TIDMRGL

RNS Number : 3977H

Regional REIT Limited

15 November 2018

15 November 2018

REGIONAL REIT Limited

Q3 2018 Trading Update, Outlook Statement and Dividend

Announcement

Regional REIT Limited (LSE: RGL) ("Regional REIT", "the Group"

or "the Company"), the UK regional office and industrial property

focused REIT, today announces its trading update for the period

from 1 July to 14 November 2018, and its dividend declaration for

the third quarter of 2018.

Stephen Inglis, Chief Executive Officer of London & Scottish

Investments Limited, commented: "We are extremely pleased with the

REIT's continued progress in 2018. Having undertaken the majority

of our trading in the first three quarters, we benefitted from

substantial gains over valuation.

As we recycle the remaining sale proceeds, we are able to take

advantage of an investment market that has slightly softened ahead

of the outcome of the Brexit negotiations, creating a buyer's

market. Contrastingly we continue to see little change in

occupational demand for our assets and we are undertaking a number

of lettings across the country at good rental levels.

These developments once again demonstrate our strategy of

refreshing the portfolio to ensure robust and diverse income

streams, with which to pay and enhance dividend returns to

investors.

Q3 2018 Trading Update

The Group has continued to pursue its strategy of providing

investors with an attractive return on a sustained and consistent

basis from investing and asset managing, in predominantly, offices

and light industrial property in the main regional centres of the

UK outside of the M25 motorway.

From 1 January 2018 to date, the Group has exchanged on 54

leases to new tenants, including 21 since 30 June 2018, totalling

195,005 sq. ft. When fully occupied these will provide

approximately GBP2.4m pa of headline rental income. In addition,

the Group has completed a number of lease re-gearings in the

quarter. The acquisition of replacement tenants and existing

tenants, who continue to hold over in the properties for which the

leases have come up for renewal, has resulted in c. 84% of headline

rent being retained and c. 89% of the units with lease renewals

remaining occupied.

Capital expenditure to 30 September 2018 was GBP5.7m gross

(GBP5.4m net of recoveries and dilapidations), consistent with our

targeted asset quality enhancement strategy.

Portfolio as at 30 September 2018:

-- 153 properties, 1,246 units and 915 tenants, amounting to c.

GBP723.2m of gross property assets; with a contracted rent roll of

c. GBP59.4m pa.

-- Offices (by value) were 75.0% of the portfolio (31 December

2017: 67.3%), industrial sites 16.2% (31 December 2017: 23.3%),

retail 7.4% (31 December 2017 8.1%), and Other 1.4% (31 December

2017:1.3%); England & Wales represented 82.4% (31 December

2017: 77.6%) of the portfolio with the remainder in Scotland.

-- Occupancy (by value) increased to 85.8%, versus 85.5% at 30

June 2018; 30 September 2018 like-for-like (versus 30 September

2017) occupancy fell slightly to 83.7% (84.3%).

-- Average lot size c. GBP4.7m (31 December 2017: GBP4.5m).

-- Net loan-to-value ratio c. 37.1% (31 December 2017: 45.0%).

Gross borrowings GBP360.3m; cash and cash equivalent balances

GBP92.0m. Cost of debt (including hedging) of 3.9% pa (31 December

2017: 3.7% pa), and 3.4% excluding the ZDP shares (31 December

2017: 3.5%). The ZDP shares are scheduled for repayment on the 9

January 2019.

Summary of activity in the quarter to 30 September 2018:

The Group undertook several asset management projects,

generating new lettings and maintaining and improving income

through lease renewals and re-gears:

-- 800 Aztec West, Bristol - following the completion of a

comprehensive refurbishment of all floors, the first floor was let

to Edvance SAS (31,549 sq. ft.) for 10 years with an option to

break in 2020 for 16,709 sq. ft. of the space, and an option to

break in 2024 for the remaining 14,840 sq. ft. The combined annual

rent is GBP678,304 (c. GBP22psf). We are seeing an encouraging

level of tenant enquiries for the outstanding 41,743 sq. ft. of

vacant space.

-- Century Way, Thorpe Park, Leeds - following the expiry of the

lease to W S Atkins (Services) Ltd, the first floor (10,748 sq.

ft.) was let to Sodexo Ltd for 5 years, with an option to break on

the third anniversary. The company also took an additional 47 car

parking spaces, resulting in a combined headline rental income of

GBP227,996pa. The rent of c. GBP17psf is a 5.9% increase on the

previous level achieved.

-- Miller Court, Tewkesbury - a new 10-year lease was agreed

with Weird Fish Ltd with a 5-year break at a headline rent of

GBP140,980pa for 10,070 sq. ft. (c. GBP14psf). The lease provides a

5-month rent free period from the start date of the lease.

-- Manor Road, Erith - letting of 9,730 sq. ft of space to

Aquaflow Drainage Services Ltd on a 10-year lease commencing

September 2018, subject to a break option at the fifth anniversary

and no rent free at a headline rent of GBP65,000pa. (c.

GBP7psf).

-- Vantage Point, Edinburgh - regear of leases to Adobe Systems

Europe Ltd for first and second floor totalling 21,741 sq. ft. The

leases provide a combined rental income of GBP347,147pa, (averaging

c. GBP16psf) with varying lease terms. The lease for the first

floor (8,413 sq. ft.) is for a 5-year term, subject to a break

option in 2019. The lease for 13,328 sq. ft. of space on the second

floor is let on a 10-year lease with the option to break at the

fifth anniversary.

-- Delta 1200, Delta Business Park, Swindon - regear of existing

lease to CMS Supatrak Ltd complete for 4,919 sq. ft. for a further

5-year term, subject to a break option on the first anniversary,

achieving a 19.2% uplift in the headline rent to GBP76,245pa (c.

GBP15psf).

Acquisitions

On 17 August 2018, Regional REIT completed the acquisition of a

portfolio of eight assets for a consideration of GBP31.4m. The

portfolio consists of offices in eight locations: Hull, High

Wycombe, Stockton-on-Tees, Ipswich, Clevedon, Wakefield, Deeside

and Lincoln. The assets total circa 275,000 sq. ft., let to 24

tenants. The assets are expected to provide a headline rental

income of approximately GBP2.81m pa, which equates to a net initial

yield of 8.66%.

Sales

-- The Point, Glasgow - following completion of asset management

initiatives, the Group completed the sale of the property for

GBP14.1m in July (30 June 2018 valuation GBP14.1m), benefitting

from a strong investment market at a premium to December 2017

valuation of 5.6%.

-- Arena Point, Leeds - disposal of development site to Unite

Students for GBP12.2m (30 June 2018 valuation: GBP3.9m) following

successful planning application. Regional REIT retains the adjacent

19 storey Arena Point office building valued at GBP8.6m 30 June

2018.

-- Wardpark Industrial Estate, Cumbernauld - sold in August 2018

for GBP26.4m. (30 June 2018 valuation: GBP24.5m). The sale price

was 21.1% above the December 2017 year end valuation.

-- Birchwood Park, Warrington - sold in August 2018 for GBP6.1m

(30 June 2018 valuation: GBP6.1m).

-- Imperial Business Park, Gravesend - sold in August 2018 for

GBP3.1m (30 June 2018 valuation: GBP3.1m), as part of the Bluebell

portfolio.

-- Turnford Place, Cheshunt - sold in September 2018 for

GBP17.25m (30 June 2018 valuation: GBP16.3m) reflects a net initial

yield of 5.8%. The 59,176 sq. ft. modern office block site was

originally acquired by Regional REIT on 27 December 2017 as part of

the Newton Portfolio. At that time, the office development was

valued at GBP14.3m. The sale price marks an uplift of 20.6% against

the 31 December 2017 valuation and a 6.2% uplift over 30 June 2018

valuation.

Sales from 30 September 2018 to date:

-- Thames Industrial Estate, Manchester - sold in October 2018 for GBP0.6m

-- Grecian Crescent, Bolton - sold in October 2018 for GBP1.2m

-- Maybrook Industrial Estate, Walsall - sold in November for GBP7.7m

Outlook

The outlook for the Group remains positive. We continue to

reinvest the proceeds from the disposals earlier in the year and

expect this to be concluded in the coming months. As announced in

September 2018, the Group has repaid GBP50m of the GBP65m 5% ICG

Longbow Ltd. loan facility, and remains on course to settle the

balance by the end of November 2018 using disposals proceeds or

through a refinancing. This is expected to result in a reduced

Group weighted average cost of debt and an increased weighted

average debt term.

Although the wider operating environment is uncertain, our

confidence is underpinned by our deliberately diversified regional,

tenant and sector portfolio, coupled with our financial position.

These strengths will allow us to adjust quickly to evolving

conditions and continue to deliver good returns for

shareholders.

Q3 2018 Dividend Declaration

The Company will pay a dividend of 1.85 pence per share ("pps")

for the period 1 July 2018 to 30 September 2018, an increase of c.

3% (1 July 2017 to 30 September 2017: 1.80pps). The dividend

payment will be made on 21 December 2018 to shareholders on the

register as at 23 November 2018. The ex-dividend date will be 22

November 2018.

The payment of dividends will remain subject to market

conditions, the Company's performance, its financial position and

the business outlook.

Forthcoming Events

21 February 2019 Q4 2018 Dividend and Portfolio Valuation

28 March 2019 Full year 2018 Preliminary Results Announcement

23 May 2019 May 2019 Trading Update and Outlook Announcement

Q1 2019 Dividend Declaration Announcement

Annual General Meeting

Note: All dates are provisional and subject to change

-S -

Enquiries:

Regional REIT Limited

Press enquiries through Headland

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Investments Tel: +44 (0) 141

248 4155

Asset Manager to the Group

Stephen Inglis

Headland PR Consultancy LLP Tel: +44 (0) 20 3805

4822

Financial PR

Francesca Tuckett / Jack Gault

About Regional REIT

Regional REIT Limited (LSE: RGL) is a London Stock Exchange Main

Market traded specialist real estate investment trust focused on

office and industrial property interests in the principal regional

locations of the United Kingdom outside of the M25 motorway.

Regional REIT is managed by London & Scottish Investments,

the Asset Manager, and Toscafund Asset Management, the Investment

Manager, and was formed by the combination of two existing funds

previously created by the Managers as a differentiated play on the

expected recovery in UK regional property, to deliver an attractive

total return to Shareholders and with a strong focus on income.

The Group's investment portfolio, as at 30 June 2018, was spread

across 151 regional properties, 1,294 units and 950 tenants. As at

30 June 2018, the investment portfolio had a value of GBP758.7m and

a net initial yield of 6.4%. The weighted average unexpired lease

term to first break was 3.5 years.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward-looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFFUFWLFASEFF

(END) Dow Jones Newswires

November 15, 2018 02:00 ET (07:00 GMT)

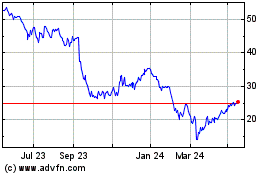

Regional Reit (LSE:RGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

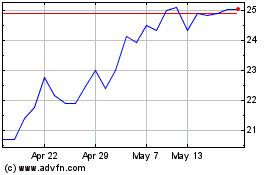

Regional Reit (LSE:RGL)

Historical Stock Chart

From Apr 2023 to Apr 2024