TIDMINS

RNS Number : 7249A

Instem plc

27 September 2022

Instem plc

("Instem", the "Company" or the "Group")

Half Year Report

Instem plc (AIM: INS.L), a leading provider of IT solutions to

the global life sciences market, announces its unaudited half year

results for the six months ended 30 June 2022.

Financial Highlights

-- Total Group revenues increased by 39 % to GBP 27.6m (H1 2021: GBP19.8m)

-- Recurring revenue (annual support and SaaS) increased 62 % to

GBP16.0m (H1 2021: GBP9.9m) with SaaS increasing 29% to GBP6.3m (H1

2021: GBP4.9m)

-- Constant currency revenue growth was 34%

-- Annual Recurring Revenue ("ARR") of GBP32.0m at 1 July 2022

-- Adjusted EBITDA* increased 8% to GBP4.5 m (H1 2021: GBP 4.2

m), representing 16.3% (H1 2021: 21.0%) of revenue

-- Profit before tax of GBP 1.9m (H1 2021: GBP1.2m)

-- Adjusted profit before tax** of GBP 3.2 m (H1 2021: GBP3.2m, as restated)

-- Basic and diluted earnings per share of 5.7p (H1 2021: 4.8p) and 5.5p (H1 2021: 4.6p)

-- Adjusted basic and diluted earnings per share** of 11.3p (H1

2021: 14.3p, as restated) and 10.8p (H1 2021: 13.6p, as

restated)

-- Net cash generated from operations of GBP1.8m (H1 2021 GBP4.1m)

-- Gross cash balance as at 30 June 2022 of GBP10.3m (H1 2021: GBP17.9m)

*Earnings before interest, tax, depreciation, amortisation and

non-recurring items (non recurring items are legal costs and

increased settlement provision relating to an historical contract

dispute plus acquisition costs, exceptional share based payment

charge and US government loan forgiveness)

** After adjusting for the effect of foreign currency exchange

and the unwinding of the finance liability included in finance

income/(costs), non-recurring items and amortisation of intangibles

on acquisitions

Operational Highlights

-- First reporting period with full contribution from The Edge

Software Consultancy Ltd ("The Edge"), d-Wise Technologies, Inc

("d-Wise") and PDS Pathology Data Systems Ltd ("PDS") (the

"Acquisitions"), with integration almost finalised

o Increasing recurring revenues and visibility

o Strengthening relationships with clients

o Increasing routes to market and cross selling

opportunities

-- Earn-outs met in full for d-Wise and The Edge (PDS has no earn out provision)

-- New banking facility finalised with HSBC of up to GBP20m,

GBP10m of which is committed and none currently utilised

Post-period end Highlights

-- Won largest ever contract

o $12m five-year agreement with global CRO, lead client for new

Aspire software solution

o Significant future SaaS revenues with long-term client

o Further expands the Group's global coverage and end-to-end

solutions

-- Full and final settlement of historical contractual licence dispute

o No impact on current operations; dispute arose in 2017

o Settled at EUR1.48m (GBP1.3m), offset by insurance

contribution of EUR450k (GBP400k), net GBP0.9m

o Settlement provision increased by GBP0.65m during H1 2022

toGBP0.9m as a non-recurring charge

o Cash payment of GBP0.9m due in October 2022

Outlook

-- Our ability to increase revenue per client, add new clients

as well as service larger contracts underpins management's growth

expectations in the current period and beyond

-- The market backdrop remains favourable, and we continue to

see high demand for our products and solutions

Phil Reason, CEO, commented: "The combination of continued

underlying growth and the contribution of the Acquisitions meant

that this was another strong period for the Company.

"Our ability to increase revenues per client, add new clients as

well as to increase recurring revenues underpins management's

growth expectations in the current period and beyond. The market

backdrop remains favourable and we continue to see high demand for

our products and solutions. While, as previously flagged, essential

salary inflation created a lag in H1 operating profit growth, this

will be less pronounced in H2 as the price rises we have

implemented take effect. Slower than expected consulting and

service revenue growth is expected to be offset by stronger growth

in higher margin software business, resulting in full year profit

performance in line with market expectations(1) .

The Acquisitions are now substantially integrated and we expect

to see further benefit to the enlarged Group as we convert our

order backlog. We will continue to focus on organic and acquisitive

growth opportunities with a view to further leveraging our business

model and strong industry standing."

1. The Board understands that consensus market expectation

adjusted profit before tax is GBP7.8m

Analyst Presentation: 11:30 today

Management will be hosting a presentation via web conference

today at 11:30. Analysts wishing to join should

register their interest by emailing instem@walbrookpr.com or by telephoning 020 7933 8780.

Investor Presentation: 16:30 today

Management will be providing a presentation and hosting an

Investor Q&A session on the results and future prospects today

at 16:30, through the digital platform Investor Meet Company.

Investors can sign up for free and add to attend the presentation

via the following link

https://www.investormeetcompany.com/instem-plc/register-investor .

Questions can be submitted pre-event and at any time during the

live presentation via the Investor Meet Company Platform.

For further information, please contact:

Instem plc Via Walbrook PR

Phil Reason, CEO

Nigel Goldsmith, CFO

Singer Capital Markets (Nominated

Adviser & Joint Broker) +44 (0) 20 7496 3000

Peter Steel

Alex Bond

Rachel Hayes

Stifel Nicolaus Europe Limited

(Joint Broker) +44 (0) 20 7710 7600

Richard Short

Ben Madison

Alex Price

Walbrook Financial PR +44 (0) 20 7933 8780

Nick Rome instem@walbrookpr.com

Tom Cooper

Joseph Walker

About Instem

Instem is a leading provider of IT solutions & services to

the life sciences market delivering compelling solutions for Study

Management and Data Collection; Regulatory Solutions for

Submissions and Compliance; and Informatics-based Insight

Generation.

Instem solutions are in use by over 700 customers worldwide,

including all the largest 25 pharmaceutical companies, enabling

clients to bring life enhancing products to market faster. Instem's

portfolio of software solutions increases client productivity by

automating study-related processes while offering the unique

ability to generate new knowledge through the extraction and

harmonisation of actionable scientific information.

Instem products and services address aspects of the entire drug

development value chain, from discovery through to market launch.

Management estimate that over 50% of all drugs on the market have

been through some part of Instem's platform at some stage of their

development.

To learn more about Instem solutions and its mission, please visit www.instem.com

Chairman's Statement

This period has been of considerable strategic importance for

the Company as we substantially completed the integration of the

three recent Acquisitions. This is the first set of results to

include their full contribution. The strong performance of the

significantly enlarged Group emphasises the benefits of our

acquisition strategy - with our increased scale and product range

strengthening our growth ambitions whilst helping to reduce

susceptibility to ongoing market fluctuations.

Having grown our reach, routes to market and ability to cross

sell, our combined operations are increasingly setting us apart

from our competitors.

Earn-Outs

I am delighted to confirm that the earn-out periods for d-wise

and The Edge have now completed, with both earn-out targets met in

full. PDS has no earn-out arrangement.

Financial Performance

While, as previously reported, there was minimal disruption to

revenue in the challenging macro-economic environment, there were

headwinds, mainly due to inflationary pressures, which led to

essential increases in remuneration for staff across the Company.

As stated earlier in the year, we successfully instigated a number

of price increases to mitigate the impact of these additional

costs.

We have seen a change in the revenue mix during the period with

greater increases in higher margin recurring SaaS and annual

support fees and lower growth in services. While service revenue is

picking up again in the second half, we anticipate that

software-related revenues will be the primary driver of growth in

the full year.

Our performance during the period was largely in line with the

Board's expectations, despite the above short-term issues, while

importantly we established foundations for continued growth and

margin improvement.

Performance in the Period for some of our key financial metrics

is summarised below:

-- Revenue increased 39%

-- SaaS Revenue increased 29%

-- Recurring Revenue increased 62%

-- Adjusted EBITDA increased 8%

Looking Forwards

As I noted earlier, our acquisition strategy is expected to

extend the reach of the Company, enabling us to take advantage of

additional growth opportunities as they arise. In this regard, we

are extremely encouraged by the recently announced post-period end,

$12m contract win - our largest ever contract. In this we will be

supporting a large contract research organisation ("CRO"), with

over 2,000 users worldwide, in its clinical trial analysis as it

adopts our new Aspire software solution. This is being supplied by

Company's Clinical Trial Acceleration business unit, formed

following the acquisition of d-Wise. We believe that over the next

3-5 years we can achieve compound annual organic growth of 10% and,

with further acquisitions, have the potential to more than double

our 2022 revenue (i.e. reaching total revenue of GBP120m+).

Our customers are continuing to experience increased demand for

their services and, as a result, we continue to see strong demand

for our solutions across the drug development lifecycle. We have a

healthy and growing order book, increased scale of operations and

increased levels of visibility resulting from our SaaS conversion

program. We remain confident about the future performance of the

business.

David Gare

Non-Executive Chairman

27 September 2022

Chief Executive's Report

Strategic Development

The Group has continued to pursue its mission to help our

clients radically reduce the cost and time of life sciences

research and development through data driven optimisation of

traditional non-clinical and clinical study processes, ultimately

replacing many of those studies with "in silico" alternatives such

as predictive analytics, simulation and modelling. The strategy is

based on leveraging trusted client and regulatory relationships and

our intimate understanding of complex scientific data, established

by providing a broad portfolio of market leading IT solutions that

optimise today's life sciences R&D processes, from early

discovery to late-stage clinical trials.

The increasing SaaS deployment of an expanded suite of solutions

ensures that we are in a stronger position to help our clients

aggregate and leverage a broader and deeper set of information

while increasing recurring revenue and visibility.

Group growth was supported by a robust underlying life sciences

research and development market as we experienced demand for our

solutions across the entire drug development life cycle. We further

embedded operations from the Acquisitions, positioning the enlarged

Group to take advantage of the positive prevailing market

conditions.

Our larger suite of solutions and broader market reach provides

further cross-selling opportunities to increase revenues from

existing and new clients. This is further enhanced by our capacity

to service larger contracts and provide a one-stop shop for clients

seeking to reduce and simplify their supplier network.

Having previously integrated areas such as Finance, People &

Culture, Information Systems and Marketing from the Acquisitions,

we have been able to complete the more comprehensive integration of

larger teams, such as those in Software Development, Out-Sourced

Services, SaaS Delivery and Customer Implementations / Support.

This is already starting to generate economies of scale, the

ability to standardise on best practice processes and opportunities

to target highly skilled resources at the most compelling business

opportunities.

A combined Governance, Risk and Compliance team is now in place,

overseeing global implementation and compliance with standards such

as ISO 9001 Quality Management, ISO 27001 Information Security

Management, industry regulation such as Good Laboratory / Clinical

Practice ("GLP" and "GCP") and the increasing importance of

Environmental, Social and Governance ("ESG") practices, standards

and regulation, which is increasingly important to all of our

stakeholders.

Most recently, we have been able to liberate senior management

bandwidth from the enlarged team to make three new US-based

appointments:

-- VP Investor Relations, to support increased investor

engagement following the appointment of Stifel as joint broker and

an active programme intended to broaden institutional shareholding

in North America and mainland Europe

-- VP Corporate Development, to support our ability to target a

growing landscape of acquisition targets, many of which are based

in North America

-- VP Strategic Partnerships, to ensure we maximise the benefits

to Instem and a growing list of existing partners while ensuring we

optimise our ability to evaluate, consummate and manage future

additions. These relationships help differentiate Instem in the

market and have previously led to acquisition opportunities.

Market Review

The market backdrop continues to be favourable for the Group

given global population growth and life expectancy underpinning

increased demand for successful innovation in life sciences.

Increasing amounts of money are being invested in the biotech

industry with the pharmaceuticals sector investing heavily in drug

development, underpinning a strong pipeline for Instem.

In the pharmaceutical industry, which represents the largest

proportion of Instem's revenue, we refer again to the Pharma

R&D Annual Review, the 2022 version of which was released by

Pharma Intelligence in March this year. This report shows that the

industry grew strongly in 2021 with an 8.2% increase (2020: 4.8%)

in the total number of drugs in the regulatory stages of global

R&D, continuing a multi-year growth trend that shows no sign of

abating. Most relevant to Instem are the increase in the number of

drugs at the preclinical (or non-clinical) phase of drug

development of 11.0% (2020: 6.0%) and clinical phases 1-3 where

there was an 8.3% increase (2020: 3.6%), as these areas account for

much of our business.

The Company works with most of the world's leading public and

private CROs and tracks their business performance as this provides

additional insight into the health of the underlying market and

almost all of those companies have recently reported strong

underlying growth and very limited impact of wider macro-economic

headwinds.

Business Performance

Study Management

Most of our study management solutions address areas where

technology adoption is mature and Instem enjoys significant market

penetration. However, with global R&D study volume steadily

increasing, existing clients have continued to expand numbers of

users for most of our study management solutions, while adding

further products from our solution portfolio. This is the area with

the greatest opportunity to transition existing clients from

on-premise to SaaS deployment. While this transition has slowed

over the last two years, as clients concentrated on advancing Covid

vaccines and therapies, we are now seeing clients refocussing on

SaaS conversion projects.

This area generates a significant proportion of our recurring

revenue, so client retention is critical and once again this has

been exceptionally strong. Clients have generally been

understanding of the inflationary pressures that are impacting

Instem, particularly salary costs, in what remains a very

competitive labour market, and have been accepting of material

price increases as recurring contracts renew. As such, the Board

remains confident that margins can be protected through this

phase.

Regulatory Solutions

The majority of our clients and revenue in this area are

associated with our software and out-sourced services to create,

visualise and share information using Food & Drug

Administration ("FDA") mandated format S (Standard for the Exchange

of Non-clinical Data). The acquisition of PDS in September 2021,

number two in the market behind Instem in S out-sourced services,

has led to Instem taking substantial market share of new and repeat

business, with good growth in new business bookings. However,

revenue conversion (particularly in Q1 2022) was at a slower rate

than in recent periods as client studies failed to deliver as many

data sets ready for S conversion as they had anticipated. We are

now seeing an improving flow of data for conversion and expect a

stronger revenue performance in Q4 2022 and beyond.

Our out-sourced services productivity was also negatively

impacted by a significant change in the commercial terms to use a

widely adopted third-party product that helps check S packages for

conformance against the standard. Along with many other

organisations, Instem stopped using the third-party product and has

performed the equivalent checks manually. In parallel we have been

developing our own automated checking software, which will be

implemented by our out-sourced services team in Q4 2022. This will

be timely as we work through a growing order book for S

conversions.

In Silico Solutions

Our Leadscope predictive analytics solutions which provide an in

silico assessment of the potential safety liabilities associated

with a specific chemical structure have continued to grow strongly

in the period. New predictive assays, developed in collaboration

with industry and regulatory partners, have been licensed and

deployed, and work continues to add new in silico models, some of

which will replace animal-based studies.

Our introduction of an out-sourced alternative to clients

licensing our software is starting to build revenue momentum, and

work is progressing well on a collaborative European Medicine

Agency funded research project to investigate the mutagenicity of

different classes of N-nitrosamines ("NAs"). Nitrosamines have

become a focus of significant concern for the global pharmaceutical

industry, and we are anticipating that a new NA-related in silico

model will be created as we contribute to this important research

project.

Our KnowledgeScan target safety assessment business, having

slowed through the height of the Covid crisis, has picked up well

in Q2 2022 and continues to grow strongly in Q3 as client

scientists have returned to their laboratories and have once again

outsourced this work.

Clinical Trial Acceleration

The highlight in this area is undoubtedly the post period end

award of Instem's largest ever contract, a $12 million multi-year

SaaS project for a large CRO. As detailed in the 2 September 2022

RNS, this project will create an early adopter and key reference

client for our new Aspire(TM) statistical computing environment

("SCE"). Our Clinical Trial Acceleration team are global leaders in

this market, providing many small to medium sized CROs and pharma

companies with a productised SCE and the largest companies with

custom SCE solutions. Aspire is expected to provide a

transformational product-based alternative for the larger clients

and to replace large, resource intensive consulting projects with a

standardised SaaS solution.

With several large consulting projects completing in the period

and other large opportunities taking longer through the sales

cycle, growth in consulting revenue will be modest in 2022; a

scenario that will diminish in frequency and impact as a

consequence of the growing annuity revenue stream arising from

Aspire.

Outlook

The combination of continued underlying growth and the

contribution of the Acquisitions meant that this was another strong

period for the Company.

Our ability to increase revenue per client, add new clients as

well as service larger contracts underpins the Board's growth

expectations in the current period and beyond. The market backdrop

remains favourable, and we continue to see high demand for our

products and solutions. While, as previously flagged, essential

salary inflation created a lag in H1 operating profit growth, this

will be less pronounced in H2 as the price rises we have

implemented take effect. Slower than expected consulting and

service revenue growth is expected to be offset by stronger growth

in higher margin software business resulting in full year profit

performance in line with market expectations(1) .

The Acquisitions are now substantially integrated, and we expect

to see further benefit to the enlarged Group as we convert our

order backlog. We will continue to focus on organic and acquisitive

growth opportunities with a view to further leveraging our business

model and strong industry standing.

Phil Reason

Chief Executive Officer

27 September 2022

1. The Board understands that consensus market expectation

adjusted profit before tax is GBP7.8m.

Financial Review

Key Performance Indicators (KPIs)

The directors review monthly revenue and operating costs to

ensure that sufficient cash resources are available for the working

capital requirements of the Group.

The primary KPIs at 30 June 2022 were:

6 months to 6 months to % Change 12 months to

30 June 2022 30 June 2021 (H1 2021 to H1 2022) 31 Dec

GBP000 GBP000 2021

GBP000

Total revenue 27,604 19,826 39% 46,017

Recurring revenue 15,973 9,889 62% 24,083

Recurring revenue as a percentage of total

revenue 58% 50% - 52%

Annual recurring revenue 32, 124 n/a - 28,741

Adjusted EBITDA 4,500 4,161 8% 8,250

Adjusted EBITDA margin % 16.3% 21% -470bps 17.9%

Cash and cash equivalents 10,280 17,850 -42% 15,021

Operating profit after non-recurring items 1,568 1,921 -18% 4,098

In addition, certain non-financial KPIs are periodically

reviewed and assessed, including customer and staff retention

rates.

Instem's revenue model consists of perpetual licence income with

annual support and maintenance contracts, professional fees,

technology enabled outsourced services fees, SaaS subscriptions and

consulting services fees.

Total revenues in the period increased by 39% to GBP27.6m (H1

2021: GBP19.8m) with constant currency revenue growth at 34%.

Recurring revenue, derived from support & maintenance contracts

and SaaS subscriptions, increased in the period by 62% to GBP16.0m

(H1 2021: GBP9.9m). Recurring revenue as a percentage of total

revenue was 58% (H1 2021: 50%). In absolute terms, recurring

revenue increased over the prior year by GBP6.1m. Revenue from

technology enabled outsourced services increased by 42% to GBP3.7m

(H1 2021: GBP2.6m).

Operating expenses increased by 47% in the period reflecting the

full year cost of the 2021 acquisitions, ongoing investment in

operational teams and the increase in the rate of inflation,

primarily in salaries.

Adjusted earnings before interest, tax, depreciation,

amortisation, and non-recurring items (Adjusted EBITDA) increased

by 4% to GBP4.5m (H1 2021: GBP4.2m). For this measure of earnings,

the margin as a percentage of revenue decreased in the period to

16.3% from 21% in H1 2021, due to the impact of the lower than

Instem average margins of d-Wise and PDS and abnormally high salary

cost inflation across the Group from January 2022. The average

number of employees (including non-executive directors) for the

period was 485 globally, an increase of 49 since December 2021.

Non-recurring costs in the period were GBP0.8m (H1 2021:

GBP1.6m), consisting of an GBP0.7m increase of the provision

associated with an historical contract dispute (see Subsequent

Events section below for more detail) and GBP0.1m for integration

costs relating to the 2021 acquisitions of The Edge, d-Wise and

PDS.

The reported profit before tax for the period was GBP1.9m (H1

2021: GBP1.2m). The calculation for the adjusted profit before tax

was changed in 2022 to include two additional components; the

effect of foreign currency exchange and the unwinding of the

financial liability included in finance income/(costs). Those two

components have been included to better reflect the normalised,

ongoing operations of the Group. Adjusted profit before tax (i.e.

after adjusting for the effect of foreign currency exchange and the

unwind of the finance liability included in finance income/(costs),

non-recurring items and amortisation of intangibles on

acquisitions) was GBP3.2m (H1 2021: GBP3.2m, restated).

The Group operates internationally and is exposed to foreign

currency risk on transactions denominated in a currency other than

the functional currency and on the translation of the statement of

financial position and statement of comprehensive income of foreign

operations into sterling. The currency that gave rise to this risk

in 2022 was primarily from realised US dollars transactions. In

2022, the revenue and Adjusted EBITDA growth on a constant currency

basis, excluding the foreign exchange exposure was 34-% and 3%

respectively. The foreign exchange gain recorded during H1 2022 was

GBP0.94m (H1 2021: GBP0.26m loss), which is composed of unrealised

gains/losses from translation of intercompany balances. The Group

seeks to settle those intercompany balances whenever possible.

The Group continues to invest in its product portfolio.

Development costs incurred in the period were GBP3.7m (H1 2021:

GBP2.3m), of which GBP1.4m (H1 2021: GBP1.0m) was capitalised. The

Group has a development process in place and is committed to ensure

its own technology continues to evolve to meet client needs.

Basic and diluted earnings per share calculated on an adjusted

basis were 11.3p and 10.8p respectively (H1 2021: 14.3p basic and

13.6p diluted, as restated). The reported basic and diluted

earnings per share were 5.7p and 5.5p respectively (H1 2021: 4.8p

basic and 4.6p diluted).

The Group cash generated from operations for the period was

GBP1.8m (H1 2021: GBP4.1m), a reduction from prior year primarily

due to more cash tied up in working capital. The deferred and

contingent consideration payments of GBP4.5m which related to the

2021 acquisitions were part of the net cash used in financing

activities. The net cash used in investing activities includes

GBP1.4m (H1 2021: GBP1.0m) from the capitalisation of software

development. As a result of the above the gross cash balance

decreased from GBP15.0m at 31 December 2021 to GBP10.3m at 30 June

2022.

The remaining financial obligations associated with The Edge,

d-Wise and PDS acquisitions for H2 2022 and 2023 are deferred and

contingent consideration payments of GBP4.2m and GBP2.2m

respectively in cash. The contingent consideration provision

reflected management's estimate that the entities would achieve

their profitability targets and that the full amount of contingent

consideration would be paid. This was confirmed in the period.

Intangible assets increased from the 30 June 2021 to the 30 June

2022 interim results due to the PDS acquisition completed on 1

September 2021 and an element of deferred consideration GBP3.2m

(US$ 4.3m) relating to the d-Wise acquisition, which was originally

recognised in H1 2021 as employee remuneration through the

Statement of Comprehensive Income. As part of the procedures

performed at the 31 December 2021 year end the accounting treatment

was reassessed and it was concluded that no substantive employment

link existed. Appropriate adjustments were made to the results in

the year ended 31 December 2021 to include the deferred

consideration as part of the cost of business combination. Any

employment remuneration expense recognised in the interim 2021

results was reversed in H2 2021. Additionally, in 2022 the Goodwill

in d-wise has increased by GBP0.05m (US$0.06m) due to a change in

the contingent consideration paid.

The deficit on the Group's legacy defined benefit pension scheme

was GBP1.3m at 30 June 2022 (H1 2021: GBP2.7m) having improved from

a deficit of GBP2.0m at 31 December 2021. Liabilities decreased

from GBP16.0m at 31 December 2021 to GBP12.5m at 30 June 2022 and

Plan Assets have decreased from GBP14.0m at 31 December 2021 to

GBP11.2m at 30 June 2022. The scheme liabilities fell in value due

to significantly higher discount rates, which reflect the rise in

the yields on corporate bonds over the period and contributions

paid by the Group during the period have caused the deficit to

reduce.

These reductions in the scheme deficit were offset by investment

returns that were materially lower than expected, as well as higher

inflation assumptions over the period that led to a decrease in the

value of the Scheme's assets.

Movements in share capital and the share premium, merger rand

share based payment reserves reflect the exercise of share options

during the period, the fair value of share options granted being

charged to the Statement of Comprehensive Income and the issue of

shares paid in lieu of cash as deferred consideration for d-Wise.

The share capital of Instem at 30 June 2022 was 22,676,808 ordinary

shares of 10p each (note 12).

In line with previous periods and given our policy of retaining

cash within the business to capitalise on available growth

opportunities, the Board has not recommended the payment of a

dividend.

Principal risks and uncertainties

The principal risk and uncertainties that management have made

for the six months ended 30 June 2022 remained unchanged with those

reported in the annual statutory financial statement for the year

ended 31 December 2021.

The current weak economic conditions, spiralling cost inflation,

the Ukrainian conflict and the threat of a global recession,

compounded by the UK's departure from the European Union ("EU"),

may disrupt or negatively impact the Group's operations and

associated revenues. The Group has no clients or operations located

in either Ukraine or Russia. The Board is actively monitoring the

developing situation and is mindful of the potential for

escalation. The impact of Covid-19 remains a challenge,

particularly in China where the zero-tolerance approach by the

Chinese government and consequent widespread lockdowns has impacted

the Group's ability to implement its solutions on site for some

clients in a timely way. However, it is not apparent that this has

caused any material revenue or client loss and the Group continues

to work closely with its clients to service their needs.

The Group operates internationally and is exposed to foreign

currency risks on transactions denominated in a currency other than

the functional currency. The main currency giving rise to this risk

is the US dollar. Whilst weak sterling against the US dollar is

beneficial to revenue , our substantial US cost base provides a

natural hedge so that a strengthening USD is only modestly

beneficial to profit.

Finally, any significant inflationary increases would quickly

impact the Group's cost base as experienced during the period with

salary increases across the Group. The Group has taken steps to

mitigate these increases with corresponding increases in sales

prices wherever possible but there will be a time lag before the

full impact of these increases is reflected in the Group's

results.

The Group seeks to mitigate exposure to all forms of risk

through a combination of regular performance review and a

comprehensive insurance programme. Additionally, t he Group has a

significant proportion of recurring revenue (circa 58% of total)

from annual support & maintenance and SaaS contracts from a

well-established global customer base. Consequently, the Group

ensures that it maintains a diversified portfolio in terms of

customers, revenue mix, geography and markets.

Subsequent events

No adjusting events have occurred between the 30 June 2022

reporting date and the date of approval of this Interim Report.

A full and final settlement has been negotiated and agreed with

a former customer regarding an historical contractual licence

dispute that arose in 2017. Instem has agreed to pay EUR1.48m

(approx. GBP1.3m), of which its insurer has agreed to contribute

EUR0.45m (approx. GBP0.4m) resulting in a net payment due of

approx. EUR1.0m (GBP0.9m). This will be made in October 2022.

As previously announced, the Company had created a provision of

GBP0.25m in respect of the dispute and this was increased in the

period by GBP0.64m, resulting in a provision at 30 June 2022 of

approx. GBP0.9m. The increase in the provision was treated as a

non-recurring, exceptional charge in the half year ended 30 June

2022.

The issue involved does not affect the ongoing operations of the

Group.

Alternative performance measures

This report contains certain financial alternative performance

measures ("APMs") that are not defined or recognised under IFRS but

are presented to provide readers with additional financial

information that is evaluated by management and investors in

assessing the performance of the Group. This additional information

presented is not uniformly defined by all companies and may not be

comparable with similarly titled measures and disclosures by other

companies.

The table below provides the data for certain performance

measures mentioned above:

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP000 GBP000 GBP000

Annual support fees 9,716 4,988 14,378

SaaS subscription and support fees 6,257 4,901 9,704

Recurring revenue 15,973 9,889 24,082

Licence fees 2,803 3,086 4,597

Professional services 1,486 1,509 3,651

Technology enabled outsourced services 3,738 2,594 6,378

Consultancy services 3,604 2,748 7,309

Total revenue 27,604 19,826 46,017

Recurring revenue is the revenue that repeats annually under contractual arrangements. It

highlights how much of the Group's total revenue is secured and anticipated to repeat in future

periods, providing a measure of the financial strength of the business.

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP000 GBP000 GBP000

Annual Recurring Revenue 32,124 - 28,741

Annual recurring revenue is revenue that annually repeats under contractual arrangements and

consists of Software as a Service (SaaS) revenue together with annual support and maintenance

fees.

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP000 GBP000 GBP000

EBITDA (before non recurring items) 3,731 3,344 7,769

Non recurring cost (see note 6) 769 1,622 1,286

Non recurring income (see note 6) - (805) (805)

Adjusted EBITDA 4,500 4,161 8,250

Adjusted EBITDA is EBITDA plus non-recurring items (as set out in note 6). The same adjustments

are also made in determining the adjusted EBITDA margin. Items are only classified as non-recurring

or exceptional due to their nature or size and the Board considers that this metric provides

the best measure of assessing underlying trading performance.

30 Jun 2022 30 Jun 2021 30 Jun 2021 31 Dec 2021 31 Dec 2021

(as restated) (as originally reported) (as restated) (as originally reported)

GBP000 GBP000

GBP000 GBP000 GBP000

Profit before

tax 1,918 1,177 1,177 2,984 2,984

Amortisation

of

intangibles

arising on

acquisition 977 599 599 1,563 1,563

Non recurring

cost (see

note 6) 769 1,622 1,622 1,286 1,286

Non recurring

income (see

note 6) - (805) (805) (805) (805)

Intercompany

foreign

exchange

(gain)/loss - - 268 - (18)

Foreign

currency

exchange

(gain)/ loss (944) 258 - 44 -

Unwinding

discount on

deferred

consideration 455 318 - 867 -

Adjusted

profit before

tax 3,175 3,169 2,861 5,939 5,010

The calculation for the adjusted profit before tax was changed in H1 2022 compared with prior

periods by including two additional components, the effect of the foreign currency exchange

and the unwinding of the finance liability included in finance income/(costs). Those two components

have been included as adjustments as they do not affect the ongoing operations of the Group.

Adjusted profit before tax is after adjusting for the effect of foreign currency exchange

and the unwinding of the finance liability included in finance income/(costs), non-recurring

items and amortisation of intangibles on acquisitions. The same adjustments are also made

in determining adjusted earnings per share ("EPS"). The Board considers this adjusted measure

of operating profit provides the best metric of assessing underlying performance.

30 Jun 2022 30 Jun 2021 30 Jun 2021 31 Dec 2021 31 Dec 2021

(as restated) (as originally reported) (as restated) (as originally reported)

GBP000 GBP000

GBP000 GBP000 GBP000

Weighted

average

number of

shares

(000's) 23,547 22,168 22,168 22,719 22,719

Adjusted

diluted

earnings per

share 10.8p 13.6p 12.2p 20.4p 16.3p

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP000 GBP000 GBP000

Cash at bank 10,280 26,848 24,019

Bank overdraft - (8,998) (8,998)

Cash balance 10,280 17,850 15,021

Nigel Goldsmith

Chief Financial Officer

27 September 2022

Instem plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Six months ended Six months ended Year

30 June 30 June ended 31 December 2021

2022 2021 GBP000

GBP000 GBP000

Note

REVENUE 4 27,604 19,826 46,017

Employee benefits expense (14,676) (11,504) (26,918)

Other expenses (8,428) (4,161) (10,491)

Net impairment loss on financial assets - - (358)

EARNINGS BEFORE INTEREST, TAXATION,

DEPRECIATION, AMORTISATION AND

NON-RECURRING COSTS (ADJUSTED

EBITDA) 4,500 4,161 8,250

Depreciation (168) (123) (312)

Amortisation of intangibles arising on

acquisition (977) (599) (1,563)

Amortisation of internally generated

intangibles (469) (397) (851)

Amortisation of right of use assets (549) (304) (945)

OPERATING PROFIT BEFORE NON-RECURRING COSTS 2,337 2,738 4,579

Non-recurring income 6 - 805 805

Non-recurring costs 6 (769) (1,622) (1,286)

----------------- ------------------ ------------------------

OPERATING PROFIT AFTER NON-RECURRING COSTS 1,568 1,921 4,098

Finance income 7 1,030 22 30

Finance costs 8 (680) (766) (1,144)

----------------- ------------------ ------------------------

PROFIT BEFORE TAXATION 1,918 1,177 2,984

Taxation (631) (154) (1,306)

----------------- ------------------ ------------------------

PROFIT FOR THE PERIOD 1,287 -1,023 1,678

================= ================== ========================

OTHER COMPREHENSIVE INCOME

Items that will not be reclassified to

profit and loss account

Actuarial gain on retirement benefit

obligations 382 785 1,375

Deferred tax on actuarial gain & loss (96) (149) (140)

Deferred tax on share options - - -

----------------- ------------------ ------------------------

286 636 1,235

Items that may be reclassified to profit

and loss account:

Exchange differences on translating foreign

operations (1,216) 24 (294)

----------------- ------------------ ------------------------

OTHER COMPREHENSIVE (EXPENSE)/ INCOME FOR

THE PERIOD (930) 660 941

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD 354 1,683 2,619

================= ================== ========================

PROFIT ATTRIBUTABLE TO OWNERS OF THE PARENT

COMPANY 1,287 1,023 1,678

================= ================== ========================

TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE

TO OWNERS OF THE PARENT COMPANY 354 1,683 2,619

================= ================== ========================

Earnings per share from continuing

operations

- Basic 5 5.7p 4.8p 7.8p

- Diluted 5 5.5p 4.6p 7.4p

Instem plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2022 Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

Note GBP000 GBP000 GBP000

ASSETS

NON-CURRENT ASSETS

Intangible assets 58,381 43,098 58,311

Property, plant and equipment 552 637 592

Right of use assets 1,542 2,110 2,077

Finance lease receivables 69 105 85

TOTAL NON-CURRENT ASSETS 60,544 45,950 61,065

---------- ---------- ------------

CURRENT ASSETS

Inventories 99 54 64

Trade and other receivables 15,224 12,250 14,852

Finance lease receivables 51 42 44

Tax receivable 15 648 130

Cash and cash equivalents 9 10,280 17,850 15,021

---------- ---------- ------------

TOTAL CURRENT ASSETS 25,669 30,844 30,111

---------- ---------- ------------

TOTAL ASSETS 86,213 76,794 91,176

========== ========== ============

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 4,905 4,055 5,723

Deferred income 17,672 14,243 18,935

Provision for liabilities and

charges 10 885 - -

Financial liabilities 11 6,235 4,515 6,612

Lease liabilities 935 1,079 1,077

TOTAL CURRENT LIABILITIES 30,632 23,892 32,347

---------- ---------- ------------

NON-CURRENT LIABILITIES

Financial liabilities 11 - 3,244 4,728

Retirement benefit obligations 1,303 2,729 2,014

Provision for liabilities and

charges 10 43 250 291

Lease liabilities 858 1,312 1,248

Deferred tax liabilities 2,977 2,855 3,247

---------- ---------- ------------

TOTAL NON-CURRENT LIABILITIES 5,181 10,390 11,528

---------- ---------- ------------

TOTAL LIABILITIES 35,813 34,482 43,875

========== ========== ============

EQUITY

Share capital 2,268 2,178 2,219

Share premium 28,224 28,191 28,191

Merger reserve 14,013 9,359 12,104

Share based payment reserve 3,045 1,447 2,294

Translation reserve (1,418) 66 (202)

Retained earnings 4,268 1,221 2,695

---------- ---------- ------------

TOTAL EQUITY ATTRIBUTABLE TO

OWNERS OF THE PARENT 50,400 42,512 47,301

---------- ---------- ------------

TOTAL EQUITY AND LIABILITIES 86,213 76,794 91,176

========== ========== ============

Instem plc

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30

June 2022 Unaudited Unaudited Audited

Six months ended 30 June Six months ended 30 June Year ended 31 December

Note 2022 2021 2021

GBP000 GBP000 GBP000

CASH FLOWS FROM OPERATING

ACTIVITIES

Profit before taxation 1,918 1,177 2,984

Adjustments for:

Depreciation 168 123 312

Amortisation of intangibles 1,446 996 2,414

Amortisation of right of use

assets 549 304 945

Share based payment charge 751 517 1,061

Retirement benefit obligations (398) (380) (530)

Finance income 7 (1,030) (22) (30)

US government loans forgiven 6 - (805) (805)

Finance costs 8 680 766 1,144

d-Wise acquisition cost 6 - 809 -

Loss on disposal of fixed

assets - 6 3

------------------------- ------------------------- -----------------------

CASH FLOWS FROM OPERATIONS

BEFORE MOVEMENTS IN WORKING

CAPITAL 4,084 3,491 7,498

Movements in working capital:

(Increase) in inventories (35) (4) (14)

Decrease/ (Increase) in trade

and other receivables 140 (151) (1,573)

(Decrease)/ Increase in trade,

other payables and deferred

income (2,995) 746 4,432

Increase in provisions 637 - -

------------------------- ------------------------- -----------------------

NET CASH GENERATED FROM

OPERATIONS 1,831 4,082 10,343

Finance income 86 3 6

Finance costs (116) (482) (276)

Income taxes (936) (485) (873)

------------------------- ------------------------- -----------------------

NET CASH GENERATED FROM

OPERATING ACTIVITIES 865 3,118 9,200

CASH FLOWS FROM INVESTING

ACTIVITIES

Capitalisation of development

costs (1,465) (922) (2,238)

Purchase of property, plant and

equipment (122) (37) (144)

Purchase of subsidiary

undertaking (net of cash

acquired) - (10,567) (14,840)

------------------------- ------------------------- -----------------------

NET CASH USED IN INVESTING

ACTIVITIES (1,587) (11,526) (17,222)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from issue of share

capital 35 22 22

Payment of deferred

consideration (3,061) - (277)

Payment of contingent (1,412) - -

consideration

Repayment of lease liabilities (587) (367) (963)

Receipts from sublease of asset 16 22 40

Repayment of former PDS

shareholder loan - - (2,387)

------------------------- ------------------------- -----------------------

NET CASH (USED)/GENERATED FROM

FINANCING ACTIVITIES (5,009) (323) (3,565)

NET (DECREASE) /INCREASE IN

CASH AND CASH EQUIVALENTS (5,731) (8,731) (11,587)

Cash and cash equivalents at

start of period 15,021 26,724 26,724

Effect of exchange rate changes

on the balance of cash held in

foreign currencies 990 (143) (116)

------------------------- ------------------------- -----------------------

CASH AND CASH EQUIVALENTS AT OF PERIOD 10,280 17,850 15,021

========================= ========================= =======================

Instem plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2022

Share

based

Share Share Merger payment Translation Retained Total

capital premium reserve reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance as at 1

January 2021 -

(Audited) 2,048 28,172 2,432 930 92 (438) 33,236

Profit for the

period - - - - - 1,023 1,023

Other

comprehensive

income - - - - 24 636 660

----------- ----------- ---------- ----------- ------------- ---------- ---------

Total

comprehensive

income - - - - 24 1,659 1,683

Shares issued 130 19 6,927 - - - 7,076

Share based

payment - - - 517 - - 517

----------- ----------- ---------- ----------- ------------- ---------- ---------

Balance as at 30

June 2021

(Unaudited) 2,178 28,191 9,359 1,447 116 1,221 42,512

Profit for the

period - - - - - 655 655

Other

comprehensive

(expense)/income - - - - (318) 599 281

----------- ----------- ---------- ----------- ------------- ---------- ---------

Total

comprehensive

expense - - - - (318) 1,254 936

Shares issued 41 - 2,745 - - - 2,786

Share based

payment - - - 544 - - 544

Deferred tax on

share options - - - 528 - - 528

Nil cost option

charge - - - (5) - - (5)

Reserve transfer

on lapse of

share options - - - (25) - 25 -

Reserve transfer

on exercise of

share options - - - (195) - 195 -

----------- ----------- ---------- ----------- ------------- ---------- ---------

Balance as at 31

December 2021

(Audited) 2,219 28,191 12,104 2,294 (202) 2,695 47,301

Profit for the

period - - - - - 1,287 1,287

Other

comprehensive

income (1,216) 286 (930)

----------- ----------- ---------- ----------- ------------- ---------- ---------

Total

comprehensive

income - - - - (1,216) 1,573 357

Shares issued 49 33 1,909 - - - 1,991

Share based

payment - - - 751 - - 751

----------- ----------- ---------- ----------- ------------- ---------- ---------

Balance as at 30

June 2022

(Unaudited) 2,268 28,224 14,013 3,045 (1,418) 4,505 50,400

=========== =========== ========== =========== ============= ========== =========

NOTES TO THE FINANCIAL INFORMATION

For the six months ended 30 June 2022

1. General information

The principal activity and nature of operations of the Group is

the provision of world class IT solutions and services to the life

sciences research and development market. Instem's solutions for

data collection, management and analysis are used by customers

worldwide to meet the needs of life science organisations for

data-driven decision making leading to safer, more effective

products. Instem plc is a public limited company, listed on AIM,

incorporated in England and Wales under the Companies Act 2006 and

domiciled in England. The registered office is Diamond Way, Stone

Business Park, Stone, Staffordshire ST15 0SD, UK.

2. Basis of preparation and accounting policies

Basis of preparation

The Group's half-yearly financial information, which is

unaudited, consolidates the results of Instem plc and its

subsidiary undertakings made up to 30 June 2022. The Group's

accounting reference date is 31 December.

The consolidated financial information is presented in Pounds

Sterling (GBP) which is also the functional currency of the

parent.

The financial information contained in this half year financial

report does not constitute statutory accounts as defined in section

434 of the Companies Act 2006. It does not therefore include all of

the information and disclosures required in the annual financial

statements.

The financial information presented for the six months ended 30

June 2022 and 30 June 2021 is unaudited.

Instem plc's consolidated statutory accounts for the year ended

31 December 2021, prepared under IFRS, have been delivered to the

Registrar of Companies. The report of the auditors on these

accounts was unqualified and did not contain a statement under

Section 498 (2) or (3) of the Companies Act 2006.

Significant accounting policies

The accounting policies used in the preparation of the financial

information for the six months ended 30 June 2022 are in accordance

with the recognition and measurement criteria of international

accounting standards and are consistent with those that will be

adopted in the annual statutory financial statements for the year

ending 31 December 2022.

While the financial information included has been prepared in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards (IFRS), these financial

statements do not contain sufficient information to comply with

IFRS's.

Instem plc and its subsidiaries have not applied IAS 34, Interim

Financial Reporting, which is not mandatory for UK AIM listed

groups, in the preparation of this half-yearly financial

report.

Significant judgement and estimates

The judgements and estimations that management have made for the

six months ended 30 June 2022 are consistent with those reported in

the annual statutory financial statements for the year ended 31

December 2021.

Going concern

The Directors continue to adopt the going concern basis of

accounting in preparing these financial statements, which the

Directors believe is appropriate given the Group's trading

performance and financial liquidity. At 30 June 2022, the Group had

cash balances of GBP10.3m together with a GBP10.0m committed

banking facility.

The Group signed a new financing arrangement on 8 April 2022,

which consists of a committed facility of GBP10.0m with HSBC UK

Bank plc to support the Group's working capital needs and its

acquisition strategy, which can be extended up to GBP20.0m if

needed, subject to further bank approval. The financial covenants

have been considered in the Group cash forecast to ensure

compliance. During 2022, the Group settled the bank overdraft

facility of GBP9.0m with NatWest Bank plc.

The Group has considered a downside scenario which is also

linked to the company's risks when modelling the forecast results

and cash flow. The downside scenario showed that there is

sufficient liquidity headroom for at least 12 months from the date

of approval of these financial statements.

In the period to 30 June 2022, we have not observed any material

detriment to our overall existing business or in the level of new

business opportunities that are being presented to us in the

markets in which we operate, and we do not anticipate any during

the next 12 months.

Cash and cash equivalents

Cash and cash equivalents for the purposes of the Statement of

Cash Flows comprise the net of cash and overdraft balances that are

shown in the Statement of Financial Position in Cash and Cash

Equivalents.

3. Segmental Reporting

The business is organised into four operating segments to better

manage and report revenues; Study Management, Regulatory Solutions,

In Silico Solutions and Clinical Trial Acceleration. During 2021

the fourth segment , Clinical Trial Acceleration (CTA), was

established following the acquisition of d-Wise.

The Group's Chief Operating Decision Maker (CODM) is its Chief

Executive who monitors the performance of these operating segments

as well as deciding on the allocation of resources to them

alongside the executive management team.

Historically the Group's finance systems have recorded costs

centrally and have managed costs in this way. Over recent years the

Group has expanded both organically and through acquisition,

increasing the number of products and services offered.

During 2021 the financial system enabled more centrally recorded

costs to be allocated to the individual segments and that process

was further developed during 2022. The operations of the Group are

managed centrally along with group-wide functions including sales,

marketing, software development, information technology, customer

support, human resources. The CTA and In Silico segments already

bear the majority of their costs directly and as such report a

lower direct contribution margin to central overheads than the

other two segments. However, for the Study Management and

Regulatory Solutions segments most of their operational costs are

centrally managed. Consequently, these bear a higher proportion of

allocated central costs resulting in a reduction in profit

contribution compared with prior periods.

The expectation in future periods is to be able to allocate a

higher proportion of centrally held operational costs to the

individual segments as internal reporting systems evolve, thereby

enabling the Board to use the segmental cost information for

meaningful decision making. A higher proportion of central costs

were allocated to the operating segments during H1 2022 (79% of

total costs) compared with H1 2021 (40%).

The analysis provided below reflects costs directly attributable

to the respective segments in H1 2022 and 2021, which are primarily

third-party costs of sale and costs of allocated employees. The

remaining indirect operational costs are accounted for centrally

and are not allocated to specific segments.

Unaudited six months Study Management Regulatory In Silico Clinical

ended Solutions Solutions Trial Total

30 June 2022 Acceleration

GBP000 GBP000 GBP000 GBP000 GBP000

Total revenue 11,908 5,594 1,651 8,451 27,604

Direct attributable

costs (6,072) (4,262) (907) (6,900) (18,141)

----------------- ----------- ------------ -------------- ---------

Contribution to indirect

overheads 5,836 1,332 744 1,551 9,463

Contribution to indirect

overheads % 49% 24% 45% 18% 34%

Central unallocated

indirect costs (4,963)

Adjusted EBITDA 4,500

Unaudited six months Study Management Regulatory In Silico Clinical

ended Solutions Solutions Trial Acceleration Total

30 June 2021

GBP000 GBP000 GBP000 GBP000 GBP000

Total revenue 9,798 4,686 1,487 3,855 19,826

Direct attributable

costs (2,024) (1,113) (771) (2,477) (6,385)

----------------- ----------- ----------- -------------------- --------

Contribution to indirect

overheads 7,774 3,573 716 1,378 13,441

Contribution to indirect

overheads % 79% 76% 48% 36% 68%

Central unallocated

indirect costs (9,280)

______

Adjusted EBITDA 4,161

Audited year ended Study Management Regulatory In Silico Clinical

31 December 2021 Solutions Solutions Trials Total

Acceleration

GBP000 GBP000 GBP000 GBP000 GBP000

Total revenue 20,259 10,010 3,042 12,706 46,017

Direct attributable

costs (10,388) (6,016) (1,681) (11,308) (29,393)

----------------- ----------- ----------- -------------- ---------

Contribution to indirect

overheads 9,871 3,994 1,361 1,398 16,624

Contribution to indirect

overheads % 49% 40% 45% 11% 36%

Central unallocated

indirect costs (8,374)

______

Adjusted EBITDA 8,250

4. Key performance measures

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

GBP000 GBP000 GBP000

a) Recurring revenue

Annual support fees 9,716 4,988 14,378

SaaS subscriptions and support fees 6,257 4,901 9,704

------------------- ------------------- -------------------

Recurring revenue 15,973 9,889 24,082

Licence fees 2,803 3,086 4,597

Professional services 1,486 1,509 3,651

Technology enabled outsourced services 3,738 2,594 6,378

Consulting services 3,604 2,748 7,309

------------------- ------------------- -------------------

Total revenue 27,604 19,826 46,017

b) Adjusted EBITDA

c)

d)

EBITDA 3,731 3,344 7,769

Non-recurring items (see note 6) 769 817 481

------------------- ------------------- -------------------

Adjusted EBITDA 4,500 4,161 8,250

Adjusted profit after tax and bank balance performance measures

are detailed in notes 5 and 9.

5. Earnings per share

Basic earnings per share are calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year. Diluted

earnings per share is calculated by adjusting the weighted number

of ordinary shares outstanding to assume conversion of all dilutive

potential shares arising from the share option scheme.

The deferred and contingently issuable shares in relation to the

d-Wise acquisition, which could potentially dilute basic EPS in the

future, were not included in the calculation of diluted EPS as they

are antidilutive for the half year and the year ended in 2021.

The dilutive impact of the share options is calculated by

determining the number of shares that could have been acquired at

fair value (determined as the average market share price of the

Company's shares) minus the issue price. The number of ordinary

shares that could have been acquired at their average market price

during the period is ignored. However, the shares that would

generate no proceeds and would not have any effect on profit or

loss attributable to ordinary shares outstanding are included.

a) Basic earnings per share

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2021

2022 2021

Profit after tax (GBP000) 1,287 1,023 1,678

------------ ------------ -------------

Weighted average number of

shares (000's) 22,464 21,145 21,591

------------ ------------ -------------

Basic earnings per share 5.7p 4.8p 7.8p

============ ============ =============

b) Diluted earnings per share

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

Profit after tax (GBP000) 1,287 1,023 1,678

------------ ------------ -------------

Weighted average number of

shares (000's) 22,464 21,145 21,591

Potentially dilutive shares

(000's) 1,083 1,023 1,128

Adjusted weighted average number

of shares (000's) 23,547 22,168 22,719

------------ ------------ -------------

Diluted earnings per share 5.5p 4.6p 7.4p

============ ============ =============

c) Adjusted earnings per share

Adjusted earnings per share is calculated after adjusting for

the effect of foreign currency exchange and the unwinding of the

finance liability included in finance income/(costs), non-recurring

items and amortisation of intangibles on acquisitions.

The adjusted profit after tax has been amended in 2022 to ensure

that the foreign exchange movements and exceptional business

expenses do not impact and distort the earnings per share

calculation.

Diluted adjusted earnings per share is calculated by adjusting

the weighted number of ordinary shares outstanding to assume

conversion of all dilutive potential shares arising from the share

option scheme. The dilutive impact of the share options is

calculated by determining the number of shares that could have been

acquired at fair value (determined as the average market share

price of the Company's shares) based on the monetary value of the

subscription rights attached to the outstanding share options.

Unaudited Unaudited Audited

Unaudited Six months Six months Year ended Audited

Six ended ended 31 December Year ended

months 30 June 30 June 2021 31 December

ended 2021 2021 (as restated) 2021

30 June (as restated) (initially (initially

2022 reported) reported)

Profit after tax (GBP000) 1,287 1,023 1,023 1,678 1,678

Non-recurring costs 769 1,622 1,622 1,286 1,286

Non- recurring income - (805) (805) (805) (805)

Amortisation of acquired

intangibles (GBP000) 977 599 599 1,563 1,563

Foreign exchange loss/(gain)

on revaluation of intergroup

balances (GBP000) - - 268 - (18)

Foreign currency exchange

(gain)/loss (944) 258 - 44 -

Finance cost on deferred

and contingent consideration

(GBP000) 455 318 - 867 -

Adjusted profit after

tax (GBP000) 2,544 3,169 2,707 5,939 3,704

------- ------- ------- ------- -------

Weighted average number

of shares (000's) 22,464 21,145 21,145 21,591 21,591

Potentially dilutive

shares (000's) 1,083 1,023 1,023 1,128 1,128

------- ------- ------- ------- -------

Adjusted weighted average

number of shares (000's) 23,547 22,168 22,168 22,719 22,719

------- ------- ------- ------- -------

Adjusted basic earnings

per share 11.3p 14.3p 12.8p 21.5p 17.2p

======= ======= ======= ======= =======

Adjusted diluted earnings

per share 10.8p 13.6p 12.2p 20.4p 16.3p

======= ======= ======= ======= =======

6. Non-recurring items

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2020

Non-recurring cost

GBP000 GBP000 GBP000

Legal cost relating to historical

contract dispute 698 62 95

Share based payment - 170 175

Acquisition costs 71 1,390 1,019

769 1,622 1,286

------------ ------------ -------------

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2020

Non-recurring income

GBP000 GBP000 GBP000

US government loans forgiven - (805) (805)

- (805) (805)

-------------------------------------------- ------------ -------------

Non-recurring costs include a cost provision relating to an

historical contractual licence dispute, which does not affect the

ongoing operations of the Group. The provision was increased by

GBP0.64m in the period to 30 June 2022.

Non-recurring costs also include acquisition costs relating to

the 2021 acquisitions of The Edge, d-Wise and PDS.

The non-recurring income of GBP0.8m ($1.1m) included in 2021

relates to US federal government COVID-19 support loans which were

forgiven during 2021 and there are no remaining unfulfilled

conditions or contingencies related to this income

7. Finance income

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBP000 GBP000 GBP000

Foreign exchange gains 945 - -

Right of use interest income 2 3 6

Other interest 83 19 24

------------ ------------ -------------

1,030 22 30

============ ============ =============

8. Finance costs

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBP000 GBP000 GBP000

Bank loans and overdrafts 116 43 85

Unwinding discount on deferred

consideration 455 318 867

Net charge on pension scheme 69 26 51

Right of use asset interest

cost 40 121 97

Foreign exchange losses - 258 44

------------ ------------ -------------

680 766 1,144

============ ============ =============

9. Cash and cash equivalents

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP000 GBP000 GBP000

Cash at bank 10,280 26,848 24,019

Bank overdraft - (8,998) (8,998)

Bank balance 10,280 17,850 15,021

============ ============ =============

The Group signed a new financing arrangement with HSBC UK Bank

plc in April 2022, which consists of a committed facility of

GBP10.0m for general corporate purposes, which can be extended up

to GBP20.0m if needed, subject to further bank approval. The

financial covenants have been considered in the forecast to ensure

compliance. During 2022, the Group settled its bank overdraft of

GBP9.0m with former bankers NatWest Bank plc.

10. Provision for liabilities and charges

Unaudited Unaudited Audited

30 June 30 June 31 December

Current liability 2022 2021 2021

GBP000 GBP000 GBP000

Historical legal dispute provision 885 - -

At end of period Current liability 885 - -

============ ========== =============

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

Non-current liability GBP000 GBP000 GBP000

Historical legal dispute provision - 250 250

PDS warranty provision 43 - 41

At end of period Non current

liability 43 250 291

============ ========== =============

At the period end the Group held a provision of GBP0.9m (2021:

GBP0.25m) in respect of an historical contract dispute against a

maximum exposure of approximately GBP3.8m. The maximum exposure

included an additional claim for consequential loss. Since the

period end a settlement has been agreed with the plaintiff (see

note 13).

11. Financial liabilities

An analysis of financial liabilities as presented in the

statement of financial position is as follows:

Unaudited Unaudited Audited

30 June 30 June 31 December

Current liability 2022 2021 2021

GBP000 GBP000 GBP000

Deferred consideration 4,271 2,435 4,276

Contingent consideration 1,964 2,080 2,336

At end of period Current liability 6,235 4,515 6,612

============ ========== =============

Unaudited Unaudited Audited

30 June 30 June 31 December

Non-current liability 2022 2021 2021

GBP000 GBP000 GBP000

Deferred consideration - 1,780 3,060

Contingent consideration - 1,464 1,668

At end of period Non current

liability - 3,244 4,728

============= ========== =============

The contingent consideration is in respect of The Edge and

d-Wise. The conditions to pay both sums have been met in full.

The deferred consideration above is in respect of the

acquisitions of d-Wise and PDS.

12. Share Capital

The share capital of Instem plc consists of fully paid ordinary

shares with a nominal value of 10p per share.

30 June 30 June 31 December

2022 2021 2021

No. of No. of No. of

shares shares shares

Shares issued:

Beginning of the period 22,189,856 20,481,909 20,481,909

Issued on exercise of employee share

options 190,000 38,667 88,667

Share issue on acquisition of The

Edge - 391,920 391,920

Share issue on acquisition of d-Wise 296,952 868,203 868,203

Share issue on acquisition of PDS - - 359,157

Total shares issued and fully paid

at end of period 22,676,808 21,780,699 22,189,856

=========== =========== ============

Share premium

Proceeds received in addition to the nominal value of the shares

issued during the year have been included in share premium, less

fees, commissions and disbursements. Costs of new shares charged to

equity amounted to GBPnil.

Share premium has also been recorded in respect of the issue of

share capital related to employee share-based payment.

Merger reserve

The merger reserve represents

-- the difference between the consideration payable at the date

of acquisition, net of merger relief, and the share capital and

share premium of Instem Life Science Systems Limited and

-- the difference between the nominal value and share issue

price of shares issued as consideration in the purchase of

Leadscope Inc, The Edge Software Consultancy Ltd, d-Wise

Technologies, Inc and PDS Pathology Data Systems

13. Subsequent Events

No adjusting events have occurred between the 30 June 2022

reporting date and the date of approval of this Interim Report.

A full and final settlement has been negotiated and agreed with

a former customer regarding an historical contractual licence

dispute that arose in 2017. Instem has agreed to pay EUR1.48m

(approx. GBP1.3m), of which its insurer has agreed to contribute

EUR0.45m (approx. GBP0.4m) resulting in a net payment due of

approx. EUR1.0m (GBP0.9m). This will be made in October 2022.

As previously announced, the Company had created a provision of

GBP0.25m in respect of the dispute and this was increased in the

period by GBP0.64m, resulting in a provision at 30 June 2022 of

approx. GBP0.9m. The increase in the provision was treated as a

non-recurring, exceptional charge in the half year ended 30 June

2022.

The issue involved does not affect the ongoing operations of the

Group.

14. Availability of this Interim Announcement

Copies of the 2022 Interim Report for Instem plc will be

available from the Group's website at www.instem.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DXGDCUGDDGDL

(END) Dow Jones Newswires

September 27, 2022 02:02 ET (06:02 GMT)

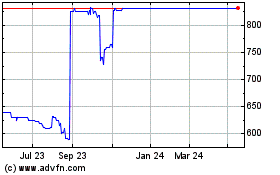

Instem (LSE:INS)

Historical Stock Chart

From May 2024 to Jun 2024

Instem (LSE:INS)

Historical Stock Chart

From Jun 2023 to Jun 2024