TIDMHUW

RNS Number : 1597A

Helios Underwriting Plc

25 September 2015

25 September 2015

Helios Underwriting plc

("Helios Underwriting" or the "Company")

Interim results for the six months ended 30 June 2015

Helios Underwriting plc, which provides investors with a limited

liability direct investment into the Lloyd's insurance market,

announces its unaudited results for the six months ended 30 June

2015.

Financial results summary

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Gross premium written 11,942 10,183 17,062

Net earned premium 7,366 6,426 13,373

Net investment income 215 268 516

Other income - - 29

Net insurance claims and

loss adjustment expenses (4,469) (3,490) (5,915)

Operating expenses (3,039) (2,680) (6,773)

Goodwill and amortisation (325) (328) (96)

(Loss)/profit before tax (252) 196 1,134

(Loss)/profit attributable

to equity shareholders (226) 156 1,043

(Loss)/earnings per share (2.62p) 1.83p 12.23p

For further information please contact:

HUW nigel.hanbury@huwplc.com

Nigel Hanbury - Chief

Executive

Smith & Williamson Corporate

Finance

David Jones 020 7131 4000

Westhouse Securities

Robert Finlay 020 7601 6100

About HUW

HUW provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). HUW's subsidiary underwriting

vehicles trade within the Lloyd's insurance market as corporate

members of Lloyd's writing GBP27 million of capacity for the 2015

account. The portfolio provides a good spread of classes of

business being concentrated in property insurance and reinsurance.

For further information please visit www.huwplc.com.

Chairman's Statement

During the first half of 2015 we continued to implement our

strategy of building our portfolio of capacity through the purchase

of another four entities in exchange for cash and shares, plus two

further entities which were acquired post June 2015 in exchange for

shares. This brings our total 2015 acquisitions to six, increasing

the portfolio capacity by GBP6.3m in 2015 to date, an increase of

31%. We will continue to retain the risk on the mature underwriting

years on the capacity that we acquire in a financial year. We

believe that we can benefit from the improvements in profit

expectations by the underlying syndicates.

Our first half year figures have been affected by the increased

reinsurance expenditure on Stop Loss policies incurred in the first

half, which is consistent with our strategy of trading with lower

risk on the most recent open underwriting years. This is intended

to limit our exposure in the event of a major loss to less than 10%

of shareholder equity. The Group retains full exposure to changes

in open years of account on the entities acquired during the year,

which should help advance second half year profits.

Our quota share arrangement whereby 70% of the risk on the most

recent open years is ceded to reinsurers will continue into 2016

due to current market conditions. This provides the reinsurers with

access to Lloyds' capacity and the capital provided gives Helios

the flexibility to deploy its resources in building its

portfolio.

Having acquired some 19 vehicles since inception the Board has

examined the advantages of the consolidation of vehicles, and has

decided that Helios would be well served with just one trading

vehicle from the start of 2016. This will ease the administrative

burden as well as improving our capital ratios.

The Parent Company's adjusted net assets plus Humphrey & Co

valuation of the Group's underwriting subsidiaries at the period

end is GBP16.4m, up from GBP14.7m at December 2014. This equates to

GBP1.83 per share, up from GBP1.72.

Vehicles have recently sold at premiums to the Humphrey & Co

valuations, but there are still a significant number for sale which

may lead to more modest prices.

Sir Michael Oliver

Non-executive Chairman

24 September 2015

Condensed Consolidated Statement of Financial Position

At 30 June 2015

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

--------------------------------- ----- ---------- ---------- ------------

Assets

Intangible assets 4,868 3,828 3,770

Reinsurance share of

assets

- reinsurers' share of

claims outstanding 3 4,851 4,221 4,682

- reinsurers' share of

unearned premium 3 2,278 1,637 1,014

Other receivables, including

insurance receivables 19,040 14,438 16,379

Prepayments and accrued

income 3,114 2,307 2,067

Financial assets at fair

value 8 25,388 21,909 22,977

Cash and cash equivalents 5,127 3,368 3,605

Total assets 64,666 51,708 54,494

--------------------------------- ----- ---------- ---------- ------------

Liabilities

Insurance liabilities:

- claims outstanding 3 28,258 23,668 26,179

- unearned premium 3 12,368 9,415 8,005

Deferred income tax liabilities 2,331 1,603 2,137

Other payables, including

insurance payables 9,652 5,909 6,213

Accruals and deferred

income 1,652 1,515 1,475

Total liabilities 54,261 42,110 44,009

--------------------------------- ----- ---------- ---------- ------------

Shareholders' equity

Share capital 9 896 853 853

Share premium 9 7,556 6,996 6,996

Retained earnings 10 1,953 1,749 2,636

--------------------------------- ----- ---------- ---------- ------------

Total shareholders' equity 10,405 9,598 10,485

--------------------------------- ----- ---------- ---------- ------------

Total liabilities and

shareholders' equity 64,666 51,708 54,494

--------------------------------- ----- ---------- ---------- ------------

Condensed Consolidated Income Statement

Six months ended 30 June 2015

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

-------------------------------------- ----- ---------- ---------- -------------

Gross premium written 11,942 10,183 17,062

Reinsurance premium ceded (3,125) (2,008) (3,418)

-------------------------------------- ----- ---------- ---------- -------------

Net premiums written 8,817 8,175 13,644

Change in unearned gross

premium provision (2,369) (2,435) (243)

Change in unearned reinsurance

premium provision 918 686 (28)

-------------------------------------- ----- ---------- ---------- -------------

(1,451) (1,749) (271)

-------------------------------------- ----- ---------- ---------- -------------

Net earned premium 2 7,366 6,426 13,373

Net investment income 4 215 268 516

Other income - - 29

-------------------------------------- ----- ---------- ---------- -------------

Revenue 7,581 6,694 13,918

-------------------------------------- ----- ---------- ---------- -------------

Gross claims paid (4,843) (3,291) (7,435)

Reinsurance share of gross

claims paid 790 593 1,375

-------------------------------------- ----- ---------- ---------- -------------

Claims paid, net of reinsurance (4,053) (2,698) (6,060)

-------------------------------------- ----- ---------- ---------- -------------

Change in provision for

gross claims 403 (464) 464

Reinsurance share of change

in provision for gross claims (819) (328) (319)

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 02:00 ET (06:00 GMT)

-------------------------------------- ----- ---------- ---------- -------------

Net change in provision

for claims (416) (792) 145

-------------------------------------- ----- ---------- ---------- -------------

Net insurance claims and

loss adjustment expenses 2 (4,469) (3,490) (5,915)

Expenses incurred in insurance

activities 2 (2,703) (2,203) (5,800)

Other operating expenses 2 (336) (477) (973)

-------------------------------------- ----- ---------- ---------- -------------

Operating expenses (3,039) (2,680) (6,773)

-------------------------------------- ----- ---------- ---------- -------------

Operating profit before

goodwill 2 73 524 1,230

Goodwill on bargain purchase 11 196 115 785

Impairment of goodwill 11 (45) (5) -

Amortisation of syndicate

capacity (476) (438) (881)

-------------------------------------- ----- ---------- ---------- -------------

(Loss)/profit before tax (252) 196 1,134

Income tax credit/(charge) 5 26 (40) (91)

(Loss)/profit attributable

to equity shareholders 10 (226) 156 1,043

-------------------------------------- ----- ---------- ---------- -------------

(Loss)/earnings per share

attributable to equity shareholders

Basic and diluted 6 (2.62p) 1.83p 12.23p

-------------------------------------- ----- ---------- ---------- -------------

The (loss)/profit and earnings per share set out above are in

respect of continuing operations.

The accounting policies and notes are an integral part of these

Condensed Consolidated Interim Financial Statements.

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2015

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------- ---------- ---------- -------------

Cash flow from operating activities

Results of operating activities (252) 196 1,134

Interest received (2) (3) (2)

Investment income (191) (240) (435)

Goodwill on bargain purchase (196) (115) (785)

Impairment of goodwill 45 5 -

Profit on sale of intangible

assets - - (36)

Amortisation of intangible

assets 476 438 881

Change in fair value of investments 255 41 156

Changes in working capital:

* Decrease/(increase) in other receivables 1,261 (1,214) (706)

* Increase in other payables 1,883 978 1,164

* Net (decrease)/increase in technical provisions (797) 274 (109)

Income tax paid 2 (49) (33)

Net cash inflow/(outflow) from

operating activities 2,484 311 (1,229)

-------------------------------------------------------------- ---------- ---------- -------------

Cash flows from investing activities

Interest received 2 3 2

Investment income 191 240 435

Purchase of intangible assets - - (439)

Net inflow of financial assets

at fair value 1,822 3,749 5,122

Acquisition of subsidiary,

net of cash acquired (2,657) (1,617) (3,930)

Proceeds from disposal of intangible

assets - - 504

Net cash (outflow)/inflow from

investing activities (642) 2,375 1,694

-------------------------------------------------------------- ---------- ---------- -------------

Cash flows from financing activities

Dividends paid (320) (384) (384)

-------------------------------------------------------------- ---------- ---------- -------------

Net cash outflow from financing

activities (320) (384) (384)

-------------------------------------------------------------- ---------- ---------- -------------

Net increase in cash and cash

equivalents 1,522 2,302 2,539

Cash and cash equivalents at

beginning of period 3,605 1,066 1,066

Cash and cash equivalents at

end of period 5,127 3,368 3,605

-------------------------------------------------------------- ---------- ---------- -------------

The accounting policies and notes are an integral part of these

Condensed Consolidated Interim Financial Statements.

Condensed Statement of Changes in Shareholders' Equity

Six months ended 30 June 2015

For the six months ended 30 June 2015

Ordinary

share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- --------- --------- ---------- --------

At 1 January 2015 853 6,996 2,636 10,485

Loss for the period attributable

to equity shareholders - - (226) (226)

Dividends paid - - (457) (457)

New ordinary shares issued 43 560 - 603

At 30 June 2015 896 7,556 1,953 10,405

----------------------------------- --------- --------- ---------- --------

For the six months ended 30 June 2014

Ordinary

share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------- --------- ---------- --------

At 1 January 2014 853 6,996 1,977 9,826

Profit for the period attributable

to equity shareholders - - 156 156

Dividends paid - - (384) (384)

New ordinary shares issued - - - -

At 30 June 2014 853 6,996 1,749 9,598

------------------------------------- --------- --------- ---------- --------

For the twelve months ended 31 December 2014

Ordinary

share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2014 853 6,996 1,977 9,826

Profit for the year attributable

to equity shareholders - - 1,043 1,043

Dividends paid - - (384) (384)

New ordinary shares issued - - - -

---------------------------------- --------- --------- ---------- --------

At 31 December 2014 853 6,996 2,636 10,485

----------------------------------- --------- --------- ---------- --------

The accounting policies and notes are an integral part of these

Condensed Consolidated Interim Financial Statements.

Notes to the Interim Financial Statements

Six months ended 30 June 2015

1. Accounting policies

Basis of preparation

The Condensed Consolidated Interim Financial Statements have

been prepared using accounting policies consistent with

International Financial Reporting Standards (IFRSs) and in

accordance with International Accounting Standard (IAS) 34 Interim

Financial Reporting.

The Condensed Consolidated Interim Financial Statements are

prepared for the six months ended 30 June 2015.

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 02:00 ET (06:00 GMT)

The Condensed Consolidated Interim Financial Statements

incorporate the results of Helios Underwriting plc, Hampden

Corporate Member Limited, Nameco (No. 365) Limited, Nameco (No.

605) Limited, Nameco (No. 321) Limited, Nameco (No. 917) Limited,

Nameco (No. 229) Limited, Nameco (No. 518) Limited, Nameco (No.

804) Limited, Halperin Limited, Bernul Limited, Dumasco Limited,

Nameco (No. 311) Limited, Nameco (No. 402) Limited, Updown

Underwriting Limited, Nameco (No. 507) Limited, Nomina No 035 LLP,

Nomina No 342 LLP, Nomina No 380 LLP, Nomina No 372 LLP and Helios

UTG Partner Limited.

The Condensed Consolidated Interim Financial Statements for the

six months ended 30 June 2015 and 2014 are unaudited, but have been

subject to review by the Group's auditors. The Condensed

Consolidated Interim Financial Statements have been prepared in

accordance with the accounting policies adopted for the year ended

31 December 2014.

The underwriting data on which these Condensed Consolidated

Interim Financial Statements are based upon has been supplied by

the managing agents of those syndicates which the Group supports.

The data supplied is the 100% figures for each syndicate. The Group

has applied its share of the syndicate participations to the gross

figures to derive its share of the syndicates transactions, assets

and liabilities.

Significant accounting policies

The Condensed Consolidated Interim Financial Statements have

been prepared under the historical cost convention. The same

accounting policies, presentation and methods of computation are

followed in these Condensed Consolidated Interim Financial

Statements as were applied in the preparation of the Group

Financial Statements for the year ended 31 December 2014. The new

standards and amendments to standards and interpretations effective

after 1 January 2015, as disclosed in the Annual Report for the

year ended 31 December 2014, have not had a significant impact on

the Condensed Consolidated Interim Financial Statements at 30 June

2015.

2. Segmental information

The Group has three segments which represent the primary way in

which the Group is managed:

-- Syndicate participation;

-- Investment management;

-- Other corporate activities.

6 months ended Other

30 June 2015 Unaudited Syndicate Investment corporate

participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------------- ------------ ------------ --------

Net earned premium 8,166 - (800) 7,366

Net investment

income 206 9 - 215

Other income - - - -

Net insurance claims

and loss adjustment

expenses (4,469) - - (4,469)

Expenses incurred

in insurance activities (2,420) - (283) (2,703)

Other operating

expenses - - (336) (336)

Goodwill on bargain

purchase - - 196 196

Impairment of goodwill - - (45) (45)

Amortisation of

syndicate capacity - - (476) (476)

Loss before tax 1,483 9 (1,744) (252)

-------------------------- --------------- ------------ ------------ --------

6 months ended Other

30 June 2014 Unaudited Syndicate Investment corporate

participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------------- ------------ ------------ --------

Net earned premium 6,502 - (76) 6,426

Net investment

income 244 24 - 268

Other income - - - -

Net insurance claims

and loss adjustment

expenses (3,490) - - (3,490)

Expenses incurred

in insurance activities (2,030) - (173) (2,203)

Other operating

expenses - - (477) (477)

Goodwill on bargain

purchase - - 115 115

Impairment of goodwill - - (5) (5)

Amortisation of

syndicate capacity - - (438) (438)

Profit before tax 1,226 24 (1,054) 196

-------------------------- --------------- ------------ ------------ --------

12 months ended Other

31 December 2014 Syndicate Investment corporate

Audited participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------------- ------------ ------------ --------

Net earned premium 13,838 - (465) 13,373

Net investment

income 473 43 - 516

Other income - - 29 29

Net insurance claims

and loss adjustment

expenses (5,915) - - (5,915)

Expenses incurred

in insurance activities (5,800) - - (5,800)

Other operating

expenses (87) - (886) (973)

Goodwill on bargain

purchase - - 785 785

Impairment of goodwill - - - -

Amortisation of

syndicate capacity - - (881) (881)

Profit before tax 2,509 43 (1,418) 1,134

-------------------------- --------------- ------------ ------------ --------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

Net earned premium within 2015 other corporate activities

totalling GBP800,000 (2014: GBP76,000) includes the net Group quota

share reinsurance premium payable to Hampden Insurance PCC

(Guernsey) Limited - Cell 6 for the 2013, 2014 and 2015

underwriting years of account of GBP400,000 (2014: GBP26,000). Also

included is the stop loss premium payable to Hampden Insurance PCC

(Guernsey) Limited - Cell 7 for the 2015 underwriting year of

account of GBP181,000 (2014: GBP50,000), the Hampden aggregate stop

loss policy premium payable to Hampden Insurance PCC (Guernsey)

Limited - Cell 1 for the 2013, 2014 and 2015 underwriting years of

account of GBP212,000 (2014: GBPnil) and Chaucer Syndicate 1176

premium for the 2015 underwriting year of account of GBP7,000

(2013: GBPnil).

Syndicate participation represents the Groups direct share of

the underlying syndicate's results for the period.

3. Insurance liabilities and reinsurance balances

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------------- -------- ------------ --------

At 1 January 2015 26,179 4,682 21,497

Increase in reserves arising from acquisition of subsidiary undertaking 4,825 (845) 5,670

Movement of reserves (403) (819) 416

Other movements (2,343) 1,833 (4,176)

------------------------------------------------------------------------- -------- ------------ --------

At 30 June 2015 28,258 4,851 23,407

------------------------------------------------------------------------- -------- ------------ --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------------- -------- ------------ --------

At 1 January 2015 8,005 1,014 6,991

Increase in reserves arising from acquisition of subsidiary undertaking 2,269 (421) 2,690

Movement of reserves 2,369 918 1,451

Other movements (275) 767 (1,042)

------------------------------------------------------------------------- -------- ------------ --------

At 30 June 2015 12,368 2,278 10,090

------------------------------------------------------------------------- -------- ------------ --------

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 02:00 ET (06:00 GMT)

Included within other movements are the 2012 and prior years'

reinsured into the 2013 year of account on which the Group does not

participate and currency exchange differences.

4. Net investment income

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- -------------

Investment income 191 240 435

Realised gains on financial

investments at fair value

through income statement 193 2 279

Unrealised (losses)/gains

on financial investments

at fair value through

income statement (171) 23 (156)

Investment management

expenses - - (44)

Bank interest 2 3 2

----------------------------- ---------- ---------- -------------

Net investment income 215 268 516

----------------------------- ---------- ---------- -------------

5. Income tax expense

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- -------------

Income tax credit/(expense) 26 (40) (91)

----------------------------- ---------- ---------- -------------

The income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used is 20% (2014: 21.49%). Material disallowed terms have been

adjusted for in the income tax calculation.

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

The Group has no dilutive potential ordinary shares.

Earnings per share have been calculated in accordance with IAS

33.

Reconciliation of the earnings and weighted average number of

shares used in the calculation is set out below.

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

(Loss)/profit for the (GBP226,000) GBP156,000 GBP1,043,000

period

---------------------------- ------------- ----------- -------------

Weighted average number

of shares in issue 8,640,938 8,526,948 8,526,948

---------------------------- ------------- ----------- -------------

Basic and diluted earnings

per share (p) (2.62p) 1.83p 12.23p

---------------------------- ------------- ----------- -------------

7. Dividends

During the period a dividend of 5.1p per share (2014: 4.5p per

share) was paid totalling GBP457,000 (see note 10).

8. Financial assets at fair value

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities.

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly.

Level 3: techniques which use inputs that have a significant

effect on the recorded fair value that are not based on observable

market data.

As at 30 June 2015, the Group held GBP20,817,000 (31 December

2014: GBP19,742,000) Level 1 Financial Assets and GBP4,571,000 (31

December 2014: GBP3,235,000) Level 2 Financial Assets. The Group

has no Level 3 investments (31 December 2014: GBPnil).

9. Share capital and share premium

Ordinary

share Share

Allotted, called up and fully capital premium Total

paid GBP'000 GBP'000 GBP'000

------------------------------------------ --------- --------- ---------

8,526,948 ordinary shares of 10p

each and share premium at 30 June

2014 853 6,996 7,849

8,526,948 ordinary shares of 10p

each and share premium at 31 December

2014 853 6,996 7,849

8,956,787 ordinary shares of 10p

each and share premium at 30 June

2015 896 7,556 8,452

------------------------------------------ --------- --------- ---------

10. Retained earnings

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------- ---------- ---------- ------------

At 1 January 2,636 1,977 1,977

(Loss)/profit attributable

to equity shareholders (226) 156 1,043

Dividends paid (457) (384) (384)

---------------------------- ---------- ---------- ------------

At 30 June 2015 1,953 1,749 2,636

---------------------------- ---------- ---------- ------------

11. Acquisition of limited liability vehicles

In order to increase the Group's underwriting capacity, the

Company has, since the balance sheet date, acquired 100% of the

voting rights (either directly or indirectly) of the following

Limited Liability Vehicles:

Nameco (No. 311) Limited

On 8 January 2015 Helios Underwriting plc acquired 100% of the

issued share capital of Nameco (No. 311) Limited for a total

consideration of GBP926,000. Nameco (No. 311) Limited is

incorporated in England and Wales and is a corporate member of

Lloyd's.

The acquisition has been accounted for using the acquisition

method of accounting. After the alignment of accounting policies

and other adjustments to the valuation of assets and liabilities to

reflect their fair value at acquisition, the fair value of the net

assets was GBP982,000. Negative goodwill of GBP56,000 arose on

acquisition and has been immediately recognised as goodwill on

bargain purchase in the income statement. The following table

explains the fair value adjustments made to the carrying values of

the major categories of assets and liabilities at the date of

acquisition:

Carrying

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

--------------------------------- --------- ------------ -----------

Intangible assets 4 328 332

Reinsurance assets:

- reinsurers' share of claims

outstanding 190 - 190

- reinsurers' share of unearned

premium 96 - 96

Other receivables, including

insurance receivables 1,014 172 1,186

Prepayments and accrued income 112 - 112

Financial assets at fair value 907 - 907

Cash and cash equivalents 234 - 234

Insurance liabilities:

- claims outstanding (1,029) - (1,029)

- unearned premium (506) - (506)

Deferred income tax liabilities (72) (100) (172)

Other payables, including

insurance payables (323) - (323)

Accruals and deferred income (45) - (45)

--------------------------------- --------- ------------ -----------

Net assets acquired 582 400 982

--------------------------------- --------- ------------ -----------

Satisfied by:

Cash and cash equivalents 926 - 926

--------------------------------- --------- ------------ -----------

Negative goodwill 344 (400) (56)

--------------------------------- --------- ------------ -----------

Nameco (No. 402) Limited

On 20 February 2015 Helios Underwriting plc acquired 100% of the

issued share capital of Nameco (No. 402) Limited for a total

consideration of GBP823,000. Nameco (No. 402) Limited is

incorporated in England and Wales and is a corporate member of

Lloyd's.

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 02:00 ET (06:00 GMT)

The acquisition has been accounted for using the acquisition

method of accounting. After the alignment of accounting policies

and other adjustments to the valuation of assets and liabilities to

reflect their fair value at acquisition, the fair value of the net

assets was GBP778,000. Goodwill of GBP45,000 arose on acquisition.

The following table explains the fair value adjustments made to the

carrying values of the major categories of assets and liabilities

at the date of acquisition:

Carrying

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

--------------------------------- --------- ------------ -----------

Intangible assets 1 346 347

Reinsurance assets:

- reinsurers' share of claims

outstanding 166 - 166

- reinsurers' share of unearned

premium 78 - 78

Other receivables, including

insurance receivables 752 265 1,017

Prepayments and accrued income 95 - 95

Financial assets at fair value 881 - 881

Cash and cash equivalents 60 - 60

Insurance liabilities:

- claims outstanding (973) - (973)

- unearned premiums (437) - (437)

Deferred income tax liabilities (75) (122) (197)

Other payables, including

insurance payables (213) - (213)

Accruals and deferred income (46) - (46)

--------------------------------- --------- ------------ -----------

Net assets acquired 289 489 778

--------------------------------- --------- ------------ -----------

Satisfied by:

Cash and cash equivalents 823 - 823

--------------------------------- --------- ------------ -----------

Goodwill 534 (489) 45

--------------------------------- --------- ------------ -----------

Updown Underwriting Limited

On 13 March 2015 Helios Underwriting plc acquired 100% of the

issued share capital of Updown Underwriting Limited for a total

consideration of GBP1,202,000. Updown Underwriting Limited is

incorporated in England and Wales and is a corporate member of

Lloyd's.

The acquisition has been accounted for using the acquisition

method of accounting. After the alignment of accounting policies

and other adjustments to the valuation of assets and liabilities to

reflect their fair value at acquisition, the fair value of the net

assets was GBP1,259,000. Negative goodwill of GBP57,000 arose on

acquisition and has been immediately recognised as goodwill on

bargain purchase in the income statement. The following table

explains the fair value adjustments made to the carrying values of

the major categories of assets and liabilities at the date of

acquisition:

Carrying

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

--------------------------------- --------- ------------ -----------

Intangible assets - 411 411

Reinsurance assets:

- reinsurers' share of claims

outstanding 186 - 186

- reinsurers' share of unearned

premium 76 - 76

Other receivables, including

insurance receivables 1,307 - 1,307

Prepayments and accrued income 84 - 84

Financial assets at fair value 1,037 - 1,037

Cash and cash equivalents 149 - 149

Insurance liabilities:

- claims outstanding (1,111) - (1,111)

- unearned premiums (414) - (414)

Deferred income tax liabilities (106) (82) (188)

Other payables, including

insurance payables (230) - (230)

Accruals and deferred income (48) - (48)

--------------------------------- --------- ------------ -----------

Net assets acquired 930 329 1,259

--------------------------------- --------- ------------ -----------

Satisfied by:

Cash 600 - 600

Shares issued by the company 602 - 602

--------------------------------- --------- ------------ -----------

Negative goodwill 272 (329) (57)

--------------------------------- --------- ------------ -----------

Nameco (No. 507) Limited

On 12 June 2015 Helios Underwriting plc acquired 100% of the

issued share capital of Nameco (No. 507) Limited for a total

consideration of GBP900,000. Nameco (No. 507) Limited is

incorporated in England and Wales and is a corporate member of

Lloyd's.

The acquisition has been accounted for using the acquisition

method of accounting. After the alignment of accounting policies

and other adjustments to the valuation of assets and liabilities to

reflect their fair value at acquisition, the fair value of the net

assets was GBP983,000. Negative goodwill of GBP83,000 arose on

acquisition and has been immediately recognised as goodwill on

bargain purchase in the income statement. The following table

explains the fair value adjustments made to the carrying values of

the major categories of assets and liabilities at the date of

acquisition:

Carrying

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

--------------------------------- --------- ------------ -----------

Intangible assets 26 463 489

Reinsurance assets:

- reinsurers' share of claims

outstanding 303 - 303

- reinsurers' share of unearned

premium 171 - 171

Other receivables, including

insurance receivables 1,408 161 1,569

Prepayments and accrued income 226 - 226

Financial assets at fair value 1,429 - 1,429

Cash and cash equivalents 150 - 150

Insurance liabilities:

- claims outstanding (1,712) - (1,712)

- unearned premiums (912) - (912)

Deferred income tax liabilities (124) (125) (249)

Other payables, including

insurance payables (422) - (422)

Accruals and deferred income (59) - (59)

--------------------------------- --------- ------------ -----------

Net assets acquired 484 499 983

--------------------------------- --------- ------------ -----------

Satisfied by:

Cash and cash equivalents 900 - 900

--------------------------------- --------- ------------ -----------

Negative goodwill 416 (499) (83)

--------------------------------- --------- ------------ -----------

12. Related party transactions

Helios Underwriting plc has provided inter-company loans to its

subsidiaries which are repayable on three months' notice provided

it does not jeopardise each subsidiary's ability to meet its

liabilities as they fall due. All inter-company loans are therefore

classed as falling due within one year. The amounts outstanding as

at 30 June 2015 are set out below:

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

Company GBP'000 GBP'000 GBP'000

---------------------------------- ---------- ---------- ------------

Balances due from/(to) Group

companies at the period end:

Hampden Corporate Member Limited 335 807 562

Nameco (No. 365) Limited 50 65 58

Nameco (No. 605) Limited (118) 210 199

Nameco (No. 321) Limited (35) 74 5

Nameco (No. 917) Limited 221 569 217

Nameco (No. 229) Limited 13 42 62

Nameco (No. 518) Limited (33) (17) (5)

Nameco (No. 804) Limited 99 298 405

Halperin Limited (48) (184) 15

Bernul Limited (33) (263) 195

Dumasco Limited (24) - 472

Nameco (No. 311) Limited (181) - -

Nameco (No. 402) Limited (241) - -

Updown Underwriting Limited (197) - -

Nameco (No. 507) Limited - - -

Nomina No 035 LLP - - -

Nomina No 342 LLP - - -

Nomina No 372 LLP - - -

Nomina No 380 LLP - - -

Helios UTG Partner Limited 1,776 2,143 1,772

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 02:00 ET (06:00 GMT)

Total 1,584 3,744 3,957

---------------------------------- ---------- ---------- ------------

The Limited Liability Vehicles are 100% subsidiaries of the

Company (either directly or indirectly) and have entered into a

management agreement with Nomina plc. Jeremy Evans, a Director of

Helios Underwriting plc and its subsidiary companies, is also a

Director of Nomina plc. Under the agreement, Nomina plc provides

management and administration, financial, tax and accounting

services to the Group for an annual fee of GBP108,000 (2014:

GBP66,000).

The Limited Liability Vehicles have entered into a member's

agent agreement with Hampden Agencies Limited. Jeremy Evans, a

Director of Helios Underwriting plc and its subsidiary companies,

is also a Director of Hampden Capital plc which controls Hampden

Agencies Limited. Under the agreement the Limited Liability

Vehicles will pay Hampden Agencies Limited a fee based on a fixed

amount, plus a fee which will vary depending upon the total level

of Group underwriting capacity. In addition, some Limited Liability

Vehicles will pay profit commission on a sliding scale from 1% of

the net profit up to a maximum of 10%. The total fees payable for

2015 and 2014 are set out below:

30 June 30 June 31 December

2015 2014 2014

Unaudited Unaudited Audited

Company GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- ------------

Hampden Corporate Member

Limited 43 38 38

Nameco (No. 365) Limited 11 7 7

Nameco (No. 605) Limited 36 18 18

Nameco (No. 321) Limited 14 7 7

Nameco (No. 917) Limited 7 6 6

Nameco (No. 229) Limited 10 7 7

Nameco (No. 518) Limited 18 10 10

Nameco (No. 804) Limited 32 24 24

Halperin Limited 14 9 9

Bernul Limited 9 10 6

Dumasco Limited - - 11

Nameco (No. 311) Limited 17 - -

Nameco (No. 402) Limited 18 - -

Updown Underwriting Limited 1 - -

Nameco (No. 507) Limited 26 - -

Nomina No 035 LLP 14 9 9

Nomina No 342 LLP 14 9 9

Nomina No 380 LLP 13 14 14

Nomina No 372 LLP 16 12 12

Helios UTG Partner Limited - - -

----------------------------- ---------- ---------- ------------

Total 313 180 187

----------------------------- ---------- ---------- ------------

The Group has entered into a 50% quota share reinsurance

contract for the 2013 underwriting year of account and a 70% quota

share reinsurance contact for the 2014 and 2015 underwriting years

of account with Hampden Insurance PCC (Guernsey) Limited, a company

registered in Guernsey.

Nigel Hanbury, a Director of Helios Underwriting plc and its

subsidiary companies, is also a Director and majority shareholder

in Hampden Insurance PCC (Guernsey) Limited. Hampden Capital Plc, a

substantial shareholder in Helios Underwriting plc is also a

substantial shareholder in Hampden Insurance PCC (Guernsey)

Limited. Under the agreements, the Group accrued a net reinsurance

premium payable of GBP400,000 during the period. A total cumulative

amount owed to Hampden Insurance PCC (Guernsey) Limited of

GBP886,000 (31 December 2014: GBP486,000) has been recognised in

the balance sheet.

The underwriting year of account quota share reinsurance

contract that each group subsidiary participates in is detailed

below:

Company

------------------------- ----- ----- -----

Hampden Corporate 2013 2014 2015

Member Limited

Nameco (No. 365) Limited 2013 2014 2015

Nameco (No. 605) Limited 2013 2014 2015

Nameco (No. 321) Limited 2013 2014 2015

Nameco (No. 917) Limited 2013 2014 2015

Nameco (No. 229) Limited 2013 2014 2015

Nameco (No. 518) Limited 2013 2014 2015

Nameco (No. 804) Limited - 2014 2015

Halperin Limited - 2014 2015

Bernul Limited - 2014 2015

Nomina No 035 LLP - 2014 2015

Nomina No 342 LLP - 2014 2015

Nomina No 380 LLP - 2014 -

Nomina No 372 LLP - 2014 2015

Dumasco Limited - - -

Nameco (No. 311) Limited - - 2015

Nameco (No. 402) Limited - - 2015

Updown Underwriting - - 2015

Limited

Nameco (No. 507) Limited - - -

13. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA")

in which the Company's subsidiaries participate as corporate

members of Lloyd's are as follows:

Syndicate Allocated capacity

or Year of account

Managing or Members' 2013 2014 2015

MAPA Number Agent

------------ --------------------------- ------------- ----------- -----------

Hiscox Syndicates

33 Limited 1,017,000 1,801,387 2,006,809

Equity Syndicates

218 Management Limited 770,066 1,156,125 1,000,192

308 R.J. Kiln & Co Limited 70,000 84,528 84,528

QBE Underwriting

386 Limited 284,386 624,877 622,220

510 RJ Kiln & Co. Limited 2,363,455 3,671,124 4,009,770

557 RJ Kiln & Co. Limited 316,109 453,590 488,331

Atrium Underwriters

609 Limited 1,129,982 2,030,088 2,276,231

Beazley Furlonge

623 Limited 1,214,571 2,486,682 2,615,026

S.A. Meacock & Company

727 Limited 519,378 601,211 628,634

ANV Syndicate Management

779 Limited 20,000 - -

Canopius Managing

958 Agency Limited 474,378 583,955 123,765

Chaucer Syndicates

1176 Limited 340,939 406,833 440,933

Argo Managing Agency

1200 Limited 157,370 158,071 93,819

Asta Managing Agency

1729 Limited - 88,432 52,747

Cathedral Underwriting

2010 Limited 442,247 703,022 691,381

Pembroke Managing

2014 Agency Limited - 1,152,199 1,051,182

Argenta Syndicate

2121 Management Limited 67,037 96,415 96,415

Asta Managing Agency

2525 Limited - 96,690 114,698

Managing Agency

2791 Partners Limited 2,446,787 3,289,868 3,153,582

ANV Syndicate Management

5820 Limited 224,170 220,259 160,259

Managing Agency

6103 Partners Limited 550,173 499,546 201,189

Hiscox Syndicates

6104 Limited 591,224 1,016,224 1,017,998

Ark Syndicate Management

6105 Limited 95,296 447,192 465,932

Amlin Underwriting

6106 Limited 346,805 - -

Beazley Furlonge

6107 Limited 32,500 372,500 372,500

Pembroke Managing

6110 Agency Limited 1,042,507 - -

Catlin Underwriting

6111 Agencies Limited 688,475 1,197,928 1,277,613

Barbican Managing

6113 Agency Limited 67,328 67,328

Asta Managing Agency

6117 Limited - 1,122,567 745,785

Members' Agents

7200 Pooling Arrangement 533,339 229,690 75,199

Members' Agents

7201 Pooling Arrangement 2,721,726 1,164,942 384,686

Members' Agents

7202 Pooling Arrangement 969,857 417,197 134,665

Members' Agents

7203 Pooling Arrangement 206,642 146,016 93,572

Members' Agents

7211 Pooling Arrangement 5,545,064 793,462 101,068

Members' Agents

7217 Pooling Arrangement 177,460 177,460 199,640

Members' Agents

7227 Pooling Arrangement - - 31,448

Total 25,426,271 27,357,408 24,811,817

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 02:00 ET (06:00 GMT)

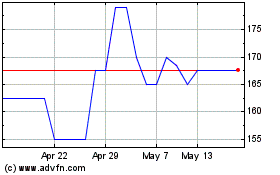

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2024 to Aug 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Aug 2023 to Aug 2024