 120

------------------------------------- ----------- ----------- ---------

Group 13,098 10,671 12,394

---------

Acquired intangible assets

---------

Digital Imaging 5,282 5,461 5,370

---------

Sensors & Control 14,777 10,260 15,068

---------

Other - - -

------------------------------------- ----------- ----------- ---------

Group 20,059 15,721 20,438

---------

Liabilities

---------

Digital Imaging (3,051) (1,185) (1,190)

---------

Sensors & Control (2,200) (1,514) (2,087)

---------

Other (245) (245) (158)

------------------------------------- ----------- ----------- ---------

Group (5,496) (2,944) (3,435)

---------

Net Operating Assets

---------

Digital Imaging 9,173 10,784 10,550

---------

Sensors & Control 18,402 12,856 19,042

---------

Other 86 (192) (183)

------------------------------------- ----------- ----------- ---------

Group 27,661 23,448 29,409

------------------------------------- ----------- ----------- ---------

A reconciliation of Net Operating Assets to net assets for the

Group is provided in Note 3.

5. Earnings per share

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of SDI Group plc divided

by the weighted average number of shares in issue during the

period. All profit per share calculations relate to continuing

operations of the Group.

Profit

attributable Weighted Earnings

to average per share

shareholders number of amount in

GBP'000 shares pence

----------------------------- -------------- ------------ -----------

Basic earnings per share:

-----------

Period ended 31 October

2020 1,978 97,582,755 2.03

-----------

Period ended 31 October

2019 1,328 97,203,951 1.37

-----------

Year ended 30 April 2020 2,591 97,277,721 2.66

-----------

Dilutive effect of share

options :

-----------

Period ended 31 October

2020 4,028,671

-----------

Period ended 31 October

2019 3,642,756

-----------

Year ended 30 April 2020 3,928,426

-----------

Diluted earnings per share:

-----------

Period ended 31 October

2020 1,978 101,611,426 1.95

-----------

Period ended 31 October

2019 1,328 100,846,707 1.32

-----------

Year ended 30 April 2020 2,591 101,206,147 2.56

----------------------------- -------------- ------------ -----------

6. Borrowings

31 October 31 October 30 April

2020 2019 2020

GBP'000 GBP'000 GBP'000

-------------------------------- ----------- ----------- ---------

Within one year:

Bank finance 1,371 - 1,371

Lease liabilities 562 449 539

1,933 449 1,910

-------------------------------- ----------- ----------- ---------

After one year and within five

years:

Bank finance 2,400 3,300 7,962

Lease liabilities 1,297 1,103 2,414

-------------------------------- ----------- ----------- ---------

3,697 4,403 10,376

-------------------------------- ----------- ----------- ---------

After more than five years:

-------------------------------- ----------- ----------- ---------

Lease liabilities 914 955 -

-------------------------------- ----------- ----------- ---------

Total borrowings 6,544 5,807 12,286

-------------------------------- ----------- ----------- ---------

Bank finance relates to amounts drawn down under the Group's

bank facility with HSBC Bank plc, which is secured against all

assets of the Group. The facility consists of a revolving facility

of GBP5m and an amortising facility which reduces in quarterly

instalments from GBP4.8m when it was taken out in November 2019 to

zero by April 2023, when the current agreement expires. The

facility has covenants relating to leverage (net debt to EBITDA),

interest coverage, and cashflow to debt service.

7 . Post Balance Sheet Event

On 2 December 2020 the Group completed the acquisition of

Monmouth Scientific Limited ("Monmouth Scientific") for an initial

consideration of GBP2.66m in cash and shares in SDI Group plc plus

further payments up to a maximum total consideration of GBP6.94

million depending on net assets delivered at completion and on

profits made by Monmouth Scientific in the 12 months to 31 March

2021. Monmouth Scientific specialises in providing controlled clean

air environments for scientific, medical and other technical

applications. For the year ended 31 March 2020, Monmouth Scientific

achieved revenue of GBP6.2m and profit before tax of GBP0.28m. The

acquisition is expected to be immediately earnings enhancing.

SDl Group plc

Beacon House

Nuffield Road

Cambridge

CB4 1TF

UK

Telephone: +44 (0)1223 727144

Fax: +44 (0)1223 727101

Email: info@thesdigroup.net

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPGMUPUPUGMR

(END) Dow Jones Newswires

December 09, 2020 02:00 ET (07:00 GMT)

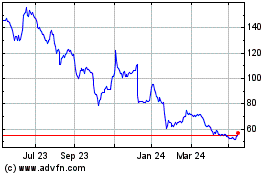

Sdi (LSE:SDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

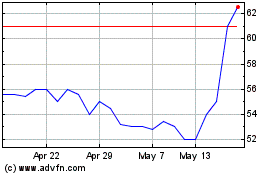

Sdi (LSE:SDI)

Historical Stock Chart

From Jul 2023 to Jul 2024