Helios Underwriting Plc Acquisition (3639A)

December 19 2014 - 10:38AM

UK Regulatory

TIDMHUW

RNS Number : 3639A

Helios Underwriting Plc

19 December 2014

19 December 2014

Helios Underwriting plc

("HUW" or the "Company")

Acquisition of Lloyd's Limited Liability Vehicle

HUW is pleased to announce that, in line with its strategy of

increasing underwriting capacity through acquisition, it has agreed

to acquire Nameco (No 311) Limited, a limited liability member of

Lloyd's ("LLV") for a total consideration of GBP1.0 million in

cash. The 2014 underwriting capacity of the LLV is GBP1.0 million;

this compares with HUW's 2014 capacity of GBP22.8 million prior to

this acquisition. Completion is subject to change of control

consent from Lloyd's. The LLV participates in a spread of Lloyd's

syndicates broadly similar to HUW's own participation.

Commenting upon the acquisition, Nigel Hanbury, the Company's

Chief Executive Officer, said:

"We are delighted to have agreed a further LLV acquisition which

will further increase our underwriting capacity. This is in line

with our stated strategy of acquiring corporate members as suitable

opportunities arise. We continue to believe that there remain

significant opportunities for further growth available to the

Company."

For further information please contact:

HUW 020 7863 6655 / nigel.hanbury@huwplc.com

Nigel Hanbury - Chief

Executive

Smith & Williamson Corporate

Finance

David Jones 020 7131 4000

Westhouse Securities

Robert Finlay 020 7601 6100

About HUW

HUW provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). HUW's subsidiary underwriting

vehicles trade within the Lloyd's insurance market as corporate

members of Lloyd's writing approximately GBP23 million of capacity

for the 2014 account. The portfolio provides a good spread of

classes of business being concentrated in property insurance and

reinsurance. For further information please visit

www.huwplc.com.

Additional information

Nameco (No 311) Limited ("Nameco 311") is a limited liability

member of Lloyd's which HUW has agreed to acquire from the

Executors of John Clegg; in the year ended 31 December 2013, Nameco

311 made a profit before tax of GBP0.1 million on gross premiums

written of GBP0.8 million. Nameco 311's expected net asset value at

completion is approximately GBP1.0 million, including underwriting

capacity with an estimated market value of GBP0.3 million.

Set out below are Nameco 311's 2012 and 2013 open years of

account forecasts:

YOA Nameco Forecast of syndicate profit

311 (30 September 2014)

syndicate

capacity

(GBP'000)

------ ----------- -------------------------------------

Mid point Mid point Range

(GBP'000) (%) (%)

------ ----------- ----------- --------- -------------

2012 895 92 10.23% 7.40 - 13.06%

------ ----------- ----------- --------- -------------

2013 952 71 7.47% 3.60 - 11.34%

------ ----------- ----------- --------- -------------

Source: Syndicate data and HUW analysis

Set out below are details of Nameco 311's syndicate

participations for the 2012 to 2014 years of account:

YOA 2012 2013 2014

---------- ------------------- --------------------- -------------------

Syndicate (GBP'000) (%)* (GBP'000) (%)* (GBP'000) (%)*

---------- ---------- ------- ---------- --------- ---------- -------

33 73 8.1% 73 7.7% 77 7.6%

---------- ---------- ------- ---------- ------- ------------ -------

218 49 5.5% 49 5.1% 49 4.8%

---------- ---------- ------- ---------- ------- ------------ -------

386 33 3.6% 33 3.4% 33 3.2%

---------- ---------- ------- ---------- ------- ------------ -------

510 153 17.1% 154 16.2% 154 15.3%

---------- ---------- ------- ---------- ------- ------------ -------

557 10 1.1% 8 0.9% 8 0.8%

---------- ---------- ------- ---------- ------- ------------ -------

609 72 8.1% 73 7.7% 74 7.3%

---------- ---------- ------- ---------- ------- ------------ -------

623 84 9.4% 88 9.3% 95 9.4%

---------- ---------- ------- ---------- ------- ------------ -------

727 8 0.9% 8 0.9% 8 0.8%

---------- ---------- ------- ---------- ------- ------------ -------

958 34 3.8% 26 2.7% 21 2.0%

---------- ---------- ------- ---------- ------- ------------ -------

1176 13 1.4% 13 1.3% 13 1.3%

---------- ---------- ------- ---------- ------- ------------ -------

1200 41 4.6% 41 4.3% 41 4.1%

---------- ---------- ------- ---------- ------- ------------ -------

1729 - - - - 19 1.9%

---------- ---------- ------- ---------- ------- ------------ -------

2010 31 3.5% 31 3.2% 31 3.1%

---------- ---------- ------- ---------- ------- ------------ -------

2014 - - - - 55 5.5%

---------- ---------- ------- ---------- ------- ------------ -------

2525 5 0.5% 5 0.5% 5 0.4%

---------- ---------- ------- ---------- ------- ------------ -------

2526 2 0.2% 2 0.2% - -

---------- ---------- ------- ---------- ------- ------------ -------

2791 165 18.5% 165 17.4% 145 14.4%

---------- ---------- ------- ---------- ------- ------------ -------

4242 14 1.6% 14 1.5% 14 1.4%

---------- ---------- ------- ---------- ------- ------------ -------

5820 - - 34 3.6% 28 2.8%

---------- ---------- ------- ---------- ------- ------------ -------

6103 10 1.1% 13 1.3% 9 0.9%

---------- ---------- ------- ---------- ------- ------------ -------

6104 10 1.1% 13 1.4% 13 1.3%

---------- ---------- ------- ---------- ------- ------------ -------

6105 8 0.9% 5 0.5% 15 1.5%

---------- ---------- ------- ---------- ------- ------------ -------

6106 10 1.1% 11 1.2% - -

---------- ---------- ------- ---------- ------- ------------ -------

6107 10 1.1% 13 1.3% 13 1.2%

---------- ---------- ------- ---------- ------- ------------ -------

6110 22 2.4% 39 4.1% - -

---------- ---------- ------- ---------- ------- ------------ -------

6111 38 4.3% 42 4.4% 44 4.4%

---------- ---------- ------- ---------- ------- ------------ -------

6117 - - - - 45 4.4%

---------- ---------- ------- ---------- ------- ------------ -------

Total 895 100.0% 952 100.0% 1,009 100.0%

---------- ---------- ------- ---------- ------- ------------ -------

* Percentage of total syndicate portfolio

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQTLBATMBJBBAI

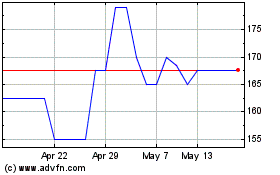

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2024 to Aug 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Aug 2023 to Aug 2024