Irish Continental Irish Continental Group Plc : Holding(s) In Company

January 19 2015 - 12:55PM

UK Regulatory

TIDMICGC

19 January 2015

Pursuant to its obligations under the Transparency (Directive

2004/109/EC) Regulations 2007 ("The Regulations"), Irish Continental

Group plc sets out below details of a notification received under The

Regulations.

Tom Corcoran

Company Secretary

STANDARD FORM TR-1

VOTING RIGHTS ATTACHED TO SHARES- ARTICLE 12(1) OF

DIRECTIVE 2004/109/EC

FINANCIAL INSTRUMENTS - ARTICLE 11(3) OF THE COMMISSION

DIRECTIVE 2007/14/EC

1. Identity of the issuer or the underlying issuer of

existing shares to which

voting rights are attached: Irish Continental Group

plc

2. Reason for the notification (please tick the appropriate

box or boxes):

[X] an acquisition or disposal of voting rights

[ ] an acquisition or disposal of financial instruments

which may result in

the acquisition of shares already issued to which

voting rights are attached

[ ] an event changing the breakdown of voting rights

3. Full name of person(s) subject to notification obligation:

Wellington Management Group LLP (Effective January

1, 2015, Wellington Management Company, LLP, a registered

US investment advisor, changed its name to Wellington

Management Group LLP ("Wellington Management Group")

and transferred its United States advisory business

to Wellington Management Company LLP, a Delaware limited

liability partnership.)

4. Full name of shareholder(s) if different from 3):

BNY Custodial Nominees (Ireland) Ltd.

BONY (Nominees) Ltd.

Brown Brothers Harriman

Chase Nominees Ltd.

Goldman Sachs Securities (Nominees) Ltd.

Nortrust Nominees Limited

State Street Nominees Limited

USBK William Blair Wellington

5. Date of the transaction and date on which the threshold

is crossed or reached:

16 January 2015

6. Date on which issuer notified:

19 January 2015

7. Threshold(s) that is/are crossed or reached: 7%

8. Notified Details:

A) Voting rights attached to shares

Class/type of shares Situation previous to

(if possible use the triggering

ISIN CODE) transaction Resulting situation after the triggering transaction

Number of Number

Number of voting of % of voting

Shares rights shares Number of voting rights rights

Direct Direct Indirect Direct Indirect

IE00BLP58571 Units 13,137,501 13,137,501 12,852,302 6.97%

SUBTOTAL A (based on

aggregate voting

rights) 12,852,302 6.97%

B) Qualifying Financial Instruments

Resulting situation after the triggering transaction

Exercise/

Type of financial Expiration Conversion Number of voting rights that may be acquired if the

instrument date Period/Date instrument is exercised/converted % of voting rights

SUBTOTAL B (in

relation to all

expiration dates)

Total (A+B) Number of voting rights % of voting rights

12,852,302 6.97%

9. Chain of controlled undertakings through which the

voting rights and/or the

financial instruments are effectively held, if applicable:

Wellington Management International Ltd is an investment

management entity that manages the assets of certain

funds and/or managed accounts and the assets under

its management include:

4,877,440 of interests described in Box 8A of this

notification

Wellington Management International Ltd is a direct

controlled undertaking of Wellington Management Global

Holdings, Ltd., which, in turn, is a direct controlled

undertaking of Wellington Investment Advisors Holdings

LLP, which, in turn, is a direct controlled undertaking

of Wellington Group Holdings LLP, which, in turn,

is a direct controlled undertaking of Wellington Management

Group LLP .

Wellington Management Company LLP is an investment

management entity that manages the assets of certain

funds and/or managed accounts and the assets under

its management include:

7,974,862 of interests described in Box 8A of this

notification

Wellington Management Company LLP is a direct controlled

undertaking of Wellington Investment Advisors Holdings

LLP, which, in turn, is a direct controlled undertaking

of Wellington Group Holdings LLP, which, in turn,

is a direct controlled undertaking of Wellington Management

Group LLP.

10. In case of proxy voting: [name of the proxy holder]

will cease to hold

[number] voting rights as of [date] .

11. Additional Information:

Done at [place] on [date] .

ANNEX TO THE STANDARD FORM TR-1

Identity of the person or legal entity subject to

a) the notification obligation

Full name (including legal form for legal entities) Wellington Management Group LLP

280 Congress Street, Boston, MA

Contact address (registerd office for legal entities) 02210 USA

Phone number 617-790-7265

Other useful information (at least legal representative

for legal persons)

b) Identity of the notifier, if applicable

Full name Mark O'Brien

Contact address 280 Congress Street, Boston, MA

02210 USA

Phone number 617-790-7265

beneficialownership@wellington.com

Other useful information Authorized Person

(e.g. functional relationship with the person or legal

entity subject to the notification obligation)

c) Additional information

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Irish Continental Group plc via Globenewswire

HUG#1888168

www.icg.ie

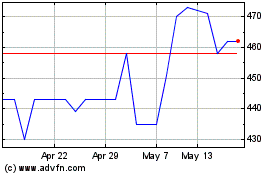

Irish Continental (LSE:ICGC)

Historical Stock Chart

From May 2024 to Jun 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jun 2023 to Jun 2024