LAW DEBENTURE CORP PLC - Interim Management Statement

April 29 2014 - 1:09PM

PR Newswire (US)

The Law Debenture Corporation p.l.c. Interim Management Statement

for the three months ended 31 March 2014 (including subsidiaries)

Company history

From its origins in 1889, Law Debenture has diversified to become a group with

a unique range of activities in the financial services sector. The group

divides into two distinct complementary areas of business.

Firstly, we are a global investment trust, listed on the London Stock Exchange.

Our portfolio of investments is managed by Henderson Global Investors Limited

under a contract terminable by either side on 6 months' notice.

Secondly, we are a leading provider of independent fiduciary services. Our

activities are corporate trusts, agency solutions, pension trusts, corporate

services (including agent for service of process) whistle blowing services and

governance services. We have offices in London, Sunderland, New York, Delaware,

Hong Kong and the Channel Islands.

Fund objective

Our objective is to achieve long term capital growth in real terms and steadily

increasing income. The aim is to achieve a higher rate of total return than the

FTSE All-Share Index through investing in a portfolio diversified both

geographically and by industry.

Company Information

At the Annual General Meeting of the Corporation on 9 April 2014 all

resolutions were passed. The final dividend for 2013 of 10.5p was paid on 17

April 2014. There are no other material events or transactions to report.

Trust information

Sector Global Growth

Benchmark FTSE All-Share index

Trust type Conventional (Ords)

Launch date December 1889

Financial year end 31 December

Dividend payment April, September

Last ex div date 19 March 2014

Management fee (based on NAV) 0.30%

Performance fee No

Ongoing charges 0.45%

Trust statistics at 31 March 2014

Gross total assets £635m

NAV per ordinary share (cum income) 483.1p

NAV per ordinary share (ex income) 479.3p

Share price (code LWDB) 527.5p

Premium/(discount) (cum income) 9.2%

NAV (debt at fair value)

NAV per ordinary share (cum income) 477.2p

NAV per ordinary share (ex income) 473.4p

Group gearing - AIC (net) 4%

Group gearing - excluding 6%

fixed interest (net)

Yield 2.8%

Performance to 31 March 2014 3mths 1yr 3yrs 5yrs 10yrs

Share price (total return) 1.7% 16.9% 68.6% 211.9% 251.3%

Net asset value (total return) 2.2% 17.1% 53.3% 193.1% 243.0%

FTSE All-Share (total return) -0.6% 8.8% 28.8% 113.3% 128.7%

Geographic breakdown at 31 March 2014

UK 76.4%

North America 8.9%

Europe 6.6%

Other Pacific 5.5%

Japan 2.6%

OEICs included

above:

Henderson Japan 2.2%

Capital Growth

Henderson Asia 2.1%

Pacific Capital

Growth

Baillie Gifford 1.9%

Pacific

First State Asia 1.6%

Pacific

Sector breakdown at 31 March 2014

Industrials 25.0%

Financials 12.5%

Consumer Goods 11.1%

Oil & Gas 10.6%

Pooled Equity 10.1%

Investments

Health Care 9.2%

Consumer Services 8.7%

Basic Materials 7.1%

Utilities 2.9%

Technology 2.4%

Telecommunications 0.4%

Top Ten Equity Holdings (excluding OEICs and Gilts) at 31 March 2014 as a

percentage of the portfolio

Senior 2.9%

GKN 2.9%

BP 2.8%

Rio Tinto 2.4%

Royal Dutch Shell 2.3%

GlaxoSmithKline 2.0%

Amlin 2.0%

HSBC 1.9%

Smith (DS) 1.6%

AstraZeneca 1.6%

Contacts

Caroline Banszky Tim Fullwood

Managing Director Chief Financial Officer

Email: caroline.banszky@lawdeb.com Email: tim.fullwood@lawdeb.com

Tel: +44 (0)207 606 5451

Copyright l 29 PR Newswire

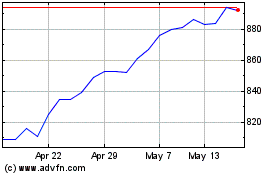

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

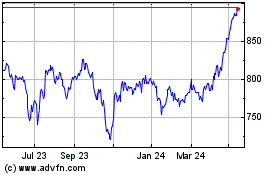

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024