Record PLC Business Update (9740W)

August 25 2015 - 2:05AM

UK Regulatory

TIDMREC

RNS Number : 9740W

Record PLC

25 August 2015

25 August 2015

RECORD PLC

BUSINESS UPDATE

Record plc ("Record" or the "Company"), the specialist currency

manager, announces today that the size of the tactical bespoke

mandate which had increased by $1.75 billion in the first calendar

quarter of 2015, has reduced by approximately $2.8 billion with

immediate effect. This decrease is a consequence of currency market

movements, and the size of this mandate may continue to be

volatile. Fee rates for this mandate are consistent with previously

published average fee rates for return-seeking strategies.

Record will announce its second quarter trading update on 16(th)

October 2015.

For further information, please contact:

Record plc Tel: +44 (0) 1753 852 222

James Wood-Collins, Chief Executive Officer

MHP Tel: +44 (0) 20 3128 8100

Nick Denton

Jack Holden

Jennifer Iveson

Notes to Editors

Record plc

Record is a specialist currency manager and provider of currency

hedging services for institutional clients. Founded in 1983, Record

has established a market leading position as a currency manager.

Specifically, the Group has a leading position in managing Dynamic

Hedging and Currency for Return for institutional clients.

The Group has three principal product lines:

- Dynamic Hedging, formerly known as Active Hedging, where

Record seeks to eliminate the impact of currency movements on

elements of clients' investment portfolios that are denominated in

foreign currencies when these movements are expected to result in

an economic loss to the client, but not to do so when they are

expected to result in an economic gain;

- Passive Hedging, where Record seeks to eliminate fully or

partially the economic impact of currency movements on elements of

clients' investment portfolios that are denominated in foreign

currencies; and

- Currency for Return, formerly known as Absolute Return, in

which Record enters into currency contracts for clients with the

objective of generating positive returns.

Record (LSE: REC) was admitted to trading on the London Stock

Exchange on 3rd December 2007.

This announcement includes information with respect to Record's

financial condition, its results of operations and business,

strategy, plans and objectives. All statements in this document,

other than statements of historical fact, including words such as

"anticipates", "expects", "intends", "plans", "believes", "seeks",

"estimates", "may", "will", "continue", "project" and similar

expressions, are forward-looking statements.

These forward-looking statements are not guarantees of the

Company's future performance and are subject to risks,

uncertainties and assumptions that could cause the actual future

results, performance or achievements of the Company to differ

materially from those expressed in or implied by such

forward-looking statements.

The forward-looking statements contained in this document are

based on numerous assumptions regarding Record's present and future

business and strategy and speak only as at the date of this

announcement.

The Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statements contained in this announcement whether as a result of

new information, future events or otherwise.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEELBLEVFZBBD

(END) Dow Jones Newswires

August 25, 2015 02:05 ET (06:05 GMT)

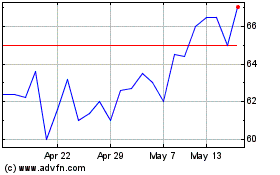

Record (LSE:REC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Record (LSE:REC)

Historical Stock Chart

From Nov 2023 to Nov 2024