Irish Continental Trading Statement

May 17 2019 - 2:01AM

UK Regulatory

TIDMICGC

IRISH CONTINENTAL GROUP plc : TRADING UPDATE

Volumes (Year to date, 11 May 2019)

2019 2018 Change

Cars 95,000 103,800 -8.5%

RoRo Freight 109,500 102,700 +6.6%

Container Freight (teu) 129,000 118,500 +8.9%

Terminal Lifts 119,600 111,300 +7.5%

Irish Continental Group (ICG) issues this trading update which covers

carryings for the year to date to 11 May 2019 and financial information

for the first four months of 2019, i.e. 1 January to 30 April with

comparisons against the corresponding period in 2018. All figures are

unaudited.

Consolidated Group revenue in the period was EUR102.3 million, an

increase of 6.1% compared with last year. Net debt at the end of April

was EUR88.4 million compared with EUR80.3 million at 31 December 2018.

It should be noted that ICG's revenue is weighted towards the summer

period due to the seasonality of tourism carryings. Fuel costs were

impacted by higher global fuel prices compared to the corresponding

period in the previous year.

Ferries Division

Total revenues recorded in the period to 30 April amounted to EUR51.7

million (including intra-division charter income), a 1.1% decrease on

the prior year. The decrease was principally due to lower tourism

volumes resulting from the planned suspension of fastcraft services on

the Dublin to Holyhead route in the period up to 14 March compared to

the prior year partially offset through increased freight volumes.

For the year to 11 May, in this seasonally less significant period for

tourism, Irish Ferries carried 95,000 cars, a decrease of 8.5% on the

previous year. Freight carryings were 109,500 RoRo units, an increase of

6.6% compared with 2018.

The planned suspension of fastcraft sailings in the off-peak season was

the primary reason for reduced tourism carrying in the period. In

addition, the proposed withdrawal of the United Kingdom ("UK") from the

European Union had some negative impact on UK passenger bookings in the

lead up to the proposed exit date of 29 March 2019. The recent agreement

between the Irish and British government to continue and formalise the

Common Travel Area whatever the outcome of the UK withdrawal

negotiations is a positive development.

Container and Terminal Division

Total revenues recorded in the period to 30 April amounted to EUR53.2

million, a 13.7% increase on the prior year. This increase was driven by

volumes, increased fuel surcharge against increased fuel costs and

additional ancillary revenues.

For the year to 11 May container freight volumes shipped were up 8.9% on

the previous year at 129,000 teu (twenty foot equivalent units) achieved

through increased load factors and additional capacity. Units handled at

our terminals in Dublin and Belfast increased 7.5% year on year to

119,600 lifts.

Group Development

The W.B. Yeats delivered in December 2018 commenced sailings on 22

January 2019, initially on the Dublin to Holyhead route before switching

to the Dublin to France service during March, swapping with the Epsilon.

The Dublin Swift also recommenced sailings on the Dublin to Holyhead

fastcraft service during March.

On 4 April, the Group took delivery of the container vessel Thetis D,

built in 2009 with a 1,421 teu container capacity. The vessel has been

on charter to a third party since acquisition by the Group. This

increases the ICG owned container fleet to 5 vessels.

On 11 April 2019, the Company announced it entered into a hire purchase

agreement for the sale of the vessel Oscar Wilde to buyers MSC

Mediterranean Shipping Company SA for an agreed consideration of EUR28.9

million, payable in instalments over 6 years. The vessel was delivered

to the buyer on 25 April.

At Belfast Port where the Group operates the sole container terminal at

Victoria Terminal Three, a 6 year extension to the current service

concession agreement has been concluded with Belfast Harbour

Commissioners ("BHC"). The arrangement will now extend to September 2026

with an option to extend at the discretion of BHC for a further 3 years

to 2029.

Dublin.

17 May 2019

Enquiries

Eamonn Rothwell, CEO, +353 1 607 5628

David Ledwidge, CFO, +353 1 607 5628

(END) Dow Jones Newswires

May 17, 2019 02:01 ET (06:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

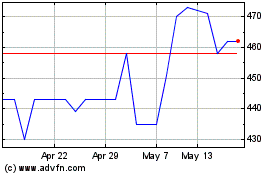

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jul 2023 to Jul 2024