RNS Number:7540T

International Nuclear Solutions PLC

27 March 2007

International Nuclear Solutions plc ("INS" or the "Company")

Preliminary results for year ended 31 December 2006

INS, one of the largest providers of specialist nuclear engineering and design

services in the UK with more than 25 years of industry experience, today

announces a 29% uplift in turnover and a 38% increase in its order book.

Financial Highlights

2006 2005

Turnover #31.7m #24.6m

Operating profit *#2.5m #2.2m

Profit before tax *#2.5m #2.2m

Profit after tax #1.0m #1.9m

Earnings per share 1.68p 3.13p

Cash #2.7m #0.4m

* before exceptional items of #832,000 in respect of the demerger from Robotic

Technology Systems plc ("RTS") and admission to AIM

* Successful demerger from RTS and admission to AIM

* Strong cash performance. #5.9m cash inflow from operating activities

(2005 - #0.2m) and closing cash of #2.7m (2005 - #0.4m)

* New office opened at Birchwood in Warrington

* Strong order book up 38% to #12.7m reflecting significant new wins

from British Nuclear Group and Carillion at Sellafield

Chris Brown, Chairman of INS, said:

"INS maintained its excellent track record of growth in 2006, and exceeded our

expectations in terms of operating performance. Our strong opening order book,

and the increasing activity levels in the nuclear industry, give us confidence

that the Group will continue to progress in 2007

As shareholders are aware, on 26 January 2007 Babcock International Group PLC

announced that it had acquired ordinary shares in INS representing 24.5% of the

issued share capital. Discussions with Babcock are ongoing."

27 March 2007

Enquiries:

International Nuclear Solutions plc Tel: 0161 222 5500

Chris Brown, Chairman

Tony Moore, CEO

College Hill Tel: 020 7457 2020

Matthew Smallwood

Chairman's Statement

Following the successful admission of International Nuclear Solutions plc

("INS") to the AIM market on 31 May 2006, I am pleased to be able to present the

Group's first set of annual accounts as an independent public company.

As the transfer of INS Innovation Ltd (formerly RTS Innovation Ltd) to INS has

been accounted for in accordance with the principles of merger accounting, the

financial statements are presented as if INS Innovation Ltd had been owned and

controlled by INS for the full financial year.

Turnover at #31.7m increased by 29% in 2006 compared with the previous year,

with the commencement of several significant new contracts, notably the SPRS and

B29 projects at Sellafield. Operating profit before exceptional items was 11.9%

higher than 2005 at #2.5m, before exceptional administrative costs of #0.8m

(2005 - #nil) relating to the demerger from Robotic Technology Systems PLC (RTS)

and subsequent admission to AIM. Profit after tax and exceptional items was

#1.0m, compared with #1.9m in 2005.

INS produced a strong cash performance in 2006, with #5.9m cash inflow from

operating activities, an increase in net funds of #2.4m, and closing cash

balances of #2.7m.

Our order book, which stood at #11.4m at the end of June, grew to #12.7m by the

end of 2006, and currently stands at #12.9m. Our total headcount at the end of

2006 stood at 274. This is an increase of 23% in permanent staff, and 21% in

total from the position at the start of the year. A new project office has been

opened at Birchwood in Warrington, and we have also relocated our Greengarth

office to new premises at the West Lakes Science Park near Sellafield.

Major Corporate Events

On 31 May 2006, INS was admitted to trading on AIM, and its share price closed

on the first day of trading at 41.25p. The closing share price on 31 December

2006 was 52.5p. Following the end of the 2006 trading period, on 18 January

2007, INS announced that it had received an approach which may or may not lead

to an offer for the Group. On 26 January 2007 Babcock International Group PLC

announced that it had acquired ordinary shares in INS representing 24.5% of the

issued share capital at 63p and intended to progress discussions with the Board

regarding the possibility of making a cash offer for the balance of the issued

share capital of INS. These discussions are still ongoing.

Dividends

As stated in the Admission Document, INS does not intend to pay a dividend for

the year ended 31 December 2006. The Board does, however, consider that a

dividend policy is likely to be introduced during 2007, consistent with the

continuing strong cash performance of the Group.

Outlook

Our strong opening order book, and the increasing activity levels in the nuclear

industry, give us confidence that the Group will continue to progress in 2007.

The Nuclear Decommissioning Authority (NDA) has announced that there is a small

increase in funding in its 2007 budget. We are aware that there will be a

reduction in operating revenues to the NDA in future years as a result of the

closure of two Magnox stations at the end of 2006. This may in the course of

time affect the funding available to the NDA in future years. However, we view

the future with confidence given the increasing overall demand for nuclear

decommissioning expertise.

Chris Brown

Chairman

27 March 2007

Operational Review

The demerger from RTS was completed successfully with no adverse impact to the

business from either customers or operational matters.

Staffing levels are up by 21% on the previous year, which is a significant

achievement bearing in mind the shortage of skilled labour and an extremely

buoyant market place for professionals.

A new project office has been opened at Birchwood in Warrington near to our

customer's office which has provided increased office capacity for the increased

work load and staffing levels.

We were successful in winning a number of important contracts during 2006 and

these include:

* a 3 year framework contract from British Nuclear Group ("BNG") for

engineering services and the supply of integrated equipment/systems for the

Sellafield MOX fuel manufacturing facility. This contract is valued at

c.#8 million over 3 years,

* a contract from Carillion for the supply of integrated equipment/systems

for the Sellafield Product and Residues Facility - the largest new build

facility on the Sellafield site - valued at c.#15 million and likely to

increase in value subject to agreement on the supply of additional support

services for site commissioning of the facility,

* a design and engineering contract from Edmund Nuttall for a new waste

storage facility on the Sellafield site. The contract is valued at c.#1

million; and

* a design and engineering contract for BNG valued in excess of #1.3 million.

INS leads a consortium of three companies for this project.

We have also been successful as part of a consortium tendering for the new Multi

Discipline Design House (MDDH) framework agreement. The three lead consortium

members include INS, AMECNNC and DGP International.

During 2005/6 INS developed its own technology for dealing with both radioactive

sludge and solid waste at the various nuclear sites owned by the NDA. We are in

the process of registering a patent for the technology. We are one of five

companies selected by BNG to present their technology and an initial feasibility

study has been completed to identify the benefits of the technology and an

estimate for the cost of implementation.

During the year we secured significant business in the clean-up and

decommissioning of the high hazard legacy ponds and silos at Sellafield. INS is

currently working on four of the major ponds and silos projects considered to be

at the top of the NDA's decommissioning priorities at Sellafield. The Company

anticipates to win further work in the coming year both directly and in

partnership through INS' various alliances.

The Atomic Weapons Establishment (AWE) at Aldermaston presents a major

opportunity for INS because it will require a significant amount of the

specialist design and engineering skills that INS possesses which are essential

for some of the projects that are to be undertaken on its two sites.

INS has long been focused on health, safety and environmental matters and

achieved accreditation to the environmental standard ISO 14001 in December 2006.

We believe that INS will continue to grow and diversify into new areas with the

emphasis on further development of our consultancy business.

Tony Moore

Chief Executive Officer

27 March 2007

Group profit and loss account for the year ended 31 December 2006

Year ended Year ended

31 December 2006 31 December 2005

#'000 #'000

Note

Turnover 2 31,745 24,610

Cost of sales (26,007) (19,823)

Gross profit 5,738 4,787

Distribution costs (364) (321)

Administrative expenses (3,703) (2,229)

Operating profit before exceptional charges 2,503 2,237

Exceptional administrative expenses included in

administrative expenses above 3 (832) -

Operating profit 1,671 2,237

Interest receivable and similar income 41 16

Interest payable and similar expenses (2) (1)

Profit on ordinary activities before taxation 1,710 2,252

Taxation on profit on ordinary activities 4 (663) (303)

Profit for the financial year 8 1,047 1,949

Earnings per share

Basic earnings per share 5 1.68p 3.13p

There were no other gains and losses other than those shown above.

There was no difference between the reported profits and losses and historical

cost profit and losses in either the current or preceding financial year.

The profit and loss account has been prepared using merger accounting and is

presented on a proforma basis as if the new holding company has been in

existence throughout both the current and prior periods.

Group balance sheet at 31 December 2006

31 December 31 December

Note 2006 2005

#'000 #'000 #'000 #'000

Fixed assets

Tangible assets 6 1,231 66

Current assets

Debtors: amounts falling due within

one year 7,355 10,872

Cash at bank and in hand 2,734 364

10,089 11,236

Creditors: amounts falling due within one

year (9,780) (8,871)

Net current assets 309 2,365

Net assets 1,540 2,431

Capital and reserves

Called up share capital 7 623 -

Merger reserve 8 (623) -

Capital redemption reserve 8 50 -

Other reserves 8 26 -

Profit and loss reserve 8 1,464 2,431

Equity shareholders' funds 9 1,540 2,431

Group cash flow statement for the year ended 31 December 2006

Note Year ended Year ended

31 December 2006 31 December 2005

#'000 #'000

Net cash inflow from operating activities 10 5,908 210

Returns on investment and servicing of finance 11 39 15

Taxation paid (208) -

Capital expenditure and financial investment 11 (1,405) (12)

Equity dividends paid 12 (1,964) (2,000)

Cash inflow/(outflow) before financing 2,370 (1,787)

Financing

Shares issued 50 -

Shares redeemed (50) -

Increase/(decrease) in cash 2,370 (1,787)

Reconciliation of net cash flow to movement in net funds

Year ended Year ended

31 December 2006 31 December 2005

#'000 #'000

Increase/(decrease) in net funds resulting from 2,370 (1,787)

cash flows in the year

Net funds at 1 January 364 2,151

Net funds at 31 December 2,734 364

Notes forming part of the financial statements for the year ended 31 December

2006

1 Basis of preparation

The financial information set out above does not constitute within the meaning

of section 240 of the Company's Act 1985 the Company's statutory accounts for

the year ended 31 December 2006 or for the year ended 31 December 2005. The

financial information for 2005 is derived from the statutory accounts of INS

Innovation Ltd for the year ended 31 December 2005 which have been delivered to

the Registrar of Companies. The auditors have reported on the 2006 accounts;

their report was unqualified and did not contain a statement under section 237

(2) or (3) of the Companies Act 1985. The statutory accounts for 2006 will be

delivered to the Registrar of Companies in the near future.

The transfer of INS Innovation Ltd (formerly RTS Innovation Ltd) on 30 May 2006

to International Nuclear Solutions plc has been accounted for in accordance with

the principles of merger accounting as set out in Financial Reporting Standard 6

"Acquisitions and Mergers". The financial statements are therefore presented as

if INS Innovation Ltd had been owned and controlled by International Nuclear

Solutions plc for the full financial year.

Comparatives have been prepared as if the continuing operations of International

Nuclear Solutions plc were in existence for the whole of 2005.

2 Turnover and profits

All turnover and profits are derived in the UK. Turnover is wholly attributable

to the principal activity of the Group.

3 Operating exceptional items: Administrative expenses

Year ended Year ended

31 December 2006 31 December

#'000 2005

#'000

Costs in connection with demerger from RTS and admission to AIM 832 -

4 Taxation

Year ended 31 December Year ended 31

2006 December 2005

Current tax #'000 #'000 #'000 #'000

UK Corporation tax - current year 658 300

- prior year adjustment 2 -

660 300

Deferred tax

Origination and reversal of current year timing differences 5 1

Origination and reversal of prior year timing differences (2) 2

3 3

Tax on profit on ordinary activities 663 303

The taxation charge for the period is significantly higher than the prior year.

This is due to the availability of group tax relief when Innovation was part of

the RTS group in 2005, and the tax treatment of certain costs in 2006 in respect

of the demerger from RTS and the subsequent flotation of the Company.

5 Earnings per share

Earnings per ordinary share has been calculated using the weighted average

number of shares in issue during the relevant financial years. The calculations

of basic earnings per share for the year are based upon a profit after tax of

#1,047,000 (2005 - #1,949,000). The weighted average number of equity shares

used in the calculation of earnings per share for the current and comparative

period is 62,335,374.

2006 2005

Pence Pence

Basic earnings per share 1.68 3.13

Adjusted basic earnings per share (see below) 3.01 3.13

There is no difference between basic and fully diluted earnings per share.

Earnings per share before the exceptional item has been calculated using the

adjusted profit after tax as follows:

2006 2005

#'000 #'000

Profit after tax 1,047 1,949

Exceptional item in administrative expenses (note 5) 832 -

Adjusted profit after tax 1,879 1,949

6 Tangible assets

Leasehold land Plant and Fixtures,

and buildings machinery fittings and

equipment Total

#'000 #'000 #'000 #'000

Cost

At 1 January 2006 - 28 257 285

Transfers (see below) 792 428 - 1,220

Additions 34 398 90 522

At 31 December 2006 826 854 347 2,027

Depreciation

At 1 January 2006 - 26 193 219

Transfers (see below) 109 228 - 337

Charge for the year 45 131 64 240

At 31 December 2006 154 385 257 796

Net book value

At 31 December 2006 672 469 90 1,231

At 31 December 2005 - 2 64 66

Transfers relate to assets purchased from former group companies.

7 Share capital

Allotted, called up and

Authorised 31 fully paid

December 2006 31 December 2006

#'000 #'000

Ordinary shares of 1p each 1,000 623

Number of shares #'000

In issue at 1 January 2006 - -

Issued in the year 62,335,374 623

In issue at 31 December 2006 62,335,374 623

* On incorporation on 10 March 2006, the Company's authorised share capital

was #100 divided into 100 ordinary shares of #1 each. One ordinary share

of #1 was allotted on incorporation.

* On 12 April 2006, the #1 share was sub divided into 100 #0.01 Ordinary

Shares. The Company's authorised share capital was then increased from

#100 to #60,000 by the creation of 990,000 new Ordinary Shares of #0.01

each and 5,000,000 redeemable preference shares of #0.01.

* On 12 April 2006, 5,000,000 redeemable preference shares of #0.01 each

were allotted and fully paid.

* On 21 April 2006 5,000,000 redeemable preference shares of #0.01 each were

redeemed by the Company for #50,000. Pursuant to a resolution of the

shareholders of the Company all of the 5,000,000 redeemable preference

shares of #0.01 in the capital of the Company were reclassified as Ordinary

Shares of #0.01 each.

* On 4 May 2006, pursuant to a resolution of the shareholders of the Company

the authorised share capital was increased to #1,000,000 by the creation

of 94,000,000 Ordinary Shares of #0.01 each.

* On 30 May 2006, the entire issued share capital of INS Innovation Ltd

(formerly RTS Innovation Ltd) was transferred from Robotic Technology

Systems PLC to the Company in consideration for the issue of 62,335,274

Demerger shares to the qualifying shareholders, one ordinary share issued

for every RTS share held.

8 Reserves

Capital

Profit and loss redemption

account Merger reserve reserve Other reserves

#'000 #'000 #'000 #'000

At 1 January 2006 2,431 - - -

Profit for the financial year 1,047 - - -

Dividend paid (1,964) - - -

Reserve arising on demerger - (623) - -

Share capital redemption (50) - 50 -

Shares to be issued - - - 26

At 31 December 2006 1,464 (623) 50 26

9 Group reconciliation of movements in equity shareholders' funds

Year ended Year ended

31 December 2006 31 December 2005

#'000 #'000

Equity shares issued 623 -

Preference shares issued 50 -

Preference shares redeemed (50) -

Reserve arising on demerger (623) -

Profit for the financial year 1,047 1,949

Dividend paid (1,964) (2,000)

Movement on other reserves relating to share options 26 -

Net deduction from equity shareholders' funds (891) (51)

Opening equity shareholders' funds 2,431 2,482

Closing equity shareholders' funds 1,540 2,431

10 Reconciliation of operating profit to net cash inflow from operating

activities

Year ended Year ended

31 December 2006 31 December 2005

#'000 #'000

Operating profit 1,671 2,237

Depreciation 240 52

Other non-cash charges 26 -

Decrease in debtors 3,213 2,682

Increase/(decrease) in creditors 758 (4,761)

Net cash inflow from operating activities 5,908 210

11 Notes to the cash flow statement

Year ended Year ended

31 December 2006 31 December 2005

#'000 #'000

Returns on investment and servicing of finance

Interest received 41 16

Interest paid (2) (1)

39 15

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (1,405) (12)

(1,405) (12)

12 Dividends paid

2006 2005

#'000 #'000

Dividends paid 1,964 2,000

The dividends were paid to Robotic Technology Systems PLC, prior to demerger.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UNOWRBOROUAR

Instem (LSE:INS)

Historical Stock Chart

From Jun 2024 to Jul 2024

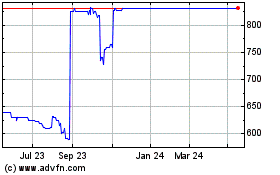

Instem (LSE:INS)

Historical Stock Chart

From Jul 2023 to Jul 2024