TIDMLWDB

RNS Number : 6647N

Law Debenture Corp PLC

30 July 2014

The Law Debenture Corporation p.l.c. and its subsidiaries

HALF YEARLY REPORT FOR THE SIX MONTHS TO 30 JUNE 2014

(unaudited)

The Directors recommend an interim dividend of 4.7p on the

ordinary shares for the six months to 30 June 2014. The report

including the unaudited results for the period was as follows:

Group summary

From its origins in 1889, Law Debenture has diversified to

become a group with a unique range of activities in the financial

and professional services sectors. The group divides into two

distinct complementary areas of business.

Investment trust

We are a global investment trust, listed on the London Stock

Exchange.

Our portfolio of investments is managed by Henderson Global

Investors Limited under a contract terminable by either side on six

months' notice.

Our objective is to achieve long term capital growth in real

terms and steadily increasing income. The aim is to achieve a

higher rate of total return than the FTSE Actuaries All-Share Index

through investing in a portfolio diversified both geographically

and by industry.

Independent fiduciary services

We are a leading provider of independent fiduciary services. Our

activities are corporate trusts, agency solutions, pension trusts,

corporate services (including agent for service of process) whistle

blowing services and governance services. We have offices in

London, Sunderland, New York, Delaware, Hong Kong, the Channel

Islands and the Cayman Islands.

Companies, agencies, organisations and individuals throughout

the world rely upon Law Debenture to carry out its duties with the

independence and professionalism upon which its reputation is

built.

Registered office

Fifth Floor

100 Wood Street

London EC2V 7EX

Telephone: 020 7606 5451

Facsimile: 020 7606 0643

Email: enquiries@lawdeb.com

(Registered in England No 30397)

Financial summary

30 June 30 June 31 December

2014 2013 2013

Pence Pence Pence

Share price 518.50 481.50 529.00

NAV per share after proposed

dividend 484.97 423.10 472.87

NAV per share after proposed

dividend

with debt at fair value 478.12 418.61 467.87

Net revenue return per share:

- Investment trust 6.08 5.60 9.31

- Independent fiduciary services 3.23 3.24 6.96

Group net revenue return

per share 9.31 8.84 16.27

Capital return per share 7.83 44.71 97.18

Dividends per share 4.70 4.50 15.00

%

Ongoing charges 0.47

Gearing 5

Ongoing charges are based on the costs of the investment trust

and include the Henderson management fee of 0.30% of NAV for the

investment trust. There is no performance element related to the

fee.

Performance to 30 June 2014

6 months 12 months

% %

Share price total return

1 0.00 10.9

NAV total return 1 3.40 18.0

FTSE All-Share Index total

return 1.60 13.1

1. Source AIC, NAV used to calculate total return has been

adjusted to reflect the fair value of the debenture. The adjustment

reduced the NAV at 30 June 2014 by 6.85p (31 December 2013: 5.00p:

30 June 2013:4.49p).

Basis of preparation

The results for the period have been prepared in accordance with

International Financial Reporting Standards (IAS 34 - Interim

financial reporting).

The financial resources available are expected to meet the needs

of the group for the

foreseeable future. The financial statements have therefore been

prepared on a going concern basis.

There have been no changes to the group's accounting policies

during the period.

Half yearly management report

Performance

Our net asset value total return for the six months to 30 June

2014 was 3.4%, compared to a total return of 1.6% for the FTSE

Actuaries All-Share Index. Net revenue per share was 9.31p, an

increase of 5.3% over the corresponding period last year, as a

result of a 8.6% increase in the investment trust and a 0.3%

decrease in independent fiduciary services.

Dividend

The board has declared an interim dividend of 4.7p (2013: 4.5p).

The dividend will be paid on 12 September 2014 to holders on the

record date of 15 August 2014. The current expectation of the

directors is that the final dividend will be maintained.

Investment trust

The equity portfolio rose in value by a small amount during the

period. This comes after a few years of strong returns from

equities. Corporate profits have risen but the appreciation of

share prices has outstripped these rises as the valuations on

equities have increased. We believe a period of consolidation is

occurring in which earnings will grow and therefore justify the

valuations. The outlook for earnings growth remains intact with the

global economy growing and companies that are producing competitive

products benefitting. Company costs remain well controlled with

modest wage growth and a low rate of raw material price increase.

The good operating margins that are being achieved are leading to

substantial cash generation by some companies. This has resulted in

corporate debt particularly in the UK falling to low levels. The

resulting strong balance sheets and high dividend cover mean we are

retaining the large exposure to UK quoted companies. After a period

of poor performance in some emerging markets we are finding

opportunities. For instance, a holding has been purchased in

Embraer, the Brazilian based aerospace company. We do not expect

there will be significant changes to the portfolio in coming months

but we will remain alive to actions that may need to be taken. We

will retain a relatively long list of stocks to mitigate risk.

Alternative Investment Fund Managers Directive

The Corporation has made its application to the Financial

Conduct Authority to become its own Alternative Investment Fund

Manager (AIFM), as it is permitted to do under the legislation. The

Corporation has appointed a depositary, as required, which together

with other costs of complying with the Directive will increase our

ongoing charges.

Independent fiduciary services

Revenue, net of cost of sales, which represents legal costs

recharged to clients, increased by 1.3% over the corresponding

period last year. Administration costs increased by 1.6% leaving

profit before interest marginally ahead. After taking account of

the cost of the bank facility put in place in the second half of

last year to provide capital in the US, profit before tax fell by

3.4%. We will continue to look for opportunities to improve

revenues and control costs.

Group income statement

for the six months ended 30 June 2014 (unaudited)

30 June 2014 30 June 2013

--------------------------------- ------------------------------------

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------- --------- --------- ----------- --------- ------------

UK dividends 7,497 - 7,497 6,531 - 6,531

UK special dividends 631 - 631 778 - 778

Overseas dividends 1,508 - 1,508 1,401 - 1,401

Overseas special dividends 8 - 8 32 - 32

Interest from securities 103 - 103 295 - 295

----------------------------- ----------- --------- --------- ----------- --------- ------------

9,747 - 9,747 9,037 - 9,037

Interest income 34 - 34 30 - 30

Independent fiduciary

services fees 15,345 - 15,345 14,751 - 14,751

Other income 49 - 49 21 - 21

Total income 25,175 - 25,175 23,839 - 23,839

Net gain on investments

held at fair value through

profit or loss - 9,388 9,388 - 52,737 52,737

----------------------------- ----------- --------- --------- ----------- --------- ------------

Gross income and capital

gains 25,175 9,388 34,563 23,839 52,737 76,576

Cost of sales (2,040) - (2,040) (1,590) - (1,590)

Administrative expenses (10,226) (169) (10,395) (9,977) (128) (10,105)

----------------------------- ----------- --------- --------- ----------- --------- ------------

Operating profit 12,909 9,219 22,128 12,272 52,609 64,881

Finance costs

Interest payable (1,434) - (1,434) (1,225) - (1,225)

----------------------------- ----------- --------- --------- ----------- --------- ------------

Profit before taxation 11,475 9,219 20,694 11,047 52,609 63,656

Taxation (507) - (507) (643) - (643)

Profit for period 10,968 9,219 20,187 10,404 52,609 63,013

----------------------------- ----------- --------- --------- ----------- --------- ------------

Return per ordinary

share (pence) 9.31 7.83 17.14 8.84 44.71 53.55

----------------------------- ----------- --------- --------- ----------- --------- ------------

Diluted return per ordinary

share (pence) 9.30 7.82 17.12 8.83 44.67 53.50

----------------------------- ----------- --------- --------- ----------- --------- ------------

Statement of comprehensive income

for the six months ended 30 June 2014 (unaudited)

30 June 2014 30 June 2013

---------------------------- ----------------------------

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------- -------- -------- -------- -------- --------

Profit for the period 10,968 9,219 20,187 10,404 52,609 63,013

Foreign exchange on

translation of foreign

operations - (106) (106) - (254) (254)

-------- -------- -------- -------- -------- --------

Total comprehensive

income for the period 10,968 9,113 20,081 10,404 52,355 62,759

-------- -------- -------- -------- -------- --------

Group statement of financial position

30 June 30 June 31 December

2014 2013 2013

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Assets

Non current assets

Goodwill 2,143 2,238 2,167

Property, plant and equipment 159 230 207

Other intangible assets 122 300 223

Investments held at fair value

through profit or loss 601,266 533,083 595,173

Deferred tax assets 704 1,020 775

---------------------------------- ------------- ------------- ------------

Total non current assets 604,394 536,871 598,545

---------------------------------- ------------- ------------- ------------

Current assets

Trade and other receivables 8,850 3,297 6,787

Other accrued income and prepaid

expenses 5,329 5,638 4,963

Cash and cash equivalents 49,136 21,332 49,688

---------------------------------- ------------- ------------- ------------

Total current assets 63,315 30,267 61,438

---------------------------------- ------------- ------------- ------------

Total assets 667,709 567,138 659,983

---------------------------------- ------------- ------------- ------------

Current liabilities

Trade and other payables 14,385 11,464 12,071

Short term borrowing 25,248 - 26,793

Corporation tax payable 656 679 951

Other taxation including social

security 636 617 655

Deferred income 4,270 4,175 4,059

---------------------------------- ------------- ------------- ------------

Total current liabilities 45,195 16,935 44,529

---------------------------------- ------------- ------------- ------------

Non current liabilities and

deferred income

Long term borrowings 39,458 39,431 39,445

Retirement benefit obligations 729 1,867 1,089

Deferred income 5,546 5,769 5,848

Total non current liabilities 45,733 47,067 46,382

---------------------------------- ------------- ------------- ------------

Total net assets 576,781 503,136 569,072

---------------------------------- ------------- ------------- ------------

Equity

Called up share capital 5,908 5,905 5,908

Share premium 8,296 8,125 8,283

Capital redemption 8 8 8

Own shares (1,712) (1,797) (1,695)

Capital reserves 528,921 457,943 519,702

Retained earnings 35,278 32,897 36,678

Translation reserve 82 55 188

---------------------------------- ------------- ------------- ------------

Total equity 576,781 503,136 569,072

---------------------------------- ------------- ------------- ------------

Group statement of cash flows

For the six months ended 30 June 2014

31 December

30 June 30 June 2013

2014 (unaudited) 2013 (unaudited) (audited)

GBP000 GBP000 GBP000

------------------------------------- ------------------ ------------------ ---------------

Operating activities

Operating profit before interest

payable and taxation 22,128 64,881 137,933

(Gains) on investments (9,219) (52,069) (114,368)

Foreign exchange 24 (62) 15

Depreciation of property, plant

and equipment 61 72 154

Amortisation of intangible assets 101 101 199

(Increase)/decrease in receivables (2,429) 1,289 1,526

Increase in payables 2,217 681 1,303

Transfer (from)/to capital reserves (14) 223 150

Normal pension contributions

in excess of cost (360) (360) (706)

------------------------------------- ------------------ ------------------ ---------------

Cash generated from operating

activities 12,509 14,216 23,154

------------------------------------- ------------------ ------------------ ---------------

Taxation (731) (863) (1,482)

Interest paid (1,434) (1,225) (2,736)

Operating cash flow 10,344 12,128 18,936

------------------------------------- ------------------ ------------------ ---------------

Investing activities

Acquisition of property, plant

and equipment (13) (43) (109)

Expenditure on intangible assets - (37) (57)

Purchase of investments (28,665) (49,489) (101,534)

Sale of investments 31,864 48,305 100,222

Cash flow from investing activities 3,186 (1,264) (1,478)

------------------------------------- ------------------ ------------------ ---------------

Financing activities

Dividends paid (12,368) (11,471) (16,768)

Proceeds of increase in share

capital 13 3 164

Purchase of own shares (17) (19) 83

------------------------------------- ------------------ ------------------ ---------------

Net cash flow from financing

activities (12,372) (11,487) (16,521)

------------------------------------- ------------------ ------------------ ---------------

Net increase/(decrease) in cash

and cash equivalents 1,158 (623) 937

------------------------------------- ------------------ ------------------ ---------------

Cash and cash equivalents at

beginning of period 22,895 22,201 22,201

Foreign exchange (losses) on

cash and cash equivalents (165) (246) (243)

------------------------------------- ------------------ ------------------ ---------------

Cash and cash equivalents at

end of period 23,888 21,332 22,895

------------------------------------- ------------------ ------------------ ---------------

Cash and cash equivalents comprise

Cash and cash equivalents 49,136 21,332 49,688

------------------------------------- ------------------ ------------------ ---------------

Short term borrowings (25,248) - (26,793)

------------------------------------- ------------------ ------------------ ---------------

23,888 21,332 22,895

------------------------------------- ------------------ ------------------ ---------------

Group statement of changes in equity

Share Share Own Capital Translation Capital Retained

capital premium shares redemption reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Equity at 1 January

2014 5,908 8,283 (1,695) 8 188 519,702 36,678 569,072

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Net profit - - - - - 9,219 10,968 20,187

Other comprehensive

income:

Foreign exchange - - - - (106) - - (106)

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Total comprehensive

income for the

period - - - - (106) 9,219 10,968 20,081

Issue of shares - 13 - - - - - 13

Movement in own

shares - - (17) - - - - (17)

Dividend relating

to 2013 - - - - - - (12,368) (12,368)

Total equity

at 30 June 2014 5,908 8,296 (1,712) 8 82 528,921 35,278 576,781

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Group segmental analysis

Independent fiduciary Total

Investment trust services

----------------------------------------- ------------------------------------------ --------------------------------------

30 31 30

June 30 June Dec 30 June June 31 Dec 30 June 30 June 31 Dec

2014 2013 2013 2014 2013 2013 2014 2013 2013

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------- ------------ ------- ------------- ------- ------------- ------------------------- ----------- -----------

Revenue

Income 9,781 9,037 15,785 15,345 14,751 31,819 24,126 23,788 47,604

Other income - - 71 49 21 112 49 21 183

Cost of sales - - - (2,040) (1,590) (4,744) (2,040) (1,590) (4,744)

Administration

costs (1,329) (1,218) (2,412) (8,897) (8,759) (17,127) (10,226) (9,977) (19,539)

---------- ------------ --------------- -------------- ------------- ----------- ------------ ----------- -----------

8,452 7,819 13,444 4,457 4,423 10,060 12,909 12,242 23,504

Interest (net) (1,286) (1,232) (2,481) (148) 37 (194) (1,434) (1,195) (2,675)

---------- ------------ --------------- -------------- ------------- ----------- ------------ ----------- -----------

Return,

including

profit on

ordinary

activities

before

taxation 7,166 6,587 10,963 4,309 4,460 9,866 11,475 11,047 20,829

Taxation - - - (507) (643) (1,679) (507) (643) (1,679)

---------- ------------ --------------- -------------- ------------- ----------- ------------ ----------- -----------

Return,

including

profit

attributable

to

shareholders 7,166 6,587 10,963 3,802 3,817 8,187 10,968 10,404 19,150

---------- ------------ --------------- -------------- ------------- ----------- ------------ ----------- -----------

Revenue

return

per ordinary

share

(pence) 6.08 5.60 9.31 3.23 3.24 6.96 9.31 8.84 16.27

---------- ------------ --------------- -------------- ------------- ----------- ------------ ----------- -----------

Assets 610,444 545,371 605,761 57,265 21,767 54,222 667,709 567,138 659,983

Liabilities (52,961) (58,480) (53,320) (37,967) (5,522) (37,591) (90,928) (64,002) (90,911)

---------- ------------ --------------- -------------- ------------- ----------- ------------ ----------- -----------

Total net

assets 557,483 486,891 552,441 19,298 16,245 16,631 576,781 503,136 569,072

---------- ------------ --------------- -------------- ------------- ----------- ------------ ----------- -----------

The capital element of the income statement is wholly

attributable to the investment trust.

Analysis of the investment portfolio

By geographical location

Valuation Valuation

31 December Costs Sales Appreciation/ 30 June

2013 Purchases of proceeds (depreciation) 2014

GBP000 GBP000 acquisition GBP000 GBP000 GBP000 %

GBP000

United Kingdom 455,812 18,717 (81) (29,048) 3,602 449,002 74.7

North America 49,223 1,195 (2) (197) 4,972 55,191 9.2

Europe 39,996 1,608 (2) (2,619) (309) 38,674 6.4

Japan 16,955 - - - (654) 16,301 2.7

Other Pacific 33,187 775 (4) - 1,751 35,709 5.9

Other - 6,370 (21) - 40 6,389 1.1

---------------- ------------- ------------ ------------------- ----------- ----------------- ---------- ------

595,173 28,665 (110) (31,864) 9,402 601,266 100.0

---------------- ------------- ------------ ------------------- ----------- ----------------- ---------- ------

By Sector (excluding cash)

As at As at

30 June 31 December

2014 2013

% %

Oil & gas 11.2 10.4

Basic materials 8.0 6.3

Industrials 24.6 25.1

Consumer goods 10.8 10.7

Health care 8.6 8.8

Consumer services 8.2 9.3

Telecommunications 0.5 0.6

Utilities 2.1 3.3

Financials 12.6 12.9

Technology 2.4 2.2

Pooled equity investments 11.0 10.4

100.0 100.0

---------------------------- --------- -------------

Investment portfolio valuation

as at 30 June 2014

UK unless otherwise

stated.

Holdings in italics were acquired

since 31 December 2013

GBP'000 %

--------- ------

Oil & gas

Oil & gas producers

BP 18,022 3.00

Royal Dutch Shell 15,255 2.54

Premier Oil 2,504 0.42

Providence Resources 2,346 0.39

Indus Gas 1,844 0.31

Total (Fra) 1,751 0.29

Tullow Oil 1,706 0.28

Xcite Energy 1,335 0.22

44,763 7.45

--------------------------------- --------- ------

Oil equipment & services

Cape 7,356 1.22

Gibson Energy (Can) 5,887 0.98

Schlumberger (USA) 5,518 0.92

National Oilwell Varco

(USA) 2,408 0.40

AMEC 1,214 0.20

Now (USA) 265 0.04

22,648 3.76

--------------------------------- --------- ------

Basic materials

Chemicals

Velocys 10,852 1.80

Croda 3,852 0.64

Elementis 2,258 0.38

Brenntag (Ger) 1,279 0.21

Linde (Ger) 1,241 0.21

19,482 3.24

--------------------------------- --------- ------

Forestry & paper

Mondi 4,248 0.71

4,248 0.71

--------------------------------- --------- ------

Mining

Rio Tinto 13,211 2.20

BHP Billiton 7,558 1.26

Glencore 3,255 0.54

24,024 4.00

--------------------------------- --------- ------

Industrials

Construction & materials

Accsys Technologies 4,546 0.76

Balfour Beatty 3,653 0.61

Marshalls 1,084 0.18

9,283 1.55

--------------------------------- --------- ------

GBP'000 %

--------- ------

Aerospace & defence

Senior 16,292 2.71

BAE Systems 7,789 1.30

Rolls Royce 5,345 0.89

Meggitt 5,060 0.83

Lockheed Martin (USA) 4,229 0.69

Embraer (Bra) 3,586 0.60

42,301 7.02

--------------------------------- --------- ------

General industrials

Smith (DS) 7,647 1.27

7,647 1.27

--------------------------------- --------- ------

Electronic & electrical

equipment

Applied Materials (USA) 6,594 1.10

Morgan Advanced Materials 6,486 1.08

Spectris 5,545 0.92

TT Electronics 2,994 0.50

XP Power 1,751 0.29

Legrand (Fra) 1,167 0.19

Philips Electronics

(Net) 1,153 0.19

25,690 4.27

--------------------------------- --------- ------

Industrial engineering

Weir Group 7,857 1.31

Hill & Smith 7,538 1.25

Cummins (USA) 6,314 1.05

Deere (USA) 5,244 0.87

Renold 2,775 0.46

Caterpillar (USA) 2,542 0.42

IMI 1,300 0.22

Severfield-Rowen 463 0.08

34,033 5.66

--------------------------------- --------- ------

Industrial transportation

AP Moller-Maersk (Den) 1,815 0.30

Wincanton 653 0.11

Goldenport 277 0.05

2,745 0.46

--------------------------------- --------- ------

Support services

Interserve 6,654 1.11

Carillion 4,131 0.69

Babcock 4,022 0.67

Johnson Service 3,459 0.58

Deutsche Post (Ger) 2,654 0.44

SGS (Swi) 1,821 0.30

Sodexo (Fra) 1,536 0.26

Adecco (Swi) 1,459 0.24

Augean 458 0.08

26,194 4.37

--------------------------------- --------- ------

GBP'000 %

--------- ------

Consumer goods

Automobiles & parts

GKN 16,413 2.73

Toyota Motor (Jap) 2,404 0.40

18,817 3.13

--------------------------------- --------- ------

Beverages

Diageo 7,089 1.18

Pernod-Ricard (Fra) 1,317 0.22

8,406 1.40

--------------------------------- --------- ------

Food producers

Associated British

Foods 6,858 1.14

Unilever 4,637 0.77

Nestlé (Swi) 3,611 0.60

15,106 2.51

--------------------------------- --------- ------

Household goods & home construction

Bellway 7,038 1.17

Redrow 6,037 1.00

L'Oreal (Fra) 1,567 0.26

14,642 2.43

--------------------------------- --------- ------

Tobacco

Imperial Tobacco 5,258 0.87

British American Tobacco 1,739 0.29

Swedish Match (Swe) 1,230 0.20

8,227 1.36

--------------------------------- --------- ------

Health care

Health care equipment

& services

Becton Dickinson (USA) 5,187 0.86

Smith & Nephew 4,879 0.81

Fresenius (Ger) 3,578 0.60

Fresenius Medical Care

(Ger) 1,527 0.25

15,171 2.52

--------------------------------- --------- ------

Pharmaceuticals & biotechnology

GlaxoSmithKline 11,726 1.95

BTG 7,590 1.26

AstraZeneca 6,510 1.08

Novartis (Swi) 2,884 0.48

Pfizer (USA) 2,603 0.43

Shire 2,285 0.38

Roche (Swi) 2,268 0.38

Novo-Nordisk (Den) 915 0.15

36,781 6.11

--------------------------------- --------- ------

GBP'000 %

--------- ------

Consumer services

Food & drug retailers

Tesco 3,552 0.59

3,552 0.59

---------------------------- --------- ------

General retailers

Dunelm 7,089 1.18

Findel 2,143 0.36

Inditex (Spa) 1,025 0.17

Topps Tiles 797 0.13

11,054 1.84

---------------------------- --------- ------

Media

Reed Elsevier 7,050 1.17

British Sky Broadcasting 4,972 0.83

Pearson 3,171 0.53

Daily Mail & General

Trust 2,204 0.37

17,397 2.90

---------------------------- --------- ------

Travel & leisure

Greene King 5,314 0.88

Carnival 4,416 0.73

International Consolidated

Airlines 3,057 0.51

Marstons 2,966 0.49

Betfair 1,827 0.30

17,580 2.91

---------------------------- --------- ------

Telecommunications

Mobile telecommunications

Inmarsat 2,712 0.45

2,712 0.45

---------------------------- --------- ------

Utilities

Electricity

SSE 4,701 0.78

4,701 0.78

---------------------------- --------- ------

Gas water & multiutilities

National Grid 5,124 0.85

Severn Trent 1,932 0.32

Centrica 1,094 0.18

8,150 1.35

---------------------------- --------- ------

GBP'000 %

------------- --------

Financials

Banks

HSBC 10,969 1.82

10,969 1.82

------------------------------- ------------- --------

Nonlife insurance

Amlin 11,464 1.91

Hiscox 7,560 1.26

19,024 3.17

------------------------------- ------------- --------

Life insurance / assurance

Prudential 4,023 0.67

Aviva 4,003 0.67

Chesnara 3,180 0.53

Permanent TSB (Ire) 25 -

11,231 1.87

------------------------------- ------------- --------

Real estate investments &

services

St Modwen Properties 4,841 0.81

4,841 0.81

------------------------------- ------------- --------

Real estate investment

trusts

Mucklow (A&J) Group 3,612 0.60

Land Securities 3,335 0.55

6,947 1.15

------------------------------- ------------- --------

Financial services

IP Group 8,030 1.34

International Personal

Finance 7,038 1.17

Provident Financial 6,278 1.04

Deutsche Börse

(Ger) 1,190 0.20

22,536 3.75

------------------------------- ------------- --------

Equity investment instruments

Henderson Japan Capital

Growth 13,897 2.31

Henderson Asia Pacific

Capital Growth 12,609 2.10

Baillie Gifford Pacific 12,009 2.00

First State Asia Pacific 10,269 1.71

Herald Investment Trust 5,525 0.92

Better Capital (2012) 5,000 0.83

Foresight Solar 3,008 0.50

Templeton Emerging

Markets Investment

Trust 2,803 0.47

Scottish Oriental Smaller

Company Trust 822 0.14

65,942 10.98

------------------------------- ------------- --------

GBP'000 %

------------- --------

Technology

Software & computer

services

Microsoft (USA) 7,316 1.22

Sage 2,191 0.36

Amadeus IT (Spa) 1,618 0.27

11,125 1.85

------------------------------- ------------- --------

Technology hardware & equipment

Imagination Technologies 1,898 0.32

Atmel (USA) 1,084 0.18

2,982 0.50

-------------------------- ------- ------

Principal risks and uncertainties

The principal risks of the Corporation relate to the investment

activities and include market price risk, foreign currency risk,

liquidity risk, interest rate risk and credit risk. These are

explained in the notes to the annual accounts for the year ended 31

December 2013. In the view of the board these risks are as

applicable to the remaining six months of the financial year as

they were to the period under review.

The principal risks of the independent fiduciary services

business arise during the course of defaults, potential defaults

and restructurings where we have been appointed to provide

services. To mitigate these risks we work closely with our legal

advisers and, where appropriate, financial advisers, both in the

set up phase to ensure that we have as many protections as

practicable, and at all other stages whether or not there is a

danger of default.

Related party transactions

There have been no related party transactions during the period

which have materially affected the financial position or

performance of the group. During the period transactions between

the Corporation and its subsidiaries have been eliminated on

consolidation. Details of related party transactions are given in

the notes to the annual accounts.

Directors' responsibility statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU;

-- the half yearly report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period.

On behalf of the board

Christopher Smith

29 July 2014

Notes

1. The financial information presented herein does not amount to

full statutory accounts within the meaning of Section 435 of the

Companies Act 2006 and has neither been audited nor reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual report and financial statements for 2013 have been filed

with the Registrar of Companies. The independent auditors' report

on the annual report and financial statements for 2013 was

unqualified, did not include a reference to any matters to which

the auditor drew attention by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

2. The calculations of NAV and earnings per share are based on:

NAV: shares at end of the period 117,788,551 (30 June 2013:

117,664,360) (31 December 2013: 117,731,109).

Income: average shares during the period 117,781,948 (30 June

2013: 117,657,023) (31 December 2013: 117,681,186).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDRXDDBGSC

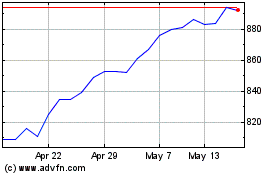

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

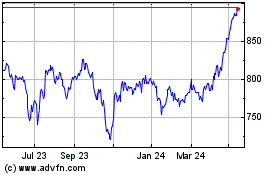

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024