TIDMRBN

RNS Number : 1028J

Robinson PLC

19 August 2021

Robinson plc

Half-year Report

Interim Results for the six months ended 30 June 2021

Robinson plc ("Robinson" or the "Group" stock code: RBN), the

custom manufacturer of plastic and paperboard packaging based in

Chesterfield, announces its interim results for the six months

ended 30 June 2021.

Financial highlights

-- Revenue up 19% to GBP21.2m (2020: GBP17.9m)

-- Gross margin decreased to 16.7% from 23.6% in 2020

-- Operating profit before amortisation of intangible assets reduced to GBP0.1m (2020: GBP1.6m)

-- Loss before tax of GBP0.6m (2020: profit of GBP1.1m)

-- Interim dividend of 2.5p per share announced

-- Net debt(1) of GBP13.7m (31/12/2020: GBP6.6m), after net

capital expenditure of GBP2.0m, consideration for the Schela Plast

acquisition of GBP1.4m and net debt acquired of GBP3.5m

Operational highlights

-- Successfully secured resin supply to allow continued operations in a very tight market

-- Acquisition of Schela Plast A/S completed on 10 February,

with integration progressing to plan

-- Recent business wins in the UK and Denmark with major FMCG

brand owners provide confidence for the future

-- "Packaging with purpose" sustainability pledge launched in

February based on five pillars and 15 ambitious commitments

-- Continued progress with the sale of surplus properties

Alan Raleigh, Chairman, commented:

"Resin prices have now stabilised and shown the first signs of a

reduction in July, however, we are not expecting a significant

reduction before the end of the year. We are also experiencing

price inflation in other areas including secondary packaging and

transport which will continue to impact on the second half of the

year.

Across our markets we are seeing a lower-than-normal level of

demand in the third quarter due to the ongoing uncertainty across

FMCG supply networks and a varying pace of recovery following the

pandemic. We are now expecting this to continue for the second

half, so we are accelerating our plans to improve our operations

for additional cost savings and profitability.

We expect full year operating profit before amortisation of

intangible assets to be in the region of GBP2.0m (2020:

GBP2.7m).

We remain committed in the medium term to delivering

above-market profitable growth and our target of 6-8% of adjusted

operating margin (2) ."

Robinson plc www.robinsonpackaging.com

Helene Roberts, CEO Tel: 01246 389280

Mike Cusick, Finance Director

finnCap Limited

Ed Frisby / Seamus Fricker, Corporate Tel: 020 7220 0500

Finance

Tim Redfern / Barney Hayward, ECM

About Robinson:

Being a purpose-led business, Robinson specialises in custom

packaging with technical and value-added solutions for food and

consumer product hygiene, safety, protection, and convenience;

going above and beyond to create a sustainable future for our

people and our planet. Its main activity is in injection and blow

moulded plastic packaging and rigid paperboard luxury packaging,

operating within the food and beverage, homecare, personal care and

beauty, and luxury gift sectors. Robinson provides products and

services to major players in the fast-moving consumer goods market

including McBride, Procter & Gamble, Reckitt Benckiser, SC

Johnson and Unilever.

Headquartered in Chesterfield, UK, Robinson has 3 plants in the

UK, 2 in Poland and recently acquired a plant in Denmark, Schela

Plast. Schela Plast specialises in the design and manufacture of

plastic blow moulded containers, serving a number of the major FMCG

brands in Denmark and neighbouring countries.

Robinson was formerly a family business with its origins dating

back to 1839, currently employing nearly 400 people. The Group also

has a substantial property portfolio with development

potential.

(1) cash less borrowings (excludes IFRS 16 lease

liabilities)

(2) operating profit margin before exceptional items and

amortisation of intangible assets

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

Chairman's Statement

Dear Shareholders

The interim results we report today reflect the very challenging

circumstances we are continuing to experience in 2021 across

materials price inflation, customer demand and the ongoing

uncertainty resulting from the Covid-19 pandemic.

We indicated in March that a lack of resin availability and

consequential sharp increase in prices were likely to create

volatility in 2021. Since 1 January the market price of resins used

in the Group have increased on average by 60% and we have

experienced substantial challenge to secure raw materials in a

market where resin unavailability has caused some competitors to

shut down production lines.

The dedication of the Robinson team in acting decisively to

procure resin supply and, where possible, to agree price increases

with customers has mitigated some of the impact of these extreme

market conditions.

Whilst over the medium-term the Group is protected from resin

price movements through contractual arrangements with most

customers, there is a short-term lag of typically three months

before prices can be changed. Largely as a result of this lag

impact, gross margins were 16.7% (2020: 23.6%) in the first half of

2021.

The pandemic has also created significant operational

challenges. Whilst we have had a small number of positive Covid-19

cases amongst our employees, the controls that we've implemented

have prevented onward transmission and no severe illness has

resulted. This has enabled us to continue to operate the business

safely and to service our customers effectively.

Revenues were 19% higher in the first half of 2021, 3% higher

excluding the Schela Plast business acquired in February. After

adjusting for price changes and foreign exchange, sales volumes in

the underlying(1) business, which have been affected by changes in

consumer behaviour and intermittent lockdowns, are in line with

2020, which included additional demand due to the Covid-19

pandemic.

Operating costs are in line with the second half of 2020, during

which we added resources to partner with key customers and

accelerate our sustainability agenda. Following this investment,

underlying(1) operating costs are 22% higher than the same period

in 2020.

Operating profit before amortisation of intangible assets has

reduced by GBP1.5m versus the same period last year, to GBP0.1m.

The Group made a loss before tax of GBP0.6m (2020: profit before

tax GBP1.1m).

Property

Work has continued on the potential disposals that we announced

had reached heads of agreement in March. We expect completion in

the second half of 2021, for a gross value of GBP3.4m for two plots

of land with a book value of less than GBP1m.

Subject to the necessary planning approvals, we would expect

further sales to be achieved in the latter part of 2021 or early

2022. The intention of the Group remains, over time, to realise the

maximum value from the disposal of surplus properties and to

reinvest the proceeds in developing our packaging business.

Net debt and capital expenditure

Net debt(2) has increased to GBP13.7m (31/12/2020: GBP6.6m)

following the acquisition of Schela Plast and the resin price

impact on profitability and working capital. In addition, deferred

consideration of GBP2.3m is payable to the former owners of Schela

Plast in 2022, this is provided for in Trade and Other Payables.

With total credit facilities of GBP22.6m, the Group considers it

has comfortable headroom for the foreseeable future.

The Group continues to invest in its property, plant and

equipment to improve efficiency and support our future growth

ambitions. Net capital expenditure in the first half year was

GBP2.0m (2020: GBP2.1m) including new production equipment,

previously announced, and now installed in Schela Plast to service

a major FMCG brand owner.

Dividend

Despite the short-term market challenges we face, the Board has

confidence in the medium term prospects for the business and

therefore announces an interim dividend of 2.5p per share to be

paid on 8 October 2021 to shareholders on the register at 10

September 2021 (record date). The ordinary shares ex-dividend date

is 9 September 2021.

The current intention of the Board is to pay a total dividend of

5.5p (2020: 8.5p including the 3.0p deferred 2019 final dividend)

per share for the year ended 31 December 2021.

Outlook

Resin prices have now stabilised and shown the first signs of a

reduction in July, however, we are not expecting a significant

reduction before the end of the year. We are also experiencing

price inflation in other areas including secondary packaging and

transport which will continue to impact on the second half of the

year.

Across our markets we are seeing a lower-than-normal level of

demand in the third quarter due to the ongoing uncertainty across

FMCG supply networks and a varying pace of recovery following the

pandemic. We are now expecting this to continue for the second

half, so we are accelerating our plans to improve our operations

for additional cost savings and profitability.

We expect full year operating profit before amortisation of

intangible assets to be in the region of GBP2.0m (2020:

GBP2.7m).

We remain committed in the medium term to delivering

above-market profitable growth and our target of 6-8% of adjusted

operating margin (3) .

Alan Raleigh

Chairman

18 August 2021

(1) excluding the results from the Schela Plast business

acquired on 10 February

(2) cash less borrowings (excludes IFRS 16 lease

liabilities)

(3) operating profit margin before exceptional items and

amortisation of intangible assets

Condensed consolidated income statement and statement of comprehensive

income

Six months Six months Year to

Condensed consolidated income statement GBP'000 to 30.06.21 to 30.06.20 31.12.20

Revenue 21,231 17,860 37,203

Cost of sales (17,689) (13,648) (28,637)

-------------------------------------------------------- ------------- ------------- ----------

Gross profit 3,542 4,212 8,566

Operating costs (3,491) (2,633) (5,878)

-------------------------------------------------------- ------------- ------------- ----------

Operating profit before amortisation of

intangible assets 51 1,579 2,688

Amortisation of intangible assets (479) (400) (809)

-------------------------------------------------------- ------------- ------------- ----------

Operating (loss)/profit (428) 1,179 1,879

Finance income - interest receivable 12 - 1

Finance costs (165) (63) (128)

(Loss)/profit before taxation (581) 1,116 1,752

Taxation 44 (263) (343)

-------------------------------------------------------- ------------- ------------- ----------

(Loss)/profit for the period (537) 853 1,409

-------------------------------------------------------- ------------- ------------- ----------

Earnings per ordinary share (EPS) p p p

Basic earnings per share (3.2) 5.1 8.5

Diluted earnings per share (3.2) 5.1 8.4

Condensed consolidated statement Six months Six months Year to

of comprehensive income GBP'000 to 30.06.21 to 30.06.20 31.12.20

(Loss)/profit after tax for the

period (537) 853 1,409

-------------------------------------------------------- ------------- ------------- ----------

Items that will not be reclassified

subsequently to the Income Statement:

Re-measurement of net defined benefit

liability 98 79 180

Deferred tax relating to items not

reclassified (19) (15) (34)

-------------------------------------------------------- ------------- ------------- ----------

79 64 146

Items that may be reclassified subsequently

to the Income Statement:

Exchange differences on retranslation

of foreign currency goodwill and

intangibles (221) 116 (55)

Exchange differences on retranslation

of foreign currency deferred tax

balances 31 (16) 7

Exchange differences on translation

of foreign operations (397) 339 (163)

-------------------------------------------------------- ------------- ------------- ----------

(587) 439 (211)

------------------------------------------------------- ------------- ------------- ----------

Other comprehensive (expense)/income

for the period (508) 503 (65)

-------------------------------------------------------- ------------- ------------- ----------

Total comprehensive (expense)/income for

the period (1,045) 1,356 1,344

-------------------------------------------------------- ------------- ------------- ----------

Condensed consolidated statement of financial position

GBP'000 30.06.21 30.06.20 31.12.20

Non-current assets

Goodwill 1,694 1,175 1,127

Other intangible assets 4,945 3,301 2,769

Property, plant and equipment 24,356 19,893 20,873

Deferred tax asset 984 1,001 978

31,979 25,370 25,747

----------------------------------------------- --------- --------- ---------

Current assets

Inventories 5,918 3,287 3,110

Trade and other receivables 10,699 9,454 9,185

Cash at bank and on hand 2,471 2,093 1,386

19,088 14,834 13,681

----------------------------------------------- --------- --------- ---------

Total assets 51,067 40,204 39,428

------------------------------------------------ --------- --------- ---------

Current liabilities

Trade and other payables 10,377 6,794 6,489

Borrowings 5,504 5,539 3,260

Current tax liabilities 126 78 69

16,007 12,411 9,818

----------------------------------------------- --------- --------- ---------

Non-current liabilities

Borrowings 10,899 2,110 4,991

Deferred tax liabilities 1,516 1,232 1,042

Provisions 173 169 173

12,588 3,511 6,206

----------------------------------------------- --------- --------- ---------

Total liabilities 28,595 15,922 16,024

------------------------------------------------ --------- --------- ---------

Net assets 22,472 24,282 23,404

------------------------------------------------ --------- --------- ---------

Equity

Share capital 84 83 83

Share premium 828 732 732

Capital redemption reserve 216 216 216

Translation reserve (426) 811 161

Revaluation reserve 4,118 4,145 4,133

Retained earnings 17,652 18,295 18,079

Equity attributable to shareholders 22,472 24,282 23,404

------------------------------------------------ --------- --------- ---------

Condensed consolidated statement of changes in equity

Capital

Share Share redemption Translation Revaluation Retained

GBP'000 capital premium reserve reserve reserve earnings Total

At 31 December 2019 83 732 216 372 4,134 17,386 22,923

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Profit for the period 853 853

Other comprehensive income 439 64 503

Total comprehensive income for

the period - - - 439 - 917 1,356

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Credit in respect of

share-based payments 5 5

Transactions with owners - - - - - 5 5

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Transfer from revaluation

reserve as a result

of property transactions 13 (13) -

Tax on revaluation (2) (2)

At 30 June 2020 83 732 216 811 4,145 18,295 24,282

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Profit for the period 556 556

Other comprehensive

income/(expense) (650) 82 (568)

Total comprehensive income for

the period - - - (650) - 638 (12)

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Dividends paid (890) (890)

Credit in respect of

share-based payments 26 26

Transactions with owners - - - - - (864) (864)

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Transfer from revaluation

reserve as a result

of property transactions (12) 10 (2)

At 31 December 2020 83 732 216 161 4,133 18,079 23,404

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Loss for the period (537) (537)

Other comprehensive income (587) 79 (508)

Total comprehensive income for

the period - - - (587) - (458) (1,045)

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Issue of ordinary shares under

employee share

option scheme 1 96 97

Credit in respect of

share-based payments 25 25

Transactions with owners 1 96 - - - 25 122

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Transfer from revaluation

reserve as a result

of property transactions (6) 6 -

Tax on revaluation (9) (9)

At 30 June 2021 84 828 216 (426) 4,118 17,652 22,472

-------------------------------- --------- --------- ------------ ------------ ------------ ---------- --------

Condensed consolidated cash flow statement

Year

Six months Six months to

GBP'000 to 30.06.21 to 30.06.20 31.12.20

Cash flows from operating activities

(Loss)/profit for the period (537) 853 1,409

Adjustments for:

Depreciation of property, plant and

equipment 1,361 988 2,164

Impairment of property, plant and equipment - - 98

Profit on disposal of other plant and

equipment (24) (5) (24)

Amortisation of intangible assets 479 400 809

Decrease in provisions - - 4

Finance income (12) - (1)

Finance costs 165 63 128

Taxation charged (44) 263 343

Other non-cash items:

Pension current service cost and expenses 98 79 180

Charge for share options 25 5 31

Operating cash flows before movements

in working capital 1,511 2,646 5,141

Increase in inventories (1,834) (488) (363)

(Increase)/decrease in trade and other

receivables (50) 316 296

Increase in trade and other payables 351 1,601 1,512

Cash (used in)/generated by operations (22) 4,075 6,586

Corporation tax paid (93) (285) (529)

Interest paid (165) (63) (128)

Net cash (used in)/generated by operating

activities (280) 3,727 5,929

--------------------------------------------------------- ------------- ------------- ----------

Cash flows from investing activities

Interest received 12 - 1

Acquisition of plant and equipment (2,014) (2,085) (4,673)

Proceeds on disposal of property, plant

and equipment 47 18 81

Cash outflow on acquisition of subsidiary (1,832) - -

net of cash acquired

--------- ------------- ----------

Net cash used in investing activities (3,787) (2,067) (4,591)

--------------------------------------------------------- ------------- ------------- ----------

Cash flows from financing activities

Loans repaid (57) - -

Loans drawndown 6,633 - -

Net proceeds from sale and leaseback

transactions 1,481 245 1,061

Finance lease capital repayments (859) (302) (710)

Proceeds from issue of ordinary shares 97 - -

Dividends paid - - (890)

------------- ----------

Net cash generated by/(used in) financing

activities 7,295 (57) (539)

--------------------------------------------------------- ------------- ------------- ----------

Net increase in cash and cash equivalents 3,228 1,603 799

Cash and cash equivalents at 1 January (896) (1,678) (1,678)

Effect of foreign exchange rate changes (23) 29 (17)

Cash and cash equivalents at end of period 2,309 (46) (896)

--------------------------------------------------------- ------------- ------------- ----------

Cash 2,471 2,093 1,386

Overdraft (162) (2,139) (2,282)

------------- ------------- ----------

Cash and cash equivalents at end of period 2,309 (46) (896)

--------------------------------------------------------- ------------- ------------- ----------

Notes to the condensed consolidated financial statements

1. Basis of preparation

Robinson plc (the Company) is a public limited company

incorporated and domiciled in the United Kingdom and its ordinary

shares are admitted to trading on the AIM market of the London

Stock Exchange. For the year ended 31 December 2020, the Group

prepared consolidated financial statements in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006. These condensed

consolidated interim financial statements (the interim financial

statements) have been prepared under the historical cost convention

adjusted for the revaluation of certain properties. They are based

on the recognition and measurement principles of IFRS in accordance

with international accounting standards in conformity with the

requirements of the Companies Act 2006.

Standards effective from 1 January 2021

None of the standards, interpretations and amendments effective

for the first time from 1 January 2021 have had a material effect

on the financial statements.

There are no standards that are not yet effective and that would

be expected to have a material impact on the Group in the current

or future reporting periods and on foreseeable future

transactions.

Accounting policies

The interim report is unaudited and has been prepared on the

basis of IFRS accounting policies. The accounting policies adopted

in the preparation of this unaudited interim financial report are

consistent with the most recent annual financial statements, being

those for the year ended 31 December 2020.

The financial information for the six months ended 30 June 2021

and 30 June 2020 has not been audited and does not constitute full

financial statements within the meaning of Section 434 of the

Companies Act 2006.

The financial information relating to the year ended 31 December

2020 does not constitute full financial statements within the

meaning of Section 434 of the Companies Act 2006. This information

is based on the Group's statutory accounts for that period. The

statutory accounts were prepared in accordance with International

Financial Reporting Standards ('IFRS') and received an unqualified

audit report and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006. These financial statements have been

filed with the Registrar of Companies, a copy is available upon

request from the Company's registered office: Field House,

Wheatbridge, Chesterfield, S40 2AB, UK or from its website at

robinsonpackaging.com .

Going concern

The Directors have performed a robust assessment, including a

review of the forecast for the 12 month period ending 31 December

2021 and longer term strategic forecasts and plans, including

consideration of the principal risks faced by the Group including

stress testing of the business, as detailed in the 2020 Annual

Report (page 68). Following this review, the Directors have a

reasonable expectation that the Group has adequate resources to

continue in business for the foreseeable future. Thus, they

continue to adopt the going concern basis of accounting in

preparing the condensed consolidated financial statements.

2. Accounting estimates and judgements

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Actual

results may differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the year ended 31 December

2020.

3. Risks and uncertainties

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as disclosed in the 2020 Annual Report on pages 16-17. The

principal risks set out in the 2020 Annual Report were: Acquisition

integration; Customer relationships; Fluctuations in input prices;

Raw material supply; IT and digital security; Environment; Plastics

legislations; Market competitiveness; People; Debt leverage and

Foreign currency risk.

The Board considers that the principal risks and uncertainties

set out in the 2020 Annual Report have not changed and remain

relevant for the second half of the financial year.

4. Earnings per share

The calculation of basic and diluted earnings per ordinary share

for continuing operations shown on the income statement is based on

the profit for the period divided by the weighted average number of

shares in issue, net of treasury shares. The potentially dilutive

effect of further shares issued through share options is also

applied to the number of shares to calculate the diluted earnings

per share.

Six months Six months Year to

to 30.06.21 to 30.06.20 31.12.20

(Loss)/profit for the period (GBP'000) (537,000) 853,000 1,409,000

Weighted average number of ordinary

shares in issue 16,673,745 16,613,389 16,613,389

Effect of dilutive share option awards* - 59,799 168,505

Weighted average number of ordinary

shares for calculating diluted earnings

per share 16,673,745 16,673,188 16,781,894

Basic earnings per share (pence) (3.2) 5.1 8.5

Diluted earnings per share (pence) (3.2) 5.1 8.4

------------------------------------------ ------------- ------------- -----------

*In the six months to 30.06.21, t here was no difference in the

weighted average number of shares used for the calculation of basic

and diluted loss per share as the effect of potentially dilutive

shares outstanding was antidilutive.

5. Dividends

Six months Six months Year to

GBP'000 to 30.06.21 to 30.06.20 31.12.20

Ordinary dividend 2020 interim of 3.5p

paid: per share - - 566

2020 interim of 2.0p

per share - - 324

- - 890

-------------- ------------------------------------------------------------------- ----------

The 2020 final dividend of 3.0p (2019: nil) per share was paid

to shareholders on 16 July 2021. An interim dividend of 2.5p (2020:

total interim dividends 5.5p) is proposed to be paid on 8 October

2021. Neither the final nor interim dividend have been included as

a liability in the financial statements.

6. Interim report

Electronic copies of this interim report will shortly be sent to

those shareholders who have requested such copies and this interim

report is also available from Robinson plc's website at

robinsonpackaging.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGMRGRKGMZZ

(END) Dow Jones Newswires

August 19, 2021 02:00 ET (06:00 GMT)

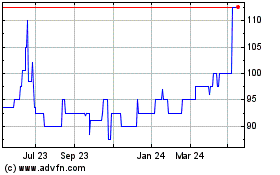

Robinson (LSE:RBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

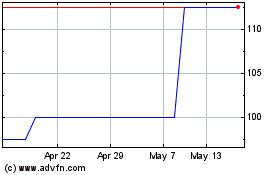

Robinson (LSE:RBN)

Historical Stock Chart

From Nov 2023 to Nov 2024