TIDMLFI

LONDON FINANCE & INVESTMENT GROUP P.L.C.

("Lonfin", "the Company" or "the Group")

Preliminary announcement of unaudited results for the year ended 30th June 2013

and dividend declaration

London Finance & Investment Group P.L.C. (LSE: LFI, JSE: LNF), the investment

company whose assets primarily consist of Strategic Investments and a General

Portfolio, today announces its Preliminary Results for the year ended 30th June

2013.

Chairman's statement

Lonfin is an investment company whose objective is to generate growth in

shareholder value in real terms over the medium to long term while maintaining

a progressive dividend policy.

In the short term, the performance of the Company can be influenced by overall

stock market performance and to ameliorate this short term risk the Company has

a combination of Strategic Investments together with a General Portfolio.

Strategic Investments are significant investments in smaller U.K. quoted

companies and these are balanced by a General Portfolio, which consists of a

broad range of investments in major U.S.A., U.K. and other European companies

which provides a diversified exposure to international equity markets.

At 30th June 2013, the Strategic Investments in which we have Directors in

common, were our associated company Western Selection P.L.C. and Finsbury Food

Group Plc. Detailed comments on our Strategic Investments are given below.

* Net assets have increased over the year by 44.6% from 31.6p per share to

45.7p per share

* The General Portfolio has increased over the year by 17.5%

* The General Portfolio is yielding 3.0% (2012 - 3.0%)

* Net borrowings of GBP534,000 compared with GBP267,000 of net cash at 30 June

2012

* Decrease of 4% in operating costs

Results

Our net assets per share have increased 44.6% to 45.7p from 31.6p last year.

The increase reflects the appreciation in the value of our Strategic

Investments of 81%, largely attributable to the appreciation in Finsbury Food

Group, and an increase in the value of our General Portfolio by 17.5%

The Group achieved a profit for the year, before tax and the fair value

adjustments of investments, of GBP171,000 (2012, including profit on sale of

freehold property of GBP2,137,000 - GBP2,074,000). The profit after fair value

adjustments, tax and non-controlling interest was GBP4,637,000 (2012 - GBP869,000)

giving a profit per share of 14.9p (2012 - 2.8p).

Strategic Investments

Western Selection P.L.C. ("Western")

The Group owns 7,864,412 shares, being 43.8%, of the issued share capital of

Western.

On 27th September 2013, Western announced a profit before associates and tax of

GBP681,000 for its year to 30th June 2013 (2012 - GBP164,000). Including associates

and after exceptional items and tax, losses per share were1.6p (2012 - profits

- 1.0p).

Western has paid an interim dividend of 0.85p and proposes an increased final

dividend of 1.05p (2012 - 0.90p). Western's net assets at market value were GBP

14,799,000, equivalent to 82p per share, an increase of 14% from 72p last year.

Our share of the net assets of Western including the value of Western's

investments at market value, was GBP6.5 million (2012 - GBP5.6 million). The fair

value recorded in the statement of financial position is the market value of GBP

3,930,000 (2012 - GBP3,144,000). This represents 27% (2012 - 32%) of the net

assets of the Group.

Mr. D. C. Marshall is the Chairman of Western and Mr. J. M Robotham and Mr.

E.J. Beale, the chief executive of our subsidiary company (City Group P.L.C.),

are non-executive Directors. Western has Strategic Investments in Creston plc,

Northbridge Industrial Services plc, Swallowfield plc and Hartim Limited. An

extract from Western's announcement relating to its Strategic Investments is

set out below:

Creston plc

Creston is a marketing services group whose strategy is to grow within its

sector both by organic growth and through selective acquisition to become a

substantial diversified marketing services group. In their trading

announcement on 29th July, Creston reported high levels of new business

activity and confidence this would lead to underlying growth in its client

base. Further information about Creston is available on their website:

www.creston.com.

The audited results for the year to 31st March 2013, show a headline profit

before tax of GBP10,000,000 (2012 - GBP10,300,000), equivalent to fully diluted

earnings of 14.66p per share (2012 - 12.34p).

Western maintained its holding of 3,000,000 shares in Creston, which is 4.9%

of their issued share capital. The value of this investment at 30th June

2013 was GBP3,240,000, an increase of 96% from the value of GBP1,650,000 at June

2012, and represents 22% (2012 - 13%) of Western's net assets.

Mr D. C. Marshall is a non-executive director of Creston.

Northbridge Industrial Services PLC

Northbridge hires and sells specialist industrial equipment to a

non-cyclical customer base. With offices or agents in the U.K., U.S.A.,

Dubai, Germany, Belgium, France, Australia, Singapore, India, Brazil, Korea

and Azerbaijan, Northbridge has a global customer base. This includes

utility companies, the oil and gas sector, shipping, construction and the

public sector. The product range includes loadbanks, transformers,

generators, compressors, loadcells and oil tools.

On 13th September Northbridge announced the acquisition of Crestchic (Asia

Pacific) PTE Limited for GBP6.63m, funded by cash resources and a share

placing of 1,561,700 new shares. The acquisition of the Singapore based

distributor of loadbanks and transformers, enhances Northbridge's presence

in the region and re-unifies the brand. Further information about

Northbridge is available on their website: www.northbridgegroup.co.uk.

Northbridge announced audited profits of GBP3,707,000 for the year ended 31st

December 2012 (2011 - GBP2,321,000) and declared a final dividend of 3.575p

per share, making 5.425p for the year (2012 - 5.0p).

Western sold 200,000 of its 2,200,000 holding in May 2013, realising GBP

738,000 and a profit of GBP527,000, and now holds 2,000,000 shares in

Northbridge. Following the sale, Western's holding is 11.6% of their issued

share capital. The value of this investment at 30th June 2013 was GBP7,040,000

(2012 - GBP5,984,000) being 48% (2012 - 46%) of Western's net assets.

Mr D. C. Marshall is a non-executive director of Northbridge.

Swallowfield plc

Swallowfield is a market leader in the development, formulation, manufacture

and supply of cosmetics, toiletries and related household products for

global brands and retailers operating in the cosmetics, personal care and

household goods market.The company has recently appointed a new Chairman and

a new Chief Executive. Further information about Swallowfield is available

on their website: www.swallowfield.com.

Swallowfield announced its annual results to June 2013 on 19th September

showing a loss after tax of GBP815,000 compared to a profit of GBP1,263,000 for

the comparable period last year. Dividends of GBP118,000 (2012 - GBP118,000)

were received from Swallowfield during the year.

At the reporting date Western owned 1,869,149 shares which is 16.5% of their

issued share capital. The market value of this investment on 30th June 2013

was GBP1,495,000 (2012 - GBP2,187,000), being 10% (2012 - 17%) of Western's net

assets.

Investments in Associates

Hartim Limited

Hartim is the unquoted holding company for Tudor Rose International Limited

("TRI") which was founded in 1984. It works closely with a number of leading

UK branded fast moving consumer goods companies, offering a complete sales,

marketing and logistical service. Based in Stroud, Gloucestershire, TRI

sells into 78 countries worldwide including USA, Spain, Portugal, Italy,

Czech Republic, Russia, Turkey, South Africa, Saudi Arabia, UAE, Malaysia,

Australia and China. Last year Hartim acquired out of administration its

principal distributor in Australia, but the Australian business has not been

successful in generating sufficient sales to cover its overhead costs and

significant losses have been incurred, leading to the winding up of this

business.

Western holds 49.5% of Hartim, which has a 31st December year end, and which

generated trading profits before exceptional items in the year to 30th June

2013 of GBP915,000. Hartim sustained exceptional losses, after tax, in

connection with Australia of GBP2,809,000. Turnover in the period was GBP

21,609,000 (2012 - GBP27,799,000). Western's share of the consolidated loss

after exceptional items and tax for the twelve months to 30th June 2013 was

GBP937,000 (2012 - loss - GBP342,000) and the book value of the investment at

30th June 2013 was GBP185,000 (2012 - GBP1,124,000), being 1% (2012 - 10%) of

Western's assets.

Despite the problems in Australia, the UK division of Hartim continues to

trade profitably. We have high hopes for this business provided that it can

avoid any more costly misadventures.

Western has two nominees on the board of Hartim: Mr E. J. Beale and Mr L. H.

Marshall (a director of City Group PLC, Western's company secretaries).

MWB Group Holdings Plc ("MWB")

MWB was placed into administration on 16 November 2012. We made an

impairment provision in the subsidiary holding this investment of GBP1,611,000

in 2012 and with a write off of GBP70,000 this year the cost has now been

fully written off.

Finsbury Food Group Plc ("Finsbury")

Finsbury is one of the largest producers and suppliers of premium cakes,

bread and morning goods in the UK. The Group currently supplies most of the

UK's major supermarket chains. Further information about Finsbury is

available on its website: www.finsburyfoods.co.uk.

The Group increased its holding in Finsbury by 1 million shares at a cost of

GBP390,000 and held 9 million shares, representing 13.95% of their share

capital. The market value of the holding was GBP5,490,000 on 30th June 2013

(cost - GBP2,283,000) and represents 38% (2012 - 19%) of the net assets of the

Group.

On 23rd September Finsbury announced audited profits on continuing

operations after tax and minority interests of GBP5,218,000 for the year ended

30th June 2013 (2012 - GBP3,291,000) and profits after tax on discontinued

operations of GBP3,034,000 (2012 - GBP1,560,000). Finsbury returned to the

dividend list for the first time since 2008, paying an interim of 0.25p and

declaring a final dividend of 0.5p per share, making 0.75p for the year

(2012 - nil).

Mr. D.C. Marshall and Mr. E. J. Beale, the Chief Executive of our subsidiary

company City Group P.L.C., are non-executive Directors of Finsbury.

General Portfolio

The investments comprising the General Portfolio at 30th June 2013 are

listed on page 11. The spread of the General Portfolio was increased by the

addition of North American holdings. The portfolio is diverse with material

interests in Food and Beverages, Natural Resources, Chemicals, and Tobacco.

We believe that the portfolio of quality companies we hold has the potential

to outperform the market in the medium to long term.

The number of holdings in the General Portfolio has reduced to 29 from 30.

We have increased the amount invested in the General Portfolio over the year

by GBP626,000 (2012: increased by GBP171,000).

Operations & Employees

All of our operations and those of our associate, Western, except investment

selection, are outsourced to our subsidiary, City Group P.L.C. City Group also

provides office accommodation, company secretarial and head office finance

services to a number of other U.K. and Jersey clients. City Group has

responsibility for the initial identification and appraisal of potential new

strategic investments for the Group and the day to day monitoring of existing

strategic investments.

Dividend

The Board recommends a final dividend of 0.4p, making 0.8p per share for the

year (2012 - 0.7p). Subject to member's approval on 28th November 2013, the

dividend will be paid on 11th December 2013 to those members on the register at

the close of business on 22nd November 2013. Shareholders on the South African

register will receive their dividend in South African rand converted from

sterling at the closing rate of exchange on 26 September 2013 being GBP1 =

ZAR16.0307.

Since the introduction on 1 April 2012 of a new dividend withholding tax in

South Africa, the JSE Listings Requirements require disclosure of additional

information in relation to any dividend payments. Shareholders registered on

the Johannesburg register are therefore advised that the new dividend

withholding tax will be withheld from the gross final dividend amount of

6.41228 SA cents per share at a rate of 15%, unless a shareholder qualifies for

an exemption; shareholders registered on the Johannesburg register who do not

quality for an exemption will therefore receive a net dividend of 5.45044 SA

cents per share. The Company, as a non-resident of South Africa, was not

subject to the secondary tax on companies (STC) applicable before 1st April

2012, and accordingly, no STC credits are available for set-off against the

dividend withholding tax liability on the final net dividend amount. The

dividend is payable in cash as a `Dividend' (as defined in the South African

Income Tax Act, 58 of 1962, as amended) by way of a reduction of income

reserves. The dividend withholding tax and the information contained in this

paragraph is only of direct application to shareholders registered on the

Johannesburg register, who should direct any questions about the application

of the new dividendwithholding tax to Computershare Investor Services (Pty)

Limited, Tel: +27 11373-0004.

Dividend dates:

2013

Last date to trade (SA) Friday, 15 November

Shares trade ex dividend (SA) Monday,18 November

Shares trade ex dividend (UK) Wednesday, 20 November

Record date (UK and SA) Friday, 22 November 2013

Pay date Wednesday, 11 December 2013

Share certificates may not be dematerialised or rematerialised between Monday

18th November and Friday 22nd November 2013, both days inclusive. Shares may

not be transferred between registers during this period either.

Outlook

We believe our mix of Strategic Investments and a General Portfolio gives us

every chance of outperforming the broader market in the medium to long term.

However, as a board we do concern ourselves that large scale quantitative

easing by central banks is creating a market that is divorced from economic

reality.

By Order of the Board

CITY GROUP P.L.C.

Secretaries

30th September 2013

Unaudited Consolidated Statement of Comprehensive Income

Consolidated Statement of Total Comprehensive Income

For the year ended 30th June 2013 2012

GBP000 GBP000

Dividends - Listed investments 313 265

Interest receivable 4 4

Rental and other income 54 70

Profits/(Losses) realised on sales of investments 215 (32)

Management services fees 228 295

------ -----

Operating income 814 602

Administration expenses (610) (638)

------ ------

Operating profit/(loss) 204 (36)

Unrealised changes in the carrying value of 4,629 (1,134)

investments

Exceptional profit on disposal of property - 2,137

Interest payable (33) (27)

----- ------

Profit on ordinary activities before taxation 4,800 940

Tax on result of ordinary activities (180) (65)

----- ------

Profit on ordinary activities after taxation 4,620 875

Non-controlling interest 17 (6)

----- ------

Profit for the financial year attributable to 4,637 869

members of the holding company

Other comprehensive income - -

----- ------

Total comprehensive income attributable to 4,637 869

shareholders

Reconciliation of headline earnings

Basic profit per share 14.9p 2.8p

Adjustment for the unrealised changes in the (14.2)p 3.6p

carrying value of investments, net of tax ------- ------

Headline profit per share 0.7p 6.4p

------- ------

Unaudited Consolidated Statement of Changes in Shareholders' Equity

Unrealised Share of Retained

Ordinary Share profits/ undistributed realised Non-

Share premium Revaluation (losses) on results of profits Controlling Total

Capital account Reserve investments Subsidiaries & losses Total interests equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Year ended 30th June

2012

Balances at 1st July 1,560 2,320 330 (1,750) 904 5,825 9,189 92 9,281

2012

Total comprehensive - - - 2,086 (1,476) 259 869 6 875

income ---------------------------------------------------------------------------------------

Transfer on disposal - - (330) - - 330 - - -

Dividends paid - - - - - (203) (203) - (203)

---------------------------------------------------------------------------------------

Total transactions - - - - - (203) (203) - (203)

with shareholders

---------------------------------------------------------------------------------------

Balances at 30th 1,560 2,320 - 336 (572) 6,211 9,855 98 9,953

June 2013 ---------------------------------------------------------------------------------------

Year ended 30th

June 2013

Balances at 1st 1,560 2,320 - 336 (572) 6,211 9,855 98 9,953

July 2012 ---------------------------------------------------------------------------------------

Total - - - 4,495 73 69 4,637 (17) 4,620

comprehensive ---------------------------------------------------------------------------------------

income

Dividends paid - - - - - (234) (234) - (234)

---------------------------------------------------------------------------------------

Total - - - - - (234) (234) - (234)

transactions

with ---------------------------------------------------------------------------------------

shareholders

Balances at 30th 1,560 2,320 - 4,831 (499) 6,046 14,258 81 14,339

June 2013 ----------------------------------------------------------------------------------------

Unaudited Consolidated Statement of Financial Position

At 30th June 2013 2012

GBP000 GBP000

Non-current Assets

Tangible assets 3 4

Investments 9,420 5,094

------ ------

9,423 5,098

------ ------

Current Assets

Listed investments 5,601 4,533

Trade and other receivables 256 272

Cash at bank 116 2,217

------ ------

5,973 7,022

Current Liabilities

Trade and other payables: falling due within one year (853) (2,167)

------ ------

Net Current Assets 5,120 4,855

Deferred taxation (204) -

------ ------

Total Assets less Current Liabilities 14,339 9,953

------ ------

Capital and Reserves

Called up share capital 1,560 1,560

Share premium account 2,320 2,320

Unrealised profits and losses on investments 4,831 336

Share of retained realised profits and losses of (499) (572)

subsidiaries

Company's retained realised profits and losses 6,046 6,211

------- -------

14,258 9,855

Non-controlling equity interests 81 98

------- -------

14,339 9,953

------- -------

Unaudited Company Statement of Financial Position

at 30th June 2013 2012

GBP000 GBP000

Non-current Assets

Investments in Group companies 6,147 5,987

---------- -----------

Current Assets

Listed investments 5,601 4,533

Trade and other receivables 35 18

Bank balance 76 2,202

------- -------

5,712 6,753

Trade and other payables: falling due within one year (757) (2,096)

------- -------

Net Current Assets 4,955 4,657

------- -------

Deferred taxation (204) -

------- -------

Total Assets less Current Liabilities 10,898 10,644

------- -------

Capital and Reserves

Called up share capital 1,560 1,560

Share premium account 2,320 2,320

Unrealised profits and losses on investments 972 553

Realised profits and losses 6,046 6,211

------- -------

Equity shareholders' funds 10,898 10,644

------- -------

Unaudited Consolidated Statement of Cash Flow

For the year ended 30th June 2013 2012

GBP000 GBP000

Cash flows from operating activities

Profit before tax 4,800 940

Adjustments for non-cash and non-operating activities -

Finance expense 33 27

Profit on disposal of property - (2,137)

Depreciation charges 1 5

Unrealised changes in the fair value of investments (4,629) 1,134

------- ------

205 (971)

Taxes paid (22) (17)

------- -------

Changes in working capital

Increase in trade and other receivables (16) (12)

Increase in trade and other payables 64 158

Increase in current asset investments (375) (301)

------- ------

(327) (155)

------- ------

Net cash outflow from operating activities (144) (63)

------- -------

Cash flows from disposal of property - 2,495

------- -------

Cash flows from investment activity

Purchase of strategic investments (390) -

------- -------

Net cash outflow from investment activity (390) -

------- -------

Cash flows from financing

Interest paid (33) (27)

Equity dividends paid (234) (203)

Net (repayment) / drawdown of loan facilities (1,300) 134

------- ------

Net cash outflow from financing (1,567) (96)

------- ------

(Decrease)/Increase in cash and cash equivalents (2,101) 2,196

Cash and cash equivalents at the beginning of the year 2,217 21

------- ------

Cash and cash equivalents at end of the year 116 2,217

------- ------

Notes

1. Earnings per share are based on the profit on ordinary activities after

taxation and non controlling interests and on 31,207,479 shares

(2012-31,207,479) being the weighted average of the number of shares in

issue during the year.

2. The financial information in this preliminary announcement of unaudited

group results does not constitute the company's statutory accounts for the

years ended 30th June 2013 or 30th June 2012 but is derived from those

accounts. The accounts have been prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European Union and

with those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The accounts are prepared on the historical cost

basis, except for certain assets and liabilities which are measured at

fair value, in accordance with IFRS and comply with IAS 34. The audited

accounts of the group for the year ended 30th June 2012 were reported on

with an unqualified audit report and have been delivered to the Registrar

of Companies.

Enquiries to:

London Finance & Investment GroupP.L.C. 020 7448 8950

David Marshall / Edward Beale

END

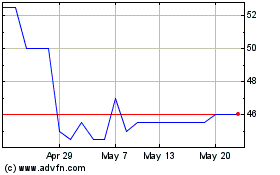

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

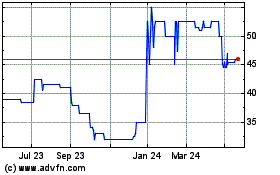

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jul 2023 to Jul 2024