Offer for Infast Group Update

June 28 2005 - 1:27PM

UK Regulatory

RNS Number:1801O

Eagerport Limited

28 June 2005

Immediate Release 28 June 2005

This announcement is not for release, publication or distribution in or into

Canada, Australia or Japan.

Recommended Cash Offer

by

KPMG Corporate Finance on behalf of the Offeror, a wholly owned indirect

subsidiary of Anixter International Inc. and (in the United States) by the

Offeror

for

Infast Group plc

Level of Acceptances Update

On 20 June 2005, Eagerport Limited (the "Offeror") announced that, as at 1:00

p.m. (London time) on 17 June 2005, valid acceptances of the Offer had been

received in respect of 95,644,845 Infast Shares, representing approximately

83.64 per cent of the entire existing issued ordinary share capital of Infast

and that the Offer was being extended and the next closing date for the Offer

will be 1.00 p.m. (London time) on 8 July 2005.

In that announcement, the Offeror stated that 4,935,000 Infast Shares,

representing approximately 4.32 per cent of the entire existing issued ordinary

share capital of Infast, were the subject of a non binding letter of intent to

accept the offer from Societe Generale Asset Management UK Limited and that

further clarification was being sought as to the extent to which these Infast

Shares were included in the valid acceptances referred to above. It has now been

confirmed that valid acceptances of the Offer had been received in respect of

all of the Infast Shares subject to the Societe Generale Asset Management UK

Limited letter of intent at 1:00 p.m. (London time) on 17 June 2005 and

therefore formed part of the acceptances referred to above.

Terms defined in the Offer Document dated 27 May 2005 have the same meaning in

this announcement save where the context requires otherwise.

Enquiries:

Anixter Dennis Letham Tel: +1 224 521 8601

KPMG Corporate Finance Charles E Cattaneo Tel: +44 (0) 121 232 3356

Buchanan Communications Charles Ryland Tel: +44 (0) 207 466 5000

James Strong Tel: +44 (0) 207 466 5000

KPMG Corporate Finance, a division of KPMG LLP which is authorised and regulated

by the Financial Services Authority for investment business activities, is

acting for Anixter and the Offeror as financial adviser in relation to the Offer

and is not acting for any other person in relation to the Offer. KPMG Corporate

Finance will not be responsible to anyone other than Anixter and the Offeror for

providing the protections afforded to its clients or for providing advice in

relation to the contents of this announcement or any transaction or arrangement

referred to herein.

This announcement does not constitute an offer or invitation to purchase any

securities or the solicitation of an offer to buy any securities, pursuant to

the Offer or otherwise. The Offer is being made solely pursuant to the Offer

Document and the Form of Acceptance accompanying the Offer Document, which

contain the full terms and conditions of the Offer, including details of how the

Offer may be accepted.

The Offer is not being made, directly or indirectly, in or into, or by use of

the mails of, or by any means or instrumentality (including, without limitation,

facsimile transmission, electronic mail, telex or telephone) of interstate or

foreign commerce of, or any facilities of a national securities exchange of

Canada, Australia, Japan or any jurisdiction where to do so would violate the

laws in that jurisdiction and the Offer will not be capable of acceptance by any

such use, means, instrumentality or facility, directly or indirectly from or

within Canada, Australia, Japan or any such jurisdiction.

The Offer in the United States is being made solely by the Offeror, and neither

KPMG LLP, KPMG Corporate Finance, nor any of its respective affiliates, is

making the Offer in the United States.

The members of the Anixter Offer Committee accept responsibility for the

information contained in this announcement. To the best of the knowledge and

belief of the members of the Anixter Offer Committee (who have taken all

reasonable care to ensure that such is the case), the information contained in

this announcement for which they accept responsibility is in accordance with the

facts and does not omit anything likely to affect the import of such

information.

The Offeror Directors, accept responsibility for the information contained in

this announcement relating to the Offeror, the Offeror Directors and their

immediate families and persons connected with them (within the meaning of

section 346 of the Act). To the best of the knowledge and belief of the Offeror

Directors (who have taken all reasonable care to ensure that such is the case),

the information contained in this announcement for which they accept

responsibility is in accordance with the facts and does not omit anything likely

to affect the import of such information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

OUPBRGDLDDDGGUI

Instem (LSE:INS)

Historical Stock Chart

From Jul 2024 to Aug 2024

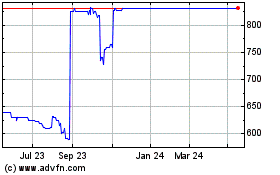

Instem (LSE:INS)

Historical Stock Chart

From Aug 2023 to Aug 2024