TIDMPDL

25 October 2022 LSE: PDL

Petra Diamonds Limited

Q1 FY 2023 Operating Update

Petra reports strong operating results for the first quarter of FY 2023

Richard Duffy, Chief Executive Officer of Petra, commented:

"Petra continued its solid and safe operating performance into the first

quarter of FY 2023. We maintain our production guidance for the year, although

expect this will be towards the lower end of the range for Cullinan Mine and

Finsch. We are very pleased with the successful tender offer for our bonds that

has further strengthened our balance sheet through a reduction in gross debt of

US$143.6m over the quarter which will save Petra some US$14m in annual interest

payments."

Highlights

* LTIFR improved 48% YoY and 43% against Q4 FY 2022 to 0.16

* LTIs improved 40% YoY and 50% against Q4 FY 2022 to 3

* Ore processed increased 22% YoY due to the resumption of mining at

Williamson in Tanzania and in line with Q4 FY 2022

* Production was down 13% YoY to 763,220 carats due to lower grades at

Cullinan Mine and Finsch but 2% higher than Q4 FY 2022

* Guidance for FY 2023 remains unchanged, although production is now expected

to be at the lower end of guidance as discussed below

* Revenue amounted to US$104.3 million (Q1 FY 2022: US$114.9 million, Q4 FY

2022 US$179.8)

+ Revenue includes US$1.4 million from Petra's 50% share in the profit

from the sale of polished stones cut from the 342.92 carat rough white

diamond sold into a partnership for US$10 million in August 2021

* Gross debt reduced by US$143.6 million during the quarter, with a further

US$1.0 million shortly after period end through the successful tender offer

to repurchase second lien notes

Safety, sales FY 2023 FY 2022

and production Unit

Q1 Q4 Q3 Q2 Q1 TOTAL

Safety

LTIFR - 0.16 0.33 0.18 0.06 0.31 0.22

LTIs Number 3 6 3 1 5 15

Sales

Diamonds sold Carats 520,011 1,205,240 735,225 1,017,665 578,186 3,536,316

Revenue1 US$m 102.9 178.78 140.6 149.9 114.9 584.1

Contribution US$m 0.0 5.7 5.5 27.7 50.2 89.1

from exceptional

stones

Safety, sales FY 2023 FY 2022

and production Unit

(continued)

Q1 Q4 Q3 Q2 Q1 TOTAL

Production

ROM tonnes Tonnes 3,042,017 3,045,843 2,792,394 2,935,488 2,466,044 11,239,768

Tailings and Tonnes 105,715 65,628 112,414 122,699 115,593 416,334

other tonnes

Total tonnes Tonnes 3,147,731 3,111,471 2,904,808 3,058,187 2,581,637 11,656,103

treated

ROM diamonds Carats 733,014 717,373 780,896 839,643 810,346 3,148,258

Tailings and Carats 30,206 28,417 49,560 61,370 66,065 205,412

other diamonds

Total diamonds Carats 763,220 745,790 830,456 901,013 876,411 3,353,670

1 Revenue reflects proceeds from the sale of rough diamonds and excludes

revenue from profit share arrangements (as noted in the text above)

Strong and safe production

* LTI and LTIFR continued to improve due to the ongoing focus on identifying

and mitigating safety risks and behaviour-based intervention programmes

* Cullinan Mine mined and treated 1.1mt for the quarter. ROM grades were in

line with those achieved in Q4 FY 2022 at 33.2cpht. This is attributable to

a lower ROM grade resulting from the previously announced change in the ore

make-up of the C-Cut block cave footprint as the production progresses from

SW to NE due to cave maturity with a higher proportion of cave waste.

Various options are being considered to mitigate this impact. Production

guidance for the full year remains unchanged although this is now expected

to be towards the lower end of the range.

* Finsch tonnes from underground were negatively impacted by a S54 stoppage

notice (since been addressed) and lower tunnel availability on 73 and 75

levels. ROM grade benefited from enhanced drill, blast and draw controls

previously reported on, as well as certain changes effected in the

treatment plant. During the quarter, the implementation of the Business

Re-engineering (BRE) Project at Finsch progressed to match our cost base to

our revised production levels. Production guidance for the full year

remains unchanged, although this is expected to be towards the lower end of

the guidance range.

* Production at Williamson improved over the prior quarter (Q4 FY 2022),

bolstered by an increase in tonnes treated and grade. Full year production

guidance remaining unchanged.

* Petra has been exploring options for a responsible exit at Koffiefontein,

as the mine approaches the end of its mine plan. The sales process

announced in April 2022 however has not resulted in a potential buyer for

the mine and Petra is therefore exploring alternative options in close

consultation with its stakeholders. The impact on production guidance will

be confirmed once a decision on the way forward has been reached.

Balance sheet further strengthened through successful debt tender offer

* Balance Sheet as at 30 September 2022:

+ Consolidated net debt of US$77.6 million (30 June 2022: US$40.6

million), increasing in line with expectations due to the Company's

tender cycle and resultant inventory build during the quarter

+ Gross cash of US$154.0 million (30 June 2022: US$288.2 million) and

unrestricted cash of US$138.2 million (30 June 2022: US$271.9 million)

reflecting the repurchase of the company's loan notes totalling

US$143.6 million during the Quarter, with a further US$1.0 million

shortly after period end.

Outlook

We continue to benefit from the operational improvements we have made across

the business which provide for greater stability and resilience. We will

continue to seek to mitigate the impact of the recent challenges experienced at

Cullinan Mine and Finsch and remain confident in our ability to generate cash

to fund capex, allow further deleveraging and the payment of dividends.

While our operations have benefitted from a weaker Rand, we continue to closely

monitor the current macro-economic uncertainties, particularly the impact of

inflation on our cost base, and the impact of sanctions on Russian producers as

well as the ongoing implications of COVID-19 on demand in China. The backdrop

of structural changes to the supply and demand fundamentals in the diamond

market remains unchanged and we anticipate it to remain supportive going

forward, although we expect some short-term volatility driven largely by the

ongoing lockdowns in China.

We have extended the closing of our second sales tender for FY 2023 for a

portion of our gem and near gem quality goods, particularly in the +1ct to 5ct

size ranges, as a result of unusual market conditions with some build up in

inventory pre-Diwali. Pricing in other size categories are in line with

expectations. We will confirm the sales results for this tender around

mid-November. This extension is not currently expected to have any impact on

the closing of our third sales tender.

CONFERENCE CALLS

09:30am and 16:00 BST today

Petra's CEO, Richard Duffy, and CFO, Jacques Breytenbach, will host calls today

to discuss this trading update at 09:30 and 16:00 BST.

Registration for calls:

United Kingdom 0800 640 6441

South Africa 087 550 8441

United States (Local) 1 646 664 1960

All other locations +44 20 3936 2999

09:30: Access code: 511492

16:00: Access code: 342891

Press *1 to ask a question, *2 to withdraw your question, or *0 for operator

assistance.

Link for recording (available later today):

https://www.petradiamonds.com/investors/results-reports/

Investor Meet webcast at 11.30 BST

Petra will present the results on the Investor Meet Company platform,

predominantly aimed at retail investors. To join: https://

www.investormeetcompany.com/petra-diamonds-limited/register-investor

FURTHER INFORMATION

Please contact

Petra Diamonds, London

Telephone: +44 207494 8203

Patrick Pittaway

investorrelations@petradiamonds.com

Julia Stone

Notes:

1. The following definitions have been used in this announcement:

a. Exceptional Stones: diamonds with a valuation and selling price of US$5m or

more per stone

b. cpht: carats per hundred tonnes

c. LTIs: lost time injuries

d. LTIFR: lost time injury frequency rate, calculated as the number of LTIs

multiplied by 200,000 and divided by the number of hours worked

e. FY: financial year

f. Q: quarter of the financial year

g. ROM: run-of-mine (i.e. production from the primary orebody)

h. m: million

ABOUT PETRA DIAMONDS

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 226.6 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's loan notes due in 2026 are

listed on the Irish Stock Exchange and admitted to trading on the Global

Exchange Market. For more information, visit www.petradiamonds.com.

Corporate and financial summary 30 September 2022

Unit As at 30 September As at 30 June

2022 2022

Cash at bank - US$m 154.0 288.2

(including

restricted

amounts)¹

Diamond debtors US$m 4.2 37.4

Diamond US$m 76.3 52.7

inventories2,3 Carats 692,219 453,380

2026 US$336.7m US$m 235.8 366.2

loan notes4

Bank loans and US$m - -

borrowings5

Consolidated Net US$m 77.6 40.6

debt6

Bank facilities US$m 55.1 61.5

undrawn and

available5

Note: The following exchange rates have been used for this announcement:

average for Q1 FY 2023 US$1: ZAR17.02 (FY 2022: US$1: ZAR15.22); closing rate

as at 30 September 2022 US$1: ZAR18.15 (30 June 2022: US$1: ZAR16.27).

Notes:

1. The Group's cash balances comprise unrestricted balances of US$138.2

million, and restricted balances of US$15.8m.

2. Recorded at the lower of cost and net realisable value.

3. Diamond inventories includes the Williamson 71,654.45 carat parcel of

diamonds blocked for export during August 2017, with a carrying value of

US$12.5 million. Under the framework agreement reached with the Government

of Tanzania, as announced on 13 December 2021, the proceeds from the sale

of this parcel are required to be allocated to Williamson.

4. The 2026 US$336.7m loan notes, originally issued following the capital

restructuring (the "Restructuring") completed during March 2021, have a

carrying value of US$235.8 million which represents the outstanding

principal amount of US$211.1 million (after the early participation phase

of the debt tender offer as announced on 27 September 2022) plus US$38.7

million of accrued interest and net of unamortised transaction costs

capitalised of US$14.0 million. Post period end, as announced on 12 October

2022, a further US$1.0 million was repurchased in the final phase of the

tender offer comprising, US$0.9 million (principal amount) and US$0.1

million of accrued interest.

5. Bank loans and borrowings represent the Group's ZAR1 billion revolving

credit facility which remains undrawn and available.

6. Consolidated Net Debt is bank loans and borrowings plus loan notes, less

cash and diamond debtors.

Mine-by-mine tables:

Cullinan Mine - South Africa

FY 2023 FY 2022

Unit

Q1 Q4 Q3 Q2 Q1 TOTAL

Sales

Revenue US$m 56.9 81.0 73.7 74.9 92.8 322.4

Diamonds sold Carats 267,728 617,677 409,030 500,008 372,296 1,899,011

Average price per US$ 212 131 180 150 249 170

carat

ROM Production

Tonnes treated Tonnes 1,110,912 1,090,897 1,053,631 1,099,644 1,207,343 4,451,515

Diamonds produced Carats 368,796 362,249 404,473 411,236 431,967 1,609,925

Grade1 Cpht 33.2 33.2 38.4 37.4 35.8 36.2

Tailings Production

Tonnes treated Tonnes 77,572 62,844 112,414 122,699 115,593 413,550

Diamonds produced Carats 26,790 28,056 49,560 61,369 66,065 205,050

Grade1 Cpht 34.5 44.6 44.1 50.0 57.2 49.6

Total Production

Tonnes treated Tonnes 1,188,484 1,153,741 1,166,045 1 222,343 1,322,936 4,865,065

Diamonds produced Carats 395,586 390,305 454,033 472,605 498,032 1,814,975

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

Finsch - South Africa

FY 2023 FY 2022

Unit

Q1 Q4 Q3 Q2 Q1 TOTAL

Sales

Revenue US$m 23.4 60.9 39.2 46.4 19.3 165.7

Diamonds sold Carats 177,285 467,195 259,164 474,643 201,652 1,402,654

Average price per US$ 132 130 151 98 96 118

carat

ROM Production

Tonnes treated Tonnes 572,976 650,670 656,408 721,741 701,378 2,730,197

Diamonds produced Carats 260,217 269,828 303,591 351,174 350,368 1,274,961

Grade Cpht 45.4 41.5 46.3 48.7 50.0 46.7

Tailings Production

Tonnes treated Tonnes 17,305 2,785 - - - 2,785

Diamonds produced Carats 3,160 362 - - - 362

Grade1 Cpht 18.3 13.0 - - - 13.0

Total Production

Tonnes treated Tonnes 590,281 653,454 656,408 721,741 701,378 2,732,982

Diamonds produced Carats 263,377 270,190 303,591 351,174 350,368 1,275,323

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

Williamson - Tanzania

FY 2023 FY 2022

Unit

Q1 Q4 Q3 Q2 Q1 TOTAL

Sales

Revenue US$m 21.2 22.4 55.7 20.2 - 75.9

Diamonds sold Carats 71,295 110,386 60,759 26,611 - 197,756

Average price per US$ 297 301 369 760 - 384

carat

ROM Production

Tonnes treated Tonnes 1,309,359 1,231,082 1,005,901 988,978 365,138 3,591,099

Diamonds produced Carats 100,750 80,194 65,003 68,453 14,420 228,070

Grade Cpht 7.7 6.5 6.5 6.9 3.9 6.4

Total Production

Tonnes treated Tonnes 1,309,359 1,231,082 1,005,901 988,978 365,138 3,591,099

Diamonds produced Carats 100,750 80,194 65,003 68,453 14,420 228,070

Koffiefontein - South Africa

FY 2023 FY 2022

Unit

Q1 Q4 Q3 Q2 Q1 TOTAL

Sales

Revenue US$m 1.4 5.0 5.4 8.3 2.8 21.5

Diamonds sold Carats 3,703 10,043 6,269 16,400 4,238 36,950

Average price per US$ 383 500 856 505 664 581

carat

ROM Production

Tonnes treated Tonnes 48,770 73,194 76,453 125,126 192,184 466,957

Diamonds produced Carats 3,253 5,101 7,829 8,780 13,592 35,302

Grade1 Cpht 6.7 7.0 10.2 7.0 7.1 7.6

Tailings Production

Tonnes treated Tonnes 10,837 - - - - -

Diamonds produced Carats 255 - - - - -

Grade1 Cpht 2.4 - - - - -

Total Production

Tonnes treated Tonnes 59,607 73,194 76,453 125,126 192,184 466,957

Diamonds produced Carats 3,508 5,101 7,829 8,780 13,592 35,302

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

END

(END) Dow Jones Newswires

October 25, 2022 02:00 ET (06:00 GMT)

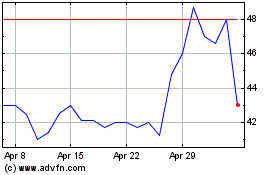

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

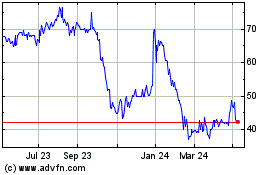

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024