Regional REIT Limited Acquisition and portfolio update (4371O)

February 09 2016 - 2:00AM

UK Regulatory

TIDMRGL

RNS Number : 4371O

Regional REIT Limited

09 February 2016

9 February 2016

Regional REIT Limited

Acquisition of GBP80 million of commercial property assets and

portfolio update

Regional REIT Limited (LSE: RGL) ("Regional REIT" or the

"Company"), the recently listed regional commercial property

company, today announces that it has exchanged contracts to buy the

Rainbow Portfolio for GBP80m from Northwood Investors.

The portfolio produces a net yield of 8.2% at a capital rate of

only GBP70 per sq.ft., well below replacement cost.

The portfolio comprises 12 assets, five offices and seven

industrial sites totalling 1.15m sq.ft. and geographically spread

throughout the UK in major regional urban areas including Bristol,

Manchester, Cardiff, Sheffield and the West Midlands. Tenants

include Clerical Medical, Equitable Life, Invensys, Vanguard

Logistics, Schenker, Veolia and FMC Technologies.

Approximately 45% of the income is derived from the industrial

assets with offices accounting for the remaining 55%. 86% of the

income is from assets in England (North East 17%, South West 14%,

South East 49%), 8% in Scotland and 6% in Wales.

This acquisition further bolsters Regional REIT's assets and has

good rental income, will be earnings enhancing and offers strong

capital growth prospects through the implementation of the

Company's intensive asset management initiatives.

The Company also announces a number of sales:

-- Churchill Plaza, Basingstoke sold for GBP12m, the property

having been acquired in August 2014 for GBP7.5m. The sale price

represents a 52% increase on the June 2015 value and a 10% increase

on the December 2015 valuation.

-- Five retail assets sold for a total consideration of GBP4.8m,

marginally ahead of the December 2015 valuation.

-- An office building in Kirkcaldy has also been sold for

GBP0.9m, 50% ahead of the June 2015 valuation and in line with the

December 2015 valuation, and an office building in Glasgow sold

just before the December 2015 valuation for GBP1.5m, in line with

valuation.

These sales are consistent with the Company's policy of selling

where real value has been created and reducing Regional REIT's

risk, specifically to development and retail properties where good

value can be achieved.

Following completion of the transactions announced today the

investment portfolio will amount to approximately GBP511m (31

December 2015: GBP405.4m), and the Company expects its net

loan-to-value ratio to increase to approximately 41%.

Commenting, Stephen Inglis, Chief Investment Officer and

Property Director of the Asset Manager, said:

"The acquisition of the Rainbow portfolio is another step in the

evolution of Regional REIT taking assets to over GBP500m. Since

listing in November 2015 we have acquired GBP120.5m of assets,

offering a good balance of income and asset management

opportunities. We remain acquisitive as we continue to re-balance

the portfolio and re-invest proceeds from the sale of non-core

holdings in quality income and capital enhancing assets to create

further value for our investors."

- ENDS -

Enquiries:

Regional REIT Limited

Press enquiries through Headland

London & Scottish Investments Tel: +44 (0) 141 248 4155

Asset Manager to the Company

Stephen Inglis

Derek McDonald

Toscafund Asset Management Tel: +44 (0) 20 7845 6100

Investment Manager to the Company

Nigel Gliksten

Headland Tel: +44 (0)20 7367 5222

Financial PR

Francesca Tuckett

About Regional REIT

Regional REIT Limited (LSE: RGL) is a London Stock Exchange Main

Market listed specialist real estate investment company focused on

office and industrial property interests in the principal regional

locations of the United Kingdom outside of the Greater London

area.

Regional REIT is managed by London & Scottish Investments

and Toscafund Asset Management, and was formed by the merger of two

existing funds created by the managers to achieve a differentiated

play on recovery in UK regional property to deliver an attractive

total return to shareholders, with a strong focus on income.

The Company's investment portfolio, as at 31 December 2015, is

spread across more than 130 regional properties consisting of

around 720 individual units, with over 500 tenants. As at 31

December 2015, the investment portfolio had a value of GBP405.4m

and an overall income yield of 8.3%. The weighted average unexpired

lease term is just under six years.

The Company's shares were admitted to the Main Market of the

London Stock Exchange on 6 November 2015. For more information,

please visit www.regionalreit.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQEAXAPEAAKEFF

(END) Dow Jones Newswires

February 09, 2016 02:00 ET (07:00 GMT)

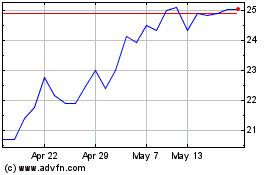

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

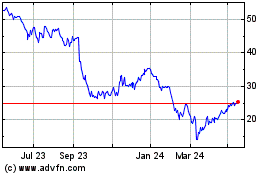

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024