TIDMNTBR

RNS Number : 6636T

Northern Bear Plc

26 November 2021

26 November 2021

Northern Bear plc

("Northern Bear" or the "Company")

Interim results for the six month period ended 30 September

2021

The board of directors of Northern Bear (the "Board") is pleased

to announce the unaudited interim results for the Company and its

subsidiaries (together the "Group") for the six months to 30

September 2021.

Financial Summary

-- Revenue of GBP30.0m (H1 2020: GBP20.1m)

-- Adjusted operating profit* of GBP1.5 m (H1 2020: GBP0.5m)

-- Net cash of GBP0.6m at 30 September 2021

-- Robust trading performance despite industry-wide supply chain

disruptions and staffing challenges

-- Positive outlook for the second half of the financial year

-- Appointment of two new independent non-executive Directors

with significant corporate, financial, and real estate

experience

* stated prior to the impact of amortisation and impairment

charges

Jeff Baryshnik, Non-Executive Chairman of Northern Bear,

commented:

"We are pleased to announce strong operating results for the

period, despite ongoing industry-wide challenges."

"It is a testament to the executive team and subsidiary

operating teams that these results exceed those from the comparable

pre-pandemic period for the six months ended 30 September 2019.

With a strong order book, we are well positioned to continue to

generate a more normalised level of profitability."

For further information please contact:

+44 (0) 166

Northern Bear plc 182 0369

Jeff Baryshnik - Non-Executive Chairman +44 (0) 166

Tom Hayes - Finance Director 182 0369

Strand Hanson Limited (Nominated Adviser

and Broker)

James Harris +44 (0) 20 7409

James Bellman 3494

Chairman's Statement

Introduction

I am pleased to report the unaudited interim results for the six

months ended 30 September 2021 (the "Period") for Northern Bear plc

(the "Company" and, together with its subsidiaries, the

"Group").

Further to the recent trading update, I am pleased to confirm

the Group's results for the Period, with adjusted operating profit

(stated prior to the impact of amortisation and impairment charges)

of GBP1.5m (H1 2020: GBP0.5m) and diluted earnings per share of

6.1p (H1 2020: 13.2p diluted loss per share).

In our last Annual Report and Accounts published in July 2021,

we noted the industry-wide challenges with respect to both

availability and price inflation of construction materials. There

also have been well-publicised challenges in relation to attracting

and retaining employees in the construction industry. Despite the

impact of these headwinds on our businesses, our Group generated

strong operating results that exceeded those of the comparable

pre-pandemic period for the six months ended 30 September 2019.

Trading

Despite industry-wide challenges, our Group companies generated

strong results in aggregate during the Period. Our roofing division

was somewhat more adversely impacted by materials shortages than

the other divisions, but our companies have strong and

well-established supplier relationships and have been able, on the

whole, to work with our robust supply chain to ensure continuity of

supply for contracts

Revenue for the Period was GBP30.0m (H1 2020: GBP20.1m) and,

through the greater economy of scale from higher revenues along

with continued careful contract selection and execution, gross

margins materially exceeded those of the period ending 30 September

2020 ("Prior Period") at 19.5% (H1 2020: 14.5%).

Administrative expenses increased to GBP4.5m (H1 2020: GBP3.8m)

due to both an element of semi-variable costs in the overhead base

and the voluntary and temporary wage reductions incurred by Group

directors during the Prior Period.

Overall profit before income tax for the Period was GBP1.4m (H1

2020: GBP2.4m loss) and diluted earnings per share was 6.1p (H1

2020: 13.2p diluted loss per share).

Cash flow

Net cash at 30 September 2021 was GBP0.6m (30 September 2020:

GBP0.6m, 31 March 2021: GBP2.1m).

We had stated in the March 2021 results that the cash position

at 31 March 2021 reflected some favourable working capital swings

which to an extent would be expected to reverse post year-end. This

was the case, and the current customer and contract mix has an

increased working capital requirement which reduced the cash

balance during the Period.

As we have emphasised previously, the net cash/bank debt

position represents a snapshot at a particular point in time and

our net cash/bank debt position can move by up to GBP1.5m in a

matter of days given the nature, size and variety of contracts and

their associated working capital requirements. The highest bank

position during the Period was GBP2.5m net cash, the lowest net

bank debt position during the period was GBP1.2m net bank debt, and

the average was GBP0.1m net cash.

Our existing GBP3.5m revolving credit facility with Virgin Money

plc (previously known as Yorkshire Bank) was renewed in March 2020

and provides us with committed working capital facilities to May

2023, along with a GBP1m overdraft facility which is renewable

annually.

Strategy and Dividend

Following recent Board appointments, as detailed below, I have

commenced a process of engaging with the Board and management to

discuss and review the Group's strategy and approach to capital

allocation, including the dividend policy. Once this process is

completed, we will provide further information to shareholders. Our

existing policy is to pay only a final dividend, at the Board's

discretion, and to assess future dividend levels in line with the

Group's relative performance, after taking into account the Group's

available cash, working capital requirements, corporate

opportunities, debt obligations, and the macro economic environment

at the relevant time.

Outlook

Our forward order book remains strong and should support our

trading performance in the coming months, subject to the ongoing

supply chain and staffing challenges noted above and the

uncertainty over the long-term outlook for the COVID-19

pandemic.

People and Board changes

As announced on 11 November 2021, I am pleased that Harry Samuel

and Anil Khera were appointed to the Board as non-executive

directors effective as of that date.

Anil Khera began his career at Credit Suisse, within DLJ Real

Estate Capital Partners, before joining Blackstone's real estate

investment team in 2006 where he spent 10 years, becoming a

managing director of the Real Estate Capital Markets team in 2011.

In 2016, Mr Khera founded Node Living, a fully integrated

residential investment, development and management company based in

London which operates across Europe and North America.

Harry Samuel spent over 20 years across various leadership roles

within Royal Bank of Canada (RBC). This included roles as Global

Head of Funding and Liquidity Asset Management, Foreign Exchange

and Commodities, and Fixed Income and Currencies, before becoming

CEO of RBC Capital Markets Europe in 2011 and subsequently CEO of

RBC Investor & Treasury Services and Chair of RBC's European

Executive Committee from 2013 to 2019. Mr Samuel currently serves

as CEO of Affordable Housing Communities Limited and Managing

Director of Affordable Housing and Healthcare Group Limited, a

leading UK developer, constructor and operator of shared ownership

communities working in partnership with local authorities, NHS

Trusts and institutional investors to create socially impactful

developments.

The Company also announces that, further to the Company's

announcement of 24 August 2021, John Holroyd has retired from the

Board. Steve Roberts, formerly Executive Chairman, resigned as a

Director of the Company on 24 August and continues to be part of

the Group's operational management team and a Director of all our

subsidiary companies. The Board and I would like to thank John and

Steve for their contributions as Directors of the Company.

Conclusion

I am pleased to report a strong set of results for the Period

that exceeded those of the comparable pre-pandemic period for the

six months ended 30 September 2019 despite widespread industry

challenges. As always, our loyal, dedicated and skilled workforce

is a key part of our success, and we make every effort to support

them through continued training and health and safety compliance. I

would once more like to thank all of our employees for their hard

work and contribution.

Jeff Baryshnik

Non-Executive Chairman

26 November 2021

Consolidated statement of comprehensive income

for the six month period ended 30 September 2021

6 months ended 6 months ended Year ended

30 September 30 September

2021 2020 31 March 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 29,973 20,105 49,182

Cost of sales (24,114) (17,190) (40,726)

--------------- --------------- --------------

Gross profit 5,859 2,915 8,456

Other operating income 86 1,366 1,549

Administrative expenses (4,459) (3,806) (8,640)

--------------- --------------- --------------

Operating profit (before

amortisation and other

adjustments) 1,486 475 1,365

--------------- --------------- --------------

Impairment charge - (2,807) (2,807)

Amortisation of intangible

assets arising on acquisitions (7) (16) (13)

--------------- --------------- --------------

Operating profit/(loss) 1,479 (2,348) (1,455)

Finance costs (65) (68) (176)

--------------- --------------

Profit/(loss) before income

tax 1,414 (2,416) (1,631)

Income tax expense (270) (60) (162)

--------------- --------------- --------------

Profit/(loss) for the period 1,144 (2,476) (1,793)

--------------- --------------- --------------

Total comprehensive income/(loss)

attributable to equity

holders of the parent 1,144 (2,476) (1,793)

=============== =============== ==============

Earnings per share from

continuing operations

Basic earnings/(loss) per

share 6.1p (13.3p) (9.6p)

Diluted earnings/(loss)

per share 6.1p (13.2p) (9.6p)

Consolidated balance sheet

at 30 September 2021

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 3,893 3,375 3,596

Right of use asset 1,183 1,198 1,094

Intangible assets 18,037 18,040 18,044

Trade and other receivables 1,006 1,080 872

Total non-current assets 24,119 23,693 23,606

Inventories 1,080 881 974

Trade and other receivables 12,010 10,673 9,843

Cash and cash equivalents 563 569 2,114

Total current assets 13,653 12,123 12,931

------------- ------------- ---------

Total assets 37,772 35,816 36,537

============= ============= =========

Equity

Share capital 190 190 190

Capital redemption reserve 6 6 6

Share premium 5,169 5,169 5,169

Merger reserve 9,703 9,703 9,703

Retained earnings 8,362 6,535 7,218

Total equity attributable to

equity holders of the Company 23,430 21,603 22,286

============= ============= =========

Liabilities

Deferred consideration 50 50 -

Trade and other payables - - 122

Lease liabilities 1,078 1,114 1,039

Deferred tax liabilities 487 294 487

Total non-current liabilities 1,615 1,458 1,648

------------- ------------- ---------

Loans and borrowings 22 31 28

Deferred consideration - 50 50

Trade and other payables 11,703 11,705 11,936

Lease liabilities 565 571 533

Current tax payable 437 398 56

Total current liabilities 12,727 12,755 12,603

------------- ------------- ---------

Total liabilities 14,342 14,213 14,251

============= ============= =========

Total equity and liabilities 37,772 35,816 36,537

============= ============= =========

Consolidated statement of changes in equity

for the six month period ended 30 September 2021

Capital

Share redemption Share Merger Retained Total

capital reserve premium reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2020 190 6 5,169 9,703 9,011 24,079

Total comprehensive income

for the period

Loss for the period - - - - (2,476) (2,476)

At 30 September 2020 190 6 5,169 9,703 6,535 21,603

========= ============ ========= ========= ========== ========

At 1 April 2020 190 6 5,169 9,703 9,011 24,079

Total comprehensive income

for the year

Loss for the year - - - - (1,793) (1,793)

At 31 March 2021 190 6 5,169 9,703 7,218 22,286

========= ============ ========= ========= ========== ========

At 1 April 2021 190 6 5,169 9,703 7,218 22,286

Total comprehensive income

for the period

Profit for the period - - - - 1,144 1,144

At 30 September 2021 190 6 5,169 9,703 8,362 23,430

========= ============ ========= ========= ========== ========

Consolidated statement of cash flows

for the six month period ended 30 September 2021

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Operating profit/(loss) for

the period 1,479 (2,348) (1,455)

Adjustments for:

Depreciation of property,

plant and equipment 312 283 600

Depreciation of lease asset 174 185 373

Amortisation 7 16 13

Impairment charge - 2,807 2,807

Profit/(loss) on sale of property,

plant and equipment (5) 2 -

1,967 945 2,338

Change in inventories (106) 126 33

Change in trade and other

receivables (2,301) (2,472) (1,434)

Change in trade and other

payables (355) 2,514 2,867

--------------- --------------- -----------

Cash (used in)/generated from

operations (795) 1,113 3,804

Interest paid (42) (33) (176)

Tax paid 111 - (252)

--------------- --------------- -----------

Net cash flow from operating

activities (726) 1,080 3,376

--------------- --------------- -----------

Cash flows from investing

activities

Proceeds from sale of property,

plant and equipment 240 218 420

Acquisition of property, plant

and equipment (727) (591) (1,200)

Acquisition of subsidiary

(net of cash acquired) - - (50)

--------------- --------------- -----------

Net cash from investing activities (487) (373) (830)

--------------- --------------- -----------

Cash flows from financing

activities

Repayment of borrowings (6) (3,500) (3,503)

Repayment of lease liabilities (332) (296) (587)

Net cash from financing activities (338) (3,796) (4,090)

--------------- --------------- -----------

Net decrease in cash and cash

equivalents (1,551) (3,089) (1,544)

Cash and cash equivalents

at start of period 2,114 3,658 3,658

Cash and cash equivalents

at end of period 563 569 2,114

=============== =============== ===========

1. Basis of preparation

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted for

use in the UK. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 March 2021 Annual Report

and Financial Statements. The financial information for the half

years ended 30 September 2021 and 30 September 2020 does not

constitute statutory accounts within the meaning of Section 434 (3)

of the Companies Act 2006 and both periods are unaudited. The

financial information has not been prepared (and is not required to

be prepared) in accordance with IAS 34 Interim Financial

Reporting.

The annual consolidated financial statements of Northern Bear

plc (the "Company", or, together with its subsidiaries, the

"Group") are prepared in accordance with International Financial

Reporting Standards in conformity with the Companies Act 2006. The

comparative financial information for the year ended 31 March 2021

included within this report does not constitute the full statutory

Annual Report for that period. The statutory Annual Report and

Financial Statements for the year ended 31 March 2021 have been

filed with the Registrar of Companies. The Independent Auditors'

Report on the Annual Report and Financial Statements for the year

ended 31 March 2021 was i) unqualified, ii) did not draw attention

to any matters by way of emphasis, and iii) did not contain a

statement under 498(2) - (3) of the Companies Act 2006.

2. Accounting policies

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2021 annual financial statements, as set out in Notes 2 and

3 of that document, except for those that relate to new standards

and interpretations effective for the first time for periods

beginning on (or after) 1 April 2021, and will be adopted in the

2022 financial statements. The accounting policies applied are

based on the recognition and measurement principles of IFRS in

issue as adopted by the UK and are effective at 31 March 2022 or

are expected to be adopted and effective at 31 March 2022.

New and amended standards and interpretations issued by the IASB

that will apply for the first time in the next annual financial

statements include:

-- Interest Rate Benchmark Reform - Phase 2 (Amendments to IFRS

9, IAS 39, IFRS 7, IFRS 4 and IFRS 16) - effective date on or after

1 January 2021.

-- Covid 19-Related Rent Concessions Beyond 30 June 2021

(Amendment to IFRS 16 Leases) - effective date on or after 1 April

2021.

Adoption of the above standards and interpretations is not

expected to have a material impact on the Group's financial

statements.

3. Taxation

The taxation charge for the six months ended 30 September 2021

is calculated by applying the Directors' best estimate of the

annual effective tax rate to the profit for the period.

4. Earnings per share

Basic earnings per share is the profit or loss for the period

divided by the weighted average number of ordinary shares

outstanding, excluding those held in treasury, calculated as

follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

Profit/(loss) for the period

(GBP'000) 1,144 (2,476) (1,793)

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held

in treasury for the proportion

of the year held in treasury

('000) 18,665 18,665 18,665

Basic earnings/(loss) per share 6.1p (13.3p) (9.6p)

------------- ------------- -----------

The calculation of diluted earnings per share is the profit or

loss for the period divided by the weighted average number of

ordinary shares outstanding, after adjustment for the effects of

all potential dilutive ordinary shares, excluding those in

treasury, calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

Profit/(loss) for the period

(GBP'000) 1,144 (2,476) (1,793)

------------- ------------- -----------

Weighted average number of

ordinary shares excluding shares

held in treasury for the proportion

of the year held in treasury

('000) 18,665 18,665 18,665

Effect of potential dilutive

ordinary shares ('000) 43 46 43

------------- ------------- -----------

Diluted weighted average number

of ordinary shares excluding

shares held in treasury for

the proportion of the year

held in treasury ('000) 18,708 18,711 18,708

------------- ------------- -----------

Diluted earnings/(loss) per

share 6.1p (13.2p) (9.6p)

------------- ------------- -----------

The following additional earnings per share figures are

presented as the directors believe they provide a better

understanding of the trading performance of the Group.

Adjusted basic and diluted earnings per share is the profit or

loss for the period, adjusted for impairment charges, acquisition

related items, and transaction and other one-off costs, divided by

the weighted average number of ordinary shares outstanding as

presented above.

Adjusted earnings per share is calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

Profit/(loss) for the period (GBP'000) 1,144 (2,476) (1,793)

Impairment charge - 2,807 2,807

Amortisation of intangible assets

arising on acquisitions 7 16 13

Corporation tax effect of above

items - - -

------------- ------------- -----------

Adjusted profit for the period

(GBP'000) 1,151 347 1,027

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held in

treasury for the proportion of

the year held in treasury ('000) 18,665 18,665 18,665

Adjusted basic earnings per

share 6.2p 1.9p 5.5p

------------- ------------- -----------

Adjusted diluted earnings per

share 6.2p 1.9p 5.5p

------------- ------------- -----------

5. Finance costs

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

On bank loans and overdrafts 42 33 97

Finance charges on lease liabilities 23 35 79

Unwinding of discount on deferred

consideration liabilities - - -

------------- ------------- -----------

Total finance costs 65 68 176

------------- ------------- -----------

6. Principal risks and uncertainties

The directors consider that the principal risks and

uncertainties which could have a material impact on the Group's

performance in the remaining six months of the financial year

remain the same as those stated on page 11 to 14, and 68 to 71 of

our Annual Report and Financial Statements for the year ended 31

March 2021, which are available on the Company's website,

www.northernbearplc.com .

7. Half year report

The condensed financial statements were approved by the Board of

Directors on 26 November 2021 and are available on the Company's

website, www.northernbearplc.com . Copies will be sent to

shareholders and are available on application to the Company's

registered office.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law pursuant to the European Union

(Withdrawal) Act 2018, as amended.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKPBPDBDBADB

(END) Dow Jones Newswires

November 26, 2021 02:00 ET (07:00 GMT)

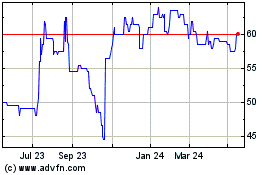

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Jul 2024 to Aug 2024

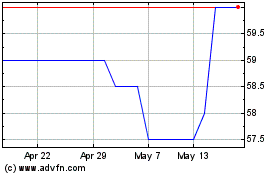

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Aug 2023 to Aug 2024