MC Mining Limited Company Update (1788D)

March 01 2022 - 4:10AM

UK Regulatory

TIDMMCM

RNS Number : 1788D

MC Mining Limited

01 March 2022

ANNOUNCEMENT 1 March 2022

Company Update

Makhado Land Acquisition - Final Instalment Paid

On 11 January 2022, MC Mining Limited (MC Mining or the Company)

announced that its subsidiary, Baobab Mining & Exploration

(Pty) Ltd (Baobab) and the vendor of the Lukin and Salaita

properties, being the key surface rights for the Makhado hard

coking coal project (Makhado Project or Makhado), agreed to extend

the due date for payment of the balance owing of ZAR35 million

(US$2.3 million), to 28 February 2022.

MC Mining is now pleased to announce that the final instalment

of ZAR35 million has been paid by Baobab and the vendor held

mortgages over the properties are in the process of being

released.

The ZAR35 million payment was sourced from funds advanced under

the staged ZAR86 million (approximately US$5.7 million or A$7.8

million) Convertible Advance and Subscription Agreement (the

Agreement) with South African based mining group, Senosi Group

Investment Holdings Proprietary Limited (SGIH), announced by the

Company on 1 February 2022. MC Mining has already developed a

positive working relationship with SGIH and its successful track

record of developing and operating coal mines in South Africa is of

great significance as the Company moves closer to finalising a

funding package to develop the Makhado Project.

To date, SGIH has advanced ZAR40 million (US$2.6 million) to the

Company on time and in full compliance with the Agreement. An

additional ZAR6,036,691 (US$0.4 million) is due to be advanced by

31 March 2022 and, subject to approval of South Africa's Reserve

Bank, the total advances of ZAR46,036,691 will convert into

38,363,909 new ordinary MC Mining shares at ZAR1.20 per share. This

will result in SGIH owning 19.9% of the Company's total issued

share capital. The issue price of ZAR1.20 per share represents a

premium of 15% above the Company's JSE closing share price on 28

February 2022.

SGIH has also agreed to advance an additional ZAR40 million to

the Company between April and July 2022 which is to convert into

33,333,333 new ordinary shares at ZAR1.20 per share, subject to the

receipt of all required approvals, including the approval of MC

Mining's shareholders.

As announced on 28 January 2022, the Industrial Development

Corporation of South Africa Limited (IDC) agreed to extend the

repayment date for the R160 million (US$10.5 million) loan, plus

accrued interest, to 30 November 2022. The IDC also agreed to

extend the terminal drawdown date of the additional R245 million

(US$16.1 million) IDC term loan for the development of Phase 1 of

Makhado, to 30 November 2022, subject to the IDC re-affirming its

due diligence.

Mr Sam Randazzo, MC Mining's interim CEO, commented:

"Payment of the final instalment of ZAR35 million and the

release of security over key surface rights for the Makhado Project

is a significant breakthrough for MC Mining. This, together with

the funding provided by SGIH and the IDC's commitment, has the

Company well placed and in the best positon it has been for several

years to finalise the funding package required to develop the

Makhado Project."

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014 as amended by the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

This announcement has been approved by the Company's Disclosure

Committee.

ASX: MCM / AIM: MCM.L / JSE: MCZ

For more information contact:

Sam Randazzo Interim Chief Executive Officer MC Mining Limited +61 408 945010

Tony Bevan Company Secretary Endeavour Corporate Services +618 9316 9100

Company advisors:

James Harris / James Dance Nominated Adviser Strand Hanson Limited +44 20 7409 3494

Rory Scott Broker (AIM) Tennyson Securities +44 20 7186 9031

James Duncan Financial PR (South Africa) R&A Strategic Communications +27 11 880 3924

Investec Bank Limited is the nominated JSE Sponsor

About MC Mining Limited

MC Mining is an AIM/ASX/JSE-listed coal exploration, development

and mining company operating in South Africa. MC Mining's key

projects include the Uitkomst Colliery (metallurgical and thermal

coal), Makhado Project (hard coking coal). Vele Colliery (semi-soft

coking and thermal coal), and the Greater Soutpansberg Projects

(coking and thermal coal).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKDBKCBKKANK

(END) Dow Jones Newswires

March 01, 2022 04:10 ET (09:10 GMT)

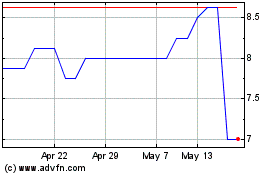

Mc Mining (LSE:MCM)

Historical Stock Chart

From May 2024 to Jun 2024

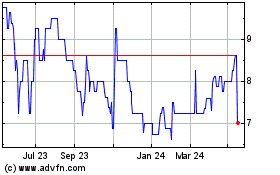

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2023 to Jun 2024