TIDMLWDB

RNS Number : 9050F

Law Debenture Corp PLC

26 February 2015

ANNUAL FINANCIAL REPORT for the year ended

31 December 2014 (audited)

This is the Annual Financial Report of The Law Debenture

Corporation p.l.c. as required to be published under DTR 4 of the

UKLA Listing Rules.

The directors recommend a final dividend of 11.0p per share

making a total for the year of 15.7p. Subject to the approval of

shareholders, the final dividend will be paid on 23 April 2015 to

holders on the register on the record date of 20 March 2015. The

annual financial report has been prepared in accordance with

International Financial Reporting Standards.

Group income statement

for the year ended 31 December

2014 2013

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

UK dividends 14,054 - 14,054 12,276 - 12,276

UK special

dividends 631 - 631 990 - 990

Overseas dividends 2,094 - 2,094 1,918 - 1,918

Overseas special

dividends 34 - 34 35 - 35

Interest from

securities 103 - 103 566 - 566

---------- -------- --------- ---------- ---------- ------------

16,916 - 16,916 15,785 - 15,785

Interest income 88 - 88 61 - 61

Independent

fiduciary services

fees 32,366 - 32,366 31,819 - 31,819

Other income 220 - 220 183 - 183

---------- -------- --------- ---------- ---------- ------------

Total income 49,590 - 49,590 47,848 - 47,848

Net gain on

investments

held at fair

value through

profit or loss - 4,638 4,638 - 114,864 114,864

---------- -------- ---------

Gross income

and capital

gains 49,590 4,638 54,228 47,848 114,864 162,712

Cost of sales (5,291) - (5,291) (4,744) - (4,744)

Administrative

expenses (20,231) (71) (20,302) (19,539) (496) (20,035)

---------- -------- --------- ---------- ---------- ------------

Operating profit 24,068 4,567 28,635 23,565 114,368 137,933

Finance costs

Interest payable (2,896) - (2,896) (2,736) - (2,736)

Profit before

taxation 21,172 4,567 25,739 20,829 114,368 135,197

Taxation (1,199) - (1,199) (1,679) - (1,679)

Profit for

year 19,973 4,567 24,540 19,150 114,368 133,518

---------- -------- --------- ---------- ---------- ------------

Return per

ordinary share

(pence) 16.95 3.87 20.82 16.27 97.18 113.45

Diluted return

per ordinary

share (pence) 16.95 3.87 20.82 16.26 97.10 113.36

Statement of comprehensive income

for the year ended 31 December

Revenue Capital Total Revenue Capital Total

2014 2014 2014 2013 2013 2013

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------- ------- ------- ------- ------- ------- -------

Profit for the year 19,973 4,567 24,540 19,150 114,368 133,518

Foreign exchange on translation

of foreign operations - 431 431 - (121) (121)

Pension actuarial (losses)/gains (2,846) - (2,846) 432 - 432

Taxation on pension 569 - 569 (100) - (100)

--------------------------------- ------- ------- ------- ------- ------- -------

Total comprehensive income

for the year 17,696 4,998 22,694 19,482 114,247 133,729

--------------------------------- ------- ------- ------- ------- ------- -------

Financial summary and performance

Financial summary

31 December 31 December

2014 2013

Pence pence

--------------------------------- ----------- -----------

Share price 530.00 529.00

NAV per share after proposed

final dividend 475.82 472.87

NAV per share after proposed

final dividend with debt

at fair value 465.62 467.87

Revenue return per share

- Investment trust 10.08 9.31

- Independent fiduciary services 6.87 6.96

Group revenue return per

share 16.95 16.27

Capital return per share 3.87 97.18

Dividends per share 15.70 15.00

--------------------------------- ----------- -----------

2014

%

------------------- ----

Ongoing charges(1) 0.47

Gearing(1) 5

(1) Source AIC.

Ongoing charges are based on the costs of the investment trust

and include the Henderson management fee of 0.30% of the NAV of the

investment trust. There is no performance related element to the

fee.

Performance

2014 2013 2012 2011 2010

% % % % %

---------------------------- ---- ---- ---- ----- ----

Share price total return(1) 3.1 28.3 32.0 (2.9) 30.5

NAV total return(1) 2.6 28.6 19.7 (1.6) 24.8

FTSE Actuaries All-Share

Index total return 1.2 20.8 12.3 (3.5) 14.5

---------------------------- ---- ---- ---- ----- ----

(1) Source AIC.

Chairman's statement and review of 2014

Performance

Our net asset value total return for the year to 31 December

2014 was 2.6%, compared to a total return of 1.2% for the FTSE

Actuaries All-Share Index. Net revenue return per share was 16.95p,

an increase of 4.2% over the previous year, as a result of a 8.3%

increase in the investment trust and a 1.3% decrease in independent

fiduciary services.

Dividend

The board is recommending a final dividend of 11.0p per ordinary

share (2013: 10.5p), which together with the interim dividend of

4.7p (2013: 4.5p) gives a total dividend of 15.7p (2013:

15.00p).

The final dividend will be paid, subject to shareholder

approval, on 23 April 2015 to holders on the register on the record

date of 20 March 2015.

The Corporation's policy continues to be to seek growth in both

capital and income. We attach considerable importance to the

dividend, which we aim to increase over a period, if not every

year, at a rate which is covered by earnings and which does not

inhibit the flexibility of our investment strategy. Our basis for

reporting earnings is more conservative than that of many

investment trusts, in that all of our expenses, including interest

costs, are charged fully to the revenue account.

Investment trust

The portfolio performed reasonably well during the year

outperforming the FTSE-All Share Index once again. James Henderson

describes the performance in 2014 in more detail in his report. We

had a less successful second half and with the benefit of

hindsight, we should have had more weight in the USA and our

position in the oil sector, particularly in small oil exploration

companies in the UK, was not well judged. More positively, holdings

in the pharmaceutical sector have again performed well and dividend

revenues have been particularly pleasing. We have retained a modest

level of gearing at 5% but continue to keep this under review.

Looking forward, the markets are particularly difficult to judge at

present. The fundamentals underlying many stocks suggest that there

is still value in the market and continuing strong cash generation

should see good dividend receipts. The reduction in the oil price

should have a positive impact in some sectors. Weighed against

these factors, continuing concerns about the strength of the global

recovery, particularly in Europe, introduce a level of uncertainty

that may prove to be a drag on markets. The portfolio continues to

be well diversified on a geographical and industry sector

basis.

Independent fiduciary services

The businesses are an integral part of Law Debenture's unique

business model. Performance in 2014 was solid - a more detailed

review of the independent fiduciary services businesses is set out

below.

125th anniversary

Law Debenture reached the age of 125 in December 2014. While we

have not sought to make too much of this, nevertheless it is a

milestone that should be noted. I am very proud to be the Chairman

of the City institution that is Law Debenture. Our shareholders

have benefited from consistently good performance and dividend

growth from the portfolio over many years. Not many will be aware,

I suspect, of just how ingrained is the reputation of Law Debenture

as an independent fiduciary within the City and more widely. That

is a testament to the professionalism of our Managing Director and

staff, whose important work often goes unseen and unheralded, but

is nevertheless important to the effective functioning of certain

sectors of the City's capital markets.

Regulatory matters - the Alternative Investment Fund Managers

('AIFM') Directive

The AIFM Directive requires certain funds, including investment

trusts, to appoint an appropriately regulated AIFM to provide

portfolio management, risk management, administration, accounting

and company secretarial services to the fund. Since all of these

functions, bar portfolio management, have traditionally been

performed by the Corporation, which unusually for an investment

trust has full time staff within the Group, the Corporation has

elected to be its own AIFM as permitted under the legislation. As

part of this, we have been required to appoint a depositary at not

insignificant cost to shareholders. The Corporation will, it goes

without saying, continue to comply with its legal and regulatory

obligations to the maximum extent necessary. Nevertheless, I am yet

to hear a satisfactory explanation for why investment trusts have

been caught by this Directive, nor have I found anybody in the

industry (or more widely) who can suggest what benefit shareholders

might derive from its adoption

The annual general meeting will be held at the Brewers Hall,

Aldermanbury Square, London, EC2V 7HR on 14 April 2015 and I look

forward to seeing as many as possible of you there.

Christopher Smith

Investment manager's review

Review

Returns from equities were positive during the year driven by

the expansion of the US economy. It was therefore US shares that

led the way and the dollar was strong.

Towards the end of the year the oil price dramatically fell as

OPEC did not cut back production despite of a build up in over

supply.

This fall has initially been met with investor concern; however,

over the longer term it will in aggregate be beneficial to

companies. It will reduce costs and will stimulate demand. For

instance the current fall in petrol prices is estimated to be a

GBP4bn windfall to car users in the UK in 2015, while it is

projected it will add 0.4% to US GDP over the year. During much of

2014, before the oil price fall, the worry was that GDP growth

could stall, particularly in Europe. This led to concerns that

industrial companies would face operational headwinds and share

prices in this area retreated. The large position in industrials in

the portfolio was a negative during the year, as was the exposure

to oil related companies. However, the exposure to overseas markets

and stocks, such as the pharmaceutical companies BTG and

AstraZeneca, meant that overall, the portfolio marginally

outperformed the FTSE All-Share. It should be remembered over a

five year period, the exposure to industrials has been a major

contributor to the portfolio's outperformance.

Biggest rises by value

Value appreciation

GBP'000

--- -------------------- -------------------

1 Applied Materials 2,654

--- -------------------- -------------------

2. BTG 2,641

--- -------------------- -------------------

3. Provident Financial 2,304

--- -------------------- -------------------

4. AstraZeneca 2,280

--- -------------------- -------------------

5. Microsoft 1,876

--- -------------------- -------------------

Biggest falls by value

Value depreciation

GBP'000

--- --------------------- -------------------

1. BP (2,750)

--- --------------------- -------------------

2. Indus Gas (2,747)

--- --------------------- -------------------

3. Providence Resources (2,233)

--- --------------------- -------------------

4. Rolls Royce (2,023)

--- --------------------- -------------------

5 BHP Billiton (1,910)

--- --------------------- -------------------

Investment Approach

The focus is on picking stocks that are long term growth

companies, trading at valuations which do not properly reflect

their long term prospects. The focus on providing good shareholder

returns through dividend growth and the international spread of

their earnings is an attractive mix. However, individual stocks

need to be blended so that the overall portfolio has genuine

diversity of underlying activities. Therefore we have a relatively

long list of stocks so that we can hold large, medium and small

companies as well as overseas equities when they bring something to

the mix that we cannot find in the UK market. An example of this

would be global oil services companies. The world leading companies

in this area such as Schlumberger, reside in the US.

The UK market last year underperformed global markets but over

the long term it has performed in line.

The UK market currently offers investors better value as

measured by the Price Earnings Ratio and a higher dividend yield

than other major markets.

Portfolio Activity

The general weakness in emerging markets equities was driven by

concerns over QE ending in the US. This has thrown up longer term

investment opportunities. During the year we purchased a holding in

Embraer, the Brazilian aerospace company that has excellent

products sold to a global client base. Templeton Emerging Markets

Investment Trust, which is on a reasonable discount to its asset

value, brings value to the overall blend of Law Debenture's

portfolio. In the UK market towards the year end, we increased a

position in Tesco at distressed prices. The problems the retailer

is facing are large but the poor sentiment towards the stock is

probably over exaggerated. We increased the position in selective

smaller companies such as Velocys, the gas to liquid, technology

company. Our holding in Shire was sold on the proposed bid that did

not materialise and the position in AstraZeneca was reduced as the

strength of its drug pipeline came to be more fully appreciated by

investors. However, as usual portfolio turnover remained low at

approximately 9% for the year

Outlook

Over the year the exposure to oil and commodity stocks has been

increased and with hindsight this has been a mistake as the oil

price has continued to weaken. The level of oversupply in oil over

demand is estimated to be 1 1/2 %. It is surprising that this level

of oversupply should result in a fall of over 50% in the price of

oil, especially as demand growth is expected to outstrip supply

growth in coming years, even before oil companies cut back on

production because of the oil price fall. This suggests that, over

time, the oil price will rise. However, the timing of any increase

is very difficult to predict. The portfolio will retain its

exposure to oil companies. The focus will be on stocks that can

survive through a sustained difficult period. These stocks bring

diversity to the portfolio and help to position it for the expected

recovery in energy prices. Meanwhile the industrial companies

should benefit from stronger economic growth and reduced cost

pressures. Industrial operating margins can rise further. These

companies are producing strong cash flows as a result of these

margins. Special dividends, share buybacks and the normal dividend

being increased will be the result. The strength of the balance

sheets of the companies held in the portfolio is high. This

positions them well to produce both good capital and income growth,

which underlies our confidence in the portfolio. As a result we

remain committed to equities and we are employing gearing of around

5%.

James Henderson

Henderson Global Investors Limited

Management review - independent fiduciary services

Results

Independent fiduciary services profit before tax decreased by

5.7% from GBP9.9million to GBP9.3million. Revenue return per share

decreased by 1.3% from 6.96p to 6.87p.

Independent fiduciary services businesses ("IFS")

Law Debenture is a leading provider of independent third party

fiduciary services, including corporate trusts (including trustee

and escrow banking), agency services, pension trusts, corporate

services, agent for service of process, whistleblowing services and

governance services to client boards and pension funds. The

businesses are monitored and overseen by a board comprising the

heads of the relevant business areas and two non-executive,

independent directors.

Review of 2014

The IFS performance was generally satisfactory, with some areas

performing strongly. As reported last year, 2013 revenues were

boosted by one-off receipts of fees accumulated but uncollected

over several years. In addition, interest costs were higher in 2014

as a result of the full year impact of the loan taken out in July

2013. This complicates comparison with 2014, which in fact

(excluding the one-offs) saw an increase in "business as usual"

profits compared to 2013.

The markets in which we operate were generally quite active and

levels of new appointments reflect this, although in some areas

these remain behind pre-recession levels. As a result, we continue

to experience downward pressure on fees as competition for new

appointments remains fierce in most of our markets, especially so

in the pensions area. Some sectors, such as service of process and

corporate trusts were very busy and Safecall, our whistleblowing

service, again had its best year so far. Market share remained

satisfactory and activity levels in pre-existing transactions,

where we are able to generate additional fees for time spent,

remained high.

In what was our 125th year as a trustee, it is clear from the

appointments we won in 2014 - some notable highlights are set out

below - that our services remain as relevant and highly valued as

ever by eminent national and multi-national bodies and corporations

throughout the world. As a testimony to our longevity, dignified

austerity and dependability, shareholders may be interested to know

that our oldest active trust - the Merchants Trust - is as old as

we are, dating back to 1889.

Corporate trusts, including trustee and escrow banking

Corporate trusts had a good year for new appointments, with the

trends that we saw in 2013 continuing: greater activity in the bond

market particularly in the European high yield bond market (where

medium sized companies are now looking to the capital markets

rather than their traditional bank lenders); and more long term

security trustee appointments such as in the airline sector.

We act as trustee of the Bank of England's own debt issuance

programme and early in 2014, the Bank issued US$2 billion 0.875%

Notes due 2017 under the programme. We were also appointed as

trustee on debt issues by a wide range of companies including

Aviva, Babcock International, BAT, Hammerson, HSBC Holdings, Legal

& General, National Grid, Pearson, TSB and Vodafone.

We have acted as trustee for many years for The Housing Finance

Corporation ("THFC"), which raises funds in the capital markets and

then on-lends to UK housing associations. THFC was selected by the

UK government to set up a new debt programme called Affordable

Housing Finance, which raises funds guaranteed by the UK Government

for affordable housing providers, and to which we were appointed

trustee.

We have also acted for International Finance Corporation ("IFC")

for many years and we were appointed in 2014 as trustee on a number

of new IFC projects including acting as offshore security trustee

on three solar energy projects in Jordan.

We were appointed as Delegate for several new sukuk bonds, which

have the benefit of a guarantee provided by The Islamic Development

Bank under its US$10 billion Trust Certificate Issuance

Programme.

Our recognised independence as an impartial third party has been

instrumental in enabling us to secure many escrow agent

appointments and our trustee and escrow banking team continues to

service our cash escrow, security trust and project finance

business.

Finally, we remained busy on post-issuance work including both

restructurings, liquidations and transaction amendments. This work

generates significant additional income.

Pension trusts and governance services

Our pension trusteeship service had a good year in a changing

market environment. An increased focus on defined contribution

schemes and the continued refinement of the needs of final salary

schemes provided an increasing demand for our services.

The performance of our sole trusteeship services, where we act

as the sole trustee of final salary schemes and deliver one-stop

governance cost effectively, continues to show progress. This

positive development, alongside the requirement for the providers

of workplace personal pensions to establish Independent Governance

Committees, has generated new opportunities for us.

Our governance and board effectiveness business completed its

fourth year in a highly competitive market that is still

developing. We continued to win assignments in the investment trust

and FTSE 250 sectors as well as reviewing several pension trustee

boards. Our corporate governance board evaluation tools are being

used widely, especially by our clients on pension fund trustee

boards. We have also published our fourth annual review of FTSE 350

board evaluation compliance.

Corporate services and agency solutions

Our long established and highly regarded service of process

business had another solid year with an increase in new

revenue.

The corporate services business (provision of corporate

directors, company secretary, accounting and administration of

special purpose vehicles) saw some good gains, including new

securitisations for Virgin Money and Unicredit Bank AG. We secured

appointments to several issuers with bonds traded on the London

Stock Exchange's Order Book for Retail Bonds market and we

continued to win new customers in the company secretarial, private

equity, pensions and corporate governance markets.

Our agency solutions team continues to provide CDO and CLO

administration, facility agency and other customised solutions

including data verification and data room services.

Safecall

It was another good year for our external whistleblowing service

with a further increase in the number of new appointments. The

demand for whistleblowing continues to remain strong both in the UK

and across Europe, particularly in the manufacturing sector, as

organisations recognise the value of an external whistleblowing

service. Notable appointments included Air Liquide, Rexam, Virgin

Atlantic, Yorkshire Water and City of Edinburgh Council.

Overseas

United States

The New York Trust Company produced mixed results. The separate

trustee business continued to grow and we are shepherding several

high profile litigation matters through the U.S. courts as trustee

for investors in the residential mortgage-backed security market.

We also secured appointment to the creditors' committee, as a

trustee for bondholders, in one of the largest U.S. leveraged

buy-out bankruptcies and we maintained our top ten ranking in the

U.S. trustee league tables (measuring business volumes). However,

we continue to face strong headwinds in the challenging

successor/bankruptcy trustee market.

The corporate services business, including Delaware Corporate

Services, continued to generate good returns.

Hong Kong

General business levels were quiet during the first half of the

year but picked up in the second half, notably in M&A related

escrow work. The service of process business continued to make a

strong contribution to revenues and we remain one of the leaders in

the employee share trust business - the continuing flow of PRC

related IPOs coming to market suggests that this is an area of

further potential. New management was taken on mid-year and has

identified some promising opportunities for the future in what is a

very competitive market.

Channel Islands

Although we had an increase in the number of service of process

appointments, 2014 generally saw a continuation in the difficult

market conditions for independent offshore corporate services.

However, enquiries received near the year end may signal a positive

change in activities and financial returns.

Outlook

We expect that 2015 will see limited growth in market activity

levels, since there are still wider macroeconomic uncertainties,

especially in Europe, that are preventing some players from

returning to the market. We will continue to keep under review the

range of services that we offer and remain open to any prospect

that might allow us safely to grow the IFS business, either by

expansion into areas where there is a need for an established,

trusted, independent third party, or through acquisition.

Caroline Banszky

Managing director

Statement of financial position

as at 31 December

2014 2013

-------------------------------------- -------- --------

GBP000 GBP000

-------------------------------------- -------- --------

Assets

Non current assets

Goodwill 2,215 2,167

Property, plant and equipment 131 207

Other intangible assets 45 223

Investments held at fair value

through profit or loss 600,894 595,173

Deferred tax assets 1,234 775

-------------------------------------- -------- --------

Total non current assets 604,519 598,545

-------------------------------------- -------- --------

Current assets

Trade and other receivables 7,491 6,787

Other accrued income and prepaid

expenses 4,679 4,963

Cash and cash equivalents 50,321 49,688

-------------------------------------- -------- --------

Total current assets 62,491 61,438

-------------------------------------- -------- --------

Total assets 667,010 659,983

-------------------------------------- -------- --------

Current liabilities

Trade and other payables 13,012 12,071

Short term borrowings 26,548 26,793

Corporation tax payable 632 951

Other taxation including social

security 613 655

Deferred income 4,027 4,059

Total current liabilities 44,832 44,529

-------------------------------------- -------- --------

Non current liabilities and deferred

income

Long term borrowings 39,472 39,445

Retirement benefit obligations 3,250 1,089

Deferred income 5,245 5,848

Total non current liabilities 47,967 46,382

-------------------------------------- -------- --------

Total net assets 574,211 569,072

-------------------------------------- -------- --------

Equity

Called up share capital 5,916 5,908

Share premium 8,622 8,283

Capital redemption 8 8

Own shares (1,686) (1,695)

Capital reserves 524,269 519,702

Retained earnings 36,463 36,678

Translation reserve 619 188

-------------------------------------- -------- --------

Total equity 574,211 569,072

-------------------------------------- -------- --------

Statement of cash flows

for the year ended 31 December

Operating activities *Restated

2014 2013

GBP000 GBP000

Operating profit before interest payable

and taxation 28,635 137,933

(Gains) on investments (4,567) (114,368)

Foreign exchange (49) 15

Depreciation of property, plant and

equipment 120 154

Amortisation of intangible assets 185 199

Increase in receivables (420) (1,526)

Increase in payables 291 1,303

Transfer (from)/to capital reserves (389) 150

Normal pension contributions in excess

of cost (685) (706)

Cash generated from operating activities 23,121 23,154

Taxation (1,408) (1,482)

Operating cash flow 21,713 21,672

---------------------------------------------- --------- ----------

Investing activities

Acquisition of property, plant and equipment (40) (109)

Expenditure on intangible assets (10) (57)

Purchase of investments (54,894) (101,534)

Sale of investments 53,997 100,222

Cash flow from investing activities (947) (1,478)

---------------------------------------------- --------- ----------

Financing activities

Interest paid* (2,896) (2,736)

Dividends paid (17,911) (16,768)

Proceeds of increase in share capital 347 164

Purchase of own shares 9 83

Net cash flow from financing activities (20,451) (19,257)

---------------------------------------------- --------- ----------

Net increase in cash and cash equivalents 315 937

---------------------------------------------- --------- ----------

Cash and cash equivalents at beginning

of period 22,895 22,201

Foreign exchange gains / (losses) on

cash and cash equivalents 563 (243)

Cash and cash equivalents at end of

period 23,773 22,895

---------------------------------------------- --------- ----------

* Interest paid has been included in financing activities. It

was previously included in operating activities.

Statement of changes in equity

Share Share Own Capital Translation Capital Retained

capital premium shares redemption reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Equity 1

January 2013 5,905 8,122 (1,778) 8 309 405,334 33,964 451,864

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Profit - - - - - 114,368 19,150 133,518

Foreign exchange - - - - (121) - - (121)

Actuarial

gain on pension

scheme (net

of tax) - - - - - - 332 332

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Total comprehensive

income - - - - (121) 114,368 19,482 133,729

Issue of

shares 3 161 - - - - - 164

Dividend

relating

to 2012 - - - - - - (11,471) (11,471)

Dividend

relating

to 2013 - - - - - - (5,297) (5,297)

Movement

in own shares - - 83 - - - - 83

Total equity

31 December

2013 5,908 8,283 (1,695) 8 188 519,702 36,678 569,072

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Equity 1

January 2014 5,908 8,283 (1,695) 8 188 519,702 36,678 569,072

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Profit - - - - - 4,567 19,973 24,540

Foreign exchange - - - - 431 - - 431

Actuarial

(loss) on

pension scheme

(net of tax) - - - - - - (2,277) (2,277)

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Total comprehensive

income - - - - 431 4,567 17,696 22,694

Issue of

shares 8 339 - - - - - 347

Dividend

relating

to 2013 - - - - - - (12,368) (12,368)

Dividend

relating

to 2014 - - - - - - (5,543) (5,543)

Movement

in own shares - - 9 - - - - 9

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Total equity

31 December

2014 5,916 8,622 (1,686) 8 619 524,269 36,463 574,211

-------------------- --------- --------- ---------- ------------ ------------ ---------- ---------- ----------

Segmental analysis

Independent fiduciary

Investment services Total

trust

2014 2013 2014 2013 2014 2013

---------------------- ------------ ---------------- ---------------- --------- ----------- --------- -----

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Segment income 16,916 15,785 32,366 31,819 49,282 47,604

Other income 60 71 160 112 220 183

Cost of sales - - (5,291) (4,744) (5,291) (4,744)

Administration costs (2,606) (2,412) (17,625) (17,127) (20,231) (19,539)

14,370 13,444 9,610 10,060 23,980 23,504

Interest (net) (2,498) (2,481) (310) (194) (2,808) (2,675)

---------------------- ------------ ----------- ----------------- ------------- ----------- ----------------

Return, including

profit

on

ordinary activities

before

taxation 11,872 10,963 9,300 9,866 21,172 20,829

Taxation - - (1,199) (1,679) (1,199) (1,679)

---------------------- ------------ ----------- ----------------- ------------- ----------- ----------------

Return, including

profit

attributable to

shareholders 11,872 10,963 8,101 8,187 19,973 19,150

---------------------- ------------ ----------- ----------------- ------------- ----------- ----------------

Revenue return per

ordinary

share 10.08 9.31 6.87 6.96 16.95 16.27

---------------------- ------------ ----------- ----------------- ------------- ----------- ----------------

Assets 609,653 605,761 57,357 54,222 667,010 659,983

Liabilities (51,100) (53,320) (41,699) (37,591) (92,799) (90,911)

---------------------- ------------ ----------- ----------------- ------------- ----------- ----------------

Total net assets 558,553 552,441 15,658 16,631 574,211 569,072

---------------------- ------------ ----------- ----------------- ------------- ----------- ----------------

The capital element of the income statement is wholly attributable

to the investment trust.

Portfolio changes in geographical distribution

Valuation Appreciation/ Valuation

31 December Costs of Sales (depreciation) 31 December

2013 Purchases acquisition proceeds GBP000 2014

GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ------------ ----------- ------------- ---------- --------------- ------------

United Kingdom 455,812 38,891 (141) (47,651) (9,171) 437,740

North America 49,223 1,195 (1) (2,891) 8,603 56,129

Europe 39,996 1,608 (2) (3,455) 457 38,604

Japan 16,955 - - - 507 17,462

Other Pacific 33,187 775 (4) - 4,663 38,621

Other - 12,425 (55) - (32) 12,338

--------------- ------------ ----------- ------------- ---------- --------------- ------------

595,173 54,894 (203) (53,997) 5,027 600,894

--------------- ------------ ----------- ------------- ---------- --------------- ------------

The financial information set out above does not constitute the

Corporation's statutory accounts for 2013 or 2014. Statutory

accounts for the years ended 31 December 2013 and 31 December 2014

have been reported on by the Independent Auditor. The Independent

Auditor's Reports on the Annual Report and Financial Statements for

2013 and 2014 were unqualified, did not draw attention to any

matters by way of emphasis, and did not contain a statement under

498(2) or 498(3) of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2013 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 31 December 2014 will be delivered to the Registrar

in due course.

The financial information in this Annual Financial Report has

been prepared using the recognition and measurement principles of

International Accounting Standards, International Financial

Reporting Standards and Interpretations adopted for use in the

European Union (collectively Adopted IFRSs). The accounting

policies adopted in this Annual Financial Report have been

consistently applied to all the years presented and are consistent

with the policies used in the preparation of the statutory accounts

for the year ended 31 December 2014. The principal accounting

policies adopted are unchanged from those used in the preparation

of the statutory accounts for the year ended 31 December 2013.

Investment trust - objectives, investment strategy, business

model

Our objective for the investment trust is to achieve long term

capital growth in real terms and steadily increasing income. The

aim is to achieve a higher rate of total return than the FTSE

Actuaries All-Share Index through investing in a portfolio

diversified both geographically and by industry.

Law Debenture shares are intended for private investors in the

UK ('retail investors'), professionally advised private clients and

institutional investors. By investing in an investment trust,

shareholders typically accept the risk of exposure to equities but

hope that the pooled nature of an investment trust portfolio will

give some protection from the volatility in share price movements

that can sometimes

affect individual equities.

Our investment strategy is as follows:

The Corporation carries on its business as a global investment

trust.

The Corporation's portfolio will typically contain between 70

and 150 listed investments. The portfolio is diversified both by

industrial sector and geographic location of investments in order

to spread investment risk.

There is no obligation to hold shares in any particular type of

company, industry or geographical location. The IFS businesses do

not form part of the investment portfolio and are outwith this

strategy.

Whilst performance is measured against local and UK indices, the

composition of these indices does not influence the construction of

the portfolio. As a consequence, it is expected that the

Corporation's investment portfolio and performance will from time

to time deviate from the comparator indices.

The Corporation's assets are invested internationally and

without regard to the composition of indices. There are some

guidelines, set by the board, on maximum or minimum stakes in

particular regions and all stakes are monitored in detail by the

board at each board meeting in order to ensure that sufficient

diversification is maintained.

Liquidity and long-term borrowings are managed with the aim of

improving returns to shareholders. The policy on gearing is to

adopt a level of gearing that balances risk with the objective of

increasing the return to shareholders. In pursuit of its investment

objective, investments may be held in, inter alia, equity shares,

collective investment products including OEICs, fixed interest

securities, interests in limited liability partnerships, cash and

liquid assets. Derivatives may be used but only with the prior

authorisation of the board. Investment in such instruments for

trading purposes is proscribed. It is permissible to hedge against

currency movements on both capital and income account, subject

again to prior authorisation of the board. Stock lending, trading

in suspended shares and short positions are not permitted. No more

than 15% of gross assets will be invested in other UK listed

investment

trusts. The Corporation's investment activities are subject to

the following limitations and restrictions:

-- No investment may be made which raises the aggregate value of

the largest 20 holdings, excluding investments in collective

investment vehicles that give exposure to the Japan, Asia/Pacific

or emerging market regions, to more than 40% of the Corporation's

portfolio, including gilts and cash. The value of a new acquisition

in any one company may not exceed 5% of total portfolio value

(including cash)

at the time the investment is made. Further additions shall not

cause a single holding to exceed 5%, and board approval must be

sought to retain a holding, should its value increase above the 5%

limit.

--The Corporation applies a ceiling on effective gearing of 50%.

While effective gearing will be employed in a typical range of 10%

net cash to 20% gearing, the board retains the ability to reduce

equity exposure so that net cash is above 10% if deemed

appropriate.

--The Corporation may not make investments in respect of which

there is unlimited liability.

Our business model is designed to position the Corporation to

best advantage in the investment trust sector. We aim to deliver

the investment trust's objective by skilled implementation of the

investment strategy complemented by maintaining and operating our

IFS businesses profitably and safely, while keeping them distinct

from the portfolio. The operational independence of the IFS means

that they can act flexibly and commercially. They provide a regular

flow of dividend income to the Corporation. This helps the board to

smooth out equity dividend peaks and troughs and is an important

element in

delivering the objective of steadily increasing income for

shareholders, fully covered by current revenues. In turn, tax

relief at the investment trust level arising from our debenture

interest and excess costs, which would otherwise be unutilised, can

be transferred to the IFS.

Fee structure, ongoing charges and Investment Management

Agreement

Our portfolio of investments is managed under delegation by

James Henderson of Henderson Global Investors Limited ('Henderson')

under a contract terminable by either side on six months' notice.

On a fully discretionary basis, Henderson is responsible for

implementing the Corporation's investment strategy and fees are

charged at 0.30% of the value of the net assets of the group

(excluding the net assets of the IFS), calculated on the basis

adopted in the audited financial statements. Underlying management

fees of 1% on the Corporation's holdings in Henderson Japanese and

Pacific OEICs are

fully rebated. This means that the Corporation continues to

maintain one of the most competitive fee structures in the

investment trust sector and this, combined with the good

performance of Henderson as our investment manager, has led the

board to conclude that the continuing appointment of Henderson as

the Corporation's investment manager is in the best interests of

shareholders.

The agreement with Henderson does not cover custody which is the

responsibility of the depositary. Nor does it cover the preparation

of data associated with investment performance, or record keeping,

both of which are maintained by the Corporation.

Investment trusts are required to publish their ongoing charges.

This is the cost of operating the trust and includes the investment

management fee, depositary and custody fees, investment performance

data, accounting, company secretary and back office administration.

Law Debenture's latest published level of ongoing charges is one of

the lowest in the marketplace at 0.47%. No performance fees are

paid to the investment manager.

Future trends and factors

Law Debenture will continue to strive to deliver its business

objectives for both the investment trust and the IFS.

The investment manager's review and the IFS management review

respectively set out some views on future developments.

Gearing

During the year, the Corporation retained a modest gearing of 5%

as described in the investment manager's review above.

Key performance indicators ('KPI')

The KPIs used to measure the progress and performance of the

group are:

-- net asset value total return per share (combining the capital

and income returns of the group);

-- the discount/premium in share price to NAV; and

-- the cost of running the portfolio as a percentage of its value.

Since the objective of the investment trust is measurable solely

in financial terms, the directors do not consider that it is

appropriate to adopt non-financial KPIs.

Top 20 equity holdings by value

2014 2014 2013 2013

----- ------------------ ------- ---------- ---------- -----

Value % of % of

----- ------------------ ------- ---------- ---------- -----

Rank Company GBP000 portfolio portfolio Rank

----- ------------------ ------- ---------- ---------- -----

1 Senior 17,419 2.90 2.96 1

----- ------------------ ------- ---------- ---------- -----

2 GKN 15,563 2.59 2.83 2

----- ------------------ ------- ---------- ---------- -----

3 BP 14,371 2.39 2.67 3

----- ------------------ ------- ---------- ---------- -----

Royal Dutch

4 Shell 13,395 2.23 2.30 4

----- ------------------ ------- ---------- ---------- -----

5 Rio Tinto 12,746 2.12 1.86 8

----- ------------------ ------- ---------- ---------- -----

6 Amlin 11,669 1.94 1.88 7

----- ------------------ ------- ---------- ---------- -----

7 HSBC 11,259 1.87 1.95 6

----- ------------------ ------- ---------- ---------- -----

8 GlaxoSmithKline 10,320 1.72 2.03 5

----- ------------------ ------- ---------- ---------- -----

9 Smith (DS) 8,862 1.47 1.68 10

----- ------------------ ------- ---------- ---------- -----

10 Bellway 8,712 1.45 1.19 19

----- ------------------ ------- ---------- ---------- -----

11 Hill & Smith 8,700 1.45 1.30 14

----- ------------------ ------- ---------- ---------- -----

12 BAE Systems 8,487 1.41 1.31 13

----- ------------------ ------- ---------- ---------- -----

13 Velocys 8,320 1.38 1.09 25

----- ------------------ ------- ---------- ---------- -----

14 Reed Elsevier 8,235 1.37 1.13 24

----- ------------------ ------- ---------- ---------- -----

15 IP Group 8,232 1.37 0.97 32

----- ------------------ ------- ---------- ---------- -----

Applied Materials

16 (USA) 7,991 1.33 0.90 36

----- ------------------ ------- ---------- ---------- -----

17 Dunelm 7,850 1.31 1.29 15

----- ------------------ ------- ---------- ---------- -----

18 Hiscox 7,662 1.28 1.40 11

----- ------------------ ------- ---------- ---------- -----

19 Glencore 7,468 1.24 - -

----- ------------------ ------- ---------- ---------- -----

20 Marshalls 7,199 1.20 0.19 110

----- ------------------ ------- ---------- ---------- -----

34.02

----- ------------------ ------- ---------- ---------- -----

Other significant holdings by value

2014 2014 2013

----- -------------------- ------- ---------- ----------

Value % of % of

----- -------------------- ------- ---------- ----------

Rank Company GBP000 portfolio portfolio

----- -------------------- ------- ---------- ----------

Henderson Japan

1 Capital Growth* 14,632 2.43 2.42

----- -------------------- ------- ---------- ----------

Henderson Asia

Pacific Capital

2 Growth* 13,516 2.25 2.11

----- -------------------- ------- ---------- ----------

Baillie Gifford

3 Pacific* 12,776 2.13 1.86

----- -------------------- ------- ---------- ----------

First State

4 Asia Pacific* 11,516 1.92 1.61

----- -------------------- ------- ---------- ----------

Templeton Emerging

Markets Investment

5 Trust 8,357 1.39 -

----- -------------------- ------- ---------- ----------

Herald Investment

6 Trust 5,559 0.93 0.98

----- -------------------- ------- ---------- ----------

Better Capital

7 (2012) 3,700 0.62 0.92

----- -------------------- ------- ---------- ----------

8 Foresight Solar 3,127 0.52 0.49

----- -------------------- ------- ---------- ----------

Scottish Oriental

Smaller Company

9 Trust 813 0.14 -

----- -------------------- ------- ---------- ----------

12.33

----- -------------------- ------- ---------- ----------

*Open ended investment companies.

Portfolio by sector 2014

Oil & gas 8.7%

-------------------- ------

Basic materials 8.0%

-------------------- ------

Industrials 25.4%

-------------------- ------

Consumer goods 11.3%

-------------------- ------

Health care 8.0%

-------------------- ------

Consumer services 8.3%

-------------------- ------

Telecommunications 0.5%

-------------------- ------

Utilities 2.9%

-------------------- ------

Technology 1.8%

-------------------- ------

Financials 25.1%

-------------------- ------

Portfolio by sector 2013

Oil & gas 10.4%

-------------------- ------

Basic materials 6.3%

-------------------- ------

Industrials 25.1%

-------------------- ------

Consumer goods 10.7%

-------------------- ------

Health care 8.8%

-------------------- ------

Consumer services 9.3%

-------------------- ------

Telecommunications 0.6%

-------------------- ------

Utilities 3.3%

-------------------- ------

Technology 2.2%

-------------------- ------

Financials 23.3%

-------------------- ------

Geographical distribution of portfolio 2014

United Kingdom 72.8%

---------------- ------

North America 9.4%

---------------- ------

Europe 6.4%

---------------- ------

Japan 2.9%

---------------- ------

Other Pacific 6.4%

---------------- ------

Other 2.1%

---------------- ------

Geographical distribution of portfolio 2013

United Kingdom 76.6%

---------------- ------

North America 8.3%

---------------- ------

Europe 6.7%

---------------- ------

Japan 2.8%

---------------- ------

Other Pacific 5.6%

---------------- ------

Acquisition of own shares

During the year, the Corporation did not repurchase any of its

shares for cancellation. It intends to seek shareholder approval to

renew its powers to repurchase shares for cancellation up to 14.99%

of the Corporation's issued share capital, if circumstances are

appropriate. On 11 March 2014, a subsidiary acquired 104,629 of the

Corporation's shares on the open market at 5.365094 pence per share

in anticipation of fulfilling awards made under the Deferred Share

Plan.

Significant financial issues relating to the 2014 accounts.

No new significant issues arose during the course of the audit.

As reported in previous years, an area of consideration continues

to be consideration of bad debt provisions.

Management makes an estimate of a number of bad debt provisions

for non-collection of fees as part of the risk management and

control framework. The audit committee has received reports from

management describing the basis for assumptions used.

Other issues that arose included: the risk that portfolio

investments may not be beneficially owned or correctly valued; and

that revenue is appropriately recognised. The audit committee has

received assurance on these matters from management.

The audit committee is satisfied that the judgements made by

management are reasonable and that appropriate disclosures have

been included in the accounts. Taken in its entirety, the audit

committee was able to conclude that the financial statements

themselves and the annual report as a whole are fair, balanced and

understandable and that conclusion has been reported to the

board.

Total voting rights and share information

The Corporation has an issued share capital at 26 February of

118,314,903 ordinary shares with voting rights and no restrictions

and no special rights with regard to control of the Corporation.

There are no other classes of share capital and none of the

Corporation's issued shares are held in treasury. Therefore the

total number of voting rights in The Law Debenture Corporation

p.l.c. is 118,314,903.

Borrowings

2014 2013

----------------------- ------- -------

GBP000 GBP000

----------------------- ------- -------

Short term borrowings

----------------------- ------- -------

Bank overdraft 26,548 26,793

----------------------- ------- -------

The Corporation has an uncommitted overdraft facility of

GBP30,000,000, repayable on demand, provided by HSBC Bank plc which

is secured by a floating charge which ranks pari passu with a

charge given in respect of the debenture. At 31 December 2014, fair

value is the same as book value.

The uncommitted facility has been drawn down in US dollars and

interest was payable at 1.5% above HSBC's bank rate.

2014 2013

------------------------------------------------ ------- -------

GBP000 GBP000

------------------------------------------------ ------- -------

Long term borrowings

------------------------------------------------ ------- -------

Long term borrowings are repayable as follows:

------------------------------------------------ ------- -------

In more than five years

------------------------------------------------ ------- -------

Secured

------------------------------------------------ ------- -------

6.125% guaranteed secured bonds 2034 39,472 39,445

------------------------------------------------ ------- -------

The 6.125% bonds were issued by Law Debenture Finance p.l.c. and

guaranteed by the Corporation. The GBP40 million nominal tranche,

which produced proceeds of GBP39.1 million, is constituted by Trust

Deed dated 12 October 1999 and the Corporation's guarantee is

secured by a floating charge on the undertaking and assets of the

Corporation. The stock is redeemable at its nominal amount on 12

October 2034. Interest is payable semi-annually in equal

instalments on 12 April and 12 October in each year.

The 6.125% bonds are stated in the statement of financial

position at book value. Restating them at a fair value of GBP51.5

million at 31 December 2014 (2013: GBP45.3 million) has the effect

of decreasing the year end NAV by 10.20p (2013: 5.00p). The

estimated fair value is based on the redemption yield of the

reference gilt (UK Treasury 4.5% 2034) plus a margin derived from

the spread of BBB UK corporate bond yields over UK gilt yields.

Related party transactions

The related party transactions between the Corporation and its

wholly owned subsidiary undertakings are summarised as follows:

2014 2013

----------------------------------------------------------- ------- -------

GBP000 GBP000

----------------------------------------------------------- ------- -------

Dividends from subsidiaries 6,500 2,500

----------------------------------------------------------- ------- -------

Interest on intercompany balances charged by subsidiaries 2,656 2,642

----------------------------------------------------------- ------- -------

Management charges from subsidiaries 192 198

----------------------------------------------------------- ------- -------

Interest on intercompany balances charged to subsidiaries 1,238 4,950

----------------------------------------------------------- ------- -------

Principal risks and uncertainties - investment trust

The principal risks facing the group in respect of its financial

instruments remain unchanged from 2013 and are:

Market risk

-- price risk, arising from uncertainty in the future value of

financial instruments. The board maintains strategy guidelines

whereby risk is spread over a range of investments, the number of

holdings normally being between 70 and 150. In addition, the stock

selections and transactions are actively monitored throughout the

year by the investment manager, who reports to the board on a

regular basis to review past performance and develop future

strategy. The investment portfolio is exposed to market price

fluctuation: if the valuation at 31 December 2014 fell or rose by

10%, the impact on the group's total profit or loss for the year

would have been GBP60.1 million (2013: GBP59.5 million).

Corresponding 10% changes in the valuation of the investment

portfolio on the Corporation's total profit or loss for the year

would have been the same.

-- foreign currency risk, arising from movements in currency

rates applicable to the group's investment in equities and fixed

interest securities and the net assets of the group's overseas

subsidiaries denominated in currencies other than sterling. The

group's financial assets denominated in currencies other than

sterling were:

2014 2014 2014 2013 2013 2013

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Investments Net monetary Total currency Investments Net monetary Total currency

assets exposure assets exposure

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Group

------------- ------------ ------------- --------------- ------------ ------------- ---------------

GBPm GBPm GBPm GBPm GBPm GBPm

------------- ------------ ------------- --------------- ------------ ------------- ---------------

US Dollar 55.4 7.7 63.1 44.3 4.9 49.2

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Canadian

Dollar 4.7 - 4.7 4.9 - 4.9

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Euro 22.8 1.2 24.0 28.2 0.4 28.6

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Danish

Krone 2.5 - 2.5 1.6 - 1.6

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Swedish

Krona 1.2 - 1.2 1.2 - 1.2

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Swiss Franc 12.1 - 12.1 11.6 - 11.6

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Hong Kong

Dollar - 0.4 0.4 - 0.5 0.5

------------- ------------ ------------- --------------- ------------ ------------- ---------------

Japanese

Yen 2.8 - 2.8 2.6 - 2.6

------------- ------------ ------------- --------------- ------------ ------------- ---------------

101.5 9.3 110.8 94.4 5.8 100.2

------------- ------------ ------------- --------------- ------------ ------------- ---------------

The group US dollar net monetary assets is that held by the US

operations of GBP34.2 million less the US dollar short term

borrowings of GBP26.5 million, which represents the fair value of

the borrowings at 31 December 2014. The short term borrowings were

designated as a hedging investment to hedge the net investment in

US operations at inception in July 2013. The hedge has been

reviewed on an ongoing basis and it has been effective at all times

since inception. The gain or loss on the hedging instrument is

recognised in the translation reserve and set off against the gain

or loss on the translation of the net investment in US

operations.

2014 2014 2014 2013 2013 2013

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Investments Net monetary Total currency Investments Net monetary Total currency

assets exposure assets exposure

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Corporation

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

GBPm GBPm GBPm GBPm GBPm GBPm

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

US Dollar 55.4 (26.5) 28.9 44.3 (26.8) 17.5

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Canadian Dollar 4.7 - 4.7 4.9 - 4.9

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Euro 22.8 0.9 23.7 28.2 0.2 28.4

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Danish Krone 2.5 - 2.5 1.6 - 1.6

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Swedish Krona 1.2 - 1.2 1.2 - 1.2

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Swiss Franc 12.1 - 12.1 11.6 - 11.6

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

Japanese Yen 2.8 - 2.8 2.6 - 2.6

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

101.5 (25.6) 75.9 94.4 (26.6) 67.8

----------------- ------------ ------------- --------------- ------------ ------------- ---------------

The holdings in the Henderson Japan Capital Growth, Henderson

Pacific Capital Growth, Baillie Gifford Pacific and First State

Asia Pacific OEICs and Templeton Emerging Markets Investment Trust

and Scottish Oriental Smaller Companies Trust are denominated in

sterling but have underlying assets in foreign currencies

equivalent to GBP61.6 million (2013: GBP47.6 million). Investments

made in the UK and overseas have underlying assets and income

streams in foreign currencies which cannot be determined and this

has not been included in the sensitivity analysis. If the value of

all other currencies at 31 December 2014 rose or fell by 10%

against sterling, the impact on the group's total profit or loss

for the year would have been GBP16.3 million (2013: GBP14.2

million). Corresponding 10% changes in currency values on the

Corporation's total profit or loss for the year would have been the

same. The calculations are based on the investment portfolio at the

respective year end dates and are not representative of the year as

a whole

.-- interest rate risk, arising from movements in interest rates

on borrowing, deposits and short term investments. The board

reviews the mix of fixed and floating rate exposures and ensures

that gearing levels are appropriate to the current and anticipated

market environment. The group's interest rate profile was:

2014

Sterling HK Dollars US Dollars Euro

-------------- --------- ----------- ----------- -----

GBPm GBPm GBPm GBPm

-------------- --------- ----------- ----------- -----

Floating

rate assets 14.5 0.4 34.2 1.2

--------------- --------- ----------- ----------- -----

2013

Sterling HK Dollars US Dollars Euro

-------------------- --------- ----------- ----------- -----

GBPm GBPm GBPm GBPm

-------------------- --------- ----------- ----------- -----

Floating rate

assets 17.1 0.5 31.7 0.4

-------------------- --------- ----------- ----------- -----

Fixed rate assets

-------------------- --------- ----------- ----------- -----

Bonds

-------------------- --------- ----------- ----------- -----

SSE 5.75% 05/02/14 2.3

-------------------- --------- ----------- ----------- -----

National Grid

6.125% 15/04/14 5.4

-------------------- --------- ----------- ----------- -----

Total 7.7

-------------------- --------- ----------- ----------- -----

Weighted average fixed rate to maturity based on fair value

5.82%.

The group holds cash and cash equivalents on short term bank

deposits and money market funds and has short term borrowings.

Interest rates tend to vary with bank base rates. The investment

portfolio is not directly exposed to interest rate risk.

2014 2013

US Dollars US Dollars

--------------------------- ------------ ------------

GBPm GBPm

--------------------------- ------------ ------------

Floating rate liabilities

--------------------------- ------------ ------------

Short term borrowings 26.5 26.8

--------------------------- ------------ ------------

Interest on the short term borrowings is 1.5% above HSBC's base

rate, the weighted average rate during the year was 1.59%

(2013:1.61%).

2014 2013

Sterling Sterling

----------------------------- ---------- ----------

GBPm GBPm

----------------------------- ---------- ----------

Total

----------------------------- ---------- ----------

Fixed rate liabilities* 39.5 39.4

----------------------------- ---------- ----------

Weighted average fixed rate 6.125% 6.125%

----------------------------- ---------- ----------

*Fixed until 2034.

The group holds cash and cash equivalents on short term bank

deposits and money market funds and has short term borrowings.

Interest rates tend to vary with bank base rates. The investment

portfolio is not directly exposed to interest rate risk.

If interest rates during the year were 1.0% higher the impact on

the group's total profit or loss for the year would have been

GBP183,000 credit (2013: GBP173,000 credit). It is assumed that

interest rates are unlikely to fall below the current level.

The Corporation holds cash and cash equivalents on short term

bank deposits and money market funds and has short term borrowings.

Amounts owed to subsidiary undertakings include GBP40 million at a

fixed rate. Interest rates on cash and cash equivalents and amounts

due to subsidiary undertakings at floating rates tend to vary with

bank base rates. A 1.0% increase in interest rates would have

affected the Corporation's profit or loss for the year by

GBP142,000 charge (2013: GBP27,000 charge). The calculations are

based on the balances at the respective year end dates and are not

representative of the year as a whole.

Liquidity risk

Arising from any difficulty in realising assets or raising funds

to meet commitments associated with any of the above financial

instruments. To minimise this risk, the board's strategy guidelines

only permit investment in equities and fixed interest securities

quoted in major financial markets. In addition, cash balances and

overdraft facilities are maintained commensurate with likely future

settlements. The maturity of the group's existing borrowings is set

out below

Credit risk

Arising from the failure of another party to perform according

to the terms of their contract. The group minimises credit risk

through policies which restrict deposits to highly rated financial

institutions and restrict the maximum exposure to any individual

financial institution. The group's maximum exposure to credit risk

arising from financial assets is GBP57.8 million (2013: GBP56.5

million). The Corporation's maximum exposure to credit risk arising

from financial assets is GBP8.0 million (2013: GBP69.5

million).

Trade and other receivables not impaired but past due by the

following:

2014 2013

------------------------ ------- -------

GBP000 GBP000

------------------------ ------- -------

Between 31 and 60 days 1,533 1,706

------------------------ ------- -------

Between 61 and 90 days 493 149

------------------------ ------- -------

More than 91 days 1,950 509

------------------------ ------- -------

Total 3,976 2,364

------------------------ ------- -------

At 31 December 2014, trade and other receivables which were

impaired and for which there was a bad debt provision totalled

GBP272,000 (2013: GBP347,000) (Corporation: GBPnil (2013:

GBP14,000)). All the impaired trade and other receivables were more

than 91 days past due.

Trade and other payables

2014 2013

------------------------------------------------------- ------- -------

GBP000 GBP000

------------------------------------------------------- ------- -------

Due in less than one month 12,448 10,863

------------------------------------------------------- ------- -------

Due in more than one month and less than three months 564 552

------------------------------------------------------- ------- -------

13,012 11,415

------------------------------------------------------- ------- -------

Fair value

The directors are of the opinion that the fair value of

financial assets and liabilities of the group are not materially

different to their carrying values, with the exception of the

6.125% guaranteed secured bonds 2034.

Principal risks and uncertainties - IFS businesses

The principal risks of the IFS arise where transactions to which

we provide a service come under stress - say by going into default,

or where re-financings or other transaction amendments are

required. Such risks may arise from the wider economic pressures on

some sectors, borrowers and regions. To mitigate these risks, we

work closely with our legal advisers and where appropriate,

financial advisers, both in the set up phase to ensure that we have

as many protections as practicable and on a continuing basis.

The single KPI of the IFS is revenue return per share, which is

reported within the financial summary and performance table.

Directors' responsibility statement pursuant to DTR4

The directors confirm that to the best of their knowledge:

the group financial statements have been prepared in accordance

with IFRSs and Article 4 of the IAS Regulation and give a true and

fair view of the assets, liabilities, financial position and profit

or loss of the group; and

the annual report includes a fair review of the development and

performance of the business and the position of the group and

parent company, together with a description of the principal risks

and uncertainties that they face.

Copies of the annual report will be available from the

Corporation's registered office or on the above website link once

published on 9 March 2015.

By order of the board

Law Debenture Corporate Services Limited

Secretary

26 February 2015

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UVVKRVRAUUAR

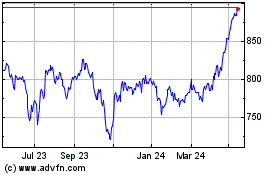

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

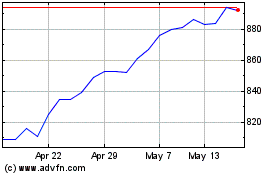

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024