ONESAVINGS BANK PLC Directorate Change

March 19 2020 - 1:29PM

UK Regulatory

TIDMOSB

LEI: 213800WTQKOQI8ELD692

OneSavings Bank plc ("OSB")

Directorate Changes

OneSavings Bank plc, the specialist lending and retail savings bank,

announces that Non-Executive Directors Tim Brooke, Margaret Hassall and

Ian Ward have each decided that they will not stand for election or

re-election at the annual general meeting on 7 May 2020.

Andy Golding, Chief Executive of OSB, said: "On behalf of the OSB Board

and executive team I would like to thank Tim, Margaret and Ian for their

guidance and contributions on the Board, and wish them well in their

future endeavours."

David Weymouth, Chairman, said: "On behalf of the entire OSB Board I

would like to thank Tim, Margaret and Ian for their significant

contributions, particularly during the combination with Charter Court

Financial Services Group plc last year."

Enquiries:

OneSavings Bank plc

Alastair Pate t: 01634 838 973

Brunswick Group

Robin Wrench/Simone Selzer t: 020 7404 5959

About OneSavings Bank plc

OneSavings Bank plc ("OSB") began trading as a bank on 1 February 2011

and was admitted to the main market of the London Stock Exchange in June

2014 (OSB.L). OSB joined the FTSE 250 index in June 2015. On 4 October

2019, OSB acquired Charter Court Financial Services Group plc ("CCFSG")

and its subsidiary businesses. OSB is a specialist lending and retail

savings group authorised by the Prudential Regulation Authority, part of

the Bank of England, and regulated by the Financial Conduct Authority

and Prudential Regulation Authority.

OSB primarily targets market sub-sectors that offer high growth

potential and attractive risk-adjusted returns in which it can take a

leading position and where it has established expertise, platforms and

capabilities. These include private rented sector Buy-to-Let, commercial

and semi-commercial mortgages, residential development finance, bespoke

and specialist residential lending, secured funding lines and asset

finance.

OSB originates mortgages organically via specialist brokers and

independent financial advisers through its specialist brands including

Kent Reliance for Intermediaries, InterBay Commercial and Prestige

Finance. It is differentiated through its use of highly skilled, bespoke

underwriting and efficient operating model.

OSB is predominantly funded by retail savings originated through the

long-established Kent Reliance name, which includes online and postal

channels as well as a network of branches in the South East of England.

Diversification of funding is currently provided by securitisation

programmes, the Term Funding Scheme and the Bank of England Indexed

Long-Term Repo operation.

(END) Dow Jones Newswires

March 19, 2020 13:29 ET (17:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

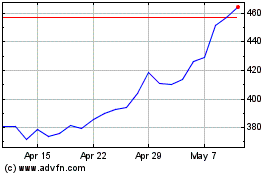

Osb (LSE:OSB)

Historical Stock Chart

From Jun 2024 to Jul 2024

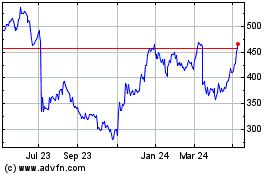

Osb (LSE:OSB)

Historical Stock Chart

From Jul 2023 to Jul 2024