TIDMROO

RNS Number : 2176A

Deliveroo PLC

19 January 2024

19 January 2024

Q4 2023 Trading Update

Deliveroo plc

Profitability ahead of guidance, GTV growth in-line

-- FY 2023 GTV in-line with guidance and adjusted EBITDA slightly ahead

-- Gross transaction value (GTV) growth of 3% in-line with

guidance of lower single digits percentage growth in constant

currency

-- Adjusted EBITDA expected to be slightly above the GBP60-80 million guidance range

-- Q4 2023 GTV growth remains resilient, with improving trend in orders

-- Q4 GTV up 4% year-on-year (YoY) in constant currency

-- Order growth improved slightly to flat YoY, while food price

inflation moderated, but with GTV per order still up 4% YoY in

constant currency

-- Continued GTV growth in UKI and return to growth in International

-- UKI GTV growth was 7% YoY, with underlying GTV trends

remaining steady; sequentially lower growth (vs Q3) was impacted by

factors including the active management of certain restaurant

partners to build consumer trust through lower mark-ups and

stronger operational performance

-- International GTV returned to growth of 1% YoY in constant

currency, with improving trends in most markets and continued

strength in Italy and UAE

-- Revenue impacted by mix shift in marketing and targeted

investment in the consumer value proposition

-- Group revenue growth of 1% in constant currency lagged GTV

growth; this was due to a mix shift in marketing spend towards

promotional marketing activity (recognised as contra revenue), as

well as some targeted investment in consumer fees, to capitalise on

ongoing signs of stabilisation in consumer behaviour

Management will provide 2024 guidance at Deliveroo's full year

results on 14 March 2024.

Will Shu, Founder and CEO of Deliveroo, said:

"I'm really proud of the team's execution in Q4, including

launching our retail offering. We delivered a good performance in

UKI and saw International return to GTV growth, with encouraging

trends in several markets. As we saw ongoing signs of stabilisation

in consumer behaviour in the quarter, we continued to invest in the

consumer value proposition to lay the foundations for future

growth. We closed out a successful 2023 with GTV in line with

guidance and adjusted EBITDA slightly above the top end of our

guidance range."

Change Change

====================== ======================

Q4 Q4 Reported Constant FY FY Reported Constant

2023 2022 currency currency 2023 2022 currency currency

=============== ====== ====== ========== ========== ====== ====== ========== ==========

Group

GTV (GBPm) 1,858 1,795 4% 4% 7,062 6,848 3% 3%

Orders (m) 75.3 75.1 0% 0% 290.2 299.2 (3)% (3)%

GTV per order

(GBP) 24.7 23.9 3% 4% 24.3 22.9 6% 6%

------------------------ ------ ------ ---------- ---------- ------ ------ ---------- ----------

Revenue (GBPm) 523 521 0% 1% 2,030 1,975 3% 2%

======================== ====== ====== ========== ========== ====== ====== ========== ==========

UK & Ireland

(UKI)

GTV (GBPm) 1,097 1,030 7% 7% 4,181 3,888 8% 7%

Orders (m) 40.9 40.6 1% 1% 159.2 158.4 1% 1%

GTV per order

(GBP) 26.8 25.4 6% 6% 26.3 24.5 7% 7%

------------------------ ------ ------ ---------- ---------- ------ ------ ---------- ----------

Revenue (GBPm) 310 298 4% 4% 1,209 1,119 8% 8%

======================== ====== ====== ========== ========== ====== ====== ========== ==========

International

GTV (GBPm) 761 765 (1)% 1% 2,881 2,960 (3)% (3)%

Orders (m) 34.4 34.5 0% 0% 131.0 140.8 (7)% (7)%

GTV per order

(GBP) 22.1 22.2 0% 1% 22.0 21.0 5% 4%

------------------------ ------ ------ ---------- ---------- ------ ------ ---------- ----------

Revenue (GBPm) 213 223 (4)% (2)% 821 855 (4)% (5)%

======================== ====== ====== ========== ========== ====== ====== ========== ==========

Appendix:

Average monthly active consumers and monthly order frequency

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2023

2022 2022 2022 2022 2023 2023 2023

===================== ======= ======= ======= ======= ======= ======= ======= ======

UK & Ireland (m) 4.1 4.0 3.9 4.1 4.0 4.0 3.9 4.0

International (m) 3.5 3.4 3.1 3.3 3.1 3.1 3.0 3.3

Average monthly

active consumers

(m) 7.6 7.4 7.0 7.4 7.1 7.1 6.9 7.3

===================== ======= ======= ======= ======= ======= ======= ======= ======

Year-on-year growth

in MACs 15% 5% 4% (1)% (7)% (4)% (2)% (2)%

===================== ======= ======= ======= ======= ======= ======= ======= ======

Average monthly

order frequency 3.4 3.4 3.3 3.4 3.4 3.4 3.4 3.4

===================== ======= ======= ======= ======= ======= ======= ======= ======

Analyst and investor call

A conference call and webcast with Q&A for analysts and

investors will be held today at 09:00 GMT / 10:00 CET.

Conference call:

https://secure.emincote.com/client/deliveroo/q4-2023/vip_connect

Webcast:

https://secure.emincote.com/client/deliveroo/q4-2023

The webcast will also be available to view at

https://corporate.deliveroo.co.uk/ . A replay will be made

available later.

Contact information

Investor Relations

David Hancock, VP Finance, Strategy & IR -

investors@deliveroo.co.uk

Tim Warrington, Investor Relations Director

Rohan Chitale, Investor Relations Director

Media Relations

Joe Carberry, VP Policy & Communications -

joe.carberry@deliveroo.co.uk

Teneo, James Macey White, Jessica Reid - deliveroo@teneo.com

About Deliveroo plc ('Deliveroo' or 'the Company')

Deliveroo is an award-winning delivery service founded in 2013

by William Shu and Greg Orlowski. Deliveroo works with

approximately 183,000 best-loved restaurants and grocery partners,

as well as around 135,000 riders to provide the best food delivery

experience in the world. Deliveroo is headquartered in London, with

offices around the globe. Deliveroo operates across 10 markets,

including Belgium, France, Hong Kong, Italy, Ireland, Kuwait,

Qatar, Singapore, United Arab Emirates and the United Kingdom.

Further information regarding Deliveroo is available on the

Company's website at https://corporate.deliveroo.co.uk/ .

Additional Notes

1. All figures in this trading update are unaudited.

2. All growth rates reflect a comparison to the three-month

period ended 31 December 2022 unless otherwise stated.

3. References to "Q4" are to the three-month period ended 31

December 2023 and to "Q3" are to the three-month period ended 30

September 2023 unless otherwise stated. References to the "year",

"financial year" or "2023 financial year" are to the financial year

ending 31 December 2023 and references to the "last year", "last

financial year" or "2022 financial year" are to the financial year

ended 31 December 2022 unless otherwise stated.

4. All 2022 figures exclude results from Australia and the

Netherlands, where operations were discontinued in November

2022.

This announcement may include forward-looking statements, which

are based on current expectations and projections about future

events. These statements may include, without limitation, any

statements preceded by, followed by or including words such as

"target", "believe", "expect", "aim", "intend", "may",

"anticipate", "estimate", "plan", "project", "will", "can have",

"likely", "should", "would", "could" and any other words and terms

of similar meaning or the negative thereof. These forward-looking

statements are subject to risks, uncertainties and assumptions

about the Company and its subsidiaries and its investments,

including, among other things, the development of its business,

trends in its operating environment, and future capital

expenditures and acquisitions. The forward-looking statements in

this announcement speak only as at the date of this announcement.

These statements reflect the beliefs of the Directors, (including

based on their expectations arising from pursuit of the Group's

strategy) as well as assumptions made by the Directors and

information currently available to the Company. Further, certain

forward-looking statements are based upon assumptions of future

events which may not prove to be accurate and none of the Company

nor any member of the Group, nor any of such person's affiliates or

their respective directors, officers, employees, agents and/or

advisors, nor any other person(s) accepts any responsibility for

the accuracy or

fairness of the opinions expressed in this announcement or the

underlying assumptions. Actual events or conditions are unlikely to

be consistent with, and may differ significantly from, those

assumed. In light of these risks, uncertainties and assumptions,

the events in the forward-looking statements may not occur. No

representation or warranty is made that any forward-looking

statement will come to pass. No one undertakes to update,

supplement, amend or revise any forward-looking statements. You are

therefore cautioned not to place any undue reliance on

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKVLFFZFLXBBE

(END) Dow Jones Newswires

January 19, 2024 02:00 ET (07:00 GMT)

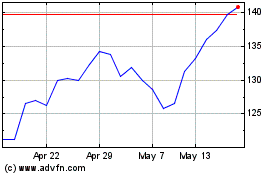

Deliveroo (LSE:ROO)

Historical Stock Chart

From Apr 2024 to May 2024

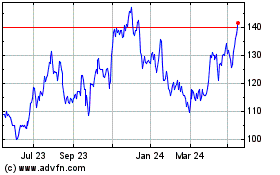

Deliveroo (LSE:ROO)

Historical Stock Chart

From May 2023 to May 2024