TIDMPGHZ TIDMPCGH

RNS Number : 0185L

PCGH ZDP PLC

19 December 2018

PCGH ZDP PLC

Legal Entity Identifier: 5493004C3YRF9HEVQI09

Annual Report and Financial Statements

for the year ended 30 September 2018

COMPANY INFORMATION

PCGH ZDP Plc (the 'Company') is a public limited company

incorporated in England and Wales on 30 March 2017, with

registration number 10700107. The principal legislation under which

the Company operates is the Companies Act 2006. The Company has a

standard listing on the London Stock Exchange.

KEY CONTACTS

Board of Directors Registered Office

James Robinson (Chairman) 16 Palace Street

Lisa Arnold (appointed 1 February London

2018) SW1E 5JD

Anthony Brampton

Neal Ransome (appointed 13

December 2017)

Investment Manager and AIFM Company Secretary

Polar Capital LLP Polar Capital Secretarial Services

16 Palace Street Limited

London 16 Palace Street

SW1E 5JD London

SW1E 5JD

Independent Auditors Depositary

PricewaterhouseCoopers LLP HSBC Bank plc

Atria One, 144 Morrison Street 8 Canada Square

Edinburgh London

EH3 8EX E14 5HQ

Registrar Legal Adviser

Equiniti Limited Herbert Smith Freehills LLP

Aspect House, Spencer Road Exchange House, Primrose Street

Lancing, West Sussex London

BN99 6DA EC2A 2EG

Company identification codes: TICKER: PGHZ LEI: 5493004C3YRF9HEVQI09

SEDOL: BDHXP96 ISIN: GB00BDHXP963

For further information please contact:

Tracey Lago - Company Secretary John Regnier-Wilson

Polar Capital Global Healthcare Polar Capital LLP

Trust plc

Tel: 020 7227 2700 Tel: 020 7227 2725

STRATEGIC REPORT for the year ended 30 September 2018

The Strategic Report has been prepared under s414A of the

Companies Act 2006 (Strategic Report and Directors Report)

Regulations 2013 and the Companies Act 2006 (the 'Act'). Its

purpose is to inform members of the Company and help them assess

how the directors have performed their duty under s172 of the

Act.

This Strategic Report is intended to provide information about

the Company's strategy and business, its performance and the

results for the year under review. The Company is a public limited

company with the sole purpose of issuing Zero Dividend Preference

('ZDP') shares. The Company is managed by a board of non-executive

directors and the day to day operations of the Company are

delegated to the Investment Manager, Polar Capital LLP. The

Company's entire ordinary share capital is owned by Polar Capital

Global Healthcare Trust plc (the 'parent' or 'PCGH') while the

Company's ZDP shares are listed on the London Stock Exchange. PCGH

and the Company form the Group (the 'Group').

Chairman's Statement

My report on the activities of the Group for the year ended 30

September 2018 is provided in the Annual Report of the parent

company which can be found on the National Storage Mechanism

('NSM') at www.morningstar.co.uk/uk/nsm and the following website

www.polarcapitalhealthcaretrust.co.uk.

Performance and Dividends

The sole purpose of the Company is to issue ZDP shares and to

advance the proceeds of the issue by way of a loan to PCGH. The

sole objective of the Company is to repay the ZDP shares on 19 June

2024 (the 'ZDP Repayment Date') their entitlement of 122.99p per

ZDP share (the 'Final Capital Entitlement') and the performance of

the Company in meeting this objective is directly linked to the

performance of the portfolio of the parent company. The Directors

do not recommend the payment of a dividend on either class of

shares.

Key Performance Indicators

Due to the limited nature of the Company's activities, the Board

does not consider it necessary to assess the performance of its

activities using key performance indicators.

Loan Agreement

The Company and PCGH entered into an intra-group loan agreement

(the 'Agreement') on 20 June 2017. Under the Agreement the gross

initial ZDP placing proceeds were lent to PCGH. The Agreement

provides that interest will accrue daily at an annual rate of 2.5%

compounded annually on each anniversary of the ZDP shares admission

to listing and will be rolled up and paid to the Company along with

any repayment of the principal amount on a date falling 2 business

days before the ZDP Repayment Date. PCGH has further provided an

Undertaking (the 'Undertaking') to provide additional funding in

the event of a short-fall between the final capital entitlement of

122.99 pence per ZDP share and the aggregate principal amount and

interest due pursuant to the Agreement at that date. Further

information is provided in the notes to the financial

statements.

The Board and Diversity

The Company has no employees. The Board comprises one female and

three male non-executive Directors. In the event that new directors

are appointed the Board would have regard to the benefits of

diversity, including gender, when seeking to make any such

appointment.

Management and Service Providers

As the Company's only purpose is to issue ZDP Shares, all of the

day to day operational, administration and other activities are

outsourced to third party service providers. The key service

providers are listed above.

Corporate and Social Responsibility and Modern Slavery

As a financing vehicle, the Company has no direct social,

community, employee or environmental responsibilities. The Company

has no direct investments as its sole purpose is to provide

financing to the Group through the issue of ZDP shares. As the

Company does not make any investments it does not subscribe to a

socially responsible investment policy and does not exercise any

voting powers. The Company does not provide goods or services in

the normal course of business and does not have any customers.

Accordingly, it is considered that the Company is not required to

make any statements in relation to modern slavery, human

trafficking or human rights.

The Environment and Greenhouse Gas Emissions

The Company's core activities are undertaken by its Investment

Manager, which seeks to limit the use of non-renewable resources

and to reduce waste where possible. The Companies Act 2006

(Strategic Report and Directors' Reports) Regulations 2013 require

companies listed on the Main Market of the London Stock Exchange to

report on the greenhouse gas ('GHG') emissions for which they are

responsible. The Company is a financing vehicle as described above,

with neither employees nor premises, consequently, it has no GHG

emissions to report from its operations nor does it have

responsibility for any other emissions.

Principal Risks and Uncertainties

The Board acknowledges its ultimate responsibility for managing

the risks associated with the Company. The principal risks and

uncertainties as identified by the Board are:

Capital Value:

The primary risk to the ZDP shareholders is that the assets of

the Company are insufficient to repay the final capital entitlement

of the ZDP Shares of 122.99 pence per share on the repayment date

of 19 June 2024. The payment will be dependent on the parent

company's ability to comply with its obligations under the

Agreement and the Undertaking.

Investment tenure:

There is a risk that there may not be a liquid secondary market

for the ZDP Shares. The investment should therefore be regarded as

long-term in nature and should not be considered a suitable

short-term investment.

Further details of financial risk management policies and

procedures are set out in note 10.

Future Developments

The Company does not have, and does not expect to have, any

other business interests, and the current activities of the Company

are expected to continue until the scheduled ZDP Repayment Date of

19 June 2024 at which time the Company will enter into voluntary

liquidation to wind up its operations.

Approved by the Board of Directors and signed on its behalf

by

James Robinson

Chairman

19 December 2018

REPORT OF THE DIRECTORS for the year ended 30 September 2018

The Directors have pleasure in submitting the Annual Financial

Report of the Company for the year to 30 September 2018.

Principal Activity

The Company was incorporated for the sole purpose of issuing ZDP

shares to raise finance for the Group and consequently it has no

investment policy. The Company has a limited life and unless prior

alternative arrangements are made, the Directors shall convene a

general meeting of the Company on 19 June 2024 for the purposes of

proposing a resolution to wind up the Company voluntarily. The

Company's only material financial obligations are in respect of the

ZDP shares and the only material assets are its loan to the parent

company.

Directors

The Directors who served in office during the year under review

were as follows:

James Robinson (Chairman)

Lisa Arnold (appointed 1 February 2018)

Anthony Brampton

Neal Ransome (appointed 13 December 2017)

John Aston (retired 28 February 2018)

Antony Milford (retired 28 February 2018)

No Director had a service contract with the Company, nor are any

such contracts proposed. Each Director was appointed pursuant to a

letter of appointment entered into with the Company.

Apart from the exception noted below none of the Directors had a

direct material beneficial interest in any contract to which the

Company was a party and which is or was significant in relation to

the Company's business during the year under review.

James Robinson and Anthony Brampton were serving non-executive

Directors of PCGH on the date the Agreement and Undertaking were

agreed and signed and declared their interest at that time. All of

the current Directors are Directors of PCGH and therefore have an

indirect non-beneficial interest in the Agreement and Undertaking

entered into by the Company and PCGH. The Directors are also

shareholders in PCGH and their interests in that company's shares

are set out in the annual report of that company.

All Directors retired and stood for election at the first AGM of

the Company held in February 2018. In accordance with the Articles

of Association each Director is required to retire and may offer

themselves for re-election at every third AGM.

Directors' Share Interests

None of the Directors had an interest in the share capital of

the Company at any time during the year, or between the year end

and the date of this report.

Directors' Indemnity

Directors' and Officers' Liability insurance has been put in

place. In addition, the Group provides, subject to the provisions

of applicable UK legislation, an indemnity for Directors in respect

of costs incurred in the defence of any proceedings brought against

them and also liabilities owed to third parties, in either case

arising out of their positions as Directors. This was in place

throughout the financial year under review, up to and including the

date of the Financial Statements.

Share Capital

The Company was incorporated with a share capital of 50,000

ordinary shares of nominal value GBP1.00 each; on 16 June 2017,

following an initial placing, 32,128,437 Zero Dividend Preference

('ZDP') shares were issued for consideration of 100 pence each and

a nominal value of 1 pence each. The ZDP shares were admitted to a

standard listing on the London Stock Exchange on 19 June 2017.

The ZDP Shares have a limited life of seven years and, on that

basis, a final capital entitlement of 122.99 pence per ZDP share on

the ZDP Repayment Date, equivalent to a redemption yield of 3.0 per

cent. per annum (compounded annually) on the initial ZDP placing

price of 100 pence per share. The Redemption Yield of a ZDP Share

is not, and should not be taken as, a forecast of profits. The

final capital entitlement is not a guaranteed or a secured

repayment amount and there can be no assurance that the final

capital entitlement will be repaid in full on the ZDP Repayment

Date (or at all).

The final capital entitlement will rank behind any liabilities

of the Group and in priority to the capital entitlements of the

Company's ordinary shares.

The ZDP shares carry no entitlement to income and the whole of

their return accordingly takes the form of capital. The ZDP

shareholders are not entitled to receive any part of the revenue

profits (including any accumulated revenue reserves) of the Company

on a winding-up, even if the accrued capital entitlement of the ZDP

Shares will not be met in full.

The ZDP shares do not carry the right to vote at general

meetings of the Company, although they carry the right to vote as a

class on certain matters affecting their class in accordance with

paragraph 1.5 of Part VI (The ZDP Shares and Principal Bases and

Assumptions) of the Prospectus published on 12 May 2017. Further

information on the rights attaching to the ZDP Shares are set out

in Part VI of the Prospectus which is available on the parent

company's website www.polarcapitalhealthcaretrust.com.

Substantial Share Interests

The Company's ordinary share capital is wholly owned by the

parent company; the Company's ZDP share capital has limited voting

capacity and as a result, such shareholders are not required to

disclose holdings to the Company or the market; the ZDP share

capital is publicly traded on the London Stock Exchange.

Going Concern

The Board has considered the ability of the Company to adopt the

going concern basis for the preparation of the Financial Statements

and considered the financial position of the Company, its cash

flows and its liquidity position. The Board has also considered in

making its assessment any material uncertainties and events that

might cast significant doubt upon the Company's ability to continue

as a going concern. With regard to the information available and

the assessment of the financial position of the Company the Board

believes the going concern basis should be adopted for the

preparation of the Financial Statements for the year ended 30

September 2018 and that the Company can continue in operational

existence for the next 12 months.

The Company has a standard listing on the London Stock Exchange

and is therefore not required to comply with the enhanced UK

corporate governance requirement to provide a longer-term viability

statement. The Company was incorporated with a limited life of

seven years ending on 19 June 2024 on which date the ZDP Shares

will be repaid and the Board will convene a general meeting to

propose a resolution to voluntarily wind up the operations of the

Company.

Statement on Corporate Governance and Internal Controls

As referred to above the Company's ZDP shares are subject to a

standard listing and the Board is therefore not required to provide

a statement of compliance with the principles of the UK Corporate

Governance Code.

The Board has overall responsibility for the Company's internal

controls. The Board aims to maintain full and effective control

over appropriate strategic, financial, operational and compliance

issues. There is no separate Audit or other Committee given the

activities of the Company are limited.

It is the Company's policy to achieve the best terms available

for all services provided to the Company from suppliers and there

is therefore no single policy adopted when negotiating terms. The

Company had no trade creditors at the year end.

Annual General Meeting ('AGM')

The second AGM of the Company will be held at 2pm or if earlier

at the conclusion of the parent company AGM on 27 February 2019. A

Notice of Meeting incorporated at the end of this Annual Report

sets out in full the resolutions to be proposed at the meeting.

Resolutions shall be proposed to receive the Report of the

Directors and Annual Financial Report, receive and approve the

Directors' Remuneration Implementation Report, to re-appoint the

auditors and authorise the Directors to set their fees. The

Directors are also seeking authorisation to make market purchases

of the Company's ZDP shares.

Independent Auditors

Each of the Directors, at the date of approval of this report,

confirms that:

a) so far as the Director is aware, there is no relevant audit

information of which the Company's auditor is unaware; and

b) the Director has taken all the steps that he ought to have

taken as a Director to make himself aware of any relevant audit

information and to establish that the Company's auditor is aware of

that information.

This confirmation is given and should be interpreted in

accordance with the provisions of s418 of the Companies Act

2006.

PricewaterhouseCoopers LLP have expressed their willingness to

continue in office as auditor. In accordance with s489 of the

Companies Act 2006, a resolution proposing their reappointment will

be proposed to the annual general meeting.

The financial statements on pages 14 to 22 were approved by the

Board of Directors on 19 December 2018 and signed on its behalf

by:

Tracey Lago, ACIS

Company Secretary

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RESPECT OF THE

FINANCIAL STATEMENTS

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulation.

Company law requires the Directors to prepare financial

statements for each six-month and annual period. Under that law the

Directors have prepared the financial statements in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union. Under company law the Directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the profit or loss of the Company for that period.

In preparing the financial statements, the Directors are required

to:

-- select suitable accounting policies and then apply them consistently;

-- state whether applicable IFRSs as adopted by the European

Union have been followed, subject to any material departures

disclosed and explained in the financial statements;

-- make judgements and accounting estimates that are reasonable and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements and the Directors' Remuneration Report

comply with the Companies Act 2006.

The Directors are also responsible for safeguarding the assets

of the Company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

The Directors consider that the annual report and financial

statements, taken as a whole, are fair, balanced and understandable

and provide the information necessary for shareholders to assess

the Company's performance, business model and strategy.

The financial statements were approved by the Board on 19

December 2018 and the responsibility statements were signed on its

behalf by James Robinson, Chairman of the Board.

Approved by the Board of Directors and signed on its behalf

by:

James Robinson,

Chairman

DIRECTORS' REMUNERATION IMPLEMENTATION REPORT

The Board has prepared this report, in accordance with the

requirements of Schedule 8 to the Large and Medium-sized Companies

and Groups (Accounts and Reports) (Amendments) Regulations 2013.

Ordinary resolutions for the approval of the Directors'

Remuneration Policy every three years and the Remuneration

Implementation Report annually, shall be put to shareholders at the

AGM.

The law requires the Group's Auditors, PricewaterhouseCoopers

LLP, to audit certain disclosures provided. Where disclosures have

been audited, they are indicated as such. The Auditor's opinion is

included in their report on page 10.

Report from the Company Chairman

As set out in the Directors' Report, the Company has a standard

listing and is not required to comply with the UK Corporate

Governance Code and does not intend to do so. The parent company

considers the Directors' remuneration for the Group as a whole and

the Directors see no benefit in creating a separate Remuneration

Committee. The Board, with Mr Robinson as Chairman, considers and

approves Directors' remuneration, for services provided to the

Company.

Directors' Remuneration Policy

The Remuneration Policy was approved at the AGM in February 2018

for the period from incorporation to 30 September 2020 and, in

accordance with the regulations, an ordinary resolution to approve

the Directors' remuneration policy will be put to shareholders at

least once every three years. The resolution will therefore be put

to shareholders again at the AGM to be held in 2021 for the period

1 October 2020 to 30 September 2023.

The Company's remuneration policy is that no fees or expenses or

any other financial benefits are payable to the Directors in

connection with their duties to the Company. Directors are not

eligible for bonuses, pension benefits, share options or long-term

incentive schemes as the Board does not consider such arrangements

or benefits necessary or appropriate.

The Directors receive fees relating to their duties to the

parent company. This policy will continue for future years and is

set out in full in the Directors' Remuneration Report of the parent

company.

Directors' service contracts and terms

None of the Directors have a contract of service with the

Company or the parent company, nor has there been any contract or

arrangement between the Company and any Director at any time during

the period. The terms of their appointment provide that a Director

shall retire and be subject to re-election at the first AGM after

their appointment, and at least every three years after that. A

Director's appointment can be terminated in accordance with the

Articles and without compensation.

Directors' interests and emoluments for the year (audited)

None of the Directors had interests in the ZDP shares at the

year end of 30 September 2018 and no personal account transactions

have been undertaken since the year end. The ordinary shares are

wholly owned by the parent company. No fees are payable to the

Directors regarding their duties to the Company.

The Directors' interests in the shares of the parent company are

shown in the Annual Report of the parent company.

Company's performance

As a finance company which has lent all of its assets to the

parent company the performance of the Company is therefore best

reflected by looking at the performance of the parent company. The

Directors' remuneration report within the Annual Report of the

parent company contains a graph comparing the total return

(assuming all dividends are reinvested) to the parent company

ordinary shareholders, compared to the total shareholder return of

the MSCI ACWI Healthcare Index. A copy of the parent company's

Annual Report can be found on the following website

www.polarcapitalhealthcaretrust.co.uk and the National Storage

Mechanism (NSM) at www.morningstar.co.uk/uk/nsm.

In accordance with the regulations a graph is provided in the

Annual Report which compares the share price of ZDP shares with the

MSCI ACWI Healthcare Index over the period since listing of the ZDP

shares on 19 June 2017 to the end of the period on 30 September

2018. The MSCI ACWI Healthcare Index has been selected as it is

considered to represent a broad equity market index against which

the performance of the parent company's assets may be adequately

assessed.

There has been no demonstration of relative importance of spend

on pay for the Company as no remuneration is payable to

Directors.

Approval

The Directors' Remuneration Report was approved by the Board on

19 December 2018.

On behalf of the Board of Directors

James Robinson

Chairman

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF PCGH ZDP PLC

for the year ended 30 September 2018

Report on the audit of the financial statements

Opinion

In our opinion, PCGH ZDP PLC's financial statements:

-- give a true and fair view of the state of the company's

affairs as at 30 September 2018 and of its result and cash flows

for the year then ended;

-- have been properly prepared in accordance with International

Financial Reporting Standards (IFRSs) as adopted by the European

Union; and

-- have been prepared in accordance with the requirements of the Companies Act 2006.

We have audited the financial statements, included within the

Annual Report and Financial Statements (the "Annual Report"), which

comprise: the balance sheet as at 30 September 2018; the statement

of comprehensive income, the cash flow statement, the statement of

changes in equity for the year then ended; and the notes to the

financial statements, which include a description of the

significant accounting policies.

Our opinion is consistent with our reporting to the Audit

Committee.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) ("ISAs (UK)") and applicable law. Our

responsibilities under ISAs (UK) are further described in the

Auditors' responsibilities for the audit of the financial

statements section of our report. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Independence

We remained independent of the company in accordance with the

ethical requirements that are relevant to our audit of the

financial statements in the UK, which includes the FRC's Ethical

Standard, as applicable to listed public interest entities, and we

have fulfilled our other ethical responsibilities in accordance

with these requirements.

To the best of our knowledge and belief, we declare that

non-audit services prohibited by the FRC's Ethical Standard were

not provided to the company.

We have provided no non-audit services to the company in the

period from 1 October 2017 to 30 September 2018.

Our audit approach

Overview

Materiality -- Overall materiality: GBP334,000 (2017: GBP325,000),

based on 1% of total assets.

Audit scope

* The Company is a subsidiary of Polar Capital Global

Healthcare Trust plc.

* We conducted our audit of the financial statements

using information from HSBC (the "Administrator") to

whom Polar Capital LLP ("the Manager") has, with the

consent of the Directors, delegated the provision of

certain administrative functions.

* We tailored the scope of our audit taking into

account the types of balances within the Company, the

involvement of the third parties referred to above,

the accounting processes and controls, and the

industry in which the Company operates.

------------------------------------------------------------------

Key audit -- ZDP preference shares (including loan to Parent

matters Company, loan interest income and appropriation

of ZDPs).

------------------------------------------------------------------

The scope of our audit

As part of designing our audit, we determined materiality and

assessed the risks of material misstatement in the financial

statements. In particular, we looked at where the directors made

subjective judgements, for example in respect of significant

accounting estimates that involved making assumptions and

considering future events that are inherently uncertain.

We gained an understanding of the legal and regulatory framework

applicable to the company and the industry in which it operates and

considered the risk of acts by the company which were contrary to

applicable laws and regulations, including fraud. We designed audit

procedures to respond to the risk, recognising that the risk of not

detecting a material misstatement due to fraud is higher than the

risk of not detecting one resulting from error, as fraud may

involve deliberate concealment by, for example, forgery or

intentional misrepresentations, or through collusion. We focused on

laws and regulations that could give rise to a material

misstatement in the company's financial statements, including, but

not limited to, the Companies Act 2006. There are inherent

limitations in the audit procedures described above and the further

removed non-compliance with laws and regulations is from the events

and transactions reflected in the financial statements, the less

likely we would become aware of it.

We did not identify any key audit matters relating to

irregularities, including fraud. As in all of our audits we also

addressed the risk of management override of internal controls,

including testing journals and evaluating whether there was

evidence of bias by the directors that represented a risk of

material misstatement due to fraud.

Key audit matters

Key audit matters are those matters that, in the auditors'

professional judgement, were of most significance in the audit of

the financial statements of the current period and include the most

significant assessed risks of material misstatement (whether or not

due to fraud) identified by the auditors, including those which had

the greatest effect on: the overall audit strategy; the allocation

of resources in the audit; and directing the efforts of the

engagement team. These matters, and any comments we make on the

results of our procedures thereon, were addressed in the context of

our audit of the financial statements as a whole, and in forming

our opinion thereon, and we do not provide a separate opinion on

these matters. This is not a complete list of all risks identified

by our audit.

Key audit matter How our audit addressed the key

audit matter

ZDP shares

Refer to page 18 (Accounting Policies) We performed testing to agree

and page 20 (Notes to the Accounts). the loan balance to the loan agreement

The ZDP shares were issued on 19 and payment schedule between the

June 2017 with a pre-determined Company and Polar Capital Global

capital growth of 3% compounding Healthcare Trust plc. We also

annually. The provision for the performed testing over the income

capital growth entitlement is accounted received from the Parent Company

for as a finance cost. We focused and the appropriation to ZDP shares

on the appropriateness of the accounting to test that they have been accounted

policy for the ZDP shares and the for in accordance with this stated

loan due from the Parent, and the accounting policy.

presentation of these balances in No material misstatements were

the financial statements as set identified by our testing which

out in the requirements of accounting required reporting to those charged

standards with governance..

-----------------------------------------

How we tailored the audit scope

We tailored the scope of our audit to ensure that we performed

enough work to be able to give an opinion on the financial

statements as a whole, taking into account the structure of the

company, the accounting processes and controls, and the industry in

which it operates.

We conducted our audit in accordance with International

Standards on Auditing (UK) ("ISAs (UK)").

We designed our audit by determining materiality and assessing

the risks of material misstatement in the financial statements. In

particular, we looked at where the Directors made subjective

judgements, for example in respect of significant accounting

estimates that involved making assumptions and considering future

events that are inherently uncertain. As in all of our audits we

also addressed the risk of management override of internal

controls, including evaluating whether there was evidence of bias

by the Directors that represented a risk of material misstatement

due to fraud.

The risks of material misstatement that had the greatest effect

on our audit, including the allocation of our resources and effort,

are identified as "key audit matters" in the table above. We have

also set out how we tailored our audit to address these specific

areas in order to provide an opinion on the financial statements as

a whole, and any comments we make on the results of our procedures

should be read in this context. This is not a complete list of all

risks identified by our audit.

Materiality

The scope of our audit was influenced by our application of

materiality. We set certain quantitative thresholds for

materiality. These, together with qualitative considerations,

helped us to determine the scope of our audit and the nature,

timing and extent of our audit procedures on the individual

financial statement line items and disclosures and in evaluating

the effect of misstatements, both individually and in aggregate on

the financial statements as a whole.

Based on our professional judgement, we determined materiality

for the financial statements as a whole as follows:

Overall materiality GBP334,000 (2017: GBP325,000)

How we determined 1% of total assets.

it

---------------------------------------------------

Rationale for benchmark We have applied this benchmark, which is deemed

applied appropriate given the nature of the entity and

the balances held.

---------------------------------------------------

We agreed with the Audit Committee that we would report to them

misstatements identified during our audit above GBP16,700 (2017:

GBP16,225) as well as misstatements below that amount that, in our

view, warranted reporting for qualitative reasons.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in

relation to which ISAs (UK) require us to report to you when:

-- the directors' use of the going concern basis of accounting

in the preparation of the financial statements is not appropriate;

or

-- the directors have not disclosed in the financial statements

any identified material uncertainties that may cast significant

doubt about the company's ability to continue to adopt the going

concern basis of accounting for a period of at least twelve months

from the date when the financial statements are authorised for

issue.

However, because not all future events or conditions can be

predicted, this statement is not a guarantee as to the company's

ability to continue as a going concern.

Reporting on other information

The other information comprises all of the information in the

Annual Report other than the financial statements and our auditors'

report thereon. The directors are responsible for the other

information. Our opinion on the financial statements does not cover

the other information and, accordingly, we do not express an audit

opinion or, except to the extent otherwise explicitly stated in

this report, any form of assurance thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit, or otherwise appears to be materially misstated. If we

identify an apparent material inconsistency or material

misstatement, we are required to perform procedures to conclude

whether there is a material misstatement of the financial

statements or a material misstatement of the other information. If,

based on the work we have performed, we conclude that there is a

material misstatement of this other information, we are required to

report that fact. We have nothing to report based on these

responsibilities.

With respect to the Strategic Report and Report of the

Directors, we also considered whether the disclosures required by

the UK Companies Act 2006 have been included.

Based on the responsibilities described above and our work

undertaken in the course of the audit, the Companies Act 2006 and

ISAs (UK) require us also to report certain opinions and matters as

described below.

Strategic Report and Report of the Directors

In our opinion, based on the work undertaken in the course of the

audit, the information given in the Strategic Report and Report

of the Directors for the year ended 30 September 2018 is consistent

with the financial statements and has been prepared in accordance

with applicable legal requirements.

In light of the knowledge and understanding of the company and

its environment obtained in the course of the audit, we did not

identify any material misstatements in the Strategic Report and

Report of the Directors.

Directors' Remuneration

In our opinion, the part of the Directors' Remuneration Report

to be audited has been properly prepared in accordance with the

Companies Act 2006.

Responsibilities for the financial statements and the audit

Responsibilities of the directors for the financial

statements

As explained more fully in the Directors' Responsibilities

Statement set out on page 7, the directors are responsible for the

preparation of the financial statements in accordance with the

applicable framework and for being satisfied that they give a true

and fair view. The directors are also responsible for such internal

control as they determine is necessary to enable the preparation of

financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditors' responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditors' report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

A further description of our responsibilities for the audit of

the financial statements is located on the FRC's website at:

www.frc.org.uk/auditorsresponsibilities. This description forms

part of our auditors' report.

Use of this report

This report, including the opinions, has been prepared for and

only for the company's members as a body in accordance with Chapter

3 of Part 16 of the Companies Act 2006 and for no other purpose. We

do not, in giving these opinions, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

Other required reporting

Companies Act 2006 exception reporting

Under the Companies Act 2006 we are required to report to you

if, in our opinion:

-- we have not received all the information and explanations we require for our audit; or

-- adequate accounting records have not been kept by the

company, or returns adequate for our audit have not been received

from branches not visited by us; or

-- certain disclosures of directors' remuneration specified by law are not made; or

-- the financial statements and the part of the Directors'

Remuneration Report to be audited are not in agreement with the

accounting records and returns.

We have no exceptions to report arising from this

responsibility.

Appointment

Following the recommendation of the audit committee, we were

appointed by the directors on 30 March 2017 to audit the financial

statements for the period 30 March to 30 September 2017 and

subsequent financial periods. The period of total uninterrupted

engagement is 1.5 years, covering the period 30 March to 30

September 2017 to the year ended 30 September 2018.

Catrin Thomas (Senior Statutory Auditor)

for and on behalf of PricewaterhouseCoopers LLP

Chartered Accountants and Statutory Auditors

Edinburgh

19 December 2018

STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30 September 2018

Year ended Period 30

30 September March to

2018 30 September

2017

Notes GBP GBP

-------------- --------------

Loan interest 1 808,878 226,660

Contribution from parent 2 163,134 45,331

-------------- --------------

Total income 972,012 271,991

-------------- --------------

Total expenses 3 - -

-------------- --------------

Profit before finance costs and tax 972,012 271,991

Finance costs

Appropriation to ZDP shares 4 (972,012) (271,991)

-------------- --------------

Total finance costs (972,012) (271,991)

-------------- --------------

Result before taxation - -

Taxation 5 - -

-------------- --------------

Net result for the year/period and

total comprehensive income - -

-------------- --------------

The amounts dealt with in the Statement of Comprehensive Income

are all derived from continuing activities.

The notes to follow form part of these financial statements.

STATEMENT OF CHANGES IN EQUITY

For the year ended 30 September 2018

Year ended 30 September 2018

--------------------------------------

Called up Capital

share capital reserve Total equity

Notes GBP GBP GBP

-------------- -------- ------------

Total equity at 1 October 2017 50,000 - 50,000

Total comprehensive income:

Result for the year ended 30 September

2018 - - -

Transactions with owners, recorded

directly to equity:

Ordinary shares issued during the

year 8 - - -

-------------- -------- ------------

Total equity at 30 September 2018 50,000 - 50,000

-------------- -------- ------------

Period 30 March to 30 September

2017

--------------------------------------

Called up Capital

share capital reserve Total equity

Notes GBP GBP GBP

-------------- -------- ------------

Total equity at 30 March 2017 - - -

Total comprehensive income:

Result for the period 30 March to

30 September 2017 - - -

Transactions with owners, recorded

directly to equity:

Ordinary shares issued 50,000 @ GBP1

per share 8 50,000 - 50,000

-------------- -------- ------------

Total equity at 30 September 2017 50,000 - 50,000

-------------- -------- ------------

The notes to follow form part of these financial statements.

BALANCE SHEET

As at 30 September 2018

30 September 2018 30 September

2017

Notes GBP

----------------- -------------

Non-current assets

Loan to parent company 6 33,372,440 32,400,428

Current assets

Cash and cash equivalents 50,000 50,000

----------------- -------------

Total assets 33,422,440 32,450,428

----------------- -------------

Non-current liabilities

Zero dividend preference shares 7 (33,372,440) (32,400,428)

----------------- -------------

Total liabilities (33,372,440) (32,400,428)

----------------- -------------

Net assets 50,000 50,000

----------------- -------------

Equity attributable to equity

shareholders

Called up share capital 8 50,000 50,000

Capital reserve - -

----------------- -------------

Total equity 50,000 50,000

----------------- -------------

These financial statements of PCGH ZDP Plc were approved by the

Board of Directors and authorised for issue on 19 December 2018.

They were signed on behalf of the Board by:

James Robinson,

Chairman

The notes to follow form part of these financial statements

CASH FLOW STATEMENT

for the year ended 30 September 2018

Year ended Period 30 March

30 September to

2018 30 September

GBP 2017

GBP

Cash flows from operating activities

Profit before finance costs and taxation 972,012 271,991

------------- ---------------

Net cash inflow from operating activities 972,012 271,991

------------- ---------------

Cash flows from financing activities

Ordinary shares issued - 50,000

Proceeds from issue of ZDP shares - 32,128,437

Increase in payables (972,012) (32,400,428)

------------- ---------------

Net cash outflow from financing activities (972,012) (221,991)

------------- ---------------

Net increase in cash and cash equivalents - 50,000

Cash and cash equivalents at the beginning

of the year 50,000 -

------------- ---------------

Cash and cash equivalents at the end

of the year 50,000 50,000

------------- ---------------

The notes to follow form part of these financial statements.

NOTES TO THE FINANCIAL STATEMENTS - POLICIES

A. General Information

In line with the Company's parent, the financial statements have

been prepared in accordance with International Financial Reporting

Standards (IFRS), which comprise standards and interpretations

approved by the International Accounting Standards Board (IASB) and

International Accounting Standards Committee (IASC), as adopted by

the European Union, and with those parts of the Companies Act 2006

applicable to companies under IFRS.

The Company's presentational currency is pounds sterling. Pounds

sterling is also the functional currency of the Company because it

is the currency of the primary economic environment in which the

Company operates.

B. Accounting Policies

The principal accounting policies which have been applied

consistently throughout the year are set out below:

a) Income

(i) Loan Interest

Under a Loan Agreement the gross initial ZDP Placing proceeds

have been lent to the Parent, Polar Capital Global Healthcare Trust

plc. The Loan agreement provides that interest will accrue daily at

an annual rate of 2.5% compounded annually on each anniversary of

ZDP Admission and will be rolled up and paid to PCGH ZDP Plc along

with any repayment of the principal amount on a date falling 2

business days before the ZDP Repayment Date.

(ii) Transfer re Parent Undertaking

Polar Capital Global Healthcare Trust plc and the Company, PCGH

ZDP Plc, have entered into an Undertaking whereby to the extent

that the Final Capital Entitlement multiplied by the number of

outstanding ZDP shares as at the ZDP Repayment Date exceeds the

aggregate principal amount and accrued interest due pursuant to the

Loan Agreement as at that date (the Additional Funding

Requirement), the Parent shall : (i) subscribe for additional

subsidiary shares to a value equal to or greater than the

Additional Funding Requirement; and (ii) make a capital

contribution or gift or otherwise pay an amount equal to or greater

than the Additional Funding Requirement.

b) Finance costs

The ZDP shares are designed to provide a pre-determined capital

growth from their original issue price of 100p on 19 June 2017 to a

Final Capital Entitlement of 122.99p on 20 June 2024. The initial

capital of 100p at 19 June 2017 will increase at an interest rate

of 3% compounding annually (see note 2). The provision for the

capital growth entitlement on the ZDP shares is included as a

finance cost. No dividends are payable on the ZDP shares.

c) Taxation

Taxation is currently payable based on the taxable profits for

the year ended 30 September 2018. Taxable profit differs from net

profit as reported in the Statement of Comprehensive Income because

it excludes items of income or expense that are taxable or

deductible in other years and it further excludes items that are

never taxable or deductible. The Company's liability for current

tax is calculated using tax rates that have been enacted or

substantively enacted at the balance sheet date.

Deferred tax is the tax expected to be payable or recoverable on

temporary differences between the carrying amounts of assets and

liabilities in the financial statements and the corresponding tax

bases used in the computation of taxable profit, and is accounted

for using the balance sheet liability method. Deferred tax

liabilities are recognised for all taxable temporary differences

and deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled or the asset is

realised based on tax rates that have been enacted or substantively

enacted at the balance sheet date.

d) Investments held at Fair Value through Profit or Loss

The Company holds no investments, rather the proceeds from the

issue of the ZDP shares have been lent to the parent, Polar Capital

Global Healthcare Trust plc, for investment purposes.

e) Loan to the Parent Company

The Company provided an interest bearing loan to its parent

company, Polar Capital Global Healthcare Trust plc in the prior

year. The loan is carried at amortised cost, which represents the

initial cost of the loan plus accrued interest and any contribution

due from the parent to meet the total ZDP entitlement.

f) Cash and Cash Equivalents

Cash comprises cash on hand and demand deposits. Cash

equivalents are short-term, highly liquid investments that are

readily convertible to known amounts of cash.

g) New and revised accounting standards

No new IFRS, or amendments to IFRS, became applicable in the

year which had any impact on the Company's financial

statements.

At the date of authorisation of these financial statements, the

following new IFRSs that potentially impact the Company are in

issue but are not yet effective and have not been applied in these

financial statements:

IFRS 9 Financial Instruments, effective for periods beginning on

or after 1 January 2018.

The requirement of IFRS9 and its application to the assets and

liabilities held by the Company were considered ahead of its

adoption. All assets and liabilities held by the Company are

currently recorded at amortized cost. The measurement approach of

all assets and liabilities remains unchanged under IFRS9 other than

the impact of expected credit loss on financial assets held at

amortised cost.

Upon adoption of IFRS 9 the zero dividend preference shares will

continue to be classified and accounted for at amortised cost.

Therefore, the adoption of IFRS 9 will result in re-evaluation of

the impairment model for financial assets to align to the

requirements of IFRS9 and the need to measure impairment based on

expected rather than incurred losses. This will require the

estimation of an expected credit loss of those financial

instruments. The measurement of financial liabilities remains

unchanged under IFRS9.

Where financial assets have not had a significant increase in

credit risk since origination the expected credit loss is based on

the expected loss in the next 12 months. The Directors believe that

there has not been a significant increase in credit risk since

origination and believe that the impact of any expected loss

provision on the financial assets would be immaterial.

Effective for periods commencing on or after 1 January 2018:

-- IFRS15, Revenue with Contracts with Customers.

-- IFRS2 (amended) Classification and Measurement of Share-based payment transactions.

-- IFRIC22 Foreign currency transactions and advance consideration.

-- Annual Improvement Cycles 2015-2017.

Effective for periods commencing on or after 1 January 2019:

-- IFRS 16 Leases.

-- IFRIC 23 Uncertainty over Income Tax Treatments.

-- IAS 19 (amended) Employee Benefits.

-- IAS 28 (amended) Investments in Associates and Joint Ventures.

The Directors expect that the adoption of the standards listed

above will have either no impact or that any impact will not be

material on the Financial Statements of the Company in future

periods.

h) Segmental Reporting

Under IFRS 8, 'Operating Segments', operating segments are

considered to be the components of an entity about which separate

financial information is available that is evaluated regularly by

the chief operating decision maker in deciding how to allocate

resources and in assessing performance. The chief operating

decision maker has been identified as the Investment Manager (with

oversight from the Board). The Directors are of the opinion that

the Company has only one operating segment and as such no distinct

segmental reporting is required.

i) Key Estimates and Judgements

Estimates and assumptions used in preparing the financial

statements are reviewed on an ongoing basis and are based on

historical experience and various other factors that are believed

to be reasonable under the circumstances. The results of these

estimates and assumptions form the basis of making judgements about

carrying values of assets and liabilities that are not readily

apparent from other sources. The Company does not consider that

there have been any significant estimates or assumptions in the

current financial year.

NOTES TO THE FINANCIAL STATEMENTS - NOTES

1. Loan Interest

Under a Loan Agreement the gross initial ZDP Placing proceeds

have been lent to the Parent. The Loan Agreement provides that

interest will accrue daily at an annual rate of 2.5% compounded

annually.

2. Contribution from parent

The contribution represents the additional funding required from

the parent to meet the entitlement due to the ZDP shareholders at

the year end. The contribution from the parent as at 30 September

2018 was GBP163,134 (2017: GBP45,331)

3. Total expenses

The Directors receive no remuneration in respect of their

services to the Company. Auditors' fees for audit services are paid

by the Company's parent, Polar Capital Global Healthcare Trust plc

and amounted to GBP4,600 (2017: GBP4,500).

4. Finance costs

The ZDP shares are designed to provide a pre-determined capital

growth from their original issue price of 100p on 19 June 2017 to a

final capital entitlement of 122.99p on 20 June 2024. The initial

capital of 100p at 19 June 2017 will increase at a growth rate of

3% compounding annually. The provision for the capital growth

entitlement for the period on the ZDP shares is included as a

finance cost.

5. Taxation

Year ended Period 30 March

30 September to

2018 30 September

GBP 2017

GBP

-------------- ----------------

a) Analysis of tax charge for the year:

Corporation tax - -

-------------- ----------------

Total tax for the year - -

-------------- ----------------

b) Factors affecting tax charge for

the year:

The charge for the year can be reconciled to the result per

the Statement of Comprehensive Income as follows:

Result before tax -- -

-------------- ----------------

Total tax for the year - -

-------------- ----------------

6. Loan to parent company

Year ended Period 30 March

30 September to

2018 30 September

GBP 2017

GBP

-------------- ----------------

Opening balance as at 1 October 2017 32,400,428 -

Initial loan - proceeds from ZDP share

issue - 32,128,437

Loan interest accrued 808,878 226,660

Additional contribution to meet ZDP

entitlement 163,134 45,331

-------------- ----------------

At 30 September 2018 33,372,440 32,400,428

-------------- ----------------

The carrying value of receivables approximates to its fair

value.

7. Zero dividend preference shares

Year ended Period 30 March

30 September to

2018 30 September

GBP 2017

GBP

-------------- ----------------

Opening balance as at 1 October 2017 32,400,428 -

Initial subscription of 32,128,437

ZDP shares @ 100 pence per share - 32,128,437

Capital growth entitlement of ZDP shares 972,012 271,991

-------------- ----------------

At 30 September 2018 33,372,440 32,400,428

-------------- ----------------

8. Called up share capital

Year ended Period 30 March

30 September to

2018 30 September

GBP 2017

GBP

-------------- ----------------

Allotted, called up and fully paid:

50,000 Ordinary shares of GBP1 each: 50,000 -

Issue of nil (2017: 50,000) ordinary

shares - 50,000

-------------- ----------------

At 30 September 2018 50,000 50,000

-------------- ----------------

9. Parent undertaking and controlling party

At 30 September 2018 the Company was a wholly owned subsidiary

undertaking of Polar Capital Global Healthcare Trust plc, a Company

registered in England and Wales, number 07251471. Copies of the

ultimate parent undertaking's consolidated financial statements may

be obtained from the Company Secretary, Polar Capital Partners LLP,

16 Palace Street, London SW1E 5JD.

10. Financial instruments - Risk management policies and

procedures for the Company

The Company's exposure to financial instruments can

comprise:

(i) Cash, liquid resources and long-term receivables and

payables that arise directly from the Company's operations.

The main risks arising from financial instruments are liquidity

risk, credit risk and market risk. The risks have remained

unchanged since the beginning of the period to which these

financial statements relate and are summarised below:

(a) Liquidity risk

The Company's assets comprise cash and long-term receivables

which it is expected will be collectable to meet ZDP funding

requirements.

(b) Credit risk

This is the risk that a counterparty to a financial instrument

will fail to discharge an obligation or commitment that it has

entered into with the Company. As at the year ended 30 September

2018, the Company's financial assets which are exposed to credit

risk is the loan to the parent company, Polar Capital Global

Healthcare Trust plc, and it amounted to GBP33,372,440 (period 30

March to 30 September 2017: GBP32,400,428)

The Company does not consider this risk to be significant as it

has limited exposure to third parties in respect of amounts

receivable. Cash balances are only deposited with financial

institutions with a high credit rating. The Company assesses all

external counterparties for the credit risk before contracting with

them.

(c) Market risk

The Company has no direct exposure to market risk as it does not

hold or trade any direct investment positions.

11. Related party

The Company provided an interest bearing loan to its parent

company, Polar Capital Global Healthcare Trust plc in the prior

year. The loan is carried at amortised cost, which represents the

initial cost of the loan plus accrued interest and any contribution

due from the parent to meet the total ZDP entitlement. At the year

end, GBP33,372,440 was due from the parent company in respect of

the loan.

NOTICE OF ANNUAL GENERAL MEETING of PCGH ZDP PLC (the

Company)

NOTICE IS HEREBY GIVEN that the ANNUAL GENERAL MEETING of the

Company will be held at 2.00p.m. or immediately following the

conclusion of the Annual General Meeting of the parent company

Polar Capital Global Healthcare Trust Plc (whichever is the

earlier), on Wednesday, 27 February 2019 at the offices of Polar

Capital LLP, 16 Palace Street, London SW1E 5JD, for the transaction

of the business as detailed below.

To consider and if thought fit to pass the following Resolutions

of which resolutions 1-4 and 6 will be proposed as Ordinary

Resolutions and resolution 5 will be proposed as a Special

Resolution:

Ordinary Business

1. To receive the Report of the Directors and the audited

financial statements for the year ended 30 September 2018.

2. To receive and approve the Directors' Remuneration

Implementation Report for the year ended 30 September 2018.

3. To re-appoint PricewaterhouseCoopers LLP as Auditors to the

Company to hold office until the conclusion of the next Annual

General Meeting of the Company.

4. To authorise the Directors to determine the remuneration of the Auditors.

Special Business

5. THAT the Company be and is hereby generally and

unconditionally authorised pursuant to Section 701 of the Companies

Act 2006 (the "Act") to make market purchases (within the meaning

of Section 693 of the Act) of zero dividend preference (ZDP) shares

of 1 pence each in the capital of the Company, on such terms and in

such manner as the Directors may from time to time determine

PROVIDED THAT:

a. the maximum number of ZDP shares hereby authorised to be

purchased shall be 4,816,052; or such number representing

approximately 14.99% of the issued share capital at 27 February

2019;

b. the minimum price excluding expenses which may be paid for an ZDP share is 1 pence;

c. the maximum price excluding expenses payable by the Company

for each ZDP share is the higher of:

i. 105 per cent. of the average of the middle-market quotations

of the ZDP shares for the five business days prior to the date of

the market purchase; and

ii. the price of the last independent trade and the highest

current independent bid for a ZDP share on the trading venues where

the market purchases by the Company pursuant to the authority

conferred by this Resolution 5 will be carried out.

d. the authority hereby conferred shall expire at the conclusion

of the next AGM of the Company, unless such authority is renewed

prior to such time;

e. the Company may make a contract to purchase ZDP shares under

the authority hereby conferred prior to the expiry of such

authority which will or may be executed wholly or partly after the

expiration of such authority and may make a purchase of ordinary

shares pursuant to any such contract; and

f. any ZDP shares so purchased shall be cancelled immediately upon completion of the purchase.

6. THAT a general meeting, other than an annual general meeting,

may be called on not less than 14 clear days' notice.

BY ORDER OF THE BOARD

Tracey Lago, ACIS

Polar Capital Secretarial Services Limited

Company Secretary

19 December 2018

Registered office: 16 Palace Street, London SW1E 5JD

NOTES TO THE NOTICE OF ANNUAL GENERAL MEETING of PCGH ZDP PLC

(the Company)

1. The holders of the Ordinary shares have the right to receive

notice, attend, speak and vote at the Annual General Meeting.

Holders of ZDP shares have the right to receive notice of general

meetings of the Company but do not have any right to attend, speak

or vote at any general meeting of the Company unless the business

of the meeting includes any resolution to vary, modify or abrogate

any of the special rights attached to ZDP shares.

2. A member entitled to attend, vote and speak at this meeting

may appoint one or more persons as his/her proxy to attend, speak

and vote on his/her behalf at the meeting. A proxy need not be a

member of the Company. If multiple proxies are appointed, they must

not be appointed in respect of the same shares. To be effective,

the enclosed form of proxy, together with any power of attorney or

other authority under which it is signed or a certified copy

thereof, should be lodged at the office of the Company Secretary,

16 Palace Street, London SW1E 5JD not later than 48 hours before

the time of the meeting. The appointment of a proxy will not

prevent a member from attending the meeting and voting and speaking

in person if he/she so wishes. A member present in person or by

proxy shall have one vote on a show of hands and on a poll, shall

have one vote for every Ordinary share of which he/she is the

holder.

3. A person to whom this notice is sent who is a person

nominated under Section 146 of the Companies Act 2006 to enjoy

information rights (a "Nominated Person") may, under an agreement

between him/her and the shareholder by whom he/she was nominated,

have a right to be appointed (or to have someone else appointed) as

a proxy for the Annual General Meeting. If a Nominated Person has

no such proxy appointment or does not wish to exercise it, he/she

may, under any such agreement, have a right to give instructions to

the shareholder as to the exercise of voting rights. The statements

of the rights of members in relation to the appointment of proxies

in Note 2 above do not apply to a Nominated Person. The rights

described in that Note can only be exercised by registered members

of the Company.

4. As at 19 December 2018 (being the last business day prior to

the publication of this notice) the Company's issued voting share

capital and total voting rights amounted to 50,000 Ordinary shares

of 100 pence each. In addition, there are 32,128,437 ZDP shares of

1 pence each nominal value in issue with no voting rights

attached.

5. The Company specifies that only those Ordinary shareholders

registered on the Register of Members of the Company as at 2.00pm

on 25 February 2019 (or in the event that the meeting is adjourned,

only those shareholders registered on the Register of Member of the

Company as at 11.30am on the day which is 48 hours prior to the

adjourned meeting) shall be entitled to attend in person or by

proxy and vote at the Annual General Meeting in respect of the

number of shares registered in their name at that time. Changes to

entries on the Register of Members after that time shall be

disregarded in determining the rights of any person to attend or

vote at the meeting.

6. Any question relevant to the business of the Annual General

Meeting may be asked at the meeting by anyone permitted to speak at

the meeting. You may alternatively submit your question in advance

by letter addressed to the Company Secretary at the registered

office.

7. In accordance with Section 319A of the Companies Act 2006,

the Company must cause any question relating to the business being

dealt with at the meeting put by a member attending the meeting to

be answered. No such answer need be given if:

a. to do so would:

i. Interfere unduly with the preparation for the meeting, or

ii. Involve the disclosure of confidential information;

b. the answer has already been given on a website in the form of

an answer to a question; or

c. it is undesirable in the interests of the Company or the good

order of the meeting that the question be answered.

8. Shareholders should note that it is possible that, pursuant

to requests made by shareholders of the Company under section 527

of the Companies Act 2006, the Company may be required to publish

on a website a statement setting out any matter relating to: (i)

the audit of the Company's accounts (including the auditors report

and the conduct of the audit) that are to be laid before the Annual

General Meeting; or (ii) any circumstances connected with an

auditor of the Company ceasing to hold office since the previous

meeting at which annual accounts and reports were laid in

accordance with section 437 of the Companies Act 2006. The Company

may not require the shareholders requesting any such website

publication to pay its expenses in complying with sections 527 or

528 of the Companies Act 2006. Where the Company is required to

place a statement on a website under section 527 of the Companies

Act 2006, it must forward the statement to the Company's auditor

not later than the time when it makes the statement available on

the website. The business which may be dealt with at the Annual

General Meeting includes any statement that the Company has been

required under section 527 of the Companies Act 2006 to publish on

a website.

9. A person authorised by a corporation is entitled to exercise

(on behalf of the corporation) the same powers as the corporation

could exercise if it were an individual member of the Company

(provided, in the case of multiple corporate representatives of the

same corporate shareholder, they are appointed in respect of

different shares owned by the corporate shareholder or, if they are

appointed in respect of those same shares, they vote those shares

in the same way). To be able to attend and vote at the meeting,

corporate representatives will be required to produce prior to

their entry to the meeting evidence satisfactory to the Company of

their appointment. Corporate shareholders can also appoint one or

more proxies in accordance with Note 2. On a vote on a resolution

on a show of hands, each authorised person has the same voting

rights to which the corporation would be entitled. On a vote on a

resolution on a poll, if more than one authorised person purports

to exercise a power in respect of the same shares:

a. if they purport to exercise the power in the same was as each

other, the power is treated as exercised in that way;

b. if they do not purport to exercise the power in the same way

as each other, the power is treated as not exercised.

10. Members satisfying the thresholds in Section 338 of the

Companies Act 2006 may require the Company to give, to members of

the Company entitled to receive notice of the Annual General

Meeting, notice of a resolution which those members intend to move

(and which may properly be moved) at the Annual General Meeting. A

resolution may properly be moved at the Annual General Meeting

unless (i) it would, if passed, be ineffective (whether by reason

of any inconsistency with any enactment or the Company's

constitution or otherwise); (ii) it is defamatory of any person; or

(iii) it is frivolous or vexatious. A request made pursuant to this

right may be in hard copy or electronic form, must identify the

resolution of which notice is to be given, must be authenticated by

the person(s) making it and must be received by the Company not

later than six weeks before the date of the Annual General

Meeting.

11. Members satisfying the thresholds in Section 338A of the

Companies Act 2006 may request the Company to include in the

business to be dealt with at the Annual General Meeting any matter

(other than a proposed resolution) which may properly be included

in the business at the Annual General Meeting. A matter may

properly be included in the business at the Annual General Meeting

unless (i) it is defamatory of any person or (ii) it is frivolous

or vexatious. A request made pursuant to this right may be in hard

copy or electronic form, must identify grounds for the request,

must be authenticated by the person(s) making it and must be

received by the Company not later than six weeks before the date of

the Annual General Meeting.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR ZKLFFVLFEFBD

(END) Dow Jones Newswires

December 19, 2018 10:19 ET (15:19 GMT)

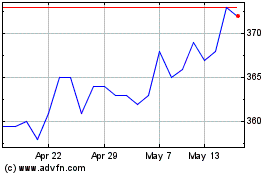

Polar Capital Global Hea... (LSE:PCGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Polar Capital Global Hea... (LSE:PCGH)

Historical Stock Chart

From Jul 2023 to Jul 2024