TIDMLWDB

ANNUAL FINANCIAL REPORT for the year ended 31 December 2013 (audited)

This is the Annual Financial Report of The Law Debenture Corporation p.l.c. as

required to be published under DTR 4 of the UKLA Listing Rules.

The directors recommend a final dividend of 10.50p per share making a total for

the year of 15.00p. Subject to the approval of shareholders, the final dividend

will be paid on 17 April 2014 to holders on the register on the record date of

21 March 2014. The annual financial report has been prepared in accordance with

International Financial Reporting Standards.

Group income statement

for the year ended 31 December

2013 2012

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

UK dividends 12,276 - 12,276 11,431 - 11,431

UK special 990 - 990 457 - 457

dividends

Overseas 1,918 - 1,918 1,792 - 1,792

dividends

Overseas 35 - 35 51 - 51

special

dividends

Interest from 566 - 566 661 - 661

securities

15,785 - 15,785 14,392 - 14,392

Interest 61 - 61 140 - 140

income

Independent 31,819 - 31,819 29,760 - 29,760

fiduciary

services fees

Other income 183 183 105 105

Total income 47,848 - 47,848 44,397 - 44,397

Net gain on - 114,864 114,864 - 59,259 59,259

investments

held at fair

value through

profit or loss

Gross income 47,848 114,864 162,712 44,397 59,259 103,656

and capital

gains

Cost of sales (4,744) - (4,744) (3,761) - (3,761)

Administrative (19,539) (496) (20,035) (18,638) (193) (18,831)

expenses

Operating 23,565 114,368 137,933 21,998 59,066 81,064

profit

Finance costs

Interest (2,736) - (2,736) (2,450) - (2,450)

payable

Profitbefore 20,829 114,368 135,197 19,548 59,066 78,614

taxation

Taxation (1,679) - (1,679) (1,753) - (1,753)

Profit for 19,150 114,368 133,518 17,795 59,066 76,861

year

Return per 16.27 97.18 113.45 15.14 50.24 65.38

ordinary share

(pence)

Diluted return 16.26 97.10 113.36 15.13 50.21 65.34

per ordinary

share (pence)

Statement of comprehensive income

for the year ended 31 December

Revenue Capital Total Revenue Capital Total

2013 2013 2013 2012 2012 2012

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Profit for the year 19,150 114,368 133,518 17,795 59,066 76,861

Foreign exchange on - (121) (121) - (204) (204)

translation of foreign

operations

Pension actuarial gains 432 - 432 336 - 336

Taxation on pension (100) - (100) (104) - (104)

Total comprehensive income 19,482 114,247 133,729 18,027 58,862 76,889

for the year

Financial summary and performance

Financial summary

31 December 31 December

2013 2012

pence pence

Share price 529.00 425.00

NAV per share after proposed 472.87 374.55

final dividend

NAV per share after proposed 467.87 367.86

final dividend with debt at

fair value

Revenue return per share

- Investment trust 9.31 8.47

- Independent fiduciary 6.96 6.67

services

Group revenue return per share 16.27 15.14

Capital return per share 97.18 50.24

Dividends per share 15.00 14.25

2013

%

Ongoing charges¹ 0.45

Gearing¹ 5

Ongoing charges are based on the costs of the investment trust and include the

Henderson management fee of 0.30% of the NAV of the investment trust. There is

no performance related element to the fee.

Performance

2013 2012

% %

Share price total return¹ 28.3 32.0

NAV total return¹ 28.6 19.7

FTSE Actuaries All-Share Index 20.8 12.3

total return

¹ Source AIC.

Chairman's statement and review of 2013

Performance

Our net asset value total return for the year to 31 December 2013 was 28.6%,

compared to a total return of 20.8% for the FTSE Actuaries All-Share Index. Net

revenue return per share was 16.27p, an increase of 7.5% over the previous

year, as a result of a 9.9% increase in the investment trust and a 4.3%

increase in independent fiduciary services.

Dividend

The board is recommending a final dividend of 10.50p per ordinary share (2012:

9.75p) which, together with the interim dividend of 4.5p (2012: 4.5p), gives a

total dividend of 15.00p (2012: 14.25p).

The final dividend will be paid, subject to shareholder approval, on 17 April

2014 to holders on the register on the record date of 21 March 2014.

Our policy continues to be to seek growth in both capital and income. We attach

considerable importance to the dividend, which we aim to increase over a

period, if not every year, at a rate which is covered by earnings and which

does not inhibit the flexibility of our investment strategy. Our basis for

reporting earnings is more conservative than that of many investment trusts, in

that all of our expenses, including interest costs, are charged fully to the

revenue account.

Investment trust

Performance of the portfolio during the year was pleasing both in terms of

revenue return and, in particular, capital return. Global equity markets forged

ahead and the portfolio comfortably outperformed the comparator index. Although

we remained wary of wider macroeconomic trends, not all of which are positive,

we introduced gearing of 5% to enable the investment manager to take advantage

of the opportunities he identified. A more detailed description of the

portfolio performance is set out in the investment manager's review.

Independent fiduciary services

The businesses produced increased returns in 2013 as market conditions showed

signs of improvement. We describe in our strategic report how the fiduciary

services businesses fit in to our business model and in particular, how

shareholders benefit from the returns that these businesses provide. A more

detailed review of the independent fiduciary services businesses is given in

the management review.

Regulatory environment

This year's annual report looks rather different to previous years. Changes to

the Companies Act, UK Corporate Governance Code and remuneration regulations

are all reflected.

In particular, we publish for the first time a strategic report, a separate

audit committee report and a remuneration policy. The aim of these changes, all

driven by legislation, is to provide more clarity for shareholders, enable more

comparability between companies in the sector and (in the remuneration area) to

enhance disclosure and make clearer what the board can, and cannot, award by

way of remuneration. Overall, we are required to ensure that the annual report

and financial statements are fair, balanced and understandable, which the board

believes is the case.

The Alternative Investment Fund Managers Directive became law in July 2013.

This legislation was primarily intended to bring funds such as hedge funds and

private equity funds within the regulatory perimeter. Unfortunately, it also

captures investment trusts which, as a result, are now compelled to appoint an

appropriately regulated Alternative Investment Fund Manager ("AIFM"). This is

despite the general perception that investment trusts were already more than

adequately regulated. The Corporation has elected to become its own AIFM, as it

is permitted to do under the legislation, and is in the process of making an

application for authorisation to the Financial Conduct Authority. There will be

additional compliance costs involved in this - principally arising from the

need to appoint a depositary - and this will result in a small increase in our

Ongoing charges.

Board

John Kay who has been a director for the past nine years has decided that he

will not offer himself for re-election at the forthcoming AGM. As one of the

UK's leading economists, the board has benefited greatly from John's insight

and wise counsel, which we shall miss. We are taking steps to recruit a new

non-executive director and will make an announcement as soon as we have

identified a suitable replacement.

The annual general meeting will be held at the Brewers' Hall, Aldermanbury

Square, London EC2V 7HR on 9 April 2014 and I look forward to seeing as many as

possible of you there.

Christopher Smith

Investment manager's review

Review

The global economy grew at a satisfactory rate in 2013. This was driven by a

pick up in activity in the USA where the industrial sector was particularly

strong. The growing importance of shale gas in reducing energy costs coupled

with certain US companies bringing back some of their manufacturing activities

from overseas resulted in a resurgent manufacturing sector. Equity markets

benefited with the USA leading the way but emerging markets lagging.

The portfolio benefited from this strength in the US economy. The manufacturing

sector is well represented through our direct holdings there and also through a

number of our UK companies, which have a significant exposure to the US. The

industrial exposure was responsible at a sector level for the outperformance of

the portfolio.

.

Biggest rises by value

GBP'000

1 Senior 7,582

2. GKN 6,625

3. BTG 4,485

4. DS Smith 4,271

Biggest falls by value

GBP'000

1. Imagination Technology (2,057)

2. Providence Resources (1,780)

3. BHP (376)

4. Indus gas (359)

Investment approach

It is often claimed that it is geographical asset allocation rather than stock

picking that is the major determinant of performance for an international fund.

This is not our view. Close attention to stocks and buying good quality ones

when the valuation is undemanding is the way to provide long term

outperformance.

The macro economic assumption that lies behind the portfolio make up is that

the global economy will be larger in ten years' time than it is today. There

will, for example, be more air miles flown and there will be more cars on the

roads of the globe. We need to be invested in companies that through the

excellence of their product or services benefit from this expansion. The UK

stock market provides us with opportunities to invest in internationally

competitive companies. For instance the aerospace sector is well represented in

the portfolio. The success of Rolls Royce's Trent engine means the company has

a substantial order book. There has been a holding in the company for many

years. It is a great success story of UK technology and manufacturing.

If there is no strong UK company in an area, we will buy an overseas company -

for instance, Toyota is in the portfolio. We are not going overseas for

diversity but rather because there is an opportunity to buy a type of company

we cannot find in the UK, coupled with the belief it will make money for the

portfolio. It is interesting to note that over the last ten years the UK index

and the world index ex UK have returned the same amount.

The UK proportion of many investors' portfolios has been substantially reduced

in recent years. For most, this has not added any value. The UK market provides

not only reasonable valuations but also good corporate governance, and decent

dividend yields with over half the earnings the companies make coming from

outside the UK economy. These are the reasons that although we are classified

as a Global fund the bulk of the assets are in UK quoted companies. If we were

not finding good investment opportunities in the UK we would not hesitate in

increasing the overseas weighting.

Investment activity

During the year we were a net buyer of equities leaving the gearing at the year

end at 105%. Portfolio turnover was relatively low. There was some selling in

the larger holdings such as Senior for portfolio balance reasons. It remains a

large holding because it is a cash generating strong company. The proceeds were

redeployed in new holdings, which include oil exploration companies. This is a

sector that has fallen out of favour but which now offers real value. The

Providence Resource holding, for instance, has been increased.

Outlook

Valuations as measured by price/earnings ratios are higher now than they were a

year ago as share price rises have outstripped profits growth. However, this is

only one measure. Equities on dividend discount models continue to look cheap.

The disciplines learnt by companies in the crisis of late 2008, coupled with

growing sales, lead to margin growth. Levels of capital spending are being

closely monitored with little speculative expansion going on. This means cash

generation is very impressive. Corporate debt has fallen and many of the

holdings in the portfolio now have net cash. This underpins good dividend

growth and means special dividends will become more frequent. It positions

companies well for any economic turbulence. This would argue for further upside

for equities.

James Henderson

Henderson Global Investors Limited

Management review - independent fiduciary services

Results

Independent fiduciary services profit before tax increased by 2.8% from GBP

9.6million to GBP9.9million. Revenue return per share increased by 4.3% from

6.67p to 6.96p.

Independent fiduciary services businesses ("IFS")

Law Debenture is a leading provider of independent third party fiduciary

services, including corporate trusts, agency services, pension trusts,

corporate services (including agent for service of process), treasury services,

whistleblowing services and governance services to client boards. The

businesses are monitored and overseen by a board comprising the heads of the

relevant business areas and two non-executive independent directors.

Review of 2013

The IFS performance was good in parts and satisfactory overall as most of the

markets in which we operate showed signs of renewed activity. Previous years'

uncertainties - caused by pressure on the banking sector and Eurozone

difficulties - were less evident. Some sectors, such as service of process and

corporate trusts were very active and Safecall, our whistleblowing service, had

its best year. Market share remained satisfactory across all of the businesses

and activity levels in pre-existing transactions, where we are able to generate

additional fees for time spent, remained high. We also benefited from receipt

of fees accumulated but uncollected over several years in a number of

transactions where historical matters were finally resolved.

Some notable highlights of the year are set out below.

Corporate trusts

Corporate trusts had a good year as a result of increased activity in the bond

market and particularly in the high yield bond sector. We were selected to act

as trustee by a wide range of companies including Anglo American, Aviva, BT,

GlaxoSmithKline, National Grid, Next, Pennon, The Housing Finance Corporation

and Unilever.

The levels of security trustee work continued to increase and included a number

of aircraft financings and transactions with both the European Investment Bank

and the International Finance Corporation. Security trust appointments often

have long maturities and so generate good long term income. Our recognised

independence as an impartial third party was also instrumental in securing many

escrow agent appointments. We remained busy on post-issuance work including

restructurings and transaction amendments.

Pension trusts and governance services

The performance of our pension trusteeship service was maintained at a time

when the environment for final salary pension schemes continued to be

challenging. We were appointed to 10 new schemes with new clients including

Penguin Books and the TSB Bank.

Andrew Parker and Gerry Degaute joined the team. Both are experienced pension

trustees having been involved in the management of major company pension

schemes.

Our move to offer sole trusteeship services, where we act as the sole trustee

of defined benefit pension schemes, to deliver one-stop governance cost

effectively, is starting to show positive results - with a number of

appointments in this role.

Our governance and board effectiveness business completed its third year in a

highly competitive market that is still developing. We continued to win

assignments in the voluntary and public sector and expect new business from the

listed sector in 2014. We have continued to develop our risk related tools and

our corporate governance board evaluation tools are being used widely,

including by pension fund trustee boards who engage us.

Corporate services

Our long established and highly regarded service of process business had

another solid year with an increase in new appointments.

The corporate services business (provision of corporate directors, company

secretary, accounting and administration of special purpose vehicles) saw some

good gains, including taking on an appointment as company secretary of Herald

Investment Trust. New securitisation deals were secured and we continued to

develop other business lines in the company secretarial and corporate

governance market.

Treasury and agency solutions

Towards the end of the year, we split these functions. Our treasury and banking

operations team is now a part of the corporate trust function and continues to

service our cash escrow, security trust and project finance business.

Our agency solutions team now sits within corporate services and continues to

provide CDO and CLO administration, facility agency and other customised

solutions including data verification and data room services.

Safecall

It was a very good year for our external whistleblowing service with a

significant increase in the number of appointments. Technological enhancements

meant that we were able to access new markets overseas, where recognition of

the benefits of external whistleblowing arrangements is gaining traction.

Notable appointments in 2013 included Adidas, Total, United Utilities, Subsea7

and Salford NHS Trust.

Overseas

United States

The US corporate trust business strengthened its management team in 2013 to

better position the company in the U.S. successor trustee market. Since 2002 a

US$50 million guarantee had been provided to the business by the group, to meet

contractual requirements under certain trust indentures where it acts as

trustee. With the advice of legal, tax and accounting advisers it was deemed

necessary to replace the guarantee with a capital contribution of US$46.5

million, funded mainly by a US$ uncommitted facility.The repositioned company

showed its promise during the year by successfully growing the separate trustee

business and adding several high profile successor trustee appointments. The

core U.S. bankruptcy trustee business continues to face challenges, but should

improve in 2014.

The corporate services business, including Delaware Corporate Services,

continued to generate good returns.

Hong Kong

General business levels remained quiet for the year, but the final quarter saw

some recovery in Hong Kong and China. Employee share trust and escrow services

continued to generate a constant source of revenue and the service of process

team had a very good year, reflecting a significant increase in appointments on

behalf of the US and UK offices as well as a moderate increase in local law

appointments.

Channel Islands

Market conditions have been difficult and new business levels remained on the

low side. Special efforts were made to extend the offshore profile of Law

Debenture, where independence is key to the relationships between transacting

parties, such as escrow arrangements.

Outlook

We expect that activity levels in markets where our IFS businesses operate will

increase in 2014, reflecting the growing consensus that the economy may be

through the worst impact of the recession. Opportunities to win new business

should therefore increase too, albeit that the downward pressure on fees

experienced during the recession, when too many players were chasing too few

deals, may take some time to reverse. We will continue to keep under review the

range of services that we offer and remain open to any prospect that might

allow us safely to grow the IFS business, either by expansion into areas where

there is a need for an established, trusted, independent third party, or

through acquisition.

Caroline Banszky

Statement of financial position as at 31 December

2013 2012

GBP000 GBP000

Assets

Non current assets

Goodwill 2,167 2,182

Property, plant and equipment 207 254

Other intangible assets 223 363

Investments held at fair value 595,173 479,521

through profit or loss

Deferred tax assets 775 1,126

Total non current assets 598,545 483,446

Current assets

Trade and other receivables 6,787 4,244

Other accrued income and prepaid 4,963 5,980

expenses

Cash and cash equivalents 49,688 22,201

Total current assets 61,438 32,425

Total assets 659,983 515,871

Current liabilities

Trade and other payables 12,071 10,745

Short term borrowings 26,793 -

Corporation tax payable 951 1,005

Other taxation including social 655 629

security

Deferred income 4,059 3,948

Total current liabilities 44,529 16,327

Non current liabilities and deferred

income

Long term borrowings 39,445 39,418

Retirement benefit obligations 1,089 2,227

Deferred income 5,848 6,035

Total non current liabilities 46,382 47,680

Total net assets 569,072 451,864

Equity

Called up share capital 5,908 5,905

Share premium 8,283 8,122

Capital redemption 8 8

Own shares (1,695) (1,778)

Capital reserves 519,702 405,334

Retained earnings 36,678 33,964

Translation reserve 188 309

Total equity 569,072 451,864

Statement of cash flows for the year ended 31 December

Operating activities 2013 2012

GBP000 GBP000

Operating profit before interest payable and 137,933 81,064

taxation

(Gains) on investments (114,368) (59,066)

Foreign exchange 15 39

Depreciation of property, plant and equipment 154 149

Amortisation of intangible assets 199 214

(Increase)/decrease in receivables (1,526) 962

Increase/(decrease) in payables 1,303 (314)

Transfer to capital reserves 150 772

Normal pension contributions in excess of (706) (575)

cost

Cash generated from operating activities 23,154 23,245

Taxation (1,482) (1,855)

Interest paid (2,736) (2,450)

Operating cash flow 18,936 18,940

Investing activities

Acquisition of property, plant and equipment (109) (89)

Expenditure on intangible assets (57) (375)

Purchase of investments (101,534) (48,376)

Sale of investments 100,222 50,193

Cash flow from investing activities (1,478) 1,353

Financing activities

Dividends paid (16,768) (15,873)

Proceeds of increase in share capital 164 16

Purchase of own shares 83 (94)

Net cash flow from financing activities (16,521) (15,951)

Net increasein cash and cash equivalents 937 4,342

Cash and cash equivalents at beginning of 22,201 18,063

period

Foreign exchange (losses) on cash and cash (243) (204)

equivalents

Cash and cash equivalents at end of period 22,895 22,201

Statement of changes in equity

Share Share Own Capital Share Translation Capital Retained Total

based

Capital Premium Shares Redemption payments Reserve Reserves Earnings

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Equity 1 5,905 8,106 (1,684) 8 201 513 346,268 31,609 390,926

January 2012

Profit - - - - - - 59,066 17,795 76,861

Foreign - - - - - (204) - - (204)

exchange

Actuarial - - - - - - 232 232

gain on

pension

scheme (net

of tax)

Total - - - - - (204) 59,066 18,027 76,889

comprehensive

income

Issue of - 16 - - - - - - 16

shares

Dividend - - - - - - - (10,582) (10,582)

relating to

2011

Dividend - - - - - - - (5,291) (5,291)

relating to

2012

Movement in - - (94) - - - - - (94)

own shares

Transfer - - - - (201) - - 201 -

Total equity 5,905 8,122 (1,778) 8 - 309 405,334 33,964 451,864

31 December

2012

Equity 1 5,905 8,122 (1,778) 8 - 309 405,334 33,964 451,864

January 2013

Profit - - - - - - 114,368 19,150 133,518

Foreign - - - - - (121) - - (121)

exchange

Actuarial - - - - - - - 332 332

gain on

pension

scheme (net

of tax)

Total - - - - - (121) 114,368 19,482 133,729

comprehensive

income

Issue of 3 161 - - - - - - 164

shares

Dividend - - - - - - - (11,471) (11,471)

relating to

2012

Dividend - - - - - - - (5,297) (5,297)

relating to

2013

Movement in - - 83 - - - - - 83

own shares

Total equity 5,908 8,283 (1,695) 8 - 188 519,702 36,678 569,072

31 December

2013

Segmental analysis

Investment trust Independent Total

fiduciary services

2013 2012 2013 2012 2013 2012

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Segment income 15,785 14,392 31,819 29,760 47,604 44,152

Other income 71 12 112 93 183 105

Cost of sales - - (4,744) (3,761) (4,744) (3,761)

Administration costs (2,412) (1,917) (17,127) (16,721) (19,539) (18,638)

13,444 12,487 10,060 9,371 23,504 21,858

Interest (net) (2,481) (2,534) (194) 224 (2,675) (2,310)

Return, including 10,963 9,953 9,866 9,595 20,829 19,548

profit on ordinary

activities before

taxation

Taxation - - (1,679) (1,753) (1,679) (1,753)

Return, including 10,963 9,953 8,187 7,842 19,150 17,795

profit attributable to shareholders

Revenue return per 9.31 8.47 6.96 6.67 16.27 15.14

ordinary share

Assets 605,761 491,643 54,222 24,228 659,983 515,871

Liabilities (53,320) (54,915) (37,591) (9,092) (90,911) (64,007)

Total net assets 552,441 436,728 16,631 15,136 569,072 451,864

The capital element of the income statement is wholly attributable to the

investment trust.

Portfolio changes in geographical distribution

Valuation Purchases Costs of Sales Appreciation/ Valuation

acquisition proceeds depreciation)

31 December 31 December

2012 2013

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

United Kingdom 330,297 69,862 (358) (36,610) 92,621 455,812

North America 31,440 8,217 (11) - 9,577 49,223

Europe 38,203 4,071 (5) (10,340) 8,067 39,996

Japan 13,174 - - - 3,781 16,955

Other Pacific 31,937 - - - 1,250 33,187

UK Gilts 34,470 19,384 - (53,272) (582) -

479,521 101,534 (374) (100,222) 114,714 595,173

The financial information set out above does not constitute the Corporation's

statutory accounts for 2012 or 2013. Statutory accounts for the years ended 31

December 2012 and 31 December 2013 have been reported on by the Independent

Auditor. The Independent Auditor's Reports on the Annual Report and Financial

Statements for 2012 and 2013 were unqualified, did not draw attention to any

matters by way of emphasis, and did not contain a statement under 498(2) or 498

(3) of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2012 have been filed with the

Registrar of Companies. The statutory accounts for the year ended 31 December

2013 will be delivered to the Registrar in due course.

The financial information in this Annual Financial Report has been prepared

using the recognition and measurement principles of International Accounting

Standards, International Financial Reporting Standards and Interpretations

adopted for use in the European Union (collectively Adopted IFRSs). The

accounting policies adopted in this Annual Financial Report have been

consistently applied to all the years presented and are consistent with the

policies used in the preparation of the statutory accounts for the year ended

31 December 2013. The principal accounting policies adopted are unchanged from

those used in the preparation of the statutory accounts for the year ended 31

December 2012, except for the implementation of IAS19 Employment benefits

(revised), which has had no material effect and the adoption of a policy in

respect of hedge accounting, which relates to a US dollar denominated short

term borrowing designated as a hedge instrument to hedge net investment in US

operations.

Investment trust - objectives, investment strategy, business model

Our objective for the investment trust is to achieve long term capital growth

in real terms and steadily increasing income. The aim is to achieve a higher

rate of total return than the FTSE Actuaries All-Share Index through investing

in a portfolio diversified both geographically and by industry.

Law Debenture shares are intended for private investors in the UK (`retail

investors'), professionally advised private clients and institutional

investors. By investing in an investment trust, shareholders typically accept

the risk of exposure to equities but hope that the pooled nature of an

investment trust portfolio will give some protection from the radical share

price movements that can sometimes affect individual equities.

Our investment strategy is as follows:

The Corporation carries on its business as a global investment trust.

Investments are selected on the basis of what appears most attractive in the

conditions of the time. This approach means that there is no obligation to hold

shares in any particular type of company, industry or geographical location.

The IFS businesses do not form part of the investment portfolio and are outwith

this strategy.

The Corporation's portfolio will typically contain between 70 and 150 listed

investments. The portfolio is diversified both by industrial sector and

geographic location of investments in order to spread investment risk.

Whilst performance is measured against local and UK indices, the composition of

these indices does not influence the construction of the portfolio. As a

consequence, it is expected that the Corporation's investment portfolio and

performance will deviate from the comparator indices.

Because the Corporation's assets are invested internationally and without

regard to the composition of indices, there are no restrictions on maximum or

minimum stakes in particular regions or industry sectors. However, such stakes

are monitored in detail by the board at each board meeting in order to ensure

that sufficient diversification is maintained.

Liquidity and long-term borrowings are managed with the aim of improving

returns to shareholders. The policy on gearing is to adopt a level of gearing

that balances risk with the objective of increasing the return to shareholders.

In pursuit of its investment objective, investments may be held in, inter alia,

equity shares, collective investment products including OEICS, fixed interest

securities, interests in limited liability partnerships, cash and liquid

assets. Derivatives may be used but only with the prior authorisation of the

board. Investment in such instruments for trading purposes is proscribed. It is

permissible to hedge against currency movements on both capital and income

account, subject again to prior authorisation of the board. Stock lending,

trading in suspended shares and short positions are not permitted.

The Corporation's investment activities are subject to the following

limitations and restrictions:

* No investment may be made which raises the aggregate value of the largest 20

holdings, excluding investments in OEICS and UK gilts, to more than 40% of the

Corporation's portfolio, including cash. The value of a new acquisition in any

one company may not exceed 5% of total portfolio value (including cash) at the

time the investment is made, further additions shall not cause a single holding

to exceed 5%, and board approval must be sought to retain a holding, should its

value increase above the 5% limit.

* The Corporation applies a ceiling on effective gearing of 150%. While

effective gearing will be employed in a typical range of 90% to 120%, the board

retains the ability to reduce equity exposure to below 90% if deemed

appropriate.

* The Corporation may not make investments in respect of which there is

unlimited liability.

* Board approval must be sought for any proposed direct investments in certain

jurisdictions.

* The Corporation has a policy not to invest more than 15% of gross assets in

other UK listed investment companies.

Our business model is designed to give us competitive advantage in the

investment trust sector. We aim to deliver the investment trust's objective by

skilled implementation of the investment strategy, complemented by maintaining

and operating our IFS businesses profitably and safely, while keeping them

distinct from the portfolio. The independence of the IFS means that they can

operate flexibly and commercially. They provide a regular flow of dividend

income to the Corporation. This helps the board to smooth out equity dividend

peaks and troughs and is an important element in delivering the objective of

steadily increasing income for shareholders, fully covered by current revenues.

In turn, tax relief at the investment trust level arising from our debenture

interest and excess costs, which would otherwise be unutilised, can be

transferred to the IFS.

Fee structure, Ongoing charges and Investment Management Agreement

Our portfolio of investments is managed by James Henderson of Henderson Global

Investors Limited (`Henderson') under a contract terminable by either side on

six months' notice. On a fully discretionary basis, Henderson is responsible

for implementing the Corporation's investment strategy and fees are charged at

0.30% of the value of the net assets of the group (excluding the net assets of

the IFS), calculated on the basis adopted in the audited financial statements.

Underlying management fees of 1% on the Corporation's holdings in Henderson

Japanese and Pacific OEICs are fully rebated. This means that the Corporation

continues to maintain one of the most competitive fee structures in the

investment trust sector and this, combined with the continued very satisfactory

performance of James Henderson as our investment manager has led the board to

conclude that the continuing appointment of Henderson as the Corporation's

investment manager is in the best interests of shareholders.

The agreement with Henderson does not cover custody or the preparation of data

associated with investment performance, which are both outsourced, or record

keeping, which is maintained by the Corporation.

Investment trusts are required to publish their Ongoing charges. This is the

cost of operating the trust and includes the investment management fee,

custody, investment performance data, accounting, company secretary and back

office administration. Law Debenture's latest published level of Ongoing

charges is one of the lowest in the marketplace at 0.45%. No performance fees

are paid to the investment manager.

Future trends and factors

Law Debenture will continue to strive to deliver its business objectives for

both the investment trust and the IFS.

The investment manager's review and the IFS management review respectively set

out some views on future developments.

Gearing

During the year, the Corporation shifted from being 100% invested to a modest

gearing of 105% as described in more detail in the investment manager's review

above.

Key performance indicators (`KPI')

The KPIs used to measure the progress and performance of the group are:

* net asset value total return per share (combining the capital and income

returns of the group);

* the discount/premium in share price to NAV; and

* the cost of running the portfolio as a percentage of its value.

Performance against these KPIs is set out in the tables above.

Top 20 equity holdings by value

2013 2013 2012 2012

Value % of % of

Rank Company GBP000 portfolio portfolio Rank

1 Senior 17,638 2.96 3.14 1

2 GKN 16,856 2.83 2.21 4

3 BP 15,862 2.67 2.35 2

4 Royal Dutch Shell 13,677 2.30 2.27 3

5 GlaxoSmithKline 12,086 2.03 2.09 5

6 HSBC 11,590 1.95 1.75 6

7 Amlin 11,206 1.88 1.74 7

8 Rio Tinto 11,068 1.86 1.65 8

9 Interserve 10,030 1.69 1.53 9

10 Smith (DS) 10,002 1.68 1.51 10

11 Hiscox 8,338 1.40 1.28 15

12 BTG 8,316 1.40 1.28 14

13 BAE Systems 7,821 1.31 1.26 17

14 Hill & Smith 7,733 1.30 1.48 11

15 Dunelm 7,650 1.29 1.22 18

16 Diageo 7,596 1.28 1.42 12

17 BHP Billiton 7,464 1.25 0.67 48

18 AstraZeneca 7,149 1.20 0.45 68

19 Bellway 7,065 1.19 0.97 29

20 Cape 6,956 1.17 0.99 25

34.64

Other significant holdings by value

2013 2013 2012 2012

Value % of % of

Rank Company GBP000 portfolio portfolio Rank

1 Henderson 14,378 2.42 2.34 4

Japan Capital

Growth*

2 Henderson 12,537 2.11 2.52 3

Asia Pacific

Capital

Growth*

3 Baillie 11,041 1.86 2.15 5

Gifford

Pacific*

4 First State 9,609 1.61 1.98 6

Asia Pacific*

5 Herald 5,823 0.98 0.91 8

Investment

Trust

6 Better 5,462 0.92 - -

Capital

(2012)

7 National Grid 5,414 0.91 1.18 7

6.125% 15/04/

14

8 Foresight 2,895 0.49 - -

Solar

9 SSE 5.75% 05/ 2,349 0.39 0.51 9

02/14

11.69

*Open ended investment companies.

Portfolio by sector 2013

Oil & gas 10.4%

Basic materials 6.3%

Industrials 25.1%

Consumer goods 10.7%

Health care 8.8%

Consumer services 9.3%

Telecommunications 0.6%

Utilities 3.3%

Technology 2.2%

Financials 23.3%

Portfolio by sector 2012

Oil & gas 9.6%

Basic materials 4.9%

Industrials 22.8%

Consumer goods 9.9%

Health care 7.5%

Consumer services 6.6%

Telecommunications 1.8%

Utilities 4.3%

Technology 2.4%

Financials 23.0%

UK?Gilts 7.2%

Geographical distribution of portfolio 2013

United Kingdom 76.6%

North America 8.3%

Europe 6.7%

Japan 2.8%

Other Pacific 5.6%

Geographical distribution of portfolio 2012

United Kingdom 68.9%

North America 6.5%

Europe 8.0%

Japan 2.7%

Other Pacific 6.7%

UK Gilts 7.2%

Acquisition of own shares

During the year, the Corporation did not repurchase any of its shares for

cancellation. It intends to seek shareholder approval to renew its powers to

repurchase shares for cancellation up to 14.99% of the Corporation's issued

share capital, if circumstances are appropriate. On 13 March 2013, a subsidiary

acquired 93,069 of the Corporation's shares on the open market at 478.8095

pence per share in anticipation of fulfilling awards made under the Deferred

Share Plan.

Significant financial issues relating to the 2013 accounts

The UK Corporate Governance Code requires us to describe any significant issues

considered in relation to the financial statements and how those issues were

addressed.

The significant issues that arose during the course of the audit were as

follows:

* management makes an estimate of a number of bad debt provisions for

non-collection of fees as part of the risk management and control framework. It

is a part of the auditor's function to test whether those impairments of

receivable balances meet the relevant accounting standards. The audit committee

has received reports from management describing the basis for assumptions used

and has discussed these with the auditors to ensure that appropriate levels of

bad debt provisions have been included; and

* the group operates a defined benefit pension scheme. The valuation of the

scheme includes a number of assumptions related to the expected returns, future

inflation rates and corporate bond yields, and longevity of members, all of

which can impact the financial statements. The valuation has been completed

with the assistance of a professional actuary and the assumptions have been

agreed with the auditors.

Other issues that arose included: the risk that portfolio investments may not

be beneficially owned or correctly valued; that revenues from the IFS

businesses are properly recognised and at the appropriate points in time; and

that the carrying values of goodwill in relation to acquisitions may be

impaired. The audit committee has received assurance on these matters.

Total voting rights and share information

The Corporation has an issued share capital at 27 February of 118,156,501

ordinary shares with voting rights and no restrictions and no special rights

with regard to control of the Corporation. There are no other classes of share

capital and none of the Corporation's issued shares are held in treasury.

Therefore the total number of voting rights in The Law Debenture Corporation

p.l.c. is 118,156,501.

Borrowings

2013 2012

GBP000 GBP000

Short term borrowings

Bank overdraft 26,793 -

The Corporation has an uncommitted overdraft facility of GBP30,000,000 provided

by its custodian, HSBC which is secured by a floating charge which ranks pari

passu with a charge given in respect of the debenture. At 31 December 2013,

fair value is the same as book value.

The uncommitted facility has been drawn down in US dollars and interest was

payable at 1.5% above HSBC's bank rate.

2013 2012

GBP000 GBP000

Long term borrowings

Long term borrowings are

repayable as follows:

In more than five years

Secured

6.125% guaranteed secured bonds 39,445 39,418

2034

The 6.125% bonds were issued by Law Debenture Finance p.l.c. and guaranteed by

the Corporation. The GBP40 million nominal tranche, which produced proceeds of GBP

39.1 million, is constituted by Trust Deed dated 12 October 1999 and the

Corporation's guarantee is secured by a floating charge on the undertaking and

assets of the Corporation. The stock is redeemable at its nominal amount on 12?

October 2034. Interest is payable semi-annually in equal instalments on 12

April and 12 October in each year.

The 6.125% bonds are stated in the statement of financial position at book

value. Restating them at a fair value of GBP45.3 million at 31 December 2013

(2012: GBP47.3 million) has the effect of decreasing the year end NAV by 5.00p

(2012: 6.69p). The estimated fair value is based on the redemption yield of the

reference gilt (UK Treasury 4.5% 2034) plus a margin derived from the spread of

BBB UK corporate bond yields over UK gilt yields.

Related party transactions

The related party transactions between the Corporation and its wholly owned

subsidiary undertakings are summarised as follows:

2013 2012

GBP000 GBP000

Dividends from subsidiaries 2,500 1,950

Interest on intercompany balances 2,642 2,654

charged by subsidiaries

Management charges from 198 198

subsidiaries

Interest on intercompany balances 4,950 4,950

charged to subsidiaries

The key management personnel are the directors of the Corporation,

Principal risks and uncertainties - investment trust

The principal risks of the investment trust relate to investment activities

generally and include market price risk, foreign currency risk, liquidity risk,

interest rate risk, credit risk and country/region risk. These are explained in

more detail below.

* market price risk, arising from uncertainty in the future value of financial

instruments. The board maintains strategy guidelines whereby risk is spread

over a range of investments, the number of holdings normally being between 70

and 150. In addition, the stock selections and transactions are actively

monitored throughout the year by the investment manager, who reports to the

board on a regular basis to review past performance and develop future

strategy. The investment portfolio is exposed to market price fluctuation: if

the valuation at 31 December 2013 fell or rose by 10%, the impact on the

group's total profit or loss for the year would have been GBP59.5 million (2012:

GBP48.0 million). Corresponding 10% changes in the valuation of the investment

portfolio on the Corporation's total profit or loss for the year would have

been the same.

* foreign currency risk, arising from movements in currency rates applicable to

the group's investment in equities and fixed interest securities and the net

assets of the group's overseas subsidiaries denominated in currencies other

than sterling. The group's financial assets denominated in currencies other

than sterling were:

2013 2013 2013 2012 2012 2012

Net Total Net Total

monetary currency monetary currency

assets exposure assets exposure

Investments Investments

Group GBPm GBPm GBPm GBPm GBPm GBPm

US 44.3 4.9 49.2 26.8 3.7 30.5

Dollar

Canadian 4.9 - 4.9 4.7 - 4.7

Dollar

Euro 28.2 0.4 28.6 24.1 0.3 24.4

Danish 1.6 - 1.6 0.7 - 0.7

Krone

Swedish 1.2 - 1.2 2.1 - 2.1

Krona

Swiss 11.6 - 11.6 11.6 - 11.6

Franc

Hong - 0.5 0.5 - 0.6 0.6

Kong

Dollar

Japanese 2.6 - 2.6 1.9 - 1.9

Yen

94.4 5.8 100.2 71.9 4.6 76.5

The group US dollar net monetary assets is the net investment in US operations

of GBP31.7 million less the US dollar short term borrowings of GBP26.8 million,

which represents the fair value of the borrowings at 31 December 2013. The

short term borrowings were designated as a hedging investment to hedge the net

investment in US operations at inception in July 2013. The hedge has been

reviewed on an ongoing basis and it has been effective at all times since

inception. The gain or loss on the hedging instrument is recognised in the

translation reserve and set off against the gain or loss on the translation of

the net investment in US operations, which it matches.

2013 2013 2013 2012 2012 2012

Net Total Net Total

monetary currency monetary currency

assets exposure assets exposure

Investments Investments

Corporation GBPm GBPm GBPm GBPm GBPm GBPm

US Dollar 44.3 (26.8) 17.5 26.8 0.2 27.0

Canadian 4.9 - 4.9 4.7 - 4.7

Dollar

Euro 28.2 0.2 28.4 24.1 0.3 24.4

Danish 1.6 - 1.6 0.7 - 0.7

Krone

Swedish 1.2 - 1.2 2.1 - 2.1

Krona

Swiss Franc 11.6 - 11.6 11.6 - 11.6

Japanese 2.6 - 2.6 1.9 - 1.9

Yen

94.4 (26.6) 67.8 71.9 0.5 72.4

The holdings in the Henderson Japan Capital Growth, Henderson Pacific Capital

Growth, Baillie Gifford Pacific and First State Asia Pacific OEICs are

denominated in sterling but have underlying assets in foreign currencies

equivalent to GBP47.6 million (2012: GBP43.2 million). Investments made in the UK

and overseas have underlying assets and income streams in foreign currencies

which cannot be determined and this has not been included in the sensitivity

analysis. If the value of all other currencies at 31 December 2013 rose or fell

by 10% against sterling, the impact on the group's total profit or loss for the

year would have been GBP14.2 million (2012: GBP11.5 million). Corresponding 10%

changes in currency values on the Corporation's total profit or loss for the

year would have been the same. The calculations are based on the investment

portfolio at the respective year end dates and are not representative of the

year as a whole.

* liquidity risk, arising from any difficulty in realising assets or raising

funds to meet commitments associated with any of the above financial

instruments. To minimise this risk, the board's strategy guidelines only permit

investment in equities and fixed interest securities quoted in major financial

markets. In addition, cash balances and overdraft facilities are maintained

commensurate with likely future settlements.

* interest rate risk, arising from movements in interest rates on borrowing,

deposits and short term investments. The board reviews the mix of fixed and

floating rate exposures and ensures that gearing levels are appropriate to the

current and anticipated market environment. The group's interest rate profile

at 31 December 2013 was:

Sterling HK US Euro

Dollars Dollars

GBPm GBPm GBPm GBPm

Floating rate 17.1 0.5 31.7 0.4

assets

Fixed rate assets

Bonds

SSE 5.75% 05/02/14 2.3

National Grid 6.125% 15/ 5.4

04/14

Total 7.7

Weighted average fixed rate to maturity based on fair value 5.82%.

US Dollars

GBPm

Floating rate liabilities

Short term borrowings 26.8

Interest on the short term borrowings is 1.5% above HSBC's base rate, the

weighted average rate during the year was 1.61%.

Sterling

GBPm

Total

Fixed rate liabilities* 39.4

Weighted average fixed rate 6.125%

*Fixed until 2034.

The group holds cash and cash equivalents on short term bank deposits and money

market funds and has short term borrowings. Interest rates tend to vary with

bank base rates. The investment portfolio is not directly exposed to interest

rate risk.

If interest rates during the year were 1.0% higher the impact on the group's

total profit or loss for the year would have been GBP173,000 credit (2012: GBP

152,000 credit). It is assumed that interest rates are unlikely to fall below

the current level.

The Corporation holds cash and cash equivalents on short term bank deposits and

money market funds and has short term borrowings. Amounts due from subsidiary

undertakings are for a term of five years and carry interest at a fixed rate.

Amounts owed to subsidiary undertakings include GBP40 million at a fixed rate.

Interest rates on cash and cash equivalents and amounts due to subsidiary

undertakings at floating rates tend to vary with bank base rates. A 1.0%

increase in interest rates would have affected the Corporation's profit or loss

for the year by GBP27,000 charge (2012: GBP74,000 credit). The calculations are

based on the balances at the respective year end dates and are not

representative of the year as a whole.

* credit risk, arising from the failure of another party to perform according

to the terms of their contract. The group minimises credit risk through

policies which restrict deposits to highly rated financial institutions and

restrict the maximum exposure to any individual financial institution. The

group's maximum exposure to credit risk arising from financial assets is GBP56.5

million (2012: GBP26.4 million). The Corporation's maximum exposure to credit

risk arising from financial assets is GBP69.5 million (2012: GBP70.4 million).

Trade and other receivables

Trade and other receivables not impaired but past due by the following:

2013 2012

GBP000 GBP000

Between 31 1,706 623

and 60 days

Between 61 149 273

and 90 days

More than 91 509 560

days

Total 2,364 1,456

At 31 December 2013, trade and other receivables which were impaired and for

which there was a bad debt provision totalled GBP347,000 (Corporation: GBP14,000).

All the impaired trade and other receivables were more than 91 days past due.

Trade and other payables

2013 2012

GBP000 GBP000

Due in less 10,863 10,237

than one

month

Due in more 552 508

than one

month

11,415 10,745

Fair value

The directors are of the opinion that the fair value of financial assets and

liabilities of the group are not materially different to their carrying values,

with the exception of the 6.125% guaranteed secured bonds 2034.

Principal risks and uncertainties - IFS businesses

The principal risks of the IFS arise where transactions to which we provide a

service come under stress - say by going into default, or where re-financings

or other transaction amendments are required. Such risks may arise from the

wider economic pressures on some sectors, borrowers and regions. To mitigate

these risks, we work closely with our legal advisers and where appropriate,

financial advisors both in the set up phase to ensure that we have as many

protections as practicable and on a continuing basis.

Directors' responsibility statement pursuant to DTR4

The directors confirm that to the best of their knowledge:

* The group financial statements have been prepared in accordance with

International Financial Reporting Standards as adopted by the European

Union (IFRSs) and Article 4 of the IAS Regulation and give a true and fair

view of the assets, liabilities, financial position and profit or loss of

the group;

* The annual report includes a fair review of the development and performance

of the business and the position of the group and parent company, together

with a description of the principal risks and uncertainties that they face.

Copies of this Annual Financial Report are available on www.lawdeb.com/

investment-trust/financial-statements

Copies of the annual report will be available from the Corporation's registered

office or on the above website link once published on 10 March 2014.

By order of the board

Law Debenture Corporate Services Limited

Secretary

27 February 2014

END

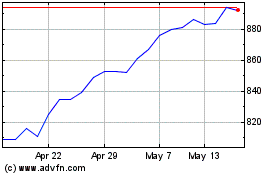

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

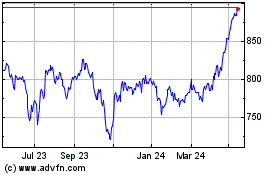

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024