Ocado Group Signs Services Agreement with Kroger

October 30 2018 - 4:10AM

Dow Jones News

By Maryam Cockar

Ocado Group PLC (OCDO.LN) said Tuesday that it has agreed

service and operational terms with U.S. retailer Kroger Co. (KR)

for a partnership between the two companies.

Under the agreement, which was first announced in May, Kroger

will order 20 customer-fulfillment centers over the first three

years of the deal, and the first three centers by the end of 2018.

The deal will consist of up-front fees and ongoing capacity

fees.

Ocado said it will install and maintain mechanical handling

equipment for Kroger's customer-fulfillment centers, which are

expected to go live within about two years of each order being

placed.

Ocado said in order to expedite the opening of the centers in

the U.S., the first centers ordered this year will have funding

requirements similar to earlier deals.

Ocado expects the earnings impact of the deal to be neutral in

fiscal 2018. Until the final funding structure has been finalized,

Ocado will finance Kroger's centers on a similar basis to previous

deals, the company said.

The expected peak net outflow for Ocado for the three centers is

90 million pounds ($115.4 million) and Ocado said with over GBP500

million of financing headroom, it is more than able to cover

this.

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

October 30, 2018 03:55 ET (07:55 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

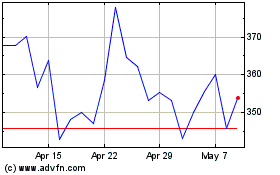

Ocado (LSE:OCDO)

Historical Stock Chart

From Apr 2024 to May 2024

Ocado (LSE:OCDO)

Historical Stock Chart

From May 2023 to May 2024