TIDMPOW

RNS Number : 2397V

Power Metal Resources PLC

08 August 2022

8 August 2022

Power Metal Resources PLC

("Power Metal" or the "Company")

Disposal of Reitenbach Uranium Property - Saskatchewan,

Canada

Power Metal Resources plc (LON:POW), the London listed

exploration company seeking large-scale metal discoveries across

its global project portfolio announces the conditional disposal of

its 100% owned Reitenbach Uranium Property ("Reitenbach" or the

"Property") located east of the prolific Athabasca Basin in

Northern Saskatchewan, Canada.

HIGHLIGHTS:

- A Property Purchase Agreement (the "Agreement") has been

signed with Teathers Financial Plc ("Teathers Financial" or

"Teathers"). Teathers Financial is to conditionally acquire 100%

ownership of the Property, subject to a 2% net smelter return

("NSR") royalty, in exchange for cash and shares.

- The consideration payable is GBP360,000 (to be settled by the

issue of Teathers Financial new ordinary shares of 0.1p ("Ordinary

Shares") and a cash payment of GBP10,000 (see detailed terms

below)).

- Reitenbach is one of ten uranium properties held by 102134984

Saskatchewan Ltd ("Power Sask"), a wholly owned subsidiary of Power

Metal Resources Canada ("POW Canada") which itself is a wholly

owned subsidiary of Power Metal.

- Teathers Financial is currently in the advance stages of

preparing for a change of business to become a uranium focused

exploration company which plans to list on the London equity

capital markets - targeted for Q3 2022.

Paul Johnson, Chief Executive Officer of Power Metal Resources

PLC commented:

"Power Metal has secured another crystallisation event with the

disposal of Reitenbach into a vehicle planning to list in the

London markets in the near term.

With the refocussing of Teathers into a uranium exploration

vehicle with Reitenbach as their flagship property, we believe the

proposition will attract pre-IPO and IPO financing interest, and

trade successfully as a listed vehicle.

Outside of Reitenbach, we continue to own 100% of our remaining

nine Athabasca properties, some of which we expect to explore

ourselves and, given the level of interest in quality uranium

projects, some may be the subject of further disposals. In this

regard, datarooms are being established for all projects to enable

expeditious third party review.

Further information to follow regarding this disposal and other

exploration and corporate activities in respect of our Athabasca

property portfolio."

TRANSACTION TERMS

For the sale of 100% of the Company's interest in the Reitenbach

Property, one of ten uranium focused properties held by Power Metal

surrounding the Athabasca Basin, Saskatchewan, Canada, the

consideration of GBP360,000 is to be settled by:

-- The issue to Power Sask of 98,700,000 Teathers Financial

Ordinary Shares at a price of 0.35461p per share for a total value

of GBP350,000.

-- A cash payment to Power Sask totalling GBP10,000, which

covers several costs incurred by Power Metal on behalf of Power

Sask and Power Canada in preparation of this transaction. This also

covers costs of the National Instrument 43-101 report that was

completed over the Property - which will allow Reitenbach to be the

main listing asset for Teathers Financial during its upcoming

planned listing.

Power Sask will retain a 2% Net Smelter Return ("NSR") [1]

royalty across the Property, 1% of which can be bought back by

Teathers Financial at anytime prior to production for

GBP750,000.

The transaction is conditional on:

- Teathers Financial securing a GBP125,000 initial pre-IPO

financing to cover transactional costs in relation to the planned

listing.

- The approval of Teathers Financial shareholders to the

transaction; to a Rule 9 Whitewash arrangement, enabling Power

Metal to acquire its interest without a requirement to make an

offer for the entire company and approval of a capital

reorganisation of Teathers.

- Admission of Teathers shares to trading on the London equity capital markets.

After the issue of further shares following completion of

Teathers Financial pre-IPO and IPO financings, Power Metal

anticipates its holding will amount to 40-55% of Teathers Financial

issued share capital on listing. Power Metal will provide further

updates on this in due course.

NEXT STEPS

-- Exploration programmes are currently being planned across the

Reitenbach Property, which subject to completion of the Agreement

will be carried out by Teathers Financial following their planned

listing in the London capital markets.

-- Power Metal, with its in house technical group with expertise

in uranium exploration, have agreed to provide Teathers with

ongoing technical consulting services, to be paid for by Teathers,

relating to planned and future exploration programmes on the

Reitenbach Property.

-- Reflecting the growing interest shown from third parties,

comprehensive datarooms and factsheets are being established for

all of the Company's Saskatchewan based uranium assets.

THE REITENBACH PROPERTY

A detailed breakdown of all publically available technical

information over the Reitenbach Uranium Property was released to

the market on 8 February 2022 and can be found at the link

below:

https://www.londonstockexchange.com/news-article/POW/reitenbach-uranium-property-athabasca-basin/15319141

The Power Metal book value of the Reitenbach Property is

GBP55,292 and no losses have been recorded in respect of the

Property in the year ended 30 September 2021, with all costs

capitalised.

URANIUM PROPERTY HOLDING STRUCTURE

Power Metal has a 100% subsidiary Power Metal Canada Inc ("Power

Canada"). which acts as the holding company for certain Canadian

project operations.

Power Canada has a wholly owned subsidiary, 102134984

Saskatchewan Ltd, which is the holder of all the uranium

properties.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please visit

https://www.powermetalresources.com/ or contact:

Power Metal Resources plc

Paul Johnson (Chief Executive Officer) +44 (0) 7766 465 617

SP Angel Corporate Finance (Nomad and Joint Broker)

Ewan Leggat/Charlie Bouverat +44 (0) 20 3470 0470

SI Capital Limited (Joint Broker)

Nick Emerson +44 (0) 1483 413 500

First Equity Limited (Joint Broker)

David Cockbill/Jason Robertson +44 (0) 20 7330 1883

NOTES TO EDITORS

Power Metal Resources plc - Background

Power Metal Resources plc (LON:POW) is an AIM listed metals

exploration company which finances and manages global resource

projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering

district scale potential across a global portfolio including

precious, base and strategic metal exploration in North America,

Africa and Australia.

Project interests range from early-stage greenfield exploration

to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through

strategic joint ventures until a project becomes ready for disposal

through outright sale or separate listing on a recognised stock

exchange thereby crystallising the value generated from our

internal exploration and development work.

Value generated through disposals will be deployed internally to

drive the Company's growth or may be returned to shareholders

through share buy backs, dividends or in-specie distributions of

assets.

Exploration Work Overview

Power Metal has internal exploration programmes completed or

underway, with results awaited, as outlined in the table below.

Exploration work programmes may also be underway within planned

IPO vehicles where Power Metal has a material interest the findings

from which will be released on their respective websites, with

simultaneous updates through Power Metal regulatory announcements

where required:

www.firstclassmetalsplc.com

www.goldenmetalresources.com

www.firstdevelopmentresources.com

For planned IPO vehicle New Ballarat Gold Corporation PLC (NBCG)

a new website is currently in development which will be found at

www.newballaratgold.com . In the interim further information in

respect of NBGC can be found at

https://www.powermetalresources.com/project/victoria-goldfields/

.

Power Metal also holds a material investment in Kavango

Resources plc with exploration updates available through their

regulatory announcements and on their website:

www.kavangoresources.com

Project Location Current Work Completed Results Awaited

POW or Underway

%

Athabasca Canada 100% Hyperspectral Finalise review of data

Uranium data analysis from 3 properties. Prepare

conducted across for summer exploration

7 properties. programme across 4 properties.

Updating to 9

data rooms for

third party review.

--------- --------- ---------------------- --------------------------------

Authier Canada Earn-in Property Evaluation Update covering exploration

North to 100% Report completed. plans for target areas

Lithium identified during the

Evaluation.

--------- --------- ---------------------- --------------------------------

Molopo Botswana 53%(#) Comprehensive Finalise drill programme

Farms data review complete targets, select drill

and establishment contractor and launch

of data room drill programme.

for third party

review. Geophysics

programme underway.

--------- --------- ---------------------- --------------------------------

Tati Botswana 100% Site visit with Exploration planning

Project mapping of gold underway including further

workings and mapping, sampling and

mine dumps. launch of an RC drill

programme.

--------- --------- ---------------------- --------------------------------

(#) subject to completion of acquisition announced 18.5.22

interest will increase to 87.71%

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISEAPPPEFAAEEA

(END) Dow Jones Newswires

August 08, 2022 04:13 ET (08:13 GMT)

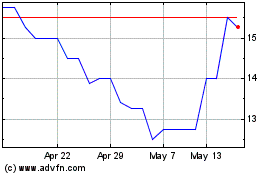

Power Metal Resources (LSE:POW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Power Metal Resources (LSE:POW)

Historical Stock Chart

From Jul 2023 to Jul 2024