TIDMIRSH

TRADING UPDATE

Volumes (Year to date, 7 May 2022)

Change

2022 2021 vs 2021 2019

Cars 123,600 15,800 +682.3% 90,900

RoRo Freight 223,900 82,700 +170.7% 105,400

Container Freight (teu) 117,800 124,100 (5.1%) 125,000

Terminal Lifts 115,100 114,800 +0.3% 115,700

Volumes -- Legacy Routes (Year to date, 7 May 2022)

Change

2022 2021 vs 2021 2019

Cars 65,300 15,800 +313.3% 90,900

RoRo Freight 100,800 82,700 +21.9% 105,400

Volumes (since last Trading Update, 5 March 2022)

Change 6/3/19-

6/3/22-7/5/22 6/3/21-7/5/21 vs 2021 7/5/19

Cars 87,700 8,500 +931.8% 58,100

RoRo Freight 129,900 44,300 +193.2% 55,800

Container Freight (teu) 60,700 60,200 +0.8% 62,000

Terminal Lifts 59,300 58,600 +1.2% 58,000

Volumes -- Legacy Routes (since last Trading Update, 5 March

2022)

Change 6/3/19-

6/3/22-7/5/22 6/3/21-7/5/21 vs 2021 7/5/19

Cars 46,100 8,500 +442.4% 58,100

RoRo Freight 51,900 44,300 +17.2% 55,800

Irish Continental Group (ICG) issues this trading update which

covers carryings for the year to date to 7 May 2022 and financial

information for the first four months of 2022, i.e. 1 January to 30

April with comparisons against the corresponding periods in 2021

and 2019. All figures are unaudited.

Consolidated Group revenue in the period was EUR161.2 million,

an increase of 80.5% compared with last year and a 57.6% increase

on 2019. For banking covenant purposes, pre-IFRS 16 net debt

figures were EUR123.2 million compared to EUR84.6 million at year

end. Including IFRS 16 lease obligations, net debt figures were

EUR174.2 million compared to EUR142.2 million at year end. The

increase in net debt is primarily derived from strategic capital

expenditure mainly comprising the acquisition of two vessels.

Ferries Division

Total revenues recorded in the period to 30 April amounted to

EUR98.3 million (2021: EUR37.1 million) (including intra-division

charter income), a 165.0% increase on the prior year (90.1%

increase on 2019). The increase was principally due to the easing

of travel restrictions as compared to the same period last year,

increased fuel surcharges and the new Dover -- Calais service which

commenced in June 2021.

For the year to 7 May, Irish Ferries carried 123,600 cars, an

increase of 682.3% on the previous year. Freight carryings were

223,900 RoRo units, an increase of 170.7% compared with 2021.

Excluding volumes on the Dover -- Calais route, Irish Ferries

carried 65,300 cars (an increase of 313.3% on 2021) and 100,800

RoRo freight units (an increase of 21.9%).

Performance against the prior year in the period since our last

trading update to 5 March shows strong growth, with car carryings

and RoRo freight (excluding Dover -- Calais carryings) up 442.4%

and 17.2% respectively on the same period in 2021.

Container and Terminal Division

Total revenues recorded in the period to 30 April amounted to

EUR71.7 million (2021: EUR56.4 million), a 27.1% increase on the

prior year (34.8% increase on 2019). This increase was

predominantly driven by the pass through of increased fuel costs

and vessel charter rates.

For the year to 7 May, container freight volumes shipped were

down 5.1% on the previous year at 117,800 teu (twenty foot

equivalent units), primarily due to weather related disruption in

the first quarter of the year. Units handled at our terminals in

Dublin and Belfast increased 0.3% year on year to 115,100

lifts.

Recent Developments

The Group's cost base has been affected by higher global prices,

particularly fuel prices and charter rates. In order to maintain

adequate returns to drive future development it has been necessary

to pass these increased costs through to customers.

The Isle of Inisheer entered service on the Dover -- Calais

route on 26 April 2022, having undergone drydocking and branding

changes following its delivery in January 2022.

In March, the Group acquired a container vessel, the CT Pachuca.

This brings to eight the total number of container vessels owned by

the Group. The vessel entered service with Eucon upon delivery.

Dublin Ferryport Inland Depot has been operational since January

2022, allowing for the storage and handling of empty containers

off-site. This has facilitated the commencement of the next stage

of our plans to increase container handling capacity at Dublin

Ferryport Terminals.

Dublin.

11 May 2022

Enquiries

Eamonn Rothwell, CEO +353 1 607 5628

David Ledwidge, CFO +353 1 607 5628

(END) Dow Jones Newswires

May 11, 2022 02:00 ET (06:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

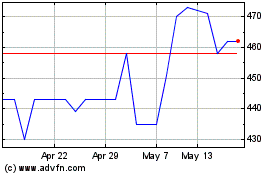

Irish Continental (LSE:ICGC)

Historical Stock Chart

From May 2024 to Jun 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jun 2023 to Jun 2024