Irish Continental Group plc : Interim Management Statement

November 14 2011 - 9:00AM

UK Regulatory

TIDMICGC

INTERIM MANAGEMENT STATEMENT

Key Points

Q3 Q3 9 months to 30 September

2011 2010 2011 2010

EURm EURm EURm EURm

Turnover 84.9 81.2 211.5 203.6

EBITDA 23.9 25.0 40.0 45.0

Operating Profit 18.5 19.0 25.0 27.8

Interim Management Statement

Irish Continental Group plc (ICG) issues its second Interim Management Statement

for 2011 which covers the period from 1 July 2011.

It should be noted that ICG's business is seasonally weighted towards the second

half of the year (and particularly the third quarter) where normally a higher

proportion of the Group's operating profit is generated than in the first six

months.

In the three months to 30 September, the Group recorded turnover of EUR84.9

million (up 4.6%) and EBITDA of EUR23.9 million compared with EUR25.0 million in the

same quarter in 2010. The reduction in EBITDA is due to sustained high oil

prices (up EUR3.7 million in the quarter) and soft tourism markets partially

offset by higher yields in the car market and volume growth in freight.

Operating profit in the quarter was EUR18.5 million versus EUR19.0 million in the

same period in 2010.

Volumes July - October

In the ferries division, the trends outlined in our half yearly report continued

in the period from July to October with lower car volumes (down 6.2%) but at

higher yields. Passenger numbers were higher (up 0.3%) reflecting increased

coach, rail and foot passengers, and there was also growth in RoRo freight (up

4.7% in the 4 months). Container freight volumes for the same period were up

4.1% at 138,400 teu, while units lifted at our ports were up 12.0% at 63,700

lifts.

Year to Date Volumes

In the year to date (ten months to 31 October 2011), passengers carried were

down 1.7% at 1,353,900, while car numbers were down 4.7% at 311,000. RoRo

freight volumes in the same period were up 9.0% on last year at 161,600 units

reflecting the benefits of reduced competing capacity on the Dublin Liverpool

route. Container freight volumes, which had been 2.5% behind the previous year

at the six month stage, were in line with the previous year after 10 months at

343,700 teu, while units handled at our port terminals in Dublin and Belfast

were up by 13.4% at 157,900 lifts.

Cumulative Financial Results to 30 September (unaudited)

Group revenue for the nine months to 30(th) September 2011 was EUR211.5 million

(2010: EUR203.6 million). Revenue in the Ferries division was in line with the

comparable period in 2010, while in the Container & Terminal division cumulative

revenue was up 9.7% year on year. EBITDA for the nine months was EUR40.0 million

(2010: EUR45.0 million), while operating profit for the nine months was EUR25.0

million compared with EUR27.8 million in the same period in 2010, a reduction of

10.1%. Year to date, i.e. to 30 September 2011, fuel costs are EUR38.6 million

versus EUR30.6 million in 2010.

Financial Position

During the quarter, there was an increase in working capital for seasonal

reasons and also as a consequence of the increase in our freight business. A

dividend of EUR8.2 million was also paid during the quarter. At the end of the

quarter, net debt stood at EUR13.0 million compared with EUR14.4 million at 30 June

2011.

Outlook

The economic backdrop remains challenging. The impact of the adjustments in

public finances in both Ireland and the UK is affecting both tourism and freight

demand although the reduction in vessel capacity on Dublin Liverpool has helped

to offset the weak freight demand. Nevertheless, we have carefully managed our

cost base and our operational capacity to continue to be able to compete

successfully in this tough trading environment. The continued high level of

fuel prices (expected to result in a fuel bill for the year of approximately EUR52

million) however means that earnings for the year, as previously indicated, will

be lower than in 2010.

14 Nov 2011

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Irish Continental Group plc via Thomson Reuters ONE

[HUG#1563503]

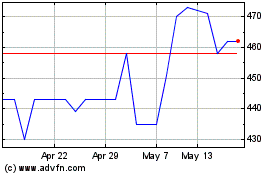

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jul 2023 to Jul 2024