RNS Number:3824U

Babcock International Group PLC

04 April 2007

EMBARGOED UNTIL 7:00 AM

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN OR INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

4 April 2007

BABCOCK INTERNATIONAL GROUP PLC

RECOMMENDED CASH OFFER FOR

INTERNATIONAL NUCLEAR SOLUTIONS PLC TO BE IMPLEMENTED

BY MEANS OF

A SCHEME OF ARRANGEMENT

Summary

- The boards of Babcock and INS are pleased to announce that they have

reached agreement on the terms of a recommended cash offer by Babcock for

the entire issued and to be issued share capital of INS not already owned

by Babcock.

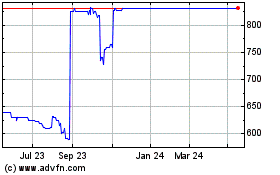

- The Offer values each INS Share at 63.0 pence and the existing issued share

capital of INS at approximately #39.3 million and represents a premium of

approximately 46.6 per cent. to the average Closing Price of 43.0 pence per

INS Share over the six month period from 18 July 2006 to 17 January 2007,

the last Business Day prior to the announcement of an approach regarding a

possible offer for INS.

- It is intended that the INS Shares will be acquired by way of a Court

sanctioned scheme of arrangement under section 425 of the Companies Act.

- The INS Directors, who have been so advised by Rothschild and Grant

Thornton, consider the terms of the Offer to be fair and reasonable. Grant

Thornton is acting as the independent financial adviser to INS in relation

to Rule 3 of the City Code. Rothschild is acting as financial adviser to

INS. Rothschild has a corporate debt advisory relationship with Babcock

and, as a consequence, with respect to the Offer, is not an independent

adviser in accordance with Rule 3 of the City Code. In providing their

advice to the Directors of INS, Rothschild and Grant Thornton have taken

into account the INS Directors' commercial assessments of the Offer.

Accordingly, the INS Directors will unanimously recommend that INS

Shareholders vote in favour of the resolutions to be proposed at the Court

Meeting and the EGM required to implement the Scheme, as they have

irrevocably undertaken to do in respect of their own beneficial holdings,

amounting to, in aggregate, 253,904 INS Shares, representing approximately

0.4 per cent. of the existing issued share capital of INS.

- Babcock currently holds 15,273,875 INS Shares, representing approximately

24.5 per cent. of the existing issued share capital of INS. In addition,

Babcock has received irrevocable undertakings to vote (or procure to vote)

in favour of the Scheme from: Bailey Robinson; Taube Hodson Stonex Partners

Limited; and Hansa Trust PLC, in respect of their entire beneficial

holdings of, in aggregate, 10,829,440 INS Shares representing approximately

17.4 per cent. of the existing issued share capital of INS. Therefore,

together with the irrevocable undertakings received from the INS Directors,

Babcock has received irrevocable undertakings to vote (or to procure to

vote) in favour of the Scheme in respect of, in aggregate, 11,083,344 INS

Shares, representing approximately 17.8 per cent. of the existing issued

share capital of INS.

- The Scheme will be subject, inter alia, to approval by INS Shareholders who

are entitled to vote and to sanction by the Court. Full details of the

Scheme, including an indicative timetable, will be set out in the Scheme

Document.

Commenting on the Offer, Gordon Campbell, Chairman of Babcock, said:

"INS offers an excellent strategic fit with our existing civil nuclear

engineering activities and brings to us an important set of new customers and

capabilities. The acquisition of INS will position the Group to bid for a wider

range of opportunities in the expanding market for nuclear utility support

services and decommissioning."

Commenting on the Offer, Chris Brown, Chairman of INS, said:

"I am pleased to announce our recommendation of Babcock's Offer this morning.

The Offer price of 63.0 pence per share represents an attractive premium to the

average share price over the last six months prior to our announcement of an

approach. The Offer provides a significant return to both our new investors at

our May IPO and our long standing investors, many of whom had been shareholders

in RTS for many years."

The Scheme Document, setting out the details of the Offer and the procedures to

be followed to approve the Scheme, and Forms of Proxy will be posted to INS

Shareholders and, for information only, to option holders in INS as soon as

practicable and in any event within 28 days of this Announcement unless

otherwise agreed with the Panel.

This summary should be read in conjunction with the full text of this

Announcement.

Enquiries:

Babcock Telephone: +44 (0) 20 7291 5000

Gordon Campbell

Peter Rogers

Bill Tame

Hawkpoint (financial adviser to Babcock) Telephone: +44 (0) 20 7665 4500

Paul Baines

JPMorgan Cazenove (broker to Babcock) Telephone: +44 (0) 20 7588 2828

Dermot McKechnie

Financial Dynamics (Babcock PR enquiries) Telephone: +44 (0) 020 7269 7121

Susanne Walker

INS Telephone: +44 (0) 161 222 5500

Chris Brown

Tony Moore

Rothschild (financial adviser to INS) Telephone: +44 (0) 161 827 3800

Greg Cant

Grant Thornton (Rule 3 adviser to INS) Telephone: +44 (0) 161 834 5414

Ali Sharifi

College Hill (INS PR enquiries) Telephone: +44 (0) 20 7457 2020

Matthew Smallwood

This Announcement does not, and is not intended to, constitute or form part of

any offer to sell, or an invitation to purchase, any securities or the

solicitation of any vote or approval in any jurisdiction. The Offer will be made

solely by means of the Scheme Document, which will contain the full terms and

conditions of the Scheme. INS Shareholders are advised to read carefully the

formal documentation in relation to the Offer once it has been despatched.

The availability of the Offer and the release, publication or distribution of

this Announcement to persons who are not resident in the United Kingdom may be

affected by the laws of the relevant jurisdictions in which they are located.

Persons who are not resident in the United Kingdom should inform themselves of,

and observe, any applicable requirements. Any failure to comply with such

applicable requirements may constitute a violation of the securities laws of any

such jurisdictions. This Announcement has been prepared for the purposes of

complying with English law and the City Code and the information disclosed may

not be the same as that which would have been disclosed if this Announcement had

been prepared in accordance with the laws of jurisdictions outside the United

Kingdom.

The Offer will not be made in or into any jurisdiction where to do so would

consititute a violation of the relevant laws of such jurisdiction. Custodians,

nominees and trustees should observe these restrictions and should not send or

distribute the document in or into any jurisdiction where to do so would

consititute a violation of the relevant laws of such jurisdiction.

Hawkpoint, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Babcock and no one else

in connection with the Offer and will not be responsible to anyone other than

Babcock for providing the protections afforded to clients of Hawkpoint nor for

providing advice in relation to the Offer, the content of this Announcement or

any matter referred to herein.

JPMorgan Cazenove, which is authorised and regulated in the United Kingdom by

the Financial Services Authority, is acting exclusively for Babcock and no one

else in connection with the Offer and will not be responsible to anyone other

than Babcock for providing the protections afforded to clients of JPMorgan

Cazenove nor for providing advice in relation to the Offer, the content of this

Announcement or any matter referred to herein.

Rothschild, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for INS and no one else in

connection with the Offer and will not be responsible to anyone other than INS

for providing the protections afforded to clients of Rothschild nor for

providing advice in relation to the Offer, the content of this Announcement or

any matter referred to herein.

Grant Thornton, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for INS and no one else in

connection with the Offer and will not be responsible to anyone other than INS

for providing the protections afforded to clients of Grant Thornton nor for

providing advice in relation to the Offer, the content of this Announcement or

any matter referred to herein.

Appendix I sets out the Conditions to the implementation of the Offer.

Appendix II sets out the bases and sources of information from which the

financial calculations used in this Announcement have been derived.

Appendix III contains the definitions of terms used in this Announcement

(including this summary).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Announcement contains certain forward-looking statements with respect to

the financial condition, results of operations and business of INS and certain

plans and objectives of the boards of INS and Babcock with respect thereto.

These forward-looking statements can be identified by the fact that they do not

relate only to historical or current facts. Forward-looking statements often use

words such as "anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "will", "may", "should", "would", "could", or other words of

similar meaning. These statements are based on assumptions and assessments made

by the boards of INS and Babcock in light of their experience and their

perception of historical trends, current conditions, expected future

developments and other factors they believe appropriate. By their nature,

forward-looking statements involve risk and uncertainty, because they relate to

events and depend on circumstances that will occur in the future and the factors

described in the context of such forward-looking statements in this Announcement

could cause actual results and developments to differ materially from those

expressed in or implied by such forward-looking statements. Although INS and

Babcock believe that the expectations reflected in such forward-looking

statements are reasonable, INS and Babcock can give no assurance that such

expectations will prove to have been correct and INS and Babcock therefore

caution you not to place undue reliance on these forward-looking statements

which speak only as at the date of this Announcement.

DEALING DISCLOSURE REQUIREMENTS

Under the provisions of Rule 8.3 of the Code, if any person is, or becomes,

"interested" (directly or indirectly) in one per cent. or more of any class of

"relevant securities" of INS, all "dealings" in any "relevant securities" of

that company (including by means of an option in respect of, or a derivative

referenced to, any such "relevant securities") must be publicly disclosed by no

later than 3.30 p.m. (London time) on the London business day following the date

of the relevant transaction. This requirement will continue until the date on

which the Scheme becomes effective or lapses or is otherwise withdrawn or on

which the "offer period" otherwise ends. If two or more persons act together

pursuant to an agreement or understanding, whether formal or informal, to

acquire an "interest" in "relevant securities" of INS, they will be deemed to be

a single person for the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the Code, all "dealings" in "relevant

securities" of INS by Babcock or INS, or by any of their respective

"associates", must be disclosed by no later than 12.00 noon (London time) on the

London business day following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Panel's website at www.thetakeoverpanel.org.uk.

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Code, which can also be found on the

Panel's website. If you are in any doubt as to whether or not you are required

to disclose a "dealing" under Rule 8, you should consult the Panel.

If you are in any doubt as to the application of Rule 8 to you, please contact

an independent financial adviser authorised under the Financial Services and

Markets Act 2000, consult the Panel's website at www.thetakeoverpanel.org.uk or

contact the Panel on telephone number +44 (0) 20 7638 0129; fax number +44 (0)

20 7236 7013.

EMBARGOED UNTIL 7:00 AM

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN OR INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

4 April 2007

BABCOCK INTERNATIONAL GROUP PLC

RECOMMENDED CASH OFFER FOR

INTERNATIONAL NUCLEAR SOLUTIONS PLC TO BE IMPLEMENTED

BY MEANS OF

A SCHEME OF ARRANGEMENT

1. Introduction

The boards of Babcock and INS are pleased to announce that they have reached

agreement on the terms of a recommended cash offer by Babcock for the entire

issued and to be issued share capital of INS, not already owned by Babcock. The

Offer is to be implemented by means of a Court approved scheme of arrangement

under section 425 of the Companies Act.

2. The Scheme

The Scheme will be subject to the Conditions set out in Appendix I to this

Announcement and any further terms to be set out in the Scheme Document. If the

Scheme becomes effective, the Scheme Shares will be cancelled and Scheme

Shareholders on the register of members at the Scheme Record Time will receive:

for each Scheme Share 63.0 pence in cash

The Offer values each INS Share at 63.0 pence and the existing issued share

capital of INS at approximately #39.3 million and represents a premium of

approximately 46.6 per cent. to the average Closing Price of 43.0 pence per INS

Share over the six month period from 18 July 2006 to 17 January 2007, the last

Business Day prior to the announcement of an approach regarding a possible offer

for INS.

3. Recommendation

The INS Directors, who have been so advised by Rothschild and Grant Thornton,

consider the terms of the Offer to be fair and reasonable. Grant Thornton is

acting as the independent financial adviser to INS in relation to Rule 3 of the

City Code. Rothschild is acting as financial adviser to INS. Rothschild has a

corporate debt advisory relationship with Babcock and, as a consequence, with

respect to the Offer, is not an independent adviser in accordance with Rule 3 of

the City Code. In providing their advice to the Directors of INS, Rothschild and

Grant Thornton have taken into account the INS Directors' commercial assessments

of the Offer. Accordingly, the INS Directors will unanimously recommend that INS

Shareholders vote in favour of the resolution to be proposed at the Court

Meeting and the EGM required to implement the Scheme, as they have irrevocably

undertaken to do in respect of their own beneficial holdings, amounting to, in

aggregate, 253,904 INS Shares, which represents approximately 0.4 per cent. of

the existing issued share capital of INS.

4. Background to and reasons for the recommendation of the Offer

INS is a specialist provider of engineering and consultancy services to the

nuclear industry with particular emphasis on the 'clean-up and decommissioning'

of the UK's nuclear legacy. This market has an estimated annual spend of #2.1

billion and a total estimated value in excess of #63 billion (Source: NDA).

Against this background, INS has achieved significant growth. Over the four

years between 1 January 2003 and 31 December 2006, turnover has grown from #12.3

million to #31.7 million (a compound annual growth rate of 37.1 per cent.) and

profit before taxation and exceptional items has grown from #0.3 million to #2.5

million (a compound annual growth rate of 101.4 per cent.).

On 18 January 2007, the board of INS announced that it had received an approach

in relation to a potential offer for the Company, after which, on 26 January

2007, Babcock announced that it had acquired 24.5 per cent. of INS's existing

issued share capital. Following Babcock's announcement, INS provided certain due

diligence information to assist Babcock in making an appropriate offer for INS's

remaining issued share capital.

The boards of INS and Babcock today reached agreement on the terms of a

recommended cash offer by Babcock for the entire issued and to be issued share

capital of INS not already owned by Babcock.

In unanimously recommending that INS Shareholders vote in favour of the Scheme,

the INS Directors have given consideration to a range of factors, including:

- the Offer of 63.0 pence per INS Share, representing a premium of

approximately 46.6 per cent. to the average Closing Price of 43.0 pence per

INS Share over the six month period from 18 July 2006 to 17 January 2007,

the last Business Day prior to the announcement of an approach regarding a

possible offer for INS; and

- the changing nature of the UK's nuclear services market. The industry is

going through a period of consolidation and rationalisation of the supply

chain and is also attracting considerable interest from larger UK and

overseas corporations. There are likely to be fewer but larger contracts

and framework agreements, under which work packages will be bundled, which

will only be accessible to INS as part of bidding consortia. As part of the

Babcock Group, the INS Directors believe that the Company will have more

opportunities to take leading roles in bidding for such future contracts

and framework agreements.

In light of the above, the INS Directors believe that the terms of the Offer are

in the best interests of INS Shareholders and have concluded that the Offer is

fair and reasonable.

5. Structure of the Scheme

(a) Introduction

It is intended that the Offer will be effected by a means of a scheme of

arrangement between INS and the Scheme Shareholders under section 425 of the

Companies Act, the provisions of which will be set out in full in the Scheme

Document. The purpose of the Scheme, together with the proposed changes to INS's

Articles, is to provide for Babcock to become the owner of the entire issued and

to be issued share capital of INS. The Scheme will provide for the cancellation

of the Scheme Shares. Scheme Shareholders will then be entitled to receive cash

on the basis set out in paragraph 2 above.

Prior to the Scheme becoming effective, application will be made to the London

Stock Exchange for INS Shares to be suspended from trading on AIM. It is

anticipated that the last day of dealings in, and for registration of transfers

of, INS Shares will be the last Business Day immediately preceding the Effective

Date. At close of business on the last Business Day immediately preceding the

Effective Date, INS Shares will be suspended from AIM and the admission of such

shares will be cancelled on the Effective Date.

If the Scheme becomes effective, Babcock (and/or its nominee(s)) will acquire

INS Shares fully paid and free from all liens, equitable interests, charges,

encumbrances and other third party rights of any nature whatsoever and together

with all rights attaching to them including the right to receive and retain all

dividends and distributions (if any) declared, made or payable after the

Effective Date. INS does not intend to declare, make or pay any dividends or

distributions prior to the Effective Date.

(b) Conditions to the Offer

The Conditions to the Offer are set out in full in Appendix I to this

Announcement. In summary, the implementation of the Offer will be conditional,

inter alia, upon:

(i) approval of the Scheme by a majority in number of the Scheme Shareholders

entitled to be present and voting, either in person or by proxy, at the

Court Meeting, or any adjournment thereof, representing 75 per cent. or

more in value of the Scheme Shares voted;

(ii) the resolution in connection with or required to approve and implement the

Scheme as set out in the notice of EGM in the Scheme Document being duly

passed by the requisite majority at the EGM;

(iii) the sanction of the Scheme and confirmation of the associated reduction of

capital by the Court (in either case, with or without modification on

terms acceptable to INS and Babcock) and the delivery of an official copy

of the Court Order to the Registrar of Companies and, in respect of the

reduction of capital, the registration of the Court Order by him; and

(iv) the Scheme becoming effective by not later than 30 June 2007 or such later

date as may be agreed in writing by INS and Babcock (and if appropriate as

the Court may approve) failing which the Scheme will lapse.

6. Irrevocable undertakings

Babcock has received irrevocable undertakings to vote (or procure to vote) in

favour of the Scheme at the Court Meeting and the resolution at the EGM (or, in

the event that the Offer is implemented by way of a takeover offer, to accept or

procure acceptance of such offer) from the following:

(a) INS Directors in respect of, in aggregate, 253,904 INS Shares,

representing approximately 0.4 per cent. of the existing issued share capital of

INS.

The undertakings referred to above will remain binding even if a higher

competing offer for INS is made. They will cease to be binding only if (i) the

Offer lapses or is withdrawn or (ii) the documentation in connection with the

Scheme is not posted to INS Shareholders within 28 days of this Announcement or

such later date as the Panel may agree.

(b) Bailey Robinson in respect of his entire beneficial holdings of 4,972,105

INS Shares, representing approximately 8.0 per cent. of the existing issued

share capital of INS.

(c) Taube Hodson Stonex Partners Limited in respect of their entire beneficial

holdings of 2,682,335 INS Shares, representing approximately 4.3 per cent. of

the existing issued share capital of INS.

(d) Hansa Trust PLC in respect of their entire beneficial holdings of 3,175,000

INS Shares, representing approximately 5.1 per cent. of the existing issued

share capital of INS.

These undertakings will cease to be binding if (i) a third party announces a

firm intention to make an offer (in accordance with Rule 2.5 of the Code) to

acquire INS's entire issued share capital, provided that the value of the cash

and non-cash elements and other terms and conditions of this offer values INS's

entire issued share capital at no less than a 10 per cent. premium to the value

placed by the Offer on INS's entire issued share capital or (ii) the Offer

lapses or is withdrawn or (iii) the documentation in connection with the Scheme

is not posted to INS Shareholders within 28 days of this Announcement or such

later date as the Panel may agree.

In aggregate, therefore, Babcock has received irrevocable undertakings to vote

(or procure to vote) in favour of the Scheme at the Court Meeting and the

resolution at the EGM (or, in the event that the Offer is implemented by way of

a takeover offer, to accept or procure acceptance of such offer) in respect of

an aggregate of 11,083,344 INS Shares, representing approximately 17.8 per cent.

of the existing issued share capital of INS.

7. Information on Babcock

Babcock Group is an asset management business, managing fixed infrastructure and

mobile assets. Babcock integrates labour, technical capabilities, systems and

supply chain partners to meet the outsourcing needs of customers.

The company has five operating divisions which are technical services, defence,

networks, engineering and plant services, and rail. Overseas operations are

based in Africa and North America.

For the year ended 31 March 2006, Babcock reported revenue of #836.7 million

(2005: #729.0 million), operating profit before exceptional items of #49.9

million (2005: #41.5 million) and profit before tax (pre amortisation and

exceptionals) of #44.6 million (2005: #35.7 million).

For the six months ended 30 September 2006, Babcock reported revenue of #487.6

million (six months to 30 September 2005: #386.7 million), operating profit

before exceptional items of #33.5 million (2005: #23.9 million) and profit

before tax (pre amortisation and exceptionals) of #30.6 million (2005:

#20.5 million).

On 9 May 2006, Babcock acquired the nuclear and airports services operator,

Alstec Group Limited, for a net cash consideration of #44.9 million, funded from

existing banking facilities. The Alstec airports business has been consolidated

into Babcock Defence Services, while Alstec nuclear and defence services has

been fully consolidated into Babcock Technical Services. In the period to 30

September 2006, Alstec contributed #42.2 million in sales and #4.5 million in

operating profit and performed ahead of Babcock's original planning assumptions.

Babcock's shares are quoted on the London Stock Exchange in the support services

sector.

8. Financing the Offer

The consideration payable under the Offer will be funded from Babcock's existing

banking facilities.

Hawkpoint, financial adviser to Babcock, has confirmed that it is satisfied that

the necessary financial resources are available to Babcock to satisfy the cash

consideration due under the Offer in full. Full implementation of the Offer

would result in a maximum cash consideration of approximately #30.4 million

being payable by Babcock to INS Shareholders (assuming all options are exercised

in full).

9. Information on INS

INS successfully completed the demerger of INS Innovation Limited from Robotic

Technology Systems PLC and was admitted to trading on AIM on 31 May 2006.

INS is a specialist provider of nuclear engineering and consultancy services in

the UK and is focused on providing services and solutions to the nuclear

industry from the initial front end design and development to eventual

commissioning and providing support to the customers' ongoing operations.

INS operates throughout all stages of the project life cycle, providing

professional engineering services for design and project implementation. These

services include procurement inspection and project management enabling the

Company to take projects from inception through all phases of project

implementation to site installation and commissioning.

The Company's main areas of expertise include:

- support to the commercial operating facilities associated with fuel

fabrication and spent fuel reprocessing activities;

- waste and nuclear materials handling;

- plant asset care and maintenance of redundant facilities;

- new build activities covering existing facilities as well as new build

required to support accelerated clean-up;

- decommissioning; and

- supply and integration of special purpose plant and equipment.

For the year ended 31 December 2006, INS reported turnover of #31.7 million

(2005: #24.6 million), operating profit before exceptional items of #2.5 million

(2005: #2.2 million) and profit before tax of #1.7 million (2005: #2.3 million).

10. Current trading and prospects

On 27 March 2007, INS issued the following announcement:

"Following the successful admission of International Nuclear Solutions plc

("INS") to the AIM market on 31st May 2006, I am pleased to be able to present

the Group's first set of annual accounts as an independent public company.

Turnover at #31.7 million increased by 29 per cent. in 2006 compared with the

previous year, with the commencement of several significant new contracts,

notably the SPRS and B29 projects at Sellafield. Operating profit before

exceptional items was 11.9 per cent. higher than 2005 at #2.5 million, before

exceptional administrative costs of #0.8 million (2005 - #nil) relating to the

demerger from Robotic Technology Systems PLC (RTS) and subsequent admission to

AIM. Profit after tax and exceptional items was #1.0m, compared with #1.9

million in 2005.

INS produced a strong cash performance in 2006, with #5.9 million cash inflow

from operating activities, an increase in net funds of #2.4 million, and closing

cash balances of #2.7 million.

Our order book, which stood at #11.4 million at the end of June, grew to #12.7

million by the end of 2006, and currently stands at #12.9 million . Our total

headcount at the end of 2006 stood at 274. This is an increase of 23 per cent.

in permanent staff, and 21 per cent. in total from the position at the start of

the year. A new project office has been opened at Birchwood in Warrington, and

we have also relocated our Greengarth office to new premises at the West Lakes

Science Park at Sellafield.

Outlook

Our strong opening order book, and the increasing activity levels in the nuclear

industry, give us confidence that the Group will continue to progress in 2007.

The NDA has announced that there is a small increase in funding in its 2007

budget. We are aware that there will be a reduction in operating revenues to the

NDA in future years as a result of the closure of two Magnox stations at the end

of 2006. This may in the course of time affect the funding available to the NDA

in future years. However, we view the future with confidence given the

increasing overall demand for nuclear decommissioning expertise."

11. Directors, management and employees and the effect of the Scheme in their

interests

Babcock has confirmed to the INS Directors that, following the Scheme becoming

effective, the existing employment rights, terms and conditions of all the

employees of the INS Group will be safeguarded.

The Non-executive Directors of INS will resign from the Board upon the Scheme

becoming effective.

12. Reasons for the Offer

Babcock Group has identified the civil nuclear decommissioning market as both a

growth opportunity and an industry consistent with the Group's skills,

capabilities and experience and signalled its intention of developing its core

capabilities with the acquisition of Alstec in May 2006.

The acquisition of INS continues, broadens and deepens this strategy by bringing

to the Group an important new set of customers and capabilities which will allow

the Group to bid for a wider range of opportunities in an expanding market.

13. INS Share Schemes

The effects of the Scheme on subsisting options under INS Share Schemes are

summarised below. All INS Shares issued on the exercise of options on or prior

to the Reduction Record Time will be subject to the terms of the Scheme.

The Scheme will not extend to INS Shares issued, including on the exercise of

options, after the Reduction Record Time. However, an amendment to INS's

Articles is to be proposed at the EGM (details of which will be set out in the

Notice of the EGM) to the effect that INS Shares issued on the exercise of

options after the Reduction Record Time will automatically be acquired by

Babcock on the same terms of the Offer.

Options under the INS EMI Scheme may be exercised in full conditional on the

Scheme becoming effective whereas options under the INS SAYE Scheme will become

exercisable on the Court's sanction of the Scheme. Participants will have the

opportunity to exercise their options conditionally on the Scheme becoming

effective in respect of the INS EMI Scheme and on Court sanction in respect of

the INS SAYE Scheme. In the case of the INS SAYE Scheme, options may only be

exercised using accrued savings and interest (if any) due on the exercise date.

Options will lapse if unexercised within 30 days of the Court's sanction of the

Scheme in relation to shares held under the INS SAYE Scheme and on the Effective

Date in relation to options held under the EMI Scheme.

14. Overseas Shareholders

The availability of the Offer to persons resident in, or citizens of,

jurisdictions outside the United Kingdom may be affected by the laws of the

relevant jurisdictions. Persons who are not resident in the United Kingdom

should inform themselves about and observe any applicable requirements. It is

the responsibility of each of the INS Shareholders who are not resident in the

UK to satisfy themselves as to the full observance of the laws of the relevant

jurisdiction in connection therewith, including the obtaining of any

governmental exchange control or other consents which may be required or

compliance with other necessary formalities which are required to be observed

and the payment of any issue, transfer or other taxes due in such jurisdiction.

Any failure to comply with such applicable requirements may constitute a

violation of the securities laws of any such jurisdictions.

This Announcement has been prepared for the purposes of complying with English

law and the City Code and the information disclosed may be different from that

which would have been disclosed if this Announcement had been prepared in

accordance with the laws of jurisdictions outside England.

15. Implementation Agreement

INS and Babcock have entered into an Implementation Agreement dated 3 April 2007

, under the terms of which the parties have agreed, amongst other things, to

co-operate to implement the Scheme. Details of the Implementation Agreement will

be set out in the Scheme Document.

Included in the Implementation Agreement is an inducement fee agreement. The

inducement fee, which amounts to circa #0.4 million, representing one per cent.

of the value of the Offer, is payable to Babcock if following this Announcement:

(a) the INS Directors withdraw or modify their approval or recommendation of the

Offer, or approve the announcement of or recommend any Competing Proposal;

or

(b) the Offer (whether structured as a Scheme or a takeover offer) lapses or is

withdrawn in accordance with its terms and prior thereto a Competing

Proposal for the Company has been announced,

and in either case such Competing Proposal or any other Competing Proposal

subsequently becomes or is declared unconditional in all respects.

16. Suspension and cancellation of admission to AIM of INS Shares

The London Stock Exchange will be requested respectively to suspend and cancel

(i) trading in INS Shares on AIM with effect from close of business on the

Business Day preceding the Effective Date and (ii) the admission of INS Shares

to AIM with effect from 8.00 a.m. on the Effective Date. The last day of

dealings in INS Shares on AIM is expected to be the last Business Day

immediately preceding the Effective Date and no transfers of INS Shares will be

registered after close of business on this date. On the Effective Date, share

certificates in respect of INS Shares will cease to be valid. In addition, on

the Effective Date, entitlements to Scheme Shares held within the CREST system

will be cancelled.

17. Dealing disclosure requirements

Under the provisions of Rule 8.3 of the Code, if any person is, or becomes,

"interested" (directly or indirectly) in one per cent. or more of any class of

"relevant securities" of INS, all "dealings" in any "relevant securities" of

that company (including by means of an option in respect of, or a derivative

referenced to, any such "relevant securities") must be publicly disclosed by no

later than 3.30 p.m. (London time) on the London business day following the date

of the relevant transaction. This requirement will continue until the date on

which the Scheme becomes effective or lapses or is otherwise withdrawn or on

which the "offer period" otherwise ends. If two or more persons act together

pursuant to an agreement or understanding, whether formal or informal, to

acquire an "interest" in "relevant securities" of INS, they will be deemed to be

a single person for the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the Code, all "dealings" in "relevant

securities" of INS by Babcock or INS, or by any of their respective

"associates", must be disclosed by no later than 12.00 noon (London time) on the

London business day following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Panel's website at www.thetakeoverpanel.org.uk.

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Code, which can also be found on the

Panel's website. If you are in any doubt as to whether or not you are required

to disclose a "dealing" under Rule 8, you should consult the Panel.

18. Expected timetable

INS expects that it will despatch the Scheme Document to INS Shareholders and,

for information only, to holders of options granted under the INS Share Schemes

within the next 28 days (or such later date as may be agreed with the Panel);

that the Court Meeting and EGM will take place during May 2007; and subject to

the Scheme becoming unconditional and effective in accordance with its terms,

the Effective Date will occur in June 2007.

19. Disclosure of interests in INS

On 26 January 2007, Babcock acquired 15,273,875 INS Shares representing

approximately 24.5 per cent. of INS's entire issued share capital. Save for this

shareholding, and the irrevocable undertakings referred to above, neither

Babcock nor, so far as Babcock is aware, any person acting in concert with

Babcock, owns or controls any INS Shares or any securities convertible or

exchangeable into INS Shares or any rights to subscribe for or purchase the

same, or holds any options (including traded options) in respect of, or has any

option to acquire, any INS Shares or has entered into any derivatives referenced

to INS Shares ("Relevant INS Securities") which remain outstanding, nor does any

such person hold any short positions in relation to Relevant INS Securities

(whether conditional or absolute and whether in the money or otherwise)

including any short position under a derivative, any agreement to sell or any

delivery obligation or right to require another person to purchase or take

delivery, nor has any such person lent or borrowed Relevant INS Securities, nor

does any such person have any arrangement in relation to Relevant INS

Securities. For these purposes, "arrangement" includes any indemnity or option

arrangement, any agreement or understanding, formal or informal, of whatever

nature, relating to Relevant INS Securities which may be an inducement to deal

or refrain from dealing in such securities. In the interests of secrecy prior to

this Announcement, Babcock has not made any enquiries in this respect of certain

parties which may be deemed by the Panel to be acting in concert with it for the

purposes of the Offer. Enquiries of such parties will be made as soon as

practicable following the date of this Announcement and any material disclosure

in respect of such parties will be included in the Scheme Document.

20. General

The Offer will be subject to the requirements of the City Code and will be on

the terms and subject to the Conditions set out herein and in Appendix I and to

be set out in the Scheme Document. The Scheme Document will include full details

of the Scheme, together with notices of the Court Meeting and the EGM and the

expected timetable.

As at 7.00 a.m. (London time) on 3 April 2007 (the last business day prior to

the date of this Announcement), INS had 62,335,374 shares of one pence in issue

(ISIN number GB00B12QZ964).

Enquiries

Babcock Telephone: +44 (0) 20 7291 5000

Gordon Campbell

Peter Rogers

Bill Tame

Hawkpoint (financial adviser to Babcock) Telephone: +44 (0) 20 7665 4500

Paul Baines

JPMorgan Cazenove (broker to Babcock) Telephone: +44 (0) 20 7588 2828

Dermot McKechnie

Financial Dynamics (Babcock PR enquiries) Telephone: +44 (0) 020 7269 7121

Susanne Walker

INS Telephone: +44 (0) 161 222 5500

Chris Brown

Tony Moore

Rothschild (financial adviser to INS) Telephone: +44 (0) 161 827 3800

Greg Cant

Grant Thornton (Rule 3 financial adviser to Telephone: +44 (0) 161 834 5414

INS)

Ali Sharifi

College Hill (INS PR enquiries) Telephone: +44 (0) 20 7457 2020

Matthew Smallwood

This Announcement does not, and is not intended to, constitute or form part of

any offer to sell, or an invitation to purchase, any securities or the

solicitation of any vote or approval in any jurisdiction. The Offer will be made

solely by means of the Scheme Document, which will contain the full terms and

conditions of the Scheme. INS Shareholders are advised to read carefully the

formal documentation in relation to the Offer once it has been despatched.

The availability of the Offer and the release, publication or distribution of

this Announcement to persons who are not resident in the United Kingdom may be

affected by the laws of the relevant jurisdictions in which they are located.

Persons who are not resident in the United Kingdom should inform themselves of,

and observe, any applicable requirements. Any failure to comply with such

applicable requirements may constitute a violation of the securities laws of any

such jurisdictions. This Announcement has been prepared for the purposes of

complying with English law and the City Code and the information disclosed may

not be the same as that which would have been disclosed if this Announcement had

been prepared in accordance with the laws of jurisdictions outside the United

Kingdom.

The Offer will not be made in or into any jurisdiction where to do so would

consititute a violation of the relevant laws of such jurisdiction. Custodians,

nominees and trustees should observe these restrictions and should not send or

distribute the document in or into any jurisdiction where to do so would

consititute a violation of the relevant laws of such jurisdiction.

Hawkpoint, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Babcock and no one else

in connection with the Offer and will not be responsible to anyone other than

Babcock for providing the protections afforded to clients of Hawkpoint nor for

providing advice in relation to the Offer, the content of this Announcement or

any matter referred to herein.

JPMorgan Cazenove, which is authorised and regulated in the United Kingdom by

the Financial Services Authority, is acting exclusively for Babcock and no one

else in connection with the Offer and will not be responsible to anyone other

than Babcock for providing the protections afforded to clients of JPMorgan

Cazenove nor for providing advice in relation to the Offer, the content of this

Announcement or any matter referred to herein.

Rothschild, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for INS and no one else in

connection with the Offer and will not be responsible to anyone other than INS

for providing the protections afforded to clients of Rothschild nor for

providing advice in relation to the Offer, the content of this Announcement or

any matter referred to herein.

Grant Thornton, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for INS and no one else in

connection with the Offer and will not be responsible to anyone other than INS

for providing the protections afforded to clients of Grant Thornton nor for

providing advice in relation to the Offer, the content of this Announcement or

any matter referred to herein.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Announcement contains certain forward-looking statements with respect to

the financial condition, results of operations and business of INS and certain

plans and objectives of the boards of INS and Babcock with respect thereto.

These forward-looking statements can be identified by the fact that they do not

relate only to historical or current facts. Forward-looking statements often use

words such as "anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "will", "may", "should", "would", "could", or other words of

similar meaning. These statements are based on assumptions and assessments made

by the boards of INS and Babcock in light of their experience and their

perception of historical trends, current conditions, expected future

developments and other factors they believe appropriate. By their nature,

forward-looking statements involve risk and uncertainty, because they relate to

events and depend on circumstances that will occur in the future and the factors

described in the context of such forward-looking statements in this Announcement

could cause actual results and developments to differ materially from those

expressed in or implied by such forward-looking statements. Although INS and

Babcock believe that the expectations reflected in such forward-looking

statements are reasonable, INS and Babcock can give no assurance that such

expectations will prove to have been correct and INS and Babcock therefore

caution you not to place undue reliance on these forward-looking statements

which speak only as at the date of this Announcement.

21. Appendices

Appendix I sets out Conditions to implementation of the Offer.

Appendix II sets out the bases and sources of information from which the

financial calculations used in this Announcement have been derived.

Appendix III contains the definitions of terms used in this Announcement.

Appendix I

CONDITIONS TO IMPLEMENTATION OF THE OFFER

The Offer will be subject to English law and the terms and conditions set out in

this document.

1.1 The Offer will be conditional upon the Scheme becoming unconditional and

effective by no later than 30 June 2007 or such later date if any as

Babcock and INS may, with the consent of the Panel, agree and (if

required) the Court may allow.

1.2 The Scheme will be conditional on:

(a) approval of the Scheme by a majority in number of Scheme Shareholders

present and voting (and entitled to vote), either in person or by

proxy, at the Court Meeting representing 75 per cent. or more in

value of the INS Shares voted;

(b) the resolution in connection with or required to approve and

implement the Scheme as set out in the notice of EGM in the Scheme

Document being duly passed by the requisite majority at the EGM or

any adjournment thereof; and

(c) the sanction of the Scheme and the confirmation of the reduction of

capital by the Court (in either case, with or without modifications

on terms acceptable to Babcock and INS) and the delivery of an office

copy of the Court Order to the Registrar of Companies and, in respect

of the reduction of capital, the registration of the Court Order by

him.

1.3 The Offer will also be conditional upon the following matters and,

accordingly, the necessary actions to make the Scheme effective will not

be taken unless such conditions have been satisfied or waived by Babcock

prior to the Scheme being sanctioned by the Court in accordance with

paragraph 1.2 above:

(a) no government or governmental, quasi-governmental, supranational,

statutory or regulatory body, or any court, institution,

investigative body, association, trade agency or professional or

environmental body or (without prejudice to the generality of the

foregoing) any other person or body in any jurisdiction (each, a

"Relevant Authority") having decided to take, instituted, implemented

or threatened any action, proceedings, suit, investigation or enquiry

or enacted, made or proposed any statute, regulation or order or

otherwise taken any other step or done any thing, and there not

continuing to be outstanding any statute, legislation or order of any

Regulatory Authority, that would or might reasonably be expected, in

a manner in each case which is material and adverse in the context of

the Offer or the wider INS Group taken as a whole:

(i) materially restrict, restrain, prohibit, delay or impose

material additional conditions or obligations with respect to,

or otherwise materially interfere with the implementation of,

the Offer or the acquisition of any INS Shares by Babcock or

any matters arising therefrom;

(ii) require, prevent or materially delay the divestiture by Babcock

or any of its subsidiaries, subsidiary undertakings or

associated undertakings (including any company of which 20 per

cent. or more of the voting capital is held by the Babcock

Group or any partnership, joint venture, firm or company in

which any of them may be interested) (together the "wider

Babcock Group") or INS or any of its subsidiaries, subsidiary

undertakings or associated undertakings (including any company

of which 20 per cent. or more of the voting capital is held by

the INS Group or any partnership, joint venture, firm or

company in which any of them may be interested) (together the

"wider INS Group") of all or any portion of their respective

businesses, assets or property or of any shares or other

securities in INS or impose any material limitation on the

ability of any of them to conduct all or any part of their

respective businesses or own their respective assets or

properties or any part thereof in each case which is material

taken in the context of the wider Babcock Group or the wider

INS Group as a whole;

(iii) impose any material limitation on the ability of any member of

the wider Babcock Group to acquire or hold or exercise

effectively, directly or indirectly, all rights of all or any

of the INS Shares (whether acquired pursuant to the Offer or

otherwise);

(iv) except pursuant to sections 977-982 of the Companies Act 2006,

require any member of the wider Babcock Group or the wider INS

Group to offer to acquire any shares or other securities or

rights thereover in any member of the wider INS Group owned by

any third party;

(v) make the Offer or its implementation or the proposed

acquisition of INS or any member of the wider INS Group or of

any INS Shares or any other shares or securities in, or control

of, INS, illegal, void or unenforceable in or under the laws of

any jurisdiction;

(vi) impose any material limitation on the ability of any member of

the wider Babcock Group or the wider INS Group to co-ordinate

its business, or any part of it, with the business of any other

member of the wider Babcock Group or the wider INS Group; or

(vii) otherwise materially and adversely affect any or all of the

businesses, assets or profits of any member of the wider

Babcock Group or the wider INS Group or the exercise of rights

of shares of any company in the INS Group,

and all applicable waiting periods during which such Relevant

Authority could institute, implement or threaten any such action,

proceeding, suit, investigation, enquiry or reference or otherwise

intervene having expired, lapsed or been terminated;

(b) all authorisations, orders, grants, consents, clearances, licences,

permissions and approvals, in any jurisdiction, which are necessary or

are reasonably considered necessary or appropriate by Babcock for or in

respect of the Offer, the proposed acquisition of any shares or

securities in, or control of, INS or any member of the wider INS Group by

any member of the wider Babcock Group or the carrying on of the business

of any member of the wider INS Group or any matters arising therefrom

being obtained in terms reasonably satisfactory to Babcock from all

appropriate Relevant Authorities or (without prejudice to the generality

of the foregoing) from any persons or bodies with whom any members of the

wider INS Group has entered into contractual arrangements in any case

(other than an anti-trust or merger control authority) to an extent which

would be material in the context of the wider INS Group taken as a whole

and such authorisations, orders, grants, consents, clearances, licences,

permissions and approvals remaining in full force and effect and there

being no intimation of any intention to revoke or not to renew the same

and all necessary filings having been made, all appropriate waiting and

other time periods (including extensions thereto) under any applicable

legislation and regulations in any jurisdiction having expired, lapsed or

been terminated and all necessary statutory or regulatory obligations in

any jurisdiction in respect of the Offer or the proposed acquisition of

INS by Babcock or of any INS Shares or any matters arising therefrom

having been complied with;

(c) appropriate assurances being received, in terms satisfactory to Babcock,

from the relevant authorities or any party with whom any member of the

wider INS Group has any contractual or other relationship that the

interests held by any member of the wider INS Group under licences,

leases, consents, permits and other rights will not be adversely amended

or otherwise affected by the Offer, to the extent which is or in a manner

which is material and adverse in the context of the Offer or the proposed

acquisition of INS or any matters arising therefrom, that such licences,

leases, consents, permits and other rights are in full force and effect

and that there is no intention to revoke or amend any of the same;

(d) save as publicly announced by INS prior to the date of this Announcement

(by the delivery of an announcement to a Regulatory Information Service)

or as fairly disclosed prior to the date of this Announcement in writing

to Babcock or its advisers by or on behalf of INS there being no

provision of any agreement, instrument, permit, licence or other

arrangement to which any member of the wider INS Group is a party or by

or to which it or any of its assets may be bound or subject which, as a

consequence of the Offer or the acquisition of INS or because of a change

in the control or management of INS or any member of the INS Group or any

matters arising therefrom or otherwise, could or might have the result to

the extent which is or in a manner which is material and adverse in the

context of the wider INS Group taken as a whole that:

(i) any material amount of monies borrowed by, or any other material

indebtedness, actual or contingent, of, or grant available to, any

member of the wider INS Group becomes or is capable of being

declared repayable immediately or earlier than the repayment date

stated in such agreement, instrument or other arrangement or the

ability of any member of the wider INS Group to borrow moneys or

incur indebtedness is withdrawn, inhibited or becoming capable of

being withdrawn;

(ii) any mortgage, charge or other security interest is created over

the whole or any material part of the business, property or assets

of any member of the wider INS Group or any such security

(whenever arising) becomes enforceable;

(iii) any such agreement, instrument, permit, licence or other

arrangement, or any right, interest, liability or obligation of

any member of the wider INS Group therein, is terminated or

materially and adversely modified or affected or any action is

taken or onerous obligation arises thereunder;

(iv) the value of any member of the wider INS Group or its financial or

trading position is prejudiced or adversely affected;

(v) any material asset or any interest of any member of the wider INS

Group being or falling to be charged or disposed of other than in

the ordinary course of trading;

(vi) the rights, liabilities, obligations or interests or business of

any member of the wider INS Group in or with any other person,

firm or company (or any arrangement relating to such interest or

business) is terminated or materially and adversely affected;

(vii) any member of the wider INS Group ceases to be able to carry on

business under any name under which it currently does so;

(viii) any such agreement, arrangement, licence or other instrument being

terminated or materially and adversely modified or any onerous

obligation arising or any material adverse action being taken or

arising thereunder; or

(ix) the creation of any material liabilities (actual or contingent) by

any such member of the wider INS Group other than in the ordinary

course of trading;

(e) since 31 December 2006, save as publicly announced by INS prior to the

date of this Announcement (by the delivery of an announcement to a

Regulatory Information Service) or as fairly disclosed prior to the date

of this Announcement in writing to Babcock or its advisers by or on

behalf of INS, no member of the INS Group having:

(i) issued or agreed to issue or authorised or proposed the issue of

additional shares of any class or issued or authorised or proposed

the issue of or granted securities convertible into or rights,

warrants or options to subscribe for or acquire such shares or

convertible securities or redeemed, purchased or reduced or

announced any intention to do so or made any other change to any

part of its share capital, sold or transferred or agreed to sell

or transfer any Treasury Shares (as defined in section 162A(3) of

the Companies Act, other than:

(A) to other members of the INS Group; or

(B) shares issued pursuant to the exercise of options or vesting

of awards in each case granted under the INS Share Schemes, or

under an employee's terms of employment;

(ii) recommended, declared, paid or made or proposed to recommend,

declare, pay or make any dividend, bonus or other distribution

other than dividends lawfully paid to INS or wholly-owned

subsidiaries of INS;

(iii) implemented or authorised any merger or demerger or acquired or

disposed of or transferred, mortgaged or charged, or created any

other security interest over, any material asset or any right,

title or interest in any material asset (in each case other than

in the ordinary course of trading) and other than transactions

between members of the INS Group;

(iv) authorised or proposed or announced its intention to propose any

merger or acquisition or disposal or transfer of material assets

or any change in its loan capital;

(v) purchased, redeemed or repaid any of its own shares or other

securities or reduced or made or authorised any other material

change in its share capital save in respect of the matters

mentioned in paragraph (i) above;

(vi) issued or authorised or proposed the issue of any material

debentures or incurred or increased any indebtedness or contingent

liability in each case other than to members of the INS Group;

(vii) entered into or varied any contract, commitment or arrangement

(whether in respect of capital expenditure or otherwise) other

than in the ordinary course of trading which is of a long term or

unusual nature or which involves or could involve an obligation of

a nature or magnitude which is material or authorised, proposed or

announced any intention to do so;

(viii) entered into, or varied the terms of, any contract or agreement

with any of the directors of INS;

(ix) other than by way of solvent winding-up in respect of a member

which is dormant at the relevant time, taken or proposed any

corporate action or had any legal proceedings started or

threatened against it for its winding-up, dissolution or

reorganisation or for the appointment of a receiver,

administrator, administrative receiver, trustee or similar officer

of all or any of its assets and revenues;

(x) waived or compromised any claim other than in the ordinary course

of trading;

(xi) made any amendment to its memorandum or articles of association or

other incorporation documents;

(xii) made or agreed or consented to:

(A) any significant change to:

(I) the terms of the trust deeds constituting the pension

scheme(s) established for its directors, employees or

their dependants; or

(II) the benefits which accrue or to the pensions which are

payable thereunder; or

(III) the basis on which qualification for, or accrual or

entitlement to such benefits or pensions are calculated

or determined; or

(IV) the basis upon which the liabilities (including

pensions) or such pension schemes are funded or made; or

(B) any change to the trustees including the appointment of a

trust corporation;

(xiii) other than in the ordinary course of its trading, entered into any

contract, transaction or arrangement which is or may be

restrictive on the business of any member of the wider INS Group

or the wider Babcock Group;

(xiv) entered into any contract, commitment or agreement with respect to

any of the transactions or events referred to in this condition;

and

(xv) been unable or admitted that it is unable to pay its debts or

having stopped or suspended (or threatened to stop or suspend)

payment of its debts generally or ceased or threatened to cease

carrying on all or a substantial part of its business;

(f) since 31 December 2006, save as publicly announced by INS prior to the

date of this Announcement (by the delivery of an announcement to a

Regulatory Information Service) or as fairly disclosed prior to the date

of this Announcement in writing to Babcock or its advisers by or on

behalf of INS:

(i) no litigation, arbitration, prosecution or other legal proceedings

having been instituted, announced or threatened or become pending

or remained outstanding by or against any member of the wider INS

Group or to which any member of the wider INS Group is or may

become a party (whether as plaintiff, defendant or otherwise)

which is material and adverse in the context of the wider INS

Group taken as a whole;

(ii) no adverse change having occurred in the business, assets,

financial or trading position, profits or prospects of any member

of the wider INS Group to the extent or which is or in a manner

which is material and adverse in the context of the Offer which is

material and adverse in the context of the wider INS Group taken

as a whole; or

(iii) (other than as a result of the Offer) no investigation by any

Relevant Authority having been threatened, announced, implemented

or instituted or remaining outstanding to the extent which is or

in a manner which is material and adverse in the context of the

Offer or which is material and adverse in the context of the wider

INS Group taken as a whole;

(g) since 31 December 2006, save as publicly announced by INS prior to the

date of this Announcement (by the delivery of an announcement to a

Regulatory Information Service) or as fairly disclosed prior to the date

of this Announcement in writing to Babcock or its advisers by or on

behalf of INS, Babcock not having discovered that:

(i) any financial, business or other information concerning any member

of the INS Group disclosed, publicly or otherwise at any time to

Babcock, by or on behalf of any member of the INS Group, either

contains a misrepresentation of fact or omits to state a fact

necessary to make the information contained therein not misleading

and which was not subsequently corrected before the date of this

Announcement by disclosure either publicly or otherwise to Babcock

to an extent which in any case is material and adverse in the

context of the wider INS Group taken as a whole; or

(ii) any member of the wider INS Group is subject to any liability,

actual or contingent, which is not disclosed in the annual report

and accounts of INS for the financial year ended 31 December 2006

and which in any case is material and adverse in the context of

the wider INS Group taken as a whole; and

(h) since 31 December 2006, save as publicly announced by INS prior to

the date of this Announcement (by the delivery of an announcement to

a Regulatory Information Service) or as fairly disclosed prior to the

date of this Announcement in writing to Babcock or its advisers by or

on behalf of INS, Babcock not having discovered that:

(i) any past or present member of the wider INS Group has failed to

comply with any applicable legislation or regulations of any

jurisdiction with regard to the storage, disposal, discharge,

spillage, leak or emission of any waste or hazardous substance

or any substance likely to impair the environment or to harm

human health or otherwise relating to environmental matters

(which non-compliance is reasonably likely to give rise to any

material liability (whether actual or contingent) on the part

of any member of the wider INS Group) or that there has

otherwise been any such disposal, discharge, spillage, leak or

emission (whether or not the same constituted a non-compliance

by any person with any such legislation or regulations and

wherever the same may have taken place) which in any such case

is reasonably likely to give rise to any material liability

(whether actual or contingent) on the part of any member of the

wider INS Group which is material and adverse in the context of

the wider INS Group taken as a whole;

(ii) there is or is likely to be any material liability (whether

actual or contingent) to make good, repair, reinstate or clean

up any property now or previously owned, occupied or made use

of by any past or present member of the wider INS Group under

any environmental legislation, regulation, notice, circular or

order of any Relevant Authority or third party or otherwise

which is material and adverse in the context of the wider INS

Group taken as a whole; or

(iii) that circumstances exist (whether as a result of the making of

the Offer or otherwise) which are reasonably likely to lead to

any Relevant Authority instituting or any member of the wider

INS Group or the wider Babcock Group might be required to

institute, an environmental audit or take any other steps which

in any such case might result in any actual or contingent

liability to improve or install new plant or equipment or make

good, repair, re-instate or clean up any land or other asset

now or previously owned, occupied or made use of by any member

of the wider INS Group which is material and adverse in the

context of the wider INS Group taken as a whole.

1.4 Subject to the requirements of the Panel, Babcock reserves the right to

waive all or any of conditions 1.3(a) to 1.3(h) above, in whole or in

part. Babcock shall be under no obligation to waive or treat as satisfied

any of conditions 1.3(a) to 1.3(h) by a date earlier than the date of the

sanction of the Scheme referred to in condition 1.2(c) notwithstanding

that the other conditions of the Offer may at such earlier date have been

waived or fulfilled and that there are at such earlier date no

circumstances indicating that any of such conditions may not be capable

of fulfilment.

1.5 If Babcock is required by the Panel to make an offer for INS Shares under

the provisions of Rule 9 of the Code, Babcock may make such alterations

to the conditions as are necessary to comply with the provisions of that

Rule.

1.6 The Offer will lapse (unless otherwise agreed by the Panel) if the Offer

is referred to the Competition Commission or if the European Commission

in respect thereof either initiates proceedings under article 6(1)(c) of

Council Regulation (EEC) 4064/89 or makes a referral to a competent

authority of the United Kingdom under article 9(1) of that Regulation,

before (in any such case) the date of the Court Meeting.

1.7 Subject to the consent of the Panel, Babcock reserves the right to elect

to implement the Offer by way of a takeover offer. In such event, the

offer will be implemented on the same terms (subject to appropriate

amendments, including (without limitation) an acceptance condition set at

90 per cent. (or such lesser percentage as Babcock may, subject to

compliance with the Code, decide) of the shares to which such offer

relates and of the voting rights carried by those shares), so far as

applicable, as those which would apply to the Scheme.

1.8 The Offer and the Scheme are governed by English law and will be subject

to the jurisdiction of the English courts and the conditions set out

above.

Appendix II

BASES AND SOURCES OF INFORMATION

Save as otherwise stated, the following constitute the bases and sources of

certain information referred to in this Announcement:

1. Information relating to INS has been extracted from the AIM admission

document, dated 5 May 2006, and from INS's preliminary annual results

announcement for the year ended 31 December 2006; information relating to

Babcock has been extracted from the relevant published audited reports and

accounts of Babcock and interim reports.

2. The value of the entire issued share capital of INS is based on 62,335,374

INS Shares in issue at 3 April 2007 being the latest practicable day prior to

this Announcement.

3. The maximum cash consideration payable under the Offer is based on 47,061,499

INS Shares (being those INS Shares in issue not already owned by Babcock) and no

more than 1,250,826 "in the money" employee share options outstanding over INS

Shares at the date of this Announcement and which are expected to become

exercisable as a consequence of the Scheme.

4. Unless otherwise stated, all prices quoted for shares are closing mid-market

prices and are derived from the Daily Official List of the London Stock

Exchange.

Appendix III

DEFINITIONS

The following definitions apply throughout this Announcement unless the context

requires otherwise.

"AIM" AIM, a market operated by the London Stock Exchange;

"Announcement" this announcement;

"Articles" articles of association;

"Babcock" Babcock International Group PLC, a public limited company

incorporated in England and Wales with registered number

02342138;

"Babcock Group" Babcock and its subsidiary undertakings and, where the context

or "Group" permits, each of them;

"Board" the full board of Directors of INS as of the date of this

Announcement;

"Business Day" a day (excluding Saturdays, Sundays and UK public holidays) on

which banks in London are generally open for business in the

City of London;

"the Code" or the City Code on Takeovers and Mergers;

"City Code"

"Closing Price" the closing middle market quotation of an INS Share as derived

from the Daily Official List;

"Companies Act" the Companies Act 1985, as amended;

or "Act"

"Competing a proposed offer, tender offer, merger, acquisition, scheme of

Proposal" arrangement, recapitalisation or other combination (including a

transaction involving a dual listed company structure) relating

to any direct or indirect acquisition or purchase of 50 per

cent. or more of the INS Shares or a material amount (as defined

in note 2 of Rule 21.1 of the City Code) of the business and

assets of INS and its subsidiaries proposed by any third party;

"Conditions" the conditions to the implementation of the Offer (including the

Scheme) and the Offer which are set out in Appendix I to this

Announcement;

"connected has the meaning given to it in section 346 of the Companies Act;

person"

"Court" the High Court of Justice in England and Wales;

"Court Hearing" the hearing at which the Court's confirmation of the reduction

of capital and the Court's sanction of the Scheme will be

sought;

"Court Meeting" the meeting of the Scheme Shareholders to be convened pursuant

to an order of the Court pursuant to section 425 of the

Companies Act for the purpose of considering and, if thought

fit, approving the Scheme (with or without modification), and

any adjustment thereof;

"Court Order" the order of the Court sanctioning the Scheme under section 425

of the Act and confirming the associated reduction of capital;

"CREST" the system for the paperless settlement of trades in securities

and the holding of uncertificated securities generated by

CRESTCo in accordance with the Uncertificated Securities

Regulations 2001 (SI 2001 No.3755);

"CRESTCo" CRESTCo Limited;

"Daily Official the Daily Official List of the London Stock Exchange;

List"

"Effective the date on which the Scheme becomes effective in accordance

Date" with its terms;

"EGM" or the extraordinary general meeting of INS Shareholders (and any

"Extraordinary adjournment thereof) to be convened in connection with the

General Offer;

Meeting"

"EMI Scheme" INS 2006 Enterprise Management Incentive Scheme;

"Forms of the blue Form of Proxy for use at the Court Meeting and the pink

Proxy" Form of Proxy for use at the EGM or either of them as the

context dictates;

"Grant Grant Thornton Corporate Finance, the corporate finance division

Thornton" of Grant Thornton UK LLP;

"Hawkpoint" Hawkpoint Partners Limited;

"holder" a registered holder, including any person entitled by

transmission;

"Independent all INS Shareholders other than Babcock;

Shareholders"

"INS" or "the International Nuclear Solutions PLC a public limited company

Company" incorporated in England and Wales with registered number 5738079

or, where the context requires, INS Innovation Limited;

"INS Directors" Christopher John Brown, Anthony Moore, Geoffrey John Mellor,

Stephen Joseph McGowan and John Gordon Ridings, who are

directors of INS;

"INS Group" INS and its subsidiary undertakings and, where the context

permits, each of them;