Half Yearly Report

September 16 2009 - 2:00AM

UK Regulatory

TIDMKEN

RNS Number : 0938Z

Kenetics Group Limited

15 September 2009

Embargoed until 0700, 16 September 2009

Kenetics Group Limited

Interim Results

Kenetics Group Limited ("Kenetics" or "the Company" or "the Group"), the Radio

Frequency Identification (RFID) company focused on Security and RFID systems and

products, announces its interim report for the 6 months ended 30 June 2009.

Key Points

* Consolidated turnover versus the corresponding period in 2008 improved by 143%

to GBP570,000 (six months ended 30 June 2008: GBP235,000).

* Consolidated loss on ordinary activities after tax and expenses was GBP204,000

(six months ended 30 June 2008: GBP289,000).

* Cash outflow before working capital changes reduced to GBP66,000 from GBP250,000

in the corresponding period in 2008.

* There was an increase of other operating expenses to GBP202,000 (six months

ended 30 June 2008: GBP145,000), mainly due to a loss in foreign exchange of

GBP52,000 (six months ended 30 June 2008: GBP21,000 gain in exchange) in the

translation of Singapore Dollars to Sterling during the first half of the year.

* The Company is pleased to announce that it is making good progress with the two

Singapore Land Transport Authority ("LTA") contracts, which were earlier

reported. These contracts have contributed to the significant increase in

revenue in the first half of the year.

* The directors believe that these contracts with LTA will enable the Company to

withstand the worst effects of the current economic uncertainty on the sector.

Commenting on the results, Ken Wong, Chairman and CEO said:

"The first half year performance has been very encouraging despite the current

global downturn in business activities. I am pleased to report that we are

making good progress in the two LTA contracts that we gained in the second half

of last year and the first quarter of this year. For the initial contract on the

Contactless Smart Card (CSC) Reader, the development and testing stages have

been successfully completed. Production of the Readers has started and field

trials are expected to commence in the second half of the year. Similarly, the

design of the On-Board Bus Equipment (OBE) under the second contract has been

completed and prototypes will begin after the review of the designs.

Notwithstanding these contracts, we have been sustaining our industrial product

sales despite the weaker market conditions, resulting in about one third of the

revenue coming from this business segment. The efforts made by our Japanese

partner have begun to bear fruit and sales orders are coming in for the products

introduced in Japan.

With regards to the Company's working capital position, as at 30 June 2009 the

Company had net liabilities of GBP438,000, after taking into account of

GBP508,000 owing to the Directors. The Company currently receives, and will

continue to receive, adequate financing through loans made by Directors but

recognizes that further third party funding will be required in the short to

medium term to finance the increased level of business activities. The Company

is talking to its advisers with regards to securing such future funding and

further announcements will be made in due course.

Despite the global markets continuing to look uncertain, the Company is

leveraging on the good progress made in the LTA contracts and expects to

introduce the new products for field trials on buses and rail systems in the

second half of the year. The Board feels confident that further progressive

improvements will be made and the Company will continue to seize the

opportunities to grow the business"

For more information, please contact:

+--------------------------------+

| Ken |

| Wong, |

| Chairman |

| and CEO |

+--------------------------------+

| Kenetics |

| Group |

| Limited |

+--------------------------------+

| Tel: +65 |

| 6749 0083 |

+--------------------------------+

| Website:www.kenetics-group.com |

| |

+--------------------------------+

+--------------+

| David |

| Newton |

+--------------+

| ZAI |

| Corporate |

| Finance |

| Ltd |

+--------------+

| (Nominated |

| Advisor) |

+--------------+

| Tel: +44 |

| 207 060 1760 |

+--------------+

+--------------+

| Peter |

| Ward / |

| Ian |

| Callaway |

+--------------+

| SVS |

| Securities |

| (PLC) |

+--------------+

| (Broker) |

+--------------+

| Tel: +44 |

| 207 638 5600 |

+--------------+

+----------+----------------+

| | Jeremy |

| | Carey / |

| | Andrew |

| | Dunn |

+----------+----------------+

| | Tavistock |

| | Communications |

| | Ltd |

+----------+----------------+

| | Tel: +44 |

| | 207 920 3150 |

+----------+----------------+

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2009

CONDENSED CONSOLIDATED INCOME STATEMENT

+------------------------------------+--------+---------------+---------------+---------------+

| | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| | | 6 months | 6 months | 12 months |

+------------------------------------+--------+---------------+---------------+---------------+

| | | Ended | Ended | Ended |

+------------------------------------+--------+---------------+---------------+---------------+

| | | 30 June | 30 June | 31 December |

+------------------------------------+--------+---------------+---------------+---------------+

| | | 2009 | 2008 | 2008 |

+------------------------------------+--------+---------------+---------------+---------------+

| | | (Unaudited) | (Unaudited) | (Audited) |

+------------------------------------+--------+---------------+---------------+---------------+

| | | GBP'000 | GBP'000 | GBP'000 |

+------------------------------------+--------+---------------+---------------+---------------+

| | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| Continuing operations | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| Revenue | | 570 | 235 | 556 |

+------------------------------------+--------+---------------+---------------+---------------+

| Other operating income | | 36 | - | 1 |

+------------------------------------+--------+---------------+---------------+---------------+

| Changes in inventories of finished | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| goods and work-in-progress | | (21) | (13) | (4) |

+------------------------------------+--------+---------------+---------------+---------------+

| Raw materials and consumables used | | (163) | (83) | (293) |

+------------------------------------+--------+---------------+---------------+---------------+

| Employee benefits expenses | | (329) | (245) | (463) |

+------------------------------------+--------+---------------+---------------+---------------+

| Depreciation of plant and | | (25) | (35) | (91) |

| equipment | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| Other operating expenses | | (202) | (145) | (283) |

+------------------------------------+--------+---------------+---------------+---------------+

| Loss arising on derivative | | (52) | - | - |

| financial instrument | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| Finance costs | | (17) | (3) | (14) |

+------------------------------------+--------+---------------+---------------+---------------+

| Loss before income tax | | (203) | (289) | (591) |

+------------------------------------+--------+---------------+---------------+---------------+

| Income tax expense | | (1) | - | - |

+------------------------------------+--------+---------------+---------------+---------------+

| Loss for the period | | (204) | (289) | (591) |

+------------------------------------+--------+---------------+---------------+---------------+

| | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| Loss attributable to: | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| Owners of the Company | | (204) | (282) | (580) |

+------------------------------------+--------+---------------+---------------+---------------+

| Minority interests | | - | (7) | (11) |

+------------------------------------+--------+---------------+---------------+---------------+

| | | (204) | (289) | (591) |

+------------------------------------+--------+---------------+---------------+---------------+

| | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

| Loss per share (pence) - Basic | | (0.77) | (1.07) | (2.24) |

| and diluted | | | | |

+------------------------------------+--------+---------------+---------------+---------------+

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2009

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

+--------------------------------------+------+---------------+---------------+---------------+

| | | 6 months | 6 months | 12 months |

+--------------------------------------+------+---------------+---------------+---------------+

| | | Ended | Ended | Ended |

+--------------------------------------+------+---------------+---------------+---------------+

| | | 30 June | 30 June | 31 December |

+--------------------------------------+------+---------------+---------------+---------------+

| | | 2009 | 2008 | 2008 |

+--------------------------------------+------+---------------+---------------+---------------+

| | | (Unaudited) | (Unaudited) | (Audited) |

+--------------------------------------+------+---------------+---------------+---------------+

| | | GBP'000 | GBP'000 | GBP'000 |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| Loss for the period | | (204) | (289) | (591) |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| Other comprehensive income: | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| Foreign currency translation | | (4) | (6) | 48 |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| Total comprehensive expense | | (208) | (295) | (543) |

| for the period | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| Total comprehensive | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| expense attributable to: | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

| Owners of the Company | | (208) | (288) | (532) |

+--------------------------------------+------+---------------+---------------+---------------+

| Minority interests | | - | (7) | (11) |

+--------------------------------------+------+---------------+---------------+---------------+

| | | (208) | (295) | (543) |

+--------------------------------------+------+---------------+---------------+---------------+

| | | | | |

+--------------------------------------+------+---------------+---------------+---------------+

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2009

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

+----------------------------------------------+--------------+----------------+---------------+

| | | | |

+----------------------------------------------+--------------+----------------+---------------+

| | 30 June | 30 June | 31 December |

+----------------------------------------------+--------------+----------------+---------------+

| | 2009 | 2008 | 2008 |

+----------------------------------------------+--------------+----------------+---------------+

| | (Unaudited) | (Unaudited) | (Audited) |

+----------------------------------------------+--------------+----------------+---------------+

| | GBP'000 | GBP'000 | GBP'000 |

+----------------------------------------------+--------------+----------------+---------------+

| Non-current assets | | | |

+----------------------------------------------+--------------+----------------+---------------+

| Plant and equipment | 100 | 124 | 121 |

+----------------------------------------------+--------------+----------------+---------------+

| Available for sale financial asset | - | 24 | - |

+----------------------------------------------+--------------+----------------+---------------+

| Total non-current assets | 100 | 148 | 121 |

+----------------------------------------------+--------------+----------------+---------------+

| | | | |

+----------------------------------------------+--------------+----------------+---------------+

| Current assets | | | |

+----------------------------------------------+--------------+----------------+---------------+

| Inventories | 449 | 248 | 332 |

+----------------------------------------------+--------------+----------------+---------------+

| Trade receivables | 90 | 55 | 68 |

+----------------------------------------------+--------------+----------------+---------------+

| Other receivables | 186 | 41 | 72 |

+----------------------------------------------+--------------+----------------+---------------+

| Cash and cash equivalents | 183 | 107 | 169 |

+----------------------------------------------+--------------+----------------+---------------+

| Total current assets | 908 | 451 | 641 |

+----------------------------------------------+--------------+----------------+---------------+

| Total assets | 1,008 | 599 | 762 |

+----------------------------------------------+--------------+----------------+---------------+

| | | | |

+----------------------------------------------+--------------+----------------+---------------+

| EQUITY AND LIABILITIES | | | |

+----------------------------------------------+--------------+----------------+---------------+

| Equity attributable to owners of the Company | | | |

+----------------------------------------------+--------------+----------------+---------------+

| Share capital | 264 | 264 | 264 |

+----------------------------------------------+--------------+----------------+---------------+

| Share premium | 280 | 280 | 280 |

+----------------------------------------------+--------------+----------------+---------------+

| Share option reserve | 5 | 28 | 3 |

+----------------------------------------------+--------------+----------------+---------------+

| Equity component of convertible loan | - | - | 16 |

+----------------------------------------------+--------------+----------------+---------------+

| Merger reserve | 370 | 370 | 370 |

+----------------------------------------------+--------------+----------------+---------------+

| Foreign currency translation reserve | 17 | (33) | 21 |

+----------------------------------------------+--------------+----------------+---------------+

| Accumulated losses | (1,374) | (914) | (1,186) |

+----------------------------------------------+--------------+----------------+---------------+

| Total equity | (438) | (5) | (232) |

+----------------------------------------------+--------------+----------------+---------------+

| | | | |

+----------------------------------------------+--------------+----------------+---------------+

| Non-current liabilities | | | |

+----------------------------------------------+--------------+----------------+---------------+

| Amount owing to director | 318 | - | 272 |

+----------------------------------------------+--------------+----------------+---------------+

| Bank loan | 81 | - | - |

+----------------------------------------------+--------------+----------------+---------------+

| Total non-current liabilities | 399 | - | 272 |

+----------------------------------------------+--------------+----------------+---------------+

| | | | |

+----------------------------------------------+--------------+----------------+---------------+

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2009

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (continued)

+-------------------------------------------+----------------+----------------+---------------+

| | | | |

+-------------------------------------------+----------------+----------------+---------------+

| | 30 June | 30 June | 31 December |

+-------------------------------------------+----------------+----------------+---------------+

| | 2009 | 2008 | 2008 |

+-------------------------------------------+----------------+----------------+---------------+

| | (Unaudited) | (Unaudited) | (Audited) |

+-------------------------------------------+----------------+----------------+---------------+

| | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------+----------------+----------------+---------------+

| Current liabilities | | | |

+-------------------------------------------+----------------+----------------+---------------+

| Trade payables | 55 | 76 | 50 |

+-------------------------------------------+----------------+----------------+---------------+

| Other payables | 137 | 132 | 115 |

+-------------------------------------------+----------------+----------------+---------------+

| Amount owing to directors | 190 | 223 | 21 |

+-------------------------------------------+----------------+----------------+---------------+

| Obligations under finance leases | - | 4 | 1 |

+-------------------------------------------+----------------+----------------+---------------+

| Convertible loan | 416 | - | 363 |

+-------------------------------------------+----------------+----------------+---------------+

| Derivative financial instrument | 52 | - | - |

+-------------------------------------------+----------------+----------------+---------------+

| Bank loan | 103 | - | - |

+-------------------------------------------+----------------+----------------+---------------+

| Bank overdraft - secured | 94 | 169 | 172 |

+-------------------------------------------+----------------+----------------+---------------+

| Total current liabilities | 1,047 | 604 | 722 |

+-------------------------------------------+----------------+----------------+---------------+

| Total liabilities | 1,446 | 604 | 994 |

+-------------------------------------------+----------------+----------------+---------------+

| Total equity and liabilities | 1,008 | 599 | 762 |

+-------------------------------------------+----------------+----------------+---------------+

| | | | |

+-------------------------------------------+----------------+----------------+---------------+

| | | | |

+-------------------------------------------+----------------+----------------+---------------+

KENETICS GROUP LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR 6 MONTHS ENDED 30 JUNE 2009

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| | Attributable to owners of the Company | | | | |

+------------------+------------------------------------------------------------------------------------------------------------------+--+----------+--+---------+

| Group | Share | | Share | | Share | | Equity | | Merger | | Foreign | | Accumulated | | Total | | Minority | | Total |

| | capital | | premium | | Option | | Component | | reserve | | Currency | | | | | | | | Equity |

| | | | | | reserve | | of | | | | Translation | | Losses | | | | Interest | | |

| | | | | | | | convertible | | | | | | | | | | | | |

| | | | | | | | loan | | | | Reserve | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Balance as at | 264 | | 280 | | 27 | | - | | 370 | | (27) | | (632) | | 282 | | - | | 282 |

| 1/1/08 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Share option | - | | - | | 1 | | - | | - | | - | | - | | 1 | | - | | 1 |

| granted | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Acquisition of | - | | - | | - | | - | | - | | - | | - | | - | | 7 | | 7 |

| additional | | | | | | | | | | | | | | | | | | | |

| interest in | | | | | | | | | | | | | | | | | | | |

| subsidiary | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Total | - | | | | | | - | | | | (6) | | (282) | | (288) | | (7) | | |

| comprehensive | | | - | | - | | | | - | | | | | | | | | | |

| expense for | | | | | | | | | | | | | | | | | | | (295) |

| the period | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Balance as at | 264 | | 280 | | 28 | | - | | 370 | | (33) | | (914) | | (5) | | - | | (5) |

| 30/06/08 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Share options | - | | - | | 1 | | - | | - | | - | | - | | 1 | | - | | 1 |

| granted | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Share options | - | | - | | (26) | | - | | - | | - | | 26 | | - | | - | | - |

| lapsed | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Equity | - | | - | | - | | 16 | | - | | - | | - | | 16 | | - | | 16 |

| component of | | | | | | | | | | | | | | | | | | | |

| convertible | | | | | | | | | | | | | | | | | | | |

| loan | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Acquisition of | - | | - | | - | | - | | - | | - | | - | | - | | 4 | | 4 |

| additional | | | | | | | | | | | | | | | | | | | |

| interest in | | | | | | | | | | | | | | | | | | | |

| subsidiary | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Total | - | | - | | - | | - | | - | | 54 | | (298) | | (244) | | (4) | | (248) |

| comprehensive | | | | | | | | | | | | | | | | | | | |

| income/(expense) | | | | | | | | | | | | | | | | | | | |

| for the period | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Balance as at | 264 | | 280 | | 3 | | 16 | | 370 | | 21 | | (1,186) | | (232) | | - | | (232) |

| 31/12/08 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Share options | - | | - | | 2 | | - | | - | | - | | - | | 2 | | - | | 2 |

| granted | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Equity | - | | - | | - | | (16) | | - | | - | | 16 | | - | | - | | - |

| component of | | | | | | | | | | | | | | | | | | | |

| convertible | | | | | | | | | | | | | | | | | | | |

| loan | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Total | - | | - | | - | | - | | - | | (4) | | (204) | | (208) | | - | | (208) |

| comprehensive | | | | | | | | | | | | | | | | | | | |

| expense for | | | | | | | | | | | | | | | | | | | |

| the period | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

| Balance as at | 264 | | 280 | | 5 | | - | | 370 | | 17 | | (1,374) | | (438) | | - | | (438) |

| 30/06/09 | | | | | | | | | | | | | | | | | | | |

+------------------+---------+--+----------+--+---------+--+-------------+--+---------+--+-------------+--+--------------+--+---------+--+----------+--+---------+

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2009

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

+--------------------------------------------+-----------------+----------------+---------------+

| | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| | 6 months | 6 months | 12 months |

+--------------------------------------------+-----------------+----------------+---------------+

| | Ended | Ended | Ended |

+--------------------------------------------+-----------------+----------------+---------------+

| | 30 June | 30 June | 31 December |

+--------------------------------------------+-----------------+----------------+---------------+

| | 2009 | 2008 | 2008 |

+--------------------------------------------+-----------------+----------------+---------------+

| | (Unaudited) | (Unaudited) | (Audited) |

+--------------------------------------------+-----------------+----------------+---------------+

| | GBP'000 | GBP'000 | GBP'000 |

+--------------------------------------------+-----------------+----------------+---------------+

| Cash flows from operating activities | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| Loss before income tax | (203) | (289) | (591) |

+--------------------------------------------+-----------------+----------------+---------------+

| | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| Adjustments for: | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| Depreciation | 25 | 35 | 91 |

+--------------------------------------------+-----------------+----------------+---------------+

| Interest expense | 18 | 4 | 15 |

+--------------------------------------------+-----------------+----------------+---------------+

| Interest income | (1) | (1) | (1) |

+--------------------------------------------+-----------------+----------------+---------------+

| Impairment loss | - | - | 31 |

+--------------------------------------------+-----------------+----------------+---------------+

| Provision for inventory obsolescence | - | - | 40 |

+--------------------------------------------+-----------------+----------------+---------------+

| Share options expenses | 2 | 1 | 2 |

+--------------------------------------------+-----------------+----------------+---------------+

| Loss arising on derivative financial | 52 | - | - |

| instrument | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| Unrealised exchange loss | 41 | - | - |

+--------------------------------------------+-----------------+----------------+---------------+

| Cash outflow before working capital | (66) | (250) | (413) |

| changes | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| Increase in contract work-in-progress | (161) | - | (24) |

+--------------------------------------------+-----------------+----------------+---------------+

| (Increase)/decrease in trade and other | (156) | 85 | 94 |

| receivables | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| Decrease/(increase) in inventories | 1 | 3 | (19) |

+--------------------------------------------+-----------------+----------------+---------------+

| Increase/(decrease) in trade and other | 64 | (116) | (363) |

| payables | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| Cash used in operations | (318) | (278) | (725) |

+--------------------------------------------+-----------------+----------------+---------------+

| Interest paid | (3) | (4) | (8) |

+--------------------------------------------+-----------------+----------------+---------------+

| Income tax paid | (1) | - | - |

+--------------------------------------------+-----------------+----------------+---------------+

| Net cash flows used in operating | (322) | (282) | (733) |

| activities | | | |

+--------------------------------------------+-----------------+----------------+---------------+

| | | | |

+--------------------------------------------+-----------------+----------------+---------------+

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2009

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW (continued)

+----------------------------------------------+--------------+--------------+----------------+

| | | | |

+----------------------------------------------+--------------+--------------+----------------+

| | 6 months | 6 months | 12 months |

+----------------------------------------------+--------------+--------------+----------------+

| | Ended | Ended | Ended |

+----------------------------------------------+--------------+--------------+----------------+

| | 30 June | 30 June | 31 December |

+----------------------------------------------+--------------+--------------+----------------+

| | 2009 | 2008 | 2008 |

+----------------------------------------------+--------------+--------------+----------------+

| | (Unaudited) | (Unaudited) | (Audited) |

+----------------------------------------------+--------------+--------------+----------------+

| | GBP'000 | GBP'000 | GBP'000 |

+----------------------------------------------+--------------+--------------+----------------+

| Cash flows from investing activities | | | |

+----------------------------------------------+--------------+--------------+----------------+

| Purchase of plant and equipment | (20) | (6) | (13) |

+----------------------------------------------+--------------+--------------+----------------+

| Capital contribution from minority interest | - | 8 | 11 |

+----------------------------------------------+--------------+--------------+----------------+

| Interest received | 1 | 1 | 1 |

+----------------------------------------------+--------------+--------------+----------------+

| Net cash flows (used in)/ generated from | (19) | 3 | |

| investing activities | | | (1) |

+----------------------------------------------+--------------+--------------+----------------+

| | | | |

+----------------------------------------------+--------------+--------------+----------------+

| Cash flows from financing activities | | | |

+----------------------------------------------+--------------+--------------+----------------+

| Receipt of loan from director | 258 | 168 | 221 |

+----------------------------------------------+--------------+--------------+----------------+

| Repayment of hire purchase loan | (1) | (3) | (8) |

+----------------------------------------------+--------------+--------------+----------------+

| Proceeds from convertible loan | - | - | 372 |

+----------------------------------------------+--------------+--------------+----------------+

| Proceeds from bank loan | 208 | - | - |

+----------------------------------------------+--------------+--------------+----------------+

| Repayment of bank loan | (25) | - | - |

+----------------------------------------------+--------------+--------------+----------------+

| Difference of fixed deposit balance due | - | (1) | (2) |

| to accumulation of interest | | | |

+----------------------------------------------+--------------+--------------+----------------+

| Net cash flows generated from financing | 440 | 164 | 583 |

| activities | | | |

+----------------------------------------------+--------------+--------------+----------------+

| | | | |

+----------------------------------------------+--------------+--------------+----------------+

| Net increase/(decrease) in cash in hand | 99 | (115) | (151) |

| and at bank | | | |

+----------------------------------------------+--------------+--------------+----------------+

| Effect of exchange rate changes | 9 | (5) | 60 |

+----------------------------------------------+--------------+--------------+----------------+

| Cash in hand and at bank at beginning of | (131) | (39) | (40) |

| period | | | |

+----------------------------------------------+--------------+--------------+----------------+

| Cash in hand and at bank at end of period | (23) | (159) | (131) |

+----------------------------------------------+--------------+--------------+----------------+

| Fixed deposit | 112 | 97 | 128 |

+----------------------------------------------+--------------+--------------+----------------+

| Bank overdraft | 94 | 169 | 172 |

+----------------------------------------------+--------------+--------------+----------------+

| Cash and cash equivalents per balance sheet | 183 | 107 | 169 |

+----------------------------------------------+--------------+--------------+----------------+

| | | | |

+----------------------------------------------+--------------+--------------+----------------+

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2009

1. Business of Kenetics Group Limited

The Company was incorporated in Jersey on 22 June 2006. The condensed

consolidated financial information of the Company for the six months ended 30

June 2009 comprise the Company and its subsidiaries, Kenetics Innovations Pte

Ltd and Kenetics Innovations (Beijing) Co., Ltd.

The registered office of the Company is located at Walker House, 28-34 Hill

Street, St Helier, Jersey JE4 8PN.

The Group is in the business of electronics design and manufacturing and

producing of electrical and electronic goods.

2. Basis of preparation of interim condensed consolidated financial

information

The interim condensed consolidated financial information for the six months

ended 30 June 2009 has been prepared in accordance with the accounting policies

set out in the annual report and financial statements for the year ended 31

December 2008, except for the adoption of the new/revised IAS that are

applicable for the current financial period. The adoption of the new/revised IAS

have no material effect on the financial statements, except for IAS 1 as noted

below.

On 1 January 2009, the Group adopted the revised IAS 1 (Revised 2007),

Presentation of Financial Statements (IAS 1(R)). IAS 1(R) requires owner and

non-owner changes in equity to be presented separately. The statement of changes

in equity will include only details of transactions with owners, with all

non-owner changes in equity presented as a single line. The revised IAS 1(R)

also introduces the statement of comprehensive income which presents all items

of income and expense recognised in profit or loss, together with all other

items of comprehensive income, either in one single statement of comprehensive

income, or in two linked statements. The Group has opted to present the

comprehensive income in two statements. In addition, the Consolidated Balance

Sheet has been renamed to Consolidated Statement of Financial Position and the

Consolidated Cash Flows Statement has been renamed to Consolidated Statement of

Cash Flows.

IAS 1(R) is a disclosure standard and has no impact on the financial position

and results of the Group.

3. Bank loan

The Group drew down a new bank loan of GBP234,900 from United Overseas Bank in

March 2009 and will be repayable over 2 years by 24 monthly instalments

commencing from April 2009. This bank loan is secured by joint and several

guarantee by certain shareholders of the Company. Interest on the bank loan is

fixed at 5% per annum. In the event of default in repayment of the instalment, a

default interest of 3.5% per annum over the prescribed rate is chargeable over

the overdue instalment.

4. Convertible loan

On 28 July 2008, the Company entered into a Convertible Loan Agreement ("CLA")

with Wong Kai Yun (the "Lender"), sister of the Chairman of the Company to

obtain a principal loan of GBP371,747. The loan may be converted into shares of

the Company on written notification at any time from 1 August 2008 in whole or

in part.

On 18 March 2009, both parties have entered into a Supplement Agreement to amend

certain terms and conditions of CLA as follows:

+------+--------------------------------------------------------------------------------+

| a) | the Lender may at any time after 30 June 2010, after giving the Company not |

| | less than 3 months prior notice in writing, require the Company to repay the |

| | whole or any part of the loan until the said loan is fully repaid. |

| | |

+------+--------------------------------------------------------------------------------+

| b) | the Company shall pay to the Lender interest at the rate of 6% per annum on |

| | the whole or part of the loan as shall remain unpaid from 1 July 2009 up to |

| | the date of actual payment. |

| | |

+------+--------------------------------------------------------------------------------+

| c) | the exchange rate is fixed at S$2.18 to GBP1 for conversion of the loan into |

| | shares of the Company. |

| | |

+------+--------------------------------------------------------------------------------+

5. Loss per share

Basic loss per share has been calculated on the basis of the losses attributable

to ordinary shareholders divided by 26,349,466 (30/06/08: 26,349,466, 31/12/08:

26,349,466), being the weighted average number of ordinary shares issued by the

Company.

In accordance with IAS 33 and as the Group has reported a loss for the period,

the potential

ordinary shares are not dilutive.

6. Exchange rates

The reporting currency of the Company is deemed to be Sterling Pounds. The

functional currencies of Kenetics Innovations Pte Ltd and Kenetics Innovations

(Beijing) Co Ltd are in Singapore dollars and Chinese Renminbi respectively. The

following exchange rates have been used in preparing this financial information:

+-----------------+----------------+----------------+

| | | |

+-----------------+----------------+----------------+

| | S$1 = GBP | RMB1 = GBP |

+-----------------+----------------+----------------+

| 30 June 2009 | 0.41640 | 0.08872 |

+-----------------+----------------+----------------+

| Average rates | 0.45012 | 0.09844 |

+-----------------+----------------+----------------+

7. Income tax

There was no income tax expense for the 6 months ended 30 June 2008 and the 12

months ended 31 December 2008 as the Group has been loss making during these

periods. The income tax expense for the 6 months ended 30 June 2009 amounted to

GBP1,000 and was an under-provision of tax provision in the prior year.

8. Nature of financial information

The interim financial information set out above is neither audited nor reviewed

and does not represent the statutory financial statements for Kenetics Group

Limited or for any of the entities comprising the Kenetics Group for the period

ended 30 June 2009. The figures for the year ended 31 December 2008 were

extracted from the consolidated financial statements which

have been presented to the shareholders. The auditors' report on those financial

statements was unqualified.

The Board approved the interim financial information for the period ended 30

June 2009 on 8 September 2009.

These interim results are available on the Company's website

www.kenetics-group.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BXGDCXXBGGCU

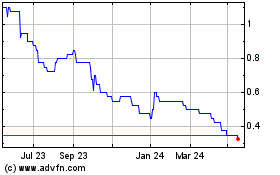

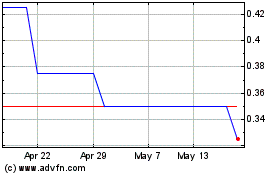

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024