Irish Continental Irish Continental Group Plc : Interim Management Statement

November 17 2014 - 2:00AM

UK Regulatory

TIDMICGC

INTERIM MANAGEMENT STATEMENT

9 months to the

Q3 Q3 end of September

Financial Highlights 2014 2013 2014 2013

EURm EURm EURm EURm

Revenue 93.4 84.7 224.1 205.6

EBITDA 28.1 26.9 42.1 42.7

Operating Profit 23.8 22.3 29.0 28.7

Current trading

In the seasonally most significant quarter of the year, the three months

to the end of September, Group revenue rose 10.3% to EUR93.4 million

(2013: EUR84.7 million) while EBITDA rose to EUR28.1 million, compared

with EUR26.9 million in the same quarter in 2013. Operating profit in

the quarter was EUR23.8 million versus EUR22.3 million in the same

period in 2013. Summer trading has been encouraging across most business

areas, with volume and revenue growth in the passenger, car and Roll on

Roll Off (RoRo) segments, partially offset by weaker container freight

volumes. Fuel costs in the quarter were EUR14.3 million (2013: EUR12.7

million) due to the additional sailings of the Epsilon, partially offset

by lower fuel prices.

Volumes 1 July - 15 November

In the 20 weeks from 1 July 2014 to 15 November 2014 total passengers

carried increased by 8%, while cars carried increased by 11%. In the

RoRo freight market, Irish Ferries volumes were up 26% in the four and a

half months. Container freight volumes for the same period were down 4%

at 105,000 teu, due to lower feeder traffic, while units lifted at our

ports were up 5% at 73,000 lifts.

Year to Date Volumes

Cumulatively, in the 46 weeks to 15 November 2014, total passengers

carried were up 5% at 1,507,500, while cars carried were up 9% at

347,200. RoRo freight volumes in the same period were up 22% on last

year at 216,200 units. Container freight volumes were down 1% at 247,700

teu, while units handled at our port terminals in Dublin and Belfast

rose by 6% to 165,700 lifts.

Cumulative Financial Results to the end of September (unaudited)

Group revenue for the nine months to the end of September 2014 was

EUR224.1 million (2013: EUR205.6 million), up 9.0%. Revenue in the

Ferries division was up 13.0% compared with the comparable period in

2013, while in the Container & Terminal division cumulative revenue was

up 2.5% year on year. EBITDA for the nine months was EUR42.1 million

(2013: EUR42.7 million), reflecting the additional operational costs of

the Epsilon which was introduced in late 2013. Operating profit for the

nine months was EUR29.0 million compared with EUR28.7 million in the

same period in 2013. Net debt at the end of September was EUR57.6

million compared with EUR71.9 million at 30 June 2014. Subsequent to the

quarter end the interim dividend of EUR6.4 million was paid.

Pensions

Separately, on 16 October 2014, the company announced that the Pensions

Authority had sanctioned the implementation of the deficit funding

proposal in respect of the main Irish Ferries Pension Scheme. Under the

terms of the proposal, the company will make deficit payments to the

scheme of EUR1.5 million per annum for a projected period of 10 years to

2023, or, until the deficit is eliminated, if earlier, with additional

payments of EUR0.5 million per annum to an escrow account over the same

period, the balance of which will also be payable to the Scheme in

certain circumstances.

Sulphur Directive

The EU Sulphur Directive will come into force on the North Sea and the

English Channel in approximately six weeks (1 January 2015). This will

reduce the permissible level of sulphur in fuel consumed in those areas

from 1% to 0.1 %. For the Group the main impact will be to require

vessels in the Eucon fleet to burn 0.1 % sulphur fuel while in the

English Channel. In Irish Ferries (until 2020 at least) the impact will

be limited to the section of the Ireland / France route which falls

within the English Channel. As 0.1% sulphur fuel is considerably more

expensive than fuel with 1% sulphur content, the Group is engaging with

its customers on the requirement to recover this additional

environmental cost, which must be borne by the end user.

Dublin

17 November 2014

Enquiries

Eamonn Rothwell, CEO, +353 1 607 5628

Garry O'Dea, Finance Director, +353 1 607 5628

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Irish Continental Group plc via Globenewswire

HUG#1871715

www.icg.ie

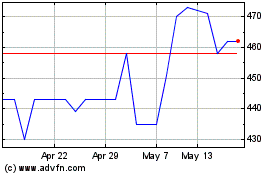

Irish Continental (LSE:ICGC)

Historical Stock Chart

From May 2024 to Jun 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jun 2023 to Jun 2024