Lon.Fin.&Inv.Grp. Interim Management Statement

June 17 2014 - 10:30AM

UK Regulatory

TIDMLFI

Date: 17 June 2014

On behalf of: London Finance & Investment Group P.L.C

London Finance & Investment Group P.L.C.

Interim Management Statement

Since our half year end on 31 December 2013 our net assets per share, including

investments at market value, have decreased by 7.9% from 46.4p to 42.7p at 31

May 2014.

There have been no material changes to our General Portfolio of equities which

currently comprises 29 blue chip stocks in the U.K., Europe and the USA. The

value of the General Portfolio increased by 4.2% compared to rises in the

Eurofirst 300 index of 4.4% and in the FTSE100 of 1.4%. The value of our

Strategic Investments over the period fell with the value of Western Selection

P.L.C. reducing by 3.6% and Finsbury Food Group Plc down by 5.1%.

The Board continues to remain cautious in its outlook for the remainder of the

year.

Enquiries to:

London Finance & Investment Group P.L.C.

Edward Beale 020 7796 9060

Notes to Editors:

? London Finance & Investment Group P.L.C. is an investment company whose

assets primarily consist of two Strategic Investments and a General Portfolio.

Strategic Investments are significant investments in smaller U.K. quoted

companies and these are balanced by a General Portfolio, which consists mainly

of investments in major U.K., European and U.S. equities.

? Its strategic investments comprise: Western Selection P.L.C. and Finsbury

Food Group plc. Western Selection P.L.C. has strategic investments in Creston

plc, Swallowfield plc, Northbridge Industrial Services plc and Hartim Limited.

END

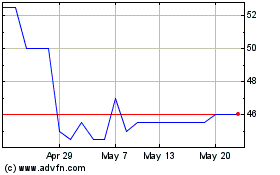

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

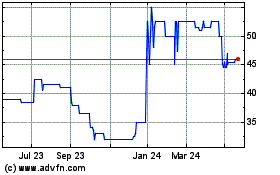

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jul 2023 to Jul 2024