JPMorgan Global Core Real Assets Ld Monthly Net Asset Value (3527Q)

February 20 2023 - 2:00AM

UK Regulatory

TIDMJARA TIDMJARU TIDMJARE

RNS Number : 3527Q

JPMorgan Global Core Real Assets Ld

20 February 2023

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN GLOBAL CORE REAL ASSETS LIMITED

(the "Company" or "JARA")

MONTHLY NET ASSET VALUE

Legal Entity Identifier: 549300D8JHZTH6GI8F97

The Company announces that the unaudited net asset value ('NAV')

as at 31 January 2023 was 100.97 pence per share.

An analysis of the components to this NAV and the relevant dates

for their valuation is provided below. Given elevated levels of

market volatility, additional commentary is also provided in this

NAV release.

Strategies

Name Date of price for % of JARA's NAV

Strategy as at 31 January

2023

US Real Estate Equity 31 December 2022 21.1%

------------------- ------------------

Asia-Pacific Real Estate

Equity 30 September 2022 17.0%

------------------- ------------------

US Real Estate Debt 31 December 2022 7.1%

------------------- ------------------

Transportation 30 September 2022 18.5%

------------------- ------------------

Infrastructure 31 December 2022 17.0%

------------------- ------------------

Liquid Strategy 31 January 2023 19.3%

------------------- ------------------

Exchange rates

The GBP/USD exchange rate was 1.2311 as at 31 January 2023.

Commentary

Overall, the Company's NAV declined by 0.8% over the month,

primarily driven by the -2.3% depreciation of USD against GBP over

the month. The Board and Manager are pleased with the NAV

performance, given background market conditions. JARA's diversified

portfolio is acting as it was intended, with areas of strength,

some of which are a direct beneficiary of increased interest rates

and higher inflation, offsetting write-downs in other areas of the

portfolio.

Three private strategies have reported their quarterly

valuations as at 31 December 2022. The decline in the valuation of

the US Real Estate Equity allocation was offset by gains in the US

Real Estate Debt and the Infrastructure strategies, both of which

delivered a positive return over the quarter. The Real Estate Debt

strategy was fully drawn down on 23 February 2022 to capitalise on

the pronounced market dislocation post COVID and is now benefitting

from rising rates. Collectively this resulted in a -2.8% USD return

from the Company's US real estate exposure in Q4. The Company notes

that the real estate debt exposure has helped reduce the volatility

in the US property allocation and speaks to the diversification of

JARA's portfolio. JARA's portfolio has no exposure to private real

estate in Europe or the UK, where rising rates have particularly

impacted real estate valuations. The Liquid strategy delivered a

positive return over the month.

The valuations for the two remaining private asset strategies

(Transportation and Asia-Pacific Real Estate) as at 31 December

2022 are expected to be incorporated into the Company's February

NAV. Core transportation has historically been a resilient market

during periods of stress and the capital market adjustments which

have driven a lot of the repricing in US real estate should have

less of an effect in Asia-Pacific markets, where interest rate

regimes differ significantly and cap rates were at less compressed

levels compared to the US and Europe.

20 February 2023

Emma Lamb

JPMorgan Funds Limited - Company Secretary

Telephone 0207 742 4000

Notes

The Company aims to provide holders of the Ordinary Shares with

a stable income and capital appreciation, measured on a constant

currency basis, through exposure to a globally diversified

portfolio of Core Real Assets in accordance with the Company's

investment policy. The Company obtains exposure to Core Real Assets

through various real asset strategies, namely: Global

Infrastructure, Global Real Estate, Global Transport and Global

Liquid Real Assets. J.P. Morgan's Alternative Solutions Group has

the primary responsibility for managing the Company's

portfolio.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVSFSFAWEDSESE

(END) Dow Jones Newswires

February 20, 2023 02:00 ET (07:00 GMT)

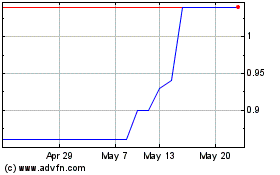

Jpmorgan Global Core Rea... (LSE:JARU)

Historical Stock Chart

From Mar 2024 to Apr 2024

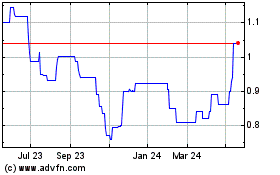

Jpmorgan Global Core Rea... (LSE:JARU)

Historical Stock Chart

From Apr 2023 to Apr 2024